CSA 2 Multi-Manager Real Estate Global Asset Management - Credit Suisse

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

CSA 2 Multi-Manager Real Estate Global

Asset Management

Credit Suisse Asset Management (Switzerland) Ltd.

Equities l Indirect Real Estate

May 2020

For qualified investors only under the Swiss Collective Investment

Schemes Act ("CISA").CSA 2 Multi-Manager Real Estate Global

An investment group of Credit Suisse Investment Foundation Pillar 2

Investment group invests

NAV as price basis for the Proven structure, exclusively

globally in non-listed real

product and the target funds for Swiss PVEs

estate funds

Investment foundation and

Core Plus investment group supervised Hedged in CHF

Target return1 of 5%–7% by Occupational Pension Target hedge ratio

(hedged in CHF) Supervisory Commission, of 95%

audited by PwC

Source: Credit Suisse

1 The target return is the IRR in CHF after foreign currency hedging and is based on a long-term investment horizon. Target return is not a projection, prediction, or guarantee of future

performance, and there is no certainty that the target return will be achieved.

Please also note the risks on page 14.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 2Agenda

1 Investment rationale

2 Product information

3 Investment process

4 Annex

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 3Investment rationale

Important reasons to invest

For many institutional investors, international real estate is Diversification

still an underweighted asset class. Real estate investments can achieve good diversification with

While around 56% of the investment volume in equities is invested respect to existing investments, since the former have a low

internationally, the average for real estate is only around 12%.1 correlation with other asset classes such as equities and bonds.

Within the international real estate segment, a high diversification

Added value through active management effect is also achieved through different target funds, target fund

Analysis and navigation of the global non-listed real estate fund managers, geographical criteria, sectors and risk profiles as well as

universe requires focused expertise and the maintenance of an investment timing.

extensive network of real estate fund managers and other fund

managers. By actively managing the entire portfolio, significant Leading provider

added value can be achieved over individual, isolated investments. Credit Suisse Asset Management Indirect Real Estate is a trusted

partner with focused expertise and institutional investment

Moderate volatility and low correlation with equities standards.

Non-traded/non-listed investment vehicles show significantly lower

volatility than listed investment products and, in particular, have a

lower correlation with equity markets.

Partial protection against inflation

A long-term investor receives partial inflation protection with an

investment in real estate assets, as rents automatically adjust to

inflation in the medium term.

1 Source: Credit Suisse Swiss Pension Fund Index Q1 2020

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 4Investment rationale

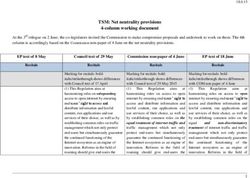

International real estate investment segment

Investments in international real estate may be made directly or indirectly.

Direct/indirect Whereas direct real estate investments are made either directly in individual properties or via property

investments in real companies, indirect investments are made via investment vehicles such as funds and similar structures.

estate

In addition to publicly traded indirect securities with real estate investments (listed), there is a broad

Traded/ range of non-traded investment vehicles (non-listed) abroad.

non-traded These differ from publicly traded securities not only in their legal form, but also in terms of liquidity and

investment volatility.

vehicles Non-traded investment vehicles generally have lower volatility and a lower correlation to equity markets,

but have lower liquidity as they are non-transferable or transferable only to a limited extent.

International real estate

Direct Indirect

Focus of CSA 2

Multi-Manager Non-listed real estate funds Listed real estate funds

Real Estate Global

Lower Liquidity/volatility Higher

Source: Credit Suisse

For illustration purposes only

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 5Non-listed real estate funds

Investment styles

Low Risk High

Investment style Core Core Plus Value Add Opportunistic

Risk Low to average Average Average to high High

Leverage (LTV) ≤ 40% 30% to 60% > 40% to 60/65% ≥ 65%

Occupancy level High Well occupied Leasing potential Turnaround

> 90% 75% to 95% 60% to 80% 0% to 70%

Target exposure ≤ 5% > 5% to ≤ 25% > 25%

to project

developments

Return composition Current income orientation Current income and capital Capital appreciation and current Capital appreciation

appreciation income

Real estate type and Existing, stabilized Existing, stabilized properties Properties with upside potential Underutilized assets in need of

location properties Well tenanted, central, slight realized through asset major repositioning

Well tenanted, central and deviations accepted management Development projects

stable income returns Capital appreciation through Refurbishments, less centrally Less centrally located or in

Long-term leases rental growth and/or modest located emerging markets

Strong tenant credit lease up

Holding period Unlimited Unlimited Typically seven to ten years Typically five to eight years

Current income orientation Focus on capital appreciation

Sources: INREV, Credit Suisse

For illustration purposes only

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 6Real estate for diversification

Stable income yields

Correlation

2000-2019 between different asset classes

Equities Bonds global REITs global Non-listed global Non-listed real estate funds as a suitable addition

global real estate to a diversified portfolio due to their low correlation

Equities global 1 -0.09 0.86 0.44

with equities and bonds

The risk profile of non-listed real estate

Bonds global 1 -0.11 -0.08 investments lies between that of bonds and

REITs global 1 0.52 equities

Non-listed global real 1

High international diversification for non-listed real

estate estate investments due to low cross-border

correlation

Attractive and stable income yields over the cycle

in the current zero/negative interest rate

Stable and substantial distribution component environment

MSCI IPD Global Real Estate Index (Asset Level)

20%

15% 15.0% 14.5%

10% 10.8% 10.5% 9.9% 10.7%

8.2% 8.9% 8.9% 8.3% 7.9%

7.1% 6.5% 7.0% 7.4% 7.3% 6.5%

5%

% p.a.

0%

-5% -5.5%

-7.3%

-10%

-15%

Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Standing Investments Income Return Standing Investments Capital Growth Standing Investments Total Return

Sources: MSCI, Credit Suisse; last data point: December 2019

Historical performance indications and financial market scenarios are not reliable indicators of current or future performance.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 7CSA 2 Multi-Manager Real Estate Global

Global network and local expertise

All invested target funds combined have over 8,700 employees in the real estate sector,

of whom more than 3,400 are real estate investment experts

Europe

> 1,000

America

> 1,900

Asia/Pacific

> 500

Source: Credit Suisse

All information as at 31.12.2019

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 8Agenda

1 Investment rationale

2 Product information

3 Investment process

4 Annex

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 9Investment process

Multi-Manager Real Estate Global

Filtering of the investment universe

(>1,000 target funds)

Investment guidelines Investability

Due diligence

Legal Business Tax

Consideration of other, fund-

independent factors

(esp. macroeconomic assessment)

Source: Credit Suisse Portfolio construction

For illustration purposes only

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 10Multi-Manager Real Estate platform

Transaction structures

Investment in a target fund through standard subscription

1 2 1 process

Primary market Late/final close

investments investments Invest in the final close of a closed-ended target fund

2

3 4 3 Acquire fund units through the secondary market from an

existing investor

Secondary Club deals

market

investments Invest in a fund with two to five other limited partners

4

5 Supporting a manager in launching a new fund by

Seed Successful 5 providing seed capital

investments Fundrasing

Co-invest in a property held by a target fund that is too

6 large for single ownership

6

Co-investments

Source: Credit Suisse

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 11CSA 2 Multi-Manager Real Estate Global

Portfolio as at March 31, 2020 based on invested capital

Sector allocation Allocation by investment style

70% 3%

Investment guidelines Current allocation

60% 12% 2%

50%

40%

34%

30%

25% 23%

20%

10% 8% 9%

0% 2% 83%

-10%

Office Retail Residential Logistics Others* Liquidity

Core Value-added Opportunistic Liquidity

Regional allocation Allocation by structure

80% 16%

Investment guidelines Current allocation 2%

70%

60%

50%

40% 44%

38%

30%

20%

16%

10%

0% 2% 82%

-10%

Americas Europe Asia-Pacific Liquidity

Closed-end Open-end Liquidity

Source: Credit Suisse

* The allocation to "other" sectors mainly consists of exposure to medical offices, senior housing, self-storage and student housing. This is an indicative asset allocation that may change

over time.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 12Product information

Key facts, CSA 2 Multi-Manager Real Estate Global

Investment policy Product information

The broadly diversified portfolio consists of Investment strategy Core Plus

international real estate funds. The target real estate Geography Global except Switzerland (Americas, Europe, Asia/Pacific)

funds are not traded and invest, for their part, in Sectors Office, retail, housing, logistics, other

properties in the respective target markets

Launch October 4, 2016

(Americas, Europe, Asia/Pacific).

Base currency CHF

CSA 2 Multi-Manager Real Estate Global pursues a

Core+ investment strategy, with most investments Currency hedging Foreign currency risks largely hedged in CHF

taking place in the core segment and additional, Portfolio buildup phase Four years

targeted investments in the Value Add and Subscriptions Capital commitments

Opportunistic segments. Redemptions Quarterly (after end of holding period)

Subscription fee None

Redemption fee 2% (remains in investment assets)

Period of notice 12 months

Target IRR (CHF) p.a. 5%–7%1

Share class Minimum investment volume Management fee p.a.2 Qualified investors

A CHF 1 mn 0.70% PVE

L CHF 10 mn 0.58% PVE

M CHF 20 mn Volume-dependent graduated tariff PVE

Source: Credit Suisse

1 Target return based on a long-term investment time horizon. Target return is not a projection, prediction, or guarantee of future performance, and there is no certainty that the target

return will be achieved.

2 This fee may be changed at any time and without notification to investors.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 13CSA 2 Multi-Manager Real Estate Global

Benefits and risks

Benefits Risks

Easy access to selected real estate managers worldwide, active Limited liquidity compared to listed investment products

management and low minimum investment Real estate fund values may fluctuate (for instance, because of

Structured investment process and experienced investment unfavorable changes in economic circumstances, interest rate

team with successful track record in global real estate developments or unfavorable local market conditions)

investments and a representative from research and teaching Risks associated with the purchase, financing, ownership,

Very high diversification (by region, sector, manager, building operation, and sale of real estate

type, tenants, market cycle) Legal and tax risks associated with investments in real estate

Professional management with many years of experience and funds

an outstanding track record in global real estate investments as

well as access to the global network and expertise of Credit

Suisse Asset Management’s real estate and equities teams

The investment objectives, risks, fees and expenses, and other information relating to this product can be found in the prospectus, which should be read carefully before investing.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 14Agenda

1 Investment rationale

2 Product information

3 Investment process

4 Annex

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 15Investment Committee

John Davidson Sven

Professor Dr. oec. publ., Christoph Bieri Filippo Rima Schaltegger

CAIA CEFA CFA MRICS, CFA, CAIA

Professor John Davidson began his career Christoph Bieri, Director, is Head of the Filippo Rima is Managing Director of the Sven Schaltegger, Director, is Senior

as a member of the Alternative Funds Indirect Real Estate team. He studied Private Banking & Wealth Management Portfolio Manager in the Indirect Real Estate

Advisory private equity team for UBS Global business administration and economics at division in Zurich. He is Head of Equities in team. He holds a master’s degree in finance

Asset Management in Zurich, where he the University of Bern, qualified as a Certified the Asset Management business. Filippo with "magna cum laude" distinction from the

served until 2005. After that, he joined Swiss International Investment Analyst (CIIA) at the Rima joined Credit Suisse Asset University of Zurich and is a CFA charter

Re, where he was one of the chief architects Swiss Training Centre for Investment Management in September 2005 from holder, CAIA charter holder, and a member

of a global portfolio of indirect real estate Professionals (AZEK) and in 1988 earned a Winterthur Asset Management, where he of the Royal Institution of Chartered

investments with 27 institutional real estate certificate of proficiency for real estate was a senior portfolio manager on the equity Surveyors (MRICS). Before he joined Credit

funds and a volume of CHF 1.4 billion. Major fiduciaries. After working on a construction team. Prior to that, he worked at a private Suisse in 2016, he was a senior manager

activities included selection of funds, due statistics project for the Swiss Federal Swiss bank for four years as an equity and head of real estate M&A at

diligence coordination and portfolio Statistical Office for three years, Christoph analyst. Filippo Rima holds a degree in PricewaterhouseCoopers Switzerland. Prior

management, as well as representing Swiss joined Zürcher Kantonalbank in 1994 as a business administration from the University of to that, he worked at SCM Strategic Capital

Re on respective advisory boards. Since the financial analyst for the banking and real St. Gallen (HSG) and a degree in civil Management (now Mercer Private Markets)

fall of 2009, Professor John Davidson has estate sectors and was a member of the engineering from the Swiss Federal Institute and Partners Group (PG) as a real estate

been Co-Head of Real Estate at the Lucerne structured Swiss equity mandate team. In of Technology (ETH) in Zurich. He is a CFA investment manager. At PG, he was a

University of Applied Sciences and Arts. 1999, he started working at Banca del charter holder and a member of the Index member of the investment committee for a

Gottardo, where he was responsible for Commission of the SIX Swiss Exchange. listed real estate fund. After completing his

setting up the Swiss equity research team. studies, Sven Schaltegger was first

Christoph joined Credit Suisse in 2002 as a employed at UBS Global Asset

Portfolio Manager, where he set up the Management, where he worked in global real

Indirect Real Estate product group he estate product development and

continues to manage. management in Zurich, and later as a Junior

Portfolio Manager of a Core+ fund with UBS

Realty Investors in Hartford, Connecticut,

US.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 16Expert Board

John

Davidson

Professor Dr. oec. Werner Heinz

publ., CAIA

Richli Tschabold

CEFA CAIA

Werner Richli, Director, is a Senior Heinz Tschabold, Director, is a Senior

Portfolio Manager in the Indirect Real Portfolio Manager in the Real Estate

Christoph Estate team. He graduated in business Securities team. He graduated in

administration from the University of Business Administration from the

Bieri Zurich and is a Certified Financial Analyst University of St. Gallen (HSG) and has a

CEFA and Asset Manager (TCIP). From 1987, master’s degree in finance. Following his

he worked as a financial analyst in Credit academic studies, he worked as financial

Suisse Investment Banking and assisted analyst at UBS Warburg and assisted

various companies such as Kaba, Swiss companies in the machinery and

Swisscom, Geberit, and Swiss Prime Site electrical engineering fields. In 2002, he

with their initial public offerings. In 2003, joined Credit Suisse and was responsible

he joined Credit Suisse Asset for implementing quantitative models in

Management. There, he developed real the real estate sector. Since 2006, he

Filippo Rima has been responsible for mandates in the

estate research and was responsible for

CFA the asset allocation of the first real estate area of international real estate

fund investing internationally, Real Estate investments. As portfolio manager of the

Fund International. This was followed in Credit Suisse (Lux) European Property

2006 by the development of the mandate Equity Fund, he is also responsible for the

business for international real estate selection of companies and funds from

Sven investment and the management of the German-speaking markets.

Schaltegger Credit Suisse (Lux) Infrastructure Equity

MRICS, CFA, Fund.

CAIA

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 17Portfolio Management (1/2)

Sven

Schaltegger

MRICS, CFA,

CAIA

Lead Portfolio

Manager

Philip Signer

Fabian Egg

CFA

Philip Signer, Assistant Vice President, is an Fabian Egg, Assistant Vice President, has worked in the

investment professional in the Indirect Real Estate Indirect Real Estate team since 2019. He graduated with

Heinz team. He holds a master’s degree in banking and a first class honors degree in management studies (BSc)

finance from the University of St. Gallen (HSG), from the London School of Economics and initially

Tschabold complemented by studies at the Seoul National worked for Goldman Sachs in London, focusing on the

CAIA University (SNU) in South Korea, and is a CFA acquisition and asset management of Pan-European Real

Charterholder. Before joining Credit Suisse in 2015, Estate and Distressed Debt. During his three years at

Philip worked in Investment Management at Zurich Goldman Sachs, he also worked for the Mortgage

Insurance Group as an Investment Performance Trading team in New York and Dallas, gaining experience

Analyst. He then joined Credit Suisse, working in in the American market.

Advisory Portfolio Management in the Investment

Solutions and Products area, and was responsible for

the construction and optimization of multi-asset-class

portfolios for advisory clients.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 18Portfolio Management (2/2)

Fabian Stäbler Marcel Kaufmann

Dipl.-Ing. FH Lic. oec. HSG

Fabian Stäbler, Director, is a Product Specialist in the Indirect Real Estate team Marcel Kaufmann screens and selects real estate funds in the Indirect Real

and Business Manager in Asset Management Equities. He studied business Estate team. He holds a master’s degree in strategy and organization from the

engineering at the University of Applied Sciences and Arts Northwestern University of St. Gallen and studied at SNU Seoul National University on the

Switzerland (FHNW). Fabian joined Credit Suisse in 2009 and worked initially as MBC program. He was a partner at Advanta Capital, a private equity advisory

Business and Project Manager in Asset Management Switzerland & EMEA in company that he co-founded, built up and sold. Before that, he worked as a

Zurich. After working in Asset Management in Hong Kong in 2011, he led the private markets investment professional for SCM Strategic Capital Management

expansion of the Asset Management area in Singapore. In 2013, he became (today Mercer Private Markets), Evolvence Capital (Dubai, UAE) and Swiss Re,

local COO for Asset Management in Singapore and was then responsible for where he was responsible for sourcing, evaluating and executing private equity,

supervising local activities, product and platform management as well as infrastructure and real estate transactions (primaries, secondaries, co-

business and strategy development. Before joining Credit Suisse, Fabian worked investments).

for four years for Swiss Life Asset Management as a Business Process

Engineer and Business Analyst.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 19Environmental Social Governance (ESG)

An integral part of due diligence

The selection of investments follows a structured, broad-based investment process that takes both quantitative and qualitative

criteria into account.

Potential investment opportunities undergo a detailed due diligence process, taking ESG-related factors into account as part

ESG in the

of the assessment.

investment

process The Global Real Estate Sustainability Benchmark (GRESB) is analyzed as the leading ESG rating for all new and existing

target funds.

In addition, other common ESG standards, ratings and guidelines are analyzed at the building, fund and fund manager levels.

CSA 2 Multi-Manager Real Estate Global – since October 2016

78 62%1 of the funds have a GRESB rating

80%2 of the invested capital has a GRESB rating

GRESB 78/100 2 – weighted average (based on GRESB rated funds)

ESG profile of

CSA2 Multi-

Manager Real

Estate Global

fund

Other ESG

standards/

ratings/ Various ratings and standards like LEED, BREEAM, Energy Star, UNPRI, etc.

programs

Proprietary policies, standards and ESG reports of target funds

Source: www.gresb.com

1 Based on Q1 2020 data or latest available GRESB rating

2 Based on invested capital in Q1 2020

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 20Agenda

1 Investment rationale

2 Product information

3 Investment process

4 Annex

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 21CSA 2 Multi-Manager Real Estate Global

Subscription and redemption

Subscription Redemption

Issuance of shares by means of capital calls The shares can be redeemed quarterly as at the end of a

quarter, subject to a notice period of twelve months

Capital calls are announced with a notice period of seven

days A redemption fee of 2% is levied (remains in investment assets)

Issued at NAV at the end of the previous quarter

No subscription fee is charged Year n

End of quarter 1 End of quarter 2 End of quarter 3

Notice deadline Notice deadline Notice deadline

Capital call Capital call

Announceme Call Announceme Call Notice Notice Notice Notice

nt (T-7 (TD) nt (T-7 (TD)

calendar calendar Redemption

Capital commitment Redemption Redemption Redemption

days) days)

Value date Value date

redemption redemption

End of End of End of End of End of (T+30 bank (T+30 bank

quarter 1 quarter 2 quarter 3 quarter 4 quarter 1 working days) working days)

Year n+1

Issued at NAV at Issued at NAV at

the end of the the end of the End of quarter 4 End of quarter 1 End of quarter 2

previous quarter previous quarter

Price Price

Price

determination determination

Source: Credit Suisse determination

For illustration purposes

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 22Annex

Anchored in Switzerland, a global platform and worldwide real estate

expertise

Fund administration Fund management

Credit Suisse Investor Services Portfolio Management

Investment Office Business Management

Investment Committee

London

Zurich Expert Board

New York

Milan

Private Fund Group (PFG)

Private Fund Group (PFG)

Real Estate Global – Asia/Pacific

Real Estate Global – America Real Estate Global – Europe Singapore Real Estate Investment Management

Real Estate Investment Management Real Estate Investment Management Real Estate Asset Management

Real Estate Asset Management Real Estate Asset Management

Credit Suisse Investment Foundation

(CSA) Global Real Estate Research Marketing

Investment Foundation management Analysis and assessment of global real estate

Sales support

Product management markets

Legal & Compliance Risk Management Global Tax Adviser

Legal clarifications and due diligence Investment risk analysis Tax due diligence (external)

Source: Credit Suisse

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 23Multi-Manager Real Estate platform

Detailed investment process

Worldwide Credit Suisse network (including Global Real Estate, Real Estate Research and Private Fund Group)

Investment Subscription Monitoring/

Sourcing Due diligence

committee process controlling

Screening of the Business Legal Tax Investment decision Subscription/KYC/ Monitoring of

fund universe due diligence due diligence due diligence AML funds and guidelines

Proactive fund Fund manager Analysis of fund Analysis of tax Portfolio allocation Subscription Complying with

screening calls/meetings structure consequences Fund selection documents for the investment guidelines

Proprietary global On-site fund Product life cycle Tax consequences Liquidity management selected funds Monitoring of

network of fund manager visits Investment guidelines for the 1–2 IC meetings held Monitoring the investment

managers, investors Real estate viewings Advisory Committee subscription/redempti per quarter (additional KYC/AML process performance

and placement Reference discussion Leverage on of shares meetings ad hoc if Side letter Strategic and tactical

agents with existing investors Reporting Analysis of the required) negotiation asset allocations

High selectivity and Peer group Corporate organizational Liquidity

cherry-picking comparisons governance structure management

Fund database and Investment strategy Liquidity Obligations to submit Management of capital

analysis of key Track record Fund charges/costs a tax declaration calls

figures for primary ESG factors Investment manager Duties of disclosure Foreign currency

and secondary Fee structure Regulations Analysis of alternative hedging

market transactions Assessment of Service provider structures Processing of

>900 meetings and valuations and future Conflicts of interest Tax ruling if corporate actions

calls with fund developments Valuations applicable Updating tax rulings

managers Organization and Business reports Client-specific

processes reporting

Source: Credit Suisse.

For illustrative purposes only, the table does not represent an exhaustive list.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 24Multi-Manager Real Estate Global platform

Transaction structures

Primary market Late/final close Secondary market Club deals Seed investments Co-investments

investments investments investments

Investment in a target Invest in the final close Acquire fund units Invest in a fund with Supporting a manager Co-invest in a property

fund through standard of a closed-ended through the secondary two to five other limited in launching a new fund held by a target fund

subscription process target fund market from an existing partners by providing seed that is too large for

Features

investor capital single ownership

Typically minority Invest in the target fund Fund might be

holding in a target fund "at cost" while Extensive network and converted or opened to Fund managers are Fund manager keeps

equalizing/ timely execution are key other investors at a later willing to grant attractive control over the

compensating existing success factors stage terms to seed investors property to execute the

investors business plan

Exposure to established Benefiting from an Immediate deployment Concentrated Dictating fund’s terms Attractive co-investor

funds with large immediate uplift after of capital in fund that ownership allows better and conditions fees

diversified portfolio and the final close would not be investable control of the manager

Rationale

low property-specific or would have a long and provides stronger Attractive seed investor Exposure to attractive

risk Good visibility over the investment queue alignment of interest fee discount single-asset

target fund’s portfolio among the limited opportunities

Higher liquidity because Benefiting from a partners

of diversified investor potential discount to

base NAV

Source: Credit Suisse

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 25Disclaimer

Distributed by CREDIT SUISSE ASSET MANAGEMENT (Switzerland) Ltd. and CREDIT SUISSE AG

Source: Credit Suisse, otherwise specified.

Unless noted otherwise, all illustrations in this document were produced by Credit Suisse Group AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief.

The information provided herein constitutes marketing material. It is not investment advice or otherwise based on a consideration of the personal circumstances of the addressee nor is it the result of objective

or independent research. The information provided herein is not legally binding and it does not constitute an offer or invitation to enter into any type of financial transaction. The information provided herein

was produced by Credit Suisse Group AG and/or its affiliates (hereafter "CS") with the greatest of care and to the best of its knowledge and belief. The information and views expressed herein are those of

CS at the time of writing and are subject to change at any time without notice. They are derived from sources believed to be reliable. CS provides no guarantee with regard to the content and completeness

of the information and where legally possible does not accept any liability for losses that might arise from making use of the information. If nothing is indicated to the contrary, all figures are unaudited. The

information provided herein is for the exclusive use of the recipient. Neither this information nor any copy thereof may be sent, taken into or distributed in the United States or to any U. S. person (within the

meaning of Regulation S under the US Securities Act of 1933, as amended). It may not be reproduced, neither in part nor in full, without the written permission of CS. The key risks of real estate

investments include limited liquidity in the real estate market, changing mortgage interest rates, subjective valuation of real estate, inherent risks with respect to the construction of buildings and environmental

risks (e.g., land contamination). The issuer and manager of CSA 2 products is the Credit Suisse Investment Foundation, Pillar 2, Zurich. The custodian bank is Credit Suisse AG, Zurich. The articles of

incorporation, the regulations and the investment guidelines as well as the latest annual reports and fact sheets can be obtained free of charge from the Credit Suisse Investment Foundation, Pillar 2. This

foundation is open only to a restricted group of tax-exempt pension funds domiciled in Switzerland (article 3 of the articles of incorporation).

Copyright © 2020 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Credit Suisse Asset Management (Switzerland) Ltd. The disclaimer mentioned at the end of this document also applies to this page. May 2020 26You can also read