IDC THAILAND: SMARTPHONE MARKET DECLINED A MODERATE 9% YOY IN 2Q2020

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

IDC Thailand: Smartphone Market Declined a Moderate 9% YoY in 2Q2020

th

BANGKOK, September 15 , 2020 - In the second quarter of

2020, the Thai smartphone market shipped 4.3 million units,

increasing by 21.2% quarter-over-quarter (QoQ) but dropping

8.8% year-over-year (YoY).

The second quarter of the year usually records a quarterly

increase in shipments due to seasonality and this was not

dampened by the lockdown due to the Covid-19 pandemic,

as OEMs quickly adapted to focus more on the online

channels and ran multiple promotional campaigns during the

quarter. As a result, while the sales in the retail channel were

almost flat QoQ, eTailers registered a four-fold growth.

Vendors and operators were able to quickly adapt to the

interruption in physical retail activities and found alternatives

using various online platforms and were able to continue

with their sales and marketing through official websites and

eTailers while leveraging social media platforms which they

used to for promotions as well as sales.

New models launched by vendors such as OPPO’s A12,

Xiaomi’s Redmi Note 9 and Huawei’s Y5p were well received

in the market due to their attractive price points. However,

Mid-to-high end segment contributed to bulk of the growth

where Samsung’s A71 and Apple’s iPhone SE (2020) gained

good traction

While Thai smartphone has started to recover, IDC expects

smartphone unit shipments to decline in 3Q20 due to

seasonally low demand during the quarter and as economic

pressures continue to weigh down on consumer demand for

the next few months. However, 4Q20 will see a boost as new

iPhones start shipping. Apple opened its second Apple Store

in Thailand in Bangkok’s Central World. This will help Apple

to build further on the already strong iPhone momentum in

the country. With retail activity getting back to normal after

- 1-the lockdown was lifted, the online/

offline shift is expected to get

back to normal as well after online

channel share peaked in 2Q20,”

says Teerit Paowan, Mobile Phone

Analyst, IDC Thailand.

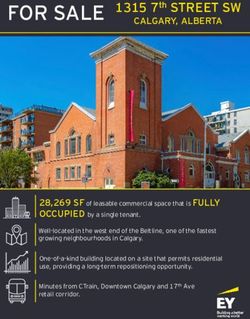

Figure 1

Figure 1: Thailand Top 5

Smartphone Companies, 2Q20

Unit Market Shares

Thailand Smartphone Market,

Top 5 Company Shipments,

Market Share, and YoY

- 2-Growth, Q2 2020 (shipments in

thousands)

Vendor

2020Q2

2020Q2

2019Q22019Q2

YOY

Shipments

MarketShipments

MarketGrowth

Share Share

1. 853 19.5%750 15.6%13.8%

vivo

2. 811 18.6%1523 31.8%-46.7%

Samsung

3. 740 16.9%839 17.5%-11.9%

OPPO

4. 536 12.2%96 2.0% 456.4%

realme

5. 462 10.6%337 7.0% 37.0%

Apple

Others971 22.2%1249 26.1%-22.2%

Total 4373 100.0%

4794 100.0%

-8.8%

Source: IDC Quarterly Mobile

Phone Tracker, 2020Q2

Note: All figures are rounded off

2020Q2 Top 5 Smartphone

Vendor Highlights:

• vivo made it to the top spot

focusing on its affordable Y series

with its low-end models Y11 and

Y15, while its newly launched

models in the mid-range Y30

and Y50 received a lukewarm

response.

• Samsung continued to be one of

the top players in the country with

its affordable Galaxy A series while

the higher priced Galaxy A71 was

amongst its top-selling models. It

did a lot of marketing activities and

launched campaigns such as “Edu

Buddy”, “Super-Hot Sales”, “Butler

to Go”..

- 3-• OPPO lost the number 1 position

in 2Q20 as sales of some of its

newly launched models were

dampened due to temporary price

increases. OPPO maintained its

focus on marketing and channel

activities.

• realme replaced Huawei for the

fourth position. Its low-end models

performed well, and it also brought

X50 Pro supporting 5G. realme

continued to expand in upcountry

areas.

• Apple maintained 5th position

in the market due to the good

performance of iPhone SE amid

Covid-19 but the best performer

was still iPhone 11.

-Ends-

About IDC Trackers

IDC Tracker products provide

accurate and timely market size,

vendor share, and forecasts

for hundreds of technology

markets from more than 100

countries around the globe. Using

proprietary tools and research

processes, IDC's Trackers

are updated on a semiannual,

quarterly, and monthly basis.

Tracker results are delivered

to clients in user-friendly excel

deliverables and online query

tools.

About IDC

International Data Corporation

(IDC) is the premier global

- 4-provider of market intelligence,

advisory services, and events

for the information technology,

telecommunications, and

consumer technology markets.

With more than 1,100 analysts

worldwide, IDC offers global,

regional, and local expertise

on technology and industry

opportunities and trends in over

110 countries. IDC's analysis and

insight helps IT professionals,

business executives, and the

investment community to make

fact-based technology decisions

and to achieve their key business

objectives. Founded in 1964,

IDC is a wholly-owned subsidiary

of International Data Group

(IDG), the world's leading tech

media, data and marketing

services company. To learn

more about IDC, please visit

www.idc.com. Follow IDC on

Twitter at @IDC and LinkedIn.

Subscribe to the IDC Blog for

industry news and insights: http://

bit.ly/IDCBlog_Subscribe.

IDC is a subsidiary of IDG, the world’s leading technology

media, research, and events company. Additional information

can be found at www.idc.com. All product and company

names may be trademarks or registered trademarks of their

respective holders.

- 5-For more information contact:

Teerit Paowan

tpaowan@idc.com

+6687 038 5336

Akash Tiwari

atiwari@idc.com

+662 009 4089

- 6-You can also read