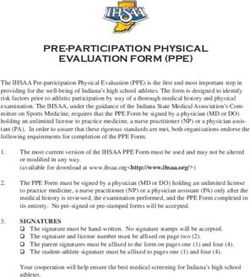

Your Guide to Paying Off Student Loans

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Choosing the right path Paying off your student loans has at least one thing in common with choosing a major. The decision you make today will greatly influence tomorrow. Graduates with student loan debt need a firm grasp of their financial situation and their available options. Some may choose to refinance and pursue more favorable terms for interest and monthly payments. Others could have alternatives to refinancing, such as income-driven repayment or student loan forgiveness plans. Which strategy works best for you? This student loan payment guide offers several options based on specific types of borrowers, the type of loans they’ve taken out, their financial status and their profession. Follow the guide to figure out whether refinancing, repayment, or forgiveness holds the most promise for paying off your student loan debt. Get started on choosing the right path today. What’s your student loan profile? Choose a profile below to explore your options for student loan refinancing, repayment, and forgiveness. Note: There may be some overlap depending on your loans and your career. For example, If you have a combination of private and federal loans, you can compare Private Loans and any other profiles that apply to you. Or you may be a Recent Graduate who’s also Military/Public Servant, etc. Recommended Path: Refinancing Other options for private loans Aside from refinancing or consolidation, private student loans don’t offer many choices. Forgiveness programs for private student loans formally don’t exist. Complete discharge of private loans is rare, even in cases of long-term disability. Unlike federal student loans, private loans aren’t eligible for IDR (Income- Driven Repayment) programs. Even if you request forbearance from your lender, you might still be obligated to pay interest and fees.

You could also request lower payments from your lender. (The Consumer Financial Protection Bureau offers a sample letter.) Some private lenders offer temporary deferments for graduates in certain professions, such as the military, health care or public service. Ask your lender about any programs or options that might ease your debt burden. Option #1: Income-Driven Repayment IDR for Recent Graduates Recent graduates may want to pay particular attention to the PAYE and IBR programs. Both require the borrower to have high debt relative to income, a situation that may be more common for people just starting out in the workforce. Option #2: Refinancing Notes on refinancing In general, recent graduates may not benefit as much from refinancing as those who’ve established themselves in the workforce. When you’ve been earning a steady salary for a while, you’ve had more opportunity to pay down your student loan debt, receive raises, and improve your overall debt-to-income ratio (DTI). Those factors can make you a more attractive candidate for lenders. Federal student loan borrowers interested in refinancing should consider the risks and rewards. By refinancing your federal loan, you could forfeit the right to take advantage of government protections such as income-driven repayment (IDR) and loan forgiveness programs. Always weigh the pros and cons of saving money with a refinanced interest rate.

Option #1: Income-Driven Repayment IDR for Experienced Employees Those who have established careers may want to consider the REPAYE program in particular to address their remaining student loan debt. Having a higher income level won’t disqualify you. Option #2: Refinancing Notes on refinancing Those who’ve established themselves in the workforce are more likely to benefit from refinancing than recent graduates. When you’ve been earning a steady salary for a while, you’ve had more opportunity to pay down your student loan debt, receive raises, and improve your overall debt-to-income ratio (DTI). Those factors can make you a more attractive candidate for lenders. Federal student loan borrowers interested in refinancing should consider the risks and rewards. By refinancing your federal loan, you could forfeit the right to take advantage of government protections such as income-driven repayment (IDR) and loan forgiveness programs. In that light, take care to weigh the pros and cons of saving money with a refinanced interest rate.

Option #1: Public Service Members of the armed forces may be eligible for repayment programs exclusive to the military. Others employed full-time by government agencies, including the military, or nonprofit organizations may qualify to have the balance of their loans forgiven under the Public Service Loan Forgiveness (PSLF) program. Option #2: Income-Driven Repayment IDR for Military/Public Servants Government/military and nonprofit employees who have made 120 payments under any Income-Driven Repayment (IDR) plan may qualify for PSLF. Option #3: Refinancing Notes on refinancing Federal student loan borrowers interested in refinancing should consider the risks and rewards. By refinancing your federal loan, you could forfeit the right to take advantage of government protections such as SLFP and IDR. Carefully weigh the pros and cons of refinancing to save money on interest. Refinancing Should you be confident or cautious? Go through the options below to get a general idea of which approach you should take —confident or cautious. Just bear in mind that every case is different, and your results don’t necessarily qualify or disqualify you for refinancing your student loan. Even if your answers suggest caution, you may be able to refinance with the help of a co-signer. Employment status Most lenders require current employment, a job offer, a residency, or some work experience. Employed - Apply with confidence Unemployed, underemployed, or still in school - Proceed with caution Credit score Requirements vary, but in general you’ll need a credit score in the mid-600s or above to qualify with top lenders.

My credit score > 650 - Apply with confidence My credit score < 650 - Proceed with caution Debt-To-Income ratio (DTI) The National Foundation for Credit Counseling recommends a monthly DTI of 36% or lower. To calculate your DTI, add up all your monthly debt obligations (not just student loans but also car loans, mortgage, credit card debt, etc.) and divide the total by your monthly gross income. Then replace the decimal (0.) with a percentage sign (%). Monthly debt divided by Monthly gross income = DTI My DTI > 36% - Apply with confidence My DTI < 36% - Proceed with caution Rules of thumb on debt and refinancing When it comes to student debt, every situation is unique. Still, using a few simple formulas can help you get a general idea of your current status, your outlook for the future, and your eligibility to refinance. 1 ANNUAL SALARY > TOTAL STUDENT DEBT Ideally, your student loan debt at graduation should not exceed your starting annual salary 2 SALARY > DEBT = DEBT-FREE IN A DECADE Ideally, your student loan debt at graduation should not exceed your starting annual sal 3 40% of MONTHLY INCOME > TOTAL MONTHLY DEBT Ideally, your student loan debt at graduation should not exceed your starting annual salary Income-Driven Repayment (IDR) Certain federal student loan borrowers may qualify for an income-driven repayment (IDR) plan such as: PAYE (Pay As You Earn) IBR (Income-Based Repayment) REPAYE (Revised Pay As You Earn) Eligibility requirements vary depending on factors including types of loans, when the loans were taken out, and your income.

The easiest way to determine your eligibility is to have the servicer of your loan take care of it. You can contact your loan servicer directly, or start an application at StudentLoans.gov and choose the first option under Repayment Plan Selection: I request that my loan holder (servicer) place me on the plan with the lowest monthly payment amount. If you have multiple servicers, you’ll need to submit a separate request to each one. In the meantime, take a look at the descriptions of IDR plans below to get a general idea of which one might fit your situation: PAYE (Pay As You Earn) Eligibility requirements specify Direct Loan Program recipients who (a) qualify as new borrowers on or after Oct. 1, 2007, and (b) received a disbursement on or after Oct. 1, 2011. Maximum monthly payments will be limited to 10% of discretionary income and won’t exceed the 10-year Standard Repayment Plan amount. High debt relative to income is required. PAYE eligible loans Direct Subsidized Loans Direct Unsubsidized Loans Direct PLUS Loans made to students Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents IBR (Income-Based Repayment) IBR benefits Direct Loan and FFEL (Federal Family Education Loan) borrowers. Like PAYE, IBR requires that the borrower’s required payment amount under the plan to be less than payments under the 10-year Standard Repayment Plan. High debt relative to income is required. IBR eligible loans Direct Subsidized Loans Direct Unsubsidized Loans Subsidized Federal Stafford Loans Unsubsidized Federal Stafford Loans

Direct or FFEL PLUS Loans made to students Direct or FFEL Consolidation Loans that do not include PLUS loans made to parents REPAYE (Revised Pay As You Earn) Launched in 2015, REPAYE is designed to extend benefits for borrowers who may not qualify for PAYE or IBR. REPAYE is only for Direct Loan borrowers with eligible loans. REPAYE doesn’t require you to have high debt relative to income or be a recent borrower. REPAYE eligible loans Direct Subsidized Loans Direct Unsubsidized Loans Direct PLUS Loans made to students Direct Consolidation Loans that do not include PLUS loans (Direct or FFEL) made to parents Public Service Military-specific programs Compared with the typical student loan borrower, members of the military can face some unique challenges. Fortunately, the government offers programs designed to help military personnel in the event of war, national emergency, and other circumstances. Repayment programs and other student loan benefits specifically for military members include: Department of Defense Student Loan Repayment Program HEAL Loan Deferment HEROES Act Extensions HEROES Act Waiver Military Private Loan Postponement Veterans Total and Permanent Disability Discharge 0% Interest/Military No-Interest Accrual Benefit

Public Service Loan Forgiveness (PSLF) Under PSLF, certain longtime participants in Income-Driven Repayment (IDR) plans may receive forgiveness for the remaining balance of their loans. Qualifying PSLF employers Government organizations (federal, state, local, or tribal) and the military Nonprofit organizations that are tax-exempt under Internal Revenue Code Section 501(c)(3) Nonprofits that are not tax-exempt under Section 501(c)(3) as long as their primary purpose is providing certain types of qualifying public services AmeriCorps and Peace Corps (for full-time volunteers) Defining full-time employment In general, you must meet the employer’s definition of full-time or work at least 30 hours per week, whichever is greater. For part-time employees with jobs at more than one qualifying employer, you may satisfy the requirement if you work a combined average of 30 hours or more per week. For nonprofit employees, time spent in the following areas may not count toward the full-time requirement: religious instruction, worship services, and proselytizing. IDR payment requirements To qualify for loan forgiveness under PSLF, you must make 120 qualifying monthly payments (which translates to 10 years’ worth) under an Income-Driven Repayment plan. Qualifying payments To qualify for PSLF, payments must be made: After Oct. 1, 2007 Under a qualifying repayment plan For the full amount due as shown on the bill No later than 15 days after your due date Qualifying loans Any non-defaulted Direct Loan received under the William D. Ford Federal Direct Loan Program Federal Family Education Loans (FFEL) and Federal Perkins Loans are not eligible for PSLF, but they may qualify if you consolidate them into a Direct Consolidation Loan. However, payments made before consolidation do not count toward the 120-payment requirement.

When to apply for PSLF The office of Federal Student Aid recommends applying as soon as possible so that you can start accruing those 120 monthly payments immediately. You can complete the Employment Certification Form online. More information on PSLF Visit the Federal Student Aid website at https://studentaid.ed.gov/sa/. Provided by: https://www.bankrate.com/loans/refinance-student-loans/#military-public-servant

You can also read