DYNAMIC ASIA PACIFIC EQUITY FUND - Benjamin Zhan, MBA, CFA, VP & Portfolio Manager

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

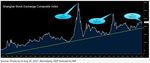

September 8, 2021 DYNAMIC ASIA PACIFIC EQUITY FUND Benjamin Zhan, MBA, CFA, VP & Portfolio Manager I think many of our readers would agree that the past few months have been very difficult for any investor in Asian equities, particularly Chinese stocks. But I think many people may not have realized that what we had experienced was the biggest correction ever for Chinese stocks listed in the U.S., bigger than the trade war and bigger than the pandemic. If history is any guide, the biggest rewards are often born out of biggest crises, and in my opinion, this is one of those moments. Why did things get so bad? Most people would point to the Chinese government’s recent regulatory changes amidst the confrontations with the U.S., but those are not enough to inflict such damage. The real reason is that some Western investors, led by George Soros, were “awakened and shocked“ by the events which unfolded over the past few weeks, and have come to the conclusion that China has started a war against private entrepreneurship, against the free market, and against Western political and economic systems, and as China goes backwards in its economic progress, all those large Chinese companies’ operating models are broken. This thinking triggered a panic among Western investors, and as they rushed to unload their Chinese stocks, Chinese ADRs listed in the U.S. and shares listed in Hong Kong experienced disproportionate pressures. But people like Soros are, in our view, wrong, and have missed two things: 1) the recent events were not a sudden change, but a continuation of China’s structural transformation that began years ago and rotated across different industries. Notable actions in the tech and media industries included those for Tencent gaming in 2018 and Ant Financial in 2020, but it has clearly reached a high note in July this year. And, 2) while many of those actions were labeled as “crackdown” in news headlines, they are very sensible actions suited to China’s unique social and economic environment, and they carry positive long-term implications for the healthy development of Chinese society. In reality those actions are the Chinese government’s responses to the calling of the Chinese society, and there is no need to demonize those events or extrapolate the implications. Ironically, what has Soros and others concerned may well have been well received by the Chinese people and investors inside China, and their trust in the Chinese government is on full display in the Chinese stock market, as a strong contrast to those ADRs in the U.S.

Dynamic Asia Pacific Equity Fund While many people view everything about China from the angle of ideological confrontation and political control, they fail to understand that the Chinese government and the Chinese people have always focused on self-improvement. This time, the government’s goal is to rebalance and enhance China’s long-term economic growth through a push towards “common prosperity”. What is the point of “common prosperity”? People in wealthy and well-balanced economies may have a difficult time appreciating, because, as the chart of the right below shows, income distribution in the U.S. has already formed an ideal olive shape with middle-class families as the stable core. But in China, shown in the left chart, middle-class families are still the minority, and well over 600 million people still in the low-income category. All it takes is a moral judgement and some basic business sense to see that, if the Chinese government manages to move a portion of the 600 million people towards the middle-class, it can become a huge source of self-generated economic growth. To truly appreciate the sheer size of consumption power to be unleashed, we just need to see the massive volume of products purchased by Chinese consumers each year against the supressed price points they are paying now. If the rebalancing efforts successfully boost the consumption capacity of the largest group of Chinese families, our thesis of the potent emergence of Chinese middle-class consumption will finally come to fruition.

Dynamic Asia Pacific Equity Fund This has huge implications for China, but it goes far beyond China. For example, there is a widely held misconception that the tiny group of super wealthy Chinese represent the future for European luxury goods companies, but anyone who knows China would see that aspirational middle-class consumers are the real driving force for this industry, and as such, what China is doing now is a major boost to the sector’s long-term growth. In the end, it is highly questionable if people like Soros actually represent the majority of Western investment community. As shown in the chart below, global investors have continuously shifted assets towards Chinese domestic stock markets, with total investment jumped 5x over the past five years, despite the trade war, tech war, capital market war, and pandemic. There has been no sign of slowdown. For the first 8 months of 2021, the total foreign inflows into Chinese A- shares reached about RMB 177 billion, compared with RMB 200 billion for the entire 2020, a nearly 30% acceleration. The Chinese people, along with many global investors, collectively see one thing: China is going through a major economic transformation, and the recent actions by the Chinese government are not a step backward, but to lay the foundation for further acceleration of this transformation. Yes, some of those actions will have negative impact on specific companies, but

Dynamic Asia Pacific Equity Fund capital doesn’t simply disappear, every dollar out of one space is being injected into other areas, some of which will carry more significant economic benefits. This is not a distraction, but a boost. I believe the sell-off has created a great buying opportunity, and now, some encouraging signs have emerged. As shown in the following chart, Hong Kong’s Hang Seng Index has dipped below the book at the end of August, for the fourth time over the past 30 years. In each of the past 3 times, it marked the bottom of the selloff and heralded the beginning of a period of strong performance in Hang Seng Index. No one can guarantee history can repeat exactly, but for investors with a long view this is a good crisis that should not be wasted. dynamic.ca Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compound total returns including changes in unit values and reinvestment of all distributions does not take into account sales, redemption or option changes or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Views expressed regarding a particular company, security, industry or market sector are the views of the writer and should not be considered an indication of trading intent of any investment funds managed by 1832 Asset Management L.P. These views should not be considered investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.

You can also read