Monday Minutes: Sharemarkets tested by news flow - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | September 27, 2021

Monday Minutes: Sharemarkets tested by news flow

Evergrande; High oil prices; US Federal Reserve meeting; Geopolitics

.

What are the current issues of note?

Last week had almost everything. Oil prices hit 3-year highs; US Federal Reserve members appeared open to winding

back some of the stimulus put in place; Aussie wealth hit record highs; and some investors worried that the collapse of

a Chinese property developer, Evergrande, could signal the start of a global financial crisis. There were even some

geopolitical machinations thrown in for good measure.

So how did sharemarkets fare? All major US indices actually ended higher over the week. The Dow Jones rose by 0.6

per cent; the S&P 500 index rose 0.5 per cent; and the Nasdaq rose by 0.02 per cent. In Europe, the Euro STOXX 600

index rose by 0.3 per cent; the UK FTSE rose by 1.3 per cent; and the German Dax lifted 0.3 per cent.

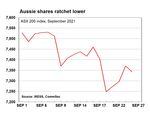

But the week was less positive in Asia with the Australian S&P/ASX 200 index and Japanese Nikkei both down by 0.8

per cent.

Over the coming week issues to watch include the Evergrande debt crisis in China; rising global oil prices; US

government funding negotiations (could lead to a closure of government operations); the potential for further falls in

iron ore prices; US economic growth and inflation data; testimony from both the US Federal Reserve chair and Treasury

Secretary; speeches by Federal Reserve presidents; and the potential for falls in cryptocurrency prices after China's

central bank put a ban on crypto trading and mining.

Monday September 20: A new financial crisis?

On Monday, global sharemarkets broadly dropped 1.5-2.5 per cent on fears that large Chinese property developer, The

Evergrande Group, might default, leading to contagion across real estate and financial sectors.

There is no doubt that since 2008 some investors have been on the look-out for a spark to ignite the next global

financial crisis (GFC). And while there is still much to be

played out on the Evergrande crisis, the control exercised

by the Chinese Government over its economy – and the

measures that can be taken - stand in stark relief to that of

the control the US Government and central bank had back

in 2008.

Evergrande is a diverse conglomerate focusing on wealth

management, food manufacturing, electric vehicle

production, sports and theme parks, and property

development. Evergrande Real Estate reportedly owns

around 1,300 projects across 280 cities in China.

Evergrande has been on a borrowing binge over the past

two decades but is now struggling to meet interest

payments on its debts.

IMPORTANT INFORMATION AND DISCLAIMER FOR RETAIL CLIENTS

The Economic Insights Series provides general market-related commentary on Australian macroeconomic themes that have been selected for coverage by the Commonwealth Securities Limited (CommSec) Chief

Economist. Economic Insights are not intended to be investment research reports.

This report has been prepared without taking into account your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a

recommendation and/or investment advice. Before acting on the information in this report, you should consider the appropriateness and suitability of the information, having regard to your own objectives, financial situation

and needs and, if necessary, seek appropriate professional of financial advice.

CommSec believes that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made based on information available at the time of its compilation, but no

representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this report. Any opinions, conclusions or recommendations set forth in this report are subject to change without

notice and may differ or be contrary to the opinions, conclusions or recommendations expressed by any other member of the Commonwealth Bank of Australia group of companies.

CommSec is under no obligation to, and does not, update or keep current the information contained in this report. Neither Commonwealth Bank of Australia nor any of its affiliates or subsidiaries accepts liability for loss or

damage arising out of the use of all or any part of this report. All material presented in this report, unless specifically indicated otherwise, is under copyright of CommSec.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399, a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124.

This report is not directed to, nor intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution, publication,

availability or use would be contrary to law or regulation or that would subject any entity within the Commonwealth Bank group of companies to any registration or licensing requirement within such jurisdiction.Economic Insights: Monday Minutes: Sharemarkets tested by news flow

Read our report on the Evergrande crisis here:

https://www.commsec.com.au/market-news/the-

markets/2021/not-so-grand-evergrande.html

The CBA Senior Asia Economist, Kevin Xie, made the following

top level points: “Evergrande’s potential default is unlikely to

trigger systemic issues in our view; Regulators will balance

maintaining financial stability and enforcing market discipline;

Growing spill overs from Evergrande’s potential default will

likely exacerbate a property downturn and pose downside risks

to our GDP growth forecast for both 2021 and 2022.”

Tuesday September 21: Moving on.

Some stability returned on Tuesday. Investors hadn’t forgotten about Evergrande. Rather they preferred to see how the

crisis would play out. Investors that panicked in the past – when Covid hit 18 months ago, or back in the GFC – paid

the price. And besides that, there was the small matter of the US Federal Reserve meeting to be held over Tuesday and

Wednesday (US time). European markets lifted around 1 per cent on Tuesday, rebounding from some of the biggest

falls in two months recorded on Monday. US markets were mixed.

After falling by 2.1 per cent on Monday – the biggest fall since February 26 – the Australian S&P 200 index only rose

by 0.2 per cent on Tuesday. The perception was that Australia would be amongst the biggest casualties if Evergrande

was to collapse. And not just because China is by far Australia’s largest trading partner. But also because demand for

our iron ore – a key steelmaking ingredient – may be crimped should there be wider problems in the Chinese real estate

sector.

Wednesday September 22: The US Federal Reserve sends a signal.

On Wednesday there were two key pieces of news. China’s Evergrande group said it would make some interest

payments. Evergrande's Frankfurt-listed shares jumped 40.7 per cent. The German Dax index lifted 1 per cent and the

UK FTSE index jumped 1.5 per cent. And the US Federal Reserve dropped hints that it was preparing to wind back

some of the monetary stimulus. Fed Chair Jerome Powell said the central bank could begin tapering asset purchases

"as soon as the next meeting [November 2-3]" and complete the process by mid-2022. In addition, according to the

Fed's economic projections and policy statement, nine of the US central bank's 18 policymakers projected borrowing

costs will need to rise next year.

The Dow Jones index rose by 338 points or 1 per cent. The S&P 500 index also gained 1 per cent and the Nasdaq

index added 150 points or 1 per cent.

After edging up 0.3 per cent on Wednesday, prior to the Fed statement, Australia’s ASX 200 index rose by 1.0 per cent

– the biggest gain in seven weeks – on Thursday.

The US Fed will clearly proceed slowly in ‘tapering’ (winding

back bond purchases). The number of Delta cases,

vaccination rates, global factors and the all-important

activity and inflation data will all be taken into account

before tapering begins. But tapering is a sign of confidence

in the US economic recovery.

Read the report from CBA International Strategists on the

Federal Reserve meeting outcomes:

FedMonetaryPolicy-23-Sep-2021-0908-1.pdf

Thursday September 23: Celebration.

On Thursday, gains of 1.0-1.5 per cent were commonplace

on US and European markets. But the UK FTSE index fell

September 27, 2021 | 2Economic Insights: Monday Minutes: Sharemarkets tested by news flow

by 0.1 per cent after the Bank of England said the case for

higher interest rates "appeared to have strengthened"

after it lifted its inflation forecasts for the year. Other

markets were supported by positive corporate news.

One development of note on Thursday was a lift in oil

prices. US crude jumped to the highest in nearly two

months as investors focused on declining global stockpiles.

The Brent crude price rose by 1.4 per cent and the US

Nymex crude price rose by 1.5 per cent.

Friday September 24: Choppy going.

Global investors kept a watch on developments at

Evergrande. Shares in Nike fell after the company cut its

sales forecasts.

And oil prices rose again, lifting by around 1 per cent –

Brent crude hit 3-year highs. The key problem is that there

are a number of supply disruptions in the oil market – some caused by events like hurricanes.

OPEC+ nations are not filling the supply void and demand for oil is rising as global economies re-open from

lockdowns. While positive for energy producers, higher oil prices could crimp spending just as consumers try to get

back on their feet.

Weekly oil market update

Over the week, Brent crude rose for the third straight week, up by US$2.75 or 3.7 per cent. Nymex crude rose for the

fifth straight week, up by US$2.01 or 2.8 per cent.

The benchmark Singapore gasoline price rose by US$2.72 or 3.2 per cent to a 3-year high of US$87.01 a barrel last

week. In Aussie dollar terms, the Singapore gasoline price lifted $3.82 or 3.3 per cent to a 3-year high of $119.24 a

barrel or 74.99 cents a litre.

Last week, the national average price of unleaded petrol fell from near 3-year highs, down by 2.0 cents to 155.4

cents per litre (c/l), according to the Australian Institute of Petroleum.

The national average wholesale (TGP) petrol price rose by 2.3 cents last week to 139.5 cents per litre. Today the

TGP price sits at 140.8 cents per litre.

MotorMouth records the following average retail prices for unleaded fuel in capital cities today: Sydney 151.3c/l;

Melbourne 155.1c/l; Brisbane 159.1c/l; Adelaide 146.6c/l; Perth 147.5c/l; Hobart 157.1c/l; Darwin 151.8c/l and

Canberra 159.8c/l.

Craig James, Chief Economist

Twitter: @CommSec

What is the importance of the economic data?

Weekly petrol prices data are compiled by ORIMA Research on behalf of the Australian Institute of Petroleum (AIP). National average retail prices are calculated as the

weighted average of each State/Territory metropolitan and non-metropolitan retail petrol prices, with the weights based on the number of registered petrol vehicles in

each of these regions. AIP data for retail petrol prices is based on available market data supplied by MotorMouth.

September 27, 2021 | 3You can also read