Card-Linking and O2O Industry Survey 2018 - The CardLinx Association www.cardlinx.org From Online-to-Offline

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Card-Linking

and O2O Industry

www.cardlinx.org

Survey 2018

The CardLinx Association

www.cardlinx.org

From Online-to-OfflineTable of Contents

EXECUTIVE SUMMARY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

KEY FINDINGS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Growth Tipping Point: Majority of Companies See CLO Transactions

Grow More Than 100%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Restaurants, Grocery and Department Stores Lead Online-to-Offline

Marketing Adoption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

What’s Next? Mobile Wallets With Embedded Coupons and Loyalty . . . . . . . . . . 4

Consumers Increasingly Prefer “Cash Back” versus Loyalty Points Rewards. . . . 5

SURVEY RESULTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Card-Linking Transaction Growth Over the Past 12 Months . . . . . . . . . . . . . . . . . 6

Card-Linking Advertising Budget Projection . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

What type of reward do consumers prefer for card-linking? . . . . . . . . . . . . . . . . . 7

Which merchant category is the best fit for card-linking?. . . . . . . . . . . . . . . . . . . . 7

Poised for Consumer Adoption Worldwide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

What feature is most important in the growth of

online-to-offline commerce? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

APPENDIX. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

About the CardLinx Association . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Copyright 2018 All Rights Reserved info@cardlinx.org 2 For more information visit www.cardlinx.orgExecutive Summary

Card-linking refers to the technology enabling the linking of a consumer’s online digital app to

a payment card or mobile wallet used for offline/in-store purchases. Card-linking is one of the

most widely used online-to-offline technologies (“O2O”). Examples include Bank of America’s

Bank Amerideals and Groupon+. This annual research study analyzes global trends in card-

linking and O2O commerce by surveying the world’s largest merchants, technology companies,

card issuers, payment networks and loyalty companies. CardLinx Association members and

survey participants include Microsoft, Rakuten, Samsung Card, Bank of America, Sumitomo

Mitsui Card, Mitsubishi UFJ Nicos, Hilton, AEON, MasterCard, JCB among others.

The 2018 study reveals the accelerating growth of online-to-offline commerce with a majority

of participants reporting over 100% annual growth in card-linked transactions. In addition,

companies report an increased use of O2O card-linking in the travel industry and for cross-

border offers. Mobile wallets are poised as the next large scale technology for O2O digital

coupons and digital loyalty programs.

2018 is also the year that artificial intelligence (AI) applications in card-linking and O2O have

finally achieved some significant scale in certain areas. Key new AI commerce areas include:

personalized ads and offer targeting, card origination, online-to-offline conversion tracking, fraud

detection and new customer services like biometric checkouts and cashier-less registers.

According to a recent McKinsey Global Institute analysis1, four of the top five industries that

derive the most value from deploying AI are also the ones most active in the O2O ecosystem:

travel, retail, automotive and high tech. Cross-border commerce and travel are a frequent focus

in O2O commerce as payment networks, retailers and card-linking technology companies use AI

to provide hyper-personalized offers to drive in-store purchases.

The line between traditional brick-and-mortar retailers and e-commerce companies is

continuing to blur as all retailers use AI, cloud computing and big data analysis for competitive

market advantage. This past year there has been an explosion in the development of AI for

cars ranging from real-time, in-car payments, like the recent Mastercard-SAP partnership

announcement to continued refinement of self-driving cars and corporate drone fleets. For

high tech titans, the pursuit of complete marketing attribution continues unabated, including

Google’s release of their card-linking API.

The card-linking and O2O ecosystem continues to grow and mature into an industry with

limitless opportunities as technological advances like payment-enabled devices, artificial

intelligence and deep learning become more common. Increased consumer data through recent

data portability regulations and consumer preference for opt-in advertising and commerce

platforms are driving the use of machine learning and AI in all aspects of retail.

Further developments of card-linking and O2O will deliver increasingly better offers and retail

experiences.

1. Notes from the AI frontier: Applications and value of deep learning, by Michael Chui, James Manyika, Mehdi Miremadi, Nicolaus

Henke, Rita Chung, Pieter Nel, and Sankalp Malhotra; https://www.mckinsey.com/featured-insights/artificial-intelligence/notes-

from-the-ai-frontier-applications-and-value-of-deep-learning?cid=other-eml-nsl-mgi-mck-oth-1805&hlkid=2d16314dbeb34a7da1

813e2d3f023dff&hctky=9936479&hdpid=5767ad8b-bf52-4971-8322-d74e8537c106; retrieved May 20, 2018.

Copyright 2018 All Rights Reserved info@cardlinx.org 3 For more information visit www.cardlinx.orgKey Findings

GROWTH TIPPING POINT: MAJORITY OF COMPANIES SEE CLO

TRANSACTIONS GROW MORE THAN 100%

For the first time in the history of the survey, the majority of respondents had their card-linked

transactions grow more than 100% in the last year. 62% of respondents across North America,

Asia and Europe experienced at least a doubling in their card-linked offer (CLO) transactions

over the past year. The growth in 2018 also signals how CLO has gone mainstream with very

significant scale. For example in the United States, Japan and the United Kingdom, many of

the top five banks including Bank of America, Sumitomo Mitsui and Barclays have significantly

expanded their online-to-offline digital marketing platforms.

In addition, the proliferation of non-bank “app based” card-linking marketing programs, from

companies including Groupon, Yelp and Uber, drove growth in new online-to-offline channels.

Card-linking’s ability to reach consumers across multiple digital channels is increasingly

enticing chief marketing officers (CMOs) of large merchants to shift digital marketing budget to

this technology.

RESTAURANTS, GROCERY AND DEPARTMENT STORES LEAD

ONLINE-TO-OFFLINE MARKETING ADOPTION

For 2018, the top three merchant categories for card-linking are 1. Restaurants at 30%, 2.

Grocery Stores at 19%, and 3. Department Stores at 17%. These merchant categories benefit

the most from online-to-offline promotions like card-linking because they have a high purchase

frequency and typically require offline fulfillment through a physical store.

One new merchant category made it to the top 4 with significant growth compared to 2017:

Travel Merchants. This growth has been driven by airlines and hotels. These companies are

seeing an increasing proportion of their revenues derived from ancillary services like baggage

fees, room services and cross promotions for non-competitive merchants. These ancillary

services are well suited to new online-to-offline marketing channels like CLO that are more data

driven than traditional marketing channels.

WHAT’S NEXT? MOBILE WALLETS WITH EMBEDDED COUPONS

AND LOYALTY

In 2017, the most promising commerce technology was AI. In 2018, it is “back to the future”

as more than 40% of respondents in both Asia and Europe selected “Mobile Payments with

coupons and loyalty” as the most promising new commerce technology. Asian markets

including China first reached mass consumer scale with mobile wallet offers/coupons on Alipay

and WeChat Pay. These offerings are now poised for broad scale adoption in Europe, North

America, and soon, other markets including Latin America, Africa and Australia/ New Zealand.

Copyright 2018 All Rights Reserved info@cardlinx.org 4 For more information visit www.cardlinx.orgCONSUMERS INCREASINGLY PREFER “CASH BACK” VERSUS

LOYALTY POINTS REWARDS

A cash back discount has always been the highest preference for consumers. However loyalty

points offers have grown in popularity for the prior two years. 2018 reversed that trend

with “Loyalty Points” rewards declining in popularity. Loyalty points offers declined from the

top preference at 16% this year compared to 20% last year. This shift signals an increasing

“cash price” sensitivity for consumers despite a robust consumer spending environment on a

global basis.

Copyright 2018 All Rights Reserved info@cardlinx.org 5 For more information visit www.cardlinx.orgSurvey Results

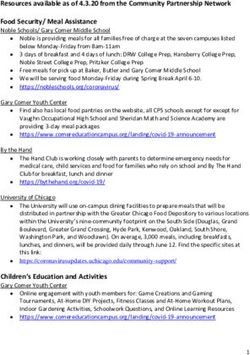

CARD-LINKING TRANSACTION GROWTH OVER THE PAST 12 MONTHS

How much have CLOs grown in the last 12 months?

10% More than 100%

50% to 100%

13%

30% to 50%

5% 10% to 30%

62% 0% to 10%

10%

72% of survey participants responded that the transaction volume for their card-linking programs

has increased more than 50% over the past year. A majority, 62%, saw transactions grow by

more than 100%. This is a first in the history of the CardLinx survey. This result demonstrates the

“mainstreaming” of CLOs in retail marketing. Card-linking’s ability to reach consumers wherever

they are makes this advertising channel a “must have” for chief marketing officers.

CARD-LINKING ADVERTISING BUDGET PROJECTION

2017 2018

Potential Advertising Budget for Card-Linking Potential Advertising Budget for Card-Linking

Over $50 billion $30 to $50 billion Over $50 billion $30 to $50 billion

$10 to $30 billion $1 to $10 billion $10 to $30 billion $1 to $10 billion

According to the Interactive Advertising Bureau2 digital advertising hit $85 billion in 2017.

According to CardLinx survey participants, card-linking has the potential to capture half of

the total global digital advertising market. Card-linking is one of the most broadly used opt-in

marketing channels. As opt-in digital platforms become more dominant, card-linking will also

grow more rapidly.

2. http://adage.com/article/digital/iab-record-breaking-year-digital-ad-revenue/311712/

Copyright 2018 All Rights Reserved info@cardlinx.org 6 For more information visit www.cardlinx.orgWHAT TYPE OF REWARD DO CONSUMERS PREFER FOR CARD-LINKING?

What Reward Type Do Consumers Prefer?

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

“% off” cash back “Fixed doller off” Loyalty program points Buy one, Other

discount cash back discount or bonus points get one free

2018 2017 2016

Consumers continue to prefer cash back discounts when using card-linked offers. This year

survey participants preferred a fixed “Dollar Off” offer to a greater extent. This signals an

increased price sensitivity in 2018 despite strong consumer spending globally.

Loyalty points offers had grown in popularity for the prior two years. 2018 reversed that trend

“Loyalty Points” rewards declining in popularity. As with other questions in the survey, there is a

flattening and diversification of survey responses over time as more industries and retailers use

more varied reward options across card-linking programs.

WHICH MERCHANT CATEGORY IS THE BEST FIT FOR CARD-LINKING?

Which Merchant Category Is Best for Card-LInking?

Other

Travel

Grocery

Clothing/Apparel

Restaurants

Department Stores

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

2016 2017 2018

Legacy card-linking programs are associated with the Restaurant category, thus this category’s

traditional dominance. For 2018, the top three merchant categories for card-linking are 1.

restaurants at 30%, 2. grocery stores at 19%, and 3. department stores at 17%. The top

categories are merchant categories that have high purchase frequency and typically require

offline fulfillment through a physical store.

Copyright 2018 All Rights Reserved info@cardlinx.org 7 For more information visit www.cardlinx.orgOver the past two years, the travel category has surged to from 2% in 2016 to 11% in 2018.

The results of this year’s survey indicates a continued diversification of merchants that use

card-linking.

POISED FOR CONSUMER ADOPTION WORLDWIDE

Europe Asia

Cashier-less Stores

13% 19% 21%

28% Biometric Payments

8%

4%

Card-linking programs

12% embedded in mobile

payment options

10% Peer-to-Peer Payments

41% 44%

Artificial Intelligence

Card-linking is uniquely poised to take off in Europe and Asia as the implementation of GDPR

and Open Banking are leading to greater use of opt-in advertising technologies like card-linking.

Regulators in North America and Asia may follow Europe’s lead by implementing new rules to

drive data portability and enhanced consumer control of data.

In 2018, it is “back to the future” as more than 40% of respondents in both Asia and Europe

selected “Mobile Payments with coupons and loyalty” as the most promising new commerce

technology. Asian markets including China first reached mass consumer scale with mobile wallet

offers/coupons on Alipay and WeChat Pay. These offerings are now poised for broad scale

adoption in Europe, North America, and soon, other markets including Latin America, Africa and

Australia/New Zealand.

41% of European respondents and 44% of survey respondents in Asia said that card-linking

was the next O2O technology to gain widespread consumer adoption. In Europe, new data

monetization models are replacing Facebook and Google “freemium” models as the focus shifts to

opt in models where consumers have greater control of their data and advertising. In Asia, there is

a focus on developing technologies to bring the online shopping experience in-store. The second

most popular response for survey respondents in Asia is cashier-less stores. Companies such as

Alibaba are already beta testing these technologies in China.

Copyright 2018 All Rights Reserved info@cardlinx.org 8 For more information visit www.cardlinx.orgWHAT FEATURE IS MOST IMPORTANT IN THE GROWTH OF

ONLINE-TO-OFFLINE COMMERCE?

Technologies Poised for O2O Growth

60%

50%

40%

30%

20%

10%

0%

a . Industry b . Big data/cloud c . Consumer d . Retail e. Artifical

standards data analysis usage/adoption branding and Intelligence

marketing

2018

We asked “What feature is most important in the growth of online-to-offline commerce?” and 50%

of the survey participants indicated “consumer adoption” was the most important followed by “big

data” and “cloud analysis”. With GDPR and Open Banking initiatives worldwide, consumers are

demanding more control of their data leading to new data monetization models that are replacing

Facebook and Google “freemium” models.

Card-linking has always been an opt-in model, and this transparent usage of consumer data with

consent is part of card-linking’s appeal and continued growth in the US and internationally. All

these components create a virtuous cycle where better targeting, loyalty benefits and personalized

offers through AI and cloud computing along with the consumer opt-in model, has spurred more

consumer usage.

Copyright 2018 All Rights Reserved info@cardlinx.org 9 For more information visit www.cardlinx.orgAppendix

ABOUT THE CARDLINX ASSOCIATION

CardLinx Association is the premier, multi-industry trade association focused on promoting

online-to-offline commerce and card-linking worldwide. On behalf of its members, the

association fosters cross-industry collaboration, develops industry services, organizes executive-

level innovation forums and institutes common standards to minimize and eliminate friction for

purchases. Founding members of the CardLinx Association include Microsoft, Mastercard, Bank

of America, TransUnion and First Data; other current members include: Hilton, FIS, MUFG, UBS,

Sumitomo Mitsui Card Company and Rakuten. Membership in CardLinx Association is open to

financial institutions, publishers, advertisers, merchants, merchant acquirers, payment networks

and fintech companies. Companies interested in joining the association should visit:

www.cardlinx.org

Copyright 2018 All Rights Reserved info@cardlinx.org 10 For more information visit www.cardlinx.orgYou can also read