Santa Cruz Graphite Project - Road To Production in 2022 "Fundamental Value in a Premier Battery Metals Jurisdiction"

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

TSXV: STS | OTCQB: STSBF

Santa Cruz

Graphite Project

Road To Production in 2022

July 2019 Corporate Presentation

“Fundamental Value in a Premier Battery Metals Jurisdiction”

Corporate Presentation: May 2021Cautionary and Forward-Looking Statements

This presentation includes certain statements that constitute “forward-looking statements”, and the extent any forward-looking statements constitute future-oriented financial information or

“forward-looking information” within the meaning of applicable securities laws (“forward- financial outlook, such statements are being provided to describe the current anticipated

looking statements” and “forward-looking information” are collectively referred to as “forward- potential of the Company and readers are cautioned that these statements may not be

looking statements”, unless otherwise stated). These statements appear in a number of places appropriate for any other purpose, including investment decisions. Forward-looking statements

in this presentation and include statements regarding our intent, or the beliefs or current speak only as of the date those statements are made. Except as required by applicable law, we

expectations of our officers and directors. Such forward-looking statements involve known and assume no obligation to update or to publicly announce the results of any change to any

unknown risks and uncertainties that may cause our actual results, performance or forward-looking statement contained or incorporated by reference herein to reflect actual

achievements to be materially different from any future results, performance or achievements results, future events or developments, changes in assumptions or changes in other factors

expressed or implied by such forward-looking statements. When used in this presentation words affecting the forward- looking statements, except as required by law. If we update any one or

such as “believe”, “anticipate”, “estimate”, “project”, “intend”, “expect”, “may”, “will”, “plan”, more forward-looking statements, no inference should be drawn that we will make additional

“should”, “would”, “contemplate”, “possible”, “attempts”, “seeks” and similar expressions are updates with respect to those or other forward-looking statements. You should not place undue

intended to identify these forward-looking statements. Forward-looking statements may relate importance on forward-looking statements and should not rely upon these statements as of any

to the Company’s future outlook and anticipated events or results and may include statements other date. All forward-looking statements contained in this presentation are expressly qualified

regarding the Company’s future financial position, business strategy, budgets, litigation, in their entirety by this cautionary statement.

projected costs, financial results, taxes, plans and objectives. We have based these forward-

looking statements largely on our current expectations and projections about future events and Confidential Material - This document contains confidential and private material that shall not

financial trends affecting the financial condition of our business. These forward-looking be re-transmitted to other parties that not its original addressee. All information contained

statements were derived utilizing numerous assumptions regarding expected growth, results of herein are for informative purposes and shall not be regarded as an offer, solicitation for any

operations, performance and business prospects and opportunities that could cause our actual financial transaction nor a valuation or commitment of financial / technical performance.

results to differ materially from those in the forward looking statements. While the Company

considers these assumptions to be reasonable, based on information currently available, they Cautionary Note: This PEA is considered by STS to meet the requirements of a Preliminary

may prove to be incorrect. Accordingly, you are cautioned not to put undue reliance on these Economic Assessment as defined by Canadian Securities Administrators' National Instrument 43-

forward-looking statements. Forward-looking statements should not be read as a guarantee of 101 ("NI 43-101") Standards of Disclosure for Mineral Projects. The economic analysis contained

future performance or results. in the technical report is based, in part, on Inferred Resources (as defined in NI 43-101) and is

preliminary in nature. Mineral Resources that are not Mineral Reserves do not have

To the extent any forward-looking statements constitute future-oriented financial information demonstrated economic viability. There is no guarantee that all or any part of the Mineral

or financial outlooks, such statements are being provided to describe the current anticipated Resource will be converted into a Mineral Reserve. Inferred Resources are considered too

potential of the Company and readers are cautioned that these statements may not be geologically speculative to have mining and economic considerations applied to them and to be

appropriate for any other purpose, including investment decisions. Forward-looking statements categorized as Mineral Reserves (as defined in NI 43-101). Additional trenching and/or drilling

are based on information available at the time those statements are made and/or will be required to convert Inferred Mineral Resources to Measured or Indicated Mineral

management's good faith belief as of that time with respect to future events, and are subject to Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated

known and unknown risks and uncertainties, including those risks and uncertainties outlined economic viability. There is no certainty that the reserve's development, production and

under “Risk Factors” in our most recent AIF, that could cause actual performance or results to economic forecasts on which the PEA is based will be realized.

differ materially from those expressed in or suggested by the forward-looking statements. To

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 2South Star Mining Highlights

Key Company Highlights

• Management team with proven track record of taking

projects into production & operations in Brazil

• Plant construction planned for H2 2021

• Current market capitalization only 2.5% of project NPV

(pre-financing)

• Strong graphite demand in Brazil: high-tech battery market as

well as steel-making, foundries, lubricants, electronics and

automotive industries

• Graphite uses include: lithium-ion batteries, graphene, fire

resistant insulation and coatings and construction materials

• Two-phased approach to minimize risks and intelligently

allocate capital for shareholder value:

✓ Phase 1 – 5,000tpy Concentrate Pilot Plant

✓ Phase 2 – 25,000tpy Concentrate Plant Industrial US$500 to US$2,500

graphite per tonne

• Low CAPEX (Santa Cruz Graphite Project Advantages

KEY PROJECT HIGHLIGHTS

Santa Cruz project situated

in second largest flake graphite

LARGE &

producing district in the world EXTRA-LARGE “The larger the flake size,

• 14% of global production in 2018 graphite flakes the higher the price!”

GEOLOGY, EXPLORATION & RESOURCES

Large Geologic Upside

of project unexplored Entire

NI 43-101 PFS & updated

Resource Estimate completed

Open-pit deposit within

13,000 ha property

95% land package mineralized according

to Brazilian Mining Authority

Open at depth & along strike

10-15 Drill-ready targets

METALLURGY & PROCESS

Excellent large flake ore Additional tests yielded

Produced quality high purity, battery

Completed bench scale concentrates and Approximately quality products

& 30 tonne pilot plant marketable flake sizes

testing programs

65% of ore

95-99% Cg > 80 Mesh Low impurities & Highly

crystalline structure

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 4STS Share Information

Stock Information as of March 2021

Cap Table (000s)*

Total Outstanding 71,569

Warrants @ $0.055 2,660 (Exp 04/2025)

Warrants @ $0.15 25,465 (Exp 02/2024)

Options @ $0.15 90 (Exp 06/2024)

Options @ $0.30 900 (Exp 05/2022)

Options @ $0.45 600 (Exp 07/2023)

Fully Diluted 101,283

Shares Outstanding 69.97 M

Market Cap @ CAD $0.24 $17.2 M

*Does not include convertible loan expiring in May 2021

“Graphite demand just for battery storage is expected to grow 494% by 2050 to a total demand of 4.6Mt.

That doesn’t even consider growth coming from industrial or other high tech uses like graphene or

expandable. It is one of the principal critical metals that will require the most investment. ”

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 5Corporate Structure

• South Star Battery Metals Corp. is a public company

traded on the Toronto Venture Stock Exchange under South Star Battery

the symbol STS and on the OTCQB under symbol Metals Corp.

STSBF. (TSXV: STS)

• Brasil Graphite Corp. is a wholly owned subsidiary

incorporated in the Cayman Islands. 100%

• Brasil Grafite Mineração Ltda. (“BGSA”) is a is a wholly

owned exploration and development company

focused on developing the Santa Cruz Graphite Project Brasil Grafite Corp.

(“Project”) in the state of Bahia, Brazil.

• BGSA owns 100% of the Santa Cruz Graphite Project. 100%

Brasil Grafite

Mineração Ltda

100%

Santa Cruz

Graphite Project

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 6Leadership Team

BOARD OF DIRECTORS

Dave McMillan

Chairman

Richard Pearce Felipe Alves Eric Allison Dan Wilton Marc Leduc

Exec. Director Exec. Director Exec. Director Indep. Director Indep. Director

MANAGEMENT

Richard Pearce

President & CEO

CHF Capital

Eric Allison Bennett Liu Felipe Alves

Markets

Business Dev. CFO Project Dev.

Investor Relations

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 7Investment Highlights

Phase 1 Construction Ready

Mining Friendly District Open Pit Mining & No Drill & Blast

With 80 + years of graphite production

With Low Strip Ratio

Simple, Proven Flowsheet

Experienced Management & Technology

Proven Mine & Plant Builders

Simple

Operations

Excellent Infrastructure

With gas, electric and excellent logistics

No Tailings Dam

With small environmental footprint

Fully Permitted & Licensed

Ready for Construction

Environmental & mining

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 8Investment Highlights

Phase 1 Derisked

All licenses & Stepping Low OPEX

Proven tested permits are valid into production Low in proven producing

process circuit & up-to-date in phases environmental risk district

MIDDLE

Low Low capital

geological risk intensity

LOW HIGH

PROJECT RISK

Established

utilities and Supply Supply chain Projected increase

infrastructure imbalance diversification In demand

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 9Santa Cruz Graphite Project

Phase 1 Construction Ready

INFRASTRUCTURE COMPETITIVE ADVANTAGES

Excellent Infrastructure

Major port Experienced

Power, gas,

1.3km water all

of Ilheus is

270km away via workforce

from paved within 5km paved federal nearby

highway highways

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 10ESG & Sustainability

ESG & Sustainable Production is part of our Corporate DNA

ENVIRONMENTAL + SOCIAL + GOVERNANCE

✓ Renewable sources provide 80% of ✓ First major industry in the region ✓ Review, evaluate and update

Brazilian energy generation ✓ Committed to responsible, equitable regularly governance policies

✓ Low cost, tax-incentive solar power hiring practices in partnership w/ ✓ 2 Independent Directors

project being studied community/municipality ✓ Executive management primarily

✓ Sustainable tailings management ✓ Phase 1 - 60-65 Est. Direct Jobs lives in Brazil and is on-site and

with filtered tailings/dry stack ✓ Phase 1 – 350 Est. Indirect Jobs hands - on

✓ Effective water management & low ✓ Phase 2 - 120-125 Est Direct Jobs ✓ TSX and OTC listing

freshwater demand with process ✓ Phase 2 – 700 Est. Indirect Jobs ✓ Audited financials

water recirculated ✓ Committed to provide community ✓ Compensation tied to ESG

✓ Waste characterized as inert/non- training & educational opportunities performance

dangerous ✓ Focus on worker safety w/ ✓ Committed to joining key industry

✓ Low strip ratio compensation tied to performance organizations and ESG frameworks

✓ Low vegetation suppression for ✓ Committed to transparency and open ✓ Committed to transparency and

project construction (Global Markets

Projected Large Increase in Graphite Demand

• Brazil has large internal demand for natural graphite (80-90kt/p.a.)

• Graphite has many uses outside of battery metals

• High tech, graphene, military, etc…

• Natural graphite has advantages over synthetic:

• Lower cost

• Smaller environmental impacts

• Easier to scale

• Higher energy density

• Need 10-15 new mines by 2025 to meet 2x

demand

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 12Global Markets

Graphite Demand is in a Perfect Storm

2018 to 2050 For Battery Metals Supply

2050 Demand Kt

Growth % (t)

Aluminum 5,583

Graphite 494%

Lithium 488% Graphite 4,590

Cobalt 460% Nickel 2,268

Indium 231% Copper 1,378

Vanadium 189% Lead 781

Nickel 99% Manganese 694

Silver 56%

Cobalt 644

Neodymium 37%

Lithium 415

Lead 18%

Moly 11% Chromium 366

Aluminum 9% Vanadium 138

Copper 7% Moly 33

Manganese 4% Silver 15

Chromium 1% Neodymium 8

Iron 1%

Titanium 3

Titanium 0%

Indium 1.73

0% 100% 200% 300% 400% 500% 600%

0 1,000 2,000 3,000 4,000 5,000 6,000

Source: 2020 World Bank - Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition 2DS Scenario

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 13Global Battery Market

Brazil - Premier Battery Metals Jurisdictions

• Brazil is largest graphite producer of high-quality graphite outside of China with 80+ years of

continuous production and 3rd most important country in EV Battery Supply Chain.

Graphite Supply 2020 EV Supply Chain Ranking

by Country By Country

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 14Santa Cruz World-Class Flake Sizes

Representative Santa

Cruz Graphite Project Flake Percentage +80 Mesh

Concentrates

Mesh Size (#) Distribution %Cg

30# 4% 95%

50# 32% 95%

80# 27% 97%

140# 17% 97%

-140# 20% 97%

Recovery 88%

+50 mesh with 98% Cg and +99.9% Cg

concentrates were also produced during

testing.

63% of concentrates contained jumbo to large

flakes (+30, +50 and +80 mesh).

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 152019 Santa Cruz Update Resource Estimate*

The 2019 updated Resource Estimate shows strong geologic

potential and continuity of high-quality graphite

mineralization in friable, easily mined, weathered materials.

New areas with at-surface mineralization were discovered,

and the deposit is open both along strike and at depth.

Santa Cruz Graphite

2019 Mineral Resources Update

Summary*

Tonnage C In-situ Graphite

Category

(t) (%) (t)

Measured 3,947,550 2.40 94,740

Indicated 10,955,570 2.25 246,500

Total M&I 14,903,100 2.29 341,240

Inferred 7,911,450 2.32 183,550

* Cautionary Note: This updated resource estimate is considered by STS to meet the requirements of a

resource and reserve estimate technical report as defined by Canadian Securities Administrators' National

Instrument 43-101 ("NI 43-101") Standards of Disclosure for Mineral Projects. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any

part of the Mineral Resource will be converted into a Mineral Reserve. Inferred Resources are considered

too geologically speculative to have mining and economic considerations applied to them and to be

categorized as Mineral Reserves (as defined in NI 43-101). Additional trenching and/or drilling will be

required to convert Inferred Mineral Resources to Measured or Indicated Mineral Resources.

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 162020 Santa Cruz Preliminary

Feasibility Study*

The financial analysis in 2020 PFS shows very favourable and

robust results that highlight the Santa Cruz Project’s advantages in Santa Cruz Graphite

the graphite sector. Mineral Reserves Summary*

Key Financial Results

Mineral In-situ

Post-tax NPV5% US$ 81,200,000 Tonnage Cg

Reserve Graphite

Post-tax all Equity IRR 35% p.a. Estimate

(t) (%) (t)

Post-Tax Free Cash Flow (LOM) US$129M

Proven 3,989,635 2.49 99,340

Payback Period 4 years

Probable 8,318,795 2.35 195,490

Total P&P 12,308,500 2.40 295,400

Key Parameters

Mining Method Open Pit

Process/Metallurgy Milling & Flotation

Life of Mine 12 years

Annual Production (years 1-2): 5,000 t p.a.

Annual Production (year 4-11): 25,000 t p.a

Capital Costs – Phase 1 US$ 7,300,000

Capital Costs – Phase 2 US$ 27,200,000

Avg. Operating Costs(LOM): US$ 396 per tonne of conc.

Avg. Weighted Price: US$ 1287/t

* Cautionary Note: This PFS is considered by STS to meet the requirements of a Preliminary Feasibility Study as defined by Canadian Securities Administrators' National Instrument 43-101 ("NI 43-101") Standards of Disclosure for Mineral Projects. The economic

analysis contained in the technical report is based, in part, on Inferred Resources (as defined in NI 43-101) and is preliminary in nature. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that

all or any part of the Mineral Resource will be converted into a Mineral Reserve. Inferred Resources are considered too geologically speculative to have mining and economic considerations applied to them and to be categorized as Mineral Reserves (as defined

in NI 43-101). Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Measured or Indicated Mineral Resources. There is no certainty that the reserve's development, production and economic forecasts on which the PEA is

based will be realized.

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 17STS Value Proposition

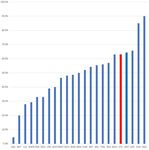

• Currently Undervalued When Compared to Peer Group

Enterprise Value as % of NPV Enterprise

Enterprise

Value

Value

per/ TT of

of Cg

Cg

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 18STS Value Proposition • Low CAPEX and First Quartile OPEX In a District with 80+ Years of Continuous Operations Capital Intensity US$/T of Capacity OPEX US$/T TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 19

STS Value Proposition

• Low CAPEX and High Return on Investments

CAPEX vs IRR (ATAX)

450

ZEN

400

GPH

Net Present Value

350

per Share

300 NOU

MNS

CAPEX - US$M

250 LLG Outstanding: C$2.52

Fully Diluted: C$2.13

200

SRG RNU EGR

FMS

150 WWR

NGC

TON

BEM BKT

100

NEXT GPX

LML

50 VRC STS

-

0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0%

IRR - ATAX

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 20STS Value Proposition

• Compelling Value Proposition with Construction Ready Project

Study Phase Vs. Market Cap

1000

NOU

TLG

Market Cap (Log $M Xchange Currency)

EGR

MNS NEXT

WWR SVM

100 BKT

FMS

GPH WKT BAT

CY GRAT SRG

RNU VRC

NG

LMR CVE HXG

BSM BEM

GEM

10 EGA LION

SJL STS Ph 1&2 STS Ph 1

1

0 TR

1 PEA

2 PFS

3 FS

4 Licensed

5 &

Study Phase Detailed Eng

Market Cap < C$20M C$20M < Market Cap < C$50M C$50M < Market Cap < C$100M Market Cap > C$100M

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 21Why South Star?

Near-term graphite producer with responsible and sustainable production, committed to tangible,

long-term benefits for employees, communities, and stakeholders.

✓ PFS NI43-101 & updated

Santa Cruz Resource Time ✓ Expanding demand in

Project ✓ Pilot plant testing

Brazil

completed

✓ Growing Li-Ion battery

✓ High proportion of large

market

flakes

✓ New markets developing

✓ 1st Quartile OPEX

✓ First production by

✓ Low CAPEX

the end of 2022

✓ Robust economics

✓ Large geological upside

✓ Mining friendly

Brazil jurisdiction Team ✓ Management &

Location ✓ Great infrastructure Directors hold ~25%

✓ Great logistics ✓ Experienced mine

✓ Prolific graphite builders, operators and

producing region financiers

✓ Experienced workforce ✓ Decades of experience

✓ Large internal market for in Brazil

graphite in Brazil ✓ ESG is in our DNA

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 22TSXV: STS | OTCQB: STSBF For more information, please contact: CHF Capital Markets Iryna Zheliasko, Manager Phone: 416 868 1079 x 229 Email: iryna@chfir.com Mr. Dave McMillan, Chairman Email: davemc@telus.net Email: info@southstarbatterymetals.com Web: www.southstarbatterymetals.com Twitter: @southstarbm Facebook: @southstarbatterymetals LinkedIn: @southstarbatterymetals Suite 1200 - 750 West Pender Street R. Barão do Triunfo, 612 – Cj 2210 Vancouver, British Columbia Brooklin Paulista – São Paulo SP Canada, V6C 2T8 Brasil, 04602-002

APPENDIX 1 - PHASE 1 PROJECT DETAILS (5,000 TPY PILOT PLANT) 20 Year Mine Life with Terminal Value TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 24

Path to Production – Macro Schedule

2021 Key Milestones

▪ Secure Offtake/Supply Agreement

▪ Complete Debt/Equity Finance for

Phase 1

▪ Begin Construction within 2-3

months of financing

▪ 10-12 month construction schedule

Santa Cruz Graphite Q1-2020 Q2-2020 Q3-2020 Q4-2020 Q1-2021 Q2-2021 Q3-2021 Q4-2021 Q1-2022 Q2-2022 Q3-2022 Q4-2022

Environmental License 19/02

Mining License GU (ANM)

31/12

Project Financing 31/07

Detailed Engineering 30/06

Community interface/Prep

Go/No Go & Start of Project 31/07

Mobilization & Preconstruction 31/08

Construction 30/06

Commissioning 01/09

Commercial Production 01/09

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 25PHASE 1 – LICENSING & PERMITTING • Environmental Permit Approved for 4 Years • Mining License Approved for 3 Years by ANM on Dec 31, 2020 • Phase 1 Operations are fully licensed • Permits and licenses can be renewed TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 26

PHASE 1 – FUNDING REQUIREMENTS

• US$12-15M Funding Requirement

• US$7M in Debt

• US$8M in Equity

• Uses and Proceeds

• US$10M CAPEX/Commissioning/ Sustaining Capital/Land Acquisition

• US3M Exploration/Phase 2 Licensing & Permitting

• US$2M Corporate Expenses & Working Capital

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 27PHASE 1 – ROBUST FINANCIAL METRICS & POTENTIAL RETURNS

• 12-month Construction Schedule

• Currently Trading at 4% of Phase 1 NPV or 2% of Phase 1+2 NPV

• Target Valuation in 24-36 Months

• C$50M = US$36M

• Conservative Approach to Valuation

• Comparables (6-8x EBITDA)

• 75% Phase 1 NPV or 44% of Phase 1 + 2 NPV

NPV5% US$ 30,9M

NPV5% + Terminal Value US$ 51,8M

IRR 32% p.a.

Cash Flow (LOM) US$62M

Payback Period (From Construction Kickoff) 3.4 years

Mining Method Open Pit

Process/Metallurgy Milling & Flotation

Life of Mine (LOM) 20 years

Annual Production (years 1): 3,000 t p.a.

• Graphite amounts to over 95% of anode

Annual Production (years 2): 5,000 t p.a.

material for commercial battery

Annual Production (year 3-20): 6,000 t p.a

technologies

Capital Costs – Phase 1 US$ 7,300,000

• No substitutes on the horizon

Avg. Operating Costs(LOM): US$ 546 per tonne of conc.

Avg. Weighted Price: US$ 1287/t Source: Benchmark Mineral Intelligence

TSXV: STS | OTCQB: STSBF www.southstarbatterymetals.com 28You can also read