Advantages of Being a Proactive Supplier - IHS Markit

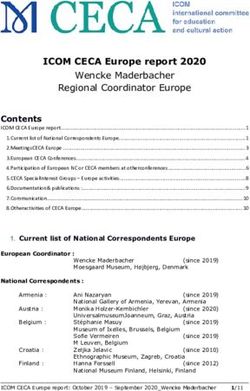

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

AUTOMOTIVE Advantages of Being a Proactive Supplier Industry Changes – Weight Loss & Power Unit Strategy 19 October 2016 | Tokyo, Japan Shou Osako Director, East Asia | Automotive Advisory Services +813 6262 1726, shou.osako@ihsmarkit.com © 2016 IHS Markit. All Rights Reserved.

Table of Contents Structural/Industry Issues • Regulatory Impacts : US/NA and China Forecasts • Industry Issues Solutions • Body-In-White Material Forecasts • VPAC Bench & Scenarios • Supplier Strategic Planning & Opportunity Targeting • Competitor Analysis © 2016 IHS Markit

Automotive Conference – Tokyo | October 2016

Regulations Strengthen : Compliance Gaps Emerge

Global CO2 Targets Are Aggressive and Converging

Notes: Reduced CO2 emission equates to improved fuel efficiency. Global convergence toward 2025.

Source: icct © 2016 IHS Markit

© 2016 IHS Markit 3Automotive Conference – Tokyo | October 2016

U.S. Midterm Evaluation Scenario

By 2021, IHS Markit and EPA/NHTSA largely agree; the gap to compliance is relatively small

> However, the years after that will be increasingly difficult for OEMs to comply

> This will require much more technology than currently assumed by EPA/NHTSA

U.S. Passenger Cars U.S. Light Trucks

60 45

40

50

35

CAFE Target

Fuel Economy

Fuel Economy

40 30

25

30

20

20 15

10

10

5

0 0

© 2016 IHS Markit 4Automotive Conference – Tokyo | October 2016

Electrification Takes Hold

Shift From S/S to Mild/Full Hybrids Starts Next Decade

Propulsion Systems – North America Electrification is

100% Required

• Larger D & E segment

90% offerings require

80% several solutions

70% • Fewer options into the

next decade

60%

• 48V is an enabler

50% though a learning/cost

curve ensues

40%

• Low oil environment

30% complicates

20% • CARB electrification

mandate complicates

10%

0%

Electrification =Stop/start, MHEV,

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 FHEV & BEV

BEV Full Hybrid Mild Hybrid Start/Stop ICE Only

© 2016 IHS Markit

© 2016 IHS Markit 5Automotive Conference – Tokyo | October 2016

Growth Plateaus: Mix Becomes Critical

Industry - Pickup, Sedan and S/CUV

Detroit

Detroit33&&Asian

Asian 4 Quarterly Volume

Quarterly Volume Quarterly Volume

2.6 1.9

1.7

NA Output (Mil)

NA Output (Mil)

2.4 1.5

1.3

2.2

1.1

2.0 0.9

0.7

6 Month Rolling Average 6 Month Rolling Average

1.8 0.5

Q1 14 Q1 15 Q1 16 Q1 17 Q1 18 Q1 14 Q1 15 Q1 16 Q1 17 Q1 18

Detroit 3 - Pickup, Sedan and S/CUV

• Asian 4 volume eclipses D3 in 2017 1.0 Quarterly Volume

Sedan decline at D3 not compensated 0.9

NA Output (Mil)

• SUV

by S/CUV & Pickups 0.8

0.7 Pickup

• Industry needs to react to the new 0.6

marketplace 0.5

0.4

6 Month Rolling Average

0.3

Asian 4: Honda, Hyundai, Nissan, Toyota Q1 14 Q1 15 Q1 16 Q1 17 Q1 18

© 2016 IHS Markit 6Automotive Conference – Tokyo | October 2016

2016 China Fuel Efficiency Forecast

Problems for big vehicles since 2016

2016 Gap 2016Target 2016 Base

L/100km

16 80%

14.4

70%

14 60%

Average gap ~20% or 1.5L/100km

12 40%

28%

26%

20% 22%

10 20% 20%

10.8

8% 9.5 9.4 9.5

3% 9.3

-24% -5% 0% -2% -7% -2%

8 7.5 0%

7.0 7.9 8.4 8.4

6.7 6.7 7.8 7.5 7.8 7.8

7.3

6.2 7.0 6.8 7.3

6 5.9 6.6 6.2 -20%

5.9

4.5

-1.42 -0.29 -0.02 -0.12 -0.49 -0.15 0.61 0.25 1.53 1.96 1.58 1.73 2.37 5.91

4 -40%

A B B MPV B SUV C C MPV C SUV D D MPV D SUV E E MPV E SUV F

*The baseline fuel consumption forecast is simulated by VPaC

© 2016 IHS MarkitAutomotive Conference – Tokyo | October 2016

2016 China Fuel Efficiency Forecast

CAFC Forecast 2016 vs. 2020

2016 Gap 2020 Gap FE Growth

Unit:L/100km

2016 Market Share 2020 Market Share 2020 Target

16 2020 Base 2016 Target 2016 Base

80%

71%

70%

14 60%

46%

43%

12 32%

40%

34% 35% 31%

29% 28%

26%

24% 20% 22%

20% 18% 20% 22% 20% 22% 22% 16%

10 13% 13% 11%

20%

12% 11%

11% 9% 10% 8% 8%

8%

2% 3%

8 0%

-1% -5% 0% -2% -2%

-7%

6 -20%

-24%

4 0.63 1.08 0.90 0.43 1.06 1.58 1.06 1.92 1.97 2.54 1.90 2.92 4.53 -40%

A B B MPV B SUV C C MPV C SUV D D MPV D SUV E E MPV E SUV F

© 2016 IHS Markit *The baseline fuel consumption forecast is simulated by VPaCAutomotive Conference – Tokyo | October 2016

Electrification is the major trend of Chinese PV market

Total PV Market

Propulsion SystemsDevelopment by Propulsion--China

– North America

Electrification is

100% Required

90% • Pure ICE engine still

80% took 80% of total PV

market in 2015

70%

• stop/start will

60% massively equipped in

50% the next 5 years and

then replaced by

40% Hybrid-Mild beyond

30% 2022

20% • Low oil environment

complicates

10%

• electrification

0%

mandate complicates

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

ICE: Stop/Start Mild-Hybrid PHEV ICE Electric HEV

© 2016 IHS Markit 9Automotive Conference – Tokyo | October 2016

Three Disruptive Realities

How Do Industry Participants Adapt ….

•S/S >> Plug-in Mild Hybrid >> Full Hybrid >> BEV

•Enablers – Legislation, 48V, mass reduction

Electrif- •Implementation depends on segment, geography, scale, infrastructure and customer purchase capability

•How does the ICE and accessories adapt through this process? What about transmissions and driveline?

ication

•Speed of implementation depends more on legislation versus technical capability

•Several disruptors enter with little patience for automotive timelines, processes and structure

Automated •Will the lack of driver intervention alter content and structure of the powertrain?

•Areas of the vehicle materially altered by automated driving: Interior, Powertrain, Electrical & Chassis

Driving

•New generations live in a more global, urban and environmentally-friendly world

•Ride sharing and reduced/limited driver input changes ownership, maintenance and use structures

Shared •Impact on municipalities, healthcare, dealer/service infrastructure, need for a license

Mobility & •How does shared mobility alter the vehicle cycle, supply base, insurance, aftermarket, standardization and safety?

Connected

Car

2015-2020 2020-2025 2025+

•PHEVs •Increased Electrification •BEVs & Infrastructure

•Level 2 >> 3 Driving •Level 3 >> 4 •Level 3 & 4 >>> 5

•Uber/Lyft •Expanding Mobility Solutions •Vehicle Park Reflects Shifts

© 2016 IHS Markit 10Automotive Conference – Tokyo | October 2016

A Looming Cost Cliff Alters The Market

OEMs, Suppliers, Regulators and Customers Are All Impacted

Success in a Rising

L3/4 Autonomy, Global influences, System Profit Pools Shift Cost Environment

~2025

Full Hybrid, BEV and Alternative Drive Formats Rise • Understand your

costs, markets & risk

Integration of ‘Non-Standard Materials’ & Joining Methods profile

• Diversify customers,

L3 Autonomy, More ADAS Content, Warranty Visibility

~2020

segments and cadence

Mild Hybrid Rise Starts in Larger Segments, 48V

• Hedge technologies

Mass Reduction Shifts Beyond The ‘Edge Segments’ • Smart vertical

integration

ADAS & Connectivity Content Rises, Warranty Costs

• Proactive engagement

Today

Down Displacement, Multi-speed Trans & S/S

• Today’s differentiators

BIW & Chassis System Lightweighting Begins are not tomorrow’s

© 2016 IHS Markit 11Automotive Conference – Tokyo | October 2016

Supplier Business Planning Needs to Change

• Increased Competition

• Faster Cycles

• Global Interconnections

> More than 70% of platforms are built in 2+ regions.

• Value Chain and Profit Pools Shift

> Suppliers hold a higher value of vehicles value: ~65% and growing

> Increased ‘Buy’ focused on electronics and powertrain vs. traditional systems

• Innovation Origination

> Suppliers drive more of the innovation and capital risk

• Product and Process Complexity

> Despite platform count reductions, homologation, legislation, reduced cadence and trim

level expansion drives increased complexity

© 2016 IHS Markit 12Automotive Conference – Tokyo | October 2016

Foresight Reigns: Suppliers Need to be More Proactive

• Anticipate market and technology trends

• Understand their organization’s priorities

• Do they have the right customer mix?

• Is there a globalization strategy?

• Are the right human resources and physical footprint in place?

• Should they entertain joint venture or affiliations to reach new markets?

Suppliers Need expand their business planning past traditional vehicle and

powertrain forecasts in an increasingly complex marketplace.

© 2016 IHS Markit 1314 Solutions • Body-In-White Material Forecasts • VPAC Bench & Scenarios • Supplier Strategic Planning & Opportunity Targeting • Competitor Analysis © 2016 IHS Markit

Automotive Conference – Tokyo | October 2016

The BIW Material Forecast Process

Establish BIW Share by System, Usage & Material

• Output in Excel and

Current Vehicle Structure

Forecasted Structures

Integral Business Planning

• IHS LV Production • IHS LV Production

Forecast Forecast PowerPoint

• 3rd Party Research • IHS Sales-Based • Ability to drive

Powertrain gap material, process &

• Industry Contacts/ location trends

Interviews analysis

• Linked to the IHS

• Primary & Secondary • Capital, supplier production forecast

Research affiliations, • Unique approach

• Multi-Material competition, suited to suppliers

exposure capability & cost of all tiers

© 2016 IHS Markit 15Automotive Conference – Tokyo | October 2016

Material Change Priority by System/Location in BIW

• Dependent upon OEM, Segment,

Cost/Availability & Compliance Gap

• Material Shift Order of Operations Assumptions (By

Segment)

• Hood

• Decklid

• Closures

• Fenders

• Front shock towers

• Roof

BIW Structure (Above)

BIW analysis also includes hood,

• A & B-Post fenders, closures, roof and decklids

• Rest of BIW bodies

© 2016 IHS Markit 16Automotive Conference – Tokyo | October 2016

Material Forecast Analysis

Total NA LV Industry By Pounds

Total BIW declines despite growth in CUVs and rising NA output

20

1010

18

Billions of Pounds (Net Usage)

0.4 0.4

Average BIW Mass (line)

16 0.5

1.0 1.5

0.7

14 2.1

2.6

12 960

1.4

1.1

10 5.1

2.6

8

6 2.6 910

4

7.0

2 5.0

0 860

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Mild Steel High Strength Steel Advanced High Strength Steel

Ultra High Strength Steel GigaPascal Steel Aluminum - Sheet

Aluminum - Cast/Ext CFRP/SMC/Plastic Other

Source: April 2016 Material Forecast

© 2016 IHS Markit 1718 Solutions • Body-In-White Material Forecasts • VPAC Bench & Scenarios • Supplier Strategic Planning & Opportunity Targeting • Competitor Analysis © 2016 IHS Markit

Automotive Conference – Tokyo | October 2016

VPaC Planning Process

• IHS Markit will set up a workshop to understand your goals:

• Europe dropping diesels from A and B segment vehicles?

• Global 2-3 cylinder dominance?

• Cost/benefit for compliance, EV or PHEV?

Workshop Quote Kickoff VPaC Custom

•Define Needs •Based on Meeting Development

•Capabilities workshop •In-person or via •Incorporation of Presentation

•Potential specifications Web Conference Sales Based

Solutions

of Findings

Powertrain

• Outputs will leverage VPaC data to answer critical

questions about the market or opportunity.

> Delivered in PowerPoint with a robust discussion of

findings between IHS Markit and you

© 2016 IHS Markit 19Automotive Conference – Tokyo | October 2016

Example: U.S. Powertrain Technology Trend

Out of the Base

forecast, IHS predicts;

• Which technologies

will gain, remain,

shrink

• When you will see

robust growth

• Electrification Trend

• Trends not only

Engine/Transmission

but other related

components

• Fuel efficiency for

each vehicle and

Power unit level

© 2016 IHS Markit 20Automotive Conference – Tokyo | October 2016

Example: U.S. Midterm Evaluation Scenario

90

MY 2021

80 Passenger Car

• There are significant gaps in

70

technology assumptions

Production Share [%]

60 EPA Phase 2

50 NHTSA Phase 2

between IHS Markit and

40 EPA TAR EPA/NHTSA

NHTSA TAR

30

20

IHS Markit

> GDI

10

0

> Stop/start

Turbocharging Gasoline Direct Injection non-Hybrid Stop-Start

> Full HEVs

16

MY 2021

14 Passenger Car > Plug-ins

12

Production Share [%]

10 EPA Phase 2

NHTSA Phase 2

8

EPA TAR • However, EPA and NHTSA

6 NHTSA TAR indicate that this is enough

4 IHS Markit technology for OEMs to

2 comply with 2021 FE and GHG

0 targets.

Mild SI-E Hybrid Full SI-E Hybrid Plug-in Hybrid Electric

© 2016 IHS Markit 21Automotive Conference – Tokyo | October 2016

Example: U.S. Midterm Evaluation Scenario

U.S. Passenger Cars

60 • What would happen if we

added additional technology to

the fleet in order for the

50

vehicles to comply in the 2022-

2025 range?

CAFE Target

40

Fuel Economy (MPG)

30 • IHS Markit works together with

our partners to set up

20

scenarios/views of a possible

future:

10 > Highest level of technology

> Specific technology path

0

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

> Lowest cost for compliance

© 2016 IHS Markit

© 2016 IHS Markit 2223 Solutions • Body-In-White Material Forecasts • VPAC Bench & Scenarios • Supplier Strategic Planning & Opportunity Targeting • Competitor Analysis © 2016 IHS Markit

Automotive Conference – Tokyo | October 2016

Supplier Business Planning is Continuous

Organizational IHS Markit

Priorities

• Competitor & Market Assessment

Plan • Legislative/Regulatory Impact

Goals & Vehicle/Powertrain & Component Forecasts

Communication •

Priorities

& Execution • Opportunity Analysis

Supplier Business planning involves all facets of

Capability/

the suppliers organization:

Targets &

Resource Finance, Sales, Marketing, Design, Engineering,

Goals

Planning

Supply Chain, Manufacturing, Logistics,

Suppliers, Customers and Stakeholders.

Opportunity

Analysis

Plan

Organizational Opportunity Capability/

Targets & Goals Gap Analysis Communication &

Priorities Analysis Resource Planning

Execution

© 2016 IHS Markit 24Automotive Conference – Tokyo | October 2016

Engine Opportunity Targeting

Supplier-specific

opportunity

targeting analysis

given unique

criteria:

• Sourcing Window

• Sourcing

Structure

• Volume,

technology,

region and

incumbent

criteria

© 2016 IHS Markit 25Automotive Conference – Tokyo | October 2016

Top 10 Opportunities – 24 Months

Average Volume

VP: Production

Nameplate 0K 10K 20K 30K 40K 50K 60K 70K 80K 90K 100K 110K 120K 130K 140K 150K 160K 170K

E: Platform E: Program E: Model VP: Platform VP: Program

S2G (HR) HR16DE (XH16) 1.6L 16V DOHC L4 Sentra CMF-C/D L21B 166.9K

DURATEC35 D33 TI-VCT 3.3L 24V DOHC V6 Explorer CD6 U625 117.2K

New ZR 2.0ZR 2.0L 16V DOHC L4 Corolla GA-C 150B 148.9K

New ZR 2.0ZR 2.0L 16V DOHC L4 Corolla GA-C 150B 141.9K

CSS-NGE/NDE (L3T) G45T-3 1.35L 12V DOHC L3 Trax VSS-F B/C 9BUC 89.7K

DRAGON DRAGON 1.5 1.5L 12V DOHC L3 Escape C2 CX482 86.6K

CUMMINS ISB ETJ 6.7L 24V OHV L6 2500/3500 DS/DJ DK 115.2K

GEN II/III/IV/V L83 - GEN V - 5.3L AFM 5.3L 16V OHV V8 Silverado VSS-T T1XC 82.4K

PENTASTAR 3.6L UPGRADE 3.6L 24V DOHC V6 Grand Cherokee WK/WK(2) WL 95.9K

VQ VQ35VD 3.5L 24V DOHC V6 Pathfinder D P42R 82.9K

2019 2020 2021 2022 2023 2024

Engine Start of Production

© 2016 IHS MarkitAutomotive Conference – Tokyo | October 2016

Top 10 Opportunities – 36 Months

Average Volume

VP: Production

Nameplate 0K 10K 20K 30K 40K 50K 60K 70K 80K 90K 100K 110K 120K

E: Platform E: Program E: Model VP: Platform VP: Program

G4-NU NU-2.0L 2.0L 16V DOHC L4 Sonata N LF(2) 117.3K

GR 7GR 3.5L 24V DOHC V6 Sienna GA-K 580L(2) 81.3K

ED6 - TIGER SHARK

WORLD ENGINE L4 2.4L 16V SOHC L4 Cherokee C-EVO/CUSW KL(2) 92.6K

M-AIR

ELECTRIC Electric 0L 0V None None Model 3 CUV GEN III Model E 75.9K

GR 7GR 3.5L 24V DOHC V6 Highlander GA-K 440A(2) 87.5K

FB FB20_DI 2.0L 16V DOHC H4 Outback SGP BF4(2) 97.4K

DURATEC35 D35 GTDI TI-VCT 3.5L 24V DOHC V6 F-150 SuperCrew T3 P702 61.5K

DRAGON DRAGON 1.5 1.5L 12V DOHC L3 C-CUV C2 CX430 53.3K

G4-NU NU-2.0L 2.0L 16V DOHC L4 Optima N JF(2) 61.4K

New-L (AP2) L15B MFI(AP2) 1.5L 16V DOHC L4 Fit GSP(2) 2WF(2) 47.8K

2020 2021 2022 2023 2024

Engine Start of Production

© 2016 IHS MarkitAutomotive Conference – Tokyo | October 2016

Top 10 Opportunities – 48 Months

Average Volume

VP: Production

Nameplate 0K 10K 20K 30K 40K 50K 60K 70K 80K 90K 100K

E: Platform E: Program E: Model VP: Platform VP: Program

New-L (AP2) L15B GDI(AP2) 1.5L 16V DOHC L4 Civic CCA 2SV(2) 91.6K

J New-J30 turbo (AP5) 3.0L 24V DOHC V6 Pilot 2SL/2SF 2SF(2) 58.3K

G4-NU NU-1.8L 1.8L 16V DOHC L4 Elantra KP3 AD(2) 65.6K

AR 8AR-FTS 2.0L 16V DOHC L4 RX GA-K 760A(2) 68.4K

New-K (AP4) New-K20 GDI 2.0L 16V DOHC L4 Civic CCA 2SV(2) 64.8K

New-K (AP4) New-K20 GDI 2.0L 16V DOHC L4 Civic CCA 2SV(2) 61.1K

G4-NU NU-2.0L 2.0L 16V DOHC L4 Optima N JF(2) 61.4K

New ZR 2.0ZR-HEV 2.0L 16V DOHC L4 Prius GA-C 690X 60.4K

SGE LFV 1.5L 16V DOHC L4 Malibu VSS-F D/E 9DSC 99.2K

G4-NU NU-1.8L 1.8L 16V DOHC L4 Sorento N UM(2) 45.2K

2021 2022 2023 2024

Engine Start of Production

© 2016 IHS Markit29 Solutions • Body-In-White Material Forecasts • VPAC Bench & Scenarios • Supplier Strategic Planning & Opportunity Targeting • Competitor Analysis © 2016 IHS Markit

Automotive Conference – Tokyo | October 2016

Competitor/Technology Assessment

Critically important to

understand;

Competitors’ Profile :

Finance, footprint etc.

Their product offerings

and tech roadmap

Differentiation strategy

Local procurement and

logistics

M&A, Investment

Market share and

Customer share

In which area change will

occur? what’s your plan?

© 2016 IHS Markit 30Automotive Conference – Tokyo | October 2016 Summary • Lack of volume growth in key markets shifts the focus to optimizing mix and focusing on high margin opportunities • Unprecedented number of challenges facing the industry: • Global regulatory initiatives • Shifting of resources and energy towards non-traditional systems • Supplier consolidation and investment expectations of multi-regional strategies • Three Disruptors: Electrification, Autonomous Vehicles & Shared Mobility • Strategies to navigate the impending ‘Cost Cliff’ • Actionable Innovation, Vertical Integration and Risk Mitigation © 2016 IHS Markit 31

IHS Markit Customer Care: CustomerCare@ihsmarkit.com Americas: +1 800 IHS CARE (+1 800 447 2273) Europe, Middle East, and Africa: +44 (0) 1344 328 300 Asia and the Pacific Rim: +604 291 3600 IHS MarkitTM COPYRIGHT NOTICE AND DISCLAIMER © 2016 IHS Markit. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent of IHS Markit. Content reproduced or redistributed with IHS Markit permission must display IHS Markit legal notices and attributions of authorship. The information contained herein is from sources considered reliable, but its accuracy and completeness are not warranted, nor are the opinions and analyses that are based upon it, and to the extent permitted by law, IHS Markit shall not be liable for any errors or omissions or any loss, damage, or expense incurred by reliance on information or any statement contained herein. In particular, please note that no representation or warranty is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, forecasts, estimates, or assumptions, and, due to various risks and uncertainties, actual events and results may differ materially from forecasts and statements of belief noted herein. This presentation is not to be construed as legal or financial advice, and use of or reliance on any information in this publication is entirely at your own risk. IHS Markit and the IHS Markit logo are trademarks of IHS Markit.

You can also read