Aviva Young Scholar Secure

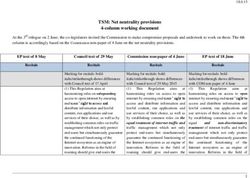

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Aviva Young Scholar Secure

“This information contained in this Training Presentation (“Presentation”) has been prepared by the Aviva Life insurance

Company India Ltd. (Aviva) and is solely for internal circulation. The content provided is for information only and is subject to

change without any prior notice. Aviva do not, directly or indirectly, authenticate the completeness or accuracy of the content

and Aviva will not be liable for any loss, direct or indirect, arising from the use of this content. Any unauthorized use of this

Presentation (extract / copy etc.) without prior written permission of Aviva shall be subject to legal proceeding before the court

of law the consequences for which shall lie solely with the person who makes such unauthorized use.”

Version 1.0/Feb 2011Research covered 2205 Parents in 2009 and

2402 Parents in 2010

Chandigarh

Delhi

Lucknow

Kolkata

Ahmedabad

Bhubaneswar

Mumbai

Fathers with children in

age groups of

Hyderabad

0 to 5 years

Bangalore

Chennai 6 to 10 years

Kochi

11 to 14 years

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Saving for Child’s Education is the top priority of

majority of the Parents

Via AVIVA child plans 1%

Via insurance child plans 36% • Of all respondents 86% Save

Via insurance 51% •2/3 rd (64%) save for the child

• Child continued to be the top driver for saving

For child 64%

Saving 86%

2010

Child’s Retirement Protection

Education 54% against death

67% 48%

Child’s Protection Retirement

Education against death 45%

2009 52%

72%

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Parents start saving early and save with a long

term view for Child’s educational milestones

70% invest in child plans when the child is between 0-5 yrs

What was the child’s age when parents purchased insurance policy for him?

86% of the Parents save for their child with a Parents want the additional funds for child’s education

long term perspective, i.e. 15 years or more as soon as the child approaches 10th Boards

%

What is the maturity period of child At what educational milestone of your child will you

plans? ideally want the total amount that you are saving?

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Parents are looking for “safe returns” from the

savings for the Child’s education

What do they look for while saving for the child?

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

Product Details

“This information contained in this Training Presentation (“Presentation”) has been prepared by the Aviva Life insurance

Company India Ltd. (Aviva) and is solely for internal circulation. The content provided is for information only and is subject to

change without any prior notice. Aviva do not, directly or indirectly, authenticate the completeness or accuracy of the content

and Aviva will not be liable for any loss, direct or indirect, arising from the use of this content. Any unauthorized use of this

Presentation (extract / copy etc.) without prior written permission of Aviva shall be subject to legal proceeding before the court

of law the consequences for which shall lie solely with the person who makes such unauthorized use.”

Version 1.0/Feb 2011Aviva Young Scholar Secure

Product Positioning – Child plan

Positioning Child Plan

Key Drivers Guaranteed payouts for important education milestones with Inbuilt Waiver of Premium

Parents with child < 8 yrs of age, who would like to save for important milestones for their

Primary Target Audience child’s education and ensure regular cash flow even incase something untoward happens to

them

Features to appeal Inbuilt Waiver of Premium, Optional riders to enhance protection

Aviva Young Scholar Secure is a unique insurance plan specially designed to provide regular

cash flows at important milestones of your child’s education.

- Guaranteed regular payouts to help you meet your child’s high school, college and higher

education

- In the event of your death:

Sales pitch

- Sum Assured is paid out immediately

- Future benefits continue without the liability of future premium payment

- All payouts are still guaranteed for your child as per the benefit structure

- In the event of disability or dread disease (if opted):

- Aviva DD Rider Sum Assured is paid to you without impacting the policy benefits

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 8Aviva Young Scholar Secure

Aviva Young Scholar Secure – 3 simple steps to quality education

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 9Aviva Young Scholar Secure

How it works on survival of parent till end of policy term

Receive Guaranteed payouts at important

Pay Premiums when the spend on education is low milestones for your child’s education

Age 18 of child Age 21 of child

(PPT ) ends at age 13 of child*

Annual Cash payouts

between class VIII to XII of (Maturity)

child

Lump sum for college Lump sum for

higher education

All payouts are guaranteed

Payment term will be 13 minus entry age (subject to minimum of 5 years)

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” 10Aviva Young Scholar Secure

How it works on death of parent during the PPT

Regular Premium Payment

Age 18 of child Age 21 of child

Annual Cash payouts

between class VIII to XII of (Maturity)

child

- Sum Assured paid immediately

- Policy continues with all future benefits intact Lump sum for college Lump sum for

- No liability of future premium payments higher education

All payouts are guaranteed

Payment term will be 13 minus entry age (subject to minimum of 5 years)

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” 11Aviva Young Scholar Secure

How it works on death of parent after the PPT

Regular Premium Payment

Age 13 of child*

(PPT ) ends

Age 18 of child Age 21 of child

Annual Cash payouts

between class VIII to XII of (Maturity)

child

All payouts are guaranteed Lump sum for college Lump sum for

higher education

- Sum Assured paid immediately

- Policy continues with all future benefits intact

Payment term will be 13 minus entry age (subject to minimum of 5 years)

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” 12Aviva Young Scholar Secure –

Product Specifications

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

The Product Specifications

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 14Aviva Young Scholar Secure –

Features

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”How are the Survival Benefits paid

Payment of Benefits

When Child's Age is Education Entry Age Entry Age Entry Age Entry Age Entry Age

(in years) Milestone 0 to 8 9 10 11 12

13 Class VIII TFS - - - -

14 Class IX TFS TFS - - -

15 Class X TFS TFS TFS - -

16 Class XI TFS TFS TFS TFS -

17 Class XII TFS TFS TFS TFS TFS

College

18 CAF CAF CAF CAF CAF

Admission

19 - - - - -

20 - - - - -

Higher

21 HER HER HER HER HER

Education

TFS: Tuition Fee Support

CAF: College Admission Fund

HER: Higher Education Reserve = Sum Assured Minus sum of (TFS+CAF) already paid

Payment will be made at the policy anniversary following immediately on or after the completing the above age by child.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completenessAviva Young Scholar Secure

The Product Features

Survival and Maturity Benefit

Maturity Benefit

This plan offers guaranteed benefits on survival during the Policy Term and at Maturity for the benefit of your child’s education.

Annual Premium Survival Benefits (Rs.)

Plan Option Excluding Tuition Fee College Admission

Service Tax(Rs.) Support (TFS) Higher Education Reserve (HER)

Fund (CAF)

Silver 25,000 15,000 40,000 SA minus sum of TFS and CAF paid

50,000

Gold 20,000 1,00,000 SA minus sum of TFS and CAF paid

1,00,000

Diamond 40,000 2,50,000 SA minus sum of TFS and CAF paid

2,00,000

80,000 6,00,000 SA minus sum of TFS and CAF paid

4,00,000

1,60,000 12,00,000 SA minus sum of TFS and CAF paid

6,00,000

Platinum 2,40,000 18,00,000 SA minus sum of TFS and CAF paid

8,00,000

3,20,000 24,00,000 SA minus sum of TFS and CAF paid

10,00,000

4,00,000 30,00,000 SA minus sum of TFS and CAF paid

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completenessAviva Young Scholar Secure

The Product Features

Death Benefit

In the unfortunate event of your death, the following benefits will be payable, provided all due

premiums are paid till date:

•A lump sum equal to Sum Assured, is paid to the nominee (beneficiary) to take care of immediate

financial needs for your child’s education. This amount will be paid to the Appointee in case nominee

is minor on such date

•Policy continues with all benefits intact without liability of future premium payment

•Aviva Term Plus Rider Sum Assured is also payable, if this rider has been opted for

•An additional sum equal to ADB Rider Sum Assured would be payable, if ADB Rider has been opted,

and death is due to an accident.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 18Aviva Young Scholar Secure

The Product Features

Upon death of Nominee (Beneficiary) before death of the Policyholder

In case of death of the nominee (beneficiary) before the death of Life Insured (parent), the Life Insured (parent) will

have a right to nominate another child or any other person as nominee (beneficiary). In such cases, the benefit

structure will remain the same as agreed at inception

Assignment and Nomination

Assignment and Nomination

Assignment and Nomination are allowed as per sections 38 & 39 respectively of the Insurance Act, 1938.

Tax Benefit

Tax benefits will be as per section 80C and 10(10(D))of Income Tax Act, 1961.

As per the prevailing tax laws, 80C is applicable for a premium up to 20% of base Sum Assured and 10(10D) at

maturity is applicable only if the premium paid in any year was less than or equal to 20% of the base Sum Assured.

Tax benefits are as per the prevailing tax laws and are subject to change from time to time.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 19Aviva Young Scholar Secure

The Product Features

Lapse Paid-up and Paid-up Value

If premiums are not paid for one policy year,

• If premium are paid for at least one policy year and

and the regular premium is not paid with the

the regular premium is not paid within the grace period

grace period, then the policy shall lapse without then the policy shall become Paid-up after the expiry

any value after the expiry of grace period. of grace period.

There will be no risk cover on a lapsed policy. • A Paid-up policy can be revived during the premium

A lapsed policy can be re-instated during the payment term within a reinstatement period of 2 years

from the date of First Unpaid Premium. The amount of

premium payment term within a reinstatement

Paid-up Sum Assured would be as per the following

period of 2 years from the date of First Unpaid formula:

Premium, failing which the policy will be

terminated without any benefit payable. Paid-up Sum Assured =

In case of death during the Policy Term, after

acquiring paid-up status, the Paid-up Sum Assured

will be payable.

•On survival till maturity, paid-up Sum Assured will be

payable. No other benefit will be payable in case of

Paid-up policy.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 20Aviva Young Scholar Secure

The Product Features

Reinstatement

•The reinstatement of a lapsed/paid up policy is subject to payment of all due premiums along with

revival fee, which is Rs.250/- at present and subject to review in future with IRDA approval.

• The policyholder may be required to pay interest and provide proof of insurability to reinstate the

policy at own cost, as per the prevailing re-instatement rules of Aviva.

•Currently the interest rate chargeable is 9% per annum compounded monthly and proof of insurability

is waived for first six months for policies where at least two years’ premiums are paid and Aviva DD

rider is not opted for. Company reserves the right whether to reinstate a lapsed / paid-up policy or not.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 21Aviva Young Scholar Secure

The Product Features

Surrender Value

•Surrender of a policy is allowed after completion of two policy years provided at least one policy year

premiums have been paid. Surrender Value payable is higher of the Guaranteed Surrender Value and

Special Surrender Value:

•Guaranteed Surrender value = 30% of the sum of all premiums paid

(excluding premiums for the first year and also excluding the rider premium, extra premiums and taxes,

if any)

•Special Surrender Value = Paid-up Sum Assured x Surrender Value Factor

(Surrender Value Factors will be decided by the Company from time to time)

Once the Surrender Value is paid, the policy will get terminated and all benefits will cease thereafter.

There will be no Surrender Value in respect of the attachable riders.

Exclusions (base policy)

Only Surrender Value (Guaranteed Surrender Value or Special Surrender Value whichever is higher), if

any, will be payable if the death of the life insured has occurred directly or indirectly as a result of

suicide or attempted suicide within one year from the date of commencement of the risk or the date of

reinstatement of the policy, if any.

In case you opt for any rider, then the rider exclusions will also apply.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 22Aviva Young Scholar Secure –

The Riders

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure –

An overview of the riders

Maximum Coverage Premium

On the life

Rider option expiry age for Minimum SA Term of Paying Term

of

rider benefit Rider of Rider

PPT of PPT of base

ADB Rider 60 Rs. 50,000

base plan plan

Life PPT of PPT of base

Aviva Term Plus Rider 70 Rs. 50,000

Insured base plan plan

PPT of PPT of base

Aviva Dread Disease (DD) Rider 65 Rs.2,00,000

base plan plan

* The maximum aggregate cover under the Accidental riders for all policies issued by Aviva is Rs. 50 lacs

* The maximum aggregate cover under the CI riders for all policies issued by Aviva is Rs. 50 lacs

Note:

4. Rider SA (for either Rider) cannot exceed the Base SA

5. Sum of Rider premiums should not exceed 30% of the base premium, otherwise Rider SA will be reduced accordingly.

6. If the Rider SA works out to be less than the minimum Rider SA, then the specific rider won’t be available.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 24Aviva Young Scholar Secure – Sample Rider Premium Rates ADB rider premium rates: ABB rider will be charged @ Rs. 0.60 per 1000 of ADB Sum Assured per year. Sample Aviva Term Plus rider premium rates: Tabular premium per Rs. 1000 of Rider Sum Assured for a healthy individual (Regular Premium) per year: Sample Aviva DD rider premium rates: Tabular premium per Rs. 1000 of Rider Sum Assured for a healthy individual (Regular Premium) per year: The rider premium rates are guaranteed for first 5 years and can be reviewed thereafter on every policy anniversary

Aviva Young Scholar Secure

Rider benefits

Rider option Rider Benefit

An additional sum equal to the ADB rider sum assured will be paid on the death of the Policyholder

Accidental Death Benefit due to accident The rider benefit is available only when the base policy is in force

(ADB) Rider

The ADB Rider will be available at an additional cost of Re 0.60 per Rs. 1000 of the Rider Sum

Assured.

An additional death benefit equal to the “Aviva Term Plus Rider Sum Assured” shall be payable on

Aviva Term Plus rider death of the Life Insured in addition to the benefits payable under the base policy. The rider benefit

is available only when the base policy is in force.

Upon Permanent Total Disability due to illness or accident OR contracting a Critical Illnesses, the

rider Sum Assured shall be paid immediately and the policy will continue without this rider.

The critical illnesses covered under this rider are: Heart Attack, Stroke, Cancer, End stage kidney

Aviva Dread Disease (DD) failure, Major organ transplant, Coronary artery bypass surgery, Benign brain tumour, Deafness,

Rider

Blindness, Aorta Graft Surgery, Heart Valve Surgery, Paraplegia, Motor Neurone Disease, Multiple

Sclerosis, Coma, End stage liver disease, End stage lung disease and Aplastic Anaemia.

There is a waiting period of 180 days for this rider from the date of commencement of risk or the

date of revival of the policy, in case of revival.

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 26Aviva Young Scholar Secure

Benefits for the customer

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

The overall benefits

Death Benefit (Base Plan) Tuition Fee Support

Fixed amount payable every year

For inforce policies: Plan Option TFS CAF

Sum Assured Silver 15,000 40,000

Plus Gold 20,000 1,00,000

All future all benefits intact without Diamond 40,000 2,50,000

premium payment liability Platinum (2L)* 80,000 6,00,000

For paid-up policies:

Paid-up Sum Assured * This amount will proportionately

Policy Terminates increase for Platinum Option if

Aviva Young premium is > 2 Lacs

Scholar Secure Rider Benefits

College Admission Fund and

Higher Education Reserve

Additional benefits through riders

•College Admission Fund: against accidental / non-accidental death,

Guaranteed lump sum at age 18 of child

critical illnesses/ disability

•Higher Education Reserve: Tax Benefit

Guaranteed Lump sum Payable at age 21 of child

Tax benefits will be as per the

SA minus Tuition Fee Support minus College

Education Pool prevailing tax laws

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.” Page 28Aviva Young Scholar Secure

Case Study

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

How does it work for a customer

Mr.Patel aged 35 has a 2 year old son Shailesh

He wants to secure his child’s future but wants:

Early payouts to take care of school fees

Guaranteed returns

College going fees

Adequate capital for higher education

Can AYS Secure help him ?

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

Illustration

oAge of parent = 35 years

oAge of child = 2 years

oSA = `10,82,000

Premium Payment oPremium Opted= ` 50,000 (Gold) + Tax Policy Term

Term

= 13-2 = 11 years = 21-2 = 19 years

13th 14th 15th 16th 17th 18th 19th 20th 21st

Year Year Year Year Year Year Year Year Year

` 20,000 ` 20,000 Higher Education Pool

` 1,00,000

` 20,000 ` 20,000

- - (Maturity Value)

` 20,000 = ` 8,82,000

College

Total Tuition Fees Support Admission

= ` 1,00,000 Fund Incase of untimely death,

= ` 1,00,000 ` 10,82,000 is paid out

immediately, and policy

If all premiums are paid till maturity or death, whichever is earlier,

continues with all benefits

intact (Waiver of premiums)

Sum of Guaranteed Payouts on Survival = ` 10,82,000

Sum of Guaranteed Payouts in case of death = ` 21,64,000

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Aviva Young Scholar Secure

Sample Sum Assured rates for 4 plan options

Silver Gold

Policy Term Policy Term

AP = 25000 AP = 50000

10 15 20 21 10 15 20 21

Age PPT Age PPT

5 7 12 13 5 7 12 13

25 146500 271500 609500 688750 25 302500 573000 1254000 1413500

30 146500 270750 605750 683500 30 302000 571500 1246000 1403500

35 146000 268500 595000 669750 35 301000 567500 1224500 1375000

40 144750 264500 575750 645000 40 299000 558500 1185000 1324500

45 143000 257750 545000 605750 45 295500 545000 1122000 1244500

50 140000 246500 498500 548000 50 289000 522000 1027500 1127000

Diamond Platinum

Policy Term Policy Term

AP = 100000 AP = 200000

10 15 20 21 10 15 20 21

Age PPT Age PPT

5 7 12 13 5 7 12 13

25 605000 1152000 2525000 2848000 25 1208000 2314000 5082000 5730000

30 604000 1149000 2510000 2827000 30 1206000 2308000 5050000 5688000

35 602000 1140000 2466000 2770000 35 1202000 2290000 4962000 5574000

40 598000 1123000 2387000 2669000 40 1194000 2256000 4804000 5370000

45 590000 1095000 2260000 2507000 45 1178000 2200000 4548000 5046000

50 577000 1049000 2070000 2270000 50 1152000 2106000 4166000 4570000

•Service Tax will apply separately on the premium payable

•Sum Assured will be increase proportionately for Platinum option (e.g. for Premium of 4 lacs, the SA will be double of amount displayed

above)

“For internal circulation and training purposes only and subject to change without prior notice. Aviva will not be liable for completeness

or accuracy of content, any loss, direct or indirect, arising from the use of this content. Any unauthorized use is prohibited.”Thank You “This information contained in this Training Presentation (“Presentation”) has been prepared by the Aviva Life insurance Company India Ltd. (Aviva) and is solely for internal circulation. The content provided is for information only and is subject to change without any prior notice. Aviva do not, directly or indirectly, authenticate the completeness or accuracy of the content and Aviva will not be liable for any loss, direct or indirect, arising from the use of this content. Any unauthorized use of this Presentation (extract / copy etc.) without prior written permission of Aviva shall be subject to legal proceeding before the court of law the consequences for which shall lie solely with the person who makes such unauthorized use.”

You can also read