PROPERTY OUTLOOK PLUS - New Launches in Selangor Q3 2017 versus Q3 2018 - Henry Butcher Malaysia

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

NEW YEAR EDITION 2019

by Henry Butcher Malaysia

PROPERTY

OUTLOOK

2019

KDN PP18893/11/2015(034373

PLUS

The Malaysian Property Market New Launches in Selangor

2018 in A Snapshot and Will Q3 2017 versus Q3 2018

We See A Revival in 2019?SALE BY TENDER

Prime Land with Commercial

Development Potential &

Freehold Bungalow Lots in

Seremban, Negeri Sembilan

Tender closes at 5pm,

Friday, 8 March 2019.

Tender documents can be

purchased at RM100.00 each.

Property 1 Property 2

20.23 acres of Prime Land with Commercial 22 Freehold Bungalow Lots located within Chemara

Development Potential near Seremban Town Hills, Seremban

Located next to Palm Mall Seremban. Located in a development scheme known as Chemara

Strategically located approximately 2km from Hills.

Seremban Town. Close distance to Palm Mall Seremban & KPJ

Commercial Zoning. Seremban Hospital.

Good access via Jalan Sungai Ujong & Jalan Lingkaran Gated & Guarded development.

Tengah. Facilities included within the development scheme.

Approximately 20.23 acres (4 lots). 22 Freehold Bungalow Lots.

For enquiries, please call

Mr. Chai Kim Keong (REN 01747), Mobile no. +6012-282 5995 Ms. Hana (REN 09525), mobile no. +6012–322 7984

Mr. Haryanto Lim (PEA 1377), mobile no. +6016–295 4988

Mr. Long Shi Chuen (PV1848), mobile no. +6012–373 5580

Exclusive Marketing Agent

Henry Butcher Real Estate (NS) Sdn Bhd Henry Butcher Real Estate Sdn Bhd

(732554-W) (236461-W)

No. 11, Ground Floor, No. 25, Jalan Yap Ah Shak,

Jalan Tunku Hassan, 70000 Seremban, Negeri Sembilan. /12 Off Jalan Dang Wangi, 50300 Kuala Lumpur.

Tel: +606-761 8688 Fax: +606-761 8689 Tel: +603-2694 2212 Fax: +603-2694 1261A CHANGE FOR THE BETTER

the new collective agreement signed our readers. As we do not accept paid

between Malaysian Commercial Banks advertisements, the cost of producing the

Association (MCBA) with the National newsletter is funded entirely by the group.

2018 was a truly tumultuous and historic Union of Bank Employees (NUBE) under As the cost of producing the newsletter

year when people’s power through the which all bank employees will enjoy 0% has gone up significantly especially with

ballot box, brought down the Barisan interest on their housing loans for the first the increase in print quantity and the

Nasional government which has ruled RM100,000 of their loan amount. additional staff needed to produce it, we

over Malaysia for more than sixty years The second was the announcement of the have taken stock of the situation and we

and replaced it with Pakatan Harapan, dates for the National Homeownership have a come to a decision to outsource

a coalition formed by parties which Campaign. This campaign is a its production although we will still take

have been cobbled together and led by collaborative effort between the Ministry charge of writing the articles to maintain

a 93-year-old former Prime Minister. of Housing and Local Government the quality. In line with this change, we

A large number of the newly appointed (KPPT) and Real Estate & Housing have also decided to revise the frequency

Ministers have no previous experience in Developers’ Association (REHDA) and of production from monthly to quarterly.

government and they struggled to get used will be a month-long campaign starting We will continue to produce articles

to their new roles amidst new revelations from 1 March 2019. The campaign will of high standards and maintain our

of wrongdoings and new scandals by involve 30,115 houses by 180 developers editorial integrity. We will look into ways

the previous administration. As the PH who will offer a 10% discount during the of enhancing our newsletter further and

leaders settle into their new roles, we will campaign period. We hope that these we welcome any suggestions from our

be sailing into the new year in uncharted efforts will finally breathe some life into readers in this regard. Just as we have

waters but buoyed with hope that the new the mundane housing market. changed our government with the hope

administration will, given sufficient time, This year marks the 8th year in print for that it will be a better one, it is our wish to

be able to clean up the mess left behind our newsletter, Herald by Henry Butcher see Herald moving forward to become an

by the previous administration, avoid Malaysia. Our circulation has gone up even more informative and useful tool to

the mistakes made and set the country to more than 4,200 and our circulation our clients and readers who are involved

on course again in our voyage to become list includes property developers, in businesses related to real estate, plant &

a developed nation which is clean, banks, public listed companies, SMEs, machinery and art.

transparent and inclusive. selected condominiums, hotels and The Editorial team at Herald as well

Of course, we also wait with abated breath eateries. Herald as it is affably known as the Management of Henry Butcher

on the introduction of new measures that is also available in digital format on our Malaysia wishes all our clients and readers

will be taken by the PH administration Henry Butcher Malaysia group website, a Happy and Prosperous Chinese New

to inject more life to the dull property facebook, LinkedIn and is also sent out Year and a productive and fruitful 2019.

market. Two pieces of good news have to selected recipients via WhatsApp.

already been announced just two weeks We have endeavoured to produce Tang Chee Meng

into the new year. The first is the new professionally written articles which are Chief Operating Officer

benefit extended to bank employees under unbiased, well researched and useful to

JANUARY 2019 OUR SERVICES Email: hbampang@henrybutcher.com.my Tel: 603-26942212 Fax: 603-26941292 PAHANG | Kuantan | MALACCA |

Email: auctions@henrybutcher.com.my Melaka |

Valuation Retail Consultancy TERENGGANU | Kuala Terengganu |

Tel: 603-26942212 Fax: 603-26943484 Tel: 603-91305550 Fax: 603-91304003 Art Consultancy PERAK | Ipoh

Email: hbmalaysia@henrybutcher.com.my Email: tanhaihsin@yahoo.com Tel: 603-26913089 Fax: 603-26021523 KELANTAN I Kota Bharu | SABAH |

Email: info@hbart.com.my Kota Kinabalu

Project Marketing Facilities & Asset Management | Sandakan | Taiwan | SARAWAK | Kuching

Tel: 603-26942212 Fax: 603-26925771 Tel: 603-62053330 Fax: 603-62062543 OUR OFFICES | Miri

Email: tang.cm@henrybutcher.com.my Email: admin.assetmgmt@henrybutcher.

Publisher com.my SELANGOR | Subang Jaya | Ampang | Designed by Rightwiz Sdn Bhd

Henry Butcher Malaysia Sdn Bhd Real Estate Agency Mont Kiara |

25, Jalan Yap Ah Shak, Tel: 603-26942212 Fax: 603-26941261 Plant & Machinery Consultancy NEGERI SEMBILAN | Seremban | Printed by Percetakan CL Wong Sdn Bhd

Off Jalan Dang Wangi, Email: hbre@henrybutchcr.com.my Tel: 603-26942212 Fax: 603-26943484 KEDAH | Alor AS-84, Jalan Hang Tuah 4,

50300 Kuala Lumpur Email: hbmalaysia_pnm@henrybutcher. Setar | Kulim | PENANG | Island | Butter- Taman Salak Selatan, Cheras,

T: (03) 2694 2212 Market Research & Development oom.my worth | Seberang 57100 Kuala Lumpur.

E: admin@henrybutcher.com.my Consultancy Perai | JOHOR | Johor Bahru | Kluang |

W: www.henrybutcher.com.my Tel: 603-42702072 Fax: 603-42702082 Auctions & Tender Sales Muar | Pontian |

3 / HERALD NEW YEAR EDITION 2019PROPERTY OUTLOOK 2019

The Malaysian Property Market 2018 in A Snapshot and Will We See A Revival in 2019?

Economic Outlook from RM12.49 billion to RM19.54 billion. the purchase of their homes. There is

Set against the background of the slower These figures exclude serviced apartments presently some degree of scepticism

global economic growth amidst the and sohos which if added on, will increase on this P2P platform and more details

disruptive trade tensions between China the total unsold stock to 40,916 units on this programme will need to be

and the United States and the drop in worth a staggering RM27.38 billion. announced to address the concerns

crude oil prices, Malaysia’s economy To address some of the prevailing issues of would-be house buyers as well as

this year is expected to grow at a slower affecting the residential property market, investors.

pace compared to the last two years. The the Finance Minister presented in Budget An allocation of RM1.5 billion will be

World Bank has projected a 4.9% growth 2019 on the 2nd of November 2018, set aside for the building of affordable

for Malaysia for 2018 and to decelerate to some positive measures to stimulate the homes targeted especially at the Below

4.7% in 2019 and 4.6% in 2020. residential property market, particularly 40 (B40) group. The plan is to build

the affordable homes segment viz: 100,000 affordable homes per year,

Residential Property Sector Stamp duty exemption on the first commencing from 2019 although

The residential property market in RM300,000 on the sale & purchase judging from the government’s

Malaysia has been chalking up lacklustre agreement and loan agreement for past track record, the figure seems

performances since 2015 with annual first time purchasers of homes costing unrealistic. Nevertheless, as this is a

declines in the volume and value of RM500,000 and below for a period of new administration with new people

transactions, increase in stocks of unsold two years till end 2020. at the helm, this lofty target set may be

houses and lower profits reported by Six-month stamp duty exemption achieved this time.

some of the major developers. Based on effective 1 January 2019 for first time A further sum of RM1 billion will be

the latest available statistics released by buyers of homes costing between provided via Bank Negara Malaysia

NAPIC, the number of unsold completed RM300,000 and RM1 million to help first time home buyers with

residential units rose 48.35% from 20,304 purchased from developers. monthly income of less than RM2,300

units to 30,115 units year-on-year as at Launch of P2P crowdfunding to finance their purchase of homes

30 September 2018 whilst the total value initiative to provide property buyers costing less than RM150,000 at a lower

of these unsold houses increased 56.44% an alternative source of funding for interest rate of 3.5%.

4 / HERALD NEW YEAR EDITION 2019and 5% for companies and foreigners)

imposed on properties sold after a

Residential Transaction Volume Trend

holding period of five years except for low

cost, medium cost and affordable homes

costing RM200,000 and below. There has

also been an increase in the stamp duty

rate for properties above the threshold

of RM1 million which means that it has

become costlier to buy properties priced

above RM1 million. As a concession, the

government has recently announced the

deferment of the new higher tax rate for

six months which means that the new tax

rate will only take effect from July.

Meanwhile for those of us who

are in the real estate industry, we wait

with abated breath on what additional

measures the government will announce

this year to support and nurse the

property sector through these challenging

times. More concrete and effective steps

need to be taken by the government

Residential Transaction Value Trend to address the fundamental structural

issues related to the property industry in

a holistic and comprehensive manner so

that house prices can be brought down to

a level within reach of most Malaysians

eg. making available more land for

development especially for affordable

homes, controlling the rise in land costs,

construction costs and compliance costs,

providing more detailed and timely

data on the property industry to allow

developers to make more informed

decisions and speeding up plan approvals

and improving the mechanisms of release

of Bumiputera quota units. Perhaps the

National Housing Policy 2.0 (plus its sub-

policies, the National Affordable Homes

Policy and the National Community

Policy) which has been delayed but

now due to be announced by the end of

An allocation of RM25 million by Malaysian Commercial Banks Association January, may provide some guidance

Cagamas will be used to provide (MCBA) with the National Union of Bank on the government’s directions on this

mortgage guarantees for first time Employees (NUBE). matter.

home buyers with monthly household Whilst these measures are all good In the meantime, it is good to note

income of less than RM5,000. news for those who are buying their first that the Ministry of Housing and Local

home, will they be enough to spur buying Government (KPPT) in collaboration

The latest piece of good news was the activity in the market and help developers with the Real Estate and Housing

announcement that all bank employees clear their unsold stocks? It is noted that Developers’ Association (REHDA), will

will enjoy 0% interest on their housing in Budget 2019 there were also some be launching a series of National Home

loans for the first RM100,000 of their loan announcements which had a negative Ownership campaign this year as part of

amount. This was included in the new impact on the property market viz., the efforts to promote home ownership and

collective agreement reached between 5% RPGT (previously 0% for individuals reduce the developers’ unsold stocks.

5 / HERALD NEW YEAR EDITION 2019REHDA will be offering a discount of at Existing Supply of Privately-Owned Purpose-Built Office Space in

least 10% on existing unsold properties Kuala Lumpur & Selangor as at Q3 2018

during the campaign. The success of State Existing New

Completion Incoming Planned

this home ownership programme will Supply (sqm) Supply Supply Planned

nevertheless depend on the location, type (sqm) (sqm)* (sqm) Supply

and pricing of the houses put up for sale (sqm)

in the programme and the attractiveness Kuala

8,340.066 0 1,149,235 626,957 340,861

of the sales packages offered by the Lumpur

developers.

W.P

We believe all these efforts will have a 350,472 53,774 364,565 31.545 0

Putrajaya

positive impact on the residential property

market and will provide a boost to property Selangor 3,529,904 39,218 39,218 10,276 0

sales by developers this year, in particular,

the affordable homes segment. We expect Total 12,220,442 1,553,018

92,992 668,778 340,861

the volume of property transactions to

increase slightly although the value of the Source: NAPIC

transactions may not rise proportionately

due to the weightage on lower priced Existing Supply of Privately-Owned Purpose-Built Office Space in

properties. Nevertheless, we note that Kuala Lumpur & Selangor as at Q3 2018

the trade tensions between the world’s Area No. of Existing % of Supply Occupancy

two biggest economies, if not resolved Buildings Supply Rate

quickly, may have a negative impact on (sqm) (%)

global economic growth and Malaysia,

being an export dependent nation, will Kuala Lumpur City Center

202 6,529,950 78 80.5

not be spared. This would place a yoke

(Seksyen 1-100, Bandar KL)

around the neck of the property market Outside City Centre (Luar 22

71 1,810,116 70.4

and prevent a sustained recovery although Seksyen 1-100, Bandar KL)

we are of the view that the market will not Total 273 8,340,066 100 78.3

experience any drastic downturn.

W.P Putrajaya 9 350,470 n.a 42.7

Purpose-Built Office Sector

The supply of purpose-built office space Selangor 160 3,529,900 n.a 72.5

(PBO) in Kuala Lumpur increased to

Source: NAPIC

approximately 95.7 million sq ft (8.890

million sqm) as at the third quarter of

The substantial supply of office space period was driven by oil and gas related

2018, based on the latest available official

due to come onto the market is expected companies (due to the recovery in oil

statistics. There is another 12.3 million sq

to result in a rise in vacancy rates and prices at the beginning of the year) as

ft (1.149 million sqm) in incoming supply

this may put pressure on rental rates well as co-working/shared office space

which will add substantially onto the

going forward. Nevertheless, in view of operators. Amongst co-working space

space available when completed.

the current soft market conditions and companies which have set up offices in

PBO’s within KL city centre recorded

no signs of any significant new sources of the Klang Valley are Common Ground,

an occupancy rate of 80.5% whilst those

demand for office space, some developers Worq, Colony, The Co, White Space and

located outside the city centre have a

may postpone their projects and this may the latest entrant, WeWork, currently the

lower occupancy rate of 70.4%. Overall,

offer some relief to the sector. largest co-working space operator in the

PBO’s in Kuala Lumpur recorded a drop in

On the whole, average office rentals in world who is scheduled to open its first

occupancy rate to 78.3% compared to 80%

Kuala Lumpur remained relatively stable office in Equatorial Plaza in early 2019

in the second half of 2017 and 81.4% in

with some investment grade buildings in with a capacity of 1,900 desks.

the first half of 2017. Putrajaya registered

good locations recording higher rentals. The slower economic growth projected

a rather low occupancy rate of only 42.7%

Older buildings which have not carried for the next two years as well as the

whilst Selangor’s occupancy rate declined

out any upgrading offered lower rentals to significant supply of office space which

slightly to 72.5%. A number of the more

retain existing tenants and to attract new is expected to come onstream without

recently completed buildings, aided by

ones. any corresponding increase in demand

more attractive terms, however managed

Office leasing activity during this presents a challenging environment for

to improve their occupancy rates.

6 / HERALD NEW YEAR EDITION 2019Supply of Office Sector (Kuala Lumpur)

Supply and Occupancy Rates of Office Buildings in Kuala Lumpur (2005 to Q3 2018)

Office Sector - Kuala Lumpur

10,000,000 84

9,000,000

82

8,000,000

7,000,000

80

6,000,000

Total (`000 s.m)

5,000,000 78

4,000,000

76

3,000,000

2,000,000

74

1,000,000

0 72

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q1-Q3 2018

Total Supplied (Sq.M) 5,854,987 5,928,254 6,039,111 6,214,639 6,484,856 6,810,670 6,962,474 7,539,833 7,699,638 8,097,642 8,282,678 8,657,577 8,747,246 8,898,497

Total Occupied (Sq.M) 4,796,936 4,849,178 5,016,212 5,122,290 5,393,858 5,501,669 5,598,775 5,735,257 6,079,454 6,739,899 6,722,600 6,747,246 7,127,482 7,065,198

& Occupied 81.9 81.8 83.1 82.4 83.2 80.8 80.4 76.1 79 83.2 81.2 77.9 81.5 79.4

Source: NAPIC

Supply of Office Sector (Selangor)

Supply and Occupancy Rates of Office Buildings in Selangor (2005 to Q3 2018)

Office Sector - Selangor

4,000,000 84

3,500,000 82

3,000,000

80

2,500,000

Total (`000 s.m)

78

2,000,000

76

1,500,000

74

1,000,000

500,000 72

0 70

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Total Supplied (Sq.M) 1,829,946 1,835,138 1,833,766 2,118,793 2,245,231 2,472,329 2,502,966 3,048,481 3,078,030 3,048,797 3,306,328 3,394,403 3,621,559

Total Occupied (Sq.M) 1,538,889 1,540,148 1,546,679 1,759,438 1,757,336 1,942,538 1,969,738 2,296,367 2,317,105 2,329,736 2,501,880 2,561,797 2,732,869

& Occupied 81.9 81.8 83.1 82.4 83.2 80.8 80.4 76.1 79 83.2 81.2 77.9 75.5

Source: NAPIC

the office sector in Klang Valley. The new

buildings which will be completed over

the next year will, unless owner occupied,

will require a longer time to get the

building filled up and may have to offer Retail Supply in Klang Valley 2018

more attractive rentals and terms to entice

No Location No. of Total Nett Average Average

tenants. As vacancy rates rise, building

Malls# Floor Area Rental Rate Occupancy

owners may feel pressured to reduce their

(sf) (RM psf Rate (%)

rentals in order to compete and to retain pm)*

existing tenants whose tenancies are up

for renewal. Rentals which have remained 1 Kuala Lumpur 118 35,320,465 12.04 79.4

relatively stable so far, may come down

when occupancy rates decline.

2 Selangor 152 39,739,806 9.08 76.5

The completion and commencement

of operations of the new MRT/LRT line

3 Putrajaya 3 1,957,573 3.72 82.0

extensions will make certain areas outside

the traditional city centre more attractive

as office locations and this may lead to a

Total 273 77,017,844 8.85 78.0

flight to better quality new buildings in city

fringe areas like Damansara Heights and # includes hypermarket malls and arcades.

Mutiara Damansara/Damansara Perdana. * exclude rental rates of anchor tenants such as supermarket, department store, cineplex, bowling alley etc.

Source: Henry Butcher Retail

Nevertheless, although the outlook for

the office sector appears challenging, no

8 / HERALD NEW YEAR EDITION 2019CONTEMPORARY ARCHITECTURE RESORT THEMED LANDSCAPING

10,000 SQFT RESIDENT CLUBHOUSE 4-ACRE PRIVATE HILL PARK

FREEHOLD

RESIDENTIAL TITLE

BUILT-UP FROM

991sf-1,637sf

READY TO

MOVE IN

SHOW UNIT

VIEWING STRICTLY BY APPOINTMENT ONLY

CALL NOW

RYAN +6012 7958 995

FUZZ +6016 3085 825

Exclusive Marketing Agent:

25 Jalan Yap Ah Shak, 50300 Kuala Lumpur, Malaysia.

Email: admin@henrybutcher.com.my IRAMA WANGSA

Tel no. +603-2694 2212 | Fax no. +603-2694 5543 SALES GALLERY

Developer’s License No.: 13498-2/02-2019/01252(L) • Validity Period: 25/02/2018-24/02/2019 • Advertising & Sales Permit No.: 13498-2/02-2019/01252(P) • Validity Period: 25/02/2018-24/02/2019 • Approving Authority: Dewan Bandaraya Kuala Lumpur (DBKL) • Building Plan Reference No.: BP U2 OSC 2014 0223 • Land Tenure: Freehold • Property Type: Condominium

• Total No. Of Units: 200 • Expected Completion Date: April 2018 • Land Encumbrances: Public Bank Bhd • Minimum Price: RM 858,000 • Maximum Price: RM 1,230,800 • Bumiputera Discount 5% • Restrictions In Interest: NIL

Disclaimer: All information contained herein (including specifications, plans, measurements, illustrations and statements) are subject to amendments and modifications without prior notice as may be required by the relevant authorities or developer’s consultants. They shall not form part and parcel or invalidate or annul any contract of sale between the developer and the

purchaser. Whilst every reasonable care has been taken in preparing this information, the developer cannot be held liable for any variation or inaccuracy.drastic downturn and decline in rentals is Industrial Transaction Volume Trend expected. Retail Property Sector As at December 2018, the Klang Valley (includes Kuala Lumpur, Selangor and Putrajaya) had a total of 273 shopping centres with a combined supply of 77 million sq ft in retail floor space. The average occupancy rate of these shopping centres dropped slightly for the third consecutive year from 79.9% in 2016 to 78.3% in 2017 and 78.0% in 2018. The breakdown of the retail floor space supply in Kuala Lumpur, Selangor and Putrajaya is as per the table (Retail Supply in Klang Valley 2018). Industrial Transaction Value Trend At least 8 new shopping centres are expected to open in 2019 with a total nett floor area of close to 3.8 million sq ft. They are located in various parts of Klang Valley. The average rental rate for retail space in the Klang Valley declined slightly for the third consecutive year from RM9.21 per sq ft per month in 2016 to RM8.97 per sq ft per month in 2017 and to RM8.85 per sq ft per month in 2018. This average does not include rental rates of anchor tenants such as supermarkets, department stores, cineplexes, bowling alleys etc. who typically pay low rents. The change of the ruling party and the ensuing bonus of a 3-month tax holiday when GST was suspended did not change Shopping centres in the Klang Valley during weekends. the fortunes of the retail sector as Klang registered a slight decline in achieved The spending patterns of Klang Valley Valley shopping centres still faced the same rental rates in 2018, especially for those consumers in shopping centres in 2019 challenges as in 2017 - higher operations located in suburban areas. Many new will be highly dependent on the Malaysian costs, reduced shopping traffic, decreased shopping centres offered rental rebates economic performance during the year. If retail sales and early termination by and longer rent-free periods to attract the economy performs well and benefits all tenants. It also took a longer time to secure prospective tenants instead of offering a business and industrial sectors, consumers new tenants to fill up lots vacated by these direct reduction in rental rates. spending will increase and this will in turn tenants. Just as experienced by the many new benefit shopping centres in general. Just as in previous years, many shopping shopping centres which opened during Retail Group Malaysia has projected centre owners needed to introduce rental the last 3 years, shopping centres targeted a 4.5% growth rate in retail sales for rebates or reduce rental rates in order to for opening in 2019 will continue to face Malaysia in 2019. The consumer spending retain existing tenants. Nevertheless, some challenges to fill up most of their retail lots pattern this year will be highly dependent established and popular shopping centres upon their opening. To attract tenants to on the economic performance and cost which suffered from low occupancy rates set up shop in their shopping centres, they of living during the year. The Malaysian in 2017 managed to fill up more retail will need to lower their rental rates and/ government expects the national economy lots in 2018. New shopping centres which or offer longer rent-free periods. Despite to be driven mainly by private sector opened in 2018 faced difficulty to achieve the rapid growth of online shopping in consumption and investment whilst at least 80% occupancy rate at the time of Malaysia, consumers are still visiting government expenditure is likely to opening. shopping malls, especially the larger ones, moderate during the year in order to cope 10 / HERALD NEW YEAR EDITION 2019

Malaysia Industrial Production Index (Jan to Nov 2018)

Source: Trading Economics, Dept. of Statistics, Malaysia

Malaysia Manufacturing Production (Jan to Nov 2018)

Source: Trading Economics, Dept. of Statistics, Malaysia

with the heavy public debt burden. overhang of unsold stock, and the office as the country could be a replacement for

Overall, the retail property sector as well as retail sectors which are in China in the sourcing of certain products

is expected to be affected by reduced an oversupply situation, the industrial for American industries and consumers

spending resultant from weaker consumer property sector managed to register and vice versa. The Industrial Production

sentiments and lower tourist arrivals, increases in both volume and value of Index, Manufacturing Index, PMI and

an oversupply of shopping centres in transactions as shown by NAPIC’s latest Exports statistics have been registering

general and some cases of poorly located available statistics for the first half of 2018. positive monthly growth in 2018 and do

and designed malls in particular, which Selangor was the star performer. Although not give rise for any concerns.

will put pressure on occupancy and the overhang of unsold industrial The Prime Minister launched the

rental rates. The retail property sector properties rose, the figures are nowhere as National Policy on Industry 4.0 named

will continue to face the same challenges alarming as the residential sector. Prices INDUSTRY4WRD on 31 October 2018

in 2019 as it has been facing over the recorded a mixed performance but were to prepare the country to embrace the

past three years. Nevertheless, we do generally very stable. fourth industrial revolution which is

not expect any significant declines in Going forward, Malaysia’s occurring worldwide. The industrial

occupancy and rental rates. manufacturing sector continues to look property sector is therefore expected to

good although the negative effects of a remain stable although certain industrial

Industrial Property Sector prolonged China–USA trade war is an property types eg. terrace factories in

Of all the sectors, the industrial property area of concern as it could have a negative certain locations may continue to face

sector was easily the best performer. impact on exports from Malaysia. high vacancy rates as they are not able to

Unlike the residential sector which faces Notwithstanding this, there could be attract the intended end users.

a problem of sluggish sales and a large certain sectors which may benefit Malaysia

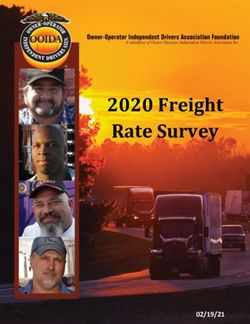

11 / HERALD NEW YEAR EDITION 2019SELANGOR

New Launches in

Q3 2017 versus Q3 2018.

RAWANG KERLING

Landed

1

Highrise

RM350 RM200

- -

3 RM800 RM250

Landed

2017 2018 RM200

-

SUNGAI RM350

BULOH KELANA JAYA

4% 46 9% 41

Highrise

RM650 Highrise

1

PETALING

- RM650

2

5

5

%

JAYA

%

56

KUALA

40

RM800 Highrise -

SELANGOR Landed

3 RM800 RM800 BANDAR

MAHKOTA

1

Landed RM300 -

RM300 - RM1200 CHERASHighrise

RM450

1

- RM400

SERI -

RM500 KEMBANGAN

RM600

Highrise

1

RM660

Highrise Highrise -

RM1500

Landed Landed

SETIA ALAM

Number of New Project Launches Landed SEMENYIH

3 RM300

Landed

2

-

RM300

RM550

-

RM550

5% 75 7% 63

%

3

2

%

SHAH ALAM

19,929 11,265 Highrise SUNGAI

RM800 LONG Highrise

1

-

2 RM900

Landed

RM300 KOTA

RM350

-

RM500

- KEMUNING

Strata Strata RM550 Highrise PUTRAJAYA

Landed RM130 PUCHONG

Landed Highrise

4 1

- Highrise

KLANG RM800

RM700

Number of Units Launched in New Projects Landed

RM500 -

4

Landed -

3

RM300 RM800

RM300 RM650

-

- Landed

RM600

RM1000 RM450

-

14 RM550

BANDAR

12 SEPANG

12 SUNWAY

Landed

3

Highrise

10

2

RM300

RM700

-

-

RM500

8 8 8

RM1200

Units

7 7 7 7 7

6

5 5 CYBERJAYA

4 4 4 4 Highrise

3 3 3 RM500

2 -

0 Jan Feb Mac

1

Apr

1

May Jun Jul Aug Sep

2 RM600

Landed

RM400

-

Total Launches by Month RM500

25

Location and Number of Project

20 21

19

15 15

Units

10 11

8

5 5 6 5

3 4

3 1 1 1 1 1

0

Apartment / Flat Bungalow Condominium Semi-D Serviced Soho / Sofo / Terrace / Super Townhouse

Residence / Sovo / Soso Link

Serviced

Apartment

Types of Projects

12 / HERALD NEW YEAR EDITION 2019Based on the data on new launches the number of strata residential units July 2018 with 8 projects launched.

compiled by us, we observed a dip in were much higher (63% vs 37%). Nevertheless, the post-electoral feel

the number of new projects launched On a monthly basis, March 2017 good factor was not sustained as

in Selangor in the first 9 months of was the most active month for new the numbers tapered off slightly in

2018 compared to the same period in launches with 12 projects before it August and September.

2017. There were 56 projects launched began to slow down in the subsequent In terms of size of units, which is

in 2017 but the figure dropped months. June 2017 experienced a usually dictated by a host of factors

28.57% to 40 in 2018 as a result of the “bottoming out” with only 3 projects such as land prices, consumer

softer market conditions. In terms of before the trend picked up in July. preferences and other socio-

number of units, there was a larger The positive movement lasted until economic variables like inflation and

decline of 43.47% from 19,929 to February 2018 with 7 projects strength of the Ringgit, units launched

11,265 units in Q3 2018 compared released to the market. The gradual in 2018 somewhat mirrored 2017’s

to the same period in the preceding rise did not continue as it was halted statistics with a heavier concentration

year. The drop did not really come as by GE14’s “Election Fever” from for sizes below 2,500 sq ft. A distinct

a surprise as the market was shrouded March onwards. But thankfully, the difference worth mentioning is

with uncertainties in the first half of change in the country’s leadership perhaps the leading sizes for the two

2018 leading up to the 14th General brought about a renewed vibe that corresponding periods ie. the more

Election (GE14). reverberated throughout the nation. conducive and livable 1,500 to 2,000

Developers launched more landed With hopes restored or seemingly sq ft led 2018 with 17 projects (25%)

than strata residential projects (51% now on a path to restoration, while the more compact less than

vs 49%) during this period but due to property footwork also followed suit 1,000 sq ft championed 2017 with 25

the higher density of such projects, with interest stirring up again in projects (24%). Larger sizes beyond

Unit Sizes $ Pricing Price Per Square

Feet (PSF)

7% 5%New Project Launches by Location

2017 2018

3,000 sq ft were few and far between property prices have risen quite In terms of location, interest has

in 2018 with only 7%, dropping from substantially since a decade ago. moved to the royal city of Klang with

17% in 2017. Case in point, up to 50% of the 4 projects followed by Setia Alam

With regards to pricing, 56% projects launched in the first three with 3 projects. In 2017, Semenyih

of the projects launched were quarters of 2018 were priced beyond led with 5 projects with Puchong next

priced between the RM400,000 RM800,000, in contrast with 2017’s with 4 projects.

and RM800,000 bracket, with an dominant RM400,000 to RM800,000

equal share between RM400,000 bracket. With prices coming down to

to RM600,000 and RM600,000 to a more realistic level now where even

RM800,000 at 28% each. In terms of the price per sq ft has experienced a

price per sq ft, there is only a marginal slide down the scale - from the most

difference between the two periods number of projects between RM751

under observation with a lion’s share to RM1,000 per sq ft in 2017 (42%, 32

of 73% (2018) and 77% (2017) of the projects) to now RM501 to RM750 in

projects priced at RM501 to RM1,000 2018 (38%, 24 projects) - it may just

per sq ft. be what the market has been yearning

The pricing mechanism in this for to remedy the less than ideal

sense may have been influenced market conditions and prevent more

by the market’s persistent call for overhang from entering the market in

more affordable housing given that the future.

14 / HERALD NEW YEAR EDITION 2019Br a n d e d

Residences

T h e Ri t z - C a r l t o n

Le ge n da r y

Service

Ex cl usi v e Own e rs - o nly

Lu x ur y A m e n i t ies

Fr e e h o l d

N ei g hb o u r i n g K LCC

Pe tron a s Twi n Tow er s

Actual show home

A H E R I TA G E O F L U X U R Y L I V I N G

A WORLD LEGENDARY BRAND Besides being equipped with advanced

amenities and features, The Residences are

The Ritz-Carlton Residences, Kuala Lumpur, managed by a dedicated team of Ritz-Carl-

Jalan Sultan Ismail, are designed to be the ton ladies and gentlemen who are on hand to

hallmark of luxury living. cater to the residents’ every need, in

accordance with the legendary brand’s

Setting the standard for service and innova- standards, providing a lifestyle that delivers

tions in a premiere living experience, The privacy and comfort for each homeowner.

Ritz-Carlton brand has built its reputation for

impeccable service and attention to detail. REDEFINED EXPERIENCE

Homeowners at The Residences and their Grand Lobby

A PRESTIGIOUS DEVELOPMENT

families are sure to enjoy an indelible journey

Ideally located in the dynamic heart of the of experience with the tailored services and

capital city, The Ritz-Carlton Residences are privacy:

one of the two towers at Berjaya Central Park, • Privileged ownership in the legendary

a prestigious development adjacent to the brand

renowned KLCC Petronas Twin Towers and • Premium management by The Ritz-Carlton

KL Tower. The development is within the • A heritage of luxury living with personalize

vicinity of corporate and commercial centers, services including 24-hour concierge services,

shopping districts, international hotels, and a la carte services such as housekeeping

famous tourist and entertainment spots. and more

• Privacy ensured with CCTV surveillance

The Residences consist of 288 homes: system and card access system to

residential lobby & dedicated floors

• Typical Units: 1,023 sf - 2,142 sf (1 Bdr, 2 Bdr Infinity Lap Pool

& 3 Bdr)

The Residences are ready to move in, with

• Penthouses: 2,605 sf - 4,284 sf (3 Bdr &

actual show homes for viewing.

4 Bdr)

C O N TA C T

C h ri s t i n e Ch u a REN09437 0 1 2 -3 1 4 2 8 6 4

N i g el Ch i n REN09436 0 1 2 -3 9 6 0 3 0 7

L i n da Oo i REN09433 0 1 2 -2 3 6 3 0 6 5

Residence Lounge

The Ritz-Carlton Residences, Kuala Lumpur, Jalan Sultan Ismail are brought to you by one of Malaysia’s largest conglomerates, Berjaya Corporation Berhad.

Developer : Wangsa Tegap Sdn Bhd (Company No. : 185589-W) (A wholly-owned subsidiary of Berjaya Corporation Berhad)

Property Gallery : 02-20, Level 2, West, Berjaya Times Square, No. 1, Jalan Imbi, 55100 Kuala Lumpur, Malaysia.

Head Office : Level 12, East, Berjaya Times Square, No.1, Jalan Imbi, 55100 Kuala Lumpur, Malaysia.

Tel : (6)03-2142 8028 / Fax : (6)03-2143 2028 | Email : info@rcr-kl.com | Website : www.rcr-kl.com

The Ritz-Carlton Residences, Kuala Lumpur, Jalan Sultan Ismail are not owned, developed or sold by The Ritz-Carlton Hotel Company, L.L.C. or any of its affiliates.

Wangsa Tegap Sdn Bhd uses The Ritz-Carlton marks under a license from an affiliate of The Ritz-Carlton Hotel Company, L.L.C.You can also read