Year in Review; Year in Preview - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | June 30 2018

Year in Review; Year in Preview

Economic & financial perspectives

Record expansion: Australia’s record economic expansion has completed its 27th year. Interest rates

remain at record lows; wage and price growth are near 2 per cent; the jobless rate is near 5.5 per cent.

Good year for shares: Total returns on Australian shares (All Ordinaries Accumulation index) lifted by 13.7

per cent over 2017/18 to a smidgen below record highs (20-year average +10.8 per cent).

The report is useful to assist investors to start planning for 2018/19.

What does it all mean?

• The 2017/18 financial year is now complete so it is time to see how investments, financial markets and economies

have performed over the past year.

• Overall, the global economy continues to gather pace, especially the United States, underpinned by tax cuts,

strong corporate earnings and a strong job market. The Chinese economy is growing at a 6.8 per cent annual

pace although authorities are focussed on shoring up the financial system. The International Monetary Fund

expects the global economy to grow by around 3.9 per cent over both 2018 and 2019 – above the long-term

average. The risk of a trade war is the main global concern.

• The Australian economy is currently growing at a 3.1 per cent annual pace. Unemployment has eased to 5.4 per

cent. Inflation stands at 1.9 per cent with wages up 2.1 per cent on a year ago. Business conditions (as judged by

the NAB survey) are just below record highs. Other surveys confirm the strength of business activity.

• Infrastructure will be a key driver of growth in 2018/19 alongside exports. There is a strong pipeline of homes still

to be built but building activity will ease as the year progresses. The economy should grow by around 2.75-3.25

per cent – near the “speed limit” of growth. Unemployment should remain between 5.0-5.5 per cent while wage

and price growth will gradually lift towards 2.5 per cent. Official interest rates may remain on hold until early 2019.

• Returns on shares lifted by just under 14 per cent in 2017/18 and growth of 7-11 per cent is expected in 2018/19.

The Australian dollar should support the record economic expansion, largely holding in the mid-to-late 70s against

the greenback.

Craig James – Chief Economist; Twitter: @CommSec

Ryan Felsman – Senior Economist; Twitter: @CommSec

Produced by Commonwealth Research based on information available at the time of publishing. We believe that the information in this report is correct and any opinions, conclusions or

recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither

Commonwealth Bank of Australia ABN 48 123 123 124 nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this report.

The report has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on the information

in this report, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice. In the

case of certain securities Commonwealth Bank of Australia is or may be the only market maker.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia.

This report is approved and distributed in the UK by Commonwealth Bank of Australia incorporated in Australia with limited liability. Registered in England No. BR250 and regulated in the UK by the

Financial Conduct Authority (FCA). This report does not purport to be a complete statement or summary. For the purpose of the FCA rules, this report and related services are not intended for

private customers and are not available to them.

Commonwealth Bank of Australia and its subsidiaries have effected or may effect transactions for their own account in any investments or related investments referred to in this report.Economic Insights: Year in Review; Year in Preview

What does the data show?

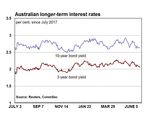

Interest rates

• The cash rate remains at record low of 1.50 per cent, and

has held those levels for a record 22 consecutive months.

• The market-determined 90-day bank bill rate held between

1.69 per cent and 2.12 per cent over 2017/18 and ended the

year near 2-year highs. Yields on the long bond – 10-year

government bonds – held in a tight range of between 2.49

per cent and 2.92 per cent and ended the year at 2.64 per

cent.

Currencies

• The Aussie dollar fell by around 4 per cent over 2017/18.

The Aussie started the year around US77 cents and ended

the year at US73.91 cents. We have calculated that the

Aussie was 87th strongest against the US dollar of 120

currencies tracked. The currencies of Albania, Malaysia, Colombia and Serbia all lifted by around 4-7 per cent.

The weakest currencies were the emerging economies of Venezuela, Argentina, Iran and Turkey. Only 35

currencies lifted against the greenback over the year.

• In the first six months of 2018, the Aussie dollar fell by around 5 per cent against the US dollar, making it the

98th strongest (23rd weakest) of 120 currencies tracked. The currencies of Albania, Japan, Colombia and Kenya

rose by around 2-3 per cent. The weakest currencies were the emerging economies of Venezuela, Argentina,

Turkey, Iran and Brazil. Only 11 currencies lifted against the

greenback over the year.

• The high for the Aussie dollar in 2017/18 was US81.35 cents

in January 2018 and the low was US73.23 cents on June 27

2018. The US8.1-cent range for the Aussie dollar was just

above the US6.25 cent range in 2016/17 – the smallest range

in 27 years.

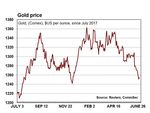

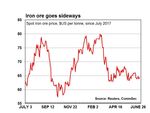

Commodities

• Commodity prices were largely firmer over 2017/18. The

Commodity Research Bureau futures index rose by 14.7

per cent over the year, out-performing the Aussie dollar

(down around 4 per cent).

• Amongst the firmest gains was crude oil (up 61 per cent),

from nickel (up 59 per cent), thermal coal (up 47 per cent),

wool (up 37 per cent) and copper and aluminium (up around

12 per cent). But beef and sugar both fell by around 12 per

cent. Iron ore rose 3 per cent and gold was up 1 per cent.

Sharemarket

• The Australian sharemarket started 2017/18 with the All Ordinaries at 5,764.0 and the ASX200 at 5,721.5. The

All Ords ended the year at 6,289.7 points (up 9.1 per cent) with the ASX200 at 6,194.6 (up 8.3 per cent). We

estimate that Australia was 26th of 73 global bourses and 26 bourses recorded declines in 2017/18. The strongest

gain was by inflation-affected Venezuela but notably Norway and Vietnam both lifted by around 26 per cent. India

(16th) and the US Dow Jones (17th) lifted 14-15 per cent. The worst performers were West Africa, Pakistan,

June 30 2018 2Economic Insights: Year in Review; Year in Preview

Oman, Pakistan and Kenya. The Chinese sharemarket fell by 10.8

per cent and was ranked second weakest.

• In the first six months of 2018, the All Ordinaries rose by 2.0 per

cent, ranking Australia 23rd of 73 nations. Norway and New Zealand

were amongst the top performers (up around 8 per cent) while the

Philippines, Turkey, China, Argentina and Poland recorded the

biggest declines.

Investment returns

• Total returns on Australian shares (All Ordinaries Accumulation

index) rose by 13.7 per cent over 2017/18. Returns on dwellings rose

by around 3 per cent while returns on government bonds also lifted

by around 3 per cent. The returns on shares in 2017/18 was the

strongest in four years.

Sectors & size groupings

• Of the 21 identified industry sub-sectors, only five recorded

declines in 2017/18.

• Leading the gains was Autos & Components (up by almost 42 per

cent) followed by Pharmaceuticals & Biotech (up 39 per cent) and

Energy (up 38.2 per cent).

• At the other end of the scale, Telecom fell by almost 35 per cent,

followed by the Banks sector (down 6.7per cent) and Utilities (down

5.7 per cent).

• Of the size categories, the Small Ordinaries outperformed (up almost

21 per cent) from the MidCap 50 (up 10.6 per cent), ASX 100 (up 7.2

per cent), ASX 50 (up 6.7 per cent).

What are the implications for investors?

• Returns on shares are near record highs. And sharemarket returns have only fallen once in the past nine years.

An investor that employed a diversified strategy across asset classes would be well pleased with the performance

over the past year.

• The economic and financial metrics remain encouraging.

Australia has underlying inflation below the Reserve Bank’s 2-

3 per cent target band at 1.9 per cent. Economic growth is

lifting with quarterly growth in the March quarter the fastest in

six years. Business conditions are just below 20-year highs.

The cash rate remains at record lows. And unemployment is at

a 5-year low of 5.4 per cent.

• While housing and infrastructure activity have driven the

economy over the past year, in the year ahead exports and

business investment are expected to play bigger roles in

driving growth.

• Over the coming year more and more apartments will be

completed with more stock hitting the market. It has taken a

little longer than expected, but supply and demand for homes

June 30 2018 3Economic Insights: Year in Review; Year in Preview

are likely to prove more balanced in 2017/18, restraining

growth in home prices.

• Last year we noted: “CommSec expects the All Ordinaries

index to be near 5,900-6,100 points at end-December 2017

and 6,000-6,200 points in June 2018”. The December forecast

was modestly exceeded and similarly the June forecast has

been more than realised although 6,200 points was only

achieved on June 15.

• Over the coming year CommSec expects the All Ordinaries

index to be near 6,400-6,600 points in December 2018 and

6,600-6,800 points in June 2019.

• Home prices nationally are likely to be largely unchanged in

2018/19 with inflation around 2.00-2.50 per cent. The Aussie

dollar is expected to largely trade in the mid-to-late 70s against

the US dollar over most of the coming year.

• The low inflation/low interest rate environment is entrenched,

meaning that lower nominal investment returns are also here to

stay. So investors will need to remain flexible and alert to the

returns achieved across sharemarket sectors and across asset

classes to ensure that their savings are keeping pace with the

cost of living.

• The people/issues/themes to watch over the coming year

include Donald Trump; Oil prices; Australian home prices;

Wages & Jobs; and Geopolitics.

• One of the key global issues is the fact that major economies

are posting solid economic growth without generating inflation.

A key reason is globalisation. Consumers can buy goods

wherever they are and whenever they want. Similarly more

businesses are selling products, securing inputs and getting

tasks done globally, rather than locally.

• In Australia wages are expected to lift gradually as skill

shortages become more prevalent. In turn, modestly higher

wages will lead to a modest lift in price inflation, and

eventually higher interest rates. Our current thinking is that the

Reserve Bank will start to lift the cash rate from record lows in

early 2019.

• Housing markets continue to rebalance. New construction in

many regions should prove more than sufficient to meet

demand and home prices should hover around the zero line –

modest price gains and losses.

• Trade issues are likely to dominate over the coming year,

driven by concerns in the United States about ‘fairness’. As

the year develops, there will also be more debate about

interest rates in the US and how close the federal funds rate is

to the “neutral” level.

• As US rates approach the “neutral” level, the greenback is

expected to start losing some of its strength, providing a boost

to exports and broader economic growth.

• Elections to watch include the Australian federal election, NSW

and Victorian state elections and the mid-term US elections in

November. Italian and German politics are also on the radar.

Craig James, Chief Economist, CommSec

Twitter: @CommSec

Ryan Felsman, Senior Economist, CommSec

Twitter: @CommSec

June 30 2018 4You can also read