ARCH, CWAG & NFA Consultation: Council Rents after 2020

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

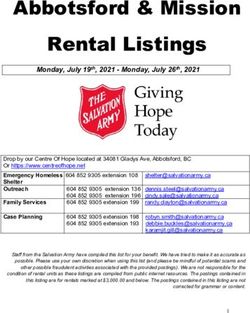

ARCH, CWAG & NFA Consultation: Council Rents after 2020 About ARCH, CWAG and the NFA 165 councils in England own over 1.6 million homes, either managing them directly or through Arms-Length Management Organisations. ARCH represents councils that have chosen to retain ownership of council housing and manage it directly. CWAG represents councils whose housing stock is managed by ALMOs and the National Federation of ALMOs represents 37 Arms-Length Management Organisations managing over 500,000 homes in 40 local authorities. Together we represent over 1.2 million council homes, one third of the social housing in England. Introduction The Housing White Paper Fixing our broken housing market confirms that the Government will continue to reduce council and housing association rents by 1% a year for the next three years. But it promises discussions with the sector before setting out, in due course, a rent policy for the period beyond 2020. This paper sets out options for council rent policy after 2020, on which ARCH and the NFA, in conjunction with the Councils with ALMOs Group (CWAG) are seeking views. We are inviting responses from councils with housing, ALMOs, council tenants and tenants’ organisations, and other relevant consultees. Based on responses received, we intend to develop a proposal to put to Government later this year. A major consideration is the impact of future rent policy on investment in the existing housing stock and the possibility of building additional homes. Councils and ALMOs are therefore asked, in their responses, not only to comment on the policy options but also to estimate their impact on future spending and investment. We plan to use this material to build an evidence base to support the proposal to Government. Responses are requested by 30 June.

Issues for consideration Views are invited on five main issues: 1. The annual rate at which rents, in aggregate, should be expected to increase after 2020. 2. The level of annual rent increase, if any, which would be needed after 2020 to maintain the existing housing stock to the minimum Decent Homes Standard and repay HRA debt by 2042. 3. Whether the current formula should continue to be used to calculate guideline rents for individual council properties. 4. Whether freedom to make local decisions on rent levels should be returned to councils. 5. The likely impact of the proposal to limit council rents’ eligibility for housing benefit to the applicable Local Housing Allowance. The Challenge Any proposal on rents policy after 2020 is a bid for public expenditure, since the Government will be expected to contribute towards rents due from tenants on low incomes through housing benefit or Universal Credit. It will therefore be necessary to show clearly, with compelling supporting evidence, the public and social benefits that derive from the preferred proposal, compared with the alternatives. Under the self-financing settlement implemented by the Coalition Government in 2012, councils took on £13 billion in extra debt in exchange for the freedom to retain rent income in full and make robust long-term plans for investment, including the construction of new homes. The settlement envisaged that rents would increase, where necessary, to converge with local housing association rents and thereafter increase annually by 0.5% more than the Retail Prices Index. This provided financial capacity estimated to be sufficient for councils to build 550,000 new homes over the business plan period of 30 years1. This potential has been compromised by subsequent Government decisions: firstly, the decision to change the annual guideline increase from RPI + ½% to CPI + 1% from April 2015, and end the allowance for convergence, and, secondly the decision to reduce council rents by 1% a year from April 2016 until March 2020. The first of these is estimated to have 1CIH & CIPFA Investing in council housing: the impact on HRA business plans 2017 http://www.cih.org/resources/PDF/Investing%20in%20council%20housing%20CIH- CIPFA%20July%202016.pdf

reduced the capacity for new building from 550,000 homes over 30 years to 160,000, the

second to have further reduced it to 45,000, an annual rate no higher than that achieved a

decade ago2.

In addition to these changes in rents policy, long-term financial planning for council housing

has been undermined by uncertainty about the impact of Government welfare reforms,

particularly the introduction of Universal Credit, on rent arrears and rent collection costs.

From 2018 there is also the as-yet un-costed threat of an annual levy on HRA assets to

fund Right to Buy discounts for housing association tenants. Taken together, these

developments are sufficient to raise serious questions about the ability of some councils

both to meet the long-term needs of their existing stock and to repay the debt on it.

In developing a proposal for rents after 2020, ARCH, CWAG and the NFA will want to be

able to demonstrate that it will allow all councils and ALMOs to raise sufficient income to

meet the long-term needs of their existing stock and also permit them to make a significant

contribution to raising the annual output of new homes to the 250,000 envisaged by the

Housing White Paper. The White Paper acknowledges that traditional council

housebuilding funded from the Housing Revenue Account should continue to provide “a

small, but growing source of new homes”. The likelihood is that whichever Party forms the

next Government will pursue a similar policy. If councils are to expand new construction

funded from the HRA the implication is that rents will need to be higher than they otherwise

would. This implies additional spending on Housing Benefit and Universal Credit, but also

additional rent income from tenants not in receipt of benefits. In deciding on the appropriate

level of rents after 2020, the additional benefits expenditure should be weighed against both

the additional income that councils will receive from tenants not on benefits and the public

benefit that will derive from additional investment, including in new homes.

Principles for National Rents Policy

A national rents policy for council housing needs to strike a balance between four criteria:

Adequacy and sustainability – as argued above, aggregate rental income should

be sufficient to finance the long-term management and maintenance of the existing

stock, repay the debt associated with it, and, allow for provision of a significant

number of additional dwellings;

Freedom – the right of individual councils to set rents according to local policies and

priorities;

Fairness – the principle that the rent paid by any council tenant should be similar to

that paid by any other tenant in a similar property, whether owned by a council or

2 Ibidhousing association, and that variations in rents among properties and locations

should reflect variations in the size and quality of those properties and the quality of

the locations;

Affordability – rents payable should be affordable by all tenants, whether or not in

receipt of housing benefit;

ARCH and the NFA believe that current policy fails three of these four criteria. It denies

local authority landlords the freedom they have traditionally enjoyed to set rents according

to local policies and priorities; it is unfair, in that council tenants may be expected to pay

significantly different rents for similar properties owned by the same or other councils or

housing associations, and it is unsustainable, in that continuation of the current policy of

rent reductions would deprive councils of the income necessary to meet the long-term

needs of the council housing stock.

Background – the evolution of national policy on council rents since

2002

Freedom

For all but two relatively brief periods in the history of council housing, local authority

landlords have been free, in law, to set the rents of individual homes and determine the

amount of any general increase in rents, in accordance with local policies. Government has

sought to influence local decisions through guidance and through financial incentives, but

only rarely through direct prescription of rents. Current law, which requires that the actual

rents chargeable on properties must, with minor exceptions, be reduced by 1% a year until

2020, has no precedent other than the Heath Government’s short-lived attempt to impose

fair rents on council homes.

Councils’ basic powers, which have been overridden by current legislation, are set out in

Part II of the Housing Act 1985, which provides only that councils should make “reasonable

charges” for homes and review them from time to time. Until 2016, Government influence

on local decisions on rents was exercised through guidance, never binding, and the subsidy

system. Until the introduction of self-financing in 2012, each council’s subsidy was reduced

annually by the product of a notional rent increase, leaving it to strike a balance between

raising rents and cutting expenditure to find that amount. Most councils in most years opted

to increase rents by the guideline amount.

The self-financing settlement apportioned debt to local authorities on the assumption that it

could be repaid from rent income, net of management and maintenance costs, over 30

years, assuming that rents continued to increase in line with the guidelines set out in pre-

existing policy. This locked in an enduring financial incentive for councils to follow rentguidelines in order to meet the long-term needs of their stock. The great majority of councils continued to follow guideline rent increases until 2016, despite the shift from RPI to CPI and the end of the convergence allowance in 2015. While the housing subsidy system discouraged councils from setting rents lower than guidelines, the housing benefit system discouraged them from setting rents higher. Housing benefit subsidy payable to councils was restricted to a limit rent based on the formula rent payable on any property, so that housing benefit paid to any tenant on a rent higher than the limit would have to be financed locally. A very small number of councils chose to set rents above formula on the basis that the income raised from tenants not receiving housing benefit more than compensated for the loss of housing benefit subsidy. In introducing the Welfare Reform and Work Bill in 2015, the Government never explained why it had decided to take direct control of council and housing association rents rather than continuing with the previous approach of guidance and financial incentives. ARCH, CWAG and the NFA consider there are no good reasons for the Government to directly continue to control rents after 2020 and would argue for a return to the status quo ante, returning local freedom over rent-setting. Fairness In 2002 the Government introduced a rent restructuring policy that sought to improve fairness by ensuring that council and housing association tenants paid similar rents for similar properties and that rent differentials between properties of different sizes and in different areas more closely reflected market differentials. Formula rents were calculated for all properties and guideline rent increases set annually. The basic increase was set at ½% above RPI, but since, at that time, average council rents were significantly lower than average housing association rents, the annual increase included an additional allowance for convergence limited to a maximum of £2 a week. In 2013 the Government announced its intention to change, from 2015/16, the annual guideline increase from RPI + ½% to CPI + 1% and to end the allowance for convergence. At this time, an estimated 500,000 properties had not reached convergence, hence around 30% of council tenants were still paying less than the formula rent. Further, a relatively small number of new homes provided since 2010 through the HCA’s Affordable Housing Programme are not subject to formula rents but let on “affordable” rents of up to 80% of market levels. In 2016, therefore, rents payable by council tenants were far from realizing the Labour government’s ambition, set 14 years previously, that tenants of similar properties should expect to pay similar rents. The rent chargeable on any specific property could be “affordable” or “social” and at or below formula, according to its history. With minor exceptions, the Welfare Reform and Work Act locks in these anomalies for a further four

years. Restoration of local freedom over rent setting from 2020 would provide greater scope for councils to address these, if they choose, although HCA policy would also need to be changed to allow a move away from “affordable” rents on properties funded through the AHP. An important question for future policy is how much weight should be given to the principle of a consistent approach to rent setting across councils and housing associations after 2020. Both sectors have moved a long way over the last 15 years, using a wider range of funding models and offering a wider variety of rented properties. And, if the existing approach to the calculation of formula rents is to continue, there is arguably a case for revisiting the basis of the calculation. Formula rents were calculated for 2002 with reference to local property prices and regional earnings at that time, and have increased annually since then by a nationally uniform percentage regardless of regional and local variations in housing or labour markets. Because, in particular, house prices in London and the South East have risen faster over the last fifteen years than in other regions, council rents are now much closer to market (and “affordable”) rents in the Midlands, North and West than in London and nearby regions. Work carried out for the ARCH submission to the 2015 consultation on Pay to Stay estimated that council rents in London in 2014/15 averaged 65% of market rents, while in the North, North West and Yorkshire and Humberside regions they were close to 90% of market rents. These regional averages mask substantial variations between and within local authority areas but serve to make the point that the relationship between market, “affordable” (80% of market) and formula rents varies widely between local authorities. Fairness does not dictate that council rents should be set at the same percentage of market rents in all areas. Affordability is also a consideration, and the gap between market rents and average incomes is also much wider in London than in some Northern areas. However, the current position is not the intended outcome of a considered policy, and is arguably unfair and in need of review. Affordability Council rents are set according to the characteristics of the property, not the individual tenant. The household incomes of council tenants vary significantly, although most are on lower incomes. DCLG’s impact assessment for the Pay to Stay policy quotes data from the English Housing Survey 2015 showing that 87% of council tenants had household incomes below £30,000, which was then roughly equivalent to the median household income. Consequently, rents have always been less affordable for some tenants than others, with those on the lowest incomes needing help from the benefits system. If it can be assumed that the benefits system will provide adequate help for those entitled to receive it, affordability needs to be assessed from the perspective of those tenants whose incomes are just too high for any housing benefit entitlement. There is no universally accepted method of assessing affordability, but it is possible to look at changes in the affordability of council rents over time. In 2002, the rent restructuring

policy introduced an annual basic increase (i.e. disregarding the allowance for convergence) in guideline rents of ½% above RPI, which continued for the next ten years; the same basic increase was written into the self-financing settlement. From 2015, it was replaced by an annual increase of 1% above CPI, until this was superseded by the rent reductions imposed by the Welfare Reform and Work Act in 2016. There is no clear justification in the policy documents of the time for the proposal to set long-term above-inflation annual increases in rents. The most likely reason is the expectation that earnings, and thus household incomes, would also rise faster than prices, so that affordability would not be compromised. Based on the movement of earnings and prices over the previous two decades that was reasonable, and for the first few years after 2002, earnings continued to rise faster than prices. However, after 2008 the relationship was reversed and price inflation outstripped earnings. Figure 1 shows average earnings from 1997 to 2016 in current and constant (2016) prices. It shows how real earnings fell between 2008 and 2014 and that, although they have been increasing for the last three years, they have still not recovered to their pre-2008 level. Figure1: Median full-time gross annual earnings in current and constant (2016) prices April 1997 to 20163 3 Source: Annual Survey of Hours and Earnings 2016 Provisional Results https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bullet ins/annualsurveyofhoursandearnings/2016provisionalresults

Figure 2 compares the rate of increase of council rents with earnings and prices since 2002.

For 2002 to 2016 it compares actual average council rents in England with movements in

median full-time gross earnings and the consumer price index. For the four years to 2020 it

models the impact of the four-year rent reductions, assuming that earnings and prices both

increase at 2% a year.

Figure 2: Indices of earnings, prices and council rents 2001-2016 and estimates for

2017-2020 (2002=100)4

It can be seen that, from 2002 to 2008, rent increases closely followed the rate of increase

in earnings, but for the next six years – the worst years of the recession - they increased

significantly faster than earnings. In 2002, average council rents stood at 12.3% of median

full-time earnings; by 2016 the ratio had risen to 16.3%. On the assumptions given above,

rent reductions will bring the ratio back to around 14.5% by 2020, similar to the level at the

introduction of self-financing in 2012.

These results do not demonstrate that, by 2016, rents had become unaffordable. One

implication of the convergence policy adopted in 2002 is that council rents were, at that

time, lower than necessary to ensure affordability, and could be safely allowed to rise to the

then higher level of housing association rents. Indeed, in 2002, average housing association

rents were around the same percentage of average earnings – 14% - as predicted for

council rents for 2020. However, the analysis above does illustrate the potential risks

associated with assuming that an above-inflation increase in rents is sustainable for the

4 Earnings: UK Median full-time gross earnings from Annual Survey of Hours and Earnings

Prices: All Items Consumer Prices Index, annual increases to April.

Rents: Average Council Rents: England DCLG Local Authority Housing Data Table 701whole of a 30-year business plan period. One response would be to link future rent increases with increases in earnings rather than CPI +1%. However, this would introduce an additional element of uncertainty into the business planning process. An alternative would be to recognise that the rent settlement negotiated with Government is unlikely to be for longer than 10 years, with the opportunity of review in the light of the divergence of earnings and price increases after that time, or earlier if it were to become necessary. Rents and benefits This section considers the issues arising from the operation of the benefits system for general needs housing. Special needs and supported housing involve additional issues on which the Government has recently consulted, and which are not addressed in this consultation paper. Throughout most of its existence, the housing benefit system for general needs housing has operated on the principle that the actual rents paid by council tenants are classed as eligible rent for calculating housing benefit, so that tenants on the lowest incomes have their rent fully met by housing benefit. Councils that charged rents that were higher than levels specified by DWP could have their rent rebate subsidy from Government reduced and be required to fund part of their housing benefit expenditure from local General Fund resources, but their tenants still received housing benefit relating to their full rent. The abolition of the spare room subsidy (the “bedroom tax”) by the Coalition Government made the first major breach in this principle. Even more important for future rents policy, however, is the proposal to limit from April 2018 the rent eligible for housing benefit (or the housing element of Universal Credit) to the relevant local housing allowance (LHA), which, for single tenants under 35 will be the single room rate. LHAs are set for Broad Rental Market Areas (BRMAs) which are defined as areas ‘within which a person could reasonably be expected to live having regard to facilities and services for the purposes of health, education, recreation, personal banking and shopping, taking account of the distance of travel, by public and private transport, to and from those facilities and services.’ Most cover more than one local housing authority area; some local authorities may have areas in more than one BRMA. When first introduced, LHAs were set for each BRMA in line with the median private market rent in that area, and adjusted monthly up or down in line with market movements. In April 2011, the method of calculating LHAs was amended to make them equivalent to the rent payable on the 30th percentile of properties (i.e. the cheapest 30%). From April 2012 LHAs were frozen, and subsequent increases limited to CPI in April 2013 and a maximum of 1% in 2014 and 2015. In the Summer Budget that followed the 2015 General Election, LHAs were frozen for a further period of four years.

The declared purpose of these restrictions, apart from limiting spending on housing benefit, was to exert downward pressure on private market rents. In practice the effect seems to have been that private landlords have become more reluctant to accept tenants on benefits, with a consequent reduction in the supply of accommodation available. However, the effect of severing the connection between LHAs and the movement of actual market rents is likely to have been that the relationship now varies widely from area to area and bears little relationship to the variation in market conditions. The relationship between council and market rents also varies from area to area, for reasons given above. It is therefore likely that the impact of the proposal to limit eligible council rents to the relevant LHA will also vary among councils. Most, if not all, councils will be affected by the proposal to restrict single under-35s to the single room rate. ARCH, CWAG and the NFA are opposed to this proposal and have made representations against it. However, it is essentially a proposal on occupancy – in effect an extension of the bedroom tax – rather than a matter for future rents policy. However, the wider proposal to restrict benefit to frozen LHA levels council undermine any policy for council rent increases after 2020. We are keen to receive information, particularly from councils and ALMOs, on the likely impact of this wider proposal to limit. Views are invited on whether this should be tackled by dropping the link between council rents and LHAs or by increasing LHAs so they more nearly reflect actual market rents.

You can also read