Fears for share schemes at takeover target Asda - (Esop) Centre

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

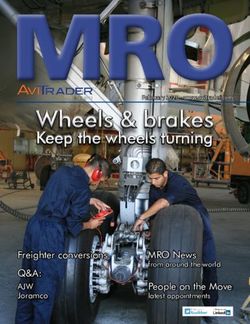

Vol 37 No 6 November 2020

Fears for share schemes at takeover target Asda

More than 25,000 Asda employee shareholders fear From the chairman

for the future of their successful SAYE-Sharesave

schemes, based on the shares of parent company

Many stories in this newspad show that - in

Walmart, as a takeover loomed. Two billionaire addition to members’ core interest in share

brothers from Blackburn appear to have won the schemes - much new thinking is bursting

battle to buy Asda from US based Walmart, in a through at the same time. The Treasury may

deal valuing the UK supermarket chain at £6.8bn. A become a shareholder in startups, people care

consortium of Zuber and Mohsin Issa’s EG Group less who owns things as long as they deliver a

and private equity firm TDR Capital will take a service, companies want to reward people who

majority stake in Asda, unless a possible late contribute but aren’t necessarily employees.

bidder, or the regulator, spoil the party.

From the US we learn that grants of restricted

The employee shareholders received a bumper

£62m return from Walmart’s 2016 SAYE- stock or restricted stock units (RSUs) are now

Sharesave, which matured in July last year. Its more common than grants of stock options.

share price has more than doubled from $65 in Employees need to understand core issues with

October 2015 to c. $146 (£113) by mid-October these grants if they are to build wealth and

this year. prevent costly mistakes.

Participating employees saved to accumulate share Users of myStockOptions.com in the United

options in Walmart, with the standard 20 percent States are encouraged to start by looking at the

discount, gaining the option of buying then selling stock grant agreement, the stock plan, and any

them for a return after vesting. If the Competition &

Markets Authority (CMA) gives the takeover employment agreement to confirm the facts and

regulatory approval, employee shareholders will be detect inconsistencies. But what is needed, in the

forced to sell their Walmart shares to the UK too now, is a free direct and neutral source

consortium, assuming no late rival tops the bid. of guidance. There is a limit to what can be

Employees again stand to make a tidy profit on the expected of employers.

value of their latest Walmart share options At the UK Shareholders Association (which I

compared to where the share price stood a year ago. also chair and where we enjoy reciprocal

However, there are doubts as to whether the new membership) this is now work in hand.

ownership consortium would want to install any

new employee share schemes. According to an Malcolm Hurlston CBE

investor blog, once the takeover goes through,:

either colleagues (employees) would get back the

total cash they have paid monthly into the SAYE held company, EG Group is thought to have little

scheme for the share options that haven’t matured, knowledge of all-employee share schemes.

or (more likely) participants would be awarded at Many Asda senior managers hold Walmart

once the Walmart shares they have options to restricted stock units (RSUs), which they were

purchase through the discounted price - and so the awarded as a retention tool. RSUs normally cannot

scheme would end. A blog user claimed that Asda be sold until they mature every three years.

would not offer any replacement share scheme Walmart will come under pressure to allow early

benefits to employees once the takeover had been maturity of these stock units once Asda changes

finalised, though that is, for the moment, only ownership. TDR Capital’s view of the current share

speculation. Another worry is that, as a privately schemes is not known.

1The Centre has long argued that corporate acquirers remain in place. Asda already has a relationship

should be required to replace established all- with the Issas through their petrol forecourt

employee share schemes (which they have to do business. The brothers own EG Group, which has

under company law, to recover 100 percent of the more than 5,200 petrol stations in the UK and

equity) with new schemes, in those companies Europe. EG Group’s auditors, Centre member

which they takeover. Deloitte, resigned abruptly, allegedly due to

Centre chairman Malcolm Hurlston CBE said: concerns over governance and internal controls

“Asda’s share schemes were introduced by its within the EG Group, raising the probability of a

transformatory chief Archie Norman, who later full-scale probe by the regulator into the proposed

sold the company to US-based Walmart. They have takeover. Mohsin and Zuber Issa’s company,

remained popular among employees, even though initially called Euro Garages, expanded from a

the SAYE options they subscribe for are for shares single site in Bury, Greater Manchester. TDR

in Walmart. Sadly, the omens do not look good, at Capital now owns half of the group, with Zuber Issa

the moment, for the survival of all-employee share controlling 25 percent and brother Mohsin the

ownership under the likely new owners. remaining 25 percent.

“Over the years, there has been a loss of all-

Valuation battle sours digital bank’s CSOP

employee share schemes from UK companies taken

over by mostly foreign based multinationals other Staff at Revolut, the $5.5bn digital bank, voiced

than those based in France or the United States. DP their frustration over the company’s handling of its

World (Dubai Ports), a UAE state-owned company, tax-advantaged share option scheme. Employees

acquired the UK-based P&O group and then closed faced delays getting the share options due to them

its employee share schemes, without replacing and claimed that they had little sight of the options

they had earned since late last year, according to an

them.

inside source.

“Walmart should know that allowing the schemes

During the height of the pandemic lockdown in

to die would contribute nothing to management-

April, Revolut sought to cut costs by offering staff

employee relations; rather it would breed employee

the chance to swap part of their salary for share

perceptions that their working lives were owned by

options on a two for one basis, meaning £1 of

remote figures who did not care for them. So it

salary could be exchanged for £2 in share options.

should consider a condition of sale that broad-based This Shares For Salary strategy is being used by a

employee share ownership will be maintained number of companies in an effort to save jobs.

under the new owners and not just restricted to the

Revolut used a tax-advantaged Company Share

executive elite.

Option Plan (CSOP) to grant share options to staff.

“We need public reassurance from a minister, Under its rules, employees must be able to acquire

backing the Centre and the Asda Eso participants shares at a price no lower than the market value of

on this issue, with perhaps a word from BEIS in the the shares on the date the option was granted.

ear of the regulator. Archie Norman is now senior

It is not known how many staff took Revolut up on

nonexec of BEIS...

this scheme, but apparently, employees were

“The adverse impact of the pandemic on share uncertain about the extent and value of their

prices has made some companies much more holdings for the better part of this year, claimed the

vulnerable to hostile takeovers, so Asda/Walmart FT-supported website Sifted. Revolut explained that

will not be the only case where the future of well- the delays were due to a lengthy to and fro

established employee share schemes could be in conversation with HMRC over how it valued shares

doubt,” warned Mr Hurlston. in the business. The fintech business took in $500m

Approval by the regulator would mean Asda from investors in February and topped up that

returning to majority UK ownership for the first round with an additional $80m in July – both at a

time in two decades. The speculation was that, if valuation of $5.5bn. Before any further share

they did succeed, the Issas would take a 20 percent options could be granted to staff, the company had

equity stake each in Asda, TDR Capital 40 percent, to report these transactions to HMRC so that the

with Walmart holding the remaining 20 percent. latter could make its final valuation assessment.

Walmart decided to sell a controlling stake in Asda However, the Covid-19 pandemic resulted in

after shelving plans to float the business following significant delays to this process. The pandemic

a planned £7.3bn merger with Sainsbury’s, which affected financial projections that Revolut had

was blocked on competition grounds. Walmart included in an earlier report for HMRC, which had

bought Asda in 1999 for £6.7bn and it plans to to be updated. Revolut finally filed its report with

retain a minority stake in the supermarket chain HMRC in July and heard back from the taxman on

after the sale goes through. Announcing the deal, September 23. HMRC said: “Due to taxpayer

Walmart said Asda would keep its Leeds confidentiality, we’re unable to comment on an

headquarters and its ceo, Roger Burnley, would indefinable business.”

2“For Revolut, having our employees share in the Speakers: Deloitte, Linklaters & Willis Towers

success of our business is really important,” said a Watson

company spokesman. “We want all our people to Day 3 - Webclave: Eso opportunities for SME

be rewarded for the hard work that makes our companies

success possible. That’s why we place a high value Speakers; Bird & Bird, David Craddock, Doyle

on all our people having the opportunity to become Clayton & Rm2 Partnership

shareholders.” Programme segments will include the impact of the

Revolut has updated staff on HMRC’s valuation pandemic on employee share plans and on

and what it means for them. Staff were told they executive remuneration trends. Further details to be

have a ten-year window in which to exercise their announced.

options, even if they leave the company. They Our thanks to Ocorian, the independent Channel

were told too that anyone who had left Revolut Islands based provider of corporate and fiduciary

before the missing options were granted would still services, for its patience in co-sponsoring the

receive their options and that these would vest on a symposium, which offers participants latest

pro-rata basis up to the date they left the company. guidance on installing and operating employee

However, some employees remained confused equity schemes for companies of all sizes.

about the value of their share options and the Delegates from share plan issuer companies, large

impact of the changes, the source claimed. Part of or small, are welcome to attend free of charge,

the appeal of working for a highly valued tech start though you must register your planned attendance

-up is the chance to be a part-owner and to profit in advance with Juliet Wigzell (see below).

from any future sale or stock market flotation. Speakers needing to update their presentations

Advisers who work for Centre members stress the should inform Fred Hackworth at:

importance of regular two-way communication fred_hackworth@zyen.com. For all other enquiries

between executives/HR managers and the about this event, including attendance logistics and

workforce about all aspects of tax-advantaged reservations, please contact Juliet at

share option schemes, to reduce the prospect of juliet_wigzell@zyen.com or call +44 (0)20 7562

employee anxiety over the award of share options, 0586.

the mechanics of which participants may not fully

understand, even in the high tech start-up sector if,

for example, they are part of a Shares For Salary newspad all-employee share plan awards 2020

scheme. Submissions are now open for the 2020 newspad all

-employee share plan awards. The newspad awards

recognise the achievements of companies which

EVENTS offer employee share plans and hold up best

practice models for other companies to follow.

This year has been particularly challenging and the

British Isles share plan symposium

awards reflect this with a new category focussing

The Centre is to deliver its fourth annual share on share plans and the Covid crisis. All-employee

plans symposium in online format on three share plans can play a key part in rising to such

successive days, namely March 23, 24 and 25 challenges by contributing to employees’ savings,

next year. This key event, originally scheduled to morale and engagement. This award category is

have been held in the London HQ of a senior designed to recognise ingenuity in adapting a share

Centre member firm, has been postponed twice, plan to fit the rapidly shifting landscape.

due to Covid restrictions,

Companies can nominate themselves or advisers

The online format will comprise three, hour-long, can make submissions on behalf of clients. The

live webclaves with the speakers for each day deadline for all nominations is 17:00 on Friday

forming a panel discussing the topic of the day January 15 2021. Results will be announced at the

with delegates able to interact live. Supporting British Isles share plan symposium.

material for each webclave will consist of the

The award categories this year are:

speakers’ pre-recorded 20 minute video

presentations, which will be released on the day 1. Best international all-employee share plan

before that speaker’s live panel session. (more than 2,500 employees)

The revised outline programme now looks like 2. Best UK all-employee share plan (fewer than

this: 2,500 employees)

Day 1 - Webclave: All-employee share plans 3. Best share plan communications

and share plan regulation 4. Best use of technology in employee share

Speakers: Baker McKenzie, Pett Franklin, Travers plans

Smith, Computershare & EQ 5. Best executive/managerial equity reward

Day 2 - Webclave: Executive equity incentives plan (involving more than 100 employees)

36. Best start-up equity incentive plan administration, legal and tax issues with share plan

7. Best HR director expert guests on his virtual sofa. He asked

8. Best share plan adaptation to the Covid colleague Bryony Padgett-Jones: Deloitte’s

crisis associate director Katie Stephens and EY’s

9. Outstanding company leader (for chairman or incentives director Suzannah Crookes what they

ceo personally associated with company plans) were witnessing in the market and what the future

Entry rules and submission form are published on holds.

the Centre’s website www.esopcentre.com Bryony said that confidence had returned to clients

after the first wave of the pandemic. Of the 13

share scheme offers which were postponed last

WEBINARS spring, all had either now taken place or were in

the process of doing so. However, there had been

Coming up some ‘churns’ in which clients had cancelled plans

Lessons from lockdown: re-assessing how you to invite employees to participate in the next round

manage share plans in a digital way. of their share plan offers. Some clients whose share

November 6 11:00-11:45am prices had fallen were capping the maximum that

Recent, current, and even expected global their employees could invest in SAYE-Sharesave

lockdowns have forced the business world to test schemes to the minimum £50 per month, or to a

whether widespread remote work is possible, and number well below the £500 per month maximum

whether employees can adapt to working from investment, because those companies would need

home effectively. Despite overall positive uptake, more shares to cover their obligations at the lower

certain adaptive measures have needed to be share price level and some faced a potential share

considered by global companies and across issue headroom problem. One client had cancelled

industries. Among the challenges which have a planned SAYE scheme launch because its now

emerged, we have seen that remote working has lower share price meant that a significant scale-

exacerbated the risks involved with effective share back in the offer would have been inevitable. A lot

plan management and employee communication. of impending SAYE maturities were still

While adopting various measures to overcome such underwater, she added. However, other clients

challenges, companies have also been required to were coping very well in the pandemic and

ensure continued compliance with governing continued to make share scheme awards as normal,

regulation and standards. with some awarding staff free shares as a thank you

for staying at work. Some companies which

In this panel discussion, ShareForce’s Adva Lewitte hitherto had operated UK-only schemes were now

and guests Graeme Cook of Eximia and Lynette

looking to go global.

Jacobs of Pinsent Masons explore how the latest

specialised technologies give businesses the No executive client share plans had been cancelled

flexibility they need to adapt in a thought-out and because of the pandemic, but a couple of awards

compliant manner. had been postponed from spring, said Bryony.

Clients were beginning to bring back longer

Insights into share valuation for employee share

holding periods – e.g. no cashing in for at least a

schemes: revealed through dynamic case studies.

year after vesting – while others had moved to

November 17 15:00-15:45

staggered options vesting – e.g. 25 percent per

Share valuation is a key step in the design and year. Some corporate plans had been put on hold –

implementation of an employee share scheme for one client put a planned merger on hold, while

an unquoted company. Tax or fiscal valuations in another had put a planned de-merger on hold!

the UK are subject to special rules which have

Susannah said that the companies she advises were

evolved over time out of a combination of case law

still using equity for reward and incentives, though

and legislation. Whether a valuation is acceptable

the extent varied from sector to sector. The

for tax purposes is ultimately a matter for HMRC. pandemic had triggered internal reviews in many

Following up his “wisdom of price setting for your companies, of which some prioritised the use of

employee share schemes” webinar in July, David shares and not cash vis-à-vis reward, so as to assist

Craddock, who is technical secretary as well as a cash flow. Some private companies had looking

member of the Share Valuation Worked Examples around their valuation and looking for more

Group, will guide us on share valuation for Esops affordable share schemes and there had been a lot

through a series of case studies. of noise about engagement, bringing the element of

Webinar reports share ownership to the fore, making sure they

* The Esop Sofa series: Employee share ownership retained an engaged and motivated workforce

hot topics where everyone felt that they had bought into the

YBS Share Plans’ corporate relationships manager success or growth prospects of the company. Her

Darren Smith discussed the latest share plan experience in no way had shown that employee

4equity was doomed because of the pandemic – far details and implications of planned rights issue,

from it, she added. which would take time, especially waiting for their

Katie said that communications with employees replies.

about share schemes had changed – it had become * Institutional investor views on the use of share

harder during the pandemic to retain that plans during the pandemic

engagement when there was so much remote Share plan and employee incentives specialists

working from home. Older style communications, Fleur Benns and Lynette Jacobs, who both work for

with posters and so forth, were gone and there was Centre member Pinsent Masons, discussed the use

a lot more targeting of the demographics for equity of employee share plans amid the economic fall out

plans. It was more important than ever that the of the pandemic. Their seminar gave insights into

value of what employers were giving was institutional investors’ thoughts on share plans and

conveyed, even if the quantum was ultimately how such views impact their operation. This

potentially reduced. It was a warlike atmosphere webinar was chaired by Professor Michael

when the pandemic started; there were reactive Mainelli, executive chairman of Z/Yen Group,

conversations, a bit panicky – people asking - did which operates the Esop Centre.

the employees understand what they were getting? Lynette said that the pandemic had made the design

When fixing equity award scheme details at this of both short-term and long-term executive reward

time, companies and advisers had to manage more complicated: share prices were volatile

expectations on performance and ensure that they (between January and March, 70 percent of

had a robust objective framework in place for what FTSE350 companies had suffered a fall in their

they were proposing. Above all, they had to ensure share price of at least 30 percent), many companies

that the arrangements were fair. Flexible working had withdrawn their dividend payments, had used

was here to stay, so the traditional reward the government’s jobs furlough scheme, or were

mechanism was challenged and so they had to find going to their shareholders to raise more capital, so

out what it was that the employees valued, said there was huge and continuing uncertainty. It was

Katie. very hard to predict what was going to happen.

Companies were looking for discretion – what Remuneration committee priorities had changed

flexibility have they got when rewarding people from those last January. The High Pay Centre had

working in different places, who were using reported in April that 37 percent of FTSE100

different skill sets? How can you tailor, if companies had cut executive pay, though a few had

appropriate, any in flight awards? asked Suzannah. since reversed those cuts. Where executive awards

There would be a lot of reviews going into the next were to be made now, it was important to avoid

reward season on how to approach performance having certain people picking up windfall gains.

targets because what they’d had during the current Vodafone had delayed its 2020 LTIP awards until

season might no longer be fit for purpose, she said. November in the hope that markets will have settled

One area where lessons may have been learned by then.

concerned those industries which had been less Marks & Spencer (M&S) did not apply discretion

fortunate during the pandemic, where we had to the variable pay outcomes of the bonus and

advice around leavers – sometimes companies Performance Share Plan (PSP) because the final

hadn’t had the flexibility they wanted about how to vesting was reflective of the last three years of

pay people who were leaving. M&S’s performance and that policy operated as

Asked about the impact of Rights Issues on share intended. However, it had delayed setting its

plans, Suzannah said it was really important to performance targets going forward until realistic

factor that in at an early stage because it would goals could be fixed. Meanwhile, the M&S PSP

make a difference according to which type of share will continue in its current form to be the primary

plan was involved and the number of participants LTIP for executives, with the typical award being

who, in many cases, had to be consulted about the 250 percent of salary (down from 300 percent). In

direct response to shareholder feedback, the plan

would retain a portion based upon Total

Shareholder Return (TSR) performance. It would

increase the shareholding requirement for all

executive directors to 200 percent of salary, but the

ceo’s requirement would remain at 250 percent of

salary. To further align executives with

shareholders and the longer-term success of the

business, executives would be expected to continue

to hold their quota of M&S shares for two years

after exiting the business.

5Fleur said the Investment Association’s (IA) aviation industry during the pandemic already had

members manage about 35 percent of UK plcs, so shown up in voting at Ryanair’s September agm;

its views on executive compensation and the remuneration report had received less than two

shareholder expectations were hugely important. It thirds approval by voting shareholders. In addition,

had responded quickly to the pandemic in April, 27 percent had voted against the re-election of the

stressing that companies should ensure that, in directors. What they didn’t like, said Lynette, was

formulating their responses on the pay front, they the huge bonus Michael O’Leary received, despite

treated executives and the workforce consistently. the collapse in Ryanair’s profitability, while

Companies should use discretion to reduce 2020 thousands of former employees had recently lost

full year bonus outcomes and should suspend or their jobs.

cancel dividends as necessary. Companies should Fleur is a legal director in the employment &

not adjust performance conditions or in-flight share reward group and a share plan and employee

awards and where performance had not lived up to incentives specialist. Lynette is a partner in the

expectations or remuneration outcomes, then rem employment & reward group, leading Pinsents’

cos should use their discretion to ensure a good share plans and incentives team. Prof Mainelli is a

link between pay and performance (i.e. qualified accountant, securities professional,

appropriate bonus cuts). Looking ahead, the IA computer specialist, and management consultant,

said that rem cos should use discretion to reduce educated at Harvard University and Trinity College

vesting outcomes where windfall gains would

Dublin. Michael was Visiting Professor of

otherwise have been received. If companies had to

Innovation & IT at the LSE. His third book, The

take taxpayers’ money via government schemes, or

Price Of Fish: A New Approach To Wicked

if they tapped shareholders for more capital, then

Economics And Better Decisions , won the

this should be reflected in executive remuneration

outcomes (i.e. cuts in share awards and/or Independent Publisher Book Awards Finance,

bonuses). Investment & Economics Gold Prize. He is an

Alderman and Sheriff of the City of London 2019-

Lynette said that proxy advisor ISS (Institutional

2021.

Shareholder Services) had been vocal on how

shareholders should vote on executive reward * Selling your company to an EOT: How it differs

issues. It said that there should be from an MBO

contemporaneous disclosure of the rationale for Employee Ownership Trusts (EOTs) provide an

changing performance metrics, goals or targets of attractive new exit route for retiring entrepreneurs

short term bonus schemes and that for LTIPs, in- who may have a succession problem. William

flight changes should be considered on a case-by- Franklin partner in Birmingham based share

case basis, but only if absolutely necessary. ISS scheme specialists Pett Franklin explained how

warned that it would be keeping an eye out for any EOTs actually work and how they differ from

attempts by companies to re-price options in Management Buyouts (MBO). The 2014 Act had

existing executive reward schemes without first set up the EOT structure, modelled on the John

running them past shareholders for their advance Lewis Partnership, which had created trusts, but

approval. The Pensions and Lifetime Savings not employee benefit trusts. He characterised the

Association (PLSA) had asked investors to monitor EOT as indirect collective employee ownership

how companies dealt with the pandemic and in with a trust having control for the long-term

particular to consider voting against directors benefit of employees as a whole. They were

whom they believed did not behave appropriately employee buy-outs, rather than the narrower

towards their workforces. Individual directors management buy-out. He reminded listeners that

should be held to account, it added. succession was the problem for thousands of

Glass Lewis expected increased shareholder SMEs in which the retiring or exiting founder

concerns over options re-pricing, share value could not find anyone to take over the reins. So

dilution, burn rates, hurdle adjustments, changes to the options were: a trade sale, sale to private

vesting periods and caps and cuts on incentives, equity, sale to management, wind down and

said Fleur. Shareholders should share the pain with closure (of which there were too many examples),

employees over compensation changes and boards or do nothing and leave a big mess for everyone

had a heavy burden of proof to justify executive else. Many trade sales led to cherry-picking by

reward levels in a drastically changed talent acquirers who were uninterested in the business

market, said Glass Lewis. culture, the employees or the locality and there

Another key issue raised by institutional investors were pressures on the business to deliver short-

was the widening gap between reward levels term gains for the purchaser, he said. In MBOs by

achieved by executives in public companies and contrast, the biggest problem was often finance

their rank-and-file employees. The massacre of the for the purchase – how could managers afford to

6take control without saddling themselves with of employee share schemes, which would

huge debt? encourage even more employee commitment.

The EOT solution relied on vendor funding, *William Franklin is a chartered accountant and a

combined with patient capital, but the company leading adviser on the valuation, accounting and

had to make distributable profits and have cash financial aspects of all forms of remuneration,

reserves to fund the EOT in order to repay its incentive and employee share schemes. He is a

debts, perhaps during five years or longer, to the member of the HMRC Employment-Related

vendor. Securities & Valuations sub-group and chairs the

The tax benefits for companies which used the Worked Examples Group, which works with

EOT route were considerable: the sale of a HMRC to publish examples of share valuations

majority stake to an EOT was exempt from CGT over a wide range of Eso and employee

because the owner was handing over the key to ownership arrangements. The webinar was

the castle to the employees. In addition, Income chaired by Simon Mills, associate, Z/Yen Group,

Tax-free (but not NICs free) bonuses could be who compared the FS Club-Esop Centre webinars

awarded annually to employees and payments to to the 18th century London coffee houses, in

the EOT by the company were not taxable. The which politics, investments and trade could be

Esop Centre had played an important role in discussed freely by customers. Simon began his

establishing that distributions to the employees career by working as a field botanist on Cloud

were not dividends because they were not and Elfin rainforest in Northern Costa Rica. He

shareholders. In several respects, the EOT looked became environmental co-ordinator for the City

like a profit-sharing scheme, added William. of London, where he established the National

There was the EOT vision thing too - employee Sustainable City Awards and worked on carbon

engagement and responsibility through trading, socially responsible investment and

ownership, long-termism, spreading wealth more climate risk. Since joining Z/Yen as an associate,

widely, localism, more secure jobs, longer-term Simon has worked on mutual distributed ledgers,

thinking and stronger performance over time, he standards, sustainable business, and policy

added. As revealed in October’s newspad, there performance bonds.

were now almost 500 UK employee-owned *Innovative communication strategies aimed at

businesses after a record 28 percent growth in increasing employee take-up

their number last year. Productivity in employee- Employee share schemes expert David

owned companies had risen by almost seven Craddock, founder of his eponymous share

percent. schemes consultancy, outlined strategies and

The corporate trustee ultimately sat over the techniques that have helped increase employee

EOT, so the question was: who were the directors take-up levels, especially in global plans, where

of the corporate trustee? They were both the main motive often was to help build corporate

directors and trustees who acted as a supervisory unity, for example after multinationals had

board, so their engagement was crucial and they acquired satellite companies. For the successful

could challenge the company’s strategy or implementation of such schemes depended upon

evaluate a takeover bid, but they were no having great communications with the workforce.

substitute for the commercial board which ran the Winning hearts and minds in employee share plan

EOT company on a day-to-day basis. The campaigns was often a combination of company

structure was akin to the two-tier boards seen in and country cultures, said David. Eso was about

many German companies, but which were the inter-connectivity of things and it required the

virtually unknown in the UK said William. tools of science to improve the design capability

A big advantage of an EOT over an MBO was employed in global share plans. It was necessary

that, in the event of corporate trouble, it was the to coach managers to believe in employee share

MBO Newco which owed the vendor debt and ownership. The concept of employee involvement

not the EOT. So if Newco could not fund the in the enterprise was relatively recent, though its

debt, then ownership could revert to the vendors. origins in a sense went back to the Commonweal

In EOTs however, if the company could not fund of Oliver Cromwell, said David. The business

the EOT’s debt repayment, then ultimately the challenge was to release and harness human

repayment might have to be written off by the energy to maximise employee contribution at

vendors, he added. work.

Mr Franklin admitted during questions that When exporting the UK Eso model, plan sponsors

keeping 100 percent of the equity within the EOT had to be aware that whereas UK schemes tended

was not necessarily the best idea. He preferred to offer more short-term incentives, those in the

that, where possible, a small slice of the equity, US tended to be more long-term, for example

say ten percent, be kept back for the installation those used in succession planning and long-term

7pension provision. When planning a global plan, *The British Virgin Islands finally committed to

the trick was to retain the same plan structure for as introducing public registers revealing beneficial

many countries as possible, while changing the ownership of companies incorporated in BVI, but

plan delivery logistics to reflect cultural and not just yet...The announcement came after years of

national differences within the various alleged tax evasion and money laundering scandals,

jurisdictions. in which shell companies incorporated in the

David had devised a cultural index score system dependent territory regularly played a central role.

based on five factors: the emotional distance index, Andrew Fahie, BVI premier and finance minister,

the individualism v collectivist index within a said that his government would work with HMG

company; the gender index, the risk index (were towards compiling public registers of beneficial

they averse to risk?) and the timescale. ownership and would aspire to match the EU’s

The presence of immigrant communities, for most recent anti-money-laundering directive. “I

example in Canada, was sometimes very relevant emphasise that this undertaking is subject to our

to Eso planning, as was respect for different reservations which include that the format must be

languages, because those speaking the same in line with international standards and best

language would not necessarily receive the Eso practices as they develop globally and, at least, as

message in the same way, said David. Then there implemented by EU member states,” he added.

was terminology: in the US, it was best not to use Foreign Office minister for the overseas territories,

the term ‘scheme’ because that had mafia Liz Sugg, tweeted that the BVI would be adopting

connotations, while in China, use of the number ‘8’ public registers by 2023.

was useful as it was associated with success, but Jersey, Guernsey and the Isle of Man announced

the number 4 was associated with death, he added. 16 months ago that they would voluntarily adopt

In Africa however, Eso messages could sometimes public registers of the true owners of offshore

be conveyed effectively by using story-telling in companies incorporated in their jurisdictions. In a

agricultural communities. Symbols and illustrations joint statement, the three islands said they would

were important too, because in some areas introduce fully public registers by 2023.

illiteracy was high, he added. Meanwhile, in Hong *Former Esop Centre staffer Joel Lewis was

Kong, employee participants in Eso plans had promoted to senior manager, markets strategy &

complained that the minimum three year vesting consulting, at Lloyd’s.

period was too long. *The London Stock Exchange Group agreed to

The webinar promoted an advanced understanding sell the Milan stock exchange to the rival group

of the role of Eso schemes within the overall Euronext for £3.9bn in cash, clearing the way for

context of human resource management and social the LSE’s purchase of the financial data provider

scientific trends. Ian Harris, md of Z/Yen Group, Refinitiv. The LSE and Amsterdam-based Euronext,

which operates the Esop Centre, chaired this which owns several European stock exchanges,

webinar. Ian specialises in strategic planning and including the Paris bourse, began exclusive talks

systematic performance improvement in both the over the Borsa Italiana deal in September. The LSE

civil society sector practice (which he leads) and believes selling Borsa Italiana will help it to gain

commercial sectors. regulatory approval from the European

Commission for its £21bn deal to buy Refinitiv,

whose Eikon terminals are found on trading floors

MOVERS & SHAKERS and compete against those supplied by Bloomberg.

On the move CORPORATE GOVERNANCE

Centre member MM&K has moved out of Bengal The Financial Reporting Council urged

Court EC3, which has been the remuneration companies to respect shareholder rights amid a shift

consultancy’s City home for many years. Its new to virtual agms. The corporate governance

City base is 1, King William Street, London EC4N watchdog said the way that some had managed

7AF. Emails and phone numbers remain unchanged. virtual meetings was “disappointing” and had led to

Ceo Paul Norris said: “We will continue with home- concerns that any move to fully digital meetings

working but our new base provides the perfect hub could disenfranchise retail shareholders. A survey

for working and meeting clients and colleagues, as of a majority of FTSE 350 companies revealed that

circumstances permit.” MM&K joined the London 81 percent had held closed agms, requiring voting

Stock Exchange Group Issuer Services Platform. in advance by proxy. Of those that held closed

Through the LSEG, it produces and participates in meetings, almost 20 percent did not make

webinars and presentations on remuneration, arrangements for shareholders, including employee

governance and related topics. shareholders, to ask directors questions. Companies

including Next, the fashion retailer, HSBC, the

8UK’s biggest bank, and BAE Systems, the defence

contractor, were criticised by Share Action, a Join the Esop Centre

charity, for not giving shareholders more The Centre offers many benefits to members,

opportunity to have their say. whose support and professional activities are

*EQ’s (formerly Equiniti) annual review of agm essential to the development of broad-based

trends revealed that plans to hold agms in hotels employee share ownership plans. Members

and conference centres had been replaced by the include listed and private companies, as well

registered office or even the company secretary’s

home address. Closed meetings are the new norm professional experts providing share plan

with formal business and voting by proxy only. services covering accountancy, administration,

“Who could have predicted at the beginning of design, finance, law and trusteeship.

the year that companies would be actively Membership benefits in full:

preventing their shareholders from attending Attend our conferences, half-day training

agms, sometimes holding meetings in car parks or seminars, breakfast roundtable discussions

at the company secretary’s home address?” asked and high table dinners. Members receive

EQ ceo Paul Matthews. “Themes and messages heavily discounted entry to all paid events

high on the list of investors last year have taken

more of a back seat whilst companies have battled

and preferential access to free events.

through the pandemic, sometimes for their very Access an online directory of Esop

survival. That is not to say that concerns over administrators; consultants; lawyers;

executive remuneration and stakeholder matters registrars; remuneration advisers;

have been forgotten. Businesses have faced companies and trustees.

pressure to support their workforces and ensure Interact with Esop practitioner experts and

that directors take their share of the financial company share plan managers

impact during the pandemic.”

Analysis showed that the key features of most Publicise your achievements to more than

agms held between the end of March to the end of 1,000 readers of the Centre’s monthly

July 2020 were: a closed meeting with no news publications.

shareholder attendance permitted, the quorum Instant access to two monthly publications

provided by board members and the company with exclusive news, insights, regulatory

secretary, shareholder engagement via Q&As briefs and global Esop updates.

submitted electronically and voting by proxy Hear the latest legal updates, regulatory

only. Other actions frequently taken by companies

briefs and market trends from expert

included restricting business at the agm to formal

matters and changing agm locations to the speakers at Esop Centre events, at a

company’s registered or head office. Some discounted member rate.

companies asked shareholders to submit questions Work with the Esop Centre on working

in advance via the company’s website or by groups, joint research or outreach projects

email, sometimes directed to the company Access organisational and event

secretary. Other arrangements put in place in sponsorship opportunities.

order to encourage shareholder participation

included: • a dial-in facility for shareholders to Participate in newspad’s annual employee

ask questions at the agm • a live broadcast • pre- share ownership awards.

recorded business presentation available on the Discounted access to further training from

website on the day of the agm • shareholder the Esop Institute.

events planned for later in the year • questions Add your voice to an organisation

answered by live audio webcast before the encouraging greater uptake of employee

meeting and live audio feed available either one ownership within businesses; receive

or two ways.

support when seeking legal/policy

In the FTSE 350, only a small minority of

companies had postponed their agm to later in the

clarifications from government and meet

year. For public companies, postponement was representatives from think tanks, media,

not always an option. It was only in June that the government, industry bodies and non-

Corporate Insolvency and Governance Act (the profits by attending Centre events.

CIG Act) was passed, meaning that agms could be How to join: contact the Centre at

held remotely, with restricted shareholder entry esop@esopcentre.com or call the team on +44

and no particular location, regardless of the (0)20 7562 0586.

provisions in a company’s Articles.

9Virtual-only agms are not supported by the vast

majority of investor relation bodies and few

companies have in their Articles the ability to hold

them. EQ predicted that physical agms would

return, but that there would be moves towards

holding hybrid agms, with part-sessions conducted

by webcasts and the like. The bulletin said that

momentum may be gathering for the wholesale

reform of agms to bring them into the 21st century

and make them a more useful vehicle for

shareholder engagement. While EQ applauded the

extension of the temporary measures introduced M&S is chaired by Archie Norman, senior nonexec

earlier this year to facilitate compliance of at BEIS.

company agms until December 31, it believes that

they should be further extended to March 31 2021

and beyond, to give more assurance to companies UK CORNER

with a December year-end.

Case Study M&S digital agm: Having run a Roadchef: disturbing questions

hybrid meeting in 2019, M&S was well positioned A key aspect of the Roadchef Esop scandal which

to run its 2020 agm as its first fully digital has received little attention concerns the tax charges

shareholder meeting at which all ‘attendees’ had the employee beneficiaries would incur, unless

the chance to listen to and question M&S directors HMRC exempts them, when their various

live from their homes. The agm recording has been compensation pots are finally paid out

watched more than 15,000 times on its corporate Morally, many ask, should the ex-Esop

website. The key drivers in the decision to hold a beneficiaries be taxed anyway, as their shares in

digital agm were M&S’s commitments to trust were transferred elsewhere without their

improving efficiency, stakeholder engagement and advance knowledge? Legislation passed in 2003

becoming a ‘Digital First’ retailer, though Covid would have meant employee share scheme gains

stay-at-home measures reinforced that decision. like those in the Roadchef Esop were free of

Executives had to master the technical logistics and Income Tax and NICs, but because the assets had

ensure compliance with the Companies Act and the already been removed from the original scheme

company’s Articles, such as establishing a quorum five years earlier, the employee participants may

with no physical attendance permitted, opening and have fallen through a legal gap. However, even if

closing the meeting, submitting questions, proxy the Esop had remained within the tax-advantaged

appointment and voting. The digital agm delivered rules, the employee participants’ gains would not

some valuable lessons; notably, that preparation for have been exempt from Capital Gains Tax (CGT)

digital-only meetings often involves stakeholders charges.

with more diverse expertise and perspectives,

Mr Christopher Winston Smith, chairman of

making effective communication more vital than

Roadchef Employees Benefits Trust Ltd

ever. Additionally, digital-only meetings require

(REBTL), is threatening to take the compensation

much forward planning and development work in

case to the tax tribunal unless HMRC agrees to

technology. Striking a balance between ‘live’ and

waive all the potential tax and NICs charges in the

pre-submitted or pre-recorded elements of the agm

exceptional circumstances. Sadly, the Tribunal of

is key for time management, smooth running of the

First Instance and the like are not interested in

meeting and engaging shareholders. Although

sentiment, they are interested solely in the

many FTSE companies chose to hold closed-door

interpretation and application of UK tax law. This

agms, or allowed questions to be submitted in

is why some beneficiaries want their compensation

advance only, M&S wanted to increase

paid now, even if it were to be taxed, because they

participation, improve efficiency and build trust.

Private shareholder engagement near trebled by are sick to the teeth of the delay over receiving

comparison with the 2019 agm; 1,511 individual what is due to them.

shareholders joined the digital platform and 86 The High Court judge, Mrs Justice Proudman,

questions were submitted (compared to 28 last summarised the tax issues in her January 2014 court

year). Both advance and live questions were ruling, starting paragraph 161.

answered during the web-cast, and every question *She said that Roadchef EBT lawyers at the hearing

submitted received a personalised written response. had grossed up their compensation claim because

The ‘as live’ recording was replayed more than they knew that their client was liable to tax charges

4,200 times in the first three days alone, by on the distribution of any agreed compensation

comparison with 496 views of the 2019 recording. which they were fighting to secure. *Further, the

10judge reminded the court that REBTL had claimed Trust was laid bare by a breach of trust,” he told

in evidence that a CGT charge would fall upon the the beneficiaries. “Further, the Trust and its

trust and that the beneficiaries would be charged beneficiaries shouldn’t lose their tax-breaks in

Income Tax and NICs on their compensation circumstances when they manage to recover what

payments. was rightfully theirs. Taxing you in these

*She dismissed REBTL’s grossing-up circumstances would make you victims twice over.

compensation claim as “too speculative and thus When parliament sanctioned tax-breaks for all-

too remote” because it was unclear as to whether employee share schemes, it surely could not have

REBTL would have made the maximum allowable been its intention to penalise beneficiaries who fall

appropriation of shares each year to maximise tax victim to a breach of trust or fraud. We are not

savings. That had not been done in the past, the seeking to change the law to avoid paying tax. This

judge said. Secondly, REBTL had claimed that is about protecting the essence of what these

EBT1 would have distributed shares directly to schemes were all about - ensuring tax breaks for

employees outside the scope of the Esop. “It is not those who deserve it and who would have benefited

clear how this would have been achieved since the but for Ingram Hill’s actions.” The trustee told the

shares would have had to have been released from Daventry Express, which covers the Watford Gap

the charge in favour of Unity Trust Bank,” she and Northampton Roadchef service stations:

added. “HMRC needs to do the right thing and bring an

Mr Winston Smith argues that HMRC should end to this mess, allowing us to make tax-free

waive all tax liabilities on the eventual pay-out distribution to the beneficiaries. An urgent inquiry

because the surviving 350-400 Esop beneficiaries is needed to ensure lessons can be learned and a

have suffered unjustly from such an resolution brought before more hardworking

unconscionable delay (now almost SEVEN years people die without getting what’s rightfully owed

since the court ruling) and because, he said, they (to them).”

would have next to nothing left in their HMRC is entitled legally to levy CGT in any event,

compensation pots after the huge case funding and but would it be on them individually, or on the

legal costs have been deducted, were the trust? This matters because although the annual

beneficiaries be to be taxed in full. CGT exemption allowance is £12,300 for

Critics ask why is that so when this same trustee individuals, it is only half that - £6,150 - for trusts.

had won already a victory for the beneficiaries To add insult to injury for the Esop beneficiaries, it

when HMRC agreed to handover to the trust a was somehow agreed among the lawyers after the

rumoured £6m-£8m which Mr Ingram Hill had High Court ruling that the term Roadchef

paid it in settlement of his due tax on his profits beneficiaries included not only the Esop

from selling the Esop shares? (Media accounts participants, but those who either were ineligible at

have ignored the fact that of the £20m Ingram Hill the time to participate AND another 3,000+

paid in tax, much of it was genuine because he had subsequent Roadchef employees who had not

owned most of the equity himself before the sale of worked for the motorway services chain when the

Roadchef. This was in the form of his performance Esop existed. As one legal commentator said: “No-

share awards- or shares acquired from other one in this shocking case is prepared to explain on

shareholders- Editor) Nevertheless, surely, the record why more recent Roadchef employees

gross amount sitting in an escrow account must be should qualify for any ‘compensation’ at all, as

now in the region of £20m-£25m in total? they were not involved in the Esop. It is believed

Mr Winston Smith said correctly earlier this year that the original trust documents, which brought the

that had Roadchef’s EBT not been stripped of its scheme into being, were not as precise in

shares (which were earmarked for its identifying the beneficiaries as they might have

beneficiaries), it would have continued as a tax been.” However, Mrs Justice Proudman, now

efficient Esop scheme and would have evolved into retired, felt unable to rule that ‘beneficiaries’ meant

what is covered by the legislation of today. “The those who had participated in the Roadchef Esop.

Trust and its beneficiaries (and others like them) Had the late great Master of The Rolls, Lord

shouldn’t lose their tax-breaks solely because the Denning, still been alive, he would have had some

choice words to say about that lapsus.

To his credit, Mr Ingram Hill insisted that the

compensation pot, which he was ordered to fund by

the judge, had to be divided in a way that ensured

the Esop participants would get the lion’s share of

the cash. So, the lawyers and the court agreed

finally that the Esop participants were to get 61

percent, the non-eligible employees nine percent

11and subsequent Roadchef employees the remaining

30 percent. The basis for that division has never

been explained because there is still a court-

imposed gagging order in force preventing the

lawyers and other involved professionals from

discussing the case in public.

Suppose the average compensation paid to the

Esop participants, after deduction of the rumoured

£5m+ legal and case funding charges, was

£50,000 per head. For those now on state pensions in court if necessary? *Why is there no regulatory

(adding a further, say, £10K to their annual income body tasked with the protection of employee

for the tax year), the result would be a one-off shareholders in ownership disputes, or corporate

Income Tax and NICs liability of perhaps £17,000 malpractice?

per individual once the annual IT exemption is *Why should a judge’s ruling, banning leading

taken into account. That would leave a typical participants in court hearings over misappropriated

Roadchef Esop participant with a theoretical c shares from commenting on settlements, be allowed

£43,300 in his or her back pocket, but if a separate to remain in force for years on end?

CGT charge were imposed as well, they might be Years later Nikko off-loaded Roadchef to an Israeli

left with barely half the headline amount in their conglomerate Delek Group, which in turn sold it on

bank accounts. to European fund Antin Infrastructure Partners, the

current owners.

HMRC faces another related problem on the

Roadchef tax front because the court-awarded

‘compensation’ to more recent employees, who lost News for newspad

nothing during this scandal, may have to be Please send your share schemes news to newspad

classed as a windfall, which is non-taxable. After for publication in the next monthly edition. Your

all, what capital gain did the Roadchef late-comer news can be about a successful launch of a new

employees make in view of the fact that they were employee share scheme; a piece of Eso research

your employer has carried out; promotions and/or

never Esop participants, yet were awarded

personnel moves in the share schemes sector, or

payments out of the blue from the compensation

even about a technical Eso problem arising during

fund – What investment had they made? – None at

the course of your work. Send your news items to

all. newspad editor Fred Hackworth at:

Were HMRC to levy CGT charges on the fred_hackworth@zyen.com.

compensation received by long-suffering Esop

beneficiaries, but not on compensation received Pandemic jobs losses

by more recent Roadchef employees, even the

Furlough pay at 80 percent of normal wages - for

stones in the street would rise up in protest.

hours not worked - was dramatically reinstated for

In 1986, cleaners, caterers and other low paid millions of employees whose jobs were being

employees at Roadchef motorway service stations suppressed again in the second national lock-down

were hoping to benefit when the then owner, imposed by the government.

Patrick Gee, planned to set up one of the UK’s first The much-altered Job Support Scheme, which had

Esops. However he died before finalising the been due to kick in on Monday (November 2), was

scheme, leaving the company in the hands of new pushed aside for all ‘non-essential’ businesses as

ceo and chairman Timothy Ingram Hill, who much PM Boris Johnson, previously opposed to a new

later transferred Esop shares into a separate trust lock-down, performed a swift policy reverse,

and sold the company to a Japanese bank in 1998. horrified by new projections of Covid deaths and

The High Court ruling voided the transfer of the intensive care unit forecasts, as the second wave

Esop shares from REBTL1 to the performance took hold. Via the Job Retention Scheme, furlough

shares trust after finding Mr Ingram Hill guilty of a pay at 80 percent, up to a cap of £2,500 monthly,

breach of his fiduciary duty. It did not, however, will apply to qualifying employees (on PAYE

find him guilt of fraud or theft. It is believed that payrolls) in the sectors forced to close - mostly

he paid the agreed compensation sum to REBTL1 hospitality and entertainment businesses, including

almost five years ago. pubs, restaurants, boutiques, hair salons, gyms,

Key questions about the Roadchef Esop disaster theatres, galleries and so on - until the lockdown

still rest unanswered: ends. Businesses can either bring back employees

*Why in the event of malpractice or negligence by on a part-time basis or furlough them full time.

a director and/or a trustee should it be so difficult Owners will be asked to pay only their employee

to protect the interests of employee shareholders, NICs and pension contributions.

12You can also read