Analysts Eye Real Estate Stocks with a Little more Scepticism

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

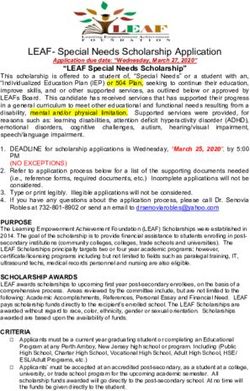

Press Release

Dr. ZitelmannPB. Real Estate Stock Barometer

Analysts Eye Real Estate Stocks with a Little more Scepticism

Berlin, 20 July 2015 – Sentiment vis-à-vis real estate stocks has slightly soured since

the previous poll but remains positive all things considered. That said, residential real

estate stocks recovered some of the ground lost during the first quarter, whereas the

euphoria that companies committed in commercial real estate had inspired during Q1

calmed back down. Short-term upside potential is now associated mainly with

commercial real estate stocks, while the upward price potential identified for residential

real estate stocks is negligible. In the medium term, analysts projected a yet more

favourable outlook for commercial real estate stocks, and even diagnosed a resurgent

upside potential for residential real estate stocks. This is the upshot of the latest Dr.

ZitelmannPB Real Estate Stock Barometer. In the short-term outlook, the score of the

sentiment indicator showed a modest decline from +0.5 to +0.4 points. The

enthusiasm for real estate stocks also softened in the medium term – without

qualifying the persistently favourable sentiment. Since the previous poll, the score

dropped from +0.9 down to +0.7 index points. This means that confidence is on the

same level it showed a year ago, when the poll returned an identical score of +0.7

points.

Fig. 1: Dr. ZitelmannPB Real Estate Stock Barometer, 3-month outlook

-1-Six out of nine analysts interviewed expect that the prices of German real estate

stocks will go up over the next twelve months, whereas three analysts predict flatlining

prices. None of the experts worry about a negative share price performance.

An index score of +2 would suggest that analysts expect to see price increases in

excess of 15% during the next three months (short-term view) or twelve months

(medium-term view). Inversely, a score of -2 would represent markdowns anticipated

at a rate exceeding 15%.

One in three analysts expects share prices to climb between 5% and 15% during the

next three months, and one analyst even considers a price rally by more than 15%

realistic. By contrast, a relative majority (four out of nine analysts) assume that prices

are unlikely to change in the short tem, and one analysts believes they will soften

slightly. As recently as the last survey, 75% of the respondents had anticipated a price

hike.

Fig. 2: Share price performance of German real estate stocks according to the analysts' estimate

-2-Commercial Real Estate Stocks: Euphoria Noticeably Subdued Lately

During the last poll, the sub-index for commercial real estate stocks had soared to a

tall score of 1.3 points. It has since normalised and returned to 0.7 points. This means

that the sentiment remains clearly positive: None of the respondents anticipate price

drops. Then again, only one analyst considers it possible that commercial real estate

stocks could gain by more than 15% in the near future. Four analysts find a modest

price growth for commercial real estate stocks most likely, while another four brace

themselves for a stagnant scenario.

Similarly, expectations for the medium term prospects of commercial real estate

stocks have been reigned in. Here, the indicator slipped from 1.3 to 0.8 points. If

nothing else, though, seven out of nine analysts believe that prices will see slight

upward growth over the next twelve months, the other two assuming that the price

level will remain stable. During the last poll, as many as three analysts had expected

substantial price gains over a twelve-month period.

Fig. 3: Share price performance of German commercial real estate stocks according to the

analysts' estimate

-3-Residential Real Estate Stocks: Not Much Upside Margin Left

Sentiment in regard to residential real estate has improved moderately, continuing the

trend returned by the previous survey. Both in regard to the short- and medium-term

prospects, optimists were in the majority, if by a narrow margin only. The Barometer

score for the short-term outlook perked up minimally from 0.1 to 0.2 points. Two

analysts assume that prices will see moderate growth, four expect them to stagnate,

and two are concerned they will soften. One of the polled experts, though, is convinced

that a price rally is imminent.

The answers returned for the assessment of the medium-term prospects paint a

strikingly similar picture. Here, the Barometer score climbed from 0.1 up to 0.3 points. It

is the same level the sub-index maintained for three quarters running (prior to our most

recent poll in March). Five of the nine analysts foretell minor price gains over the next

twelve months, whereas two believe they will cling to the current level, and another two

experts forecast a slow downward trend for the stock prices.

-4-Fig. 4: Share price performance of German residential real estate stocks according to the

analysts' estimate

The nine analysts interviewed did not seem to agree on the extra question regarding

the chances of an imminent shift in interest rates. Five analysts rejected the notion, but

three others feel the time has come for a trend reversal, and the last respondent could

not say. A relative majority of four analysts stressed the point that the most recent

fluctuations of the Bunds Futures index are perfectly natural given the high level.

Statements by Three out of a Total of Nine Analysts Polled

Helmut Kurz, analyst at Bankhaus Ellwanger & Geiger:

“There is an ongoing transition from a dynamic that is driven by falling interest rates to

a development paced by the actual economic situation. Actual real estate industry

news has become more relevant than the unverifiable notion of a scarcity of

investment opportunities as key motive.

Because of the uncertainty regarding the interest tendency and the ambiguities

associated with the introduction of the rent freeze, the transition to commercial real

estate stocks as favoured type of securities is likely to continue and to result in a

volatile lateral development for real estate stocks overall.

-5-Which securities segment you invest in will decide over your return on investment.”

Ulf van Lengerich, analyst at Solventis AG:

“Residential real estate stock is likely to keep falling. The valuations remain rather

ambitious. The race to outsize each other results in overpriced acquisitions (see

Deutsche Annington/Südewo). This in turn causes the anyway low yield rates to be

diluted even further.”

Thomas Neuhold, analyst at Keplercheuvreux:

“Residential real estate stocks are likely to keep benefiting from structural rental

growth in major conurbations, from cost synergy effects generated by acquisitions,

and from a continued downtrend in borrowing costs.

Especially the market segments addressed by the listed residential real estate

companies (low- and medium-price segments) are likely to see a further increase in

rents and prices in Germany's metro areas because both the rents and the prices

remain far below the level that would make property development a financially

attractive proposition.”

Survey Method:

Dr. ZitelmannPB.'s Real Estate Stock Barometer is the sentiment indicator for

Germany's real estate stock market. Each quarter, Dr. ZitelmannPB. GmbH interviews

leading analysts for German real estate stock as to their estimate of how the real

estate stock market will develop over the next three and twelve months. Respondents

are asked about the likely share price performance of commercial and residential real

estate stock in separate questions. Analysts use a scale of +2 (rising fast) to -2

(declining fast) for their assessments The Barometer maps the average of all analyst

assessments.

This survey saw the participation of analysts from the following financial

institutions:

Bankhaus Lampe, Equinet Bank, Commerzbank, Independent Research, ODDO

Seydler Bank, Bankhaus Ellwanger & Geiger, Drescher & Cie. Immoconsult,

Keplercheuvreux, and Solventis Wertpapierhandelsbank.

Dr. ZitelmannPB. GmbH:

-6-For the past 15 years, Dr. ZitelmannPB. GmbH has been Germany's leading consultancy firm in real

estate, investment fund, and financial market communication. It advises clients inside and outside

Germany on any issue involving strategic communication. Domiciled in Berlin, Dr. ZitelmannPB.

employs 40 advisers in the areas of public relations, investor relations, corporate publishing, and online

positioning. Since September 2013, Dr. ZitelmannPB. has been the official listing partner of Deutsche

Börse. Out of more than 1450 agencies serving the areas of PR and financial communication in

Germany, only twelve are listing partners of the German Stock Exchange.

Your contact for the Dr. ZitelmannPB Real Estate Stock Barometer:

Dr. Alexander Knuppertz

Rankestrasse 17

D-10789 Berlin

T +49 (0)30 – 72 62 76 174

F +49 (0)30 – 72 62 76 163

knuppertz@zitelmann.com

-7-You can also read