Bangkok Condominium Market Overview Q1 2020 - Residential Research - Knight Frank

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

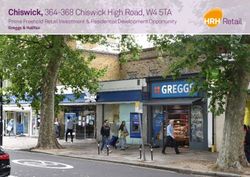

BANGKOK CONDOMINIUM MARKET OVERVIEW Q1 2020

HIGHLIGHTS

1 2

THE ACCUMULATED SUPPLY OF BANGKOK ONLY 1,791 UNITS WERE SOLD FROM THE NEW SUPPLY

CONDOMINIUMS INCLUDED 629,388 UNITS AT THE END DURING THE FIRST QUARTER OF THIS YEAR FROM A

OF Q1 2020; A GRAND TOTAL OF 6,007 UNITS FROM 20 TOTAL OF 6,007 UNITS, REPRESENTING A 30 PER CENT

PROJECTS WERE LAUNCHED DURING Q1 2020. THE SALES RATE - AND REFLECTING A 9 PER CENT DROP IN

NEW SUPPLY IN Q1 2020 DECREASED BY 53.4 PER CENT, SALES WHEN COMPARED TO THE SAME PERIOD IN THE

COMPARED WITH THE NEW SUPPLY IN Q1 2019. PREVIOUS YEAR OR A 20 PER CENT DECREASE WHEN

COMPARED WITH THE PREVIOUS QUARTER.

3 4

FOR THE SURVIVAL OF EACH COMPANY, IT IS APPARENT THE TRENDS OF THE CONDOMINIUM MARKET IN

THAT MANY OPERATORS ARE TRYING TO ENGAGE IN BANGKOK FOR THE REMAINING 9 MONTHS OF THIS

MARKETING SCHEMES TO CREATE SALES, INCLUDING YEAR WILL INCLUDE A SLOWDOWN IN THE LAUNCHES

DISCOUNT PROMOTIONS FROM 20 PER CENT UP TO 50 OF NEW CONDOMINIUMS FOR SALE - ESPECIALLY

PER CENT FOR SOME UNITS IN PROJECTS THAT WERE THE LARGE CONDOMINIUM PROJECTS AND HIGH-

COMPLETED OR EXPECTED TO BE COMPLETED WITHIN PRICED CONDOMINIUMS, LARGE-SCALE PROJECTS

THIS YEAR - IN ORDER TO TRY TO ATTRACT CUSTOMERS THAT REQUIRE MORE THAN 5 YEARS TO DEVELOP, AND

TO VISIT THE PROJECT. HOWEVER, REGARDING THE CONDOMINIUMS THAT FOCUS ON SELLING TO INVESTORS

ASKING PRICES OF NEWLY LAUNCHED CONDOMINIUMS AND FOREIGNERS.

IN BANGKOK, IT WAS FOUND THAT THE PRICE LEVEL

INCREASED IN ALL LOCATIONS. THE ASKING PRICE OF

CONDOMINIUMS IN THE CBD WAS 268,300 BAHT PER

SQUARE METRE, WHEREAS THE ASKING PRICE OF

CONDOMINIUMS IN THE CITY FRINGE AND THE SUBURBS

WAS 149,600 AND 81,150 BAHT PER SQUARE METRE,

RESPECTIVELY.

“ The condominium market in the first quarter of 2020

has been relatively slow in terms of both supply and

demand. The market at the moment is considered to

be a buyer’s market, where the buyers’ bargaining

power can push condominium price levels below the

market prices.

“

RISINEE SARIKAPUTRA

Director, Research and Consultancy

2BANGKOK CONDOMINIUM MARKET OVERVIEW Q1 2020

Market Overview

2020 marks a sluggish year for the Bangkok condominium market. The condominium market in the first quarter of 2020 has

been relatively slow in terms of both supply and demand - due to the outbreak of the new coronavirus strain, or Covid-19. The

outbreak began in late January 2020, and in March, it became more severe. As a result, from mid-March to April, there were

no new condominiums launched for sale in Bangkok. Projects that had planned launches postponed them to the last quarter

of the year. As many companies implemented a work-form-home policy for employees, the sales office of many condominium

projects closed and stopped services. Customers could, however, view the projects by calling in advance. The sales approach

has shifted to the digital platform; many companies are now using applications to communicate with customers, including

sales via LINE, websites and apps, with virtual project visits via VDO call, Live Youtube, and Facebook or unit reservations

using various online booking formats.

Supply of Newly Launched Condominiums Q1 2016 - Q1 2020 Supply Trend

As the end of Q1 2020, the accumulated

supply of Bangkok condominiums

included 629,388 units. In Q1 2020,

there were approximately 6,007 new

condominium units from 20 projects added

to the supply. The new supply in Q1 2020

decreased by 53.4 per cent, compared

with the new supply in Q1 2019. The main

reason for the decreasing of new supply

in Q1 2020 was the Covid-19 pandemic.

The majority of new supply in Q1 2020

was Grade C condominium representing

58 per cent of total, followed by Grade B

Source: Knight Frank Thailand Research

and Grade A condominiums, representing

27 per cent and 14 per cent, respectively.

Supply of Newly Launched Condominiums by Grade, Q1 2020 The new supply of Super Prime and

Prime condominium was only 1 per cent

of the total. In Q1 2020, up to 56 per cent

of the newly launched units were located

in the suburbs of Bangkok, followed by

28 per cent in the City Fringe and only 16

per cent in the Central Business District

(CBD).

Demand Trend

The outbreak of the new coronavirus

strain, or Covid-19, resulted in a clear

decline in purchasing power in new

condominium projects launched in the

Source: Knight Frank Thailand Research

first quarter of 2020. Only 1,791 units

were sold from the new supply during

Supply of Newly Launched Condominiums by Location, Q1 2020

the first quarter of this year from a total

of 6,007 units, representing a 30 per cent

sales rate – and reflecting a 9 per cent

drop in sales when compared to the same

period in the previous year or a 20 per

cent decrease when compared with the

previous quarter. In March, the outbreak

of Covid-19 was especially severe,

resulting in a decrease in the number of

people visiting projects. In addition to new

condominium sales decreasing, concerns

remain about the number of condominium

transfers for projects that are completed

and ready to be transferred this year

Source: Knight Frank Thailand Research amidst the nationwide lockdown. As such,

3BANGKOK CONDOMINIUM MARKET OVERVIEW Q1 2020

Supply, Demand and Sales Rate of Newly Launched almost every business stopped close to

Condominiums, from 2016 - 2020 100 per cent of their activities. Naturally,

when businesses stop operating, there

is an inevitable effect on employment in

various business organisations. In some

cases, businesses have decreased their

employee numbers and reduced the

salaries of employees. In turn, this has

caused many people to lose their jobs,

lack in income or have reduced income.

Buyers may be unable to complete

their transfers, as banks are also more

cautious in granting loans for real estate.

It is expected that the loan rejection rates

are likely to increase this year.

Source: Knight Frank Thailand Research

Quarterly Asking Prices of Condominiums by Location,

Selling Price Trend

2016 - 2020 For the survival of each company, it is

apparent that many operators are trying

to engage in marketing schemes to create

sales, including discount promotions from

20 per cent up to 50 per cent for some

units in the projects that were completed

or expected to be completed within this

year - in order to try to attract customers

to visit the project. In addition, there are

many other promotions, such as waiving

of charges on the day of transfer, which

includes the transfer fee of 1 per cent of

the appraised price (only for customers),

Source: Knight Frank Thailand Research

stamp duty fee, installation and insurance

fee for the electricity meter, common

facilities fee for 1 year, and initial capital

fund contribution. In addition, some

companies have promotions that attract

both investors and those who buy

residences for their own occupancy

(real demand), which include coverage

of 2 years of instalment payments. For

customers who have already bought

condominiums and are in the process

of making their down payment, many

companies implemented measures to

help, as many of the customers from

temporarily halted businesses, like

hotel staff, airline staff, restaurant staff

and department store staff, may be

experiencing the difficulties of having no

income. Many companies have helped

customers who are having problems

with the suspension of temporary down

payments, beginning at 3 months.

However, the slowdown in real estate

has been good for investors with savings

and cash in their pockets; such investors

have taken this opportunity to buy

condominiums at prices that have been

reduced to below market rates, in order

to make a profit when the economy has

recovered. As some projects only take the

4BANGKOK CONDOMINIUM MARKET OVERVIEW Q1 2020

reservation payment and the rest of the trying to reduce prices in order to attract condominium buyers due to the conve-

payments when ownership is transferred, customers. The condominium market at nient access to many shopping and

an investor can purchase a unit in such a the moment is considered to be a buyer’s transportation centres. The City Fringe

project with a 2-year instalment payment market, where the buyers’ bargaining Area can be divided into the following

promotion. They will then not have to pay power can push condominium price sub-areas:

anything out of pocket for 2 years when levels below the market prices; buyers

the economy has not yet recovered. would subsequently be able to resell their • SKV 44-70 SKV 65-103 :

purchases at a good price in the future This area encompasses the edge of

However, regarding the asking prices when the economy has revived. Sukhumvit Soi 65 to Sukhumvit Soi 77 as

of newly launched condominiums in well as the edge of Sukhumvit Soi 44 to

Bangkok, it was found that the price level Sukhumvit Soi 50.

increased in all locations. As of Q1 2020, Location Definitions

the asking price of condominiums in the • Ratchada / Rama 9 / Ladprao :

Central Business District was 268,300 Central Business District (CBD) : This is the area along Ratchadapisek

baht per square metre, increasing from This is the Central Business District area Soi 1 to Soi 17 and Soi 2 to 28; Ladprao

Q1 2019’s price of 263,500 baht per as well as the area that surrounds it; it is along Ladprao Soi 1 to Soi 23 and Soi 2

square metre, representing an increase popular for expatriates, tourists and upper to Soi 28; and Rama 9 Road, covering the

of 1.8 per cent, or increasing by 0.1 per class Thais for both for shopping and Ratchada/Rama 9 intersection to Rama 9/

cent from Q4 2019. The asking price of residences. It also includes areas along Wattanatham Road.

condominiums around the City Fringe as the Chao Phraya River on Charoen Krung

of Q1 2020 was 149,600 baht per square and Rama III Roads. The CBD Area can • Phahonyothin / Phayathai :

metre, reflecting a 1.9 per cent increase be divided into sub-areas as follows: This is the up-and-coming area that offers

from the previous year, where the price convenient access to many academic

was 146,700 baht per square metre, or • Silom / Sathorn : institutions and government agencies.

increasing by 0.07 per cent from Q4 2019. This is the area that encompasses The area covers Phahonyothin Road

The asking price of condominiums in the Sathorn Road, Silom Road and the sois between Soi 1 to 15 and Soi 2 to 20.

suburbs of Bangkok as of Q1 2020 was in between such as Sala Daeng, Nang

81,150 baht per square metre, increasing Linchee, etc. • Petchburi Road :

at the rate of 1.7 per cent from Q1 2019’s This area covers Petchburi Road from

price of 79,800 baht per square metre, or • Prime Sukhumvit (Prime SKV) : Nikhom Makasan intersection to the

increasing by 0.2 per cent from Q4 2019. This is the section of Sukhumvit Road intersection of Petchburi and the end

between Soi 1 to 63 (North side) and Soi Sukhumvit Soi 63.

2 to 42 (South side).

Outlook • Charoen Nakorn/Thonnburi :

• Central Lumpinee (CL) : This area stretches along the Chao

The trends of the condominium market in The area encompasses Ploenchit Road Phraya River from Krungthep Bridge to

Bangkok for the remaining 9 months of this (end of Sukhumvit Road), to Rajdamri, Krungthonburi Bridge.

year include a slowdown in the launches Ratchaprasong, Wireless Road, Chidlom

of new condominiums for sale - especially Road, Soi Tonson, Soi Langsuan, Sarasin • Bangsue / Tao Poon / Pracharat :

the large condominium projects and high- Road, Rajdamri Road, Ratchaprasong This area covers Samsen Road, Thaharn

priced condominiums, large-scale projects Road, Rama 1 Road and Phayathai Road. Road, Pracharat Sai 1, Pracharat Sai 2,

that require more than 5 years to develop, The area is popular with expatriates, and Krungthep-Nonthaburi Soi 1-39 and

and condominiums that focus on selling tourists and affluent Thais. Soi 2-50.

to investors and foreigners. Condominium

projects launched for sale this year • Charoenkrung / Narathiwad / Rama 3 : Bangkok Peripheral Area :

will focus on selling to buyers with real This is the area that stretches along The three major areas under this classi-

demand. The selling price level will not Charoen Krung Road of the Chao Phraya fication are :

exceed 100,000 baht per square metre. River southward just past the Sathorn

The trend of condominiums is likely to Bridge, and to the north of Sipraya Road • Eastern Bangkok :

slow both in terms of supply and demand, as well as the area along both sides of This covers the following roads: Bangna,

and it is expected that it will take another Narathiwas Road. Srinakarin, Ramkamhaeng, Theparak,

2 years for the condominium market to Romklao and Chalermprakiat.

improve. There are still around 100,000 • Surawongse / Samyan / Siphaya :

units remaining units for sale in Bangkok. This is the area on Surawongse Road, • Late Sukhumvit :

However, the delay in the launches of Samyan Road and Siphaya Road as This is the section of Sukhumvit Road on

condominiums will benefit the market in well as some parts of Rama 4, which are both sides after Sukhumvit Soi 105 and

Bangkok, providing opportunities to sell located near the mentioned roads. 70, stretching to Samutprakran.

outstanding stock. Also, postponing the

launch of new projects would result in City Fringe Area : • Northern Bangkok :

reduced competition in the market. As for The area is located on the edge of the This area covers the road along the

condominiums that will be completed this CBD, and provides easy access to the northern part of Bangkok, which include

year, it has been found that operators are CBD. This area is an alternative for Ngamwongwan, Chaengwattana, Ratta-

5BANGKOK CONDOMINIUM MARKET OVERVIEW Q1 2020

nathibet and Sanambin Nam.

• Southern Bangkok :

This is the area covering the followings

roads: Petchkasem, Ratchapruk, Kala-

prapruk, Charansanitwongse and Wuttha-

kart.

• Late Ratchada / Ratchayothin / Late

Ladprao :

This area covers Ratchada from Soi 19

and Soi 30 to the end; Ladprao from

Soi 25 and 30 to the end; Ratchayothin

Road; and Kaset Navamin, Ramindra and

Nuanchan Roads.

We like questions, if you’ve got one about our research, or would Recent Publications

like some property advice, we would love to hear from you.

Logistics Property Market H2 2019

Residential Research

Phuket Villa Market 2019

RISINEE SARIKAPUTRA

Director, Research and Consultancy

+66 (0)2643 8223 Ext 180

risinee.sarikaputra@th.knightfrank.com

Knight Frank Research, Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range

of clients worldwide including developers, investors, funding organisations, corporate institutions and

Reports are available at the public sector. All our clients recognise the need for expert independent advice customised to their

knightfrank.co.th/Research specific needs. Important Notice: © Knight Frank LLP 2020. This report is published for general information

only and not to be relied upon in any way. Although high standards have been used in the preparation

of the information, analysis, views and projections presented in this report, no responsibility or liability

whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance

on or reference to the contents of this document. As a general report, this material does not necessarily

represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this

report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and

content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with

registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may

look at a list of members’ names.

6You can also read