HENRY STREET THE RESEARCH - Knight Frank

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

THE HENRY STREET REPORT RESEARCH

SUMMARY HENRY STREET

1. Growth in real incomes is Introduction projected to rise by 2.5% in 2017

according to the Economic and Social

conscious Irish consumer, a behavioural

legacy of the recent recession. Whether

With 1 GPO Buildings now let agreed, the

only building available on a new lease is

spread over ground and upper ground

levels, a reduction of a third compared

supporting an expansion in

Situated in the north city centre, the retail Research Institute (ESRI). In the context this changes as real incomes grow 45 Henry Street, which is being marketed to its previous combined footprint. The

consumer spending

thoroughfare known as Henry Street is of a 0.6% forecast for general inflation, remains to be seen. The fall in the value at a rent of €3,660 psm. Regarding the new larger unit is the flagship store for its

comprised of a single pedestrianised the growth in earnings will boost real of Sterling against the Euro since the shadow letting market, 52 Henry is let Topshop brand in Ireland, with the Zone

2. Prime Zone A Henry Street street bounded by O’Connell Street to incomes and thus consumer spending Brexit referendum is providing a further agreed while a new tenant is being sought A rent standing at €4,155 psm. The

rents are now in the order of the east and Jervis Street to the west. power. Also, net migration returned to incentive for cross-border shopping. for 17 Henry Street. letting illustrates a preference for large

€4,850 psm However, it should be noted for reference positive territory last year for the first time This, together with the continued rise of floorplates by high-end international

purposes that Henry Street is technically since 2009, providing another layer of online retailing, will limit the scope for The Arcadia Group last year triggered retailers, unit configurations which are

comprised of two separate streets, demand. This all supports increases in greater high street retail pricing power. co-terminus 20-year break options at its presently in short supply in Dublin City

3. Competition between five stores in the Jervis Shopping Centre. Centre. A further example of this demand

namely Henry Street and Mary Street, consumer confidence, which is almost

institutional investors for prime

retail assets in Dublin has

with the demarcation between the two

occurring at Liffey Street. Recording an

back at the ten-year high level achieved

in early 2016, before the uncertainty

Letting The retailer has dropped its Wallace, Miss

Selfridge and Burton stores, replacing them

was TK Maxx’s letting of 3,250 sq m at

the Ilac Centre in 2014, where they pay

benefited Henry Street surrounding the Brexit referendum forced An early marker of Henry Street’s rental with one large unit extending to 1,858 sq m an annual rent of €550,000 per annum.

annual footfall of 30 million, the street has

arguably the best retail offering in Dublin a retreat. These trends have seen total recovery was Mango’s letting in Q1 2014

4. Prime yields currently stand due to the combination of high street private consumption rise by over 10% of 1,797 sq m at 46-47 Henry Street at a

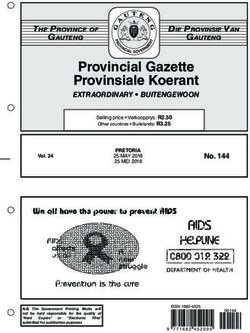

at 3.75% shops, department stores and two in the past three years to now exceed Zone A rent of €3,444 psm. At the time, FIGURE 2

shopping centres all in close proximity. pre-crisis levels, although on a per capita the deal represented an important Prime Henry Street Zone A Rents

Prominent occupiers include Arnotts, basis they remain slightly below, endorsement of the street from a leading

5. Henry Street and its environs suggesting scope for further appreciation. international brand, in what is one of the

Penneys, Debenhams, M&S, Dunnes 8,000

are undergoing a substantial Stores, TK Maxx, Zara, H&M, Mango and In this regard, the ESRI are forecasting largest units on the street. In Q1 2016,

facelift, with a number of River Island. private consumption to grow by 3.1% in Ann Summers let the former Pamela Scott 7,000

redevelopment projects at 2017 and by 3.0% in 2018. premises at 3 Henry Street – which 6,000

various stages of delivery

Economy Despite the strong headline fundamentals,

extends to 345 sq m – for a Zone A rent of

€4,585 psm, setting a new bar for prime 5,000

€/sq m

challenges remain for the retail sector,

The macro underpinnings that provide Grade A rents on the street at the time. 4,000

challenges which are best illustrated

the basis for the case to invest in The high rent achieved can be attributed

by comparing retail sales versus volumes. 3,000

Irish retail remain compelling, with to the building’s prime positioning on

While retail volumes have recovered to

employment, wages, immigration and Henry Street, which places it at the 2,000

such an extent that they are approximately

consumer confidence all trending in the juncture between the Jervis Shopping

10% ahead of pre-crisis levels of 2008, 1,000

right direction from an investor’s point Centre, Arnotts and the Ilac Centre. More

retail values remain approximately 10%

of view. recently, Elvery’s Sports moved from 0

below. Strong discounting and price

Arnotts to let 808 sq m in Q1 2017 under 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

With the recovery of the labour market deflation are two factors behind the 2017

a ten-year lease at 18 Henry Street for

bringing employment back to 2006 difference, and encapsulate the

a Zone A rent of €4,413 psm. Source: Knight Frank Research

levels, wage inflation has begun to take competitive pressures faced by retailers

hold – average hourly earnings are who are pitching their products to a value

FIGURE 1

Retail Sales Index (Excluding fuel, motor and bar sales)

RET

130

REN AIL

120

TS

110

ON

FOR HENRY S

100

PRIM TREE

E ZO T AR

NE A E €4

SPAC ,850

90

Value E PSM

Volume

80

2010 2011 2012 2013 2014 2015 2016 Q2

2017

Source: CSO

2 3THE HENRY STREET REPORT RESEARCH

HENRY STREET

1 5 GPO Buildings 1 Former Clery’s 2 Dublin Central 3 Ilac Shopping

2 Centre 4 7- 9 Henry Street

3 53 Jervis 1 36 Henry Street

Estimated Sale Price: €8,500,000 Department Store Developer: Hammerson Developer: Hammerson & Irish Life Developer: Fitzwilliam Shopping Centre Date: Q4 2014

Yield: NIY 4.55% EY 3.25% Developer: Natrium Status: Planning granted Status: Completed Capital Partners Developer: Arcadia Group Tenant: iConnect

Sold: Q2 2015 Status: Planning granted Retail space: 56,155 sq m Retail space: 735 sq m Status: Under Construction Status: Completed Owner: Hammerson

Buyer: Irish Life Retail space: 3,478 sq m Note: Total planning permission Note: Amalgamation and extension of Retail space: 3,783 sq m Retail space: 1,858 sq m Accommodation: 492 sq m

Note: Planning permission allows granted for this mixed-use existing retail units to incorporate part Note: Consists of the creation of Note: Consisted of the amalgamation Rent: €160,000 pa

for two medium sized units at development extends to of covered walkway as internal space a single retail unit via the separation of three retail units into one single unit Zone A: €1,841 psm

basement, ground and first floors 158,000 sq m of 7-9 Henry Street from Arnotts with

2 35 Henry Street completion due for September 2018

Sale Price: €9,500,000 2 37 Henry Street

Yield: NIY 4.27% EY 3.50%

Date: Q4 2015

DOM

Sold: Q4 2016

Tenant: eir

Buyer: Friends First

Owner: Hammerson

Accommodation: N/A

INIC

Rent: €215,000 pa

3 42-43 Henry Street Zone A: €2,917 psm

KING

STR

Sale Price: €20,500,000

Yield: NIY 4.04% EY 3.88% 3 22-23 Henry Street

LOW

S INN

Sold: Q2 2017 Date: Q3 2015

Buyer: AEW Tenant: Pull & Bear

ER

Owner: SSGA

STRE

Cineworld Accommodation: 632 sq m

ET

STRE

4 18-21 Henry Street Rent: €375,000 pa

LL

RNE

Zone A: €3,014 psm

ET

Estimated Sale Price: €34,000,000

Yield: NIY 3.66% EY 3.93% PA

Sold: Q4 2014

Buyer: Irish Life

4 21 Henry Street

Date: Q3 2016

Tenant: The Health Store

Owner: Irish Life

5 17 Henry Street Accommodation: 332 sq m

Sale Price: €3,500,000 Rent: €200,000 pa

MOO

Yield: NIY 6.02% EY 7.83% Zone A: €4,004 psm

Sold: Q3 2014

Buyer: IPUT

RE S

O’CONNELL STREET

5 18 Henry Street

Date: Q1 2017

Ilac

TREE

Tenant: Elverys Sports

6 51 Henry Street Shopping 2 Owner: Irish Life

Estimated Sale Price: €5,600,000 Centre 3 Accommodation: 808 sq m

T

Yield: NIY 3.39% EY 3.75% Rent: €460,000 pa

Sold: Q2 2015 Zone A: €4,413 psm

Buyer: Irish Life

6 45 Henry Street

7 52 Henry Street For Let: Q3 2017

Estimated Sale Price: €7,100,000 Owner: IPUT

Yield: NIY 4.05% EY 3.50% Accommodation: 402 sq m

Sold: Q2 2015 Quoting Rent: €420,000 pa

Buyer: Irish Life

8 Zone A: €3,660 psm

LIFESTYLE SPORTS

2 1

DUNNES ST

9 7 6 7 6

RIVER ISLAND

ANN'S BAKERY

2

DEBENHAMS

JD SPORTS

VODAF D

ICONNECT

LET AG

CARROLLS

BAG CITY

PENNEYS

DIFFNEY

TOURSIT 7 46-47 Henry Street

THREE

DIESEL

MANGO

DEALZ

STAR

TO LET

JERVIS STREET

BUCKS

LUSH

ZARA

EVANS

H&M

8 43-44 Mary Street

ORES

3 INFO

EIR

ONE

REE

EIR

BUTLERS Date: Q1 2014

Sale Price: €17,000,000 VODAPHONE

GINOS Tenant: Mango

Yield: NIY 4.76% EY 3.99% PETER MARKS MARY STREET CARPHONE WAREHOUSE HENRY STREET DIRECT SPORTS SWAROVSKI PANDORA

LET Owner: Irish Life

Sold: Q4 2014 AGREED

HICKEYS

Accommodation: 1,797 sq m

POST OFFICE

BOOTS

HEALTH MIST

KORKYS

DIRECTION

FIELDS

CLARKS

SPARY

HAIR

JD SPOR

GAME STOP

HOLLAND

ELVERYS

HICKEYS

VISION

OFFICE

PULL &

NEXT

SKECHERS

MARKS & SPENCERS

ANN SUMMERS

THREE

TOPSHOP

ALDO

H SAMUEL

McDONALDS

FOREVER 21

Buyer: SSGA 9 Rent: €650,000 pa

1

CHE

1 Zone A: €3,444 psm

EXPRES

STORE

BEAR

TS

SPORTS

SUGAR DOLLS

& BARRET

5 4

4 3

S

9 14-16 Mary Street 5 4

8 8 3 Henry Street

T

Sale Price: €17,000,000 GPO Arcade

Yield: NIY 4.13% EY 4.04%

5 Date: Q1 2016

Tenant: Ann Summers

Sold: Q3 2017

Buyer: SSGA Jervis Owner: Irish Life

Shopping Arnotts Former Clery's Accommodation: 345 sq m

LIFFEY STREET

Department Rent: €360,000 pa

Centre Department Zone A: €4,585 psm

Store Store

Key

Lettings 9 39 Mary Street

Sales Date: Q3 2015

Tenant: Dealz

Significant developments Owner: Irish Life

Luas Cross City Line Accommodation: 431 sq m

Rent: €275,000 pa

Luas Red Line Zone A: €3,401 psm

ABBEY STREET

4 5THE HENRY STREET REPORT RESEARCH

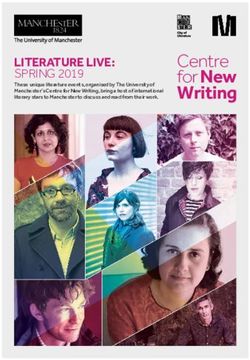

Investment More recent transactions of note include

SSGA’s purchase of the McDonald’s

Institutional investment competition for tenanted 14-16 Mary Street in Q3 2017 for

“AEW’s acquisition prime retail assets in Dublin has benefited €17.0 million at a net initial yield of 4.13%.

is a timely indicator Henry Street and resulted in yields In a welcome development, international

declining from 6.5% in 2011 to 3.75% now.

that there is still Mirroring their activity in Grafton Street,

fund AEW completed the purchase of

42-43 Henry Street for €20.5 million in Q2

value to be had in Irish Life have been a key long-term 2017 representing a net initial yield of 4.04%.

stakeholder on Henry Street, having built

Dublin’s prime retail up a substantial portfolio of assets through

The property is let to the Arcadia Group Ltd,

trading as Evans, and has an unexpired

investment market the years. Chief amongst these is their lease term of over three years and will sit in

50% stake in the Ilac Centre – an acronym

when viewed in a of ‘Irish Life Assurance Company’ – which

its City Retail Fund, a fund targeting prime

high street retail in Europe. It is unlikely that

European context.” was the first city centre shopping centre in Evans will seek to renew the lease upon

Dublin and the largest in Ireland when it expiry given they unsuccessfully marketed

opened in 1981. In addition to this core the lease for assignment/sub-lease in 2014.

holding, they own many own door retail

With pan-European portfolio managers

units on Henry Street with their most recent

seeing prime retail as the best way to gain

large acquisition being the purchase of

exposure to an expected pick-up in

18-21 Henry Street as part of the Capital

European consumer spending while

Collection for an estimated €34 million.

mitigating the negative impact of online

RENTS

spending, we perhaps would have expected

FIGURE 3

greater interest from international funds in

Prime Henry Street yields

Dublin high street retail given Ireland’s

8

out-perform growth prospects relative to its

7

European peers. While yield compression

6

has been significant, it is interesting to note

5

that of 27 major European cities tracked by

%

4

Knight Frank, there are still ten cities that are

3

at least as expensive as Dublin based on

2

current yields. AEW’s acquisition is a timely

1

indicator that there is still value to be had in

0

Dublin’s prime retail investment market

2001

2010

2011

2015

2006

2012

2000

2004

2008

2013

2002

2014

2003

2007

Q3

2017

2009

2005

2016

when viewed in a European context.

Source: Knight Frank Development management. As detailed earlier, much of two new streets under the plan would link

this value creation is being achieved by Upper O’Connell Street and Henry Street,

Henry Street and its environs are currently amalgamating smaller stores into larger boosting consumer draw and enhancing the

undergoing a substantial facelift, with ones in order to meet the demands of large accessibility of the location. In addition, the

a number of redevelopment projects at international retailers. In a similar vein, portion of Dublin Central with frontage onto

various stages of delivery. When finished, Arnotts has just announced that they will Henry Street should significantly strengthen

these projects have the cumulative inject a further €4.0 million in capital the retail offering of the GPO end of the

potential to significantly augment Henry expenditure into the store following the street which has struggled to attract

Street’s retail appeal. €2.5 million commitment announced last high-end retailers, owing to the presence of

Leading much of this change is Hammerson, year, with a major component of this a number of small and poorly configured

PRIME YIELDS who have acquired a significant interest in

the area following their acquisition of Project

expected to be spent on reconfiguring the

store. Meanwhile, following a deal with the

retail units.

CURRENTLY STAND AT On the eastern side of O’Connell Street,

3.75%

Jewel from NAMA in 2015, which included a Westin Family, Noel Smyth has started

the redevelopment of the former Clery’s

50% stake in the Ilac Centre as well as the construction to separate 7-9 Henry Street

Department Store will provide for 3,478

Dublin Central site. At the Ilac Centre they, from the Arnotts store in order to create an

sq m of retail and will re-establish the street

along with joint venture partner Irish Life, independent retail unit which will consist

as a retail destination once again, having

have recently completed the reconfiguration of 3,783 sq m of retail space.

become increasingly dominated by food

of ten smaller units into five larger ones, with Long-term, however, the real catalyst for and beverage retailers in recent times. The

the rental uplift achieved, returning twice the change will be Hammerson’s ‘Dublin Clery’s and Dublin Central redevelopments

€1.5 million capital expenditure invested. Central’ project. Assembled over a decade along with the addition of two Luas stops on

With the Ilac Centre achieving rents of about by Chartered Land, the five acre city centre the new Cross City Line will bring increased

a third of Dundrum – despite having the site has planning permission for 158,000 footfall to O’Connell Street and Henry

same annual footfall of approximately 18 sq m of mixed-uses. With the majority of Street. The linking with the Luas Green Line

million – there is a clear opportunity to the development fronting onto Upper will help the location make inroads into the

enhance returns through active asset O’Connell Street, the proposed addition of south-side retail catchment area.

6 7RESEARCH

John Ring, Head of Research

john.ring@ie.knightfrank.com

Robert O’Connor, Research Analyst

robert.oconnor@ie.knightfrank.com

CAPITAL MARKETS/RETAIL

Adrian Trueick, Director

adrian.trueick@ie.knightfrank.com

Peter Flanagan, Director

peter.flanagan@ie.knightfrank.com

Ross Fogarty, Director

ross.fogarty@ie.knightfrank.com

Shaun Collins, Surveyor

shaun.collins@ie.knightfrank.com

© HT Meagher O’Reilly trading as Knight Frank

This report is published for general information only and not to

be relied upon in any way. Although high standards have been

used in the preparation of the information, analysis, views

and projections presented in this report, no responsibility or

RECENT MARKET-LEADING RESEARCH PUBLICATIONS liability whatsoever can be accepted by HT Meagher O’Reilly

trading as Knight Frank for any loss or damage resultant

from any use of, reliance on or reference to the contents

of this document. As a general report, this material does

RESEARCH RESEARCH

not necessarily represent the view of HT Meagher O’Reilly

THE 2018 REPORT trading as Knight Frank in relation to particular properties

or projects. Reproduction of this report in whole or in part

is not allowed without prior written approval of HT Meagher

THE FUTURE

O’Reilly trading as Knight Frank to the form and content

OF REAL ESTATE

TH E TRE N DS SHA P I N G

40 LE A D I N G C I TI E S within which it appears. HT Meagher O’Reilly trading as

COLLEGE STUDENT Knight Frank, Registered in Ireland No. 385044, PSR Reg.

ACCOMMODATION ELON

SURVEY MUSK DUBLIN

OFFICE MARKET OVERVIEW

DUBLIN

STUDENT HOUSING REPORT

No. 001266. HT Meagher O’Reilly New Homes Limited trading

as Knight Frank, Registered in Ireland No. 428289, PSR

TR A I N S, R O C KETS Q2 2017 2017

& S OL A R EN ER GY

GLO B A L CI TI E S

KNIGHTFRANK.COM/GLOBALCITIES

Reg. No. 001880. Registered Office – 20-21 Upper Pembroke

NGKF.COM/GLOBALCITIES 4th Edition

OCCUPIER TRENDS INVESTMENT TRENDS MARKET OUTLOOK TRENDS ANALYSIS OUTLOOK

College student Global cities Report Dublin Office Market Dublin Student Street, Dublin 2.

Accommodation Survey - 2018 Overview - Q2 2017 Housing Report - 2017

Knight Frank Research Reports are available at KnightFrank.com/ResearchYou can also read