California's Fiscal Outlook - The 2021-22 Budget: WINDFALL - Legislative ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The 2021-22 Budget:

California’s Fiscal Outlook

$30 WINDFALL

Billion

20

10

2022-23 2023-24 2024-25

2021-22

-10

-20

OPERATING DEFICITS

GABRIEL PETEK

L E G I S L A T I V E A N A LY S T

NOVEMBER 20202021-22 BUDGET

L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

Executive Summary

State Economy Has Undergone Rapid but Uneven Recovery. Although the state economy

abruptly ground to a halt in the spring with the emergence of coronavirus disease 2019, it has

experienced a quicker rebound than expected. While negative economic consequences of the

pandemic have been severe, they do not appear to have been as catastrophic from a fiscal

standpoint as the budget anticipated. But, the recovery has been uneven. Many low-income

Californians remain out of work, while most high-income workers have been spared.

Recent Data on Tax Collections and Expenditures Consistent With Economic Picture.

Recent data on actual tax collections and program caseloads have been consistent with a more

positive economic picture, especially among high-income Californians. For example, between

August and October, collections from the state’s three largest taxes so far in 2020-21 have been

22 percent ($11 billion) ahead of budget act assumptions. Simultaneously, data on new applications

for safety net programs, like Medi-Cal and CalFresh, in the first few months of 2020-21 show that

new applications for these programs have been below 2019-20 levels.

Estimated Windfall of $26 Billion in 2021-22… Under our main forecast, we estimate

the Legislature has a windfall of $26 billion to allocate in the upcoming budget process. This

windfall—or one-time surplus—results from revisions in prior- and current-year budget estimates

and is entirely one time. Current unknowns about the economic outlook create an unprecedented

amount of uncertainty about this fiscal picture. Our analysis suggests revenues easily could end

up $10 billion or more above or below our main forecast in 2021-22. Over the budget window,

the cumulative effect of these revenue differences means the windfall is more likely than not to lie

between $12 billion and $40 billion.

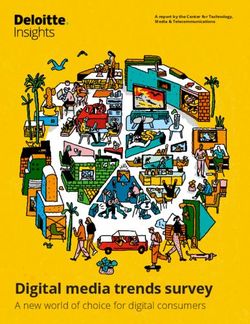

…But State Also Faces an Operating Deficit Beginning in 2021-22. Under our main forecast,

General Fund revenues from the state’s three largest sources would grow at an average annual rate

of less than 1 percent. Meanwhile, General Fund expenditures under current law and policy grow at

an average 4.4 percent per year. The net result is that the state faces an operating deficit, which is

relatively small in 2021-22,

but grows to around

Under Main Forecast,

$17 billion by 2024-25 (see Operating Deficits Grow Over Multiyear Period

figure). (In Billions)

Budget for Schools

$30

and Community Colleges

25

Is More Positive. The General Fund "Windfall"

20

budget picture for schools General Fund Operating Deficit

15

and community colleges

10

is more positive—the

5

minimum funding level

required by Proposition 98

-5

(1988) is projected to grow

-10

more quickly than school

-15

and community college

-20

programs. A new statutory 2021-22 2022-23 2023-24 2024-25

requirement to provide

www.lao.ca.gov 12021-22 BUDGET

supplemental payments on top of the minimum level makes even more funding available for schools

and community colleges but contributes to the state’s operating deficit.

What Revenue Level Would Balance the Budget? We also estimate how much faster

revenues would need to grow in order to erase the operating deficit. Revenues would need to beat

our expectations by $5 billion in 2021-22 and $35 billion in 2024-25 for the budget to break even.

The figure below shows where the breakeven point falls in our likely range of revenue outcomes.

The bulk of likely outcomes are below the breakeven point, suggesting the budget is quite likely to

face an operating deficit under current law and policy.

How Likely Is the Budget to Break Even?

General Fund Revenue (In Billions)

The shaded regions on this graph show our estimates of how much revenues might differ from our main forecast. Our estimates suggest

revenues are more likely than not to be in the inner shaded area. Revenues in the outer shaded area are less likely. Revenues beyond

that are very unlikely. The breakeven point shows the amount of revenue needed for the budget to stay balanced without further solutions.

LAO Main

2020-21

$142 $154 $164

Breakeven Point

2021-22

$139 $152 $165

2022-23

$133 $151 $170

2023-24

$131 $153 $173

2024-25

$133 $158 $182

Most of the outcomes are below the breakeven point, suggesting the budget is likely to face

an operating deficit, even if revenue growth differs substantially from our main forecast.

Comments and Recommendations. We conclude the report with our comments and we

recommend the Legislature:

Restore Budget Resilience. We recommend the Legislature use half of the windfall—about

$13 billion—to restore the budget’s fiscal resilience. For example, the Legislature could make

an optional deposit into a state reserve, like the Safety Net Reserve, to help maintain services

when demands on the state’s safety net programs increase.

Address One-Time Pandemic Needs. The significant windfall provides the Legislature with

an opportunity to develop a robust COVID-19 response that was not feasible when facing a

$54 billion budget problem in the spring. We recommend the Legislature use the other half of

the windfall—about $13 billion—on one-time purposes, focusing on activities that mitigate the

adverse economic and health consequences of the public health emergency.

Begin Multiyear Effort to Address Ongoing Deficit Now. The budget cannot afford

any new ongoing augmentations. Moreover, we recommend the Legislature use the

2021-22 budget process to begin to address the state’s ongoing deficit through spending

reductions or revenue increases. The significant budget windfall in 2021-22 buys the

Legislature time to enact or phase-in changes over the longer term.

2 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET INTRODUCTION Each year, our office publishes the Fiscal Outlook in anticipation of the upcoming state budget process. In this report, we provide our assessment of the state’s fiscal situation for the budget year and over a multiyear period. The fiscal situation has continued to rapidly evolve since the beginning of the coronavirus disease 2019 (COVID-19) pandemic earlier this year. As such, the first section of this report describes how the budget situation has changed since lawmakers passed the 2020-21 Budget Act in June. In the second section of this report, we aim to help lawmakers understand whether—and to what extent— the budget has sufficient resources to fund government services authorized under current law (at both the state and federal levels). We address this issue both for the upcoming fiscal year and over the longer term. We conclude the report with our comments on the state’s fiscal condition and our recommendations for the Legislature as it begins constructing the 2021-22 budget. Throughout this report, our analysis depends on assumptions about the future of the state economy, its revenues, and its expenditures. Consequently, our analysis and conclusions are not definitive, but rather reflect our best guidance to the Legislature based on our current professional assessment. WHAT HAS HAPPENED SINCE THE BUDGET PASSED? Economy Rapid Rebound Results in Incomplete, Uneven Economic Recovery. The COVID-19 pandemic has been an unprecedented disruption to California’s economy. In the spring, the economy abruptly ground to a halt: millions of Californians lost their jobs, businesses closed, and consumers deeply curtailed spending. Almost as quickly, Californians began to adjust to the realities of the pandemic. With this adjustment, and accompanying major federal actions to support the economy, came a rapid rebound in economic activity over the summer. This recovery, however, has been incomplete and uneven. Many low-wage, less-educated workers remain out of work, while few high-wage, highly educated workers have faced job losses. Certain sectors—such as leisure and hospitality—remain severely depressed, while others—such as technology— remain strong. Reaching full recovery will be a slow process that will depend heavily on continued progress on management and treatment of the virus. Below, we highlight a few key economic developments with particular importance to the state’s fiscal situation. Spike in Unemployment Was Historic, but Less Than Feared. This spring, the state’s unemployment rate peaked at 16 percent—the highest since the Great Depression. Despite this surge, unemployment fortunately did not reach the 25 percent rate assumed by the 2020-21 Budget Act. The unemployment rate has since improved, but remains at 11 percent as of September—a level comparable to the Great Recession. Low-wage workers have borne most of the job losses during the pandemic, as workers earning less than $20 per hour (slightly below the state average) make up the vast majority of job losses as of September. In contrast, employment among workers earning over $60 per hour remains at pre-pandemic levels. Drop in Consumer Spending Was Very Large, but Short-Lived. The spring job losses coincided with a dramatic drop in consumer spending. One measure of consumer spending in California was roughly one-third lower in April than immediately before the pandemic. Spending has since rebounded, improving consistently in each month between May and October. As of October, spending had risen to within roughly 10 percent of pre-pandemic levels. Stock Market and Technology Sector Doing Particularly Well. Like other parts of the economy, stock markets experienced a rapid decline and recovery earlier this year. Unlike most areas of economic activity, www.lao.ca.gov 3

2021-22 BUDGET

however, stock prices have seen such a dramatic rebound that they have reached historic highs. A key

driver of rising stock prices has been the continued success of many companies in the technology sector—

including several headquartered in California—throughout the pandemic.

Revenues

Tax Collections Have Been Much Better Than Anticipated. The budget act assumed the state would

face a historic revenue decline in 2020-21. In particular, it anticipated total collections from the state’s three

largest taxes—personal income, corporation, and sales taxes—would fall 15 percent from the prior year. Actual

collections in recent months, however, have been much better than anticipated. Between August and October,

collections from the three largest taxes were 9 percent higher than the prior year. As a result, actual collections

so far in 2020-21 are 22 percent ($11 billion) ahead of budget act assumptions, as can be seen in Figure 1.

Higher-Than-Expected Collections Consistent With Economic Picture. At first blush, strong tax

collections may seem at odds with widespread unemployment and the continued struggles of many

businesses. These strong collections, however, are consistent with the relatively good economic outcomes

experienced by high-income Californians, who account for a large share of state tax payments. Stable

employment among high-income earners and a rebound in investments held by wealthy Californians has led

to continued growth in tax payments from these taxpayers.

Program Caseload

Safety Net Caseload Increases Have Not Materialized as Anticipated. The budget anticipated

the state’s safety net programs—in particular, Medi-Cal, CalFresh, and California Work Opportunity and

Responsibility to Kids (CalWORKs)—would experience significant caseload increases at the end of 2019-20

and into 2020-21. For each of these programs, our data lags by a few months, meaning we currently only

have data on actual caseloads through June or July of 2020 (and the most recent months are preliminary

estimates). To date, actual caseload figures through the end of 2019-20 have come in significantly below

budget act projections. In addition,

preliminary data from safety-net Figure 1

program applications in 2020-21

do not suggest a major upturn. In Tax Collection Well Ahead of Budget Act

particular: Total 2020-21 Collections to Date

Personal Income, Corporation, and Sales Taxes (In Billions)

Medi-Cal. The budget

$70

act assumed average

monthly caseload of about 60

13 million in 2019-20, but

ions

lect

preliminary data reveal 50 a l Col

u

Act

this number is closer to

s

12.6 million. Moreover, initial 40 ption

c t A ssum

et A

data from 2020-21 shows Budg

30

new applications for the Through October, tax

collections are 22 percent

program have been below 20 ahead of the budget act

2019-20 levels. For example, assumption.

for July through October 10

2020, new applications have

been down 15.6 percent

July August September October

relative to the same period in

4 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

2019. Without an upturn in new applications, 2020-21 Medi-Cal caseload is unlikely to reach the levels

assumed in the budget act.

CalFresh. The budget act assumed average monthly caseload of about 2.3 million in 2019-20, but

preliminary data show a number closer to 2.2 million. Also, initial data on total applications for CalFresh

from July through October 2020 shows new applications have been below the corresponding period in

2019 by 13.3 percent.

CalWORKs. Although the budget act assumed average monthly caseload of about

412,000 participating families, preliminary data show a number closer to 365,000. Also, initial data on

total applications for CalWORKs from July through October 2020 shows new applications have been

below the corresponding period in 2019 by 24.7 percent.

As we will discuss later, we anticipate caseloads for Medi-Cal and CalWORKs to rise in the future given

the severe economic impact of the pandemic on lower-income workers. To date, however, other economic

mitigation interventions—like expanded unemployment insurance and federal stimulus payments—likely have

delayed enrollment in these programs.

DOES THE STATE HAVE ENOUGH RESOURCES TO PAY

FOR ITS CURRENT COMMITMENTS?

Economic Uncertainty Clouds Outlook

Unprecedented Amount of Uncertainty About Economic Future. A host of unknowns cloud the

state’s economic outlook. Will virus cases worsen further over the fall and winter? How soon will effective

treatments or vaccines be widely available? Can businesses continue to withstand diminished revenues

in the face of rising debts? Will the federal government take additional actions to support the economy?

Could the pandemic create

a permanent shift toward Figure 2

remote work and, if so, will

this shift change people’s

Disagreement on Economic Future Historically High

Range of Professional Forecasts of U.S. Unemployment Rate One Year Ahead

and businesses’ decisions

about locating in California? 12%

In the third quarter 2020 release of the Survey of Professional Forecasters, the

These unknowns create an difference between the most pessimistic unemployment rate forecast for the third

unprecedented degree of 10 quarter of 2021 (12.5 percent) and most optimistic (5.3 percent) was 7.2 percent.

uncertainty about the economic

outlook. This uncertainty is 8

evidenced by the wide range

of opinions among economists 6

about where the economy

is heading. For example, as 4

Figure 2 shows, divergence

among economists’ forecasts 2

of what the unemployment rate

will be a year from now is at a

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020

www.lao.ca.gov 52021-22 BUDGET

50-year high. This uncertain environment presents a significant challenge for the Legislature as it enters the

2021-22 budget process.

Main Forecast Is Our Best Assessment... Despite an uncertain future, the Legislature will need to select

a revenue assumption around which to build the 2021-22 budget. Given this reality, our Fiscal Outlook

presents a main revenue forecast, which is our office’s best assessment of the most likely outcome. The

economic assumptions underlying our main revenue forecast reflect the average of forecasts from various

professional economists (collected in October). Our main forecast is the gold line in Figure 3.

…But Revenues Will Deviate From Our Main Forecast. Despite being our best assessment, our

main forecast will be wrong to some extent. A wide range of outcomes is possible. Because of this, in

addition to our main forecast, we also estimated how much actual revenues might end up above or below

our main forecast. To do so, we looked at how much forecasts tended to differ from actual revenues over

the last 50 years. We then estimated the relationship between these past forecast errors and the range

of disagreement among professional economic forecasts at the time. Finally, we used this relationship to

estimate the likely forecast errors for our current forecast.

Our analysis groups alternative revenue outcomes into three categories based on the chances that they

might occur. These three categories, illustrated with the shaded areas in Figure 3, are:

Most Likely (Darker Shaded Area). These outcomes are most similar to our main forecast. Within this

category, unforeseen developments could alter the economic trajectory somewhat, but would not lead

to a major departure or paradigm shift. We estimate that revenues are more likely than not to be within

this category. For example, we estimate it is more likely than not that 2021-22 General Fund revenues

will be somewhere between $139 billion and $165 billion.

Less Likely (Lighter Shaded Area). These outcomes represent more significant departures from our

main forecast. For example,

a combination of negative Figure 3

developments (such as

delayed vaccine deployment,

Estimating Uncertainty in Our Main Outlook

General Fund Revenue (In Billions)

widespread business

failures, or instability in The shaded regions on this graph show our estimates of how much revenues might differ from

housing markets) could push our main forecast. Our estimates suggest revenues are more likely than not to be in the inner

shaded area. Revenues in the outer shaded area are less likely. Revenues beyond that are

revenues into the lower part very unlikely.

of this category. Similarly,

a combination of positive $200

developments (such as a

190

surge in consumer spending

180

from pent-up demand,

a smooth transition of 170

unemployed workers back to 160

LAO Main

their jobs, or substantial new 150 Forecast

federal fiscal stimulus) could

140

push revenues into the upper

130

part of this category.

120

Very Unlikely (Outside

of Lighter Shaded Area). 110

These outcomes are 100

associated with major 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25

unforeseen events that

dramatically shift the state’s

6 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

economic situation—such as the COVID-19 pandemic from the vantage point of 2019 or the housing

crisis from the vantage point of 2005.

Likely Significant One-Time Budget Windfall in the Upcoming Year

Estimated Windfall of $26 Billion in 2021-22. Figure 4 shows our estimate of the General Fund

condition under our main forecast. As the figure shows, the state would have a windfall of $26 billion to

allocate in the upcoming budget process. In Figure 4, the windfall is shown as the balance of the Special

Fund for Economic Uncertainties (SFEU) in 2021-22. The windfall is the net effect of three main factors

driven by prior- and current-year trends:

Higher Revenues. Revenue collections to date have been much better than anticipated and are

consistent with the economic picture. As such, under our main forecast, we estimate tax revenues are

higher by $38.5 billion across 2019-20 and 2020-21 compared to budget act estimates.

Higher Spending on Schools and Community Colleges. General Fund spending on schools and

community colleges is determined by a set of constitutional formulas under Proposition 98 (1988),

as well as recently enacted statute that creates a new supplemental payment obligation beginning

in 2021-22. Under our outlook, the state allocates about 40 percent of General Fund revenue to

K-14 education each year of the budget window. As such, with General Fund tax revenue increases,

our estimate of required General Fund spending on schools and community colleges for 2019-20 and

2020-21 correspondingly increases by $14.4 billion.

Lower Caseload Related Costs. The budget anticipated caseload-related costs, for example in

Medi-Cal and CalWORKs, would increase substantially. However, as discussed above, these substantial

increases have not materialized yet. For those two programs, caseload-related costs are lower in

2020-21 (compared to budget estimates) by $2.9 billion.

Despite Windfall, Budget Also Faces an Operating Deficit in 2021-22. Despite the windfall, the SFEU

balance declines from 2020-21 to 2021-22 under our estimates (also shown in Figure 4). This has two

important implications. First, it means the state faces an operating deficit in 2021-22. That is, the projected

revenue collections in 2021-22 are less than the projected expenditures in that year. Second, it means the

windfall is one time because it is entirely attributable to current- and prior-year revisions, not budget-year

conditions. (We estimate the multiyear operating deficit in the next section. In the box on the next page, we

discuss how it is possible for the

state to have a windfall and an

operating deficit simultaneously.) Figure 4

Approach Assumes Current General Fund Condition Under Fiscal Outlook

Policy and Maintains Current (In Millions)

Service Levels. The estimates 2019‑20 2020‑21 2021‑22

throughout this report rely on a

Prior-year fund balances $11,280 $5,550 $32,159

number of important assumptions.

Revenues and transfers 141,851 173,464 151,725

For example, we assume: (1) the Expenditures 147,581 146,855 154,360

state makes a constitutional deposit Ending fund balances 5,550 32,159 29,523

into the Budget Stabilization Encumbrances 3,175 3,175 3,175

Account in 2021-22, bringing SFEU Balances $2,375 $28,984 $26,348

the balance of that account to Reserves

$10.9 billion; (2) state employee BSA balances $16,489 $8,683 $10,871

compensation reductions are not Safety Net Reserves 450 450 450

in effect in 2021-22; (3) possible Total Reserves $16,939 $9,133 $11,321

program expenditure suspensions SFEU = Special Fund for Economic Uncertainty and BSA = Budget Stabilization Account.

www.lao.ca.gov 72021-22 BUDGET

Windfall and Operating Deficit

What Do We Mean by “Windfall”? The main goal of our Fiscal Outlook is to assess how

much capacity the budget has to pay for existing and—potentially—new commitments. To

answer this question, we compare our projections of revenues to spending under current law and

policy. When projected revenues exceed those expenditures, we ordinarily use the term “surplus”

to describe the difference. This year, we are using a different term to describe this dynamic:

windfall. We use this term for two reasons. First, because the estimated resources available in

2021-22 are only the result of revisions in prior- and current-year budget estimates. And second,

because the available resources are entirely one time under our main forecast.

What Do We Mean by “Operating Deficit”? The windfall is the amount available to allocate

in the budget year (2021-22), whereas an operating deficit occurs over a multiyear period. An

operating deficit results when annual revenues are lower than expenditures under current law and

policy, causing a year-over-year decrease in the Special Fund for Economic Uncertainties. An

operating surplus occurs when the reverse is true.

How Can There Be an Operating Deficit and Windfall in 2021-22? When the Legislature

passed the 2020-21 budget, the state faced a sudden and unknown budget problem. The

Legislature took $54 billion in actions to address that problem (for example, it withdrew funds

from reserves, shifted costs, reduced spending, and increased revenues). Based on new

information learned since the budget was passed, the actual budget problem that needed to be

solved in 2020-21 will be much lower than initially estimated. In short, the Legislature took more

actions—predominantly one-time actions—than were needed to balance the budget this year.

However, we continue to project that expenditure growth outpaces revenue growth. This means

that, on an ongoing basis, the budget does not have sufficient revenues in each year to cover the

cost of current commitments. That is, the state has an operating deficit. (Notably, the multiyear

estimates by the Department of Finance at the time of the budget act also showed an operating

deficit.)

included in recent budgets are not operative; and (4) the state maintains spending on COVID-19 response

efforts in 2020-21 and 2021-22. Under our current law assumption, we do not assume the state receives

any new federal funding and the budget solutions passed subject to receipt of additional federal funding are

not reauthorized (the “trigger reductions”). These expenditure assumptions, and others, are described in

more detail in “Appendix 1.”

Windfall Could Be Higher or Lower Depending on Revenue and Economic Conditions. The state has

a $26 billion windfall under our main forecast. However, as discussed earlier, revenues easily could end up

$10 billion or more above or below our main forecast. If revenues in 2020-21 and 2021-22 are at the lower

end of our most likely alternative outcomes, the windfall would be about $12 billion in 2021-22. If revenues

are at the higher end, the windfall would be closer to $40 billion.

Costs Very Likely to Quickly Exceed Revenues in Future Years

In this section, we describe the budget’s condition over the multiyear period in our outlook—until

2024-25. First we address trends in revenues and expenditures over this multiyear period and then give our

assessment of the budget’s condition under a range of possible outcomes for state revenue collections.

Tax Revenue Growth Is Projected to Grow Slowly Over the Period. Under our main forecast, General

Fund revenues from the state’s three major tax revenues would grow from $148 billion in 2021-22 to

$152 billion in 2024-25. This represents average annual growth of less than 1 percent. While this growth is

8 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

still positive, it is much slower than our projections for revenue growth before the onset of COVID-19. For

example, in our Fiscal Outlook released in November 2019, we estimated annual revenue growth from these

taxes would average 3.7 percent over a similar period. Slower revenue growth puts significant pressure on

the budget’s bottom line.

Ongoing General Fund Expenditure Growth of 4.4 Percent. Expenditures, conversely, are expected to

grow faster over the next four years compared to our forecasts before COVID-19. This outlook anticipates

overall General Fund expenditures would grow at an average annual rate of 4.4 percent between 2020-21

and 2024-25, representing total cost growth of $27.9 billion. In the following paragraphs, we discuss some

notable areas of spending growth, which also are shown in Figure 5.

Medi-Cal. Under our estimates, General Fund spending on Medi-Cal would increase by $8.6 billion over

the period, representing 31 percent of the total cost increase. There are several major drivers of this increase

including: (1) lower federal funding for Medi-Cal when the enhanced federal match for Medicaid programs

expires (which we assume occurs the end of 2021); (2) the expiration (without reauthorization) of the

managed care organization tax, which occurs midway through 2022-23 under current law; and (3) underlying

cost growth from caseload changes and per capita cost increases.

K-14 Education. Annual growth in Proposition 98 General Fund spending on K-14 averages 3.4 percent

over the period. Although schools and community colleges represent nearly 40 percent of the General Fund

budget, they represent only 30 percent of the total growth in state expenditures. The largest single factor

in the increase is the new ongoing statutory supplemental payment for schools, created as part of the

2020-21 budget. Over the multiyear period, General Fund spending on schools and community colleges

grows 3.4 percent per year on average, but absent the supplemental payments, would average 0.8 percent

per year (the rate of growth of General Fund revenues). As discussed in the box on page 12, growth in

Figure 5

Major Drivers of Cost Growth From 2020‑21 to 2024‑25

100%

Other 2.6%

CDCR 4.0%

DDS 4.2%

80

Universities 7.9%

IHSS 10.0%

60

Employee

Compensationa 10.4% $200

billion

Cost Growth

40

100

2020-21 Spending Level

Schools and

Community Colleges 29.8%

20

2020-21 2021-22 2022-23 2023-24 2024-25

Medi-Cal 31.1%

a Excludes CDCR employees.

IHSS = In Home Supportive Services; DDS = Department of Developmental Services; and CDCR = California Department of Corrections

and Rehabilitation.

www.lao.ca.gov 92021-22 BUDGET

school and community college funding exceeds statutory program cost growth through the outlook period

both with and without the supplemental payment.

Corrections. General Fund spending on the California Department of Corrections and Rehabilitation

(CDCR) increases by about $1 billion over the period. This represents only 4 percent of total cost increases,

although CDCR is nearly 8 percent of the General Fund budget. Low cost growth for CDCR is primarily the

net result of two opposing factors. On the one hand, declines in the inmate population due to several policy

changes that will reduce prison terms are expected to lower state costs by allowing the state to reduce the

number of prisons it operates. On the other hand, we assume employee compensation costs continue to

grow, which offsets these declines. (We discuss our assumptions about employee compensation and CDCR

spending in more detail in “Appendix 1.”)

Growth in Safety Net Program Costs Expected Through 2022-23. While anticipated safety net

program caseload growth has not materialized thus far, we do anticipate it to do so in the coming years.

For the state’s two major safety net programs described earlier—Medi-Cal and CalWORKs—we anticipate

there will be notable caseload-related cost growth in 2021-22 and 2022-23. For example, in Medi-Cal,

caseload-related costs result in increased General Fund expenditures of $1.2 billion in 2021-22 (compared

to our estimates in 2020-21). In CalWORKs caseload-related costs would increase by nearly $400 million in

2022-23 (compared to our estimates in 2020-21).

Operating Deficits Begin in 2021-22 and Persist Over Multiyear Period. The result of these two

trends—faster growth in costs and slower growth in revenues—is that the state faces large and growing

operating deficits over our outlook period. As Figure 6 shows, although the budget is expected to have

a windfall in 2021-22, it is also expected to have an operating deficit in that year. The operating deficit is

relatively small in 2021-22, but would grow to around $17 billion by 2024-25.

Figure 6

Under Main Forecast,

Operating Deficits Grow Over Multiyear Period

(In Billions)

$30

25

General Fund "Windfall"

20

General Fund Operating Deficit

15

10

5

-5

-10

-15

-20

2021-22 2022-23 2023-24 2024-25

10 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

What Revenue Level Would Balance the Budget? While our main forecast suggests the state faces

an operating deficit, revenues could differ substantially from our main forecast. What are the chances

that revenues could beat our main forecast by enough to erase the operating deficit? For this to happen,

revenues would need to be nearly $5 billion higher in 2021-22. Further, revenues would need to be

$35 billion higher in 2024-25. (These figures exceed the size of the operating deficit due to the requirements

of Proposition 2 and Proposition 98, which require increased reserve deposits and school and community

college spending with higher revenues.) Our analysis suggests this level of revenue growth is unlikely.

Figure 7 shows where the budget “breakeven point” (the point at which revenues are enough for a balanced

budget under current law and policy) falls in our range of revenue outcomes (first shown in Figure 3 on page

6). As the graphic shows, the bulk of likely outcomes are below the breakeven point. This suggests that it is

unlikely the budget will break even under current law and policy.

Figure 7

How Likely Is the Budget to Break Even?

General Fund Revenue (In Billions)

The shaded regions on this graph show our estimates of how much revenues might differ from

our main forecast. Our estimates suggest revenues are more likely than not to be in the

inner shaded area. Revenues in the outer shaded area are less likely. Revenues beyond that

are very unlikely. The breakeven point shows the amount of revenue needed for the budget to

stay balanced without further solutions.

LAO Main

2020-21

$142 $154 $164

Breakeven Point

2021-22

$139 $152 $165

2022-23

$133 $151 $170

2023-24

$131 $153 $173

2024-25

$133 $158 $182

Most of the outcomes are below the breakeven point, suggesting the budget is likely to face

an operating deficit, even if revenue growth differs substantially from our main forecast.

www.lao.ca.gov 112021-22 BUDGET

Outlook for Schools and Community Colleges

Funding Changes

Dramatic Upward Revision to Current-Year Funding Estimates. The state meets the

Proposition 98 guarantee through a combination of General Fund and local property tax revenue.

Our estimate of the guarantee in 2020-21 is $84 billion, an increase of $13.1 billion (18.5 percent)

over the June 2020 estimate. This increase is the largest change relative to the enacted budget

since the passage of Proposition 98 in 1988. Nearly all of the increase is due to our higher

General Fund revenue estimates, though a small portion reflects higher property tax estimates.

Growth in 2021-22 Mainly Attributable to New Supplemental Payments. Under our outlook,

the 2021-22 guarantee grows $595 million (0.7 percent) over our revised 2020-21 estimates. In

addition, the state makes its first supplemental payment ($2.3 billion) on top of the guarantee. The

state created the supplemental payments in the June 2020 budget plan to accelerate growth in

funding following the anticipated drop in the guarantee.

Significant Ongoing and One-Time Funds Available. After accounting for a 1.14 percent

statutory cost-of-living adjustment (COLA) and various other adjustments, we estimate the

Legislature has $4.2 billion in ongoing funds available for new commitments. In addition, after

accounting for the higher 2020-21 guarantee and various prior-year adjustments, we estimate the

Legislature has $13.7 billion in one-time funds available.

Guarantee Growing Faster Than Program Costs. Under our outlook, the statutory

COLA hovers around 1.5 percent per year after 2021-22. We also project declines in student

attendance. Due to these factors, school and community college programs grow relatively slowly

compared with the Proposition 98 guarantee. As shown in the figure, under our main forecast the

state has a growing amount of funds available for new commitments. The supplemental payments,

which grow to $6.3 billion by 2024-25, make the difference even larger.

Funding for New Commitments Grows Over Time Comments

(In Billions) Legislature Could

Pay Down All Existing

$14

Deferrals. The

12 2020-21 budget deferred

Supplemental $12.5 billion in payments

10 payments

to schools and community

8 colleges. Using one-time

6 funds to eliminate these

Amount by which

deferrals would improve

4

guarantee exceeds local cash flow and

program costsa

2 remove pressure on future

Proposition 98 funding.

2021-22 2022-23 2023-24 2024-25 Since the deferrals are

scheduled to begin

a Assumes existing programs are adjusted for the statutory cost-of-living adjustment and

in February 2021, the

attendance changes.

Legislature would need to

take early budget action

12 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

if it wanted to rescind them this year. (If the Legislature does not take early action, it could

eliminate the deferrals starting in 2021-22.)

Rebound in Funding Warrants a Reassessment of the Supplemental Payments. Under our

outlook, the Proposition 98 guarantee no longer experiences declines and instead grows more

quickly than the COLA over the next several years. Based on these developments, we think the

Legislature should reassess the supplemental payments after reviewing all of its budget priorities.

The supplemental payments involve long-term trade-offs with other parts of the state budget and

increase the size of the operating deficit over the multiyear period. To the extent the Legislature

remains interested in providing funding on top of the guarantee, it has many options—such as

providing a larger one-time payment without committing to long-term increases.

www.lao.ca.gov 132021-22 BUDGET COMMENTS AND RECOMMENDATIONS Near-Term Considerations Budget “Overcorrected” in 2020-21 in Response to Unprecedented Uncertainty. Compared to Governor’s budget estimates in early 2020, revenue estimates in June were lower by $42 billion—a historic decline. In light of the unprecedented uncertainty around the state budget, those estimates were reasonable at the time. However, in hindsight, they were too pessimistic. This means the state took a number of almost entirely one-time and temporary actions to balance the budget—like making withdrawals from reserves, shifting costs, increasing revenues, and reducing spending—that were larger than ultimately necessary. These overcorrections are the reason the state has a significant windfall in 2021-22. In Light of Coming Budget Problems and Safety Net Needs, Recommend Restoring Budget Resilience. Just over one-third of the solutions used to balance last year’s budget (excluding Proposition 98-related solutions) were tools—like reserves, internal borrowing, and other cost shifts— that the state will need in the coming years. Consequently, we recommend the Legislature use half of the windfall—about $13 billion—for restoring the budget’s fiscal resilience. For example, the Legislature could: make an optional deposit into a state reserve, like the Safety Net Reserve; make a supplemental pension payment; or repay special fund loans made to the General Fund. Each of these actions would allow the state to maintain services in future years when the Legislature is likely to face a budget problem as a result of the projected operating deficits. Making a deposit into the Safety Net Reserve, in particular, would help the state maintain services when demands on the state’s safety net programs increase. Recommend Using Other Half of Windfall to Address One-Time Pandemic-Related Needs. As noted earlier, the COVID-19 pandemic has had severe health and economic consequences for many Californians. The upcoming budget process provides the Legislature an opportunity to determine how the state could further mitigate those adverse effects. Moreover, the significant windfall provides the Legislature with an opportunity to develop a robust COVID-19 response that was not feasible when facing a $54 billion budget problem in the spring. As such, we recommend the Legislature use the other half of the windfall—about $13 billion—on one-time purposes, focusing on activities that mitigate the adverse economic and health consequences of the public health emergency. Some Early Actions Would Be Reasonable. There is some uncertainty about the size of the windfall that will ultimately materialize. However, given its size, we think it would be reasonable for the Legislature to take early action to use several billion dollars to address some of the state’s immediate needs. Similarly, we think taking early action to undo most of the school-related deferrals would be reasonable. Long-Term Challenges State Faces Sizeable and Growing Operating Deficits. The state should expect to face an operating deficit during a recession and the years that follow. The existence of an operating deficit during an economic downturn is not inherently a cause for concern, especially if the state also has enough resources (like reserves) to cover the ensuing budget deficits. However, some features of the operating deficits estimated here make them concerning. First, even if the state saved the entire $26 billion windfall in 2021-22, the savings would be insufficient to cover the operating deficits over the multiyear period. Second, our estimates of the operating deficits grow with each year of the outlook, suggesting they will continue past the multiyear period shown here. Third, our breakeven analysis found it is quite unlikely revenues will end up growing fast enough to cover the growth in costs necessary to maintain current levels of government services. Recommend Legislature Begin Multiyear Effort to Address Ongoing Deficit Now. Given the multiyear deficits, the budget cannot afford any new ongoing augmentations. In fact, in light of the concerning nature of these operating deficits, we recommend the Legislature use the 2021-22 budget process to begin to 14 L E G I S L AT I V E A N A LY S T ’ S O F F I C E

2021-22 BUDGET address the state’s ongoing deficit. This could mean, for example, identifying ways to reduce spending or increase revenues in future years. However, the Legislature need not necessarily take these actions this year. Rather, the significant budget windfall in 2021-22 buys the Legislature time to enact or phase-in longer-term changes. For example, reductions to the state’s workforce and some revenue increases can take years before their fiscal effects are fully captured. The Legislature also could consider permanently reauthorizing the MCO tax, which would reduce the budget problem in both 2023-24 and 2024-25 by about $2 billion. Lastly, in light of improved Proposition 98 estimates, the Legislature could reassess the planned supplemental payments to schools. (We discuss this in more detail in our report, The 2021-22 Budget: The Fiscal Outlook for Schools and Community Colleges) Overall, we strongly encourage the Legislature to engage in long-term planning and consider what needs to be done today to address the budget problem over the multiyear period. www.lao.ca.gov 15

2021-22 BUDGET

APPENDIX 1

This section describes the major expenditure-related assumptions made in our outlook.

State Makes 2021-22 BSA Deposit. The state is required to make annual deposits into the Budget

Stabilization Account (BSA) unless the withdrawal is reduced or suspended under a budget emergency.

In 2020-21, the state suspended the required BSA deposit and withdrew $7.8 billion from the BSA. (We

assume the state does not make a “true up” deposit related to 2020-21.) Because of the anticipated

windfall, we assume the state makes its constitutionally required deposit for 2021-22, which is $2.2 billion

under our revenue estimates, and each subsequent year of the outlook period.

Suspensions Are Not Operative. Similar to action taken in 2019-20, the 2020-21 spending plan

made some spending subject to suspension in 2021-22. In these cases, statute directs the Department of

Finance (DOF) to calculate whether General Fund revenues will exceed General Fund expenditures—without

suspensions—in 2021-22 and 2022-23. If DOF determines revenues will exceed expenditures, then the

programs’ ongoing spending amounts will continue and not be suspended. Otherwise, the expenditures are

automatically suspended. Because the state has substantial resources available in 2021-22 and 2022-23

under current law and policy, we assume these suspensions are not operative in 2021-22 and subsequent

years.

State Does Not Receive New Federal Funding. Our outlook assumes no major changes in federal policy

over the outlook period. Various decisions by the federal government, however, could influence future state

General Fund costs, for example, if the federal government provided the state with broad-based budgetary

assistance, resulting in lower General Fund costs. We also assume the state does not reinstate any spending

reductions included in the budget act that were subject to federal “trigger” legislation.

Enhanced Federal Match for Medicaid Ends Midway Through 2021-22. Medicaid is an entitlement

program whose costs generally are shared between the federal government and states. Earlier this year,

Congress approved a temporary 6.2 percentage point increase in the federal government’s share of cost

for state Medicaid programs until the end of the national public health emergency declaration. We assume

the declaration expires at the end of calendar year 2021, resulting in an increase in General Fund costs of

Medicaid programs midway through 2021-22. If the federal executive branch allowed the declaration to

expire earlier, costs would be higher, and vice versa.

Spending on Disasters Continues Through 2021-22. The state has been spending money to

respond to coronavirus disease 2019 (COVID-19) mainly through the Governor’s disaster and emergency

authorities, for example, under the Disaster Response and Emergency Operations Account. We assume

COVID-19 response efforts continue on their current trajectory in 2020-21 and that there is additional

spending, but it is roughly half as large, in 2021-22. The state also is likely to incur additional disaster-related

costs, for example, for debris removal and other remediation activities as a result of the fires that began this

summer. We have adjusted state expenditures for these efforts and assume the state receives 75 percent

reimbursement from the federal government for these disaster-related activities.

Managed Care Organization (MCO) Tax Expires. For a number of years, the state has imposed a tax on

MCOs’ Medi-Cal and commercial lines of business. We assume the state’s MCO tax expires midway through

2022-23, consistent with current law. The MCO tax leverages significant federal funding. Annually, revenues

from the MCO tax offset almost $2 billion in General Fund Medi-Cal spending, which means our estimate of

the General Fund cost of Medi-Cal increases by this amount in 2023-24.

General Fund Salary Increases for State Employees. As part of the 2020-21 spending plan, the

Legislature ratified labor agreements that reduce state employee compensation costs by up to 10 percent.

The predominant cost saving policy implemented by these labor agreements is the Personal Leave

Program (PLP) whereby employees accept reduced salaries in exchange for time off. For a majority of state

employees, labor agreements establish PLP in 2020-21 and allow PLP in 2021-22 in the event that the state

16 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET withdraws funds from the BSA in 2021-22. We assume that PLP is in effect for all of 2020-21 but is not in effect in 2021-22 because our outlook does not assume that the state will need to withdraw funds from the BSA in 2021-22. Beginning in 2021-22, we assume that state employees receive General Salary Increases based on our compensation index. General Fund Costs for the Universities Increase. General Fund spending for the California State University and University of California is more discretionary than many other areas of the budget, with no major federal or state spending requirements. Our university outlook assumes the state maintains existing services at the universities by funding certain expected cost increases. Specifically, we assume cost increases for salaries, benefits, scheduled debt service, and demographically driven enrollment growth. We assume the state bears the full cost of these increases, with tuition held flat. (Tuition has not been raised in the past nine years, and the governing boards of the universities have not signaled potential tuition increases in 2021-22.) Because General Fund spending for the university is discretionary, different assumptions reasonably could be made. State Closes Five Prisons Due to Decline in Inmate Population. We estimate that—due to the effects of the COVID-19 pandemic and several policy changes that will reduce prison terms—the inmate population will remain around 100,000 throughout the forecast period. This is about 20,000 inmates below the 2019-20 level. Our forecast assumes that the state will accommodate a portion of this decline by closing one prison in 2021-22 and a second prison in 2022-23, consistent with the administration’s current plans. However, our forecast also reflects the closure of three additional prisons—for a total of five closures—by 2024-25, given the size of decline in the population. www.lao.ca.gov 17

2021-22 BUDGET

APPENDIX 2

Appendix 2, Figure 1

LAO Fiscal Outlook Main Revenue Forecast

(In Billions)

2019‑20 2020‑21 2021‑22 2022‑23 2023‑24 2024‑25

Personal income tax $99.5 $106.6 $104.0 $104.6 $106.6 $109.9

Sales and use tax 25.7 25.4 25.2 25.9 26.9 28.0

Corporation tax 13.6 16.1 17.4 15.3 13.8 14.4

Subtotals, Big Three Revenues ($138.8) ($148.0) ($146.7) ($145.7) ($147.3) ($152.3)

BSA transfer -$2.5 $7.8 -$2.2 -$1.6 -$1.3 -$1.3

Federal cost recovery 2.1 7.6 1.6 0.4 0.1 0.1

All other revenues 5.3 5.5 5.6 5.7 6.0 6.2

All other transfers -1.9 4.5 0.1 -0.6 -0.3 —

Total Revenues and Transfers $141.9 $173.5 $151.7 $149.6 $151.7 $157.2

BSA = Budget Stabilization Account.

Appendix 2, Figure 2

Spending Through 2021-22

LAO Baseline Expenditure Estimates (In Millions)

Estimates Outlook

Change From

2019-20 2020-21 2021-22 2020-21

Major Education Programs

Schools and community collegesa $54,310 $57,818 $59,547 3.0%

California State Universityb 4,702 4,047 4,281 5.8

University of California 3,938 3,466 3,714 7.2

Child care 1,710 1,644 1,868 13.6

Financial aid 1,389 2,137 2,237 4.7

Major Health and Human Services Programs

Medi-Calc $22,413 $22,703 $25,925 14.2%

Department of Developmental Servicesc 5,014 5,846 6,038 3.3

In-Home Supportive Servicesc 4,298 4,485 5,595 24.8

SSI/SSP 2,732 2,705 2,679 -0.9

Department of State Hospitals 1,767 1,877 1,893 0.8

CalWORKs 650 1,135 1,422 25.3

Major Criminal Justice Programs

Corrections and Rehabilitation $12,465 $11,212 $11,318 0.9%

Judiciary 2,254 2,135 1,974 -7.5

Debt Service on State Bonds $5,092 $5,309 $5,779 8.8%

Other Programs $24,846 $20,337 $20,090 -1.2%

Totals $147,581 $146,855 $154,360 5.1%

a Reflects General Fund component of the Proposition 98 minimum guarantee, including statutory supplemental payments.

b Includes state contributions for CSU retiree health.

c Program costs in 2021-22 reflect expiration of enhanced federal share of cost for Medicaid-funded programs at the end of 2021, which results in General

Fund cost growth that is higher than it would be otherwise.

18 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET

Appendix 2, Figure 3

Spending by Major Area Through 2024-25

LAO Baseline Expenditure Estimates (In Billions)

Estimates Outlook Average

Annual

2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 Growtha

Education

Schools and community collegesb $54.3 $57.8 $59.5 $61.5 $63.0 $66.1 3.4%

Other major education programs 11.7 11.3 12.1 13.0 13.7 14.5 6.5

Health and Human Services 36.9 38.8 43.6 47.4 49.6 51.4 7.3

Criminal Justice 14.7 13.3 13.3 14.4 14.7 14.5 2.1

Debt service on state bonds 5.1 5.3 5.8 5.6 5.8 5.9 2.8

Other programs 24.8 20.3 20.1 19.8 21.0 22.4 2.4

Totals $147.6 $146.9 $154.4 $161.7 $167.8 $174.7 4.4%

Percent change -0.5% 5.1% 4.7% 3.8% 4.1%

a From 2020-21 to 2024-25.

b Reflects General Fund component of the Proposition 98 minimum guarantee, including statutory supplemental payments.

Note: Program groups are defined to include departments listed in Appendix 2, Figure 2.

www.lao.ca.gov 192021-22 BUDGET

LEGISLATIVE ANALYST’S OFFICE

WWW.LAO.CA.GOV (916) 445-4656

Legislative Analyst

Gabriel Petek

Chief Deputy Legislative Analyst Chief Deputy Legislative Analyst

Carolyn Chu Anthony Simbol

State Budget Condition K-12 Education

Ann Hollingshead a Edgar Cabral, Deputy

Economy, Taxes, and Labor Michael Alferes

Brian Uhler, Deputy Sara Cortez

Chas Alamo Kenneth Kapphahn

Justin Garosi Amy Li

Seth Kerstein

Higher Education

Brian Weatherford

Jennifer Kuhn Pacella, Deputy

Health, Developmental Services, and IT Jason Constantouros

Mark C. Newton, Deputy Lisa Qing

Corey Hashida Paul Steenhausen

Ben Johnson Environment and Transportation

Brian Metzker Brian Brown, Deputy

Sonja Petek Ross Brown

Ned Resnikoff Rachel Ehlers

Frank Jimenez

Human Services and Governance

Helen Kerstein

Ginni Bella Navarre, Deputy

Eunice Roh

Ryan Anderson

Jackie Barocio Public Safety and Business Regulation

Lourdes Morales Drew Soderborg, Deputy

Nick Schroeder Luke Koushmaro

Angela Short Anita Lee

Caitlin O’Neil

Jessica Peters

Administration, Information Services, and Support

Sarah Kleinberg Sarah Scanlon

Sarah Barkman Terry Gough

Tamara Lockhart

Jim Stahley

Michael Greer Anthony Lucero

Vu Chu

Mohammed Saeed

Rima Seiilova-Olson

a General Fund Condition analyst, Fiscal Outlook coordinator.

20 L E G I S L AT I V E A N A LY S T ’ S O F F I C E2021-22 BUDGET LAO PUBLICATIONS This report was prepared by Ann Hollingshead, with contributions from others across the office, and reviewed by Carolyn Chu and Anthony Simbol. The Legislative Analyst’s Office (LAO) is a nonpartisan office that provides fiscal and policy information and advice to the Legislature. To request publications call (916) 445-4656. This report and others, as well as an e-mail subscription service, are available on the LAO’s website at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000, Sacramento, CA 95814. 21 L E G I S L AT I V E A N A LY S T ’ S O F F I C E

You can also read