What If Election Results Are Delayed or Contested? - Fidelity ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

FIDELITY INSTITUTIONAL INSIGHTS What If Election Results Are Delayed or Contested? Election uncertainty is no reason to abandon financial plans. KEY TAKEAWAYS • The election outcome may be delayed by mail-in voting and lawsuits. • The U.S. political system has rules that ensure these obstacles will be overcome and offices filled. • Markets may be volatile if the election is unresolved. • Short-term volatility is not a reason to abandon a long-term financial plan. While polls continue—as they have for months—to show former Vice President Joe Biden leading President Trump, financial markets are suggesting the vote could be close and that the outcome of presidential and congressional elections may not be known on November 3. In anticipation of the markets potentially turning volatile if the vote’s outcome is not known on election day, some investors and traders have been building hedging strategies using derivatives, gold, and options. Concerns center on how much the COVID-19 pandemic may affect the speed with which votes are cast by mail and counted and the potential for prolonged litigation. Dirk Hofschire of Fidelity’s Asset Allocation Research Team sums up the situation, saying, “There’s a reasonable probability we won’t know the outcome for at least a few days and maybe a few weeks after election day. The pandemic is creating huge logistical challenges for the electoral process, making in-person voting more difficult and causing delays in counting due to the high volume of mail-in ballots.” To be sure, a delayed outcome is not inevitable but regardless of the result, one thing is certain: The election result is not a reason to change long-term financial plans. Markets may turn choppy but volatility should pass and may even provide opportunities for investors holding cash to buy stocks at attractive prices.

EXHIBIT 1: The road to the White House

How the electoral college chooses the president

Congress counts President and vice

Jan. 20

electoral votes and Jan. 6 president are inaugurated. 2021

declares a winner. 2021

Dec. 23

2020

Dec. 14

Election day 2020

Electoral college

Dec. 8

2020 voting must be

complete.

Nov. 3

2020

Electoral college meets

to vote for president

and vice president.

States confirm the electors

who will represent them in

the electoral college.

Source: Fidelity Investments.

Challenges within a stable system defeat in close outcomes. “The highly polarized

While the pandemic and the use of mail-in voting partisan atmosphere isn’t making this situation any

present unique circumstances, federal election law better and I expect a messy or prolonged aftermath

recognizes that delays are likely and includes a specific could extend into December and maybe even

timetable and provisions for resolving challenges January,” he says.

that may arise as votes are counted. The 133-year-

There will be resolution

old Electoral Count Act allows 35 days following the

election for states to complete their counting and for But while disagreement and delay in the election

any legal challenges to the results to be resolved. outcome would add yet more turmoil to a tumultuous

year, it would not necessarily be catastrophic for

As orderly as the path from election day to

the government or for the markets. Nor would it be

inauguration may look on paper, some aspects of the

unprecedented. In 2000, procedural and technical

law are ambiguous and it’s reasonable to expect that

issues involving vote counting in Florida led Democrat

the complications involved in this year’s vote could

Al Gore’s campaign to challenge the declared victory

yield court cases and other delays along the way. Also,

of George W. Bush. After five weeks of uncertainty,

Hofschire foresees the possibility that the parties may

the Supreme Court considered Gore’s claims and

prefer to challenge outcomes rather than concede

ruled in favor of Bush on December 12. Then, as

What If Election Results Are Delayed or Contested? | 2now, stocks had recently hit a record high, and the administrative agencies, and courts play important

S&P 500® declined 7% during the period between roles in the making and implementing of government

the election and Gore’s concession. Meanwhile, the policy and continue to operate predictably, whether

U.S. government and economy continued to operate or not the outcome of legislative or executive branch

despite the uncertainty over who would be its next elections is known.

head of state.

How might markets be affected?

The distributed nature of power in the U.S. system of

government is one reason why an unresolved election While laws govern how to resolve a contested

didn’t pose a risk to stability in 2000 and isn’t likely election, there are no rules that limit how volatile

to in 2020. The president does not hold a monopoly financial markets may become or what might trigger

on power and; the constitution specifies when a that volatility. Historically, the record shows markets

president must leave office and provides a system of do respond to political and other non-financial

checks and balances between the three branches of events and many investors expect that an unresolved

government. The system even provides a way to deal election result could be accompanied by increased

with the unlikely event that a president would not be volatility in markets, as was the case in 2000. “Given

determined by inauguration day when the Speaker of the pandemic, passions surrounding this election, and

the House would become the acting president. uncertainty about how and when the election results

may be resolved, it would not be surprising if markets

Another feature that further stabilizes the system is the

got volatile,” says Hofschire.

fact that the elected executive and legislative branches

are not the only pillars upon which government sits. Markets dislike uncertainty and they can prepare for

Unelected entities such as the Federal Reserve, events that they can see coming. They are also efficient

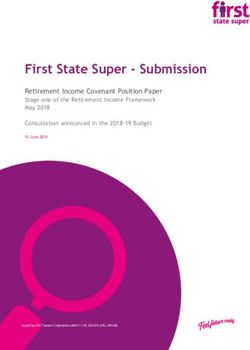

EXHIBIT 2: Volatility may accompany the vote, but other things matter.

Historically, stocks become volatile around elections and markets are pricing in volatility for the rest of the year. However,

Fidelity analysts don’t see the election as the biggest factor in how markets may perform in the coming months.

Equity volatility around elections Fidelity company analyst survey

2016 2020 Average since 1990 Percentage of Respondents

VIX Level 90%

Election Day

35

80%

30 70%

60% Which will have a larger

25 impact on your industry

50%

in the next 6 months?

20 40%

30%

15 20%

10%

10

-50-45-40-35-30-25-20-15-10 -5 0 5 10 15 20 25 30 35 40 45 50 0%

Trading Days from Election U.S. Election Covid-19

Left: VIX: Chicago Board Options Exchange Volatility Index® (VIX). Data for the 2020 line after 9/30/20 derives from VIX futures contracts until the next contract

date. The rest of the 2020 line and all others show historical VIX levels. Source: Bloomberg Finance L.P., Fidelity Investments Asset Allocation Research Team

(AART), as of 9/30/20. Right: Source: Fidelity Investments Asset Allocation Research Team (AART), as of 9/30/20.

What If Election Results Are Delayed or Contested? | 3and stock prices often reflect risks that investors Investors who experience anxiety when stocks drop

believe may exist in the future. Unlike the contested should remember that’s a normal response to volatility.

election of 2000 which caught markets off-guard, many It’s important for investors to consider sticking with

observers believe that today’s stock prices reflect their long-term investment mixes and to have enough

expectations that the election may not initially produce growth potential to achieve goals. Investors who can’t

a clear winner. Those factors could reduce potential tolerate the ups and downs of their portfolios should

volatility if the election is unresolved. The abundance consider a less volatile mix of investments that they

of hedging strategies being employed by cautious can stick with.

traders might also produce a rally if the election is

settled quickly and those investors exit their hedges Policy matters

and return to stocks. A close, delayed, or contested election is by no

means certain. A decisive result is also possible, but

Staying the course whether the election is settled quickly or only after

While the combination of political dysfunction and a lengthy legal challenge, it will be settled and the

volatile markets may be a recipe for anxiety, volatile winners will take their seats in the White House and

periods are as much a part of investing as capital Congress. They will face the challenge of reviving an

gains. Attempting to “time the market” and move economy that is fitfully recovering from COVID-related

in and out of stocks in anticipation of volatility that shutdowns. They may seek to change current policies

might happen is a risky approach that history says may on taxes, spending, regulation, and more, the sorts

increase the likelihood that investors may not reach of governmental issues that can impact the markets

long-term goals. History shows that staying invested and our clients’ financial wellbeing. Our investment

and diversified is a better approach to confronting teams closely monitor these issues and incorporate

anxiety. The financial crisis of late 2008 and early 2009, policy analysis into their decisions. As Lars Schuster,

when stocks dropped nearly 50% might have seemed institutional portfolio manager with Fidelity’s Strategic

a good time to run for the perceived safety of cash. But Advisers, LLC puts it, “We focus on policy, not politics.”

a Fidelity study of 1.5 million workplace savers found While the causes of present uncertainty may be unique,

that those who stayed invested in the stock market we’ve been through times of turmoil before. Now,

during that time were far better off than those who as always, the key for investors is to stay focused on

headed for the sidelines.1 personal goals and their plans to reach them—no matter

what life, elections, or the markets may throw at them.

What If Election Results Are Delayed or Contested? | 41 This statement is based on a longitudinal study of active participants in Fidelity record-kept corporate defined contribution savings plans. The data looked at a cohort of 1,470,700 participants who were active in workplace savings plans for the entire period from June 2007 through June 2017. Roughly 1.5% of participants went to 0% equities during the fourth quarter of 2008 or first quarter of 2009. Please note that past performance is not a guarantee of future results and the averages can obscure significant variation for individual account results. Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Views expressed are as of October 2020, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Information provided in this document is for informational and educational purposes only. To the extent any investment information in this material is deemed to be a recommendation, it is not meant to be impartial investment advice or advice in a fiduciary capacity and is not intended to be used as a primary basis for you or your client’s investment decisions. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in them, and receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services. Investing involves risk, including risk of loss. Past performance is no guarantee of future results. Diversification and asset allocation do not ensure a profit or guarantee against loss. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Indexes are unmanaged. It is not possible to invest directly in an index. VIX® is the Chicago Board Options Exchange Volatility Index®, a weighted average of prices on S&P 500 options with a constant maturity of 30 days to expiration. It is designed to measure the market’s expectation of near-term stock market volatility. S&P 500® is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P 500 is a registered service mark of The McGraw-Hill Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation and its affiliates. The Chartered Financial Analyst® (CFA®) designation is offered by CFA Institute. To obtain the CFA charter, candidates must pass three exams demonstrating their competence, integrity, and extensive knowledge in accounting, ethical and professional standards, economics, portfolio management, and security analysis, and must also have at least four years of qualifying work experience, among other requirements. Third-party marks are the property of their respective owners; all other marks are the property of FMR LLC. Fidelity InstitutionalSM provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC (Members NYSE, SIPC); and institutional advisory services through Fidelity Institutional Wealth Adviser LLC. Personal and workplace investment products are provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC. Institutional asset management is provided by FIAM LLC and Fidelity Institutional Asset Management Trust Company © 2020 FMR LLC. All rights reserved. 936090.1.0 1.9900698.100

You can also read