Financial Capability and Well-being in Ireland in 2018 - CCPC.ie

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Financial Well-being Financial well-being is defined in the study as ‘the extent to which someone is able to meet all their current commitments and needs comfortably and has the financial resilience to do so’. Financial Capability Financial capability is defined in the study as ‘the behaviours and approaches to financial decision making that influence someone’s financial well-being’.

Table of Contents 1. Chairperson’s Foreword 4 2. Introduction 6 3. Summary of Key Findings 9 4. Findings at a Glance 12 5. Key Findings 14 6. International Comparisons 26 7. Conclusions and Recommendations 27 8. Technical Appendix 31

Foreword

Unquestionably, many people’s

financial circumstances changed

considerably at that time. From

2008, the recession had a significant

impact on financial well-being in

Ireland and for many people, this

impact continues to be felt. We

commissioned this research to gain an

up-to-date assessment of the levels

I am pleased to present this report, of financial capability and financial

‘Financial Capability and Well-being well-being in Ireland and to draw

in Ireland in 2018’, which summarises out the implications for public policy

the findings of large-scale research and the CCPC’s financial education

conducted earlier this year on behalf programmes.

of the Competition and Consumer

Developing a deeper understanding

Protection Commission (CCPC).

of the current level of financial

Our mission is to use our knowledge capability and well-being among

and statutory powers to promote people in Ireland is crucial, not just for

competition and enhance consumer the CCPC in the performance of our

welfare. We have a specific role role, but also for the large number of

under the Competition and Consumer organisations and individuals, involved

Protection Act 2014 to promote the in education, Government, service

interests of consumers by providing provision and social policy. In this area,

information in relation to the costs, understanding the factors behind the

benefits and risks of financial services current levels of financial capability

as well as promoting the development and well-being, is particularly

of financial education and capability. valuable, as this understanding

enables the CCPC, and others, to

This research focuses on both financial develop responses to the needs of

capability, which is the behaviours particular groups.

and approaches to financial decision

making that influence someone’s The CCPC’s role does not differentiate

financial well-being, and well-being between different types of consumers

itself, which is the extent to which and our programmes are targeted

someone is able to meet all their at everyone. However, the research

current commitments and needs has confirmed, not unexpectedly,

comfortably and has the financial that income and employment

resilience to do so. status are crucially linked to better

financial well-being and for some

The previous large-scale study of consumers, information to promote

this kind was commissioned by the better financial capability is unlikely to

Financial Regulator, which measured provide either help or comfort.

levels of financial capability in 2008.

4Foreword

In these instances, more appropriate research in Ireland, particularly

responses lie in public and social policy Professor Elaine Kempson and

supports. Given that the research Christian Poppe of Consumption

quantifies the level of well-being Research Norway (SIFO), to Amárach

across the population, it is hoped that Research for conducting the survey in

this research will assist not only the Ireland and to the CCPC team. I would

CCPC, but many other organisations, also like to personally express my

particularly those who are tasked gratitude to the survey participants

with providing supports to address across Ireland who gave their time

challenges that sections of society to this research and so generously

face in relation to their financial shared details of their financial habits

capability. and attitudes.

The research shows that a large Finally, particularly in the context of

proportion of people could benefit the many people who continue to

from interventions specifically aimed recover from the financial challenges

at growing their levels of financial arising from the recession, it is my

capability over time. While the hope that the insights from this

average score for the general financial research will help individuals and

well-being of Irish people is 64 out of groups from all sectors, Government,

100, the results clearly show that there the financial services industry, and

is an expected variation in financial the community sector, to develop

well-being across different groups. effective ways to build financial well-

Therefore, certain groups may benefit being for all. I would like to take this

most from certain interventions. opportunity to reaffirm the CCPC’s

The results of the study point to commitment to playing our part, by

particular areas of strategic activity helping consumers make informed

for the CCPC – focusing on children decisions through the information we

and young people, the importance provide and continuing to promote the

of active saving and encouraging development of financial education

financial resilience for retirement. and capability in Ireland.

The methodology used in this research Our work in this area will be

mirrors an evolution in research which underpinned by a number of strategic

is being pursued in other countries. priorities for delivery between 2019

This approach is quickly becoming and 2021.

a global benchmark for studies of

financial well-being. It also, very

valuably, creates a benchmark for

Ireland against other countries that

have followed this same methodology.

I would like to express my thanks Isolde Goggin

to all those who contributed to Chairperson

the development of this important

5Introduction

Introduction Financial well-being is ‘the extent to

which someone is able to meet all

This report presents the key insights their current commitments and needs

and findings from ‘Assessing the comfortably and has the financial

Levels of Financial Capability and resilience to do so’.

Financial Well-being in Ireland’,

a study commissioned by the Financial capability is ‘the behaviours

Competition and Consumer Protection and approaches to financial decision

making that influence someone’s

Commission (CCPC) on the financial

financial well-being’.

well-being of people in Ireland1. The

CCPC commissioned the study from

academics based at Consumption

Background to the study

Research Norway (SIFO), a research Irish consumers face multiple

centre at Oslo Metropolitan decisions and conflicting pressures in

University, who have been pioneering managing their money. The decisions

understanding of financial well- consumers make are influenced by

being on a global basis. Face-to-face their financial capability, and the

survey fieldwork was undertaken and impact of those decisions is seen in

managed by Amárach Research2. their financial well-being.

The CCPC has a statutory function to Yet our understanding of how certain

promote the development of financial financial capabilities determine

education and capability. We fulfil this financial well-being, how these

function by providing information to capabilities vary across the Irish

consumers about financial products population, and what influences them,

and through the provision of financial requires development. A better real

education programmes in the world understanding of these factors

workplace, through our Money Skills enables the design of interventions

for Life programme and through that promote financially capable

schools programmes, including a short behaviours and, ultimately, bring

course that has been designed for the about greater financial well-being

Junior Cycle curriculum. in Ireland.

The aim of the study was to assess The aim of the study was to assess

the levels of financial capability and the levels of financial capability and

financial well-being in Ireland and financial well-being in Ireland, both to

to consider the implications of the inform the CCPC’s work on financial

findings for financial education and education and capability, and to up-

public policy. date our knowledge from an earlier

study, commissioned by the Financial

The definitions of financial well-being Regulator, which measured levels

and financial capability employed in of financial capability in 2008, just

the study are: before the effects of the financial crisis

began to be felt in Ireland3.

1

The study was conducted by Elaine Kempson and Christian Poppe of Consumption Research Norway. It was based on a model which they have designed and that has

been adopted in a number of locations worldwide for studies of financial well-being. The full report is available on www.ccpc.ie. 2The sample size was 1,500. Valid sample

of 1,401 after exclusions. This was a larger sample than in many surveys designed to provide a nationally representative sample size. 3The study, Financial Capability in

Ireland: An Overview, was published in early 2009.

6Introduction

The 2008 survey was based closely create 27 measures of behaviour

on a study designed to measure that covered spending, saving,

financial capability in the UK (Atkinson borrowing, money management and

et al. 2006). Its primary focus was on aspects of financial decision making,

behaviours and measuring levels of including product purchase. There was

financial capability rather than focussing considerable overlap in the subject

on knowledge and skills as in many coverage with the five behaviour

previous studies of financial literacy. domains4 identified in the 2008

survey in Ireland. In the 2008 survey,

In the decade since that report was however, some of the measures of

published, the study of financial making ends meet and all of those

capability has continued to develop relating to planning for the future

and the approach used in such studies were actually measuring outcomes,

has been refined, most notably in whereas in the 2018 questionnaire

a large-scale project involving 12 these are included as measures of

middle- and low-income countries financial well-being.

that was undertaken by the World

Bank (Kempson, Perotti, and Scott

Methodology

2013a, 2013b). This work was further

Financial well-being reflects the

developed with a study carried

ability of consumers to have financial

out in Norway, which built on this

comfort now and into the future, and

methodology and separated out

is strongly influenced by consumers’

the measures of financial capability

financial behaviour and their socio-

(behaviours) and financial well-being

economic circumstances, including

(outcomes of those behaviours), as

income, income and expenditure

well as extending the range of factors

changes, working status, educational

likely to influence them (Kempson,

level, and family circumstances.

Finney, and Poppe 2017).

The study identified three key factors

This current study approach reflects

of financial well-being which inform an

international developments in the

overall measure of financial well-being:

study of financial capability, with a

meeting current commitments, being

broader focus on both capabilities

financially comfortable, and financial

and well-being outcomes, using an

resilience for the future. Those key

approach and questionnaire that was

measures are in turn informed by a

developed in Norway, adapted to the

range of other capabilities. A further

Irish context. The same model has

factor, resilience for retirement, was

also been adapted and employed in

measured separately.

Australia, Canada and New Zealand.

In total, the questionnaire contained The study allocated a score between

over 60 questions covering financial 0 and 100 for each factor of well-

well-being outcomes, retirement being or capability. These scores give

and the range of behaviours, or us a guide to how the Irish population

capabilities, which inform financial is doing now.

well-being. These were used to

Making ends meet; Keeping track of money; Planning ahead; Choosing products and Being and staying informed.

4

7Introduction

To facilitate the study, a face-to-face survey of 1,500 individuals aged 18 to 80

across Ireland was carried out by Amárach Research in January and February 2018.

After exclusions a valid sample of 1,401 was tested in the model developed by SIFO.

This was a larger sample than used in many surveys designed to provide a nationally

representative sample size. The questionnaire contained 60 questions to understand

consumers’ socio-economic circumstances, how they manage their money, how

they plan for the future, their understanding of financial products, and how their

disposition and attitudes affect their financial behaviour. The responses they gave

were analysed using the model developed by SIFO to provide scores for a wide range

of factors influencing financial well-being.

The approach employed (by Kempson and Poppe) focuses on both financial

capabilities (e.g. behaviours) and outcomes (that is, financial well-being). From this, a

conceptual model was built bringing together financial well-being, a range of capable

behaviours, knowledge and experience of financial matters, a range of psychological

factors, as well as socio-economic factors. For the results of the Irish research, the

survey data was first analysed using the statistical approach Principal Components

Analysis (PCA). This approach was used to identify an underlying set of aggregate

components from the answers given to the survey questions. This also allowed a

score to be calculated for each component on a scale of 0 to 100. These components

were used as possible explanatory variables in a series of regression models,

alongside socio-economic factors, such as age and income, to establish which had a

significant effect, first on financial well-being and then on each of the behaviours that

determined it.

Figure 1 Conceptual model 2018

Income

Income Attitudes

drops to money

Active

Expenditure saving

increase General

Spending

Not financial

restraint

borrowing well-being

for daily

expenses

Personality Financial locus

of control

Figure 1 above provides an illustration of the factors that have the biggest effects5 on

financial well-being in Ireland and the key behaviours and other factors that drive it.

5

This diagram is restricted to the factors which were scaled from zero to 100 that had a coefficient of 0.20 or greater, along with the economic factors that had large

effects. It thereby captures the most important factors - though not all factors - that have an influence on financial well-being.

8Summary of

Key Findings

Summary of key findings

The average score for the general financial well-being of Irish people is 64 out of

100. The score suggests that the average consumer in Ireland is doing fairly well but

has limited capacity to deal with unexpected events. The overall score is the average

of the financial well-being scores across four segments of the population which each

received an average financial well-being score. Those scores are calculated from

three sub-measures of financial well-being: meeting current commitments, being

financially comfortable, and financial resilience for the future. The overall score

reflects the range of financial well-being outcomes across consumers in Ireland as,

while there were people doing a lot better than this, there were others with scores

well below the average.

While the overall score is useful in terms of seeing where consumers in Ireland are

overall and for international comparisons, the real value in the study is found by

breaking down the overall results into distinct sub-categories. Targeted actions

can then be developed from this. The research team and the CCPC steering group

identified four categories of relative financial well-being among Irish consumers:

52%

Struggling

Just about coping

25%

16% Doing fine now but with

7% little put by

Secure

Struggling Just about coping Doing fine now, but Secure

7% of respondents were 16% of respondents were with little put by 25% of people can be

in financial difficulty within this category. They A majority, 52%, of regarded as financially

now, had no reserves had an average financial respondents performed ‘secure’ with an average

to protect them against well-being score of just well in terms of meeting score of 87 on the

possible income or 41. People within this current commitments general measure of

expenditure shocks, and category appear to be at and had a positive level financial well-being. Both

those who were yet to risk of falling into financial of financial comfort, but their current financial

retire had very little or difficulties currently, they performed less situation and their

no provision for their as well as having little well in respect of their provision for the future

retirement. This category financial resilience for the financial resilience for was strong, although

had an average score future or for retirement. the future, including for their provision for

of 20. retirement. This category retirement left room for

had an average score improvement.

of 66.

9Summary of

Key Findings

The study finds that the overall Though there is scope for

financial well-being of consumers is improvement, compared to other

influenced by a combination of the countries, Irish consumers perform

amount of money they actually have relatively well on the core behaviours

and how they use and manage that driving financial well-being.

money - in other words, their financial

capability. A particular issue identified in the

study is a lack of spending restraint,

Unsurprisingly, the study found that where scores are significantly lower

income had a strong influence on than in a number of other countries.

financial well-being as did the extent

to which consumers had recently The findings suggest that promoting

encountered drops in their income or improvement in all of the core

increases in their expenditure. behaviours will mean addressing

attitudes to saving, spending and

The study found that two core borrowing. The study also found a

behaviours affect financial well-being strong link between formal financial

across all groups directly: active education and financial well-being.

saving, and not borrowing for

daily expenses. By way of contrast, specific knowledge

of financial products and experience

Other behaviours that had an of money management are less

important, if indirect, influence on important factors in determining

financial well-being include restrained overall well-being.

spending, feeling in control of your

financial situation and general Finally, the study found that Irish

attitudes to saving, spending and consumers have low scores generally

borrowing. when it comes to resilience for

retirement6.

Taking control of household and

personal finances is important for The study assessed resilience for

improved financial well-being. retirement among both consumers

who had yet to retire and those who

Feeling responsible for their financial had already retired. Even among the

actions and outcomes affects the ‘Secure’ category, which achieved the

financial well-being of consumers both highest overall financial well-being

directly and in a number of indirect score, respondents scored an average

ways. The results of the study point of 66 in regard to their resilience for

to the need to promote financially retirement. Among the other three

capable behaviours, not least through categories the scores were lower

financial education. and declined largely in keeping with

declines in overall financial well-being.

6

This under-provision has been recognised as a public policy concern for some time. The Irish Government’s ‘Roadmap for Pensions Reform 2018-2023’ included a

commitment to introduce an Automatic Enrolment pension scheme. In turn the Department of Employment Affairs and Social Protection launched a consultation on the

design of an Automatic Enrolment scheme in August 2018. That scheme is expected to be launched in 2022.

10Summary of

Key Findings

We can compare financial well-being in Ireland with a number of other countries.

Similar studies have been carried out in Norway, Australia, Canada and New Zealand

which employed the same definitions and similar methodology. There are some

positives to take away from making comparisons7.

In terms of overall well-being Ireland’s score of 64 is lower than Norway’s score of 77

and just below the score of 65 in Canada, but higher than Australia and New Zealand

who both scored 59 in a study released in early 20188.

7

Similar definitions of financial capability and financial well-being were employed in Norway, Australia and New Zealand 8 https://bluenotes.anz.com/financialwellbeing

11Findings at a Glance

Findings at a Glance

Financial well-being scores for Ireland

80 61

64 Meeting current

commitments

Being financially

comfortable

Overall financial 52 46

well-being score

for Ireland

E

Financial Financial

resilience for resilience for

the future retirement

Scores for well-being categories

87 66 41 20

Secure Doing fine now, Just about Struggling

but with little coping

put by

12Findings at a Glance

Personal circumstances that affect well-being

BILL

Income Education Employment Expenditure

shocks

Financial education-important Key behaviours

for well-being for well-being

Vs

60% of ‘Secure’ category received Active saving Not borrowing

financial education at school but only for daily

10% of ‘Struggling’ category did expenses

Retirement planning

50% 25%

Vs

50% of ‘Secure’ category auto-en-

rolled in workplace pension v only 25%

of the ‘Doing fine now’ category

13Key Findings

Key Findings This measure captures whether

consumers have the ability to pay bills

1. Compared with their counterparts and other commitments on time and

in other countries, people in Ireland have sufficient money for food and

are doing reasonably well in terms other expenses.

of general financial well-being

but have low levels of financial Less than 15% of the people

resilience for the future, including interviewed said that they were

retirement experiencing payment difficulties.

The average score for the general In contrast, the score for being

financial well-being measure in Ireland financially comfortable was

was 649. This is lower than in Norway considerably lower, at 61.

(77) but higher than in either Australia

or New Zealand (both 59). We explore This showed that a large number of

international comparisons further in people did not have a lot of money

the next section. left over after paying for essentials to

allow them to do the things they want

Four measures of financial well-being or enjoy in life.

were identified, three of which make

up the general measure of well-being. The score for the longer-term

measure of financial resilience for the

The measures were: meeting current future was lower still at 52.

commitments, being financially

comfortable and financial resilience

for the future. Financial resilience

for retirement was the fourth, and

separate, longer term measure.

As might be expected, the mean score

was highest (80) for meeting current

commitments.

9

On a scale from zero to 100.

14Key Findings

This indicates that a large proportion As shown in Figure 2, a quarter of the

of Irish consumers have quite poor Irish population could be considered

provision against financial shocks. financially ‘Secure’ (scoring an

Over half of the people interviewed average of more than 80). The largest

scored 50 or less on this measure. category – half of the population –

were people who were ‘Doing fine

The average score for financial now, but with little put by’ (scoring

resilience for retirement - for those between 50.01 and 80). A sizeable

who were yet to retire - was 4610. minority (16%) could be considered to

be ‘Just about coping’ (they scored

This was lower than the measures of

between 30.01 and 50) with 7% of

general financial well-being, including

the population obviously ‘Struggling’

general resilience for the future11.

financially (with scores of 30 or less)13.

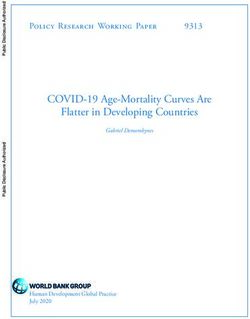

2. Financial well-being varies Figure 2 Overall financial

considerably across various groups well-being

of people

Reflective of Irish society generally,

there was a large degree of variation

around the average scores, with some 7%

people doing very well and regularly

meeting all their current commitments 25% 16%

with a comfortable margin, as well

as being relatively insulated against

future income or expenditure shocks12.

At the opposite end of the spectrum,

others, however, are clearly in financial

difficulty. To explore how financial

capabilities are distributed across the 52%

population, the study assigned people

to one of four categories based on

Struggling

their scores for general financial well-

being. Those categories are: ‘Secure’; Just about coping

‘Doing fine now, but with little put by’,

Doing fine now but with

’Just about coping’, and ‘Struggling’.

little put by

Secure

10

This did not form part of the general financial well-being measure and comparable figures are not available for other countries. 11 Resilience for retirement was assessed

through three measures: the extent to which people would have sufficient income without needing to continue to work; the extent to which the provision they were making

for retirement would be likely to provide sufficient income even without the state pension and the proportion of their total retirement income that they anticipated would be

derived from the state pension. 12 The survey did not ask respondents to detail what was the cause of any drop in income or increase in expenditure. 13 The categories are

comparable with those identified in Australia and New Zealand in a similar study conducted earlier in 2018.

15Key Findings

Over the following pages we Who are they? The oldest of the four

outline the four categories, with categories, with an average age of

more detail about the key factors 53, they are the most affluent with an

that explain their differing levels of average gross income per person of

financial well-being. €52,899 per year. They are the least

likely to have experienced an income

Secure: 25% of respondents are shock or expenditure increase in the

considered to be financially secure, past 12 months. They have the highest

with an average score of 87 for overall levels of education, with 53% holding

financial well-being. a university degree. Almost none are

unemployed or unable to work due to

Both their current financial situation

sickness or disability.

and their provision for the future are

strong. Although generally doing well,

What about the key behaviours?

their provision for retirement left room

Members of the ‘Secure’ category

for improvement.

have the highest levels of financial

They have very high scores for capability. They have a high score

meeting financial commitments (98) for a key positive behaviour with

and financial resilience for the future an average of 83 for active saving.

(85), while their average score for Almost none of them borrow to pay

being financially comfortable was also bills or meet daily living expenses –

very positive (82). 50% have more they have an overall score of 94 for

than 12 months income in savings this measure. They are quite confident

while a further quarter have between about their ability to manage money

6 and 12 months income saved. (73) and take quite a high degree

of personal responsibility for their

Financial resilience for retirement financial decisions and outcomes (74).

among working age members of the

‘Secure’ category is good, but less Did they learn about money when they

positive than other well-being factors. were young? Three quarters of them

Their overall score is 63 – much lower said that their parents had discussed

than their general resilience for the money with them as a child and six

future. While 48% report that they in ten recalled being taught about

would have adequate income in managing money or saving when they

retirement, even without the State were at school or college.

pension, 12% would rely on it entirely

and a further 21% report it would

account for two thirds of their income.

Among those who have adequate

supplementary provision, half have

been automatically enrolled in a

workplace pension.

16Key Findings

Doing fine now, but with little Who are they? This category

put by: By far the largest of the four was most reflective of the overall

categories - 52% of respondents fell population. They have an average age

within this category – they have an of 46 with average gross income per

overall financial well-being score person of €40,100 per year. Few in this

of 66. category have experienced income

shocks or significant expenditure

In regard to meeting financial increases in the past year. They

commitments they are doing well, with are also generally unlikely to be

an average score of 83. However, 45% unemployed or unable to work due

of them report occasionally struggling to sickness or disability. 43% hold a

to pay their bills or meet other university degree.

commitments on time. Compared

to the secure category, they have

What about the key behaviours?

less leeway in their budgets, with an

People in this category scored well on

average score of 63 in terms of being

financial capability, though less well

financially comfortable.

than those in the ‘Secure’ category.

They scored 70 for active saving and,

This category perform less well in

with a score of 86, almost none of

terms of financial resilience for the

them borrow for daily expenses. They

future. Their average score is 51,

are fairly confident in their ability

pointing to a lack of provision against

to manage money (62) and take

financial shocks in future. For example,

a reasonable degree of personal

54% have more than three months’

responsibility for their financial

income in savings, considerably lower

decision making (67).

than the secure category.

Lower still was this category’s score Did they learn about money when

for financial resilience for retirement. they were young? Two thirds of this

In measuring the resilience of those category reported discussing money

yet to retire, the study scored this with their parents as a child, while

category an average of 47, pointing to 52% said they were taught about

major under-provision for retirement managing money or saving when they

among a large segment of Irish were at school or college.

consumers. Only one quarter of

this group report that they would

have sufficient income in retirement

without the State pension. A further

quarter have been automatically

enrolled in a workplace pension. 51%

of respondents are expected to rely

on the State pension for two thirds or

more of their income in retirement.

17Key Findings

Just about coping: Consumers in – €30,969. One in five of them has

this category account for 16% of the experienced a substantial drop in

population. They have an average income in the past 12 months, which

score of 41 for overall financial well- is double the average for all groups in

being and show signs of some strain the study. A quarter have seen their

on their finances. expenditure rise substantially in the

same time period. With an average

Although they have an average age of 43, they are the youngest of the

score of 60 for meeting financial four categories.

commitments, they have little room

for manoeuvre in their finances One in ten of them are unemployed

and scored 41 on average for being – twice the average for all groups in

financially comfortable. Close to a the study. This category contained

third of this category said that it is the highest proportion of part-time

a constant struggle to pay bills on workers (19%) of all the categories.

time and 57% said that they struggle Like those in the “Doing fine now, but

occasionally. 46% said that their with little put by” category, they were

finances do not allow them to do the fairly well-educated with 24% holding

things that they wanted to in their a university degree and 20% holding

leisure time. a further education qualification. Over

50% rent their homes – well above the

In addition, this group has very little national average.

money put aside to cover them

against income or expenditure shocks

What about the key behaviours?

– with an average score of 22 on

People who are ‘Just about coping’

the financial resilience for the future

had much lower levels of financial

measure.

capability than the previous two

categories. They have a particularly

Seven in ten of them (68%) have less

low score for active saving (41)

than a month’s income in savings

although most avoid borrowing to pay

and a further two in ten (20%) have

bills or meet daily living expenses (77).

between one and three months’

They are not particularly confident

income put by.

about their abilities to manage money

They had a low score for financial (54) and take a moderate degree

resilience in retirement (30). 72% said of personal responsibility for their

that they would not have an adequate financial decisions and outcomes (60).

income in retirement without the

State pension, which would make up Did they learn about money when

all of their retirement income for a they were young? Half of this category

third of people (32%) in this category. (52%) said that their parents had

12% were automatically enrolled in a discussed money with them when they

workplace pension. were young, and 44% recalled being

taught about managing money or

Who are they? This category has saving when they were at school

below-average gross annual incomes or college.

18Key Findings

Struggling: About 7% of consumers Who are they? These consumers

are struggling financially. They have have gross average annual incomes

an average score for overall financial of €23,878 – less than half that of the

well-being of 20 and consistently low ‘Secure’ category. Further comparison

scores across all the more detailed to the ‘Secure’ category shows that

measures. they are eight times more likely to

have experienced a substantial

They have a score of 39 for meeting income drop in the past year and

financial commitments indicating four times as likely to have had a

that they are in financial difficulty. substantial expenditure rise.

Three quarters said it was a constant

struggle to pay bills and meet their They have an average age of 44, one

financial commitments on time, while a third are unemployed and a further

further quarter state that they struggle 8% are unable to work due to illness or

from time to time. With an average disability. They have the lowest levels

score of 6 for financial resilience of education, with 50% having been

for the future they have essentially educated to Junior Certificate

no protection against income or or below. Half of this category rent

expenditure shocks. 94% of this their home.

category have less than one month’s

income in savings, and most of the rest What about the key behaviours?

have less than three months. Members of this category have the

lowest levels of financial capability

They have almost no leeway in

across the board. They have an

their budget as demonstrated by

average score of 30 for active saving

their average score of 18 for being

and while scoring 74 for not borrowing

financially comfortable. In fact, 89% of

for daily expenses, this was the lowest

respondents said that their financial

overall score for that indicator.

situation did not allow them to do the

things they wanted in their leisure time. People in the ‘Struggling’ category

have low levels of confidence in their

When it came to financial resilience

ability to manage money (47) and

for retirement, they have an average

tend to feel a low degree of personal

score of 17, with hardly any of the

responsibility for their financial

respondents of working age saying

decisions (51).

that they would have an adequate

income in retirement without the

Did they learn about money when

State pension. In fact, 55% said that

they were young? 38% recalled

all of their income in retirement would

discussing money with their parents

come from the State pension while a

as children, while little more than one

further 27% estimated that it would

in ten reported being taught about

contribute at least two thirds of their

managing money or saving when they

total retirement income. Just 8% of

were at school or college.

this category have been automatically

enrolled in a workplace pension.

19Key Findings

Figure 3 Financial well-being scores at a glance

100

90

80

70

60

50 98

83 82 85

40

30 60 63 63

51

47

20 39 41

30

10 22

18 17

6

0

Struggling Just about coping Doing fine now but Secure

with little put by

Meeting Financial Commitments Financial Resilience for the Future

Being Financially Comfortable Financial Resilience for Retirement

3. Socio-economic factors have a crucial influence on financial well-being

The study assessed the effect of a wide range of socio-demographic and economic

characteristics which included age, gender, family circumstances, income, changes

to income and expenditure, economic activity status, educational level, housing

tenure and geographical area. The model employed in the study identified the

independent effect of each factor after holding all the others constant. This allowed

for the identification of those characteristics that directly influence financial well-

being. The study identified correlations in the analysis. The initial regression models

used included a very large number of variables and as such it was possible to rule

out some alternative explanations for the correlations found - and equally identify

evidence that supports the explanations that were put forward.

The study bears out what would be intuitively assumed; namely that higher incomes,

more stable working lives, having responsibility for household finances, as well as

your own, and higher educational attainment are all associated with higher financial

well-being.

However, only people in the ‘Secure’ category have positive scores for resilience

for the future, implying an ability to deal better with income shocks or expenditure

increases. Unsurprisingly lower scores across all measures of financial well-being are

also strongly associated with economic factors, including income level and experience

of either a substantial income fall or a substantial increase in household expenses.

People with the lowest scores included those who are unemployed or unable to work

through sickness or disability. Another group with low scores are part-time workers.

20Key Findings

Overall, socio-demographic factors are not nearly as important as economic factors.

However, as shown in Figure 4, the study found a strong association with education,

with those educated to Junior Certificate level or below at particular risk of having

low financial well-being. In addition, renters also stood out as having much lower

scores than home owners, particularly those that owned their home outright.

Figure 4 Percentage of consumers in each segment who are tenants or educated to

Junior Certificate.

60

50

40

30

54% 53%

50%

20

32% 32%

26%

10

17% 20%

11% 15%

0

Struggling Just about Doing fine Secure All

coping now but with

little put by

Tenant Junior Certificate

21Key Findings

4. Behaviours have an important fifth of the population either cannot or

impact on financial well-being does not save. As would be expected,

income levels and employment status

The study found that financial well-

have an important influence on the

being is influenced by a combination

ability of consumers to save. Other

of the money people have, how they

factors influencing active saving

use and manage that money and

included whether consumers had been

their inclination to save and to avoid

educated beyond Junior Certificate

borrowing for daily expenses. Key

and whether they managed household

behaviours such as active saving,

finances or just their own. Higher

not borrowing for daily expenses and

educational qualifications and having

restrained consumer borrowing all

responsibility for household finances

have a direct effect on financial well-

had a positive effect on active saving.

being – with the first two having an

effect across all three factors of well-

The biggest behavioural influence

being: meeting current commitments,

on active saving, in turn, is the ability

being financially comfortable and

of consumers to exercise spending

financial resilience for the future.

restraint, while making informed

decisions also has a substantial effect.

Restrained consumer borrowing has

an important effect on the ability

Feeling in control of your finances

of people to meet their current

also has a large influence on active

commitments but is less important for

saving15. This measures whether

having financial comfort or in terms of

consumers feel personally responsible

financial resilience. As shown on the

for their financial situation or not, and

next page, the key behaviours are in

as such whether it is to a greater or

turn influenced by other behaviours.

lesser extent outside of their control.

Unsurprisingly, income level and

5. Being an active saver makes a work status are directly related to

big difference the extent to which consumers feel

The study found that people in Ireland they have such control. The study

are moderately good savers, with found that believing that you are

a score of 68, particularly when responsible for your finances leads

compared with other countries. The to more active saving behaviour. In

Norwegian score for active saving addition, attitudes to saving, spending

was 75, while in Australia the score and borrowing, as measured in the

was 63 and in New Zealand lower still study, have a strong influence on the

at 60 (see section on International likelihood of consumers to save.

Comparisons). As recorded in Central

Bank of Ireland statistics, Irish

households have been gradually

building up their savings over the past

three and a half years14. However, one

(https://www.centralbank.ie/docs/default-source/statistics/data-and-analysis/credit-and-banking-statistics/private-household-credit-and-deposits/trends-in-

14

personal-credit-and-deposits-june-2018.pdf?sfvrsn=9). 15 This is measured in the study as ‘locus of control’.

22Key Findings

Thinking about finances with a long term view is likely to incline someone to be an

active saver. Finally, being taught about money both at school and by parents or

guardians had a positive effect on saving capability. This is an important finding for

the work of the CCPC.

6. Most people do not borrow for daily expenses

The overall score for not borrowing for daily expenses (86) was very positive, and

this was a trend across all four categories of consumers. It means that most people

rarely use credit to pay for food or other daily essentials, and nor do they borrow

to pay off debts or rely on their overdraft facility. People who managed both the

household finances and their own money are less likely to borrow for daily expenses.

A small minority of consumers, however, have low scores for this factor indicating

that they are in a particularly tight financial situation. However, income levels are less

important in explaining this than drops in income or sudden expenditure increases.

The study found overlapping influences on whether consumers borrowed for daily

expenses or not. As might have been expected, exercising spending restraint,

consumer attitudes to spending, saving and borrowing, and feeling in control of their

finances are the key drivers for this behaviour. On the other hand, financial education

seemed to have little or no effect in this area, unlike in relation to active saving.

The spread of these key behaviours across categories of consumers is shown in

Figure 5.

Figure 5 Average scores for the key behaviours across each segment.

100

90

80

70

60

50

94

86 83 86

40

74 77

70 68

30

51

20

33

10

0

Struggling Just about Doing fine Secure All

coping now but with

little put by

Active Saving Not Borrowing for Daily Expenses

23Key Findings

7. Knowledge and experience helps, managing their money and felt a high

but it is not as important as sense of control of their personal

behaviour finances. They also were the most

likely to report receiving financial

One area in which knowledge and

education at school.

experience has an influence is on

restrained consumer borrowing.

Better knowledge of money 9. Overall provision for retirement

management and experience of is poor

managing money and using financial The study measured provision for

products makes people less likely to retirement separately to the other

borrow for consumption – but the indicators of well-being. It found that

effects are quite small. Again, this is provision both for people who are

separate to the important effect that below retirement age and for those

financial education more broadly has who have already retired is poor

on financial well-being. overall (see Figure 6). With an overall

average score of 46 this was lower

8. Some people have consistently high than the scores for general resilience

levels of financial well-being for the future. This means that while

Irish consumers generally have

As we have seen, income has a strong

provision for a rainy day, their longer

effect on financial well-being, as do

term prospects in retirement are not

a range of other socio-economic

so good.

factors. The study shows, however,

that it is the interaction of factors such

A number of reasons for this

as income and housing tenure with

stand out. A substantial number

behaviours that have a positive effect

of respondents to the survey have

that lead to greater financial well-

low supplementary provision for

being. The ‘Secure’ category, which

retirement beyond the State pension

has the highest average financial

(47% of people yet to retire have

well-being, also has the highest

made no provision beyond the State

average income, the highest levels of

pension). Even among those who

education of the four categories and

are already retired and who have a

was typically older than the average.

supplementary pension, the financial

They meet current commitments with

outcomes for many have been

ease and have a high level of financial

underwhelming.

comfort.

Their resilience for the future is

also substantial. They typically

have positive scores for retirement

resilience but less so than their score

for general resilience for the future.

They tended to be confident about

24Key Findings

A wide range of factors influence whether people have resilience for retirement,

ranging from income and work status to educational attainment and housing tenure.

There were also regional disparities, with residents of Dublin having a higher level of

resilience for retirement than the national average. The prevalence of employers with

workplace pension schemes (particularly the public sector) in the Dublin area may

account for much of this.

Being an active saver also has a positive effect on pension provision. The study

found a strong link between better pension outcomes and having been automatically

enrolled in a workplace pension scheme. In particular auto-enrolment had a large

positive effect. Simply having the option of enrolling in a workplace pension scheme

was not enough, the study found it is better if consumers have to consciously ‘opt out’

rather than placing the expectation on them to ‘opt in’ to workplace pensions.

Figure 6 Average scores for resilience for retirement among the non-retired population.

70

60

50

40

30

63

48 46

20

30

10

17

0

Struggling Just about Doing fine Secure All

coping now but with

little put by

25International

Comparisons

International Comparisons Even though the Irish scores are lower

than the Norwegian scores, compared

How does financial well-being in with Australians and New Zealanders,

Ireland compare with other countries? Irish consumers do not do too badly

on these core capabilities.

Similar studies have been carried out

in Norway, Australia, Canada and The one exception relates to a lack of

New Zealand and there are some spending restraint, where the average

positives to take away from making score (67) is lower than in Norway (71),

comparisons. indicating a lower level of spending

restraint in Ireland but also lower

In terms of overall financial well-being

than in Australia and New Zealand too

Ireland’s score of 64 is lower than

(both 74).

Norway’s score of 77 and Canada’s

score of 65 but higher than Australia Irish consumers had positive scores for

and New Zealand who both scored active saving (68) and not borrowing

59 in a study released in early 201816. for daily expenses (86), with only

In terms of the sub-measures of Norwegian consumers scoring better.

well-being, Ireland performed better

than Australia or New Zealand but The Norwegian score for active saving

underperformed compared to Canada was 75, in Canada the score was 68,

and Norway. while in Australia the score was 63

and in New Zealand lower still at 60.

Irish consumers performed well for However regarding spending restraint

meeting financial commitments, and having financial confidence, Irish

scoring an average of 80. Norwegian consumers scored lower than their

consumers scored an average of 91, counterparts in the other countries.

Canadians scored 81, in Australia the In respect to feeling personally

score was 70, while New Zealanders responsible for your financial situation

scored 72. For being financially Irish consumers scored better than

comfortable the scores ranged from Australians and New Zealanders but

70 (Norway) to 61 (Ireland), and lower than Norwegians17.

down to 55 (Australia) and 54 (New

Zealand). Finally, financial resilience There was no equivalent data relating

for the future was an area where to resilience for retirement in any

Irish scores (52) were equivalent to of those countries and as such no

Australians (53) and New Zealanders comparisons are possible.

(52). Norwegian consumers by

contrast scored an average of 73

while Canadians scored 60.

16

https://bluenotes.anz.com/financialwellbeing. 17 Spending restraint: Ireland (67), Norway (71), Australia (74), New Zealand (74). Financial confidence: Ireland (62), Norway

(71), Australia (65), New Zealand (66). Locus of control: Ireland (67), Norway (71), Australia (61), New Zealand (61).

26Conclusions

Conclusions and and discuss the findings and their

Recommendations implications. The study has established

that a number of factors impact on

This is the first study that gives an

financial well-being. Naturally some

insight into both financial capability

of these relate to income levels and,

and well-being in Ireland. It provides

for some consumers, information to

both the CCPC and other stakeholders

promote better financial capability

with valuable insights and further

is unlikely to provide either comfort

provides suggestions for how the

or help. In these instances more

financial well-being of consumers in

appropriate responses lie in public and

Ireland could be improved through a

social policy supports. Having said that,

range of actions.

if one considers the longer term, the

The CCPC’s statutory functions report suggests that a lower proportion

empower us to promote and of consumers may find themselves

protect the interests and welfare of in financial difficulty if interventions

consumers18, as well as entrusting are made, particularly at an early

us with a specific role in providing age. While financial education is by

information in relation to financial no means a panacea which can solve

services, and promoting the broad income disparities in society, it

development of financial education has a valuable part to play in a wider

and capability19. The authors of the series of overall State supports.

study identified a number of key

areas that they believe require future Financial education initiatives

attention, whether by the CCPC, or Since its establishment in 2014, the

other organisations. In that regard CCPC has focussed on delivering

the CCPC has developed a number three core programmes of financial

of strategic priorities for delivery education: Money Skills for Life,

between 2019 and 2021. We deal here Money Matters and Money Counts.

with areas within the CCPC’s remit. In commissioning a study on financial

capability and well-being, the

However, we suggest that other

CCPC was motivated by a wish to

stakeholders could usefully consider

understand more fully the role that

the findings of the study to inform their

financial education can play, and

own activities in promoting financial

crucially, what we should focus on to

well-being, including in consideration

support the financial well-being of

of reform of the pensions framework

people in Ireland. Our objective is that

and support for the most financially

these programmes and the financial

vulnerable. The findings should also

information that we provide have

prove useful to those involved in

a tangible benefit. To that end it is

the provision of financial education

essential that we understand what

initiatives. The CCPC will proactively

will be most effective and select the

engage with stakeholders in the

most important areas to focus our

financial education sphere to share

efforts on.

18

Competition and Consumer Protection Act 2014, Section 10(1)(b) 19 Competition and Consumer Protection Act 2014, Section 10(3)(j)

27Conclusions

Building on the findings of the study, This study provides further evidence

the CCPC will review and revise the that the overall policy objective of

materials and supports that we automatic enrolment is correctly

provide for financial education. In targeted and can be expected to have

addition, the CCPC has identified a positive effect on the resilience for

specific strategic themes for its retirement of Irish consumers. The

financial education work to ensure CCPC will contribute positively through

that efforts are focussed on particular our advocacy work to the pension

objectives that take account of the reform agenda, as well as fulfilling

study’s findings and seek to influence its statutory mandate as it relates to

children at an early age. information and education regarding

pensions.

Policy initiatives

Active saving

In fulfilling our statutory role to

promote and protect the interests and The study has found however that

welfare of consumers, the CCPC works for many consumers in Ireland,

to influence public debate and policy their financial well-being could and

development, promoting competition would be improved through two key

and highlighting the interests of behaviours: active saving and not

consumers20. The study contains borrowing for daily expenses. The

valuable findings to support this crucial question arising is ‘what can be

work. Specific themes emerge in the done to influence those behaviours?’

study that point to an opportunity for and in many cases, the ability of

the CCPC to seek to influence policy consumers to save and/or not

development. borrow for daily expenses is limited

by their income. Such matters point

Resilience for retirement to public and social policy supports.

However, initiatives that support the

The study makes the strong

development of active saving will be

observation that automatic enrolment

supported by the CCPC. In addition,

in a workplace pension scheme

there are also obvious learnings for

is a decisive factor in increasing

our financial education programmes.

consumers’ levels of resilience for their

retirement. Simply having the option

Financial confidence is important, and

of enrolling in a workplace scheme is

financial education can help

not sufficient on its own. The CCPC

is aware that a core objective of the There was also a clear link between

Government’s Roadmap for Pensions higher financial well-being and

Reform 2018 – 2023 is to introduce engagement with financial services

a system of automatic enrolment to – and therefore financial inclusion -

increase the levels of supplementary even when other factors were taken

retirement savings coverage. into account.

20

CCPC Strategy Statement 2018-2020, Strategic Goal 3

28Conclusions

Promoting greater engagement with financial services would clearly have a beneficial

effect on all measures of financial well-being. However, specific aspects of knowledge

and experience were not as important21. For consumers, having confidence in their

ability to deal with different aspects of money management and decision-making,

and accepting personal responsibility for their finances, were also significant. Also

important, was the positive effect of having received financial education at school. All

these findings point to the benefits of the provision of financial education in the school

system and the CCPC will work to advocate for this.

By way of illustration, among other things the study tested for were whether consumers’ understanding of risk, knowledge of money management or experience of

21

money management had effects on their well-being.

29You can also read