ANNUAL INFORMATION FORM BMTC GROUP INC - 2011 Montreal, February 16th, 2012

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

ANNUAL INFORMATION FORM

2011

BMTC GROUP INC.

Montreal, February 16th, 2012TABLE OF CONTENTS Page

1. INCORPORATION OF ISSUER ........................................................................... 1

1.1 Incorporation of Issuer ............................................................................... 1

1.2 Corporate organizational chart................................................................... 2

2. GENERAL DEVELOPMENT OF THE BUSINESS ............................................... 2

2.1 Company Background ............................................................................... 2

3. NARRATIVE DESCRIPTION OF THE BUSINESS .............................................. 5

3.1 Description of Business Activities .............................................................. 7

3.2 Customers and Distribution Network.......................................................... 7

3.3 Supplies ..................................................................................................... 9

3.4 Competition................................................................................................ 9

3.5 Seasonal Variations................................................................................... 9

3.6 Human Resources ................................................................................... 10

3.7 Risk Factors............................................................................................. 10

4. DIVIDENDS AND SPLITS .................................................................................................... 12

4.1 Dividends……………………………………………………………………….12

4.2 Splits…………………………………………………………………………….13

5. GENERAL DESCRIPTION OF CAPITAL STRUCTURE .................................... 13

6. MARKET FOR SECURITIES OF THE COMPANY ............................................ 16

7. DIRECTORS AND OFFICERS........................................................................... 17

7.1 Directors .................................................................................................. 17

7.2 Officers .................................................................................................... 17

8. AUDIT COMMITTEE .......................................................................................... 17

8.1 General .................................................................................................... 17

8.2 Mandate of the Audit Committee ............................................................. 17

8.3 Relevant Education and Experience of the Audit Committee Members... 18

8.4 Policies and Procedures for the Engagement of Audit Services ............. 18

8.5 External Auditor Service Fees ................................................................. 19

9. TRANSFER AGENTS AND REGISTRARS........................................................ 19

10. LEGAL PROCEEDINGS .................................................................................... 2011. ADDITIONAL INFORMATION ............................................................................ 20

-1-

Unless the context should indicate otherwise, “we,” “ours,” “us” and other similar terms

refer to BMTC Group Inc. (the “Company”) and its subsidiaries, as a group.

Forward-Looking Statements

We make “forward-looking statements” in this Annual Information Form. By their nature,

these statements necessarily involve risks and uncertainties that could cause actual

results to differ materially from those contemplated by these forward-looking

statements. We consider the assumptions on which these forward-looking statements

are based to be reasonable, but caution you that these assumptions regarding future

events, many of which are beyond our control, may ultimately prove to be incorrect or

unfounded since they are subject to risks and uncertainties that affect us. You will find

elsewhere in this Annual Information Form certain risks and uncertainties affecting us

(see “Narrative Description of the Business – Risk Factors”). We disclaim any intention

or obligation to update or revise any forward-looking statements as of the date of this

Annual Information Form, whether as a result of new information, future events or

otherwise, other than as required by law.

1. INCORPORATION OF ISSUER

1.1 Incorporation of Issuer

Established on September 5, 1989, the Company is governed by Part IA of the

Companies Act (Quebec). It succeeded Cantrex Group Inc. as the parent

company of Brault et Martineau Inc., Ameublements M.T. Inc. and Colonial

Furniture Company (Ottawa) Ltd. pursuant to a corporate reorganization which

took effect on November 1, 1989. After this reorganization, the Company became

a reporting issuer. Its Class A Subordinate Voting Shares were then listed on the

Montreal Exchange, and, have been listed on the Toronto Stock Exchange under

the symbol “GBT.A” since November 6, 1999.

Our head office is at 8500 Marien Square, Montreal East, Quebec, H1B 5W8.-2-

1.2 Subsidiaries of the Issuer

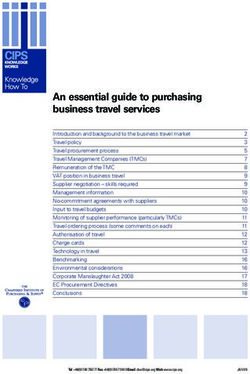

The corporate organizational chart depicted below presents the existing

corporate structure of the Company.

Actionnaires Actionnaires

Class B Class A

Groupe BMTC inc.

100 %

Brault et Martineau inc.

(« Brault et Martineau »)

100 %

Ameublements Tanguay inc.

(« Ameublements Tanguay »)

2. GENERAL DEVELOPMENT OF THE BUSINESS

2.1 Company Background

Cantrex Group Inc., our predecessor, commenced activities as a retailer of

furniture and household appliances when it acquired, on October 1, 1986, all of

the outstanding shares of Brault et Martineau. At the time one of the largest

furniture and household appliance retailers in Quebec, Brault et Martineau had

five stores in the Montreal region and sales in the order of approximately

$50 million.

From 1987 to 1989, the retail sector of Cantrex Group Inc. broadened its field of

activities principally with the acquisition by Brault et Martineau of Ameublements

Tanguay, the largest retailer of furniture, appliances and electronic goods in the

Quebec City region, and of Colonial Furniture, a firm solidly established in the

Ottawa-Hull region, which we sold early on in fiscal year 2000.-3- In 1989, the Company was incorporated, and we took over the Cantrex Group’s retail sales sector. The following years were marked by new store openings, the relocation, replacement and expansion of existing stores, the opening and expansion of distribution centers and the opening or conversion of stores into liquidation centers. In 2001, we opened a new 47,300-square-foot Signature Maurice Tanguay store in Ste-Foy with respect to which a 15-year lease was concluded. We built and opened a new 70,000-square-foot store in Repentigny and have an option to purchase the lot. This new store replaced our 40,000-square-foot store in Pointe-aux-Trembles. We also built and opened a new 70,000-square-foot store in Laval. Another store that already existed in Laval was converted into a liquidation center. Also in 2001, we purchased a lot and undertook the construction of a new 70,000 square foot store in Kirkland. Open since September 2002, this store replaced the old 40,000 square foot store whose lease had expired in August 2002. In November 2002, we expanded our Jean-Talon Street store in St-Leonard by 10,000 square feet. In April 2002, we restructured the Chicoutimi store to add 13,000 square feet of selling space. We also announced that we would be expanding the store in St-Hubert by 10,000 square feet, and the store in Ste-Thérèse by 24,000 square feet, increasing the surface area of these stores to 70,000 square feet each. Expansion of the St-Hubert store was completed in 2003, while expansion of the Ste-Thérèse store has since been postponed to 2004. In 2002, we also purchased a lot and began constructing a new 70,000 square foot store in Brossard. Open since September 2003, this store replaced the old 40,000 square foot Brossard store that has since been transformed into a liquidation center. In 2003, we moved our Beauport store into new 60,000 square foot premises. The old 40,000 square foot store in Beauport was sold to a company controlled by certain officers. We have since closed down our liquidation center on Langelier Street in Montreal, and purchased a lot in Rimouski in order to relocate our store in 2005. In 2004, we expanded our distribution center in Quebec City by 68,000 square feet, for a total of 260,762 square feet, and our distribution center in Montreal by 23,000 square feet, for a total of 523,239 square feet. Also in 2004, we expanded our Ste-Therese store by 25,000 square feet, and its official re-opening occurred in early 2005. A new 60,000 square foot store in Rimouski, was opened very successfully in November 2005. Subsequent to the transfer of operations, the old store was put up for sale.

-4- During the month of February 2006, the Company finalised the sale of excess land in Kirkland for an amount of $2,000,412, resulting in a pre-tax profit of $453,118. During the month of May 2006, the Company opened a new liquidation center of 63,000 square feet. This liquidation center is situated at 3782 Côte-Vertu, Ville St-Laurent and has been rented out for a period of ten years, ending May 31st, 2016. During the month of August 2006, the Company finalised the sale of excess land in Ste-Thérèse for an amount of $547,212, resulting in a pre-tax loss of $134,997. During the month of October 2006, the Company opened its 11th Brault & Martineau Sleep Gallery. This latest point of sales of 5,400 square feet is located in St-Hyacinthe and is the first to be situated outside of a regular store. During 2007, the Company opened 5 new Brault & Martineau Sleep Galleries of approximately 6,000 square feet each situated outside of a regular store and are located in the areas of St-Jean-sur-le-Richelieu, Granby, Vaudreuil, Mascouche and St-Jérôme. During the month of April 2007, the Company finalised the sale of its liquidation center in Longueuil for an amount totalling $2,350,000 resulting in a pre-tax profit of $1,197,983. Following this sale, the Company has concluded a lease agreement ending in May 2008 which was extended to May 2009, therefore allowing the continuation of operations until the liquidation center is relocated. During the month of May 2007, the Company finalised the sale of a property in Ottawa for an amount totalling $3,800,000 (of which $950,000 was in the form of a mortgage bearing an interest rate of 5.46% repayable in June 2012), resulting in a pre-tax profit of $1,507,717. On October 17, 2007, the Superior Court of Quebec rendered a judgment against the Company’s subsidiary Brault & Martineau Inc. ordering Brault & Martineau to pay punitive damages in the amount of $2 million (plus interests from the judgment date and costs of distribution) in relation to a class action instituted by a group of consumers that had purchased goods from Brault & Martineau using the financing programs offered by Brault & Martineau and its credit supplier. Based on its analysis of the judgment rendered, the Company has decided to appeal the judgment to the Québec Court of Appeal. The Company intends to vigorously defend its position. The Company believes its appeal is well-founded and is confident that it will ultimately succeed. Pending this appeal, the Company recorded an extraordinary charge in the amount of $2.545 million, or $1.731 million on an after-tax basis, representing the full amount of the award by the Superior Court and the Company’s estimate of the ancillary distribution costs.

-5- As at December 31st, 2007, the Company held Canadian asset-backed commercial paper (ABCP) investments having a nominal value of $6.1 million, representing 6% of the aggregate of its cash and investments as at December 31st, 2007. The Company’s ABCP investments matured on August 30th, 2007. The Company is assessing its alternatives and recourses, including legal action, to recover the full value of these ABCP investments. The Canadian market for Third Party ABCP suffered a liquidity disruption in mid- August 2007 following which a group of financial institutions and other parties agreed, pursuant to the Montreal Proposal, ( “the Montreal Proposal” ), to a standstill period in respect of ABCP sold by twenty-three conduit issuers. Participants to the Montreal Proposal also agreed in principle to the conversion of the ABCP investments into longer-term financial instruments with maturities corresponding to the underlying assets. A Pan-Canadian Investors Committee (“the Committee”) was subsequently established to oversee the orderly restructuring of these instruments during this standstill period. A restructuring plan was announced on December 23, 2007, which was anticipated to be completed by March 2008. On January 21st, 2009, the Company received notes with a date of redemption as well as partial interest payments on the amount owed. The Company is not a signatory to the Montreal Proposal. The company records its investments at market value. However, due to liquidity issues related to ABCP, there is currently no market for these investments. Therefore, the Company has recorded fair value for ABCP investments by calculating the present value of expected future cash flows. The Company as determined the net present value of future cash flows using a discount rate that factored the deteriorating conditions for worldwide credit markets, the prolonged liquidity crunch for ABCP investments specifically, as well as increasing market volatility. As at December 31st, 2007, a charge of $1,525,000 before tax or $1,288,000 after tax was recorded as a provision for the estimated loss in value. This charge represented Management’s best estimation of the loss in value within a reasonable band of possible outcomes. As at December 31st, 2008, the Company decided to record an additional charge for its ABCP investments of $3,004,249 before tax or $2,534,835 after tax bringing the provision for eventual loss to 75% of its nominal value. The Company’s evaluation is founded on management’s assessment of prevailing market conditions, something that is subject to change in the future. Important factors affecting the future value of ABCP investments include changes in market liquidity for these investments. During the month of February 2008, the Company finalised the sale of a property in Rimouski for an amount totalling $450,000, resulting in a pre-tax profit of $97,000.

-6- During the month of March 2008, the Company finalised the sale of a property in Ottawa for an amount totalling $7,000,000, resulting in a pre-tax profit of $4,196,000. During the month of April 2008, the Company concluded a deal for the sale of a property in Rock Forest for an amount totalling $3,900,000, which resulted in a pre-tax profit of $2,210,000. This transaction was recorded during the last quarter of 2008. At the beginning of the month of May, the Company started the construction of its new 70,000 square foot store in Sherbrooke on the St-Joseph plateau, which was inaugurated in November 2008. This new store replaces the existing store located in Rockforest. On August 15th, 2008, the Company offered to purchase up to 4,000,000 of its Class A Subordinate Voting Shares at a price of $20.00 per share. This offer expired on September 30th, 2008 at 12:00 p.m., Montreal time. The Company purchased for cancellation all of the 3,152,567 Class A Subordinate Voting Shares deposited under the offer for an amount of $63,051,340 which were paid out of the general funds of the Company. During the fiscal year ended December 31st, 2009, the Company completed renovations of three of its electronic departments in order to model them according to the new concept which was developed during the construction of the Sherbrooke store that opened last year. All other stores shall be renovated during the 2010 fiscal year at a disbursement. During the last quarter of 2009, the Company renovated a appliance department in order to enhance the product presentation. Once completed, this new layout concept will be reproduced in other appliance departments during a period yet to be determined. During the twelve month period, the Company completed the renovations of 6 of its electronic departments and of 5 of its appliance departments, 3 additional appliance departments will be renovated at the beginning of 2011. During the third quarter of 2010, the Company acquired land in Levis for an amount of 2,951,000$ for the construction, at the beginning of 2011, of a new store as a replacement for the existing one. Finally, on April 6, 2010, following a 2 for 1 stock split, the Company issued 10,037,987 Class B multiple voting shares and 15,962,013 Class A subordinate voting shares. During the year ended December 31st, 2011, the Company completed the renovation of the last 3 appliance departments left from the previous 2010 period.

-7-

Finally, during the month of May 2011, construction of the new store in Lévis

started. The opening is scheduled for early 2012.

3. NARRATIVE DESCRIPTION OF THE BUSINESS

3.1 Description of Business Activities

Through our subsidiairies Brault et Martineau and Ameublements Tanguay, we

are retailers of furniture, electronic goods and household appliances in the areas

of Montreal, Quebec City, Repentigny, Ste-Therese, Laval, Longueuil, Kirkland,

St-Georges, Trois-Rivières, Sherbrooke, Chicoutimi, Rivière-du-Loup, Rimouski,

Levis, Beauport, Ste-Foy, Gatineau, Ste-Hyacinthe, St-Jean-sur-le-Richelieu,

Granby, Vaudreuil, Mascouche and St-Jérôme.

3.2 Customers and Distribution Network

Our customers are primarily composed of consumers who are seeking

good-quality products at reasonable prices. Our sales and distribution network

includes 20 stores, 6 liquidation centers, 6 Brault & Martineau Sleep Gallery and

2 distribution centers. The following table provides, for each subsidiary, the

address and surface area of each location and shows, where appropriate, the

expiry date of leases.

Area Expiry Date

Address of Establishment Type (square feet) of Lease

Brault et Martineau

8500 Place Marien, Montreal-East Distribution 523,239 ----

center

145 de la Fayette Blvd., Repentigny Store 69,120 ----

500 le Corbusier Blvd., Laval Store 70,420 ----

6700 Jean-Talon St., St-Léonard Store 70,000 ----

7272 Newman Blvd., LaSalle Store 41,600 ----

500 de la Gappe Blvd., Gatineau Store 59,749 ----

9500 Taschereau Blvd., Brossard Store 73,047 ----

3950 Josephat Rancourt, Sherbrooke Store 74,350 ----

3150 St. Charles Blvd., Kirkland Store 73,770 ----

125 Desjardins Blvd. East,

Ste-Thérèse Store 74,830 ----

1351 Montée des Promenades,

St-Hubert Store 69,713 ----

12605 Sherbrooke Street East, Liquidation

Montreal center 43,000 ----

8220 Taschereau Blvd., Brossard Liquidation center 39,460 ----

1770 des Laurentides Boulevard,

Laval (1) Liquidation center 30,050 March 31, 2020-8-

Area Expiry Date

Address of Establishment Type (square feet) of Lease

3782, Côte-Vertu, St-Laurent (1)

Liquidation center 77,318 May 31, 2016

3300, Cusson, St-Hyacinthe (1) Sleep Gallery

Store 5,704 Nov 30, 2016

575, Pierre-Caisse, St-Jean-sur-le- Sleep Gallery

Richelieu (1) Store 6,950 March 31, 2017

50 Simonds North, Granby (1) Sleep Gallery

Store 6,478 July 31, 2017

585, Avenue St-Charles, Vaudreuil (1) Sleep Gallery

Store 7,245 August 31, 2017

210, Montée Masson, Sleep Gallery

Mascouche (1) Store 6,286 Nov 30, 2022

(1)

21 Gauthier, St-Jérôme Sleep Gallery

________________ Store 6,500 Dec 31, 2018

(1) premises leased by the Company

Ameublements Tanguay

7200 Armand Viau, Quebec Distribution ----

Center 260,762

5720 Etienne Dallaire Blvd., Lévis Store 42,444 ----

535 Ste-Anne Blvd., Beauport Store 61,384 ----

4875 Lormière Blvd., Quebec City Store 62,970 ----

2200 des Récollets Blvd.,

Trois-Rivières Store 49,448 ----

375 Montée Industrielle et

Commerciale, Rimouiski Store 66,971 ----

1990 Talbot Blvd., Chicoutimi Store 83,253 ----

245 Hôtel-de-Ville, Rivière-du-Loup Store 46,265 ----

8955 Lacroix Blvd.,

St-Georges-de-Beauce Store 39,441 ----

2700 Laurier Blvd., Ste-Foy (1) Store 6,500 October 31, 2016

2450 Laurier Blvd., Ste-Foy (1) Store 51,267 March 31, 2016

5000 des Galeries Blvd., Québec (1) Liquidation center 52,919 Dec 31, 2024

79B Kennedy Blvd., Levis (1) Liquidation center 24,750 Dec 31, 2024

4050 Jean-Marchand Blvd., Quebec (1) Repair shop and

wharehouse 29,925 Dec 31, 2018

(1) premises leased by the Company

In the vast majority of cases, the stores are used as showrooms and points of

sale. As a general rule, deliveries are exclusively provided by distribution centers.

In 2004, our management made certain changes to our Montreal distribution-9- center and relocated its distribution center in the Quebec City region in order to add 68,000 square feet, for a total of 260,762 square feet. We believe that, with these changes made, our distribution centers will be large enough to meet our anticipated growth needs. With respect to Brault et Martineau, all deliveries are carried out by subcontractors on an ad-hoc basis. This allows us to meet our seasonal needs more efficiently and economically. Ameublements Tanguay prefers to deliver the goods it sells rather than turn to subcontractors, as its sales are generally less affected by seasonal variations than those of Brault et Martineau (see “Seasonal Variations” below). To that end, Ameublements Tanguay owns a fleet of delivery trucks but also uses outsourcing. 3.3 Supplies Each division is supplied by major manufacturers and distributors with which it has long-standing business relations. No subsidiary is dependent on any particular supplier. We do not foresee, for the next fiscal year, any problem in obtaining supplies and therefore intend to continue implementing our purchasing policy, which consists of obtaining supplies from a large number of suppliers. 3.4 Competition The retail furniture, household appliance and electronics market is highly competitive. In Quebec, our main competitors are Sears Canada, The Bay, Leon and the Brick Group. Moreover, we compete with certain specialized retailers in their respective markets, such as IKEA, Best Buy, Future Shop and Corbeil. Other more specialized retailers, such as superstores and smaller independent stores, also compete with us. Competition has also grown with the proliferation of warehouse and discount stores offering ready-to-assemble furniture and home appliances at affordable prices. However, in view of our financial resources, the size of our sales and distribution network, the variety and superior quality of our merchandise, the flexibility of our financing as well as the emphasis we place on customer service, we believe that our market position is strong. In 2007, we believed we held approximately 30% of the Quebec furniture and household appliance retail market. 3.5 Seasonal Variations For Brault et Martineau, the month of July is generally the busiest of the year, and most of the revenue is earned in the second half of the year. This trend is caused by a very high rental/ownership ratio in the Montreal region, where a significant portion of leases expire on June 30. However, Brault et Martineau has managed to attenuate this trend in the past few years by launching a “buy now, pay later” type of a promotional program. This has significantly shifted in the sales traditionally recorded in July.

- 10 -

In the Quebec City region, the trend is less significant given a lower

rental/ownership ratio than in the Montreal region. Nevertheless, the month of

July constitutes, for Ameublements Tanguay, one of the strongest months of the

year.

3.6 Human Resources

As at December 31, 2011, we had 2,264 permanent employees distributed

among our subsidiaries as follows:

Number of Employees

Department Brault et Martineau Ameublements Tanguay

Administration 356 165

Sales 518 432

After-sale service 46 127

Warehouse & Delivery 325 295

1,245 1,019

Of this staff, only 192 employees working at the Montreal warehouse are

unionized. The Company entered into a new collective agreement which ended

on December 31st, 2011. The Company entered into a new collective agreement

on March 8th, 2012, ending December 31, 2015.

3.7 Risk Factors

Sensitivity to General Economic Conditions

The furniture, household appliance and electronics retailing industry in Canada is

subject to cyclical variations in the general economy and to uncertainty regarding

future economic prospects. The health of the economy in Canada, especially in

Quebec, territory in which we operate, will have an effect on our sales.

Fluctuating interest rates, gross domestic product growth, the availability of

consumer credit, the level of unemployment as well as consumer trends can all

affect consumer confidence. A decline in economic conditions could decrease

the overall demand for household appliances and thus decrease our sales.

Maintaining Profitability and Managing Growth

A number of variables could adversely affect our business strategy. Some of the

factors that may influence our ability to remain profitable and maintain growth

include competition in the furniture and household appliance retailing industry;

our ability to keep our products affordable; the effectiveness of our marketing

programs; our ability to adapt to changing consumer trends; our ability to retain

qualified staff, including senior executives and store management personnel; our

ability to improve customer service to attract new clients and retain existing

clients as well as general economic conditions.- 11 - In light of all of these factors, there can be no assurance that we will be able to implement our business plan, or that this business plan will enable us to maintain our past rates of return or sales growth rates. Failure to successfully implement a material part of our strategic plan could have an adverse effect on our activities, financial condition, liquidity and results of operation. Competition The furniture, household appliance and electronics retailing industry is highly competitive. We face competition in all regions in which we operate. Our competitors include department stores, specialty stores, national and international furniture and household appliance store chains as well as independent retailers, particularly those associated with larger buying groups. The actions and strategies of our current and potential competitors could have a material adverse effect on our business. Third-Party Credit Providers We rely on third-party credit suppliers to provide our clients with financing solutions. There can be no assurance that we will be able to continue to secure advantageous financing products for our customers that will allow us to maintain current financial yields. Investment Portfolio Risks Our investment portfolio is subject to market conditions and certain risks. The poor performance of this investment portfolio could have a material adverse effect on our financial condition, liquidity and results of operation. Labour Relations The success of our business depends on a large number of employees, some of whom are unionized. Any organized work stoppage or other similar job action may have a material adverse effect on our business, financial condition, liquidity and results of operation. The Company entered into a new collective agreement on January 14th, 2008, ending December 31, 2011, with these employees Reliance on Key Personnel Our success depends, in part, on the retention of senior management. There can be no assurance that we will be able to find qualified replacements for the individuals who make up our senior management team. The loss of services of one or more members of our senior management team could adversely affect our business, operating income and our ability to pursue our business strategy effectively. Suppliers We rely on a stable and consistent supply of furniture and household appliances to carry out our retail operations. To that end, we maintain business relationships with a number of suppliers at negotiated prices. There can be no assurance that we will be able to continue to purchase products from our current or future suppliers on terms similar to current terms. Significant increases in the prices of

- 12 -

the products we sell, and our inability to find substitute products at a lesser cost

from new suppliers, could have a material adverse effect on our business,

financial condition, liquidity and results of operations.

Dependence on Management Information Systems

Our management relies heavily on management information systems to analyze

our business’s operating performance on a regular basis. Additionally, we

depend on our management information systems in all areas of our operations,

including supply chain management, inventory control, point-of-sale systems and

after-sales service. We may be adversely affected should these systems fail or

become obsolete.

Distribution Operations

Any significant interruption in the operation of our distribution centers may delay

shipment of merchandise to our stores and customers, damage our reputation or

otherwise have a material adverse effect on our business, financial condition,

liquidity and results of operations. Any failure to coordinate successfully the

operations of our distribution centers also could have a material adverse effect

on our business, financial condition, liquidity and results of operations.

Distribution problems may materially affect our net revenue in particular periods

and/or the timing of the recognition of revenue from orders not yet delivered.

Changes in Fashion Trends and Consumer Tastes

Furniture and household appliances are subject to fashion trends and consumer

tastes, which can change very rapidly. If we are unable to anticipate or respond

to changes in consumer tastes and fashion trends in a timely manner, we could

experience a decrease in sales and be faced with excess inventory. Disposal of

excess inventory may materially affect our business, financial condition, liquidity

and results of operation.

Profits

Some of our products are sold at a higher profit than others. An increase in the

sales of lower profit products at the expense of the sales of higher profit products

could result in a decrease in earnings.

4. DIVIDENDS AND SLPITS

4.1 Dividends

It is our policy to declare and pay dividends on a semi-annual basis to our

holders of Class A Subordinate Voting Shares and Class B Multiple Voting

Shares. Since our listing on the Exchange in October 1986, we have declared

and paid gradually increasing dividends each and every year. The following table

lists the amount of dividends declared semi annually over the last ten fiscal years

for each class of issued and outstanding shares.- 13 -

Dividends declared each fiscal half year over the last ten fiscal years for Class A

Subordinate Voting Shares and Class B Multiple Voting Shares

Dividends declared on Class A Dividends declared on Class B

Subordinate Voting Shares Multiple Voting Shares ($/share)

($/share)

Fiscal year ended 1st fiscal half 2nd fiscal half 1st fiscal half year 2nd fiscal

December 31 year year half year

2002 0,015 0,0175 0,015 0,0175

2003 0,0175 0,025 0,0175 0,025

2004 0,025 0,03 0,025 0,03

2005 0,03 0,035 0,03 0,035

2006 0,06 0,06 0,06 0,06

2007 0,07 0,075 0,07 0,075

2008 0,085 0,09 0,085 0,09

2009 0,09 0,10 0,09 0,10

2010 0,12 0,12 0,12 0,12

2011 0,12 0,12 0,12 0,12

4.2 Splits

The Company proceeded with stock splits over the last ten fiscal years for Class

A Subordinate Voting Shares and Class B Multiple Voting Shares

Class A Subordinate Voting Shares

Date of and

Stock split Class B Multiple Voting Shares

December 6, 2000 2 for 1 stock split

June 3, 2002 2 for 1 stock split

December 11, 2003 2 for 1 stock split

April 6, 2010 2 for 1 stock split

5. GENERAL DESCRIPTION OF CAPITAL STRUCTURE

Our authorized share capital consists of:

a) an unlimited number of Class A Subordinate Voting Shares without par

value;

b) an unlimited number of Class B Multiple Voting Shares without par value;

c) an unlimited number of First Preferred Shares, without par value, issuable

in series; and

d) an unlimited number of Second Preferred Shares, without par value,

issuable in series;- 14 - The following is a summary of the material characteristics of the Class A Subordinate Voting Shares, Class B Multiple Voting Shares, First Preferred Shares and Second Preferred Shares. Class A Subordinate Voting Shares and Class B Multiple Voting Shares Voting Rights Class A Subordinate Voting Shares carry one vote per share, while Class B Multiple Voting Shares carry 20 votes per share. As at December 31, 2011, we had 46,156,165 issued and outstanding Class A Subordinate Voting Shares and 2,118,835 issued and outstanding Class B Multiple Voting Shares. As at December 31, 2010, the voting rights attaching to the Class A Subordinate Voting Shares represented 52.13% of all voting rights attaching to our securities. Dividends Class A Subordinate Voting Shares and Class B Multiple Voting Shares entitle their holders to receive any dividend that may be declared, paid or set aside for payment, on a share-for-share basis. Split or Consolidation Neither the Class A Subordinate Voting Shares nor Class B Multiple Voting Shares may be split or consolidated unless the Class A Subordinate Voting Shares or Class B Multiple Voting Shares, as the case may be, are simultaneously split or consolidated in the same manner. Liquidation or Winding-up In the event of the liquidation or dissolution of the Company or any other distribution of its property among the shareholders for the purposes of winding up its affairs, all Company property available for payment or distribution to the holders of Class A Subordinate Shares and the holders of Class B Multiple Voting Shares will be paid or distributed equally among them, on a share-for- share basis. Exchange of Class A Subordinate Voting Shares Subject to the provisions set out below, should a takeover bid or an offer to exchange or redeem the Class B Multiple Voting Shares be presented to the holders of such shares without a similar offer being presented at the same price and conditions to the holders of Class A Subordinate Voting Shares, each Class A Subordinate Voting Share may be exchanged for a Class B Multiple Voting Share as of the date of the offer, at the option of its holder, but solely for the purposes of authorizing said holder to accept the offer. However, this exchange right will be void where the holders of Class B Multiple Voting Shares altogether holding a sufficient number of shares of any class of the

- 15 - Company’s shares to allow them to cast more than 50% of all voting rights attaching to the outstanding shares of any class of voting shares of the Company notify the transfer agent that they refuse the offer. Moreover, this exchange right will be presumed not to have taken effect if the offer is not completed by the offeror. The articles of the Company contain a definition of “offer” giving rise to the exchange right and stipulate certain exchange procedures. It further stipulates that, when such an offer is made, the Company or transfer agent must send the holders detailed written instructions on how to exercise their exchange right. Exchange of Class B Multiple Voting Shares Class B Multiple Voting Shares may at all times be exchanged, at the option of their holder, for Class A Subordinate Voting Shares at a rate of one Class A Subordinate Voting Share per Class B Multiple Voting Share. The articles of the Company contain a definition of “offer” giving rise to the exchange right and stipulate certain exchange procedures. It further stipulates that, when such an offer is made, the Company or transfer agent must send the holders detailed written instructions on how to exercise their exchange right. Amendments The rights, privileges, conditions and restrictions attaching to the Class A Subordinate Voting Shares or Class B Multiple Voting Shares may respectively be amended if such amendment is approved by no less than three quarters of the votes cast at a meeting of the holders of Class A Subordinate Voting Shares and Class B Multiple Voting Shares duly convened for the purposes thereof. However, should the amendment affect the holders of Class A Subordinate Voting Shares, as a class, or the holders of Class B Multiple Voting Shares, as a class, differently, it must receive the additional approval of no less than three quarters of the votes cast at a meeting of the holders of the shares that are affected differently. Rank Except as provided above, each Class A Subordinate Voting Share and Class B Multiple Voting Share shall carry the same rights and rank equally in all respects; these shares shall be treated by the Company as though they were shares of a single class. First Preferred Shares and Second Preferred Shares First Preferred Shares and Second Preferred Shares may both be issued in one or several series, the number and characteristics of which will be determined by our Board of Directors prior to the issuance thereof. These First Preferred Shares and Second Preferred Shares will carry no voting rights and will rank prior to the Class A Subordinate Voting Shares and Class B Multiple Voting Shares as regards the payment of dividends and sharing of the property of the Company in

- 16 -

the event of its liquidation, dissolution or any other distribution of its assets.

Furthermore, as regards the foregoing, the First Preferred Shares will rank prior

to the Second Preferred Shares. As at December 31, 2011, there were no First

Preferred Shares or Second Preferred Shares outstanding.

A first series of First Preferred Shares consisting of one “Series 1 First Preferred

Share” is authorized, and will carry the right to receive, for each fiscal year of the

Company, a fixed, preferred and non-cumulative dividend of 5% of the issued

and paid-up capital relating to this share. This series of shares may at all times

be redeemed at the option of the Company pending payment of an amount equal

to the issued and paid-up capital of this share, plus any dividend declared on the

share remaining unpaid on the redemption date. As at December 31, 2011, there

were no Series 1 First Preferred Shares outstanding.

A second series of First Preferred Shares consisting of one “Series 2 First

Preferred Shares” is authorized, and will carry the right to receive, for each fiscal

year of the Company, a fixed, preferred and non-cumulative dividend of 5% of

the issued and paid-up capital of this share. This series of shares may at all

times be redeemed at the option of the Company pending payment of an amount

equal to the issued and paid-up capital of this share, plus any dividend declared

on the share remaining unpaid on the redemption date or for the same amount,

at the option of its holder. As at December 31, 2011, there were no Series 2 First

Preferred Shares outstanding.

6. MARKET FOR SECURITIES OF THE COMPANY

Our Class A Subordinate Voting Shares currently issued and outstanding are

listed on the Toronto Stock Exchange under the symbol “GBT.A”.

Month of fiscal year ended Closing Price High Low Volume

December 31, 2011 ($) ($) ($)

January 2011 21.50 22.00 20.20 143,161

February 2011 22.64 22.72 21.58 67,437

March 2011 22.85 23.00 22.00 195,903

April 2011 22.90 23.25 22.51 173,032

May 2011 20.00 22.99 19.25 425,915

June 2011 21.34 21.34 18.51 461,898

July 2011 21.22 22.00 20.11 245,984

August 2011 21.94 21.95 19.29 267,172

September 2011 23.00 23.75 21.50 370,854

October 2011 21.70 23.00 20.10 323,397

November 2011 20.25 22.77 19.83 61,784

December 2011 18.80 20.10 17.81 57,502- 17 -

7. DIRECTORS AND OFFICERS

7.1 Directors

Some information on members of our Board of Directors and its committees is

presented under the heading “Election of Directors” on pages 5, 6 and 7 of the

management information circular dated February 16th, 2012 (the “Management

Information Circular”) accompanying our Notice of Annual Meeting. This

information is incorporated herein by reference. Copies of the Management

Information Circular are available at our head office or on SEDAR at

www.sedar.com.

7.2 Officers

The officers of the Company are the following:

Province and country of

Name residence Position

Yves Des Groseillers Quebec, Canada Chairman of the Board,

President and Chief

Executive Officer

Marie-Berthe Des Quebec, Canada Secretary

Groseillers

Over the past five years, all officers held the same positions in the Company.

As at the date hereof, our directors and officers directly or indirectly hold or

control, as a group, 27,383,370 Class A Subordinate Voting Shares representing

59.22% of these shares, and 1,160,000 Class B Multiple Voting Shares

representing 57.01% of these shares.

8. AUDIT COMMITTEE

8.1 General

Our Audit Committee currently consists of Messrs. Serge Saucier (Chairman),

André Bérard and Gilles Crépeau. All members of the Audit Committee are

considered “independent” and “financially literate” within the meaning of

Multilateral Instrument 52-110, Audit Committees.

8.2 Mandate of the Audit Committee

The primary function of our Audit Committee is to oversee our accounting and

financial reporting procedure, as well as the audits of our financial statements.

This includes reviewing and overseeing financial reports, annual and interim

management reports, and other financial information that we provide to any

regulatory authority or the public, our system of internal control for finances,

accounting and regulatory compliance established by members of our

management and our Board of Directors, as well as our practices in terms of

auditing, accounting, internal control and financial reporting. In the performance

its duties, the Audit Committee promotes the continued improvement of our- 18 -

policies, methods and practices at all levels, ensuring the compliance thereof and

encouraging the observance of industry best practices in such matters.

We have included our Audit Committee Charter in Schedule A hereto.

8.3 Relevant Education and Experience of the Audit Committee Members

The following table contains a brief summary of the relevant education and

experience of each member of the Audit Committee, including any education or

experience that has provided the member with a sound understanding of the

accounting principles that we use to prepare our annual and interim financial

statements.

Name of audit Relevant education and experience

committee member

Serge Saucier Serge Saucier has been a chartered accountant

since 1964 and is a Fellow of the Ordre des

Comptables Agréés du Québec. Now retired, he

has dedicated his professional life to the firm

Raymond Chabot Grant Thornton LLP, in which

he has performed all the functions required from

a chartered accountant.

André Bérard André Bérard is a corporate director. He sits on

the board of directors of numerous public

companies and is a member of the audit

committee of numerous public companies. He

spent over four decades with National Bank of

Canada and was during 12 years the chairman

of the board and chief executive officer of

National Bank of Canada.

Gilles Crépeau Gilles Crépeau is a corporate director. He has

been on the board of BMTC Group inc. since

1989

8.4 Policies and Procedures for the Engagement of Audit and Non-audit

Services

One of the duties of our Audit Committee is to approve, in advance, auditing

services and other non-auditing services entrusted to our external auditors.

Another is to adopt and implement policies governing the approval process. The

Audit Committee is also responsible for reviewing the remuneration paid to

external auditors for auditing and other ancillary services. In case of

emergencies, the Chairman of the Board may alone approve an auditing

mandate or other mandate entrusted to an external auditor.- 19 -

On the date hereof, no formal approval policy has been adopted by our Audit

Committee. The Audit Committee evaluates non-audit services entrusted to

external auditors separately.

8.5 External Auditor Service Fees

The following table shows the fees paid to Raymond Chabot Grant Thornton LLP

in Canadian dollars for the years ended December 31st, 2010 and 2011 for

various services provided to us:

Service rendered Year ended Year ended

December 31, 2010 December 31, 2011

Audit fees $ 188,900 $ 169,500

Audit – related fees $ 11,100 $6,500

Tax fees $ 10,700 $3,500

Adoption of IFRS $ 30,000 $35,000

Total : $ 240,700 $213,500

Audit Fees

These fees cover professional services rendered by the external auditors for

statutory audits of the annual financial statements and for other audits.

Audit-related Service Fees

These fees cover professional services that reasonably relate to the performance

of the audit or review of our financial statements.

Tax Fees

These fees cover professional services for tax compliance, tax advice and tax

planning.

Other Fees

These fees include total fees paid to the auditors for all services other than those

presented in the categories of audit fees, audit-related service fees and tax fees.

9. TRANSFER AGENTS AND REGISTRARS

Our transfer agent and registrar is Computershare Investor Services Inc. The

register of transfers of our Class A Subordinate Voting Shares and Class B

Multiple Voting Shares maintained by the Computershare Investor Services Inc.

is located at its offices in Montreal, Quebec.- 20 -

10. LEGAL PROCEEDINGS

The Company is involved in claims and disputes that it is currently contesting.

Except as described below, the management believes that the settlement of

these legal proceedings will not adversely affect its financial position, results or

cash flow.

On October 17, 2007, the Superior Court of Quebec rendered a judgment against

the Company’s subsidiary Brault et Martineau ordering it to pay punitive

damages in the amount of $2 million (plus interests from the judgment date and

costs of distribution) in relation to a class action instituted by a group of

consumers that had purchased goods from Brault et Martineau using the

financing programs offered by Brault et Martineau and its credit supplier.

The Court of Appeal having maintained the judgment of the Superior Court, the

Company has taken arrangement for payment of an amount of 2,435 M$ which

was paid during the 2011 period.

11. ADDITIONAL INFORMATION

Additional information on us can be found on SEDAR at www.sedar.com.

Additional information, including directors’ and officers’ remuneration and

indebtedness, if loans have been granted to them, the principal holders of our

securities, stock options and the interests of insiders in material transactions, if

any, can be found in the Management Information Circular dated February 16th,

2012 prepared for our April 5th, 2012 Annual Meeting of Shareholders. Additional

financial information is provided in our financial statements and the MD&A for our

most recently completed fiscal year.SCHEDULE A Audit Committee Charter (See attached document)

BMTC Group Inc.

CHARTER

OF THE AUDIT COMMITTEE

August 10, 20041. PURPOSE AND MANDATE

The audit committee (the “Committee”) of BMTC Group Inc. (the “Company”) is a

Committee of the board of directors of the Company (the “Board of Directors”). It

is responsible for overseeing the accounting process, the presentation of the

Company’s financial information, and the auditing of its financial statements.

This charter (the “Charter”), adopted by the Board of Directors, sets out the

mandate and principal responsibilities of the Committee.

The principal duties of the Committee are to oversee the accounting and financial

reporting procedures of the Company, as well as to audit its financial statements.

This includes reviewing and overseeing financial reports, annual and interim

management reports, and other financial information that the Company provides

to any regulatory authority or the public, the Company’s systems of internal

control regarding finances, accounting and regulatory compliance established by

management and the Board of Directors, as well as Company auditing,

accounting, internal control and financial reporting processes.

Consistent with this function, the Committee should encourage continuous

improvement of, and foster adherence to, the Company’s policies, procedures

and practices at all levels.

2. COMPOSITION

The Committee shall consist of no less than three members, including a

chairman, all appointed by the Board of Directors. All members shall be directors

of the Company.

All members of the Committee shall abide by the requirements in effect at any

given time as regards the composition of the audit committees and the

independence of their members, as these requirements may be promulgated by

the relevant securities authorities, stock exchange on which the securities of the

Company are traded and any other governmental or regulatory authority to which

the Company is subject (individually, the “Regulatory Authority” and, collectively,

the “Regulatory Authorities”), as the Board of Directors may see fit.

All members of the Committee shall have a working familiarity with basic finance

and accounting practices, as the Board of Directors may see fit. At least one

member of the Committee shall have accounting or related financial

management expertise, as determined by the Board of Directors.

A person with no financial skills may be nominated to sit on the Committee,

provided he acquire the necessary skills within a reasonable delay following hisnomination on such conditions as may be established in applicable regulation

and by the Board of Directors.

Unless they should resign, be removed from office or no longer qualify as

director, the members and chairman of the Committee shall remain in office until

the next annual shareholder meeting or until a successor is nominated, if any.

A member may step down from office upon written notice to the Company. Any

Committee member may be removed from office by resolution of the Board of

Directors, which may then fill any resulting vacancy. A Committee member who

ceases being a director of the Company shall automatically cease being a

member of the Committee.

The Committee may appoint a Committee secretary, who need not be a member

of the committee or Board of Directors, and it may remove and replace him at

any given time.

Committee members shall receive such remuneration for their services as the

Board of Directors may from time to time determine, if any.

3. OPERATIONS

The Committee shall be called as often as is necessary to perform its duties, but

no less than once quarterly, by the Chairman of the Board of Directors or the

external auditors to discuss any specific issue.

Committee meetings shall be called by the Chairman of the Committee, by any

other member of the Committee, by the Chairman of the Board of Directors or by

the external auditors upon written notice of no less than two days prior to the

date set for the meeting.

When necessary, the Committee may invite such other persons to its meetings,

as it may deem necessary, whether or not these individuals are directors of the

Company. Any member of Company management, the head of internal auditors

and the external auditors, among others, may be invited to speak before the

Committee, whenever necessary. The notice of meeting shall be sent to the

external auditor or head of internal auditors who are invited to attend any such

Committee meeting.

The quorum for Committee meetings shall be set at two of its members. No

business may be transacted where no quorum is present.

Each member may cast one vote at Committee meetings. In the event of a tie

vote, the Chairman shall not have the deciding vote.Committee members may convene their meetings anywhere inside or outside

Quebec and, should all agree, they may attend any such meeting using technical

means that allow participants to communicate orally, such as by telephone.

A written resolution executed by all members of the Committee entitled to vote

thereon shall be as valid as though adopted at a meeting.

The Committee may determine all aspects of its operational procedures. Should

it fail to do so, it shall follow those that apply to the Board of Directors.

4. RESPONSIBILITIES AND DUTIES

Management of the Company shall be responsible for the preparation,

presentation and integrity of the Company’s financial statements, and for

compliance with the appropriate principles and practices that apply to accounting,

financial reporting and to the internal controls and procedures that ensure

compliance with accounting standards and applicable legislation.

External auditors shall be responsible for planning and auditing the annual

financial statements of the Company, in keeping with professional standards.

The main purpose of the Committee is to review the relevance and efficiency of

its activities while assisting the Board in its role of overseeing:

11.1.1 the integrity of the Company’s financial statements;

11.1.2 the skills and independence of external auditors;

11.1.3 the performance of the duties of the internal auditors and external auditors

of the Company;

11.1.4 the relevance and efficiency of internal control; and

11.1.5 the Company’s compliance with legal and regulatory requirements.

To honour its obligations and meet its responsibilities, the Committee shall:

Documents/Reports Review

(i) Review interim financial statements, annual financial statements

and other elements of financial information presented in the annual

and interim documents of the Company, and this prior to their

publication; review statements made by management of the

Company, management reports and press releases the Company

may issue in connection therewith, and report thereon to the Board

of Directors.(ii) Satisfy itself that the interim financial statements, annual financial

statements and other elements of financial information presented in

the annual and interim documents of the Company comply with

generally accepted accounting principles and give, in all material

respects, and accurate description of the financial situation of the

Company, its operating results and cash flow for the relevant dates

and periods, as the case may be, and recommend to the Board of

Directors whether they are to be approved for inclusion in the filings

required by regulatory authorities and for disclosure and publication

purposes.

(iii) Satisfy itself that the information contained in the Company’s

quarterly and annual financial statements, annual report to

shareholders and other financial publications, such as

management’s discussion and analysis, annual information form

(and similar documentation required by the Regulatory Authorities)

and the information contained in a prospectus, registration

statement or other similar document does not contain any untrue

statement of any material fact or omit to state a material fact that is

required or necessary to make a statement not misleading, in light

of the circumstances under which it was made.

(iv) Review material financial reports or other material financial

information of the Company submitted to any Regulatory Authority,

or the public.

(v) Review such matters and questions relating to the financial position

of the Company and its affiliates or the reporting related thereto as

the Board of Directors may from time to time refer to the

Committee.

(vi) Review, with management and the external auditors, all material

changes proposed to be made to the policies and accounting

practices followed by the Company.

(vii) Review and update this Charter and evaluate its efficiency in

meeting its mandate as circumstances may require, but no less

than once a year or at any time upon request of the Board of

Directors.

External Auditors

(i) Recommend to the Board of Directors the appointment,

remuneration, renewal of mandate or, where applicable, termination

of external auditors (including the proposal not to retain or toterminate) and oversight of any external auditor engaged by the

Company for the purpose of preparing or issuing an audit report or

related work.

(ii) Ensure that the external auditors of the Company are “independent”

of management, in keeping with industry best practices. Obtain

from the external auditors, at least annually, a formal written

statement delineating all relationships between the external

auditors and the Company.

(iii) Satisfy itself that management of the Company or the external

auditors give prior notice of any mandate pertaining to an audit

issue that was or would have been entrusted to an accounting firm

others and the external auditors.

(iv) Approve in advance any audit and non-audit mandate awarded to

external auditors and adopt and implement policies for such pre-

approval and review all remuneration paid to external auditors,

including for such additional audit and non-audit services; in cases

of an emergency, the chairman of the Committee, acting

independently, shall be authorized to approve in advance any and

all audit and non-audit mandates awarded to external auditors.

(v) Review the performance and the remuneration of the external

auditors and recommend to the Board of Directors the discharge of

the external auditors when circumstances warrant.

(vi) Oversee the work of the external auditors and satisfy itself that the

audit function has been effectively carried out and that any matter

which the external auditors wish to bring to the attention of the

Board of Directors has been settled and that there are no

“unresolved differences” with the external auditors. Be directly

responsible for the resolution of any disagreements between

management and the external auditors regarding reporting matters.

(vii) Ensure the orderly transition of files in the event of a change of

external auditors, and review any issue referred by Regulatory

Authorities regarding financial reporting procedures.

Financial Reporting Procedure and Risk Management

(i) Review the audit plan of the external auditors for the current fiscal

year, review the integration of the external audit with the internal

control program and review advice from the external auditorsYou can also read