THE FED'S LIBOR GAME CHANGER - The Federal Reserve's plan to simplify legacy LIBOR loans may change the shape of the transition

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

THE FED’S LIBOR GAME CHANGER The Federal Reserve’s plan to simplify legacy LIBOR loans may change the shape of the transition November 2020 Adam Schneider Pin Su Paul Cantwell

The Fed’s LIBOR Game Changer

ADDRESSING THE “TOUGH LEGACY”

Randal K. Quarles, the Federal Reserve’s Vice Chairman for Supervision, in his November 2020

testimony to the US Senate Committee on Banking,1 offered a preview into how the Federal

Reserve might help the financial services industry address the issues of legacy contracts that

use the London Interbank Offered Rate (LIBOR). If the solution described by Quarles can be

created — a “mechanism” allowing existing LIBOR contracts to mature beyond 2021 without

having to be renegotiated — then transition can be simplified; application of fallbacks can be

limited, and existing loans can mature organically while new loans use new rates.

These legacy contracts have been the elephant in the room of LIBOR transition. When LIBOR

ends, there will be many contracts that are difficult or impossible to change: There may be no

defined process; language in the contract may be inadequate; language may rely on parties

that no longer exist; or consent is needed from multiple parties. The core issue is that any shift

to a new rate creates winners and losers. Many have called litigation inevitable.

We have been advocating that this is not a problem that participants can solve. It cries out for a

central approach and generally as participants understand the issue, they concur. The financial

regulatory authorities seem to have determined they need to help and are about to intervene.

If the proposed mechanism comes to be, it will be a game changer — with the transition from

LIBOR remaining a herculean task, but the focus can shift to lending on new alternative rates.

If the proposed mechanism comes to be, it will be a game changer—

with the transition from LIBOR remaining a herculean task, but the

focus can shift to lending on new alternative rates.

LIBOR TRANSITION BACKGROUND

Market participants have been preparing for the discontinuation of LIBOR which industry

regulators have indicated could be as soon as the end of 2021. This massive task impacts the

entire banking system and did not stop or slow down due to COVID-19. If anything, the transition

has seen major developments during October 2020, including:

1. Major Central Clearing Counterparties (CCPs) have shifted discounting and price alignment

interest (PAI) to the Secured Overnight Financing Rate (SOFR);

2. The International Swaps and Derivatives Association (ISDA) published updated fallback

definitions and a related protocol for derivatives;

1 Oversight of Financial Regulators, Hearing before the US Senate Committee on Banking, November 10, 2020 (Video testimony

of Randal K. Quarles): https://www.banking.senate.gov/hearings/10/23/2020/oversight-of-financial-regulators.

© Oliver Wyman 2The Fed’s LIBOR Game Changer

3. Legislation to mitigate some “tough legacy” contracts has been introduced to the New York

State legislature and is being discussed on a federal level; and

4. Regulators published initial results of the Credit Sensitivity Group workshops, indicating

they would not recommend a specific adjustment to SOFR, a feature many in the banking

community were asking for.

A KEY ANNOUNCEMENT

There is more to look forward to on the horizon. On November 10, 2020, Randal K. Quarles,

the Federal Reserve’s Vice Chairman for Supervision, testified to the US Senate Committee on

Banking2 (and the US House Committee on Financial Services the following day) and provided

important news. At the hearing, Quarles said:

“We need to consider a mechanism that would allow so-called legacy contracts, the great bulk of

them, to mature on their existing basis without having to be renegotiated and shifted to a new

rate without allowing the continuation of the writing of new contracts.”

“There are a variety of ways to do that … Within the next month or two, we should have a plan to

share that would address that.”

Quarles is referencing legacy LIBOR contracts which are an enormous problem. There are

millions and when LIBOR ends, in the best case, lenders and borrowers see an economic change,

and in the worst case, their economics are not even known. Financial institutions have been

hard at work reviewing and remediating contracts, but apparently the Fed is concerned that this

problem is too enormous and too risky to not take action.

If the solution described by Quarles comes to pass — a mechanism

allowing existing LIBOR contracts to mature beyond 2021 without

having to be renegotiated — then transition can be simplified;

application of fallbacks can be limited, and existing loans can mature

organically while new loans use new rates.

2 Oversight of Financial Regulators, Hearing before the US Senate Committee on Banking, November 10, 2020 (Video testimony

of Randal K. Quarles): https://www.banking.senate.gov/hearings/10/23/2020/oversight-of-financial-regulators.

© Oliver Wyman 3The Fed’s LIBOR Game Changer

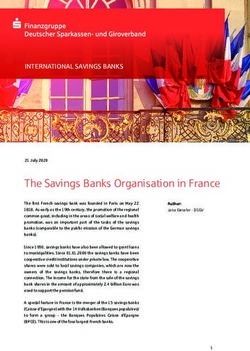

Exhibit 1: The considerations

This is an enormous change and there is uncertainty as to what is to come, but Quarles’s testimony implies:

Randal K. Quarles testimony1 Our Interpretation

“A mechanism that would allow so-called Many existing LIBOR contracts can continue to maturity.

legacy contracts, the great bulk of them, to The “mechanism” might be:

mature on their existing basis …”

• A continuation of LIBOR submissions.

• A legislative definition of a “safe-haven.”

• A redefinition of the methodology (also known as “synthetic” LIBOR).

The mechanism is likely to last 2-3 years, but not indefinitely. If true not all

contracts will be addressed and remediation will still be needed for longer-

dated items.

It will come with a deadline for ending new LIBOR issuance.

“ … without having to be renegotiated and Existing economics continue.

shifted to a new rate”

“Within the next month or two, we should Discussions are already in progress; a timeline would not be announced if there

have a plan to share that would address that.” were not the makings of a plan already.

Most straightforward is to continue USD LIBOR, which would require consent from

the UK Financial Conduct Authority (FCA).

Other Considerations: Our Interpretation

Is this a US federal legislative approach? Does not seem likely given specific statements to lawmakers.

Does this affect the pending New York Not directly, although if there are fewer LIBOR contracts it will be less impactful.

State legislation?

Which loans and contracts are affected? Likely all USD LIBOR contracts under US law. The global situation is murkier.

While we anticipate a “last date” for writing new contracts in the US, globally it may

be possible to write new USD LIBOR loans not under the purview of the Fed.

Is this likely to occur? Yes. We do not think the Fed would discuss in Congress unless likely.

Why now, and not before? We hypothesize the Fed recognized that millions of LIBOR contracts moving to

fallbacks is disruptive and wants a less risky path. The more interesting question is

why was this not determined earlier on in transition.

Will the proposed mechanism affect all Likely yes under US law, not as clear globally.

existing USD LIBOR contracts?

Does this have knock-on effects across the Absolutely. We are assessing this across the system and multi-currency facilities

financial system? and swaps are two core areas of examination.

We believe the ISDA protocol for swaps needs synchronization with the

mechanism. Right now, the FCA declaring LIBOR “unrepresentative,” triggers

swaps moving off LIBOR and this is anticipated in 2021. But this does not

move loans off LIBOR and any scenario where the two fall out of sync raises

enormous issues.

What about other market developments? The interplay between this proposal and the UK’s “synthetic LIBOR” approach is

not clear.

The interplay between this proposal and NYS/Federal legislation is also not clear.

It is unlikely the mechanism will apply to other LIBOR currencies.

1 Oversight of Financial Regulators, Hearing before the US Senate Committee on Banking, November 10, 2020

(Video testimony of Randal K. Quarles): https://www.banking.senate.gov/hearings/10/23/2020/oversight-of-financial-regulators

© Oliver Wyman 4The Fed’s LIBOR Game Changer

RECOMMENDATIONS

This is a complex subject which requires monitoring. Given the uncertainty, many are asking the

question of “what to do now” and “what to say” to customers.

Our thoughts for the next 60 days — while monitoring for new information:

Follow the Hippocratic Oath and do no harm — nothing is final yet and firms should continue

current plans. However, we do suggest:

• Prioritize longer-term contracts, for example, those maturing after 2023

• Hold off on client communications about fallbacks and timing

• Consider the impact of the ISDA protocol across multiple timeline scenarios before adhering —

different mechanisms may change economics or applicability to your portfolio

Recognize that only legacy LIBOR contracts will be impacted:

• Plans to offer SOFR/ARR products should not change

• Prepare to stop issuing USD LIBOR loans by June 30, 2021, the ARRC’s recommended date

Be prepared for vigorous industry discussions

In the longer term, once the proposed mechanism and ramifications are clear:

• Take advantage and simplify transition efforts

• Be prepared to support multiple transition timelines and mechanisms, since currencies and

products may not be in sync

• Rework customer communications

• Get on board with SOFR lending — that is definitely coming in 2021

• Continue monitoring the market:

–– The transition is ever-evolving — this is a reminder to keep abreast of all changes

–– Keep an open eye on alternate-alternate rates. There are many approaches in the market

that may be more to lender-liking — be prepared

© Oliver Wyman 5The Fed’s LIBOR Game Changer

CLOSING THOUGHTS

While LIBOR transition is a major program, it was never based on an immovable date like “the

year 2000” (Y2K). It now seems possible that transition may end up being simplified for USD

legacy contracts, which would address major concerns.

But even as the LIBOR transition continues to evolve, it will inevitably happen. In the words

of New York Federal Reserve President John Williams, “Some say only two things in life are

guaranteed: death and taxes. But I think there are three: death, taxes, and the end of LIBOR.”

And apparently, the end of LIBOR is going to get a multi-year reprieve.

© Oliver Wyman 6Oliver Wyman is a global leader in management consulting that combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. For more on the latest advice and guidance on what replacing the LIBOR rate could mean for your business, please visit our LIBOR Transition Hub www.libortransition.com For more information, please contact the marketing department by phone at one of the following locations: Americas EMEA Asia Pacific +1 212 541 8100 +44 20 7333 8333 +65 6510 9700 AUTHORS Adam Schneider Paul Cantwell Partner, Retail & Business Banking and Digital practices Partner, Financial Services and Digital practices adam.schneider@oliverwyman.com paul.cantwell@oliverwyman.com Pin Su Engagement Manager, Financial Services pin.su@oliverwyman.com Copyright © 2020 Oliver Wyman All rights reserved. This report may not be reproduced or redistributed, in whole or in part, without the written permission of Oliver Wyman and Oliver Wyman accepts no liability whatsoever for the actions of third parties in this respect. The information and opinions in this report were prepared by Oliver Wyman. This report is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accountants, tax, legal or financial advisors. Oliver Wyman has made every effort to use reliable, up-to-date and comprehensive information and analysis, but all information is provided without warranty of any kind, express or implied. Oliver Wyman disclaims any responsibility to update the information or conclusions in this report. Oliver Wyman accepts no liability for any loss arising from any action taken or refrained from as a result of information contained in this report or any reports or sources of information referred to herein, or for any consequential, special or similar damages even if advised of the possibility of such damages. The report is not an offer to buy or sell securities or a solicitation of an offer to buy or sell securities. This report may not be sold without the written consent of Oliver Wyman. Oliver Wyman – A Marsh & McLennan Company www.oliverwyman.com

You can also read