Contagion effect Overnight Highlights Need to Know - Kennedy Partners

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Wednesday, 12 February 2020

Overnight Markets Overnight Highlights

Need to Know

Contagion effect

More walls are going up. Trade wars, technology

protectionism and Brexit-type barriers have knocked

worldwide integration over the last few years. As the

coronavirus from China spreads, it will give countries and

companies fresh reasons to rethink the merits of cross-

border commerce and supply chains.

Restricting movement may help contain the virus that had

killed 213 people as of Friday, infected nearly 10,000 and

led the World Health Organization to declare a global

health emergency. With Chinese people expected to take

over 160 million trips abroad this year, it’s no wonder that

other regions are strictly curbing inbound visitors from the

People’s Republic. The likes of HSBC and LG Electronics

are also clamping down, banning travel to China. British

Airways is one airline suspending flights to and from the

country.

Some concern is warranted. Starbucks, which has been

counting on growth in China, this week warned of a

financial hit from the virus as it temporarily closed

thousands of locations. Yangtze Optical Fiber and Cable,

based in Wuhan, where the virus originated, accounts for

55% of global production by volume of an essential

material for 5G telecom service, according to TS Lombard

economists. A shortage is bound to push prices up.GLOBAL MARKET

Global Equities. Global stocks struggle for footing after

fraught week. Asia halted 6d losing streak following pos

handover from Wall St. US shares bounced back from

initial coronavirus-induced selloff w/earnings providing

relief. Bonds drop w/US 10y at 1.59%. Gold drops to

$1572, Bitcoin 9.4k.

The Baltic Dry Index, is reported around the world

as a proxy for dry bulk shipping stocks as well as a

general shipping market bellwether, has fallen to its

lowest level since 2016.

S&P500 has ended Jan 0.2% lower while Fed balance sheet has

shrunk by $14bn or 0.3% in Jan.

Price of 100y Austria bond has bounced back

heavily. Gained 20% Ytd. Chart looks like a crazy

tech stock.

A $22bn injection into Chinese markets won’t be enough

to prevent the country’s stocks and currency falling on

Monday, but it may ease a global sell-off sparked by the

spread of the coronavirus.

The share price of Kawamoto, the Japanese

manufacturer of facemasks, is up 750%(!) year-to-date.ASX MARKET Aust Dec credit growth remained soft at

0.2%mom/2.4%yoy but housing credit momentum

ASX to open lower, as global investors rushed looks to be bottoming esp. for owner occupiers with

to the sidelines over the weekend, wary of being caught flow of new housing debt looking like it’s starting to

unable to trade if the coronavirus outbreak intensifies. offset paydown of existing debt. Still soft though.

ASX futures were down 119 points or 1.71 per cent to (Bloomberg table, Macquarie chart)

6835. The Australian dollar sank 0.4 per cent to

US66.93¢; it's now shed near 5 per cent against the

greenback this year.

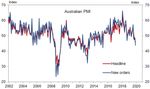

Aust Jan AIG manufacturing PMI -2.9pts to 45.4,

lowest since 2015 with respondents citing

bushfire impacts. Supports case for more policy

stimulus. (Goldman Sachs chart)

a bigger impact from the travel ban will come if

Aust education exports are hit (Aust ed exports to

China are around 0.6% of GDP) which would occur

if the travel ban into Aust from Ch is for a long

period-which takes us back to how long it will take

to contain Coronavirus (Goldmans chart)NEED TO KNOW:

You’re not a celebrity but your Some News:

There are 4 types of people in this world. Those that:

handbag can be… 1) won’t ever think to wear anti-viral masks (buy and hold)

WSJ – 29/01/2020

2) bought anti-viral masks weeks ago (value)

3) will now pay $100 for a set on eBay (growth)

4) bought anti-viral masks weeks ago to sell on eBay

(private equity)

LVMH Moët Hennessy Louis Vuitton, the luxury-goods

giant owned by the world’s second-wealthiest man, Bank of England has kept rates unchanged. It is paying

Bernard Arnault, said late Tuesday that revenue more attention to the forward-looking indicators than it is

increased by 8% in the three months through December the hard data from the past, which is why the committee

after stripping out the impact of exchange-rate moves voted 7-2 – as it did at its last meeting – to keep interest

and portfolio changes. The quarterly growth rate was rates unchanged.

LVMH’s slowest since late 2016.

As one of the first companies in the luxury business to

report this quarterly earnings season, LVMH’s results

will be scrutinized for any slowdown in spending by

wealthy Chinese shoppers who now buy one-third of all

such goods globally. So far, demand for designer

handbags and clothing hasn’t been impacted by slower

economic growth in China or by political protests in Hong

Kong. According to CitiGroup --- Buy the Corona Dip.

That should reassure investors worried that the luxury- SARS experience suggests equities, especially in Asia, will

goods sector’s three-year winning streak might be keep falling until coronavirus infections stabilize. Cyclical

coming to an end. LVMH’s sales in Japan fell by 4% in the sectors are most vulnerable. Although Tobias Levkovich’s

fourth quarter from the year-ago period, but this was Panic/Euphoria indicator flags short-term caution, our

due to an increase to value-added tax that incentivized global Bear Market Checklist (5/18 red flags) still wants to

shoppers to make their purchases in the third quarter buy this dip. Our strategy team are currently targeting a

before the new levy came into effect. 4% gain in global equities in 2020, in line with EPS growth.

The luxury sector’s spectacular rally will eventually Any further drop in global equities would make forecast

come to an end, but LVMH hasn’t been the one to break returns more attractive (Report Ref: Coronavirus: Buy This

the spell for now. Dip by Robert Buckland published 30-Jan-20)IMAGES OF THE DAY: Pictures of construction workers sleeping on-site at Huoshenshan Hospital. From nothing to being able to receive patients, the makeshift hospital for coronavirus patients in Wuhan completed on Sunday within only 10 days! Salute to the hardworking people behind this miracle!

Australia has gone 28 years without a recession. The longest run in the developed world belongs to Japan, from 1960 to 1993.

You can also read