Zillow Group ZG - JULY 1, 2020 - Cook Investment Research

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Zillow Group

Zillow Group

ZG

Entertainment Software /

General Real Estate

JULY 1, 2020

Cook Investment Research, LLC

1Zillow Group

Overview

Zillow Group operates the largest portfolio of real estate After purchasing the home, they do any small

and home-related brands on the web, which focus on all repairs or updates that add value to the home, and

stages of the home lifecycle: renting, buying, selling and then turn around and sell the home on their site

financing. within a few months. By selling the home quickly,

Zillow tries to avoid any of the long-term costs

Over 180 million users visit Zillow sites each month. The associated with owning a house.

company’s subsidiaries include Trulia, StreetEasy, HotPads,

and RealEstate.com.

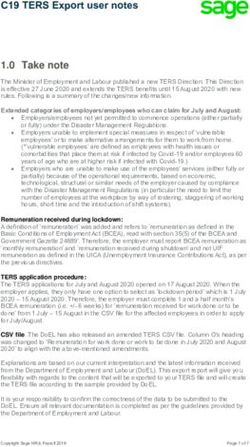

Revenue by Segment

IMT (2024 estimate)

Zillow’s Internet Media and Technology segment consists of

Premier Agent, Rentals, and Display marketing. 3%

9%

Premier Agent was the largest contributor to sales up until

Offers. As a Premier Agent, users (real estate agents) get

placed on the side banners of the Zillow platform. In

addition, the company sends agents leads for interested

buyers, and only charges them if those leads get to a

certain point in a transaction.

Zillow Rentals includes all of the revenues generated

through rental property listings on various Zillow Group 88%

sites.

Offers IMT Mortgages

Mortgages

In late 2018, Zillow acquired Mortgage Lenders of America

(MLOA) to complement their real estate platform.

Management expects MLOA to be a large part of their

supporting sales in the future.

Revenue by Region

Offers

Zillow Offers is part of the large scale iBuyers movement

for residential homes. They use recent transaction data to

make an offer on a residential home.

How it works: First, a homeowner submits to Zillow that

they would like to sell their home. Within a few days Zillow

sends out one of their appraisers to examine the property.

Using their price algorithms, Zillow comes up with an offer. US

If the seller decides to go through with the offer, a Premier 100%

Agent will assist in the sale. For their service, Zillow

charges a 6-9% fee. The nature of the program also allows

them to pick up homes at a discount, compared to similar

homes in the area.

1Zillow Group

Short-Term Outlook

$80

ZG Shares

200 MA

$60

$40

$20

$0

2012 2016 2020

The current volatility in ZG shares can be traced back to their decision to join the iBuyer movement.

The main problem that investors had with Offers, was that management was shifting from an online

platform that had the potential for extremely high margins, to the very capital-intensive and low

margin business of “flipping homes”. In addition, the company needed to open a large credit line to

partake in the high volume of transactions they plan to do.

Consequently, when the pandemic hit financial markets, it hit Zillow especially hard. The residential

real estate market is directly linked to trends in consumer spending. With the unemployment rates

soaring above 20%, investors were rightfully concerned. What’s more, no iBuying company has yet to

weather a recession. It’s impossible to know how Zillow will perform when prices begin to revert,

and the company is stuck with a large inventory of homes.

Prior to the pandemic the company was also having problems with their IMT segment. Premier

Agents were concerned with a change in how they receive their leads, as well as the quality of those

leads. This change left many of their Premier Agents frustrated with the service. Although they have

since rekindled most of these broken relationships, management decided to completely change the

fee structure of the program. Rather than being based off an upfront, fixed-price system, Premier

Agent will now be lead-based. This program is called “Flex”, and even though it has been a hit

among agents, it temporarily pushed back some profitability targets.

3Zillow Group

Long-Term Outlook

Growth Estimates → 2025

Growth (Revenue) S&P 500: 5.84% Industry: -% ZG: 46.00%

Growth (Earnings) S&P 500: 7.19% Industry: -% ZG: 193.00%

IMT Segment:

Rentals has been one of Zillow’s fastest growing areas, growing at a rate of 30% year-over-year. Currently,

Rentals revenue stands at only $37.84 million, a number vastly smaller than the total $3 billion property

managers spend on marketing their rental properties each year.

When it comes to Premier Agent, the continued growth in unique user count is likely to push real estate

agents to join the program. Familiarity with Zillow is also highest amongst Millennials, who are now entering

their prime years of purchasing a home. In addition to the growth of unique users, Zillow can also now offer

agents the chance of a commission from their Zillow Offers purchases. This creates a huge incentive for real

estate agents to pay for Zillow’s services. Referral fees typically fall around 35% for the industry, but Zillow

may demand a premium because of their reach.

Offers:

Zillow Offers already receives a request for the service every 2 minutes. This means that every day the

company receives around $200 million in requests to purchase real estate. Within the next 3-5 years they

plan on buying approximately 6,000 homes every month. 6,000 homes per month equates to 72,000 homes

per year; generating an estimated $20 billion in annual revenues.

What’s more, the benefits of Zillow Offers extends into their other segments. For example, in their MLOA

segment Zillow sees the likelihood that they’ll be able to obtain a 33% attachment rate on their in-house

mortgages. Considering they’ll be flipping around 72,000 homes per year, they’ll be getting around $800

million per year in just origination fees for those mortgages.

The downside with offers, is that the company will be heavily invested (with their own capital) in the

residential real estate market. This creates an enormous risk that the company has yet to face. Other than

risk, Zillow Offers itself will not be generating much in the form of income. Net margin will probably fall

below 3%, and that’s with low interest rates. The real opportunity in Offers, comes from the company’s ability

to leverage the platform into other segments of their operations.

4Zillow Group

For more coverage visit us at https://cookinvestmentresearch.com, and subscribe to our Bi-weekly

Reports email list.

Report archives: https://cookinvestmentresearch.com/reports

Thank you for choosing Cook Investment Research!

Our Next Report:

Advanced Micro Devices (AMD)

We’ll see you in two weeks, but until then…

Happy Investing!

5You can also read