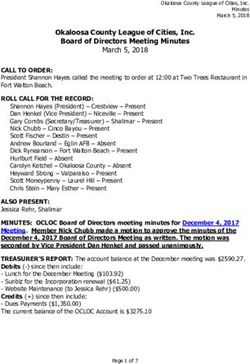

Market Insights: March Quarter 2021 - Assistant Sydney

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Market Insights: March Quarter 2021 The first quarter of 2021 was anticipated by many as it signalled the end to a year prior, that most would rather forget. This time last year, the Australian economy suffered the largest quarterly fall in GDP since the 1930’s. Comparatively, we have now posted the strongest back-to-back quarter growth, since being on record. Job advertisements across ANZ are currently at a twelve-year high. Despite JobKeeper expiring at the end of March, unemployment has continued to decrease f rom 7.5%, to 5.8% to 5.6%. The International Monetary Fund has upgraded its forecasts for the Australian economy, saying it is expected to grow by 4.5% through 2021. In Q1, however, we continued to face issues as a country that we’ve become all too familiar with. Snap lockdowns in both VIC and QLD, amidst easing restrictions in NSW and other states. The timeline on the vaccine rollout is heavily in doubt, and as that has a symbiotic relationship with our international borders, our tourism sector remains under incredible stress. Wage growth remains low, and the gender pay gap remains high. Telling will be the months ahead, as to what consistency we can expect in Australia moving forward. * A full source appendix is available on request for all data referenced in this report, all up to date as per Friday 16th April 2021.

Assistant Sydney Market Insights March Quarter, 2021

The Data

→ According to SEEK.com, total job ads in NSW for

Office Support saw month on month growth

throughout the March quarter. Namely 1.8% in

January, 15% in February and a further 15.9%

in March.

→ The role of an Administration Assistant is currently

the 5th most in demand job type in Australia.

→ According to Indeed.com, the current average

salaries for the below five key Office Support

positions in NSW are as follows (note all figures are

base plus superannuation):

• Executive Assistants $83,378

(5.7% above the national average)

• Personal Assistants $73,056

(5.5% above the national average)

• Office Managers $73,707

(4.6% above the national average)

• Administration Officers $61,297

The Talent Market

(2.3% below the national average)

There was constant speculation leading up to the

• Receptionists $56,151

close of JobKeeper in March, that the wage subsidy

(3.2% above the national average)

was propping up ‘zombie’ businesses in our economy.

→ Interestingly, the majority of Office Support salaries Businesses are closing due to the subsidy ending,

in NSW have dropped by 0.5-2% in the first quarter. however the impact on corporate talent has been

Using the role of a Receptionist as an example, neutral. There has not been a rapid influx of people

in the December quarter the average salary was hitting the job market.

$69,450, much higher than the current NSW

Job ads in ANZ are currently at a level 23% higher than

average. Assistant Sydney suggest that the volatility

experienced pre Covid, and as such competition for

experienced at the most junior and most senior

talent is rife. Application volumes have slowed down

end of the job market, is always going to be more

considerably, yet candidates are feeling optimistic

noticeable. If you reference the case study provided

about moving jobs. We are seeing more and more

in our job seeker section under ‘Behaviour’,

instances of high-quality people securing multiple

you will note this is also the case for senior EA

job offers after only one to two weeks of commencing

remuneration.

their search, with only two to three job applications

→ The national unemployment rate has continued made.

to decrease, recently falling to 5.6%. In March 2021

With our international borders remaining closed,

alone, SEEK recorded the highest number of job

the pain is being felt across industries that are

ads posted in a month, in their 23 year history. This

heavily reliant on foreign workers. This includes our

is coupled with the fact that job advertisements

hospitality, retail, and agricultural sectors. Assistant

across ANZ, are currently at a twelve-year high

Sydney have formed a partnership with Allara

(since November 2008).

Learning, to try and support the shortfall in talent we

have observed in the junior Office Support market.

Typically, a high number of our temporary vacancies

would be filled by seasonal working holiday visa

applicants, who are no longer available. Focusing

on homegrown, local talent pipeline strategies has

become more important now, than ever before.

assistantsydney.com.au | 02Assistant Sydney Market Insights March Quarter, 2021

Who Is Hiring?

According to the National Skills Commission, two of Industries to watch? The Assistant Sydney tip is

the industries that have recently experienced the Fintech and Agritech. The Australian Agritech

largest employment growth is healthcare and social industry is a fast growing sector of the economy that

assistance, up roughly by 250,000 jobs, or 14.2%. is creating skilled jobs, regional hubs of expertise

Property remains to be Australia’s largest employer and significant domestic benefits for large portions

accounting for 1.4 million jobs: this alone is stimulating of everyday Australians. Similarly, we are seeing an

our economy, with investment in large inf rastructure, increasing number of successful start-ups and scale-

residential and commercial projects continuing to ups across the Fintech industry that is driving forward

be a priority at both state and federal level. This is innovative outcomes for consumers and corporates

reflected in the job advertisement data f rom with a particular focus on lending and refinancing.

Jan 2020 to present.

Regional job growth is booming with job ads up by

39.7%, with 24% of new jobs created being in Office

Support. Geographically, every state and territory are

currently experiencing a demand for Office Support

staff and call centre people. Often the first to be let go

as traditionally these roles are not deemed ‘revenue

generating’, it seems the same works in reverse. Office

Support and Call Centre people are in demand.

SEEK Employment Report

Healthcare & Medical

Trades & Services

March 2021

Hospitality & Tourism

320 34.8% m/m

300

9.1% m/m

280

260

8.6% m/m

240

220

200

Index (100-2013 avg)

180

160

140

120

100

80

60

40

20

0

Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-20 Feb-20 Mar-20

* Source: SEEK Employment Report March 2021

assistantsydney.com.au | 03Assistant Sydney Market Insights March Quarter, 2021

Behaviour

Hiring Managers

Companies continue to recruit with an awareness that

workers who are technologically savvy and skilled,

quick learning, and forward thinking are the best

suited to evolve and stay with them over time. In a

study completed by the ABS on over 400 occupations,

it was found that automation and technology is set to

have a further impact on a variety of roles; specifically

on jobs that focus on repetitious tasks that can be

easily copied by automated systems. Due to this,

talent managers are looking for professionals who

embrace new ways of working and are willing to learn

and grow outside of their existing skill-set.

We have seen an uptick in skills testing and

psychological assessments taking place throughout

a recruitment process or as a determination of

offer at close. Assistant Sydney have seen this even Due to the increased demand for talent, high-quality

on temporary hires; we have a number of clients candidates are quickly realising it is now a job seeker

who currently choose to place all prospective temp market and are using this to their advantage to

candidates through a 3-6 minute online behavioural negotiate competitive remuneration offers. This

survey prior to selection for work. They use this awareness is concurrent to the rise in Senior Executive

assessment to understand the candidates working Assistant salaries, which is in part due to the influx

style and determine whether they would integrate of HNWI’s moving back to Australia or choosing our

quickly and efficiently into their current team shores as their preferred home.

environment.

→ Case Study: In the March quarter, Assistant Sydney

Contributing to the above, we do believe is the successfully placed a Senior Executive Assistant in

pressure companies now find themselves under to a position working for a UHNWI who had recently

rebuild their workforces to be high-performing and relocated permanently to Sydney. This position

stable. The significance and emotional attachment to was hybrid in nature, and required a candidate

spending a dollar has heightened, as has sharing time with a mix of senior, corporate Executive Assistant

with another person. Meaning considered decisions experience (ideally in Venture Capital) and private

are being made on investment in people, and cultural in-home PA experience. The requirement for

alignment to teams. This mindset is impacting the the successful candidate to be available, 24-7,

way in which recruitment processes are currently 365 days a year did exist. This person achieved a

being managed, the way a selection is made, and how remuneration offer that exceeded $200,000 on the

a person is onboarded into a business. base, with superannuation and bonus on top.

Due to the current political climate and individuals

Job Seekers that have come forward to share their stories, an

increased awareness is present with respect to

People are looking for flexibility when considering workplaces that support gender equality and safe

new opportunities. Those companies that cannot offer working environments. People want to work for

competitive policies which include flexible start and businesses who operate under a strong ethical

finish times, work from home allowances, and results code of conduct and are willing to play their part in

focused performance assessments are struggling to impacting change for better. Being connected to the

attract tier one candidates. Further, our gig economy purpose and leadership of a company is of significant

continues to grow in Australia, as people realise their importance to many, as awareness grows on the

desire to work from wherever they like, whilst they gender imbalance issues corporate Australia

live, experience and travel. continue to face.

assistantsydney.com.au | 04Assistant Sydney Market Insights March Quarter, 2021

The Office

Contrasting perspectives and continued varying In Australia, the NSW State Government for various

responses f rom different industry sectors has left the departments is looking to mandate a three-day

future of the office still in debate. work week in office. This is supplemented by recent

research from the NSW Innovation and Productivity

Using technology as an example; Salesforce, Facebook

Council, which found that working from home for

and Amazon have all gravitated towards the hybrid

two days per week can be beneficial for productivity

model, working both remotely, and in the office.

and would have positive effects in strengthening

Spotify and Twitter remain entirely flexible, proposing

the economy. With a growth mindset back in action,

complete f reedom for employees. Sundar Pichai, CEO

private sector businesses are also wanting employees

of Google, recently announced their plan to ‘fast track’

to return to the office. As Kylie Rampa, Lendlease

their reopening ahead of schedule.

Property CEO states, “people need interaction,

In the finance sector, Goldman Sachs CEO, David engagement and a sense of collective effort.”

Solomon commented recently on working from home

What do the stats actually show? Office vacancy

– “it’s not a new normal”. Barclays CEO Jes Staley, has

rates in the Sydney CBD remain between 8.6% and

mirrored this sentiment and cited collaboration as a

11.9%. The below graph by the Property Council of

key reason to get their people back into the offices,

NSW reflects the increase in office occupancy across

this being especially important for junior workers.

every major capital city and territory in Australia. Not

The unsustainability of an ongoing work f rom home surprisingly, Melbourne being the most impacted

arrangement, seems to be a concern for the broader state by COVID-19 still has the lowest office

finance industry. occupancy rate, followed by Sydney.

Office Occupancy by CBD

CBD Dec 2020 Jan 2021 Feb 2021 Mar 2021

Melbourne 13% 31% 24% 35%

Sydney 45% 45% 48% 50%

Brisbane 61% 63% 64% 63%

Canberra 65% 68% 65% 65%

Adelaide 68% 69% 69% 71%

Hobart 76% 80% 76% 80%

Perth 77% 66% 65% 71%

Darwin 82% 80% 80% 84%

Source: The Property Council of Australia

assistantsydney.com.au | 05The Sentiment The first quarter of 2021 has mirrored the preceding We hope for consistency from Q2 2021. Increased year in its unpredictability. The million dollar question domestic travel, a continued buoyant property many are asking at the moment, is when can we market, consumer retail spending, a fluid job market, expect the vaccination program to be complete? and of course firmer timeframes on the vaccine Surely until that is finalised, businesses cannot have program should position Australia for a strong close true and complete confidence that our rebuild will not to 2021. The IMF economic growth forecast of 4.5% is a be impacted by cluster outbreaks and mutant strains punchy target, but certainly achievable should we stay breaking f ree of hotel quarantine. on track as we currently are. In saying that, the data is incredibly promising. The unemployment rate and ANZ job advertisements speak for themselves. Not for a long time, has Australia experienced an economic recovery so strong and quick f rom such a severe event. * A full source appendix is available on request for all data referenced in this report, all up to date as per Friday 16th April 2021. Want to know more? Scan this code to contact the Assistant Sydney Director today. We value your feedback, and would love to work with you. © 2021 Assistant Sydney assistantsydney.com.au | 06

You can also read