ATLANTA MARKET OVERVIEW - July 2018 - Moran & Company

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

INTRODUCTION

The apartment transaction market appears to be cooling slightly across the country. The US

major metros are currently at a 12-month volume of $39.8B, down 24.6% from $52.8B in

the third quarter of 2016. Similarly, the NCREIF South has dropped 9.6% in just one quarter,

moving from $49.7B to just $44.9B. The Atlanta market has also dropped nearly 19% and

is transacting at $6.9B as opposed to the $8.5B seen in the third quarter of 2017. While the

overall volumes still reflect a very healthy market, this change in direction is important to note

at this late stage of the cycle.

The multifamily fundamentals in Atlanta have remained strong. Occupancies hold steady

between 94-94.5% while effective rents continue to grow in the 3% range. Deliveries of new

apartments in 2018 is anticipated to be 9,704 units, which is down from 11,711 units in

2017; however, absorption of new supply has been strong, meeting the new supply numbers.

In 2017, thirty-three new projects achieved stabilization, and on average it only took them

19 months.

TrendTracker

These strong fundamentals have led many investors to put Atlanta high on their target list,

Printed on 7/18/2018

which has led to several notable transactions already in 2018.

Atlanta Apartment Volume ($) Charlotte Apartment Volume ($) Nashville Apartment Volume ($)

Orlando Apartment Volume ($)

$8B

$6B

Volume in USD

$4B

$2B

$0

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Price floor selections do not apply to Indices or Fundamentals data. Volume displayed as 12 Month Totals. Cap rates and PPU displayed as a 12 Month Average.

Includes property or portfolio sales $2.5 million or greater. Q2 2018 preliminary data..

SOURCE: REAL CAPITAL ANALYTICS

ATLA NTA MA RK E T U P D AT E 2RENT GROWTH

3.1% Y-O-Y EFFECTIVE RENT

GROWTH

94.3% OCCUPANCY RATE AS OF

SECOND QUARTER

8,331 NEW MULTIFAMILY PERMITS

(DOWN 19.67%)

484,554 INVENTORY (TOTAL RENTAL

UNITS)

POPULATION GROWTH

7.8%+ POPULATION GROWTH

2010-2016

5.75M ATLANTA, GA MSA

POPULATION

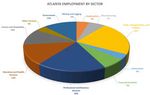

JOB GROWTH

5.8% WEEKLY SALARY INCREASE

(THROUGH MAY)

ANNUAL JOB GROWTH,

46,000 ROLLING 12 MONTHS

THROUGH MAY

INVESTED IN VENUTRE

$480M CAPITAL ENDEAVORS IN

ATLANTA UP SINCE 2016

HOSPITAL AND MEDICAL

$2B OFFICE EXPANSION

UNDERWAY

SOURCE: AXIOMETRICS AND YARDI MATRIX

ATLA NTA MA RK E T U P D AT E 3NOTABLE TRANSACTIONS

Anthem on Ashley Juncture I & II

Sale Price $74, 963, 000 Sale Price $141, 700, 000

Price Per Unit $307, 225 Price Per Unit $253, 036

Price/SF $369 Price/SF $207

Sale Date June 2018 Sale Date March 2018

Number of Units 244 Number of Units 560

Address 720 Ralph McGill Blvd NE Address 910 Deerfield Crossing

Atlanta, GA 30308 Alpharetta, GA 30004

Year Built 2018 Year Built 2017

Total SF 203, 008 Total SF 685, 440

Owner/Buyer Invesco Owner/Buyer Carter Haston JV KKR

Seller North American Properties Seller JLB Partners

Lender N/A Lender Mesa West Capital

Avg Rent/Unit $1, 837 Avg Rent/Unit $1, 699

Avg Rent/SF $2.21 Avg Rent/SF $1.39

ATLA NTA MA RK E T U P D AT E 4Modera Morningside Jefferson at Perimeter

Sale Price $110, 000, 000 Sale Price $102, 800, 000

Price Per Unit $366, 666 Price Per Unit $203, 968

Price/SF $368.72 Price/SF $192

Sale Date February 2018 Sale Date June 2018

Number of Units 300 Number of Units 504

Address 1845 Piedmont Ave NE Address 4867 Ashford Dunwoody Road

Atlanta, GA 30324 Dunwoody, GA 30338

Year Built 2016 Year Built 1996

Total SF 282, 000 Total SF 536, 256

Owner/Buyer GID Owner/Buyer Steadfast Apartment REIT

Seller Mill Creek Residential JV Fuqua Seller LivCor

Development Lender Fannie Mae

Lender N/A Avg Rent/Unit $1, 368

Avg Rent/Unit $1, 845 Avg Rent/SF $1.23

Avg Rent/SF $1.97

*Prices include retail space

SOURCE: REAL CAPITAL ANALYTICS

ATLA NTA MA RK E T U P D AT E 5DEALS TO WATCH

AMLI Northwinds Azure on the Park

Address 32000 Gardner Drive Address 1020 Piedmont Avenue NE

Alpharetta, GA 30009 Atlanta, GA 30309

Number of Units 800 Number of Units 329

Year Built 1997 (I)/ 1999 (II) Year Built 2017

Total SF 827, 940 Total SF 310, 247

Owner AMLI Residential Owner Atlantic Realty Partners

Comments AMLI Northwinds is a large value-add Comments Azure on the Park is the first luxury

play in the wonderful submarket of core project to sell arms-length in

Alpharetta. The interiors are mostly midtown in the past two years. It is

untouched, and it should trade at a estimated to trade for over $400,000

very aggressive cap rate for a large per unit.

deal. It is estimated to be over $160M.

SOURCE: AXIOMETRICS

ATLA NTA MA RK E T U P D AT E 6WHAT DO BUYERS AND

SELLERS WANT?

BUYERS WANT A DEAL WITH A LITTLE MORE YIELD. SELLERS WANT THEIR PRICE AND TERMS MET.

The majority of deliveries in the Atlanta market off market offer was able to meet the seller’s

are Inside the Perimeter (ITP); however, both goals while the deal represents a new pricing

buyers and developers are actively seeking level for a project with non-structured parking.

properties Outside the Perimeter (OTP) in Another example of OTP activity can be

order to achieve better rent growth in the highlighted by the fact that a local developer

short term. Despite increased OTP interest, has decided to build one of their first frame

there does appear to be more interest in the construction deals in Gwinnett County after

ITP submarkets Buckhead and Midtown than a number of high-rise projects. This reflects

there was at this time last year. Since supply the increased construction costs for high rise

is slowing in late 2018, there have been an projects ITP as opposed to suburban product.

increased number of off market offers made to

sellers. That being said, many sellers remain

on the sidelines waiting to fully stabilize to

achieve maximum value.

The recent sale of The Juncture in Alpharetta

is an example of an OTP off market deal. The

ATLA NTA MA RK E T U P D AT E 7ATLANTA SUBMARKET PIPELINE

PLANNED, PROSPECTIVE, UNDER CONSTRUCTION

Perimeter

Property Count:

12

Unit Count:

5,005

Cumberland

Property Count:

11 Buckhead

Unit Count: Property Count:

2,943 35

Unit Count:

9,739

Midtown

Property Count: DeKalb

51 Property Count:

Unit Count: 25

14,930 Unit Count:

5,165

Downtown

Property Count:

27

Unit Count:

5,974

SOURCE: YARDI MATRIX

ATLA NTA MA RK E T U P D AT E 8BUCKHEAD DELIVERIES

MIDTOWN DELIVERIES

SOURCE: AXIOMETRICS AND YARDI MATRIX

ATLA NTA MA RK E T U P D AT E 9SINGLE FAMILY PIPELINE

The Atlanta multifamily market is a subset of the overall Atlanta housing market; therefore, the single-

family market and the multifamily markets can be tracked collectively to understand overall market

supply and demand.

There is an overall trend of increasing housing permits, as illustrated in the graph below. While the

number of multifamily permits has been on an uptrend in 2017, reaching 7,884, it is still only roughly

half of the number of permits that were issued in 2004, when it reached 16,232. On the single-family

side, it is clear that 2017 was also on the upswing at 24,849 permits, but this is still well below the

61,231 permits in 2005. While there has been a clear trend of increased permit activity over the last

ten years, it is still significantly below the previous cycle levels.

Demand for multifamily can be summarized by the physical occupancy rate, which, according to

Axiometrics, has remained in the 94% range since the beginning of 2014. As for single-family, the

best indicator of demand is monthly inventory, which is the total active listings divided by the total

sales. Both FMLS and Case-Shiller are reporting inventory in Atlanta to be between 2 and 3 months.

Since a six-month supply inventory is considered normal, the Atlanta inventory is very tight suggesting

that single family demand is very high as well.

The Atlanta housing market as a whole is very healthy in 2018, and the demand demonstrates that

neither the single family or multifamily markets are close to overbuilding. Future job growth and net

migration will continue to drive single family pricing and multifamily rental rates up.

SOURCE: REAL CAPITAL ANALYTICS

ATLA NTA MA RK E T U P D AT E 1 0CIVIC PROJECTS

MERCEDES-BENZ STADIUM

Mercedes-Benz stadium opened in the Fall of Hotel, over 500 residential units, and extensive

2017 and not only serves as the home of the shopping and dining. In addition, The Battery

Atlanta Falcons and Atlanta United FC, but it is includes an office tower that houses Comcast’s

also the current home of the SEC Championship Southeast regional headquarters.

Football Game. After hosting the 2018 National Philips Arena, home to the Atlanta Hawks, is

Championship Football Game, Mercedes-Benz currently undergoing a $192M renovation. All

will host Super Bowl LIII in 2019 and the Men’s office space is being removed from the venue and

College Basketball Final Four in 2020. Soccer is

the new renovation will repurpose the now empty

increasingly popular in Atlanta, and in a recent space so that it can be used for social experiences

home game at Mercedes-Benz Atlanta United, in for fans. In addition to sporting events, Philips

only their second season in the league, broke the Arena is a popular concert destination for Atlanta.

MLS single-game attendance record. The renovation project has entered its final phase

SunTrust Park, located 10 miles north of and is expected to be completed by Fall 2018.

downtown Atlanta, opened in the Spring of 2017

and is home to the Atlanta Braves. The park is

surrounded by The Battery Atlanta, a mixed-use

entertainment district that features an Omni

ATLA NTA MA RK E T U P D AT E 1 1ECONOMIC GROWTH

SOURCE: BUREAU OF LABOR STATISTICS

ATLA NTA MA RK E T U P D AT E 1 2FORTUNE COMPANIES IN ATLANTA

FORTUNE 500 FORTUNE 1000

NATIONAL NATIONAL

RANK RANK

23 565

44 605

75 665

87 679

126 681

177 685

194 687

303 871

341 896

346 983

347 996

430

432

434

477

SOURCE: METRO ATLANTA CHAMBER OF COMMERCE

ATLA NTA MA RK E T U P D AT E 1 3EAST PARTNERS

NATIONAL PARTNERS

ATL A NTA | CHICA GO | DALLA S | DENVE R | H O U ST O N | IRVIN E | PH O EN IX | SEAT T L E | WA S H I N G T O N D C

ATLA NTA MA RK E T U P D AT E 1 4EAST TEAM

Amory Lenahan Robert Yates

ASSOCIATE ASSOCIATE

Bill Edwards Jjana Valentiner

SENIOR ASSOCIATE MARKETING AND DUE

DILLIGENCE COORDINATOR

SOUTHEAST

3414 Peachtree Rd NE

Suite 475

Atlanta, Georgia 30326

404.841.4844

www.moranandco.com

ATLA NTA MA RK E T U P D AT E 1 5You can also read