A Living Wage for Salt Spring Island, 2018

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Executive Summary

Salt Spring Island’s 2018 Living Wage

The 2018 living wage for Salt Spring Island is $20.95/hour. This is

“the hourly rate at which a household can meet its basic needs, once

government transfers have been added to the family’s income (such

as federal and provincial child tax benefits) and deductions have been

subtracted (such as income taxes and Employment Insurance premiums).”1

Put more simply, a living wage is the hourly wage that each parent must

make to cover baseline expenses for an average family of four. Ensuring

that a family has the means to provide adequate housing, transportation,

childcare, and other essentials has positive effects on children, parents,

and employers.

What is a living wage family?

A living wage family is defined as four people—two adults and two

children (a 4-year-old and a 7-year-old). Both parents in the living

wage family work 35 hours per week, year-round, and they work to pay

for housing, food, transportation, childcare, health care, clothing and

footwear, parents’ education, a small contingency fund, and other regularly

occurring expenses.

Why is a living wage important?

Salt Spring Island is rich in arts and culture and outdoor and recreational

opportunities. The community is tightly knit and characterized by high

rates of engagement through volunteerism, interest in local issues,

and charitable giving. At the same time, Salt Spring Island residents—

particularly those with young families—may face cost of living challenges

due to the rural and somewhat remote location of the island, the

dependence of the island on tourism, and the need to work two or more

part-time jobs to make ends meet.

The living wage differs from the minimum wage. A minimum wage “is the

legal minimum all employers must pay. The living wage sets a higher

test—a living wage reflects what earners in a family need to bring home,

based on the actual costs of living in a specific community.”1

Though the minimum wage in British Columbia rose to $12.65 in June 2018,

the minimum wage still remains lower than the living wage by $8.30. By

examining the living wage, and placing it in the context of the minimum

wage, we can better understand the costs that influence quality of life on

Salt Spring Island.

2Salt Spring Island Context

Relevant demographic and contextual information:2

• Salt Spring Island’s population is 10,557.

-- Of that number, 1731 individuals, or 16%, are children ages 0 to 19.

-- Of the 3,090 families on Salt Spring Island, 900, or 29%, are

couples with children.*

-- There are an additional 400 families on Salt Spring Island headed by

single parents.**

• Sales and service is the most prevalent industry on Salt Spring Island,

with 20% of employed islanders working in this industry. Many of these

employees are engaged in visitor services, with 2010 estimates noting that

tourism generates an annual before-tax revenue of $18 million.3

• 16.3% of children live in poverty in the Capital Regional District, which

includes Salt Spring Island.

• A single person earning minimum wage spends 59.7% of their income on rent.

• Food costs are nearly 10% higher than in neighbouring communities on Vancouver Island.

• Ferry rides are essential to access some health services, some social services, and recreation and cultural activities.

*Not all of these families are living wage families, as some are two parents and one child, or two parents and three or more children

**While some communities have concluded that their living wage is also enough for single-parent families, this has not been

calculated for Salt Spring Island.

Our Vital Signs survey (2017) asked residents to reflect on the biggest challenges facing the island. Affordability

and housing were the most frequent responses, with this quote linking housing, affordability, and employment:

“My biggest concern is affordable housing. There is nothing for our mid-to-lower income families to rent

[and that is] making it difficult for our businesses to find reliable and stable employees.”

How is the living wage decided?

The report uses a national standard for the living wage calculation: The Canadian Living Wage Framework, which

was developed by the Canadian Centre for Policy Alternatives (CCPA) in conjunction with First Call BC: BC Child

and Youth Advocacy Coalition.4 The CCPA and First Call BC are joined by non-profits, social planning councils,

municipalities, and community foundations across the country to form a community of practice. Jointly, these

organizations promote the methodology and work toward building national consistency.

The living wage family is comprised of two parents and two children aged four and seven. Each parent works full-

time (35 hours per week), year-round.

The purpose of the living wage calculation is to understand the income needed for a basic quality of life. Thus, the

living wage is the hourly rate of pay at which a household can meet its expenses after government transfers have

been added (i.e., Child Tax Benefits, GST), and government deductions have been subtracted (i.e., taxes, CPP,

EI). Family expenses are described on page 5, and methodology (including government transfers and deductions)

is detailed on page 6.

3The Salt Spring Island 2018 Living Wage

With two parents working full-time, the amount needed for a family of four to pay for necessities, support healthy

childhood development, and escape financial hardship is $20.95 per hour, or $72,503.19 annually ($36,251.60 per

parent, annually, if both parents earn the same wage).

The monthly family expenses are based on conservative or lower than average amounts to provide only an

adequate level of well-being based on what a family requires.5

Monthly expenses

Shelter: $2,061.65

Food: $900.37

Transportation: $491.55

Child care: $1,100.00

Health – MSP: $75.00

Health – non-MSP: $148.00

Clothing & Footwear: $146.14

Parent’s Education $86.92

Contingency: $248.38

Other: $789.87

TOTAL: $6,047.88

Living wage calculations do not include any additional costs, including the following:

• Debt payments, such as credit cards or student loans • The cost of owning a home

• Retirement savings • The cost of care for aging parents

• Children’s post-secondary education savings

Itemized costs as percentage of total monthly expenses

Parent education - 1.4% Clothing and footwear - 2.4%

MSP - 1.3% Non-MSP health expenses - 2.5%

Contingency - 4.1%

Shelter - 34.1% Transportation - 8.1%

Other - 13.0%

Child care - 18.2% Food - 14.9%

4Monthly Expenses

Food: $900.37 Childcare: $1,100.00

This is the monthly cost of healthy eating for a family of The amount listed is the median monthly cost of full-time

four living in the southern region of Vancouver Island. care for a 4-year-old and out-of-school care (summer

and holidays) for a 7-year-old.

Note: Because a standard living wage methodology

is used across the province, the variables of each On Salt Spring Island: There are no licensed childcare

participating living wage community must be providers currently offering before-school care on Salt

considered. Our Vital Signs report found that food cost, Spring Island, and only one provider currently offering

on average, 10% higher on Salt Spring than in Victoria. after-school care. Therefore, this cost has been omitted

To comply with methodology, we were not able to add from our calculation.

an additional 10% to the monthly cost of food.

Since there is no school on Fridays, parents must also

arrange for care for their young children. Paid recreation

Shelter: $2,061.65 programs, shared childcare with other families, and

unpaid time off may all be employed to ensure young

Shelter costs include monthly rent for a three-bedroom

children are not left alone.This is the mandatory monthly

unit, plus utilities and insurance. Shelter costs are also

provincial rate for a family of three or more.

inclusive of internet and two basic cell phone plans

(Canada-wide talk and text only; no data).

Clothing & Footwear: $146.14

Transportation: $491.55 This is the estimated monthly cost for a family of four.

This is the monthly cost of owning, operating, and

maintaining one used vehicle. Contingency: $248.38

Ferry travel is also necessary for families living on Salt This is the only savings included in the living wage

Spring Island, so the cost of one ferry trip to Vancouver calculation, and it is coverage for unexpected

Island per month has been added to the calculation. expenses. It is comprised of two weeks’ pay for two

Using spring 2018 fare rates, and applying the parents earning the living wage. This does not include

Experience Card discount, the living wage family would long-term savings, like a down payment, children’s

pay $39.70 per trip. education, or retirement.

Health – MSP: $75.00 Parents’ Education: $86.92

This is the mandatory monthly provincial rate for a family This is the average cost of two courses at Camosun

of three or more. College, including tuition, student fees, and textbooks.

This cost assumes that the parent utilizes online learning.

On Salt Spring Island: Some medical services require

travelling off island, which is costly even with the Transit On Salt Spring Island: This figure does not include

Assistance Program (TAP). time away from work or children, or travel costs.

Health – Non-MSP: $148.00 Other: $789.87

This is the cost for health care not covered by MSP, This amount reflects a variety of costs, including

including prescriptions, and vision and dental services. personal care, household supplies and furnishings,

small appliances, entertainment, recreation, etc. It is

estimated at 75% of the combined cost of food and

clothing and footwear.

5Methodology notes

The national living wage framework includes both a living wage definition and calculation methodology that have

been adopted across the country. British Columbia has produced a specific Calculation Guide, which is updated

annually to reflect any provincial changes in governments transfers.6 This calculation guide was used in the

preparation of this report. Additionally, CCPA and First Call BC leads were engaged throughout the process to

ensure that our data and methods are correct.

Both government transfers and government deductions have been taken into consideration, and are as follows:

Government transfers: Government deductions and taxes:

• Canada Child Tax Benefit (CCTB) • Employment Insurance premiums

• Universal Child Care Benefit (UCCB) • Canada Pension Plan premiums

• BC Early Childhood Tax Benefit (BCECTB) • Provincial taxes

• GST credit • Federal taxes

• BC Rental Assistance Program • Tax credits

• BC Childcare Subsidy -- Employment Tax Credit

• British Columbia Low Income Climate Action Tax -- Tuition, education, and textbook amount

(BCLICAT) -- Medical expenses

Government transfers positively influence the living -- BC Tax Reduction Credit

wage by providing a source of income for family Government deductions and taxes negatively affect the

expenses and thus reducing the amount of money living wage by taking away from employment income.

parents need to earn. Negative impacts can be reduced via tax credits.

In some instances, data for Salt Spring Island was not readily available and divergences from the methodology

were required. These are noted below, alongside the data sources.

Taxes and transfers

These data were drawn from the following points in time, and from provincial and federal sources: government

transfer amounts (CTTB, GST, and BCLICAT) for July 2017 to June 2018, UCCB and BCECTB for the 2018

calendar year, and government deductions and taxes for the 2017 tax year.

Some families benefit from the British Columbia Low Income Climate Action Tax or the British Columbia Rental

Assistance Program, but the earnings of the Salt Spring Island living wage family are too high to allow for participation.

6Household Costs Childcare

This cost includes the median cost of full-time, full-year care

Food for the 4-year-old, and full-time holiday and summer care

for the seven-year-old. Typically, living wage calculations

Food cost estimates were derived from the 2017 food

also include the cost of before- and after-school care for

costing data provided by Population and Public Health,

children, but no licensed childcare provider offered before-

BC Centre for Disease Control, part of Provincial Health

school care at the time of this report, and only one licensed

Services Authority.7

provider offers after-school care.

The Salt Spring Island Foundation’s Vital Signs report

This data was obtained by conducting phone and email

was also used as a source when comparing the cost of

interviews with licensed childcare providers on Salt Spring

groceries on Salt Spring Island to the cost of groceries

Island. The median cost was used. Since the living wage

in Victoria.2

assumes that the four-year-old is in full-time, full-year

care, none of the preschools or partial-day options were

Shelter

considered in determining the median rate.

Reliable and recent housing data specific to Salt Spring

Island is difficult to find. After weighing many options, Healthcare

the Salt Spring Island Affordable Housing Needs

This cost includes the price of mandatory enrolment in

Assessment, 2015, was determined to be the best

the Medical Services Plan of BC, and the estimate for a

choice.8 This source was chosen because it is the most

Pacific Blue Cross family plan.15, 16

localized and comprehensive of all options. Because

the data was from 2015, the rental figures were updated Clothing & Footwear

using 2017 Consumer Price Index values. This is a

conservative estimate. Anecdotal evidence suggests This very conservative cost is taken from the Market

that families are paying higher rents at the time of this Basket Measure and adjusted using the 2017 Consumer

report. Since 2015, short term vacation rentals have Price Index.10,13

increased in popularity, decreasing the availability of

Parent’s Education

long-term rentals for island residents.

This cost was calculated in April 2018, using information

Utilities (water, fuel, and electricity) were calculated available online from Camosun College. This is the cost

using Vancouver Island data and adjusted using the of two basic courses, and does not include fees for lab

2017 Consumer Price Index.9, 10 or science courses.17

Internet and cell phone estimates are both from Telus.

Contingency

The internet service provided is for the use of 15mbps

download, 1mbps of upload, and 200GB of data per This is a small fund reserved for emergencies. It is

month. The cell phones (one for each parent) have calculated at two weeks of pay at the living wage rate for

unlimited Canada-wide talk and text but no data.11 each parent.

The insurance estimate was provided online by Island Other

Savings, for $50,000 coverage and a $1,000 deductible.12 This category includes items such as toiletries and

personal care, cleaning and household supplies,

Transportation

furniture, laundry, children’s school supplies and fees,

The cost of transportation, which includes payments on bank fees, minimal recreation and entertainment, family

a used car, insurance, maintenance, and gas, comes outings (to a local play or concert, for example), birthday

from the Market Basket Measure, which has been presents, a modest vacation, and hobby activities for the

adjusted using the 2017 Consumer Price Index.10,13 children (an art class or participation on a sports team,

for example).

Our calculation also includes the cost of one ferry trip

to Vancouver Island per month, and assumes families Costs that fall under this category are calculated at 75%

are utilizing the BC Ferries Experience Card. Fares were of the combined cost of food and clothing and footwear.

obtained online from bcferries.ca.14

7About the Salt Spring Island Foundation

Vision:

A healthy and caring community

Mission:

To inspire philanthropy in support of local charities for the enduring benefit of our community

Who We Are:

Since 1984, the Foundation has enriched our island’s quality of life by assisting local charities through responsive

grant making and by fostering community partnerships and initiatives. Foundation grants tackle important

community needs and touch the lives of virtually every islander in some way.

Community Research:

Our Living Wage Report is a natural development from our VitalSigns® report. We believe that this important

information helps create a fuller picture of our community and assists us in supporting local charities that work with

islanders to realize our shared vision of a healthy and caring community.

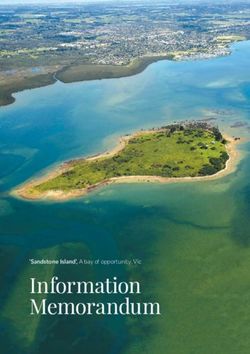

Photo credits:

Pages 1 & 3: John Allison. Page 2 (top to bottom): Jen MacLellan, Christopher Roy, Dave French

Sources:

1. Living Wage Canada, “What is a Living Wage?” Accessed April 2018.

2. Salt Spring Island Foundation, 2017 VitalSigns® report

3. Tourism British Columbia, Salt Spring Island Tourism Development Plan. Accessed May 2018.

4. Living Wage Canada, “Canadian Living Wage Framework.” Accessed April 2018.

5. Living Wage Canada, “Calculating a Living Wage.” Accessed April 2018.

6. Canadian Centre for Policy Alternatives, British Columbia Calculation Guide. Accessed April 2018.

7. Food cost estimate derived from the 2017 food costing data provided by Population and Public Health, BC Centre for

Disease Control, part of Provincial Health Services Authority.

8. Salt Spring Island Affordable Housing Needs Assessment, 2015. Accessed April 2018.

9. Data provided by Canadian Centre for Policy Alternatives.

10. Statistics Canada, Consumer Price Index. Accessed April 2018.

11. Estimate provided by Telus via telus.com. Accessed April 2018.

12. Estimate provided by Island Savings via islandsavings.ca. Accessed April 2018.

13. Statistics Canada, Market Basket Measure. Accessed April 2018.

14. Fares calculated using BC Ferries Fare Index. Fare costs were calculated assuming the use of an Experience Card.

Accessed May 2018.

15. British Columbia Medical Services Plan Monthly Premium Rates. Accessed April 2018.

16. Estimate provided by Pacific Blue Cross, via pac.bluecross.ca. Accessed April 2018.

17. Camosun College, Tuition and Fees. Accessed April 2018.

For more information:

Salt Spring Island Foundation

158A Fulford Ganges Road, Salt Spring Island, BC (office)

PO Box 244 Ganges PO, Salt Spring Island, BC, V8K 2V9 (mail)

250-537-8305 info@ssifoundation.ca www.ssifoundation.ca

8You can also read