Sustainable growth leadership - Speed Dating hosted by ABG Sundal Collier 2 October 2020 Anders Lonning-Skovgaard, EVP & CFO Ellen Bjurgert, Vice ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Sustainable growth leadership Speed Dating Stina hosted by ABG Sundal Collier 2 October 2020 Anders Lonning-Skovgaard, EVP & CFO Ellen Bjurgert, Vice President, Investor Relations Making life easier

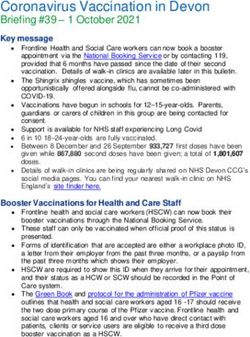

Key takeaways from our CMD

LEAD20 strategy successfully accelerated growth and value creation

We are building the consumer healthcare company of the future

Our new strategy will drive value creation through Sustainable Growth

Leadership with an emphasis on innovation (Clinical Performance Programme),

US and China

We are fully committed to investing in and scaling our Interventional Urology

and Wound & Skin Care businesses

Our new strategy will be supported by key growth enablers including

Efficiency, People and Sustainability

We will actively pursue M&A opportunities to build growth options

Page 2We are building the consumer healthcare company

of the future

Chronic Care

Macro Trends Impact Commercial model

Ageing population

Superior, clinically

differentiated

products

Healthcare consumerism

Digital transformation Consumer

preference Data and Clinical

digital tools preference

Price pressure

Payer preference

Channel consolidation

Page 3Our new strategy will drive continued long-term value

creation through revenue and earnings growth

Chronic Care

Interventional Wound &

Urology Skin Care

7-9% more than30%

organic growth p.a. EBIT margin1

Talent,

Innovation Leadership &

Culture

Unparalleled Sustainability

efficiency

1) Constant currencies, based on FX rate as of September 29, 2020

Page 4Innovation: We will enable growth

and deliver superior products

Deliver on the Clinical Performance

Program in Chronic Care

Continue to deliver new products

within existing technologies

Build more options into the pipeline

Page 5All our business areas will

contribute to growth

Main strategic themes

• Innovation

Chronic Care • China – Build on Market

Leading Position

• US - Challenger to Leader

• Market development

Wound & • 3DFit Technology

Skin Care • Scale our Chinese and US

businesses

• Drive profitability

• Innovation

Interventional • Geographical expansion

Urology • Enter adjacent categories

through M&A

Page 6Supporting sustainable development with a strong emphasis

on improving our environmental performance

Our mission

Making life easier for people

with intimate healthcare needs

Our 2025 priority Our 2025 priority

Reducing Improving

emissions products and

packaging

0 emissions from scope 1&2 80% packaging made from renewable materials

100% renewable energy 50% production waste recycled

Our on-going commitment

Responsible

operationsWe will actively pursue M&A opportunities as a lever for

long-term growth

Opportunity based Systematic screening

Channel Portfolio expansion Early stage

Large plays

expansion & adjacencies technologies

Page 8Short term we have been negatively impacted by COVID-19

but we will leverage learnings going forward

Short term implications Long term opportunities

• Lower group growth due to cancellation of elective

procedures 1. Clinically differentiated products

• Largest uncertainty related to rebound in Interventional that reduce total cost for payers

Urology and UK situation 2. Leveraging digital solutions to

• Sales reps unable to connect with customers in person connect with consumers and

healthcare professionals

• Challenges in conducting clinical trials

3. Home delivery and consumer

Three key priorities: keeping our people safe, continuing to channel increasingly attractive

serve our customers and maintaining business operations

Prudent cost management

Page 92019/20 impacted by COVID-19 – Momentum is improving,

but growth in 2020/21 will be back-end loaded

2019/20 was impacted due to COVID-19 … with many moving parts impacting 2020/21

9%

8% • Interventional Urology positively impacted by comparison

period in 2019/20

Group revenue • Uncertainty around growth in new patients across Chronic

organic growth ~4% Care in UK and other markets in particular in Europe

~2%

organic growth • Uncertainty around resumption of hospital activity impacting

in 2019/20 Wound and Skin Care

• No current knowledge of significant healthcare reform vs.

-2% French reform in 2019/20

Q1 19/20 Q2 19/20 Q3 19/20 Q4 19/20E

31% 32% 31% 31-32%

• H1 margin will be impacted by lower sales

• Investments initiated again across all BA’s and we will invest

Group ~31% up to 2% of revenues in R&D and commercial investments

EBIT margin EBIT margin • Continued savings due to less travel and lower sales &

in 2019/20

marketing costs due to Covid-19

Q1 19/20 Q2 19/20 Q3 19/20 Q4 19/20E

Page 10Investments have fueled broad-based growth in the LEAD20

period which is also the ambition for the Strive25 period

Growth contribution LEAD20 period Illustrative growth contribution Strive25 period

Revenue growth contribution FY 15/16 to 19/20 (DKKm) Revenue growth contribution FY 20/21 to 24/25 (DKKm)

Above market 7-9%

High single digit organic growth

Above market growth

organic growth

Above market growth

Business growth

area

Ostomy Continence Int. Wound & M&A FY15/16- Ostomy Care Continence Care Interventional Wound & Skin Care Total growth

Care Care Urology Skin Care FY19/20 Urology FY20/21 - FY 24/25

Growth contribution LEAD20 period Illustrative growth contribution Strive25 period

Organic growth contribution FY 15/16 to 24/25 (DKKm) Revenue growth contribution FY 20/21 to 24/25 (DKKm)

+10% 7-9%

organic growth organic growth

US Chronic Care

+10% organic growth

Regions Above market

growth

European Other Emerging M&A FY15/16 - European markets Other developed markets Emerging markets Total growth

markets developed markets FY19/20 FY20/21 - FY24/25

markets

Page 11EBIT margin development continues to be a function of

growth, scalability, cost discipline and investment activity

EBIT margin (%) Future drivers of EBIT margin

ILLUSTRATIVE

EBIT will be positively impacted by:

+ Leverage effect on fixed costs e.g.

>30%

distribution, admin and R&D costs

~31% especially driven by Europe

Possible incremental investment of

up to 2% of revenue per year EBIT will be negatively impacted by:

÷ Investments in P/L (Commercial &

R&D)

Reported EBIT ∆ Gross margin Leverage Incremental EBIT margin

margin FY 19/20 effect/scale investments FY 24/251

on fixed costs

1) Constant exchange rates

Page 12Continued strong development in free cash flow during the

Strive25 strategy period

Taxation Net working capital CAPEX(2)

Reported tax rate Net working capital in % revenue Depreciation in % of revenue CAPEX DKKm

CAPEX in % of revenue

~5% 6%

4% 4%

4%

4%

3% 950

23% 23% 23% 23% ~23% 23% 23% 23% 23% 24% ~24% ~24%

616 617

15/16 16/17 17/18 18/19 19/20 Long 15/16 16/17 17/18 18/19 19/20 Long 17/18 18/19 19/20 Long

term term term

• DK statutory corporate tax rate • Net working capital expected to be • Continued investment in machines and

lowered to 22% in 2016 stable, impacted by: capacity expansion

• Coloplast tax rate expected to be • Growth in mature markets • Widen factory footprint – 2 factories

~23% going forward planned in Costa Rica

• Growth in Emerging markets which

have long credit times • GOP5 investments – focus on Automation

• Increasing inventory levels on • IT investments

strategic products and raw

• Sustainability investments

1) Impacted by provision for Mesh litigation materials

2) Gross investments in PPE

Page 13Our long-term guidance for the Strive25 strategy period is

aimed at continued long-term value creation

7-9% more than30%

organic growth p.a. EBIT margin1

1) Constant currencies, based on FX rate as of September 29, 2020

Page 14You can also read