GLOBAL ENDOWMENT - Discovery

←

→

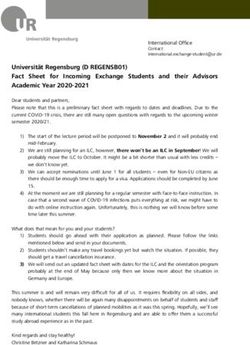

Page content transcription

If your browser does not render page correctly, please read the page content below

CONTENTS

AT A DECIDING HOW WHY THE INVESTMENT

GLANCE TO INVEST DISCOVERY CHOICES

GLOBAL

ENDOWMENT?

SMART FEES ON YOUR OTHER GLOBAL

VERIFICATION INVESTMENT INVESTMENT

PLANSAT A GLANCE

INVEST BELOW THE PREVAILING EXCHANGE RATE

The Global Endowment provides

you with a simple solution You could qualify for an enhanced exchange rate depending

on your investment choices and term of investment.

to hold international assets.

It allows you to invest below the

prevailing exchange rate and FLEXIBILITY AND TRUST FEATURES

offers you maximum efficiency

through the most optimal You can nominate multiple owners and beneficiaries.

You can also nominate a sub-trust in the Discovery Life

tax and estate structuring,

Purpose Trust as a beneficiary for proceeds.

investment liquidity and cost-

effective international

trust options. ACCESS TO YOUR INVESTMENT

Each plan has 100 contracts. You can make multiple

INVESTMENT TYPE withdrawals, subject to regulatory restrictions.

Guernsey-linked life plan with easy

tax administration in USD.

ACCESS TO A WIDE RANGE OF INVESTMENT CHOICES

INVESTMENT TERM Our wide range of investment choices allows you to

structure a global investment portfolio that suits your needs.

Medium to long term

Our managed solutions leverage the expertise of the biggest

and best international asset managers, offering choice

between risk-profiled portfolios with allocations managed by

MINIMUM INVESTMENT

BlackRock and share portfolios with allocations advised by

AMOUNT

Goldman Sachs.

USD 25 000;

EUR 22 000;

GBP 20 000; or

ZAR 375 000

SIMPLE DIGITAL ONBOARDING

Hassle-free direct international investing through the use

of smart verification.

View provider disclaimers

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserDECIDING HOW TO INVEST

You can make your

contribution in US dollars (USD),

British pounds (GBP) euros (EUR) MINIMUM INVESTMENT AMOUNT

or rands (ZAR). The minimum investment amount per currency is as follows:

USD 25 000

GBP 20 000

EUR 22 000

ZAR 375 000

LOCAL MONEY

You can make your lump-sum contribution in ZAR. If you invest

in qualifying investment choices, you could qualify to invest below

the prevailing exchange rate with the currency enhancer.

MONEY IN OTHER COUNTRIES AND CURRENCIES

If you already have money or investments abroad, you can move it

into this investment. If you invest in qualifying investment choices,

you could still qualify for an enhancement from the currency

enhancer.

MONEY FROM AN EXISTING LOCAL ENDOWMENT

If you have a qualifying local Discovery lump-sum Endowment Plan,

you can choose to convert your investment to a Global Endowment

on your boost payment date, instead of getting your local boost.

If you do this, you may qualify for an even greater enhancement

through the currency enhancer at the time of conversion.

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserWHY THE DISCOVERY

GLOBAL ENDOWMENT?

FLEXIBILITY THROUGH MULTIPLE OWNERS

INVEST BELOW THE PREVAILING EXCHANGE RATE

AND BENEFICIARIES

When you convert your rands into another currency,

the currency enhancer is designed to let you he Global Endowment may be owned by multiple

T

effectively do the conversion at a better exchange owners and multiple beneficiaries and types of

rate than what is available in the market. beneficiaries can be nominated, which allows for

the investment proceeds to pass to the beneficiaries

without the need for international probate.

If you are invested in the latest version

of our local lump-sum Endowment

TAX EFFICIENCY

(launched in February 2020), you can

choose to convert your investment to

We take care of the tax administration (calculation,

a Global Endowment on your boost

collection and payment to SARS) on your behalf,

payment date, instead of receiving your

which makes the tax process much simpler. Taxation

local boost. If you do this, you will get an on endowments may also result in lower tax for

even greater currency enhancement investors with higher marginal tax rates.

at the time of conversion.

ACCESS TO YOUR INVESTMENT

ESTATE PLANNING AND INTERNATIONAL Each plan has 100 contracts, which allows multiple

TRUST ADVANTAGES withdrawal possibilities during the initial five-year

period, and unlimited withdrawals thereafter.

Your investment forms part of your South African

estate, and therefore it avoids the complications

which could arise from having part of an estate MULTIPLE CURRENCIES AND A WIDE RANGE

located in another country. You can also get access OF INVESTMENT CHOICES

to an international trust at a cost-effective price, and

get a refund of up to 50% of the annual trust fee You can make your contribution in US dollars (USD),

after five years. British pounds (GBP) euros (EUR) or rands (ZAR), and

choose from a wide range of investment choices.

You can also switch seamlessly between investment

choices and completely customise your portfolio for

your own specific requirements.

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserINVESTMENT CHOICES

Our wide range of investment choices allows you to structure a global investment portfolio that suits your needs. The range

of investment choices, as shown in the diagram below, has been designed to pair sophistication with simplicity. Our managed

solutions leverage the expertise of the biggest and best international asset managers, offering choice between risk-profiled

portfolios with allocations managed by BlackRock and share portfolios with allocations advised by Goldman Sachs.

We also have a wide variety of external investment choices from international asset managers to choose from on our open

architecture, as well as a researched shortlist of leading investment options picked by a team of analysts from around the world.

Read more about the international investment options

View provider disclaimers

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserSMART

VERIFICATION

Global investing has never been easier with our smart verification. When you invest with us, you no longer need to provide

original identity documents, proof of address or proof of banking. We have eliminated the need for these original supporting

documents by building a first-of-its-kind smart digital functionality, called smart verification. With this functionality, we can verify

the details you supply to us on your application form digitally without the need of these physical, certified documents.

SMART VERIFICATION WITH DISCOVERY

05

02 03 04

Application form Certified proof Certified ID Certified banking Assessment of

Issue case

and source of funds of residence documents details application

INTERNATIONAL TRUSTS AND COMPANIES

Currently, this functionality is available to individual investors who are South African citizens. While international companies and

trusts must still provide the entity’s supporting documents, such as trust deeds and founding documents, directors and trustees

who are SA citizens no longer need to supply their identity documents or proof of residence*.

* If we are unable to verify your details, you may still need to submit these documents to us.

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserFEES

ON YOUR FEES TO YOUR FINANCIAL ADVISER

INVESTMENT

Your financial adviser may charge initial

and/or ongoing fees for the advice they give.

See more about the advantages of using

a financial adviser.

There are certain fees that apply to your investment

FEES TO DISCOVERY INVEST

There are no initial investment fees.

We charge a single, competitive yearly

admin fee, which depends on the total value

of all your Global Endowments. This fee includes

trustee fees, custodian fees and international

administration fees.

An access fee may also be applicable,

depending on your investment choices.

FEES TO THE INVESTMENT MANAGERS

Investment managers may charge initial and

ongoing fees. These fees depend on the investment

choices you choose.

Refer to the Fact File for more information

about all fees.

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserOTHER OTHER GLOBAL INVESTMENT OPTIONS:

GLOBAL

INVESTMENT Global Recurring Endowment

PLANS

The Global Recurring Endowment is a unique investment

plan that allows you to invest monthly in USD with ease.

We are the only company that allows you to invest globally

in an endowment on a monthly basis. An endowment is

an investment plan that helps you save over the medium

to long term, while giving you estate planning benefits and

We offer three other global investments tax-efficient structures.

to suit your investment needs.

Global Flexible Investment

Visit www.discovery.co.za for more information The Global Flexible Investment is a lump-sum investment

on our other global investment plans. plan that gives you access to your money when you need

it, and a wide range of international investment funds

to choose from, ensuring you can take advantage of

investment opportunities all over the world.

Global Discovery Retirement Optimiser

The Global Discovery Retirement Optimiser allows you to

save for retirement in US dollars and convert your unused

life cover from your Discovery Dollar Life Plan into tax-free

income in retirement, through a benefit called the Dollar

Life Plan Optimiser.

Through shared value, you can also benefit from fee

discounts to help you save towards the international

retirement you aspire to.

Read the Global Endowment Fact File relevant to your investment Things to discuss with your financial adviserREAD THE RELEVANT FACT FILE AND

SPEAK TO YOUR FINANCIAL ADVISER

The details of the features we offer are set out in

the relevant Fact File. Speak to your financial adviser

to help you make informed decisions about your

investments. If you don’t have a financial adviser,

you can contact our call centre on 0860 67 57 77.

To optimise the domicile, legal structures and

liquidity, the Discovery Global Endowment consists

of multiple endowment insurance contracts issued

by the Guernsey branch of Discovery Life Limited.

www.discovery.co.za

Product rules, terms and conditions apply. This document is meant only as information and should not be taken as financial advice. For tailored financial advice,

please contact your financial adviser. Examples and figures are for illustrative purposes only. The value of investments may go down as well as up and past

performance is not necessarily a guide to the future. Fluctuations or movements in exchange rates may also cause the value of underlying investments to go up

or down. This document does not include the full details of how our investment plans work. The information in this document must be read with the relevant

fact files. The Global Endowment Plan is a unit-linked life insurance policy contract, issued by Discovery Life International, the Guernsey branch of Discovery

Life Limited (South Africa), licensed by the Guernsey Financial Services Commission under the Insurance Business (Bailiwick of Guernsey) Law 2002, to carry

on long-term insurance business. Discovery Life is a registered long-term insurer registered under the South African Long-term Insurance Act of 1998 and an

authorised financial services provider (registration number 1966/003901/06). Discovery Invest is an authorised financial services provider (registration number

2007/005969/07). All benefits are offered through the insurer. The insurer reserves the right to review and change the qualifying requirements for benefits at any

time. The information given in this document is based on Discovery’s understanding of current law and practice in South Africa and Guernsey. No liability will

be accepted for the effect of any future legislative or regulatory changes.

Lima Capital LLC is a company licensed under the Laws of Mauritius as an investment advisor and a collective investment schemes manager. It is regulated by the

Mauritius Financial Services Commission. The outsourcing agreement provides for an annual fee of 0.05% of the total assets under management (AUM) for Global

Endowments. This fee is included in the annual admin fee and pays for the following services: to enter into, vary, or renew Life Insurance Policies for and on behalf

of the Insurer, and in the name of the Insurer (0.04%); to determine the value of policy benefits under Life Insurance Policies (0.005%); to settle claims under Life

Insurance Policies (0.005%).

We pay this fee to Lima monthly in advance and it is capped at USD7,500 a month (based on volumes that are currently foreseeable).

RCK_71460DI_14/05/2020_V23WHAT TO

DISCUSS WITH

YOUR FINANCIAL

ADVISER

SPEAK TO YOUR FINANCIAL ADVISER ABOUT

THE FOLLOWING: Your trusted financial adviser is here

to assist you on your international

WHAT ‘INVESTING GLOBALLY’ MEANS FOR YOUR investment journey

OVERALL INVESTMENT PORTFOLIO

Introducing direct international investments to your overall

investment portfolio from a South African perspective has

ADVANTAGES OF USING

many implications that need to be carefully considered.

A FINANCIAL ADVISER

ESTATE PLANNING AND TAX CONSIDERATIONS

KNOWLEDGEABLE ABOUT MANAGING MONEY

Planning for the next generation is an important

Financial advisers are qualified in financial

consideration when investing globally. It is also important

planning and can help you decide on – and keep

to consider tax as it could erode your investment returns

track of – your investment goals, savings strategies

if not managed properly.

and retirement options.

THE UNPREDICTABLE NATURE OF MARKETS

LICENSED TO SELL CERTAIN PRODUCTS

The value of investments may go down as well as up and

We only allow financial advisers who are registered

past performance is not necessarily a guide to the future.

with the Financial Sector Conduct Authority (FSCA)

Fluctuations or movements in exchange rates may cause

and have professional qualifications (passing

the value of underlying investments to go up or down.

regulatory examinations and undergoing training),

to sell you specific financial products. They are

DIVERSIFICATION

required to have extensive knowledge of the

It’s important to diversify your investments across different product they are recommending to you, and they

asset classes, such as equities (shares), bonds, property and must be professional and skilled in the financial

cash. This will ensure that your risk is spread – so if one asset advice they provide.

class performs poorly, the value of your other investments

can make up for this. Diversification can also refer to OBJECTIVE ADVICE

diversifying across different types of investment management

(single- or multi-manager), across different geographical Our code of conduct for financial advisers is strict:

regions, and in different currencies. It’s also important to our advisers must be able to give clients objective

discuss which currency to use to monitor performance and advice about the products they buy so that they

the risks of monitoring performance in ZAR. can make informed decisions. It’s essential that

clients’ best interests are at the heart of everything

our advisers do so they must avoid or disclose any

HOW MUCH RISK YOU CAN AFFORD TO TAKE

conflicts of interests. At the core of everything is

Your investment strategy starts with understanding your treating clients fairly.

attitude to risk. Generally, the higher the potential risk of

an investment, the higher the potential return. The amount of

risk you can afford to take depends on your appetite towards

risk and your financial capacity to take risk. Different asset If you don’t have a financial adviser, you

classes like cash, bonds, property and equities have different can contact our call centre on 0860 67 5777.

levels of expected risk and return; cash has low levels

of expected risk and return, while equity has high levels

of expected risk and return.

COMPOUND INTEREST

Compound interest lets you earn returns on previously

reinvested money. You earn interest on interest.THE

CURRENCY

ENHANCER

INVEST BELOW THE PREVAILING EXCHANGE RATE

You can effectively invest below the prevailing exchange The additional investment value from the currency enhancer

rate, depending on your investment in qualifying grows at the same rate as your underlying investment,

investment choices. and will pay into your investment after 10 years.

When you convert your rands into USD, GBP or EUR,

The amount you receive will be affected if you:

this benefit lets you do the conversion at below the

prevailing exchange rate, which adds extra value to your Switch out of qualifying investment choices

investment. If you already have money or investments

Make a partial or full withdrawal from your Global Endowment

abroad that you would like to move it into our Global

The currency enhancer falls away if you make a full

Endowment, this benefit will still apply and increase your

withdrawal from your Global Endowment or on death

investment amount by the same amount as that received

of the last life assured before 10 years.

by investors investing in rands through the currency enhancer.

CONVERT A LOCAL ENDOWMENT TO A GLOBAL ONE FOR AN EVEN BETTER EXCHANGE RATE

If you are invested in the latest version of our local lump-sum Endowment (launched in February 2020), you can choose

to convert your investment to a Global Endowment on your boost payment date, instead of getting your local boost.

If you do this, you will get an even greater currency enhancement at the time of conversion.

Go back to Why the Discovery Global EndowmentESTATE

PLANNING

ADVANTAGES

Our Global Endowment forms part of your South African estate, and therefore avoids

the complications that could arise from having part of an estate located in another country.

The investment proceeds can be passed directly to any person or structure, as nominated

by you, in any currency or country.

This means that there is no requirement for an international will, and no need to worry about

probate, foreign estate duty, or executor fees on death, which can all add up to thousands

of US dollars.

Go backACCESS

TO YOUR

INVESTMENT

Endowments usually only allow for one withdrawal during the first five years of the investment.

However, our Global Endowment is structured in such a way that it allows multiple withdrawal

possibilities during the initial five-year period, and unlimited withdrawals thereafter.

The extra amount from the currency enhancer may be affected by withdrawals.

See the fact file for more details.

Go backA WIDE RANGE

OF INVESTMENT

CHOICES

We offer a range of Our investment range can be split into four groups:

investment options to Discovery Global Portfolios Global Share portfolios

meet your investment needs

Our risk-profiled portfolios offer you Portfolios of listed securities for

giving you access to a wide a global all-in-one investment solution, clients with higher risk tolerances

range of international comprising a broad spectrum of asset and greater asset values that seek

investment choices managed classes across many geographies. greater global equity exposure.

and advised by the world’s The portfolios are an active-passive Each of the three Discovery Share

blend of index trackers and external Portfolios have focused, specialised

leading asset managers.

asset managers that provide a diverse mandates, a strong track record,

holding across asset classes and and are advised by Goldman Sachs,

geographies – capturing opportunities a world-class asset manager.

across the globe. They are managed Available for selection on the Global

to achieve sustained, strong returns Endowment.

within a given risk appetite.

Available for selection on the Global Global Alpha Investment Choices

Endowment, Global Recurring Endowment

A curated list of investment choices

and Global Discovery Retirement Optimiser.

selected through a rigorous

screening and selection process

Global External Investment Choices

by a team of analyst from around

A wide range of investment choices the world with over 250 years of

from some of the top local and combined investment experience.

international managers from around The investment choices are

the world. catergorised by strength, ranging

Available for selection on the Global from high-conviction investment

Endowment and Global Flexible Plan. choices to satellite strategy

investment choices.

Available for selection on the Global

Endowment.

Go back to Why the Discovery Global Endowment Go back to Investment choicesGET UP TO 50%

BACK ON YEARLY

INTERNATIONAL

TRUST FEES

Setting up an international trust for your international assets has estate planning benefits

but may carry heavy costs. With our Global Endowment, you can get access to an international

trust at just GBP 200 per year, and get a refund of up to 50% of these fees after five years.

If you have a qualifying Global Endowment above USD 100 000 fully invested in qualifying

investment choices, you will get a refund of up to 50% of your trust fees after five years.

The criteria must be met for five consecutive years. A maximum of USD 650 will apply for

the Global Endowment refund. This maximum may be updated from time to time in line with

changes to trust fees and inflation. See the fact file for more details on this benefit.

Go backFLEXIBILITY

THROUGH

MULTIPLE

OWNERS

The Global Endowment may be owned by multiple natural owners, and beneficiaries

for ownership or proceeds can be nominated on the investment.

The endowment pays out a death benefit on the death of the last life assured.

Beneficiary nomination allows for the investment proceeds to pass to the beneficiaries

outside of the estate winding-up process and without the need for international probate.

Go backPROVIDER

DISCLAIMERS

BlackRock

iShares® and BlackRock® are registered trademarks of BlackRock, Inc. and its affiliates (“BlackRock”) and are

used under license. BlackRock has licensed certain trademarks and trade names of BlackRock to Discovery Life

Limited. The Licensee Product/Service is not sponsored, endorsed, sold, or promoted by BlackRock. BlackRock

makes no representations or warranties to the owners of the Licensee Product/Service or any member of the

public regarding the Licensee Product/Service. BlackRock has no obligation or liability in connection with the

operation, marketing, trading or sale of any product or service offered by Discovery Life Limited.

Goldman Sachs Asset Management

Goldman Sachs Asset Management (GSAM) are registered trademarks of Goldman Sachs International and

its affiliates (“Goldman Sachs”) and are used under license. GSAM has licensed certain trademarks and trade

names of GSAM to Discovery Life Limited. The Licensee Product/Service is not sponsored, endorsed, sold, or

promoted by GSAM. GSAM makes no representations or warranties to the owners of the Licensee Product/

Service or any member of the public regarding the Licensee Product/Service. GSAM has no obligation or

liability in connection with the operation, marketing, trading or sale of any product or service offered by

Discovery Life Limited.

Go back to investment choices Go back to at a glanceYou can also read