US - ADDICTED TO STUFF - Arca Fondi

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Aprile 2021

US — ADDICTED TO STUFF

People obsess about post-Covid debt. But the reality, as the pandemic begins to wane, is that private

sector balance sheets (in aggregate) are healthy. They’ve been boosted by forced savings and buoyant

asset prices. Fed up of doing nothing, people are itching to spend. The government is not shirking either.

High deficits are going to persist amid ongoing transfers to the private sector and higher discretionary

spending to keep the economy humming. Only heretics mumble austerity. Demand will show up

everywhere, higher external deficits, higher corporate profits but also higher prices. In fact we haven’t

seen conditions like this since the late 1980s. Boom times for now.

There have been numerous papers written of late, drawing comparisons between the outlook for the post-Covid

world and the so called roaring 1920s. This seems odd. For many, the 1920s were actually pretty grim. Europe

was recovering from the war to end all wars, troubled by recessions and reconstruction costs. Even in the US,

where growth was rapid, we saw quite a bit of volatility, with three technical recessions before the big one hit at

the end of the decade.

This looks far from removed from the conditions of today. Sure we’ve had Covid. But there has been no capital

destruction. Even human loss avoided the productive sectors of the economy, to look at it through a crude macro

lens. In many respects, today’s economy and society look more like a coiled spring than a populace that is weary

Disclaimer ARCA FONDI SGR SpA. Via Disciplini 3, 20123, Milano.

La presente pubblicazione è prodotta da Independent Strategy e distribuita da ARCA FONDI SGR. Pur ponendo la massima cura nella predisposizione della presente

pubblicazione e considerando affidabili i suoi contenuti, ARCA FONDI SGR non si assume tuttavia alcuna responsabilità in merito all’esattezza, completezza e attualità dei

dati e delle informazioni nella stessa contenuti ovvero presenti sulle pubblicazioni utilizzate ai fini della sua predisposizione. Di conseguenza ARCA FONDI SGR declina ogni

responsabilità per errori od omissioni. La presente pubblicazione viene a Voi fornita per meri fini di informazione ed illustrazione, non costituendo in nessun caso offerta al

pubblico di prodotti finanziari ovvero promozione di servizi e/o attività di investimento né nei confronti di persone residenti in Italia né di persone residenti in altre giurisdizioni,

a maggior ragione quando tale offerta e/o promozione non sia autorizzata in tali giurisdizioni e/o sia contra lege se rivolta alle suddette persone. ARCA FONDI SGR non potrà

essere ritenuta responsabile, in tutto o in parte, per i danni (inclusi, a titolo meramente esemplificativo, il danno per perdita o mancato guadagno, interruzione dell’attività, perdita

di informazioni o altre perdite economiche di qualunque natura) derivanti dall’uso, in qualsiasi forma e per qualsiasi finalità, dei dati e delle informazioni presenti nella presente

pubblicazione. La presente pubblicazione è destinata all’utilizzo ed alla consultazione da parte dei collocatori di ARCA FONDI SGR cui viene indirizzata, e, in ogni caso, non si

propone di sostituire il giudizio personale dei soggetti a cui si rivolge. ARCA FONDI SGR ha la facoltà di agire in base a/ovvero di servirsi di qualsiasi elemento sopra esposto

e/o di qualsiasi informazione a cui tale materiale si ispira ovvero è tratto anche prima che lo stesso venga pubblicato e messo a disposizione della sua clientela. ARCA FONDI

SGR può occasionalmente, a proprio insindacabile giudizio, assumere posizioni lunghe o corte con riferimento ai prodotti finanziari eventualmente menzionati nella presente

pubblicazione. In nessun caso e per nessuna ragione ARCA FONDI SGR sarà tenuta, nell’ambito dello svolgimento della propria attività di gestione, sia essa individuale o

collettiva, ad agire conformemente, in tutto o in parte, alle opinioni riportate nella presente pubblicazione.

1and exhausted. A more appropriate time comparison to

make is probably the latter half of the 1980s, where the

rapid liberalisation of developed economies unleashed

the last real organic demand boom. That is where you

need to focus if you want to go back to the future.

The post-Covid bounce isn’t going to be your regular

recovery. While the pandemic hit certain sectors of

the economy and millions of individuals hard, for many

there have actually been material improvements in their

economic positions. That comes as a result of generous

transfer payments and the forced thrift imposed by

lockdowns and restricted social and economic mobility,

which are visible across the developed world. This shows

up in everything from savings rates to bank deposit data

and credit.

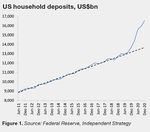

Looking at the US, households have accumulated

around US$2-3trn in excess savings since the start of

2020 (Figure 1). That’s around 9% of GDP and closer to

13% of household disposable income. The $16trn stock

of savings compares to total household mortgage debt of

$11trn. And these gains pale compared to the surge in

household net worth, which has been juiced even further

by rising asset markets. Indeed, based on the historical

relationship between savings and net worth we should

expect to see the savings rate drop back towards 5%

over the next couple of years (Figure 2), amplifying the

natural recovery we should see in demand.

And more is to come as President Biden’s spending

plans wash through. The third round of stimulus

cheques paid in March is hitting an economy that was

already recovering strongly. We can see an increased

willingness to spend in the data even before this money

hit. Whereas at the onset of the crisis worried Americans

squirreled away nearly all of the stimulus cash paid out,

by the time the second cheques landed in January, 35%

was spent immediately (Figure 3).

The liabilities side also continues to improve. Consumer

credit has been shrinking as households have used

free cash flow to pay down debt. Mortgage borrowing,

transaction volumes and prices have all surged as

wealthier householders — now spending more time at

home — have been tempted into moving. This is not

the distressed adjustment you typically see in recessions

and certainly not the pattern we saw during the sub-prime

2crunch! In fact, the market has bifurcated between the

low-risk (where mortgage delinquencies have risen) and

high-risk ends of the credit spectrum. Any widespread

tightening of credit conditions that such developments

would normally trigger have been almost completely

avoided. And this backdrop looks set to persist amid very

low housing inventory levels, an offset to a probable drop

in transaction levels due to the recent rise in mortgage

rates. That’s not to be confused with the earlier drop

in financing costs (low rates which borrowers locked in)

and a preference for these cheaper mortgage deals over

pricier consumer loans.

The reality is that consumer balance sheets are in rude

health and flush with liquidity. Having been cooped up

for the best part of a year in many cases, they have

an unprecedented spending itch to scratch. Big ticket

items shunned during uncertain times are likely to be

big winners as are services missed during lockdown

— dining out with friends, concerts, holidays and alike.

Book early!

But the gains do not end there. The forced changes

imposed on society will leave a lasting effect on many

people’s lives. Huge numbers of workers will find

themselves liberated from the office-based nine-to-five

routine. The office isn’t going to die entirely, but its role

will be transformed with more flexible working conditions.

And that will change both the daily grind and consumption

habits. While working lives will continue to be rapidly

digitised, demand for the services that suffered most

acutely during Covid will rebound strongly. Less dead

time and dead money spent on commuting for instance

will free up resources that can be used elsewhere. Bad

news for the downtown barista but great news for the

local brunch place and gym.

Demand from the consumer side is not the complete

equation of course. Many businesses not directly

affected by the restrictions seem to have managed to skirt

the pandemic relatively effectively. A good barometer of

This memorandum is based upon information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell

or a solicitation of an offer to buy or sell the securities mentioned herein. Independent Strategy Limited has no obligation to notify investors when opinions or information in

this report change and may disseminate differing views from time to time pertinent to the specific requirements of investors. Independent Strategy Limited is authorised and

regulated by the Financial Conduct Authority in the UK. Save for any liability or obligations under the Financial Services and Markets Act 2000, Independent Strategy Limited

accepts no liability whatsoever for any direct or consequential loss arising from any use of this memorandum and its contents. It may not be circulated to or used by private in-

vestors for any purpose whatsoever, or reproduced, sold, distributed or published by any recipient for any purpose without the written consent of Independent Strategy Limited.

3this is investment spending. And the data for that are

very encouraging. Not only was the decline in capex

modest compared to typical downturns but the recovery

has been swift and robust (Figure 4). Furthermore,

inventory levels are low which will further support the

recovery. The Federal Reserve Bank surveys and PMIs

corroborate this tone, all reporting brisk growth in new

orders.

And like consumers, corporates will also benefit from

ongoing fiscal largesse, directly and indirectly. The

federal government will still be running an 11% of GDP

budget deficit this year (down from 14.7% last). Gone

is the austere logic that drove decision-making after the

GFC; today’s tone is that the risks of not doing enough far

outweigh the risks of doing too much. Biden’s US$2trn

infrastructure package is further evidence and more is

planned for education, social services and health. That’s despite signs the overall economy is moving quickly

back towards business as usual and the strong balance sheet the private sector has emerged from the crisis with.

So the outlook for this coming year is a stark contrast to last, where the fiscal push was needed to basically offset

the forced savings of the private sector (Figure 5).

Now, with all three sectors effectively dissaving, a number of things are likely to happen. First, the external deficit

will widen, driven by the recovery in domestic demand. America’s current account balance came in around -3.0%

of GDP last year; it could well be double that this year as the relative outperformance of the economy boost

imports over exports and the persistence of Covid slows recovery elsewhere. US dissaving will require more

foreign investors. But the market seems to be moving to facilitate this with the rise in medium and long-term US

yields. And the traditional export powers will end up with more dollars for their reserves pile anyway. This is a

strong dollar story, not a weak one.

This excess cash is also likely to feed into higher corporate profits as households and the government boost

consumption. It’s a story that is going to be kind to margins. But it could also feed into prices. While digital

goods are not supply-constrained, many of the things consumers are going to want are. We’ve already seen a

big increase in shipping rates. And certain inputs are also supply constraints. Most topical are the stories of chip

shortages, and this doesn’t simply cover the latest cutting-edge silicon but more of the rudimentary stuff: the chips

that make millions of fairly mundane goods tick. Demand drivers are also likely to be present across services.

Alongside the base effects from the disruptions of the past 12 months, headline inflation rates could end up looking

healthier than they have in a while. Deglobalisation trends also feed into this reflationary narrative.

The last time we saw these type of demand conditions, certain (optimistic) individuals were cruising round in their

convertibles, hair gel excessively applied, with Robert Palmer at full volume.

Policy makers meanwhile seem committed to staying behind the curve; the Fed wants to see inflation sustainably

above 2%. Such aims proved merely hopeful in the last cycle but macro conditions post-Covid seem to be rather

more favourable. We’re not going to get 1980s bond prices, but pressure on yields should remain on the upside.

We are short US 10-year Treasuries.

4There are a few risks of course. To what extent will the most burdened sectors and the associated workers that have been displaced impact the recovery? While businesses as a whole saw a rise in net savings, those most acutely impacted by the pandemic required billions of debt and support to stay afloat. Will this lead to more permanent scarring? Looking at the unemployment insurance claims data there is a large sticky group that remain out of work as a function of the pandemic that do not show up in the headline unemployment rate (Figure 6). But assuming the shuttered areas of the economy can return to normality these jobs (or similar) should come back. We’re optimistic based on spending power and the ability of flexible businesses to capture such opportunities. Or as Mr Palmer might phrase it, we might as well face it we’re addicted to stuff. This memorandum is based upon information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned herein. Independent Strategy Limited has no obligation to notify investors when opinions or information in this report change and may disseminate differing views from time to time pertinent to the specific requirements of investors. Independent Strategy Limited is authorised and regulated by the Financial Conduct Authority in the UK. Save for any liability or obligations under the Financial Services and Markets Act 2000, Independent Strategy Limited accepts no liability whatsoever for any direct or consequential loss arising from any use of this memorandum and its contents. It may not be circulated to or used by private in- vestors for any purpose whatsoever, or reproduced, sold, distributed or published by any recipient for any purpose without the written consent of Independent Strategy Limited. 5

You can also read