What Australia's new independent traveller did this Summer - Mapping domestic tourism patterns & behaviour in the era of COVID-19

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

What Australia’s new independent traveller did this Summer Mapping domestic tourism patterns & behaviour in the era of COVID-19

Executive Summary Nick Baker, CEO Much like COVID-19 caused mass disruption of industries and fluctuations in browsing, buying behaviour and media consumption, so too did it change the travel app landscape. Phocuswire reported the majority of travel apps saw little to no growth in 2020. Notable exceptions were Airbnb, Uber and Disneyland who filled essential needs for landlocked travellers. As the pandemic continued, TripTech’s outdoor and independent travel planning app CamperMate saw consistent growth as the domestic traveller searched for new experiences, helping the app reach number one on the Google Play Store in Australia in January 2021. At TripTech we’ve been analysing the travel movements of the independent traveller through our network of apps since pre COVID-19. This enables us to provide a unique perspective on travel prior to, and throughout the course of the pandemic, including what the domestic audience is searching for, where they are going, and in-trip travel behaviours. The Summer Report highlights some real opportunities for local, regional and state tourism regions to promote travel to the domestic market this year and prepare to welcome overseas visitors when the gates finally do open.

Key takeaways Australians have stepped up and regions have benefitted A substantial increase in TripTech app usage by the domestic traveller reveals Australians’ desires to get out on the road. Is it strong enough to take us through 2021? That remains to be seen, but Australians have filled some of the gap left by international tourism. We’ve learned about their unique in-trip behaviour and trends in search, spend, points of interest and passenger movement as a result of the continued ‘new normal’ and mass travel uncertainty. Experiences remain a challenge Prompting travellers to explore new, out of the way experiences remains a challenge yet our greatest opportunity, and TripTech data shows an uptick in categories like Walks & Trails, Wineries & Breweries and regional towns across the country. The road trip is evolving The rise of the road trip is evident in the strength of the camping and caravanning sector, however the focus has shifted away from iconic road trip destinations to more dynamic, regional trips.

04 Introduction 06 The domestic traveller is building strength 11 Interactions with POIs (Points of Interest) 12 The evolution of the Australian road trip 16 Caravan Parks Case Study: Reflections Holiday Parks

Introduction 1

Much has been said about the Australian traveller and their ability to

sustain a struggling tourism industry. Landlocked by border closures, the

new independent traveller has been travelling closer to home, and hopes

have been pinned on their ability to fill the gap left by the international

traveller. TripTech data shows that the domestic market’s thirst for

planning, booking and exploring Australia has indeed aided in the recovery

of tourism, with a 43% increase in engagement over summer (Dec 2020 –

Jan 2021) compared to the previous year.

But what changes in domestic tourism have been born from the new

COVID-19 landscape to result in this shift, where exactly have domestic

travellers stepped up, and which regions have benefitted?

04By geofencing each square kilometre of Australia through a unique grid

reference we are able to identify fluctuations in arrivals, visitation, behaviour

and passenger movement.

Our Australia TripTech Summer Report includes real-time data from our

specialised dashboards including traveller heat maps, points of interest,

regional statistics, search behaviour and more, to equip industries, brands

and agencies with strategies to navigate 2021 and beyond.

“ These exclusive insights reveal the

thoughts and actions of the domestic

traveller, where they visit, what they

engaged with in-trip and where they have

come from in a continued effort to give

industry timely insights to inform their

sales and marketing initiatives.

Grant Webster, CEO of THL (Tourism Holdings Ltd)

”

052

The domestic traveller is

building strength

As border closures became the norm, Australians proved they would

not be deterred in their quest to plan, search for and experience a much-

needed summer vacation.

From December 2019 to January 2020, international travellers accounted

for 37% of total users across the TripTech network of camping and road

trip apps. Surprisingly, unique users (international and domestic) were still

up 6.9% from December 2020 to January 2021 compared to the previous

year. This spike can be attributed to a 43% increase in domestic travellers

using TripTech’s apps during this period.

The strength of the domestic traveller has filled the gap left by international

visitors, however the international market purchased 70% more in-trip

during January 2020 than the domestic audience.

43% increase in

domestic travellers

06State traffic by the numbers

Over the same summer time period, Queensland saw the lowest percentage

decrease (-1%) across total users (international and domestic) with domestic

activity rising by 36% year on year (YOY). Tasmania and the ACT saw the

largest decrease over that time period.

The biggest state performers* amongst domestic users were Western

Australia (52% YOY) and Northern Territory (43% YOY).

Domestic Devices Dec19/Jan20

Domestic Devices Dec20/Jan21

(Percentage against prior period)

+29%

+26%

+36%

+52%

+38%

+14%

+43% -2%

NT QLD SA TAS VIC WA NSW ACT

07Interstate Travel

While total visitation (domestic and international) was up, there was a 63%

decrease in interstate travel over the same period.

Source market data for NSW, QLD and VIC showed an overall decrease of 33%

to 49%. The chart below includes a breakdown by state and the top two source

markets for each state.

Visitors from NSW Visitors from VIC

-33.70% -41.30%

Visitors from QLD Visitors from VIC

-31.70% -43.40%

Visitors from NSW Visitors from QLD

-41.70% -49.20%

Percentage of visitors to NSW, QLD and VIC

from summer 2019/20 to summer 2020/21

With source markets down overall, any increases in state activity cannot

be attributed to interstate travel.

08Regions and Councils hardest hit last summer

Many of Australia’s regional areas with iconic places of interest rely heavily on the

international traveller and as a result, the following areas have suffered greatly.

Regions

• Lasseter

• Murray East

• The Murray

• Wilderness West

• Murray East

• The Murray • Great Ocean Road

• Phillip Island

• Western Grampians

• Murray East

• The Murray

Councils

• Greater Hume Shire Council

• Corangamite Shire

• Colac Otway Shire

• Surf Coast Shire

• Moyne Shire

Councils found within the Great Southern Touring Route have seen the

greatest decrease of travellers over summer (Dec 2019 - Jan 2020) YOY.

09These Regions and Councils have fared well

The following areas saw positive signs of growth aided by the growing domestic

audience, hinting at a 2021 recovery for these less iconic destinations:

Regions

• Darling Downs

• Australia’s

North West

• Outback NSW

• New England North West

• Central NSW

Councils

• Walcha Council

• Broken Hill City Council

• Mid-Western Regional Council

• Walgett Shire Council

• Uia Whyalla

10Interactions with POIs

(Points of Interest)

3

A recent survey by KPMG reported that 61% of Australian respondents said they were

planning on booking a holiday between January and June 2021, further demonstrating

positive signs for independent travel in the months to come.

Domestic engagement showed the largest increases in the following search categories

Australia-wide:

Things to do

Road Warnings

Campgrounds

Accommodation

Wineries & Breweries (+381%) and Walks & Trails (+228%) saw the largest increase in

subcategory engagement within the Things to Do category overall.

Campgrounds and Things to Do were the most interacted categories in summer 20/21.

Other notable spikes in activities included fishing, culture and nature-based activities.

The Accommodation category saw a 152% increase in app engagement in summer 20/21

compared with the same time period the previous year.

The wariness of domestic travellers with respect to border closures is evident in search

category behaviour for Road Warnings which showed a 459% summer increase YOY.

114

The evolution of the

Australian road trip

Australia’s iconic, internationally recognised road trips have suffered

greatly with the decline in international visitors, but this has also spurred

domestic travellers to visit previously less-frequented locations.

The idea of epic road trip journeys has transformed into more regional, less

iconic, experience-driven getaways.

TripTech’s road trip heat maps and real-time data points to emerging

trends in road trips to Western Australia’s South West and the Limestone

Coast in South Australia.

12Adelaide to Darwin

Based on geofences placed along Australia’s iconic Darwin to Adelaide road

trips, TripTech data shows that 65% of recorded visitors moved through

three or more locations during the December 2020 to January 2021 period.

Along the road trip the most common journey over the summer break was

Adelaide City to Victor Harbor and return.

Adelaide

Victor Harbour

Traveller Dwell-Time

South Australia provided 50% of the source

market for the journey. Other large contributors

included Queensland and Victoria.

Western Australia, the third largest source

market for the road trip saw a 6% decrease

compared to the previous year (Dec 2019 - Jan

2020).

When reviewing time of day and its correlation

to road trip app usage, 50% of all traffic on the

trip was recorded between 10am and 5pm.

Traveller Density Clusters

13Great Southern Touring Route

Of the top performing regions, the Great Ocean Road took the biggest hit over the summer

20/21 period with a 52.4% decrease in engagement for the same period year on year.

The state picked up some of the gap with 85% of Victorians captured on the route in summer

20/21 versus 67% the year prior.

However, what was once the most popular destination along the Great Southern Touring

Route (GSTR), the Twelve Apostles dropped to seventh place with a 75% reduction in visitors.

Geelong took the number one spot along the GSTR from December 2020 to January 2021,

followed closely behind by Ballarat.

Summer 2019/20 to summer 2020/21

Heatmap of the 12 Apostles carpark summer 2019/20

Heatmap of the 12 Apostles carpark summer 2020/21

showing a 75% reduction of visitors

As one of Australia’s most internationally recognised icons, this steep decline in the Great

Ocean Road can be directly attributed to the large decline in the international market and

lack of interest as a travel destination for the domestic market over summer.

14Trending search terms

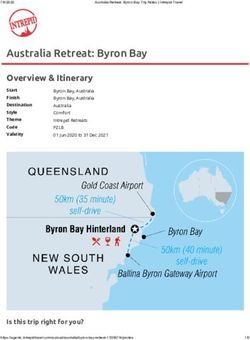

The top 10 search terms in the locations category pointed to increased interest in two key

regions: Western Australia’s South West & Great Southern Region, and South Australia’s

Limestone Coast. This could be an indication of the domestic traveller’s interest in new,

regional journeys. Travel time of at least five hours between major Points of Interest in these

regions also shows positive signs for the desire to travel for extended periods.

Mount Gambier - Robe - Beachport

Mount Gambier saw the highest increase in in-app searches with an increase of 666%

(summer 2019/20 YOY), followed closely behind by Beachport (445%) and Robe (423%).

When broken down by the prior destination travelled, there was an even split between visitors

travelling into the region from both Adelaide and Melbourne, with the majority of travellers

returning back to Adelaide.

While there was a rise in overall domestic visitation, there were less recorded days in the travel

period indicating shorter trips over summer (Dec 2020 - Jan 2021).

50% Outflow

Murraylands

Robe

Beachport

Mount

Gambier

50% Outflow

Great Ocean Road

Limestone Coast Traveller Movements

15Caravan Parks Case

5 Study: Reflections

Holiday Parks

The rise of the road trip and increase in domestic visitors during COVID-19 has aided in the

recovery of the caravan park sector in many parts of the country. According to the Caravan Industry

Association of Australia Accommodation Insights Report, national cabin occupancy rose by 17%

(January 21 YOY).

Stuart Lamont, CEO of Caravan Industry Association of Australia said, “the caravanning and camping

sector is playing a significant role in the recovery of tourism during an unprecedented time. The

industry’s resilience can be credited not only to its ability to provide a safe way to vacation, but as an

outlet for freedom, health and wellness during tough times.”

Despite an overall drop-off in international visitors during summer, TripTech data shows only a

12% decrease in general app engagement (viewing on the app) with Reflections Holidays Parks

between December 2020 to January 2021, compared to the prior year. This highlights rising domestic

engagement attributed to consistent in-app bookings for Reflections Holiday Parks compared to the

same period last year.

Furthermore, visitor numbers, engagement with points of interest and contact requests showed

strong results amongst the domestic market over the December 2020 to January 2021 timeframe:

POI views/taps: 49,000

“ Reflections

Calls: 400+

Website Clicks: 800+ has partnered with the

team at CamperMate for over the last

3 years and their platform has been

instrumental in contributing over

$861,000 in Revenue in FY20.

Michelle Griffin

Group Manager Corporate Services, Reflections Holiday Parks

”

The full report will be detailed in an upcoming Reflections Parks Case Study.

16Australians are in the fortunate position to experience the privilege of travel in

and around their own backyard and campaigns like Tourism Australia’s ‘Holiday

Here This Year’ reminds travellers what’s waiting for them to explore.

In 2021, TripTech is partnering with governments and operators to help

Australians fulfill their domestic travel bucket list by promoting and dispersing

experiences throughout the country. This, combined with the Australian traveller’s

ability to maintain a flexible work schedule and desire to help boost the tourism

economy, may help revive travel to the destinations suffering most.

This report forms part of our Industry Intelligence series which will be published

on an ongoing basis to provide additional opportunities for businesses to connect

with consumers and tailor marketing strategies to suit their needs.

To stay up to date on the latest reports from our Industry Intelligence Series,

follow us on LinkedIn.

17About the Audience

TripTech data is collected from multiple users across our network of branded travel apps.

Users fit within four traveller profile types: the young adventurer, active empty nester,

families and 4WD off roaders and travel for five main reasons:

• Seeking new experiences

• To connect with self

• Meet new friends

• Outdoor adventures

• See and do new things

Sample size data indicates 61% of users are aged 25 to 54 and 27% fit within the 55+

category with a 60/40 split between male and female users.

18How we can help you

navigate 2021

Gain more leads

Are you a tourism operator, park, attraction or accommodation offering? If you want to reach

travellers while they are in app ready to make purchase decisions, talk to us about how to add

your listing to the CamperMate app.

Click here or email Jenny Guala (Partnership Executive) at jenny@campermate.com.au

Access real-time passenger movement data

Do you need more insights to make business decisions or want to access changes in traveller

patterns and behaviour including our visitor economy dashboard?

Click here or email info@triptech.com

For media enquiries

Click here or email Michelle Hatch (PR & Comms Manager) at michelle@triptech.com

Data provided is an indication of travelers based on users of TripTech’s network of travel apps.

Data has been compared across the Dec 2019 - Jan 2020 and Dec 2020 - Jan 2021 timeframe.

* Top performing tourism regions experience the most in app engagement based off unique user ID

19About us

TripTech (a THL & Jayco, Inc. Company) is a travel technology company operating across

Australia and New Zealand. Our apps include CamperMate and custom branded travel

apps in multiple categories. These assets connect businesses to travellers to plan and

book in-trip and the data generated enables comprehensive, real-time dashboards

and reports on tourist movement. This powerful combination arms national and state

tourism offices, local and regional councils, government, media agencies and brands

with access to new audiences and real-time data on their travel patterns and behaviour.

www.triptech.com

The CamperMate app inspires Australians and New Zealanders to explore the magic of

the outdoors through curated experiences, timely deals and the best camping tips for

the independent traveller both young and old at heart.

www.campermate.com.au

TripTech and CamperMate are subsidiaries of THL & Jayco

20www.triptech.com

You can also read