2021 3 TOP CANNABIS STOCKS - Midas Letter

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

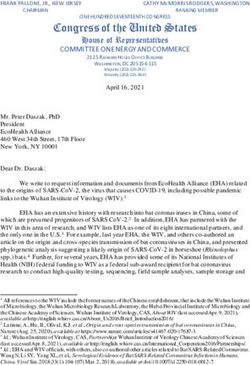

3 TOP CANNABIS STOCKS

COLUMBIA CARE INC.

(OTCMKTS: CCHWF

CNSX: CCHW)

Website: https://col-care.com

Investor Relations: https://ir.col-care.com

You could still argue that New York is just a small piece

Weighted average common shares outstanding of Columbia Care’s pie. The footprint and scale of this

- basic and diluted: 264.7M company is second only to Curaleaf Holdings Inc. - trading

at almost 5X Columbia Care’s market cap.

Market Capitalization (At market close March 31, 2019):

US$1.9B Columbia Care has licenses in 18 U.S. jurisdictions and

Cash & Cash Equivalents: US$61M operates 27 U.S. cultivation facilities with 87 dispensaries.

2020 Revenue: US$197.9M All-in-all the company has over 1 million square feet of

production and 300 plus acres of outdoor cultivation

Y/Y Rev. Growth: 151%

capacity at its growing disposal.4

Q4 Revenue: US$81.8M

Q/Q Rev. Growth: 51%

*as of December 31, 2020 unless otherwise stated

As New York became the 15th U.S. state to legalize

recreational cannabis for adult-use1, it begs the question

which weed stock is poised to benefit the most from

state-by-state recreational legislative change?

New York will quickly become one of the largest adult-use

markets in the nation. With a population of around 19.5

million2 , New York is touted to generate up to $7 billion in

annual sales once the market is fully established.3 *These picks are not in order of priority or

New York City headquartered Columbia Care Inc. could expected performance. They are in alphabetical

find itself best positioned to captain the new legal Empire order. Do your own due diligence, and only invest

(State). The company is vertically integrated in all of the with the advice of a registered investment

markets it operates in and already has wholesale

professional in your jurisdiction.

distribution, a cultivation/manufacturing facility, and four

dispensaries in New York.

1 https://www.nytimes.com/2021/03/31/nyregion/cuomo-ny-legal-weed.html

2 http://www.populationu.com/us/new-york-population 4 https://d1io3yog0oux5.cloudfront.net/_

3 h ttps://www.businessinsider.com/guide-new-york-legal-marijuana-timeline- fe270c2c6e3bf48c50a3a306a395bf60/colcare/db/354/2637/pdf/

stocks-investor CCHW+Presentation+Q4+2020+_+vFINAL%282%29.pdf

midasletter.com 23 TOP CANNABIS STOCKS

These impressive stats allow Columbia care to have The company purchased Green Solutions - the largest fully

an addressable market of over 53% of the total U.S. integrated operator in Colorado. Green Solutions adds 23

population. That’s a population of 173.6 million people dispensaries and six cultivation/manufacturing facilities

generating estimated 2021 sales of $14.28 billion - and that are expected to generate approximately US$88.5

that sales figure is expected to almost double to $27.86 million in revenue and US$18.5 million in adjusted EBITDA

billion by 2026.5 in FY 2020.6

The positive news for shareholders is out of the 18 Next, Columbia Care completed the acquisition of Project

jurisdictions Columbia Care operates in, only seven have Cannabis. Project Cannabis creates the foundation for

full recreational legality. As discussed with the conversion scaled success in California. Project Cannabis adds over

of New York state, the company is well-positioned in states 100 dispensaries to its wholesale distribution network

that could come online in the future. Florida, Pennsylvania, throughout California and immediately turns Columbia

and Virginia are just three examples of states that the Care’s Californian operations to adjusted EBITDA and cash

company has already established itself within for the flow positive.7 California is the world’s largest cannabis

medical market - these states will have significant upside market with annual sales above $4 billion. Expect California

potential if the states were to eventually allow recreational to be one of the biggest stories with MSOs this year.

sales - let alone federal de-prohibition.

As mentioned, the two previous acquisitions establish

Columbia Care made three major acquisitions in late 2020, Columbia Care in the two largest cannabis markets in the

which positions them for solid growth in the future. world, California and Colorado. But perhaps more

importantly, its acquisition of Green Leaf Medical expands

Columbia Care's operational scale and footprint into four

key, limited license markets.8 The deal enhances the scale

5 https://d1io3yog0oux5.cloudfront.net/_

fe270c2c6e3bf48c50a3a306a395bf60/colcare/db/354/2637/pdf/ 7 https://ir.col-care.com/news-events/press-releases/detail/95/columbia-

CCHW+Presentation+Q4+2020+_+vFINAL%282%29.pdf care-signs-definitive-agreement-to-acquire

6 h ttps://col-care.com/2020/09/01/columbia-care-completes-acquisition-of- 8 h ttps://ir.col-care.com/news-events/press-releases/detail/109/columbia-

the-green-solution/ care-signs-definitive-agreement-to-acquire-green

midasletter.com 33 TOP CANNABIS STOCKS

and capabilities of its seed-to-sale operations and

substantially expands its footprint and operating scale

in the Northeastern states and the Mid-Atlantic.

The Northeastern coastal states that Green Leaf Medical

opens for Columbia Care are the states coming online for

legal adult consumption. New Jersey and New York were

the most recent to be approved for recreational sales.

Green Leaf Medical also brings vertical integration to

Pennsylvania and Maryland, immediately positioning

Columbia Care as a leading wholesaler in those states.

Those two states have also already seen legislation to

legalize recreational sales.

Columbia Care reported 2020 annual revenue growth of

151% up to $197.9 million, helped by its fourth-quarter

revenue increasing 51% QoQ to $81.8 million.9 These record

company results, along with its gross margin expansion,

show the success of its expansion and acquisition strategy.

The company ended the year with $61 million in cash,

having raised $149.5 million from a bought deal public

offering, which supports any long-term continuation of its

growth initiatives.10

Columbia Care has provided Pro Forma 2021 revenue

guidance of up to $530 million. However, this does not

include any additional revenues coming online in newly

legalized states such as New York and New Jersey.

With revenues expected to reach over half a billion without

any recreational approvals, shareholders could see

significant upside in the future.

The company has a market cap of $1.1 billion - a valuation

significantly cheaper than the largest MSOs. With large

revenues and margins expected to keep improving from

recreational successes. In the state that never sleeps,

could Columbia Care find itself king of the hill and top

of the heap?

9 https://col-care.com/2021/03/16/columbia-care-reports-record-fourth- 10 https://ir.col-care.com/news-events/press-releases/detail/113/columbia-

quarter-and-full-year-2020-results-reaffirms-2021-guidance/ care-announces-closing-of-bought-deal-public

midasletter.com 43 TOP CANNABIS STOCKS

GREEN THUMB

INDUSTRIES INC.

(OTCMKTS: GTBIF

CNSX: GTII)

Website: https://www.gtigrows.com

Investor Relations: https://investors.gtigrows.com/

investors/overview/default.aspx

Connecticut, Florida, Illinois, Maryland, Massachusetts,

Shares Issued and Outstanding: 213.2M Nevada, New Jersey, New York, Ohio and Pennsylvania.

Fully Diluted: 217.2M

The company’s growth strategy focuses on States with

Market Capitalization (At market close March 31, 2019): large populations and limited licenses. The company looks

US$6.5B to enter States with a strong medical cannabis market

Cash & Cash Equivalents: US$83.8M where recreational legalization is a real possibility in the

future. To keep this report concise, we focus on two

2020 Revenue: US$556.6M

specific States that we see as the key growth markets this

Y/Y Rev. Growth: 157.2% year; Pennsylvania and Illinois.

Q4 Revenue: US$177.2M

Cannabis is still illegal for recreational use in Pennsylvania

Q/Q Rev. Growth: 12.8%

but has a roaring medical market. Pennsylvania is the

*as of December 31, 2020 unless otherwise stated fifth-largest state by population and has exceeded original

projections for patient number growth.12 The State is

expected to bring in $1 billion in cannabis sales within the

next three to four years.13 This makes the State the fastest-

growing medical cannabis market in the U.S.

According to the Oxford dictionary, to possess a green

thumb relates to the natural talent of growing plants. Well,

the multi-State cannabis operator (MSO), Green Thumb

Industries Inc., may have expanded that definition simply

from growing cannabis plants to scaling its business.

Green Thumb has six brands that sell across 12 U.S. States.

The company has 13 production facilities, 56 stores, and 97

retail licences.11

Green Thumb’s brands are produced, distributed, and sold

in the following U.S. markets: California, Colorado,

11 https://investors.gtigrows.com/investors/overview/default.aspx

12 h ttps://mjbizdaily.com/pennsylvania-successful-medical-cannabis-market- 13 https://mjbizdaily.com/pennsylvania-successful-medical-cannabis-market-

brightens-recreational-prospects/ brightens-recreational-prospects/

midasletter.com 53 TOP CANNABIS STOCKS

Another key point to outline is the high barrier to entry/ cannabis sales were $109.1 million in March 2021 - a 204%

competition within the State regarding obtaining licences. increase YoY and 35% since the previous month.18 In 2020,

The State has a licensing cap limited to a specific number Illinois sold more than $1 billion of legal cannabis and has

of cannabis licences available. Green Thumb is one of the already seen an increase of 153% in sales this year

early entrants into this market and a clear beneficiary of compared to last. This upward trend is bound to continue.

such regulation. Green Thumb recently opened its 55th national store within

the Prairie State.19

As more states pass bills to legalize cannabis

recreationally, you could make a case for Pennsylvania to It is no surprise that the last two retail openings were in

be the next candidate. Recently, lawmakers have introduced these two States. However, it is important to point out after

a bipartisan bill to do precisely that.14 According to recent these store openings, Green Thumb is one retail location

polls, two-in-three voters support allowing the sale of shy of reaching its retail licence limit in both of these

adult-use cannabis.15 The companies with significant States. With only one more available store to open in these

market share and infrastructure already in the State will States, shareholders will be looking for major retail growth

take advantage of any change in this regard. Green Thumb in other locations such as Florida and New Jersey - but will

just recently opened its 56th national retail location within be confident with the increase in sales and already

the Keystone State.16 prominent market share within stores in PA and IL. Where

Green Thumb can continue to expand across all of its

Illinois is another state Green Thumb has established markets is its wholesale business pillar.

strong retail and wholesale presence within.

The cannabis wholesale is the other side of Green Thumb’s

Illinois became the 11th State to officially legalize coin, making the value proposition attractive. The company

recreational marijuana in 2020.17 Total recreational has invested heavily into cultivation to supply other

14 https://www.mpp.org/States/pennsylvania/

15 ttps://drive.google.com/file/d/18rM2UjQGvrqL0FHk64TR_dA-LzelHCgA/

h

view

16 h ttps://investors.gtigrows.com/investors/news-and-events/press-releases/ 18 ttps://www.idfpr.com/Forms/AUC/IDFPR%20monthly%20adult%20use%20

h

press-release-details/2021/Green-Thumb-Industries-to-Open-Rise- cannabis%20sales.pdf

Meadville-in-Pennsylvania-Its-56th-Retail-Location-in-the-Nation-on- 19 h ttps://investors.gtigrows.com/investors/news-and-events/press-releases/

March-31/default.aspx press-release-details/2021/Green-Thumb-Industries-to-Open-Rise-Lake-in-

17 https://www.illinoispolicy.org/what-you-need-to-know-about-marijuana- the-Hills-in-Illinois-Its-55th-Store-in-the-Nation-and-McHenry-Countys-First-

legalization-in-illinois/ Cannabis-Store-on-March-31/default.aspx

midasletter.com 63 TOP CANNABIS STOCKS

retailers. This way, Green Thumb can benefit from the sales acquisitions and have kept dilution to shareholders to

growth within states without having to build new stores. a minimum.

Green Thumb’s wholesale revenue actually grew more

than its retail revenue last quarter, 150% vs 130% growth CEO Ben Kovler says he is excited to start 2021 with the

respectively.20 first sale of SEC-registered shares to U.S. investors.23 The

CEO has 26% stake in Green Thumb with nearly 59% of the

As the company completed its U.S. initial public offering voting power.24 With such significant ownership of the

(IPO), raising US$56 million by selling approximately 1.6 company, any future shareholder will be pleased to know

million shares of the company21, U.S. investors will now be that he has an incentive to maximize the company’s growth

keen to see how robust Green Thumb’s Financial into the future. As the founder of the company and its

Statements are. The company’s Q4 financial report a fourth stellar growth, Kovler is so far proving his thumbs are

consecutive quarter of positive cash flow from operations sufficiently green.

supported by a 157.2% yearly increase in revenue, and a

balance sheet current asset position of $183.9 million to

support further growth across the U.S.22

Green Thumb’s growth strategy involves organic growth

through licence applications. Unlike other MSOs, the

company has avoided state-by-state expansion through

20 https://investors.gtigrows.com/investors/news-and-events/press-releases/

press-release-details/2021/Green-Thumb-Industries-Reports-Record-

Resultsfor-the-Fourth-Quarter-and-Full-Year-2020/default.aspx

21 h ttps://investors.gtigrows.com/investors/news-and-events/press-releases/

press-release-details/2021/Green-Thumb-Industries-Raises-US56000000- 23 https://investors.gtigrows.com/investors/news-and-events/press-releases/

Selling-Approximately-1.6-Million-Shares-in-the-U.S/default.aspx press-release-details/2021/Green-Thumb-Industries-Reports-Record-

22 h ttps://investors.gtigrows.com/investors/news-and-events/press-releases/ Resultsfor-the-Fourth-Quarter-and-Full-Year-2020/default.aspx

press-release-details/2021/Green-Thumb-Industries-Reports-Record- 24 h ttps://www.morningstar.ca/ca/news/211008/stock-of-the-week-green-

Resultsfor-the-Fourth-Quarter-and-Full-Year-2020/default.aspx thumb-industries.aspx

midasletter.com 73 TOP CANNABIS STOCKS

TRULIEVE

CANNABIS CORP.

(OTCMKTS: TCNNF

CNSX: TRUL)

Website: https://www.trulieve.com

Investor Relations: https://investors.trulieve.com

Its vertically integrated, seed-to-sale operation boasts a

Shares Issued and Outstanding: 113.6M 51% market share stranglehold across the whole state.25

Currently, Trulieve has 79 out of the total 325 dispensing

Fully Diluted: 118.3M

locations in Florida - which over half of the state’s medicinal

Market Capitalization (At market close March 31, 2019): cannabis patients frequent.26

US$5.61B

Cash & Cash Equivalents: US$146.7M The total number of qualified Florida medical marijuana

patients is just over half a million people with estimated

2020 Revenue: US$521.5M

annual sales of around $1 billion.27 Even though Florida

Y/Y Rev. Growth: 106% doesn’t permit recreational marijuana use and sales,

Q4 Revenue: US$168.4M Trulieve’s widespread dispensary network and extensive

delivery services have still made the company $177.2

Q/Q Rev. Growth: 24%

million in December quarterly revenue. Florida patients are

*as of December 31, 2020 unless otherwise stated expected to boost cannabis sales to $2.6B by 2025 - a

CAGR of 25.3% from 2019.28 Speaking of growth, Trulieve

has doubled its sales every year for three years and said

they expect sales to continue to grow by at least 60%

in 2021.29

Florida is the home of Disney World, oranges, humidity

and Trulieve. Trulieve was the first and now the leading

medical cannabis company in the sunshine state.

The norm within the corporate cannabis industry has been

to expand operations into as many legal states as possible

- with the hope to capture the largest population of

cannabis patients/users. Trulieve has used a different

tactic that has seemingly paid off. Trulieve has used its

first-mover advantage to focus almost exclusively on the

medical market in Florida.

25 https://investors.trulieve.com 28 ttps://investors.trulieve.com/static-files/ed820945-78a9-44b5-8a11-

h

26 https://s27415.pcdn.co/wp-content/uploads/ommu_updates/2021/032621- bfe539ef420c

OMMU-Update.pdf 29 h ttps://investors.trulieve.com/events/event-details/trulieve-cannabis-corp-

27 Ibid. fourth-quarter-2020-results

midasletter.com 83 TOP CANNABIS STOCKS

vertical operations, cultivation permits, and dispensaries

in West Virginia and a cultivation/processing facility in

Massachusetts.31

We are still at the beginning of Trulieve’s MSO expansion,

but future scaling opportunities across different states

could make shareholders truly believe in the companies

value proposition.

We have spoken with CEO Kim Rivers a few times

throughout the company’s history. Most recently, here

where she discusses Trulieve’s profitability. The story

hasn’t changed since then (in terms of business strategy),

only grown.

Trulieve’s command of Florida cannabis, in terms of Kim Rivers presently owns approximately 17M shares -

footprint, brand recognition, and high-quality product equating her inside ownership to 13.82% of the company.32

reputation, has provided the company with solid With a significant equity position behind her and the fact

profitability and positive free cash flow - a rarity in the Ms. Rivers is the founder of the company, there is a large

cannabis industry. Trulieve’s cash-flow margins of 46%, incentive to keep pushing the company’s strong financial

gross margin of 60%, and customer retention rate of 79% performance and commitments to grow, state by state.

speak loudly to these points and the companies success in

its dedicated market.30

Trulieve has been profitable since 2017!

The legalization of recreational cannabis in Florida would

be the largest valuation catalyst in the near-to-medium

term - supposing Republican senators were to follow the

lead of many other U.S. states.

With Florida in Trulieve’s back pocket, the company has

started to expand its successful business to new U.S.

states. West Virginia, Massachusetts, California,

Pennsylvania, and Connecticut are the first markets

Trulieve aims to break into. Each of these states is

expected to see a double-digit CAGR by 2025 without

considering potential U.S. federal regulatory changes.

Trulieve’s strategy for entering these new markets is

through accretive acquisitions. Trulieve has the free cash

flow from its Florida operations to acquire existing

companies with proven operations in their respective

states. Most recently, dispensaries, 2021, Trulieve acquired

Mountaineer Holding LLC - positioning them to have

30 ttps://investors.trulieve.com/static-files/ed820945-78a9-44b5-8a11-

h

bfe539ef420c

31 h ttps://investors.trulieve.com/news-releases/news-release-details/ 32 https://simplywall.st/stocks/us/pharmaceuticals-biotech/otc-tcnn.f/

trulieves-national-expansion-momentum-continues-acquisition trulieve-cannabis#management

midasletter.com 93 TOP CANNABIS STOCKS

JAMES WEST

PUBLISHER, EDITOR & HOST OF MIDAS LETTER RAW

James West founded Midas Letter in 2008 and has since

been covering the best of Canadian and US small cap

companies. He covers global economics, monetary policy,

geopolitical evolution, political corruption, commodities,

cannabis and cryptocurrencies. As an active market

participant, James is not a journalist and is invariably

discussing markets and the world in the context of where

his financial interests lay. Midas Letter is conceived as an

educational and entertainment platform where visitors can

learn what James is investing in and why.

ALEXANDER ROBERTS, MSc

MIDAS LETTER ANALYST & CONTRIBUTOR

Alexander Roberts joined Midas Letter in 2018 after

LATEST INTERVIEWS, Visit the Cannabis

section of the website working in several investment service positions for leading

VIDEO CONTENT & banks. He obtained a Master’s degree in Finance &

STOCK INFORMATION LEARN MORE

Investment from The University of Leeds in England. As an

active market participant, Alexander provides in depth

insights for educational and entertainment purposes but

does not offer professional investment advise.

MIDASLETTER FINANCIAL GROUP LTD. DISCLAIMER

Midas Letter is provided as a source of information only, and is in no way to be construed as investment advice. James West, the

author and publisher of the Midas Letter, is not authorized to provide investor advice, and provides this information only to readers

who are interested in knowing what he is investing in and how he reaches such decisions.

Unit 101 - 65 Front St E

Investing in emerging public companies involves a high degree of risk and investors in such companies could lose all their money.

Always consult a duly accredited investment professional in your jurisdiction prior to making any investment decision.

Toronto ON M5E 1M2

Midas Letter occasionally accepts fees for advertising and sponsorship from public companies featured on this site. James West

Canada and/or Midas Letter may also receive compensation from companies affiliated with companies featured on this site. James West

and/or Midas Letter also invests in companies on this site and so readers should view all information on this site as biased.

PHONE (905) 961-8789 WARRANTY

Midas Letter is provided as a source of information only, and is in no way to be construed as investment advice. Neither James

West, the author and publisher of the Midas Letter, nor any authors or contributors to Midas Letter, are authorized to provide

MAIL midasletter@midasletter.com investor advice, and we provide this information only to readers who are interested in knowing what he is investing in and how he

reaches such decisions.

WEB midasletter.com Investing in emerging public companies involves a high degree of risk and investors in such companies could lose all their money.

Always consult a duly accredited investment professional in your jurisdiction prior to making any investment decision.

©2019 MidasLetter.com

All Rights Reserved. Unauthorized duplication or distribution of all content herein prohibited. This document is copyright protected and

may not be copied, disseminated or distributed without the prior express consent of James West and / or Midas Publishing Group Ltd.You can also read