A Guide to New York City Taxes: History, Issues and Concerns - Business Real Estate Personal Income Sales and Use Excise

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

A Guide to New York City Taxes:

History, Issues and Concerns

Business

Real Estate

Personal Income

Sales and Use

Excise

Marilyn M. Rubin

December 2010A GUIDE TO NEW YORK CITY TAXES:

HISTORY, ISSUES AND CONCERNS

Marilyn Marks Rubin

John Jay College

December 2010

Funded by the Peter J. Solomon Family Foundation

Marilyn Marks Rubin Peter J. Solomon

Professor Chairman

John Jay College Peter J. Solomon Company

City University of New York 520 Madison Avenue

445 W. 59th Street New York City, NY 10022

New York City, NY 10019 (212) 508-1600

(212) 237-8091 pjsolomon@pjsolomon.com

mrubin@jjay.cuny.edu http://www.pjsolomon.com/Preface The origin of the Guide was a report on New York City taxes prepared in 1979 by Dr. Marilyn Rubin, a consultant to me when I served as Deputy Mayor for Economic Policy and Development under Mayor Edward I. Koch. When I entered NYC government in the late 1970s, the City was deep in its financial crisis and tax policy and its effect on the City’s budget and economy were critical. I was surprised to learn that there was no comprehensive summary of all the taxes imposed by the City, and that the Mayor and other policy makers lacked basic information to make decisions. In the ensuing 31 years, no government office, public policy organization nor academic institution has, to our knowledge, provided a comprehensive and comprehensible report on taxes in New York City. Before embarking on this project, we confirmed that observation. I commissioned Dr. Rubin through the Peter J. Solomon Foundation and under the auspices of John Jay College, where she is a Professor of Public Administration and Economics, to prepare this Guide. She is a recognized expert on state and local taxes and is an elected fellow of the prestigious National Academy of Public Administration (NAPA), chartered by the U.S. Congress to help government leaders build accountable, efficient and transparent organizations that deliver results. I am indebted to Dr. Rubin for her usual thorough and thoughtful analysis. Her colleagues Dr. Catherine Collins at George Washington Institute of Public Policy and Dr. Yi Lu at John Jay College provided extensive input into the report as did current and former students in the College’s MPA Program: Annemarie Eimicke, Dov Horwitz and Lauren McNerney. Dr. Rubin and I are grateful to the many professionals who have read and commented on the report including David Frankel, Commissioner of the New York City Department of Finance, and Michael Hyman, the Department’s Assistant Commissioner for Tax Policy, and his staff. We thank John Grathwol, Assistant Director of the NYC Office of Management and Budget, and his staff, for providing us with the data we needed to produce the report, and Ronnie Lowenstein, Executive Director of the NYC Independent Budget Office (IBO), and her staff for their helpful comments, particularly Michael Jacobs, David Belkin, Ana Champeny and Alan Treffeisen. We also thank Steve Spinola, President of the NYC Real Estate Board, and Michael Slattery, the Board’s Senior Vice President, for their valuable comments, Stephen Solomon and Kenneth Moore of Hutton & Solomon, LLP for their input on some of the more technical aspects of the City’s taxes and Diane Coffey, my partner at our firm, for her editing and publishing assistance. New York City and State are once again faced with severe budget issues. We hope that this Guide, clearly defining the history of NYC taxes, their rates and bases, who pays them and the issues associated with each will allow more informed tax policy decisions and a better understanding of the effect of changes. As we completed the Guide, the State had passed its 2010 budget, which includes several changes to its tax structure and rates (see Exhibits 3 and 4 in Executive Summary). With the exception of the increased NYS tax on cigarettes, which was already in place before the Guide was completed, these changes are not reflected in the report, nor are any changes made to NYC taxes, including the elimination of Off-Track Betting. In closing, the work is ours and, while we have received many helpful suggestions from the persons listed above, we bear full responsibility for its accuracy and completeness. We welcome comments. Peter J. Solomon Chairman, Peter J. Solomon Company, L.P. December 2010

CONTENTS Executive Summary ……………………………………………………………………… i Real Property Tax ……………………………………………………………………..…. 1-1 Real Property Transfer Tax …………………………………………………………….. 2-1 Mortgage Recording Tax ………………………………………………………………... 3-1 Commercial Rent Tax …………………………………………………………………… 4-1 Personal Income Tax …………………………………………………………………….. 5-1 Sales and Use Tax ………………………………………………………………………... 6-1 Cigarette Tax …………………………………………………………………………….. 7-1 Hotel Tax ……………………………………………………………………………….… 8-1 General Corporation Tax ……………………………………………………………….. 9-1 Unincorporated Business Tax …………………………………………………………... 10-1 Banking Corporation Tax ………………………………………………………………. 11-1 Utility Tax ………………………………………………………………………………… 12-1 Other Taxes ………………………………………………………………………………. 13-1

EXECUTIVE SUMMARY

Introduction businesses to both the City and State are much

higher than those in other localities in the nation.

The purpose of the Guide to New York City Taxes

is to provide information to a wide range of Cities as Creatures of the State

readers on New York City taxes in a format that is

broad in scope and non-technical in its Under the U.S. Constitution, states retain the

presentation. power to impose any tax that does not violate the

U.S. Constitution or their own state constitutions.

The information presented in the Guide can be This means that states are generally free to decide

found in several other sources.1 None, however, how, what and whom to tax. The U.S.

provides a broad non-technical picture of NYC Constitution, however, does not mention local

taxes, showing their structural elements as well as governments. Instead, each state decides what

other relevant details – how they have evolved types of local governments to allow and what

over time, how much revenue they generate and powers they may exercise. Cities are thus

how they compare to similar taxes imposed in creatures of the state unless specific state action

other U.S. cities. Nor do these other sources, with alters this relationship by permitting home-rule for

few exceptions, look at the extent to which NYC local governments.

taxes are imposed in addition to New York State

taxes on the same base. The creature of the state principle is based on

what is known as Dillon’s Rule, which dictates

The Guide provides this information for all of that municipalities only have the powers explicitly

NYC’s major taxes as of FY2009. It also presents given to them by the state. Established in 1872 in

issues and concerns associated with each tax that a treatise on municipal corporations authored by

need to be addressed as part of the City’s ongoing Iowa Supreme Court Judge John F. Dillon, the

efforts to maintain its competitive position for creature of the state principle remains the legal

businesses and its standing as one of the best doctrine governing current city-state relationships

places to live in the U.S. throughout the U.S., as modified by individual

state laws permitting home rule.

Overview

Most states, including New York, have modified

New York City is home to more than 8.3 million Dillon’s Rule by providing home-rule powers to

people. It is the largest city in the U.S., more than certain or all local governments, either under their

twice the size of Los Angeles, the second-largest constitutions or by statute. Home rule

city in the nation, and close to three times the size municipalities are taken out from under Dillon’s

of Chicago, the third most populous. If New York Rule and permitted to operate under their own

City were a state, it would rank as the 12th largest charter, which establishes local governance and

in the U.S. with respect to population size. This administrative practices. In general, however,

would place it behind New Jersey with its 8.7 home rule authority does not extend to autonomy

million residents and ahead of Virginia with its 7.9 over the power to tax, with few exceptions.

million residents.

The only tax-related action that NYC, a home rule

New York City’s tax structure also resembles that jurisdiction, is permitted to take without NYS

of a state but with two critical differences. The legislative and gubernatorial approval is the

first is that states are sovereign with respect to setting of its annual Real Property Tax rates and

taxation; cities are creatures of the state. The even this action is taken within NYS constitutional

second is that the taxes paid by NYC residents and and statutory constraints. All other actions related

i

to the NYC Real Property Tax and to any other tax exceed the costs of service provision, they become

are subject to initiation or approval by the NYS part of the City’s General Fund.3

Governor and Legislature.

Figure 2: NYC Revenue Sources, FY 2009

NYC and NYS Taxes: A Double Burden

The second factor that differentiates New York

City from the 50 states is that City residents and

businesses pay high taxes to both NYC and NYS,

sometimes on the same base. Figure 1 shows that

of the 19 taxes imposed by the City and included

in its General Fund revenues, 11 are also levied by

the State.2 NYS imposes more than 20 taxes that

impact City residents and/or businesses, including

Source: NYC Office of Management and Budget

the Estate and Gift Tax and the Insurance Tax (see

Exhibit 2 for a list of NYS taxes). This taxing of

Taxes. The Real Property Tax is the City’s largest

the same base by NYC and NYS is one of the

revenue producer, accounting for 40% of total tax

concerns associated with City taxes discussed later

revenues and 24% of revenues from all sources in

in the Executive Summary.

FY 2009. Together with the City’s three other real

estate related taxes, more than 45% of tax

Figure 1: NYC and NYS:

revenues and 27% of City revenues from all

Taxing the Same Base

sources were attributable to property owners and

Personal Income Tax renters (see Exhibit 1). The three other real estate

Sales/Use Tax related taxes are: the Real Property Transfer Tax

General Corporation Tax (RPTT), the Mortgage Recording Tax (MRT) and

Banking Corporation Tax the Commercial Rent Tax (CRT).

Utility Tax

Cigarette Tax

The second-largest NYC tax source is the Personal

Mortgage Recording Tax

Real Property Transfer Tax

Income Tax (PIT). In FY 2009, the PIT yielded

Alcoholic Beverage Tax $6.5 billion, accounting for 18% of all NYC tax

Off-Track Betting revenues and 10.6% of City revenues from all

Wireless Communications Surcharge sources.

The Sales/Use Tax, the third-largest NYC tax

Taxes and Other NYC Revenue Sources source, generated 12.8% of all City tax revenues

and 7.6% of City revenues from all sources in FY

Taxes are the primary source of NYC revenues. Figure 2009. The City also levies selective sales taxes,

2 shows that in FY 2009, of the $60.6 billion total known as excise taxes, on cigarettes, hotels,

City revenues, $35.9 billion or 59.1% was beer/liquor and certain other items and

attributable to taxes, almost three times the 20% transactions.

attributable to State aid, the second-largest source

of City revenues and almost six times the 10%

NYC business taxes imposed on general

from Federal aid. corporations, banking corporations and utilities

and its tax on unincorporated businesses together

Fees for services, licenses, fines and similar generated 15.7% of all NYC taxes and 9.2% of

charges, accounted for 7.4% of total City revenues total City revenues in FY 2009.

in FY 2009. Generally, fees are equal to the cost

of providing a service. To the extent that fees

ii

Trends in NYC Tax Revenues4

Total NYC tax revenues in 2009 were $35.8 September 11th and the national recession. Real

billion, a decrease of 7.1% over the $38.6 billion tax revenues resumed their positive growth trend

in 2008. These revenues are, however, in current in 2003 and continued to increase until 2007. In

or nominal dollars which do not take inflation into 2008, real revenues fell by 2% – a year before the

account. Constant dollar values are adjusted for City’s economy went into decline – and again in

inflation and show real tax changes over time. 2009.

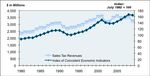

For example, as shown in Figure 3, real tax

revenues adjusted for inflation began to decline in Figure 4: Constant 2000 Dollar Total NYC Tax

Revenues and Real Economic Growth, 1980-2009

2008 rather than in 2009 as indicated by current

dollar values. In real terms, FY2009 tax revenues

were slightly below FY2005 revenues.

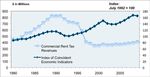

Figure 3: NYC Total Tax Revenues in Current and

Constant 2000 Dollars, 2000-2009

Sources: Index of Coincident Economic Indicators, NY Federal

Reserve Board; Moody’s.com NY State & Local Government

Product Deflator used to convert current dollar values into constant

2000 dollars.

Sources: Current Dollars, NYC OMB; Moody’s Economy.com NY One of the reasons that the relationship between

State & Local Government Product Deflator used to convert current tax revenues and economic change differed in the

dollars into constant 2000 dollars.

2008-09 period as opposed to the early 1990s is

the City’s growing reliance on economically

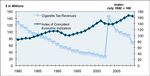

Figure 4 shows how real dollar tax revenues over

sensitive taxes, particularly personal and business

the last 30 years have generally tracked NYC

income taxes. In 1990, personal and business

economic conditions as measured by the NYC

income tax revenues comprised 26% of the NYC

Index of Coincident Economic Indicators.

tax base; by 2009 they represented 33%.

The NYC Index of Coincident Economic

Indicators was developed by the Federal Common Issues and Concerns

Reserve Bank of New York.5 It combines

individual indicators of economic activity, The following sections of the Guide to New York

including employment, to measure overall City Taxes describe the structural elements of each

changes in economic conditions in the City. NYC tax as well as other relevant details about the

The Index provides a broader measure of tax – how it has evolved over time, how much

economic conditions than does a single revenue it generates and how it compares to

indicator such as unemployment or income. similar taxes in other U.S. cities.

In the 1980s, real growth in tax revenues closely Although the taxes differ with respect to structure

tracked economic conditions in the City. During and their contribution to City revenues, several

the 1990s, tax revenues continued to grow – with a issues and concerns are common among them.

dip only from 1994 to 1995 – when economic These issues and concerns shown in Table 1 are

conditions in the City declined. discussed briefly below and explained more fully

in the descriptions of the individual taxes in the

Tax revenues increased along with the economy following sections of the Guide.

until 2002 when they slumped in the wake of

iii

Table 1: Common Issues and Concerns Related to Major NYC Taxes*

Tax NYC/NYS Double Electronic Regulatory Unique

Tax Same Taxation Commerce Reforms Tax

Base

Real Property

Real Property Transfer

Mortgage Recording

Commercial Rent

Personal Income

Sales/Use

Hotel

Cigarette

General Corporation

Unincorporated Business x

Banking Corporation

Utilities

*

Table does not show taxes that account for less than 0.1% of City tax revenues (see Exhibit 1).

NYC and NYS Taxing the Same Base. Of the 19 Unincorporated Business Tax (UBT) and the PIT

taxes levied by NYC and included in its General on the same income stream.

Fund, 11 are imposed by the State on the same

base (see Figure 1, p.ii). Among U.S. cities, Double taxation also occurs when commercial

comparative tax burden studies always show NYC tenants occupying space below 96th Street in

with the highest or close to the highest combined Manhattan pay the Commercial Rent Tax as well

city/state burden.6 as increases in Real Property Taxes on their

buildings.

NYC has the highest corporate tax rate of any

local government in the U.S., and the highest Electronic Commerce. The growth in e-commerce

combined state/local corporate income tax

is a new challenge. NYC taxes were instituted

rate.

Among local governments imposing some when doing business required a physical presence

type of personal income-based tax, only and geographic borders generally defined the

Philadelphia has a higher tax rate than NYC – boundaries for purposes of taxation. Today, as a

but a lower combined state/local rate. result of changing communications technologies,

The combined NYC/NYS Real Property geographic borders for purposes of many types of

Transfer Taxes and Mortgage Recording taxation are rapidly disappearing.

Taxes give NYC the highest real estate

closing costs in the country. The growth in sales made over the Internet and the

fact that most individuals pay no sales or use tax

Double Taxation. Many City taxpayers, especially

on many of these purchases has negatively

City residents, pay more than one tax on the same

impacted the City’s tax revenues. The combined

income stream. For example, NYC residents who

New York City/New York State loss of revenues

are S Corporation owners/ shareholders pay the

in FY 2009 resulting from untaxed e-commerce

NYC General Corporation Tax (GCT) or the NYC

sales is estimated at $257 million.7 Cigarette Tax

Bank Tax, and the NYC Personal Income Tax

and Hotel Tax revenues are also adversely

(PIT) on income derived from the corporation.

affected by Internet transactions.

Additionally, NYC business owners who are

residents with more than $42,000 in taxable

income for City PIT purposes pay the The increased use and reliability of tele-

communications technology means that more

iv

business can be conducted electronically and that taxes is also imposed on the same base as another

physical location is no longer as necessary as it NYC tax.

once was. This, too, has an adverse impact on tax

revenues as businesses act to reduce their tax Conclusions

liability through increased use of the Internet and

other telecommunications technologies.

NYC imposes a wide variety of taxes and has a tax

burden exceeding that of all other U.S. cities.

Government Regulatory Reforms Most of the City’s taxes were enacted more than

50 years ago, long before dramatic technological

Passage of the Federal

Gramm-Leach-Bliley Act advances changed the environment in which taxes

(GLBA) in 1999 removed the demarcation are imposed. Over time, the City’s tax base has

between banks, securities firms and other also become increasingly sensitive to changes in

financial institutions. the City’s economy.

Changes resulting from GLBA blurred the line The tax burden in NYC, the complexity and

between businesses that have to file under the

inequitable application of a number of taxes, the

NYC Bank Tax and those that have to file under impact of technology and the increasing volatility

the City’s General Corporation Tax. NYS has of the City’s tax base are the impetus for the

begun a study of the possibility of creating a Guide to New York City Taxes. The information

single tax structure for financial institutions. presented in the Guide can provide a baseline for

Government deregulation of utilities also has tax any efforts undertaken to modernize the City’s

implications. Before deregulation, utilities were revenue structure.

permitted to operate only within specific service Conclusions regarding taxes in New York City,

territories. Customers could purchase tele- their comparative burden and and their effect on

communications services and electric power only

taxpayer behavior obviously cannot be reached

from their local regulated utilities. without considering the City’s expenditures and

the relationship between City and State taxes.

Deregulation has changed the marketplace so that

cheaper telecommunications services and power in As we complete the Guide, the State has passed its

other parts of the region and nation will be an 2010 budget which includes several changes to its

increasingly important issue for the City’s tax structure and rates (see Exhibits 3 and 4). With

competitive position. NYC/NYS utility taxes the exception of the increased NYS tax on

contribute to making the City’s utility costs among cigarettes which was already in place before the

the highest in the country. Guide was completed, these changes are not

reflected in the report.

Changes in the regulatory environment make the

distinction between NYC’s General Corporation

Taxpayers and some Utility Taxpayers more

problematic. NYC Real Property Tax revenues are

also impacted since utility properties are taxed

differently than other types of business properties.8

Unique Tax

NYC is one of only two jurisdictions in the U.S.

to impose a specific tax on unincorporated

businesses (UBT) and to levy a Commercial Rent

Tax (CRT). As discussed above, each of these

v

Endnotes

1

The 2007 New York City Independent Budget Office Management and Budget (OMB). Constant 2000 dollar

(IBO) publication Comparing State and Local Taxes in values for all taxes were calculated using the Moody’s

Large U.S. Cities provides information on taxes imposed in Economy.com NY State & Local Government Product

the nation’s 9 largest cities. The report is found at Deflator provided to the author by IBO with permission

http://www.ibo.nyc.ny.us/iboreports/CSALTFINAL.pdf. from Moody’s Economy.com. The legislative history of

The March 2010 NYC Office of Management and Budget each tax is primarily based on information reported in the

Tax Revenue Forecasting Documentation, Financial Plan March 2010 OMB Tax Revenue Forecasting

Fiscal Years 2009–2013 includes information used to Documentation, Financial Plan, Fiscal Years 2009-2013.

5

forecast NYC taxes. It is available at James Orr, Robert Rich, and Rae Rosen. Current Issues in

http://www.nyc.gov/html/omb/downloads/pdf/methodology Economics and Finance. Federal Reserve Bank of NY.

_2010_02.pdf. The NYC Department of Finance Webpage October 1999 Vol. # 5, no. 14. Can be found at

provides information on each of the City’s taxes. The http://www.newyorkfed.org/research/current_issues/ci5-

information is available at 14.pdf.

6

http://www.nyc.gov/html/dof/html/business/business_tax_b See, for example, Tax Rates and Tax Burdens in the

usiness.shtml. District of Columbia–A Nationwide Comparison 2008. Can

2

The General Fund is the primary City fund. Most taxes be found at

and expenditures are in the General Fund. Two additional http://www.cfo.dc.gov/cfo/frames.asp?doc=/cfo/lib/cfo/cas

taxes are imposed by the City and dedicated to the NYC h_reports/08study-final.pdf. Also see IBO report referenced

Police and Fire Departments. Neither is included in General in Endnote 1 above.

7

Fund revenues. Bruce et al. State and Local Government Sales Tax

3

Letter from NYC Independent Budget Office to NYC Revenue Losses from Electronic Commerce. Can be found

Council advising that “fees need not exactly reflect the cost at http://cber.utk.edu/ecomm/ecom0409.pdf

8

of providing a service, so long as it is reasonably related to

Utility properties are classified as either special franchise

the provision of the service and is not a subterfuge for properties or Real Estate Utility Corporations. The

raising general revenue.” October 2000. valuation of special franchise properties is done by the

http://www.ibo.nyc.ny.us/iboreports/spignerletter.pdf. NYS Office of Real Property Services.

4

Current dollar revenue data used in the Guide are based on

tax collection data reported by the NYC Office of

vi

Exhibit 1: New York City Taxes and Other Revenue Sources, FY 2009

Revenue in % of Total % of NYC

Millions of $ NYC Taxes Revenues from All

Revenue Type Revenues Sources

Total Revenues $60,646 - 100.0%

Taxes 35,873 100.0% 59.2

Real Estate Related Taxes 16,179 45.1 26.6

Real Property Tax 14,339 40.0 23.6

Real Property Transfer Tax 742 2.1 1.2

Mortgage Recording Tax 515 1.4 0.8

Commercial Rent Tax 583 1.6 1.0

1

Personal Income Tax 6,450 18.0 10.6

Sales and Excise Taxes 5,032 14.0 8.3

Sales/Use Tax 4,594 12.8 7.6

Hotel Tax 342 1.0 0.6

Cigarette Tax 96 0 .3 0.2

Business Taxes 5,602 15.6 9.2

General Corporation Tax 2,320 6.5 3.8

Unincorporated Business Tax 1,785 5.0 2.9

Banking Corporation Tax 1,099 3.1 1.8

Utility Tax 398 1.1 0 .7

Other Taxes 1,662 4.6 2.7

Commercial Motor Vehicle Tax 48 * *

Auto Use Tax 28 * *

Taxi Medallion Transfer Tax 11 * *

Beer and Liquor Excise Tax 24 * *

Retail Beer, Wine and Liquor 5 * *

License Tax

Horserace Admission Tax 0.03 * *

Off-Track Betting Surcharge 4 * *

2

Other Tax-related Revenues 1,542 4.3 2.5

Audits 947 2.6 1.6

Transfers 1,124 - 1.9

Charges for Services, Fines, etc. 4,481 - 7.4

Non-government grants 1,103 - 1.8

State Categorical Aid 12,124 - 20.0

Federal Categorical Aid 5,941 - 9.8

*Less than 0.1%. 1Does not include $138 million in PIT revenues dedicated to the Transitional Finance Authority

(TFA). NYC did not begin including these revenues as part of its General Fund until FY 2010. In FY2009,

inclusive of these revenues, PIT revenues were $6,588 million. 2 Includes tax waivers, PILOTS, interest

payments. Total includes School Tax Relief (STAR) payments to the City from NYS, which were $1.2 million in

FY 2009. Total is net of refunds and does not include revenues from the premiums tax on foreign and alien fire

insurers that are dedicated to the Fire Department or the E-9/11 S and Wireless/Cellphone Surcharges, which are

part of the Police Department’s revenue budget.

Source: NYC Office of Management and Budget

vii

Exhibit 2: New York State Taxes, FY 2009

Revenues in % of Total % of NYS Revenues

Revenue Type Millions of $ NYS Taxes from All Sources

Total Revenues1 $117,256 - 100.0%

All Taxes2 58,921 100.0% 50.2

Real Estate Related Taxes 1,371 2.3 1.2

Real Estate Transfer Tax 701 1.2 0.6

Mortgage Recording Tax3 670 1.1 0.6

Estate and Gift Taxes 1,165 2.0 1.0

Personal Income Tax 36,840 62.5 31.4

Sales and Excise Taxes 12,613 21.4 10.8

Sales/Use Tax 10,374 17.6 8.9

Motor Fuel 504 0.9 0.4

Cigarette and Tobacco Products 1,338 2.3 1.1

Alcoholic Beverage 206 0.3 0.2

Highway Use 141 0.2 0.1

Auto Rental 50 0.1 *

Business Taxes 6,614 11.2 5.6

General Corporation Tax 2,729 4.6 2.3

Banks 1,062 1.8 0.9

Insurance 1,005 1.7 0.9

Petroleum Business Taxes 1,107 1.9 0.9

Utility Taxes 711 1.2 0.5

Other Taxes 318 0.5 0.3

4

Pari-mutuel Total 10 * *

4

Off-Track Betting 18 * *

Hazardous Waste Assessment 1 * *

Waste Tire Management 24 * *

Wireless Communication 191 0.3 0.2

Other 74 0.1 0.1

1

Total revenue from NYS Financial Plan 2009-2010, p. T-25 plus estimated Mortgage Recording Tax.

2

Tax data are from NYS Department of Taxation & Finance Annual Tax Collections and may differ slightly from other

published data. Audit collections are not reported separately for each tax as reported for NYC taxes in Exhibit 1.

3

MRT is estimated by the author; it is not included in the Department of Taxation & Finance Table 2. The State MRT is

collected by the local recording offices at the time the mortgage is recorded.

4

Includes uncashed tickets and racing fee.

* Less than 0.1%

viii

Exhibit 3: NYS FY 2010 Budget: Major Actions with Specific Application to NYC Taxes

Tax Action

Personal Income Tax: Itemized For Tax Years 2010 through 2012, for taxpayers with NYAGI over $10 million,

Deductions for High-income the only itemized deduction allowable in calculating NYS Personal Income

Filers Tax liability is 25% of their charitable contributions claimed for Federal

Income Tax purposes. NYC has the option to accept this change for purposes

of calculating City PIT liability.

Currently, for taxpayers with more than $1 million in NYAGI, the only

itemized deduction permitted for NYC PIT purposes is 50% of charitable

contributions claimed for Federal Income Tax purposes.

Personal Income Tax: New For TY 2010, the maximum City PIT rate increased for all taxpayers with

York City Tax Rate taxable income of $500,000 or over is increased to 3.4%. This 3.4% does not

include the 14% additional tax imposed on all City PIT filers. Including the

14% increases, the top marginal PIT rate increased to 3.876%, up from the

current 3.648% top marginal rate.

Sales Tax: Exemption on The current NYS Sales Tax exemption for clothing and footwear up to $110

Clothing and Footwear per item is suspended for one year. NYC and other localities have the option to

exempt clothing and footwear up to $110 per item (or $55 per item) from local

sales taxes. The current NYC Sales Tax exemption applies to clothing and

footwear up to $110 per item.

Hotel Tax: Responsibility for Currently, when a hotel room is booked over the Internet through a remarketer

Tax Collection (sometimes referred to as an intermediary) such as Travelocity or Expedia, the

hotel operator is responsible for collecting the tax on the price charged to the

remarketer and remitting it to the NYC Department of Finance. The remarketer

is responsible for collecting and remitting the tax on the mark-up (the

difference between the price paid to the hotel and the price paid by the guest).

Under the new law, the room remarketer will collect the Hotel Tax on the full

charge to the customer and pay the hotel the portion of the tax on the room

price charged by the hotel. The hotel will be responsible for remitting these tax

payments to the NYC Department of Finance. The remarketer will receive a

credit for the tax it has paid to the hotel and will remit that portion of the tax it

collects on the mark-up to the Department of Finance.

The 2010 NYS Budget treats remarketers as hotel operators, requiring them to

also collect the NYS and NYC Sales Taxes based on the price paid by the hotel

guest for the hotel room.

Exhibit 4: Major Tax Actions Adopted in New York

State 2010 Budget

ix

Exhibit 4: Major Tax Actions Adopted in New York State FY 2010 Budget1

Budget Action

Section

A Modifies qualified emerging technology company and bio-fuels production tax credit for limited liability

companies (LLCs) and partnerships.

B Makes compensation for past services taxable for non-residents who had NYS nexus at time of payment.

C Treats certain S Corporation income as NYS source income for non-resident shareholders.

N Narrows the definition of vendor for purposes of the Sales/Use Taxes.

P Provides a credit against State PIT for persons or entities investing in low income housing.

Q Increases the cap on the film production tax credit by $420 million per year for 2010 through 2014; allows up to

$7 million per year in post-production tax credits.

Provides that Empire Zone de-certifications imposed in 2009 were applicable to tax years beginning on or after

R 1/1/08. Clarifies that businesses certified as qualified Enterprise Zone entities (QEZEs) or qualified investment

projects prior to 6/30/2010 retain eligibility for Empire Zone investment and employment incentive tax credits.

S Extends the exclusion for Sales Tax exemptions for business aircraft and vehicles included in transactions

between affiliated entities.

W Repeals provisions allowing private-label credit card lenders to take Sales Tax credit/refund on uncollectable

accounts.

X Repeals the Sales Tax vendor credit for monthly filers (receipts of $300,000 or more in taxable sales/quarter).

Y Defers most business tax credits over $2 million for tax years 2010, 2011 and 2012 until tax year 2013 or later.

Z Conforms NY Bank Tax deductions for bad debts to Federal Internal Revenue Code (IRC) calculations.

AA Codifies requirement for hotel room remarketers to collect NYS/NYC Hotel Taxes and Sales Taxes on hotel

rooms.

EE For TY 2010, increases the NYC Personal Income Tax base rate to 3.4% for taxable income over $500,000.2

Suspends NYS Sales Tax exemption on clothing and footwear priced at $110 and less from October 2010 through

March 2011. Reinstated at $55 in April 2011 through March 2012; full reinstatement April 1, 2012. Gives local

GG governments option to keep exemption of $55 or $110.

For Tax Years 2010 through 2012, the only itemized deduction allowed for NYS taxpayers with NYAGI of $10

million or more is 25% of charitable contributions claimed on their Federal Income Tax returns. Local

HH governments have the option of accepting this change for purposes of calculating local PIT liability.

M Makes permanent 2008 amendments related to closely held REITS for General Corporation and Bank Taxes.

N Clarifies that certain publicly traded REITS are not subject to provisions for closely held REITs.

W Relates to exclusion of transportation services provided by affiliated livery vehicles in NYC from City and State

NYS Sales Taxes.

Y Modifies the definition of little cigar for purposes of NYS Tobacco Tax.

1

Prepared August 5, 2011 based on NY State Senate S.6610-C and Assembly 9710-D.

2

Does not include 14% additional tax, which increases NYC top marginal PIT rate to 3.876%.

Sources: Pokalsky, Ken. Summary of Business-Related Provisions of S.6610-C/A.9710-D. The Business Council of New York

State, Inc; Albany, New York, August 4, 2010.

x

Real Property Tax

1.0 REAL PROPERTY TAX

1.1 Overview

Class 1: Residential properties with up to

New York City has imposed the Real Property 3 units and certain vacant land for

Tax (RPT) in its current format since 1983 under residential use2

the NYS Real Property Tax Law, as amended by Class 2: Residential properties not

Chapter 1057 of the Laws of 1981 – generally included in Class 1, including cooperative

properties (co-ops) and condominiums

referred to as S.7000A.1 Some type of property tax

(condos)

has been levied in the City since the mid-17th

century when a voluntary tax was imposed on

Class 3: Regulated utility corporation

properties and special franchise

certain types of property including land and properties, excluding land and certain

houses. buildings

Class 4: All other properties including

In FY 2009, the City’s RPT yielded $14.3 billion, office buildings, industrial facilities,

accounting for 40% of NYC tax revenues and retail establishments, and hotels/motels.

23.6% of City revenues from all sources. The

NYC Department of Finance administers and All properties in the 4 classes are subject to the

collects the tax. RPT with certain exceptions. State law mandates

that property owned by government entities and

The RPT is imposed on the value of land and not-for-profit organizations be fully exempt from

buildings located within the City with certain the RPT (see Exhibit 1.1).

exceptions described in Section 1.3. Unlike all

other NYC taxes whose rates are established by Properties owned by City residents in specific

the State, the RPT rates are set annually by the demographic categories, such as veterans, senior

NYC Council, within constraints established under citizens and disabled persons are eligible for

the NYS Real Property Tax Law. partial exemptions and/or abatements from the

RPT. Certain residential, commercial and

The RPT statutory tax rates set for each of the industrial properties are also eligible for partial

City’s four classes of property are not, however, property tax exemptions and/or abatements under

the real (effective) tax rates paid by taxpayers. The several NYC tax relief programs.3

EFT, the tax paid on every $100 of market value,

is discussed in Section 1.4. Exemptions reduce a property’s taxable value

and thus its RPT liability. In FY 2009, the tax

1.2 Factoring in the State dollar value of RPT exemptions was $11.4

billion (see Table 1.1).

The State of New York does not impose its own Abatements are subtracted directly from RPT

liability, generally at a specified dollar

tax on real property.

amount. The total value of abatements in FY

2009 was $472.7 million.

1.3 The New York City RPT Taxpayer

Some taxpayers receiving exemptions and/or

As a result of changes made in S.7000A to the abatements provide the City with payments-in-

NYC property tax structure, the City has had a lieu-of-taxes (PILOTS). In FY 2009, the City

classified property tax system with four property collected $221 million in PILOTS.4

classes in place since 1983.

1-‐1

Table 1.1: Tax Dollar Value of NYC Real Property Tax Exemptions, FY 2009

Property Type # Exemptions % of Total Tax Value* % of Total

($ in millions)

Total 734,700 100.0% $11,385.9 100.0%

Government 11,182 1.5 4,945.9 43.4

Public Authorities 9,463 1.3 2,525.6 22.2

Institutional 15,363 2.1 1,736.9 15.3

Residential 82,533 11.2 1,396.2 12.3

Commercial/ Industrial 6,333 0.9 543.0 4.8

Individual Assistance 609,826 83.0 238.3 2.1

*Tax dollar value of exemption is calculated as the exempt property value multiplied by the tax rate. The exempt property value is

actual assessed value (or, for partially exempt properties, a portion of actual assessed value). Actual assessed value is the product of

the assessment ratio multiplied by market value.

Source: NYC Department of Finance, Annual Report, NYC Property Tax FY2009, page 13.

1.4 The New York City RPT Base responsible and the total assessed value in each

class (class shares are discussed below).

The Real Property Tax base is determined by the

total taxable value of property in the City and the Taxable Value of NYC Property. For purposes of

average Citywide tax rate set by the NYC Council the RPT, taxable value is equivalent to assessed

when it establishes the total RPT levy needed for value, the base for determining taxpayer liability.

budget-balancing purposes. The average City- Each of the elements in the calculation of taxable

wide rate is not, however, used to calculate value and tax liability for individual properties is

individual taxpayer liabilities which are shown in Figure 1.1 and explained below.

determined by applying class-specific tax rates to

each property’s market value. Class-specific tax Market Value. The starting point for calculating

rates are set by the Council based on the share of the taxable value of a property is its market value.

the total tax levy for which each class is Market value can be defined conceptually as “the

cash price a property would bring in a competitive

Figure 1.1: Calculating NYC Property and open market.”5 The NYC Department of

Tax Liability Finance determines market value for NYC

properties using three approaches: (1) the

Market value as determined by the NYC comparable sales or market data approach, (2) the

Department of Finance (DOF) income approach, and (3) the cost or summation

Multiplied by

approach.

Class-specific Assessment Ratio

established by the DOF

Minus All properties in the City are reassessed each year

RPT Tax Exemptions, if applicable between June and January. Once the new market

Equals value of a property is determined, it is multiplied

Assessed or Taxable Value by the class-specific assessment ratio to determine

Multiplied by the new assessed value.

Class-specific Tax Rates set by the

NYC Council An assessment ratio is the ratio of assessed

Equals value to market value. For example, a 10%

NYC RPT Liability before Abatements assessment ratio means that a property with a

Minus $100,000 market value is assessed at 10% of

RPT Tax Abatements, if applicable this value or $10,000. The RPT statutory tax

Equals rate is applied to the $10,000 to calculate tax

NYC RPT Liability liability.

1-‐2

(1) In the Comparable Sales Approach, the market Under S.7000A, NYC is permitted to set

value of a property is determined based on sales assessment ratios for each of the 4 classes. The

prices of comparable properties that have recently current target assessment ratio for Class 1

been sold. Comparable properties are those with properties is 6% while the ratio for each of Class

characteristics similar to the property being 2, 3 and 4 properties is 45%.

valued, such as location, lot size, square footage,

architectural style, age of the home and property For Classes 1, 2 and 4, when market values

use, especially density of use. increase in any given year, class-specific

restrictions, i.e., caps, imposed by S.7000A and

Dollar adjustments are made for differences subsequent legislation determine how assessment

between the property being valued and the increases are to be phased in.

comparable properties, based on periodic physical

inspections by the City and a Computer Assisted Class 1: Assessment increases are capped at

Mass Appraisal (CAMA) model.6 6% annually and at 20% over any 5-year

period.

The Department of Finance uses the Classes 2 and 4: Assessment increases are

comparable sales approach to estimate the phased in over a 5-year (transition) period

market value of Class 1 properties. with no annual caps except on 4-10 unit rental

buildings and co-op and condo buildings with

10 units or less. For these properties,

(2) In the Income Approach, two techniques are assessment increases are capped at 8%

generally applied to determine market value for annually and at 30% over any 5-year period.

purposes of the RPT. In the first, the estimated Annual taxpayer liability is the lower of the

future net operating income (NOI) of the property transitional or actual values.

being valued is divided by an appropriate Class 3: There are no caps on assessment

capitalization (CAP) rate.7 In the second increases or phase-in requirements.

technique, a multiplier is applied to the gross

income of the property being valued to estimate Real Property Tax Rates. As shown in Figure 1.1,

market value.8 tax liability is calculated by multiplying the

assessed value of a property by its class-specific

The Department of Finance uses the income statutory tax rate established by the City Council

approach to estimate the market value of Class annually. In 2009, these rates were:

2 and Class 4 properties.

Class 1: 16.787%

(3) In the Cost Approach, property valuation is Class 2: 13.053%

generally determined on the basis of the value of Class 3: 12.577%

the land on which the property is sited plus Class 4: 10.612%

reproduction/replacement costs minus

The statutory rates are not, however, the real, i.e.,

depreciation.

effective tax rates (ETR), imposed on property

The Department of Finance uses the cost owners.

approach to estimate the market value of Class

3 properties. The ETR is calculated by dividing the Real

Property Tax liability of a property by its

market value and multiplying by 100.

Assessed Value. Assessment is the process by For a property with a $100,000 market value

which a taxing jurisdiction establishes the assessed and a 10% assessment ratio, taxable value

or taxable value of a property relative to its market would be $10,000. If the statutory RPT rate is

value. The NYC Department of Finance (DOF) 5%, tax liability would be $500. The ETR

determines assessed values for City properties would be 0.5% ($500/$100,000 x 100), far

based on assessment ratios. less than the statutory 5%.

1-‐3

The RPT as the Budget Balancer. As mentioned 1.5 The RPT in Other Jurisdictions

earlier, the NYC Council sets the average City-

wide RPT rate once expenditures and revenues New York and most other states do not levy a tax

from all other sources e.g., aid from NYS have on real property. It is, however, imposed at some

been estimated. When revenues from all other level of government in all 50 states and in the

sources are not sufficient to bring the budget into District of Columbia. Because of different

balance, RPT rates are usually increased. In 2008, assessment practices, statutory property tax rates

the City-wide rate was reduced to $11.66; in 2009 cannot be compared across jurisdictions. What can

it was increased slightly to $11.70. be compared, however, are property tax structures.

Class Shares of the Property Tax. The total City State laws may require or permit local

RPT levy is shared among its 4 property tax governments to structure their property taxes so

classes. Provisions in S.7000A ensured that each that different assessment ratios and/or different

property class would continue to provide the same tax rates are applied to different types of

share of the City’s RPT levy that it contributed in properties. Among the largest cities in each of the

1981. S.7000A also restricted the ability of the 50 states, 16 use market value as their taxable base

City to shift taxes from one class to another by in assessing residential properties (see Exhibit

requiring that taxes be levied in accordance with 1.2). The median assessment ratio for the 50 cities

base proportions, i.e., shares of the RPT pie in is 60%; 2 of the 50 cities have assessment ratios

1981. less than the 6% applied to Class 1 properties in

NYC.

In 1989, State legislation reset the base year for

calculating base proportions to 1991. This meant Due to extreme fiscal stress and the need for

that for each of the City’s 4 property classes its additional revenues, many local governments have

base proportion share of the total tax levy must been re-evaluating their RPT incentive programs.

remain the same as it was in 1991, after Some have begun to charge non-profit institutions

adjustments for new construction, demolitions, for essential services. For example, local

alterations and changes in taxable status. governments in Indiana are imposing fees on them

for police and fire services. Some jurisdictions are

NYS law also prohibits base proportions for each turning taxes into fees which can be levied against

class in any one year from increasing more than otherwise tax exempt organizations.

5% over its base proportion in the previous year.

Any increase that would be in excess over the 5% 1.6 New York City RPT Revenue Trends

in one class must be distributed to the other

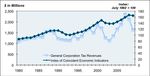

classes. In FY 2009, NYC Real Property Tax revenues

stood at $14.3 billion, a 9.8% increase over the

The NYC Council has sole discretion to $13.1 billion in 2008. Figure 1.2 shows that in

decide how the excess is apportioned among current dollars, property tax revenues have

the remaining classes. increased every year since 2000. In constant

dollars, there has been more fluctuation, with

In several years, the NYS Legislature, at the revenues falling slightly in 2005, 2007, and 2008.

request of the City, has lowered the 5% cap; in

2009, it was reduced to 0% for the third

consecutive year. The impact of the base

proportions requirement and the reducible cap on

the inter-class share of the property tax burden has

been to favor Class 1 properties over the other

three classes.

1-‐4

Figure 1.2: NYC Property Tax Revenues, Current and 1.7 New York City RPT History

Constant 2000 Dollars, 2000-2009

Since the implementation of S.7000A in 1983,

NYC has been operating under a Real Property

Tax system in which different assessment ratios

and tax rates are applied to 4 statutorily defined

property classes. Several changes since 1981 have

been made by the NYS Legislature to modify the

RPT tax law. A description of these changes and

actions taken under NYC local rule are described

in Exhibit 1.3.

Sources: Current Dollars, NYC OMB; Moody’s Economy.com NY

State & Local Government Product Deflator used to convert current

dollars into constant 2000 dollars. 1.8 Issues and Concerns

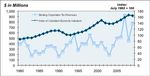

Figure 1.3 shows that constant dollar RPT revenues Preferential Treatment of Class 1 Properties. As

rise and fall within a narrow margin over shown in Table 1.2, in FY 2009, Class 1 properties

relatively long periods of time, indicating that the accounted for 52% of the $811.1 billion market

RPT is a stable tax. Figure 1.3 also shows that value of all properties in the City (excluding fully

RPT revenues are relatively insensitive to exempt properties), but for 10.5% of the City’s

changing economic conditions, as measured by the total billable assessed value. In contrast, Class 4

NY Federal Reserve Board Index of Coincident properties accounted for 22.2% of market value in

Economic Indicators. This means that the tax does the city, but for 47.3% of billable assessed value.

not fluctuate as dramatically as other taxes when Within Class 2, rental buildings accounted for

the economy goes into recession. It also means 7.7% of market value compared with 15.4% of

that when the economy is growing, revenues are billable assessed value.

not as responsive as they are for other taxes.

Table 1.2: NYC Billable Assessed Value,* by Tax Class, FY

Figure 1.3: Constant 2000 Dollar RPT Revenues and Real 2009 ($ in millions)

NYC Economic Growth, 1980-2009

Class Market % of Billable % of

Value Total Assessed Billable

(MV) Market Value Assessed

Value Value

Total $811.1 100.0 $133.0 100.0

Class 1 422.8 52.1 14.0 10.5

Class 2 186.0 22.9 46.5 35.0

Rentals 62.3 7.7 20.5 15.4

Sources: Index of Coincident Economic Indicators, NY Federal

Reserve Board; Moody’s.Com NY State & Local Government Co-ops 35.8 10.1 12.9 9.7

Product Deflator used to convert current $ values from NYC OMB to

constant 2000 dollars. Condos 20.2 2.5 6.4 4.8

Class 3 22.4 2.8 9.6 7.2

Class 4 179.9 22.2 62.9 47.3

*Billable assessed value is the assessed value on which tax liability is

based. For properties in Classes 2 and 4, it is the lower of the actual

or transitional assessed value minus any exemptions.

Source: NYC Department of Finance, Annual Report, NYC Property

Tax FY2009, page 1.

The lower assessment ratios for Class 1 properties,

along with the 6%/20% caps on their assessment

1-‐5

increases, have resulted in their favorable property data from comparable buildings, many of which

tax treatment relative to properties in the other contain rent-controlled or rent-stabilized units. As

three classes. For example, the caps made it a result of applying the income approach using

difficult for the City to take full advantage of the data from comparable rental buildings, co-ops and

run-up in residential property market values earlier condos are assigned market valuations that may

in this decade. bear little relationship to their actual value.

Annual State legislative amendments to the Tax Exemptions and Abatements. As discussed in

adjusted base proportion statutes to reduce the 5% Section 1.3, the total assessed value of exemptions

cap on market value adjustments – made at the and abatements in FY 2009 was almost $11.4

City’s request – have also contributed to the billion. Relief for some taxpayers will result in

preferential treatment of Class 1 properties. higher taxes for others if the City is to meet the

revenue targets needed to balance the budget.

Valuation of Co-ops and Condominiums. Under

NYS Real Property Tax Law, the NYC Non-transparency of the RPT. The RPT is

Department of Finance is required to value a difficult tax to understand with each of its

residential condominiums and cooperatives in four classes having its own assessment ratio,

Class 2 as if they were rental apartments. This tax rate and specific caps on assessment

means that the actual sales prices of co-ops and increases. The City Council’s discretion to adjust

condos cannot be used to determine market value base proportions makes the RPT even less

as is the case with Class 1 residential properties. transparent.

Instead, DOF must base its valuation on income

Endnotes

1

For a summary of events leading up to the adoption of S.7000A see 2006 report issued by the NYC Independent Budget

Office (IBO) http://www.ibo.nyc.ny.us/iboreports/propertytax120506.pdf

2

Outside Manhattan residentially zoned vacant land or land not residentially zoned but adjacent to a parcel improved

with a 1-3 family residence is included in Class 1. If the vacant land is in Manhattan and meets certain other conditions,

alternative requirements apply.

3

For industrial and commercial properties see

http://www.nyc.gov/html/dof/html/property/property_tax_reduc_taxreductions.shtml#individual

For residential property owners see

http://www.nyc.gov/html/dof/html/property/property_tax_reduc_taxreductions.shtml#commercial

4

Information supplied by NYC OMB, May 2009

5

Joe Eckert, Property Appraisal and Assessment of Administration (Chicago, International Association of Assessing

Officers, 1990, 35)

6

Computer Assisted Mass Appraisal (CAMA) is a term to describe software packages used to help taxing jurisdictions

establish market values for property tax calculations.

7

The CAP rate is determined in several ways, including market extraction, band-of-investments or a built-up method.

The NYC Department of Finance uses the band-of-investments approach, which is explained on

http://www.nyc.gov/html/dof/html/pdf/10pdf/income_guidelines_fy11.pdf

8

Gross income multipliers are determined using income and expense statements for a sample of rental properties in each

decile range and the CAP rate to estimate market value. The sample data are used to set the gross income multiplier for

each income band. This approach is explained on

http://www.nyc.gov/html/dof/html/pdf/10pdf/income_guidelines_fy11.pdf

1-‐6

Exhibit 1.1: New York City RPT: Exempt Properties

by Type of Organization and Use of Property*

420(a) Charitable Moral/mental health of

Educational men/women/children

Hospital Religious

420(b) Bar Association Library

Benevolent Medical Society

Bible Missionary

Enforcement of Law Patriotic

relating to children or Public Playground

animals Scientific

Historical Supervised Youth

Infirmary Sportsmanship

446 Cemetery

462 Parsonage Manse

*To be fully exempt from the NYRPT, properties must be in one of the exempt

categories described in Sections 420(a), 420(b), 446 or 462 of the NYS RPT Law.

Source: NYC Department of Finance

Exhibit 1.2: Residential Property Tax Rates, Largest City in each U.S. State, 2008

State/City Statutory Assessment State/City Statutory Assessment

Rate/$100 Ratio Rate/$100 Ratio

AK: Anchorage 1.72 100% MT: Billings 1.86 34%

AL: Birmingham 7.53 10 NC: Charlotte 1.3 82.9

AR: Little Rock 7.05 20 ND: Fargo 45.54 4.4

AZ: Phoenix 8.75 10 NE: Omaha 2.05 96

CA: Los Angeles 1.1 100 NH: Manchester 1.69 98.6

CO: Denver 7.06 8 NJ: Newark 2.6 60

CT: Bridgeport 3.87 70 NM: Albuquerque 4.52 30

DC: District of Col. 0.85 100 NV: Las Vegas 3.27 35

DE: Wilmington 3.38 47.2 NY: New York City* 15.43 6

FL: Jacksonville 1.6 100 OH: Columbus 5.94 33.4

GA: Atlanta 4.1 40 OK: Oklahoma City 10.98 11

HI: Honolulu 0.33 100 OR: Portland 1.95 52.1

IA: Des Moines 4.5 45 PA: Philadelphia 8.26 32

ID: Boise 1.32 100.5 RI: Providence 2.37 100

IL: Chicago 6.72 10 SC: Columbia 26.26 4

KS: Wichita 12.32 11.5 SD: Sioux Falls 1.49 85

KY: Louisville 1.24 100 TN: Memphis 7.47 23.3

LA: New Orleans 12.93 10 TX: Houston 2.52 100

MA: Boston 1.02 100 UT: Salt Lake City 1.19 100

MD: Baltimore 2.27 100 VA: Virginia Beach 0.89 100

ME: Portland 1.77 91 VT: Burlington 1.78 100

MI: Detroit 6.58 32.1 WA: Seattle 0.94 83.4

MN: Minneapolis 1.2 92.5 WI: Milwaukee 2.42 100

MO: Kansas City 6.32 19 WV: Charleston 1.44 60

MS: Jackson 17.16 10 WY: Cheyenne 7.1 9.5

*NYC assessment ratio applies only to Class 1 properties.

. Source: Tax Rates and Tax Burdens in the District of Columbia - A Nationwide Comparison, 2008.

1-‐7

You can also read