Weekly Economic Commentary - The Government, the virus and the QE program.

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Kahurangi National Park, New Zealand

Weekly Economic

Commentary.

The Government, the virus and the QE program.

After a tumultuous few weeks, financial markets have calmed again. In part, that’s due to

signs that the daily number of new Covid-19 infections globally is flattening off. However, the

major factor that has soothed frazzled nerves in financial markets has been the extraordinary

level of fiscal and monetary stimulus that has been announced globally in recent weeks. Those

measures have supported a rally in equity markets, though major indices are still well down on

their pre-outbreak highs and they remain choppy.

Financial markets sentiment remains fragile and will be sector. Both the wage scheme and the business loan scheme

repeatedly tested over the months ahead as the extent of the appear to be working smoothly, with massive take up of both.

downturn in economic conditions becomes clearer and weak The major banks are also providing mortgage repayment

economic data emerges. The strain on businesses’ financial deferrals of up to six months for households, which we expect

position is already evident, with growing reports of layoffs and will also be heavily subscribed.

some business closures already occurring. We expect to see

more of this in the coming weeks. These schemes make sense. They will allow businesses

and households to tide themselves over through a period

The centre pieces of the Government’s effort to backstop the of extreme disruption, but will not unduly stress the

economy are its wage subsidy scheme and its Business Finance Government’s balance sheet. The thing to remember,

Guarantee Scheme. Under the guarantee scheme, banks will though, is that once Covid-19 has passed businesses will find

provide loans to businesses but the Government will take 80% themselves carrying more debt, and will be more focussed

of the credit risk and the Reserve Bank will provide the funding, on balance sheet repair than expansion. For example, if the

if needed, under a newly announced Term Loan Scheme. This is business loan scheme is fully taken up it would amount to

almost as though the Crown is lending directly to the business about 5% of all current business lending (ex agriculture).

01 6 April 2020 Weekly CommentaryIn addition to measures to cushion the economy through the economy now in train, we do expect that inflation will drop to

Covid-19 disruption, the Government is also looking at policies low levels over the coming year.

that will support a recovery in activity and employment

when the virus has passed. Details of this spending are still However, it is conceivable that upward pressure on inflation

being determined. Thus far the Government has signalled its could emerge over time, for example if permanent disruptions

intention to significantly ramp up spending on infrastructure to global supply chains caused higher production costs.

and building. That comes a top of the $12bn expansion of the This could eventually force the Reserve Bank to curtail its QE

Government’s building program which was announced late program and allow interest rates to rise. In turn, that would

last year. hamper the recovery and would make it more difficult for

the Government to continue borrowing. We view this as a

This sort of state-led building program could help to address risk scenario only, but it does illustrate why inflation will be

some of the coming increase in unemployment, and it also important to watch.

fits with the Government’s aims of refreshing the nation’s

infrastructure stock. However, we do have some doubts about

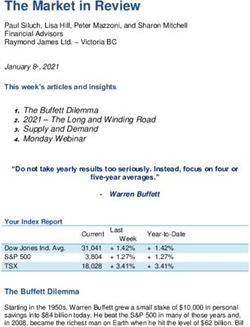

Operating balance as a % of GDP

how fast such spending can realistically be rolled out. The

Government is prioritising projects that will be ‘shovel ready’ % of GDP % of GDP

8 8

within six months and has highlighted that the expected rise in Actual Forecasts

6 6

unemployment will ease capacity constraints. But as we have HYEFU projections

4 4

often seen, infrastructure spending can take an extended Westpac estimate

2 2

period to get underway. We suspect that this spending

will be introduced in conjunction with other measures to 0 0

bolster demand and support the labour market after the -2 -2

lockdown period. -4 -4

-6 -6

The Government’s support packages will be expensive. -8 Source: The Treasury, Westpac

-8

Automatic fiscal stabilisers will further add to the pressure -10 -10

2001 2004 2007 2010 2013 2016 2019 2022

on the Government’s books, as tax revenue drops and

June years

expenditure in areas like health and social welfare increases.

We have calculated that the combination of automatic

stabilisers and the support measures already announced Net core Crown debt as a % of GDP

will require the Government to increase its borrowing by

$65bn over the coming four years. And with further measures % of GDP % of GDP

60 60

likely to be introduced over the coming months, that figure Forecasts

Actual

will likely rise to around $70bn. That would result in the 50 50

government debt to GDP ratio rising from 18.5% now to 40% HYEFU projections

40 40

by mid-2022. That is high by New Zealand standards, but Westpac estimate

still low by international standards and quite manageable at 30 30

today’s low interest rates.

20 20

In order to fund this debt, the Government has announced 10 10

that it is issuing $17bn of bonds over the coming three months, Source: The Treasury, Westpac

and we estimate that total issuance between now and June 0 0

1992 1996 2000 2004 2008 2012 2016 2020 2024

2021 will have to be $48bn. June years

That is an awful lot of bonds for the market to swallow, but

fortunately there is a ready buyer. The RBNZ has committed

to buying $30bn worth of Government bonds over the

coming year under its Large Scale Asset Purchase Program

(i.e. Quantitative easing). The purpose of this program is to

prevent an unwanted increase in interest rates. We believe

that the RBNZ is aiming to keep longer-term Government

bond rates at roughly 1%. In order to achieve that the RBNZ is

probably going to have to increase its program beyond $30bn,

as well as stepping up the weekly pace of purchases (currently

running at $1.35bn).

This raises the question of how long the RBNZ can continue

to print cash to support increases in Crown spending? The

key consideration on this front is the RBNZ’s inflation target.

Provided inflation remains low, the RBNZ can continue with

asset purchases. And with a significant downturn in the

02 6 April 2020 Weekly CommentaryThe week ahead.

NZ Q1 Survey of Business Opinion QSBO domestic trading activity and GDP

Apr 7, General business situation, Last: -26 % %

Domestic trading activity (past 3 months), Last: -11 50 3

40

– This quarter’s survey includes responses up to 20 March. While that 2

predates the country’s shift to Level 4 COVID-19 restrictions, it still 30

captures much of the recent disruptions to economic activity and related 20

1

changes in business sentiment. 10

– Consistent with other recent surveys, we expect the March quarter survey 0 0

will show a sharp drop in business confidence. We also expect a drop in -10

the backwards looking trading activity questions, which tend to be a good Domestic trading activity, -1

-20

next 3 months (lhs)

gauge of quarterly GDP growth. Weakness is expected to be widespread, -30

but especially pronounced in the manufacturing sector. Quarterly GDP growth -2

-40 Sources: NZIER, Stats NZ (rhs)

– We will also be watching the hiring and investment gauges, which -50 -3

are expected to record sizeable drops in the face of a deteriorating 1999 2002 2005 2008 2011 2014 2017 2020

economic outlook.

NZ Apr ANZ business confidence NZ business confidence

8 Apr, Last: -63.5 net % %

100 5.0

– Business confidence has plummeted in the face of the Covid-19 outbreak Business confidence (left axis)

and the related disruptions to economic activity. The number of 80 4.5

businesses expecting weaker trading conditions over the coming year Inflation expectations (right axis) 4.0

60

has dropped to a multi-decade low. Against this backdrop there has 3.5

40

been a sharp drop in the number of businesses planning to take on new 3.0

staff or undertake capital expenditure over the coming year. The fall in 20

2.5

confidence has been broad based. 0

2.0

– A preliminary result for the April survey will be released this week. This -20

1.5

survey will cover the first week of the lock down. The activity gauges -40 1.0

will certainly be weak. We’ll be watching to see how plans for hiring

-60 0.5

and investment are being affected in the face of both the lockdown and Source: ANZ

Government support packages. -80 0.0

2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

Aus Feb trade balance, AUDbn Aus trade balance

Apr 7, Last: 5.2, WBC f/c: 3.5 AUDbn AUDbn

Mkt f/c: 3.8, Range: 0.7 to 4.5 46

8

– Our forecast is for the trade surplus to narrow to $3.5bn in February, led 42 Trade balance (rhs) 7

Exports (lhs) 6

lower by exports. However, there is extreme uncertainty around this 38

Imports (lhs) 5

forecast. Both exports and imports could move in a very large range. 4

34

3

– On February 2, Australia closed its borders to flights from China for non-

30 2

residents. China was in lock-down in February, triggering a collapse in 1

output. Australia sources 25% of goods imports from China - so this is a 26 0

significant disruption. -1

22 -2

– Domestically, exports were also dented by weather disruptions to iron ore -3

shipments. 18

Sources: ABS, Westpac Economics -4

14 -5

Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20

03 6 April 2020 Weekly CommentaryThe week ahead.

Aus Apr RBA policy decision RBA cash rate and 3 year bonds

Apr 7, Last: 0.25%, WBC f/c: 0.25% % %

Mkt f/c: 0.25%, Range: 0.25% to 0.25% 8

monthly

8

– The RBA cut the cash rate by 25bps at its March meeting and by another 7 7

RBA cash rate 3 year bonds

25bps to 0.25% at an emergency inter-meeting move on March 19 that 6 6

also included the deployment of a range of QE measures including

policies aimed at lowering key market rates (3yr bonds) and providing 5 5

low cost term funding for banks. The RBA has also moved to provide large 4 4

liquidity injections to stabilise increasingly dislocated financial markets.

3 3

– With the RBA continuing to rule out negative rates, the cash rate is set to

remain at its current level for a very long time. As such, the focus of RBA 2 2

meetings will be on how the Board assesses its QE measures and whether 1 1

they may require adjusting. For April we do not anticipate this requiring Sources: RBA, Bloomberg, Westpac Economics

any adjustments. 0 0

Mar-06 Mar-08 Mar-10 Mar-12 Mar-14 Mar-16 Mar-18 Mar-20

Aus Feb housing finance approvals Aus housing finance by segment

Apr 8, Last: 4.6%, WBC f/c: 1.5%

$bn value of housing finance $bn

– Australia's housing market had started the year with good momentum 14 14

'upgraders'

ahead of the coronavirus shock, with prices posting solid gains in the first Source: ABS, Westpac Economics

since May

12 investor 12

few months and turnover holding on to the strong gains in late last year, foreign buyers*

*based on annual FIRB

+29%

approvals, financial

Q1 sales up 28% on the same time last year. In terms of housing finance 10 FHBs years (latest is 2017-18) 10

approvals, Jan showed a robust broad-based gain, the total value of

approvals surging 4.6%mth with gains in both volumes and average loan 8 8

size, and across all segments, albeit with investor activity continuing +22%

6 6

to lag.

+34%

4 4

– We expect Feb to show a similar pattern with a more moderate pace, the

total value of approvals rising a further 1.5%. This is ahead of what will be 2 2

a steep drop through March and April as the sector moves into a virus-

related shutdown. The outright ban on physical auctions and open homes 0 0

that came into effect in late March coupled with wider social distancing Jan-00 Jan-04 Jan-08 Jan-12 Jan-16 Jan-20

requirements and health concerns and a deep shock to economic activity

mean property market activity will be reduced to a trickle of online and

private sales.

04 6 April 2020 Weekly CommentaryNew Zealand forecasts.

Economic forecasts Quarterly Annual

2019 2020

% change Dec (a) Mar Jun Sep 2018 2019 2020f 2021f

GDP (Production) 0.5 -1.0 -14.0 9.9 3.2 2.3 -5.6 6.7

Employment 0.0 -0.9 -6.8 3.6 1.9 1.0 -2.4 3.6

Unemployment Rate % s.a. 4.0 4.7 9.0 8.0 4.3 4.0 7.0 5.6

CPI 0.5 0.5 0.4 0.9 1.9 1.9 2.3 1.0

Current Account Balance % of GDP -3.0 -3.0 -3.5 -3.7 -3.8 -3.0 -4.1 -3.3

Financial forecasts Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21

Cash 0.25 0.25 0.25 0.25 0.25 0.25

90 Day bill 0.40 0.40 0.40 0.40 0.40 0.40

2 Year Swap 0.60 0.60 0.60 0.65 0.70 0.80

5 Year Swap 0.70 0.75 0.80 0.90 1.00 1.10

10 Year Bond 1.00 1.00 1.00 1.05 1.10 1.20

NZD/USD 0.60 0.62 0.64 0.65 0.65 0.66

NZD/AUD 0.97 0.97 0.96 0.96 0.96 0.95

NZD/JPY 64.2 65.1 67.8 69.6 69.6 70.7

NZD/EUR 0.56 0.58 0.60 0.61 0.61 0.61

NZD/GBP 0.49 0.50 0.52 0.52 0.52 0.52

TWI 67.8 69.3 70.7 71.4 71.2 71.2

2 year swap and 90 day bank bills NZD/USD and NZD/AUD

2.00 2.00 0.70 1.00

1.80 90 day bank bill (left axis) 1.80

0.68 0.98

1.60 2 year swap (right axis) 1.60

0.66

0.96

1.40 1.40

0.64

1.20 1.20 0.94

0.62

1.00 1.00

0.92

0.60

0.80 0.80 NZD/USD (left axis)

0.58 0.90

0.60 0.60 NZD/AUD (right axis)

0.40 0.40 0.56 0.88

Apr-19 Jun-19 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20 Apr 19 Jun 19 Aug 19 Oct 19 Dec 19 Feb 20 Apr 20

NZ interest rates as at market open on 6 April 2020 NZ foreign currency mid-rates as at 6 April 2020

Interest rates Current Two weeks ago One month ago Exchange rates Current Two weeks ago One month ago

Cash 0.25% 0.25% 1.00% NZD/USD 0.5870 0.5691 0.6334

30 Days 0.35% 0.43% 1.00% NZD/EUR 0.5428 0.5341 0.5582

60 Days 0.42% 0.55% 0.91% NZD/GBP 0.4796 0.4894 0.4853

90 Days 0.48% 0.67% 0.83% NZD/JPY 63.62 63.13 66.09

2 Year Swap 0.49% 0.68% 0.71% NZD/AUD 0.9761 0.9826 0.9579

5 Year Swap 0.60% 0.92% 0.77% TWI 67.85 66.91 70.35

05 6 April 2020 Weekly CommentaryData calendar.

Market Westpac

Last Risk/Comment

median forecast

Mon 06

NZ Mar ANZ commodity prices –2.1% – –5.0% Sharp declines across all major commodity exports.

Aus Mar MI inflation gauge 1.6% – – A secondary consideration, but below target.

Mar ANZ job ads 0.7% – – Hiring freezes should see a sharp pullback.

Eur Apr Sentix investor confidence –17.1 – – Confidence evaporated in Mar. Another soft print expected.

Tue 07

NZ QSBO general business situation –26 – – Confidence and trading activity set to fall.

Aus RBA policy decision 0.25% 0.25% 0.25% Policy rate on hold; QE will be the focus going forward.

Mar AiG PSI 47 – – COVID-19 disruptions to hit hard.

Feb trade balance A$bn 5.210 3.750 3.500 Exports and imports to be disrupted by COVID-19.

Chn Mar foreign reserves $bn 3106.72 3096.25 – Little changed despite market volatility.

US Feb JOLTS job openings 6963 – – Pre-dates COVID-19 shock.

Feb consumer credit $bn 12.021 13.500 – Auto loans to come under pressure as COVID-19 shock hits.

Wed 08

NZ GlobalDairyTrade auction result –3.9% – – Futures markets signal another decline in prices.

Apr ANZBO business confidence –63.5 – – Early result, covers the first week of the lockdown.

Aus Feb housing finance approvals 4.6% 2.5% 1.5% Market was tracking well ahead of the virus shutdown.

Thu 09

Aus RBA's Financial Stability Review – – – Six-monthly update comes at a time of exceptional instability.

UK Feb trade balance £mn 4212 – – Trade flows to exhibit significant volatility hence.

US Mar PPI –0.6% –0.3% – Surprised to the downside in Feb.

Initial jobless claims 6648k – – To be watched closely following two record breaking weeks.

Feb wholesale inventories –0.5% – – Final read; prelim showed solid unwinding.

Fri 10

NZ, Aus Good Friday – – – Public holiday, markets closed.

Chn Mar PPI %yr –0.4% –1.3% – Upstream prices continue to decline.

Mar CPI %yr 5.2% 4.8% – Disrupted demand, low oil prices to apply downward pressure.

Mar foreign direct investment %yr –25.6% – – FDI flows to drop sharply and remain weak given COVID-19.

Mar new loans, CNYbn 905.7 1775.0 – Credit growth to accelerate in coming months ...

Mar M2 money supply %yr 8.8% 8.7% – ... as authorities encourage economy back to work.

US Mar CPI 0.1% –0.3% –0.2% Expected to fall as demand slows; well below target.

06 6 April 2020 Weekly CommentaryContact the Westpac economics team.

Dominick Stephens, Chief Economist Paul Clark, Industry Economist

+64 9 336 5671 +64 9 336 5656

Michael Gordon, Senior Economist Any questions email:

+64 9 336 5670 economics@westpac.co.nz

Satish Ranchhod, Senior Economist

+64 9 336 5668

Past performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the

forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

Disclaimer.

Things you should know directly or indirectly into any restricted jurisdiction. This communication is made in compliance with

Westpac Institutional Bank is a division of Westpac Banking Corporation ABN 33 007 457 141 the Market Abuse Regulation (Regulation(EU) 596/2014).

(‘Westpac’). Investment Recommendations Disclosure

Disclaimer The material may contain investment recommendations, including information recommending an

This material contains general commentary, and market colour. The material does not constitute investment strategy. Reasonable steps have been taken to ensure that the material is presented in

investment advice. Certain types of transactions, including those involving futures, options and high a clear, accurate and objective manner. Investment Recommendations for Financial Instruments

yield securities give rise to substantial risk and are not suitable for all investors. We recommend covered by MAR are made in compliance with Article 20 MAR. Westpac does not apply MAR Investment

that you seek your own independent legal or financial advice before proceeding with any investment Recommendation requirements to Spot Foreign Exchange which is out of scope for MAR.

decision. This information has been prepared without taking account of your objectives, financial

situation or needs. This material may contain material provided by third parties. While such material Unless otherwise indicated, there are no planned updates to this Investment Recommendation

is published with the necessary permission none of Westpac or its related entities accepts any at the time of publication. Westpac has no obligation to update, modify or amend this Investment

responsibility for the accuracy or completeness of any such material. Although we have made every Recommendation or to notify the recipients of this Investment Recommendation should any

effort to ensure the information is free from error, none of Westpac or its related entities warrants the information, including opinion, forecast or estimate set out in this Investment Recommendation

accuracy, adequacy or completeness of the information, or otherwise endorses it in any way. Except change or subsequently become inaccurate.

where contrary to law, Westpac and its related entities intend by this notice to exclude liability for the

information. The information is subject to change without notice and none of Westpac or its related Westpac will from time to time dispose of and acquire financial instruments of companies covered in

entities is under any obligation to update the information or correct any inaccuracy which may become this Investment Recommendation as principal and act as a market maker or liquidity provider in such

apparent at a later date. The information contained in this material does not constitute an offer, a financial instruments.

solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or

to enter a legally binding contract. Past performance is not a reliable indicator of future performance. Westpac does not have any proprietary positions in equity shares of issuers that are the subject of an

Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based investment recommendation.

are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks Westpac may have provided investment banking services to the issuer in the course of the past 12

and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

months.

Country disclosures

Westpac does not permit any issuer to see or comment on any investment recommendation prior to

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). This material is its completion and distribution.

provided to you solely for your own use and in your capacity as a wholesale client of Westpac.

Individuals who produce investment recommendations are not permitted to undertake any

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products transactions in any financial instruments or derivatives in relation to the issuers covered by the

and services are provided by either Westpac or Westpac New Zealand Limited (“WNZL”). Any product investment recommendations they produce.

or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries

(other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the Westpac has implemented policies and procedures, which are designed to ensure conflicts of

performance of WNZL in respect of any such product. The current disclosure statements for the interests are managed consistently and appropriately, and to treat clients fairly.

New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.

co.nz. For further information please refer to the Product Disclosure Statement (available from your The following arrangements have been adopted for the avoidance and prevention of conflicts in

Relationship Manager) for any product for which a Product Disclosure Statement is required, or interests associated with the provision of investment recommendations.

applicable customer agreement. Download the Westpac NZ QFE Group Financial Advisers Act 2008

Disclosure Statement at www.westpac.co.nz. (i) Chinese Wall/Cell arrangements;

China, Hong Kong, Singapore and India: This material has been prepared and issued for distribution (ii) physical separation of various Business/Support Units;

in Singapore to institutional investors, accredited investors and expert investors (as defined in the

applicable Singapore laws and regulations) only. Recipients in Singapore of this material should (iii) and well defined wall/cell crossing procedures;

contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this

material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision (iv) a “need to know” policy;

by the Monetary Authority of Singapore. Westpac Hong Kong Branch holds a banking license and

is subject to supervision by the Hong Kong Monetary Authority. Westpac Hong Kong branch also (v) documented and well defined procedures for dealing with conflicts of interest;

holds a license issued by the Hong Kong Securities and Futures Commission (SFC) for Type 1 and

Type 4 regulated activities. This material is intended only to “professional investors” as defined in (vi) steps by Compliance to ensure that the Chinese Wall/Cell arrangements remain effective and

the Securities and Futures Ordinance and any rules made under that Ordinance. Westpac Shanghai that such arrangements are adequately monitored.

and Beijing Branches hold banking licenses and are subject to supervision by the China Banking and

Insurance Regulatory Commission (CBIRC). Westpac Mumbai Branch holds a banking license from U.S: Westpac operates in the United States of America as a federally licensed branch, regulated by

Reserve Bank of India (RBI) and subject to regulation and supervision by the RBI. the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity

Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with,

UK: The contents of this communication, which have been prepared by and are the sole responsibility a Futures Commission Merchant registered with the US CFTC. Westpac Capital Markets, LLC (‘WCM’),

of Westpac Banking Corporation London and Westpac Europe Limited. Westpac (a) has its principal a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities

place of business in the United Kingdom at Camomile Court, 23 Camomile Street, London EC3A 7LL, Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority

and is registered at Cardiff in the UK (as Branch No. BR00106), and (b) authorised and regulated by the (‘FINRA’). This communication is provided for distribution to U.S. institutional investors in reliance on

Australian Prudential Regulation Authority in Australia. Westpac is authorised in the United Kingdom the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to

by the Prudential Regulation Authority. Westpac is subject to regulation by the Financial Conduct all of the independence and disclosure standards applicable to debt research reports prepared for

Authority and limited regulation by the Prudential Regulation Authority. Details about the extent retail investors in the United States. WCM is the U.S. distributor of this communication and accepts

of our regulation by the Prudential Regulation Authority are available from us on request. Westpac responsibility for the contents of this communication. All disclaimers set out with respect to Westpac

Europe Limited is a company registered in England (number 05660023) and is authorised by the apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein,

Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential please contact WCM on +1 212 389 1269. All disclaimers set out with respect to Westpac apply equally

Regulation Authority. to WCM.

This communication is being made only to and is directed at (a) persons who have professional Investing in any non-U.S. securities or related financial instruments mentioned in this communication

experience in matters relating to investments who fall within Article 19(5) of the Financial Services and may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject

Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (b) high net worth entities, and to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related

other persons to whom it may otherwise lawfully be communicated, falling within Article 49(2)(a) to (d) financial instruments may be limited. Non-U.S. companies may not subject to audit and reporting

of the Order (all such persons together being referred to as “relevant persons”). Any person who is not standards and regulatory requirements comparable to those in effect in the United States. The value

a relevant person should not act or rely on this communication or any of its contents. The investments of any investment or income from any securities or related derivative instruments denominated in

to which this communication relates are only available to and any invitation, offer or agreement to a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive

subscribe, purchase or otherwise acquire such investments will be engaged in only with, relevant or adverse effect on the value of or income from such securities or related derivative instruments.

persons. Any person who is not a relevant person should not act or rely upon this communication or

any of its contents. In the same way, the information contained in this communication is intended for The author of this communication is employed by Westpac and is not registered or qualified as a

“eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct research analyst, representative, or associated person under the rules of FINRA, any other U.S. self-

Authority and is not intended for “retail clients”. With this in mind, Westpac expressly prohibits regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically

you from passing on the information in this communication to any third party. In particular this stated, the views expressed herein are solely those of the author and may differ from the information,

communication and, in each case, any copies thereof may not be taken, transmitted or distributed, views or analysis expressed by Westpac and/or its affiliates.You can also read