COVID-19 ROUND 4 An exclusive benefit for ISM members - Presented by - Institute for Supply Management

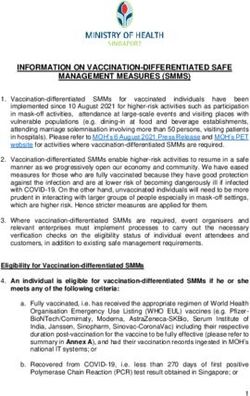

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Research Report

COVID-19 ROUND 4

An exclusive benefit for ISM members

Presented byIntroduction

A fourth wave of COVID-19 research looking at impacts that supply

management organizations face shows an optimistic latter half of 2021.

This report is based on COVID-19 Round 4 data collection administered

between December 22, 2020 to January 11, 2021.

We received responses from both ISM-affiliated customers and members and

non-ISM affiliated practitioners. The sample for Round 4 did not specifically

include previous responders from earlier rounds of COVID-19 research

conducted by ISM. Round 4 research produced 779 usable records.

For Round 4:

• 56% of respondents were from the manufacturing sector and 44% from

the services sector.

• 47% represented organizations with revenue under $50MM to < $500MM

and 53% from $500MM and more.

• The make-up of positions held include 38% at director and above and 53%

for manager and individual contributors.

2 © Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®.Respondent outlook on business in 2021

Please indicate how you and your management feel about ... Worse Same Better Diffusion Index

Business in the 1H2021 compared to 2H2020? 15% 43% 42% 63%

Business in the 2H2021 compared to 1H2021? 7% 29% 64% 78%

The next 12 months, overall 8% 26% 66% 79%

Volume of new orders for exports during 1H2021 19% 50% 31% 56%

Volume of imports of inputs during 1H2021 17% 50% 33% 58%

Profit margins during the 1H2021 21% 42% 37% 58%

Year-over-year change and expected

change of key business metrics

Please indicate the following ... Average %

Revenue change between 2019 and 2020 -2.2

Revenue budget in 2021 compared to 2020 actuals 7.8

CAPEX change between 2019 and 2020 -3.8

CAPEX budget in 2021 compared to 2020 actuals 4.0

Demand change for your outputs between 2019 and 2020 1.1

Demand forecast for your outputs in 2021 compared to 2020 actuals 10.0

Year-over-year change and expected

change of key business metrics

Please indicate the following ... Average %

Organization’s headcount change between 2019 and 2020 -2.6

Headcount forecast in 2021 compared to 2020 actuals 4.9

Prices paid for inputs change between 2019 and 2020 5.7

Prices for inputs forecast in 2021 compared to 2020 6.8

Labor rate (with benefits) change between 2019 and 2020 3.9

Labor rate (with benefits) forecast in 2021 compared to 2020 5.8

© Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®. 3Top concerns of coronavirus on your

organization (mentions)

What are your organization’s top COVID-19 concerns?

Increased risk to tier 1 suppliers 30%

Increased risk to tier 2 and lower suppliers 28%

Tier 1 suppliers closing 24%

Tier 2 and below suppliers closing 28%

Delays in shipment/supply 56%

Managing remote work 31%

Need to invest more in remote work infrastructure 21%

Fearing illness and health and safety of employees 52%

Business disruptions affecting operations 51%

Planning for risk mitigation and uncertainty 51%

Business disruptions affecting employee productivity 43%

Limited availability of raw materials or supply 43%

Business disruptions creating production limitations 42%

Increased cost to supply management 42%

Managing business growth and demand 39%

Reducing expenses 38%

Unexpected changes in inputs pricing 38%

Negative impact on organization’s financial viability 37%

Negative impact on macroeconomy 34%

Change to business model/paradigm 29%

Shortage of necessities (protective equipment, 28%

cleaning, food)

Lack of information from suppliers 28%

Suspending travel 27%

Maintaining social distancing 27%

Pivoting international trade and projects 20%

Other 4%

4 © Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®.Disruption of supply chains by transportation

restrictions

How much have transportation restrictions because of the coronavirus disrupted your supply chains in:

Not at all Minimally Moderately Severely Average

U.S. 11% 45% 33% 10% 1.4

Mexico 14% 47% 31% 8% 1.3

Canada 20% 50% 22% 7% 1.2

Europe 8% 36% 41% 15% 1.6

China 8% 26% 37% 28% 1.9

Japan 23% 38% 28% 10% 1.3

Korea 23% 41% 27% 9% 1.2

India 17% 36% 35% 12% 1.4

Middle East 30% 36% 26% 8% 1.1

Organization’s top concerns for 2021 related

to COVID-19?

Ranked by importance, “most important”= 1.0

Fearing illness and health and safety of employees 4.7

Business disruptions affecting operations 5.1

Delays in shipment/supply 5.5

Planning for risk mitigation and uncertainty 5.7

Business disruptions creating production limitations 5.8

Negative impact on organization’s financial viability 6.0

Business disruptions affecting employee productivity 6.6

Increased cost to supply management 6.7

Limited availability of raw materials or supply 6.9

Managing business growth and demand 6.9

Reducing expenses 6.9

Negative impact on macroeconomy 7.0

© Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®. 5Expected impact of coronavirus on operations

None = 0, Severe = 3

At this time, for 2021, what is the expected impact of the coronavirus on operations during :

None Minimal Moderate Severe Average

2021 Q1 3% 27% 48% 19% 2.6

2021 Q2 4% 35% 45% 8% 1.8

2021 Q3 13% 44% 21% 2% 1.0

2021 Q4 22% 36% 13% 1% 0.7

Lead time expectations: “right now” compared

to end of previous year

Compared to the end of 2020, what do you think will be your experience during Q1 2021 ...

Shorter Same Longer Diffusion Index

U.S. 4% 42% 54% 75%

Mexico 3% 45% 52% 74%

Canada 5% 55% 40% 67%

Europe 4% 28% 68% 82%

China 3% 33% 64% 81%

Japan 1% 45% 54% 77%

Korea 3% 46% 51% 74%

India 4% 41% 55% 76%

Middle East 6% 45% 49% 72%

Among those experiencing longer lead-times

“right now,” multiple of increased lead-time

You said that lead times are expected to be longer Q1 2021. Estimate the increased lead time … Average

U.S. 177%

Mexico 176%

Canada 176%

Europe 193%

China 202%

Japan 190%

Korea 189%

India 198%

Middle East 192%

6 © Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®.Lead time expectations: 4Q2021 compared

to end of previous year

Compared to the end of 2020, what do you think will be your experience during Q4 2021 ...

Shorter Same Longer Diffusion Index

U.S. 35% 54% 11% 38%

Mexico 28% 61% 10% 41%

Canada 30% 62% 8% 39%

Europe 32% 48% 20% 44%

China 30% 53% 17% 43%

Japan 23% 67% 10% 44%

Korea 27% 65% 8% 41%

India 23% 63% 14% 45%

Middle East 33% 50% 17% 42%

Regional operating rate and change in regional

operating rate of manufacturing

At what proportion of normal capacity are your operations in the following areas ... Average

U.S. 87%

Mexico 77%

Canada 82%

Europe 76%

China 86%

Japan 76%

Korea 73%

India 75%

Middle East 69%

Activation and effectiveness of risk mitigation plan

We have No plan, no Going almost/ Have a No plan for Activated We have We DON’T

plan, not expected according to plan, not CURRENT plan, plan plan have a plan

activated impact plan working disruptions working

Does your organization has a risk mitigation plan for large scale supply disruptions?

U.S. 26% 6% 53% 6% 10% 90% 85% 15%

Mexico 21% 16% 42% 8% 13% 83% 71% 29%

Canada 26% 14% 44% 3% 13% 93% 73% 27%

Europe 24% 12% 46% 7% 12% 86% 76% 24%

China 18% 10% 47% 11% 14% 81% 76% 24%

Japan 24% 14% 45% 5% 12% 90% 74% 26%

Korea 22% 18% 42% 5% 14% 90% 69% 31%

India 16% 15% 40% 10% 19% 80% 66% 34%

Middle East 16% 17% 41% 8% 17% 84% 65% 35%

© Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®. 7Changes in payment terms: A/R and A/P

You changed terms with suppliers Percent

No, and not considering this 47%

No, but we are seriously considering it 7%

Yes, on a case by case basis 32%

Yes, for some defined groups of suppliers 9%

Yes, for all suppliers 6%

Customers changed terms with you Percent

No, and we don’t expect changes 54%

No, but we have heard that it’s being considered 14%

Yes, mostly payment terms have lengthened 7%

Yes, some shorter, some longer 15%

Yes, mostly payment terms have shortened 10%

Consideration of moving operations

Has your firm considered reshoring or moving operations?

Has your firm considered reshoring or moving operations? Percent

Yes, we have begun to reshore or nearshore most operations 1%

Yes, we are planning to reshore or nearshore most operations 7%

Yes, we have begun to reshore or nearshore some operations 3%

Yes, we are planning to reshore or nearshore some operations 15%

We are considering whether to reshore or nearshore 18%

No, reshoring or nearshoring is not being considered 56%

Inventory adjustments due to COVID-19

How have your input inventories been adjusted in response to coronavirus?

Percent

Intentionally holding less than usual 14%

Unintentionally holding less than usual 12%

Intentionally holding more than usual 49%

Unintentionally holding more than usual 7%

No adjustment 18%

8 © Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®.Sufficient inventory to operate “right now”

Do you expect to have sufficient inventory to support your operations during Q1 2021 in ...

Yes Likely Maybe Not likely

U.S. 50% 27% 12% 11%

Mexico 45% 27% 17% 11%

Canada 56% 26% 13% 5%

Europe 45% 25% 16% 14%

China 44% 23% 18% 15%

Japan 44% 40% 11% 5%

Korea 49% 35% 12% 5%

India 46% 20% 20% 14%

Middle East 50% 34% 6% 9%

Sufficient inventory to operate “during Q4”

Do you expect to have sufficient inventory to support your operations during Q4 2021 in ...

Yes Likely Maybe Not likely Don’t know*

U.S. 60% 26% 11% 3% 17%

Mexico 57% 24% 15% 3% 12%

Canada 51% 31% 14% 5% 18%

Europe 60% 21% 15% 4% 15%

China 56% 27% 11% 6% 14%

Japan 45% 36% 15% 4% 22%

Korea 49% 33% 15% 3% 17%

*The proportion shown for “Don’t know” is the proportion of all responses. The proportions for “Yes” through

“Not Likely” are among those with an opinion.

Evolution of manufacturing staffing levels

At this time, at what proportion of normal is your operational and support staffing level in ...

Average

U.S. 88%

Mexico 85%

Canada 87%

Europe 84%

China 88%

Japan 86%

Korea 83%

India 79%

Middle East 75%

© Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®. 9Elements of COVID-19 response operating

plan elements

Which of the following are elements of your organization’s plan for operating in 2021?

We will disinfect work areas on a regular basis 57%

Employees that exhibit symptoms of illness will immediately be sent home 52%

We will limit the size of in-person meetings 51%

We have/are putting in place policies that allow for more remote work 47%

We will make available gloves and/or masks for returning employees 46%

Disinfecting supplies will be more readily available 44%

Employees who can work remotely may be offered the option to do so long term 40%

Employees who can work remotely may continue to do so for a short time 39%

We will have periodic temperature checks of employees 37%

We will need to adjust our office layout to allow for social distancing 29%

Employees are returning according to a plan/schedule 27%

We are delaying reopening our offices beyond state/federal guidelines 26%

We will investment more in remote work technology 24%

Reduce office space as transition to virtual office 18%

Transition to virtual office 17%

We never closed/suspended our operations 15%

We are modifying our sick-time policies to better control the return of employees 15%

We will need additional space to allow for social distancing 10%

Everyone is returning to the office at the same time 3%

Adjusting the use of labor

How do you anticipate adjusting your use of labor for the rest of this quarter and next quarter?

Q1 2021 Q2 2021

Delay hiring plans 39% 27%

Reduce hours 12% 9%

Reduce headcount 19% 14%

Temporary pay reduction 7% 6%

Increase hours 21% 15%

Increase headcount 6% 20%

25%

Permanent pay reduction 3% 3%

No adjustment* 34% 40%

*”No adjustment” is an exclusive choice.

10 © Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®.About Institute for Supply Management®

Institute for Supply Management® (ISM®) is the first and leading not-for-profit professional supply

management organization worldwide. Its 50,000 members in more than 100 countries around the world

manage about US$1 trillion in corporate and government supply chain procurement annually. Founded

in 1915 by practitioners, ISM is committed to advancing the practice of supply management to drive value

and competitive advantage for its members, contributing to a prosperous and sustainable world. ISM

empowers and leads the profession through the ISM® Report On Business®, its highly-regarded certification

and training programs, corporate services, events and the ISM Mastery Model®. The Manufacturing and

Services ISM® Report On Business® are two of the most reliable economic indicators available, providing

guidance to supply management professionals, economists, analysts, and government and business

leaders.

www.ismworld.org

This publication contains general information only and Institute for Supply Management®, Inc. (ISM®) is not, by

means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional

advice or services. This publication is not a substitute for such professional advice or services, nor should it be

used as a basis for any decision or action that may affect your business. Before making any decision or taking

any action that may affect your business, you should consult a qualified professional adviser.

For more information, contact membersvcs@ismworld.org.

Contact Us

Institute for Supply Management Member Services Team

309 W. Elliot Road, Suite 113

Tempe, AZ 85284-1556

P: +1 480.752.6276

E: membersvcs@ismworld.org

© Institute for Supply Management®. All rights reserved. Commercial use is prohibited without the express permission of the Institute for Supply Management®. 11You can also read