Top Risks For The Global Insurance Industry - Could COVID-19's second wave shake up the sector? - S&P Global

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Top Risks For The Mario Chakar

Associate

Global Insurance Industry Insurance Ratings

Nov. 17, 2020

Could COVID-19’s second wave shake up the sector?Contents

Key Takeaways 3

Risk Categories 5

Developed EMEA Key Risks 7

Developing EMEA Key Risks 13

Asia-Pacific Key Risks 19

North America Key Risks 25

Latin America Key Risks 31

Analytical Contacts 37

2Key Takeaways

– The impact of COVID-19 on global insurance markets is largely felt through asset

risks, notably capital markets volatility, and weaker premium growth prospects.

– We expect most COVID-19-related losses (business interruption, event cancellation,

etc.) to be picked up by reinsurers, so primary insurers' technical performance is

unlikely to deteriorate materially.

– Strict lockdown measures helped maintain satisfactory performance, as motor and

medical claims had a positive impact on loss ratios.

– Developed markets, particularly life ones, are likely to shrink in real terms as a

result of the economic slowdown.

– Developing markets, through their riskier asset allocation, will likely experience more

declines in return on equity than developed markets.

– Ultralow interest rates mean that the most significant source of risk to insurers is

the performance of investments, especially life insurers with guaranteed back books.

3Insurance | Relative Resilience, Risks Remain

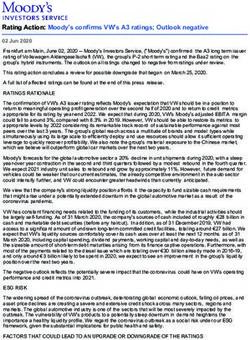

2020 Insurance Rating Actions In Context: For Insurance Capital,

Quantity And Quality Matter

– Insurance downgrades this year have

CreditWatch

Downgrade Outlook revision

placement

been almost exclusively linked to

sovereign rating changes.

– Outlook changes occurred for issuers

Global C&G with thinner capital buffers and

those most impacted by financial

Global Insurance market volatility.

– We expect insurance ratings to

EMEA continue to show resilience, but risks

remain from: investment portfolio

North America exposure, business lines most

acutely affected by the pandemic,

Asia-Pacific

wider pressures on investment

returns, low interest rate, and lower

Latin America

economic growth.

0 10 20 30 40 50

– Since second-quarter 2020, the

% of ratings

following sectors have carried

negative sector outlooks: U.S.,

Canada, Australian mortgage

insurance, global reinsurance, APAC

C&G--Corporates & Governments. EMEA--Europe, the Middle East, and Africa. life, and Latin America.

Source: S&P Global Ratings.

4Top Risks For The Global Insurance Sectors

Risk Category Description

Investment performance risk Capturing financial markets risks, including interest rates, mark to market, and asset quality.

Exposure to high-risk assets High-risk assets typically include equities (listed and unlisted), real estate, fixed-income investments

or deposits in institutions that are rated 'BB+' or lower, and unrated bonds and loans.

Country risk Risk factor taking into account considerations such as macroeconomic risk, sovereign rating

limitations, geopolitical, and rule of law risks.

Intense competitive environment Whether the market is concentrated with a few players or contains a high number of smaller ones, an

intense competitive environment could lead to price wars and hurt profitability.

Muted market growth prospects The lack of potential for premium growth in a market, either because it is mature or due to adverse

macroeconomic conditions, with high inflation resulting in near-zero (or negative) real growth.

Weak technical results An industry where technical performance, typically measured by combined ratios (non-life) and return

on assets (life) is loss-making.

Exposure to natural catastrophes Markets with material exposure to climate risk, notably, earthquakes, hurricanes, and other natural

disasters.

Litigious legal system A sector where litigation often leads to lengthy court cases, increasing the tail of an insurer's

liabilities, and consequently, resulting in unpredictable claims settlements.

Government and regulatory policy Markets exposed to changes in government or regulatory policies, often resulting in material impacts

risks on insurers' business models and/or profitability.

Foreign exchange impact Reflects the impact foreign exchange risks could have on profitability.

Other Risk classification that does not fit any of the 10 categories described above.

5Key Risks

Developed EMEA Property/Casualty Insurance

German-speaking

–Austria

–Germany

–Switzerland

Nordic

–Denmark

–Finland

–Norway

–Sweden

Northern Europe

–Belgium

–France

–Ireland

–Netherlands

–U.K.

Southern Europe

–Italy

–Portugal

–Spain

Source: S&P Global Ratings.

7Developed EMEA P/C | Investment Performance Is

A Major Risk

Investment performance risk Intense competitive environment Exposure to high risk assets Exposure to natural catastrophes

Government and regulatory policy risks Country risk Litigious legal system Foreign exchange impact

Weak technical results Other

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– To a lesser extent than life insurers, the low interest rate environment will likely impact investment

yields for P/C insurers, and consequently ROE.

– Insurers (particularly Nordics) have increased investment leverage to enhance returns through

higher-risk assets, mainly equities.

– The intense competitive environment translates into weaker technical earnings, particularly on

motor and medical lines in the U.K. and Ireland.

– Changes in government and regulatory policies historically resulted in profit volatility, notably in the

U.K. and Ireland (for example, the discount rate in the U.K. used in settling bodily injury claims). The

countries' litigious legal system has also increased product risk, and consequently unpredictable

claims settlements.

– Exposure to natural catastrophes is mainly limited to flooding and weather events such as

hailstorms, windstorms, and torrential rain. Their impact has generally been manageable.

Source: S&P Global Ratings.

8Developed EMEA P/C | Performance Metrics

Capital Markets Volatility To Impact Nordic ROE,

Relatively Stable Combined Ratios

The Result of Insurers' Risky Asset Mix

German-speaking Nordic Northern Europe Southern Europe German-speaking Nordic Northern Europe Southern Europe

100.0% 16%

97.5%

12%

95.0%

8%

92.5%

4%

90.0%

87.5% 0%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

South Europe's Economic Performance Going Into

COVID-19 Gives It Solid Push For GWP Growth

German-speaking Nordic Northern Europe Southern Europe

4%

3%

2%

1%

0%

(1%)

2018 2019 2020f 2021f

f--Forecast. ROE—Return on equity. Source: S&P Global Ratings.

9Developed EMEA Life

German-speaking

–Austria

–Germany

–Switzerland

Nordic

–Denmark

–Finland

–Norway

–Sweden

Northern Europe

–Belgium

–France

–Netherlands

–U.K.

Southern Europe

–Italy

–Portugal

–Spain

Source: S&P Global Ratings.

10Developed EMEA Life | Low Interest Rate Risk Is

Pronounced

Investment performance risk Country risk Exposure to high risk assets Government and regulatory policy risks

Intense competitive environment Muted market growth prospects Exposure to natural catastrophes Foreign exchange impact

Weak technical results Other

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– We assess investment performance risk as a key driver of industry risks.

– The ultra low interest rate environment will continue to weigh on life insurers' profitability (ROA and

ROE), particularly those with guaranteed products. This is especially relevant for insurers in the

German-speaking and Nordic regions.

– In search of higher investment yields, some markets are exposed to the volatile equity and real

estate classes. These high-risk assets result in ROE volatility.

– The subdued macroeconomic environment weighs on growth prospects, where we expect real

premium growth to remain flat at best in 2020-2021.

– Despite competitive market dynamics, most markets are dominated by a few large players that

share the market's premiums and profits.

Source: S&P Global Ratings.

11Developed EMEA Life | Performance Metrics

Conservative Investment Portfolio Limits ROA Capital Markets Volatility To Impact Nordic ROE In

Volatility Outside The Nordic Region 2020

German-speaking Nordic Northern Europe Southern Europe German-speaking Nordic Northern Europe Southern Europe

2.5% 16%

2.0% 12%

1.5% 8%

1.0% 4%

0.5% 0%

0.0% (4%)

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Real Premium Growth To Remain Flat At Best

German-speaking Nordic Northern Europe Southern Europe

10%

5%

0%

(5%)

(10%)

2018 2019 2020f 2021f

f--Forecast. ROA--Return on assets. ROE--Return on equity. Source: S&P Global Ratings.

12Developing EMEA Property/Casualty

Group 1

–Bahrain

–Jordan

–Kuwait

–Qatar

–Saudi Arabia

–United Arab Emirates

Group 2

–Czech Republic

–Israel

–Poland

–Slovenia

Group 3

–Azerbaijan

–Kazakhstan

–Russia

–South Africa

–Turkey

Group 4

–Angola

–Kenya

–Morocco

Source: S&P Global Ratings.

13Developing EMEA P/C | Macroeconomic And

Geopolitical Risks Prevalent

Country risk Investment performance risk Intense competitive environment Muted market growth prospects

Foreign exchange impact Weak technical results Exposure to high-risk assets Government and regulatory policy risks

Exposure to natural catastrophes Other

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– Country risk, particularly sovereign rating caps and geopolitical risk, is pronounced for many of

EMEA’s developing sectors, notably in the Middle East and North Africa.

– Foreign exchange risk results currency devaluation in non-pegged regimes, which increases the

cost of claims for the dominant motor and medical lines. This is particularly the case in Turkey, South

Africa, and Angola.

– Low market growth prospects in the absence of new mandatory covers increases competitive

pressures, which often results in poor technical performance.

– Exposure to high-risk assets (equities and real estate) results in earnings volatility.

Source: S&P Global Ratings.

14Developing EMEA P/C | Performance Metrics

Combined Ratios Feel Little Impact From COVID- ROE Likely To Take A Hit From Equity Volatility,

19 As Russia/CIS Drives Deterioration In Group 3 Lower Interest Rates, And Lower Oil Prices

Group 1 Group 2 Group 3 Group 4 Group 1 Group 2 Group 3 Group 4

106% 30%

25%

102%

20%

98% 15%

10%

94%

5%

90% 0%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Real GWP Growth Materially Impacted in CEE By

Currency Devaluation Increases Claims Costs

The Economic Downturn, But Will Rebound

Group 1 Group 2 Group 3 Group 4 USD per AOA USD per TRY USD per ZAR USD per RUB

8% 40%

20%

4%

0%

0% (20%)

(40%)

(4%)

(60%)

(8%) (80%)

2018 2019 2020f 2021f Oct-17 Mar-18 Aug-18 Jan-19 Jun-19 Nov-19 Apr-20 Sep-20

AOA--Angolan kwanza. CEE--Central and Eastern European countries. f--Forecast. ROA--Return on assets. ROE--Return on equity. TRY--Turkish new lira. USD--U.S.

dollar. RUB--Russian ruble. ZAR--South African rand. Source: S&P Global Ratings.

15Developing EMEA Life

Source: S&P Global Ratings.

16Developing EMEA Life | Weak Macroeconomic

Conditions Impede Growth Potential

Country risk Investment performance risk Muted market growth prospects Government and regulatory policy risks Foreign exchange impact Litigious legal system Other

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– In EMEA's developing markets, insurance sectors have little in common, but country risks and

government and regulatory risks are more prevalent than in developed markets.

– Prolonged periods of weak economic conditions, muted growth prospects, together with low levels

of wealth, have led to increased lapse rates, particularly as policyholders find themselves with less

disposable income.

– The low interest rate environment and volatility in capital markets are factors weighing on

profitability.

– Litigation risk on certain unit-linked policies in Czech Republic and Poland.

Source: S&P Global Ratings.

17Developing EMEA Life | Performance Metrics

2020 ROA Supported By Bounce In Israel After A

ROE To Remain Relatively Unaffected

One-Off Reserve Strengthening in 2019

1.2%

15%

1.0%

14%

0.8%

13%

0.6%

12%

0.4%

0.2% 11%

0.0% 10%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Real Premium Growth Remains Albeit Below

Historic Levels

14%

12%

10%

8%

6%

4%

2%

0%

2018 2019 2020f 2021f

f--Forecast. ROA--Return on assets. ROE--Return on equity. Source: S&P Global Ratings.

18APAC Property/Casualty

Developed

–Australia

–Hong Kong

–Japan

–Korea

–New Zealand

–Singapore

Developing

–China

–Malaysia

–Taiwan

–Thailand

Source: S&P Global Ratings.

19APAC P/C | Fierce Competition Amid Low Growth

And Exposure To Natural Catastrophes

Intense competitive environment Muted market growth prospects Exposure to natural catastrophes Investment performance risk

Weak technical results Exposure to high-risk assets Government and regulatory policy risks

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– Mature and saturated markets, with some segments producing reasonable returns, resulting in

increased competition.

– Exposure to natural catastrophes, notably tsunamis, earthquakes (Japan and New Zealand), and

flooding (Taiwan and Thailand). We also note an increase in frequency of cat events, such as in

Australia and New Zealand.

– Excessive risk-taking in the investment portfolio, mainly through domestic and foreign equity

investments. This leads to earnings volatility.

– Rising compliance costs and government policy changes (Hong Kong and Malaysia) make the

operating environment uncertain.

Source: S&P Global Ratings.

20APAC P/C | Performance Metrics

Deterioration In ROE, Particularly In Developing

Combined Ratios To Remain Relatively Stable

Markets Unlikely To Bounce Back Materially

Developed Developing Developed Developing

102% 11%

10%

100% 9%

8%

7%

98%

6%

5%

96% 4%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

No Material Impact On Real Premium Growth In

Developing Markets As A Result Of The Pandemic

Group 1 Group 2

10%

8%

6%

4%

2%

0%

2018 2019 2020f 2021f

f--Forecast. ROA—Return on assets. ROE—Return on equity. Source: S&P Global Ratings.

21APAC Life

Developed

–Australia

–Hong Kong

–Japan

–Korea

–New Zealand

–Singapore

Developing

–China

–Malaysia

–Taiwan

–Thailand

Source: S&P Global Ratings.

22APAC Life | Low Interest Rates Are The Source Of

Weak Underwriting Profits

Investment performance risk Weak technical results Muted market growth prospects Intense competitive environment

Government and regulatory policy risks Exposure to high-risk assets Foreign exchange impact Other

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– The low interest rate environment and volatility in financial markets mean that investment returns

are unlikely to be a major offsetting factor to improve ROA and ROE.

– Legacy high-yield guaranteed policies and structural duration mismatch cause material ALM risk,

which leads to weak technical results.

– Life insurance technical results have been dampened by weaker-than-expected experience across

disability lines.

– The economic slowdown caused by COVID-19 means that premium growth will be subdued in 2020,

with developed markets likely to shrink materially in real terms.

– Increased regulatory scrutiny in relation to sales and distribution, notably in Australia and New

Zealand.

Source: S&P Global Ratings.

23APAC Life | Performance Metrics

Developing Markets' ROA Unlikely To Recover To Developing Markets' Riskier Assets to Generate

Pre-Pandemic Levels in 2021 Higher ROE Than Developed Markets

Developed Developing Developed Developing

1.1% 16%

1.0% 14%

12%

0.9%

10%

0.8%

8%

0.7%

6%

0.6% 4%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Developed Markets To Shrink While China

Continues To Drive Growth in Developing APAC

Developed Developing

15%

10%

5%

0%

(5%)

(10%)

2018 2019 2020f 2021f

f--Forecast. ROA—Return on assets. ROE—Return on equity. Source: S&P Global Ratings.

24North America Property/Casualty

Source: S&P Global Ratings.

25North America P/C | Catastrophe Risk And Litigious

Claims Increase Claims Severity

Exposure to natural catastrophes Investment performance risk Litigious legal system Muted market growth prospects

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– The weaker investment environment, namely due to low interest rates and volatile equity markets,

will continue to suppress investment performance.

– Macroeconomic pressures will continue to weigh on the market's growth prospects.

– The U.S.'s legal system is generally litigious, resulting in unpredictable claims settlements and

related reserve volatility arising from unanticipated spikes in claims severity or frequency trends

than in most other markets.

– Material exposure to natural perils, especially hurricanes, tornados, and wildfires, the latter

becoming more prevalent in recent years. These losses tend to be borne by insurers as exposures are

within retention levels.

Source: S&P Global Ratings.

26North America P/C | Performance Metrics

Net Combined Ratios Not Materially Impacted By

Some Dip In ROE From Financial Market Volatility

COVID-19

Canada U.S. Canada U.S.

101% 10%

100% 8%

99% 6%

98% 4%

97% 2%

0%

96%

2018 2019 2020f 2021f

2018 2019 2020f 2021f

Source: S&P Global Ratings. f--Forecast. Source: S&P Global Ratings. f--Forecast.

Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved. Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved.

Drop In Real Premium Growth, Particularly The

U.S., Before A Rebound In 2021

Canada U.S.

4%

2%

0%

(2%)

(4%)

(6%)

2018 2019 2020f 2021f

Source: S&P Global Ratings. f--Forecast.

Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved.

f--Forecast. ROA—Return on assets. ROE—Return on equity. Source: S&P Global Ratings.

27North America Life

Source: S&P Global Ratings.

28North America Life | Weak Macroeconomic

Conditions Amid Rising Counterparty Credit Risk

Investment performance risk Weak technical results Country risk

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– Ultralow interest rates, which we expect will remain for longer, coupled with guaranteed policies,

give rise to weak technical performance.

– Macroeconomic risk, namely weak economic growth and higher unemployment in the developed

U.S. and Canadian markets, make for a difficult operating environment.

– Financial market risk arising from increased credit risk in corporate bonds, together with significant

losses in equity markets.

Source: S&P Global Ratings.

29North America Life | Performance Metrics

Low Interest Rates Coupled With High Guarantees Equity Market Losses To Depress ROE In 2020

To Impact ROA Before A Considerable Rebound In 2021

Canada U.S. Canada U.S.

1.2% 11%

1.0% 10%

0.8% 9%

8%

0.6%

7%

0.4%

6%

0.2%

5%

0.0% 4%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Source: S&P Global Ratings. f--Forecast. Source: S&P Global Ratings. f--Forecast.

Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved. Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved.

Sharp Decline In Real Premium Growth In 2020 To

Recover In 2021

Canada U.S.

10%

5%

0%

(5%)

(10%)

2018 2019 2020f 2021f

Source: S&P Global Ratings. f--Forecast.

Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved.

f--Forecast. ROA—Return on assets. ROE—Return on equity. Source: S&P Global Ratings.

30Latin America Property/Casualty

Source: S&P Global Ratings.

31Latin America P/C | Macroeconomic And Political

Instability Hinder Growth Prospects

Country risk Muted market growth prospects Investment performance risk Weak technical results Forex impact

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– Weak technical results due to a high cost base and aggressive competition, with insurers relying on

investment returns to produce overall net profits.

– Exposure to currency devaluation, particularly on the largest lines of business (motor and medical).

– The economic downturn caused by COVID-19 will have an adverse effect on potential premium

growth for the sectors.

– A history of sovereign defaults, notably in Argentina, exposes insurers' credit quality. Unstable

political environments also pose a drag on insurance sectors.

Source: S&P Global Ratings.

32Latin America P/C | Performance Metrics

Some Deterioration In Combined Ratios, Partly Adverse Currency Movements And Lockdown

Reflecting Foreign Exchange Movements Measures To Impact ROE

102% 15%

101% 14%

100% 13%

99% 12%

98% 11%

97% 10%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Markets To Shrink In Real Terms In 2020 Before A

Currency Devaluation Increases Claims Costs

Strong Rebound In 2021

4% USD per ARS USD per BRL USD per COP USD per MXN

3%

20%

2%

1% 0%

0%

(20%)

(1%)

(2%) (40%)

(3%)

(60%)

(4%)

(5%) (80%)

2018 2019 2020f 2021f Oct-17 Mar-18 Aug-18 Jan-19 Jun-19 Nov-19 Apr-20 Sep-20

ARS--Argentine peso. BRL--Brazilian real. COP--Colombian peso. f--Forecast. MXN--Mexican peso. ROA--Return on assets. ROE--Return on equity. USD--U.S. dollar.

Source: S&P Global Ratings.

33Latin America Life

Source: S&P Global Ratings.

34Latin America Life | Weak Growth Potential Amid A

Difficult Macroeconomic Environment

Country risk Investment performance risk Muted market growth prospects Government and regulatory policy risks

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

– Difficult management of asset-liability mismatches for insurers carrying long-tail businesses such

as workers' compensation and annuities in Colombia.

– Unfavorable country risk, characterized by unstable political environments and an economic

slowdown attributed to COVID-19, and relatively high inflation.

– Lower disposable income for consumers means that life insurance sectors will likely remain

immature and underpenetrated.

Source: S&P Global Ratings.

35Latin America Life | Performance Metrics

ROA To Feel Impact Of Lower Investment Returns Interest Rates To Keep High, But Reduced ROE

And Higher Lapse Rates Levels In A High Inflationary Environment

3.0% 29%

28%

2.8%

27%

2.6% 26%

2.4% 25%

24%

2.2%

23%

2.0% 22%

1.8% 21%

2018 2019 2020f 2021f 2018 2019 2020f 2021f

Lockdown Measures To Have A Sizable Impact On

Real Premium Growth In 2020

12%

8%

4%

0%

(4%)

(8%)

2018 2019 2020f 2021f

Note: f--Forecast. ROA--Return on assets. ROE--Return on equity. Source: S&P Global Ratings.

36Analytical Contacts

Global Global

Mario Chakar Ali Karakuyu

London London

+44-20-7176-7070 +44-20-7176-7301

mario.chakar@spglobal.com ali.karakuyu@spglobal.com

Developed EMEA Developed EMEA

Volker Kudszus Mark D Nicholson

Frankfurt London

+49-69-3399-9192 +44-20-7176-7991

volker.kudszus@spglobal.com mark.nicholson@spglobal.com

Asia-Pacific North America

Craig Bennett John Iten

Melbourne Princeton

+61-3-9631-2197 +1-212-438-1757

craig.bennett@spglobal.com john.iten@spglobal.com

Latin America

Alfredo Calvo

Mexico City

+52-55-5081-4436

alfredo.calvo@spglobal.com

37Copyright © 2020 by Standard & Poor’s Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified,

reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial

Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors,

officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any

data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY

WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S

FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any

party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost

income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's

opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and

do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is

not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P

does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform

an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are

not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the

right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal,

or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain

business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain

nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its

opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.spcapitaliq.com (subscription)

and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at

www.standardandpoors.com/usratingsfees.

Australia: S&P Global Ratings Australia Pty Ltd holds Australian financial services license number 337565 under the Corporations Act 2001. S&P Global Ratings' credit ratings and

related research are not intended for and must not be distributed to any person in Australia other than a wholesale client (as defined in Chapter 7 of the Corporations Act).

STANDARD & POOR'S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor's Financial Services LLC.

spglobal.com/ratings

38You can also read