Half year results presentation - 6 months ended 30 June 2021 - Bupa

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Agenda

Section 1

Overview

Section 2

Market Unit performance

Section 3

Financial review

Section 4

Outlook and operating priorities

Section 5

Questions and answers

Martin Potkins Gareth Gareth Evans

Interim Chief Roberts Group

Financial Group Financial Treasurer

Officer Controller

Bupa half year results presentation 2021 2Section 1 Section 2 Section 3 Section 4 Section 5

Overview

Martin Potkins

Interim Chief

Financial

Officer

Bupa half year results presentation 2021 3Section 1 Section 2 Section 3 Section 4 Section 5

Group financial highlights

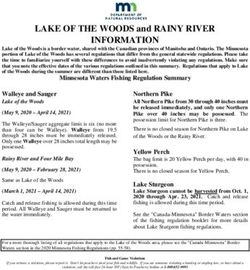

The Half Year results show Revenue1 Solvency II capital coverage ratio2

early signs of a return to

growth, as we navigate the

ongoing impacts of COVID-

£6.5bn 163%

10% AER FY 2020: 160%

19 9% CER

Statutory profit before taxation Net cash generated from

operating activities

£245m £440m

2020: £153m AER 2020: £843m AER

Underlying profit before taxation Ratings

£191m A3 BBB+

+36% AER Moody’s senior Fitch senior

+44% CER debt rating debt rating stable

negative outlook

1 Balances have been restated for a gross up between other revenue and financial expense in relation to the remeasurement of i mputed revenue and interest in respect of interest-free

refundable accommodation deposits received by the Group as payment for aged care units in Bupa Villages and Aged Care - Australia.

2 The 2021 Solvency II capital position is an estimate, and it is unaudited.

Bupa half year results presentation 2021 4Section 1 Section 2 Section 3 Section 4 Section 5

Operational highlights

We launched our new 3x6 Strategy We launched a global

and introduced our ambition to be talent programme, eco-Disruptive,

"the world's most customer that brings together Bupa teams

centric healthcare company“. and eco-startups.

We announced our commitment to

Our 2021 People Pulse employee

the Science Based Target

survey showed 78% overall

Initiative (SBTi) to reduce our

engagement

carbon emissions.

Bupa half year results presentation 2021 5Section 1 Section 2 Section 3 Section 4 Section 5

Our new Strategy and Values

Our purpose

Helping people live longer, healthier, happier lives and

making a better world

Our ambition

To be the world’s most customer-centric healthcare company

Bupa half year results presentation 2021 6Section 1 Section 2 Section 3 Section 4 Section 5

New Strategy – Driving Bupa’s transformation

Our purpose

Helping people live longer, healthier, happier lives and making a

better world

Our ambition

To be the world’s most customer-centric healthcare company

3x Ambition KPIs

40% of customer care 60% active digital Net Promoter Score of 80

touchpoints owned by Bupa customers

6x Strategic and Enabling Pillars

Customers Growth

Obsession with our customers’ experience Strong performance and governance

Transformation Sustainability

Continuous innovation and preparation Making a positive impact on the world

Data Agile Culture

Enhanced data driven decision making The best, most diverse people and a great place to work

Bupa half year results presentation 2021 7Section 1 Section 2 Section 3 Section 4 Section 5

Market Unit

performance

Martin Potkins

Interim Chief

Financial

Officer

Bupa half year results presentation 2021 8Section 1 Section 2 Section 3 Section 4 Section 5

Australia and New Zealand

Results largely driven by increased customer volumes in Revenue1 Revenue by business

£2.5bn

A. Bupa Health

Health Services, lower operating costs in Australian Aged

Insurance 77%

Care and improved margins in health insurance B. Bupa Health Services 13%

2020: £2.4bn CER C. Bupa Villages and Aged Care

Australia 7%

▪ Health Insurance: Revenue growth largely due to customer retention, +6% CER D. Bupa Villages and Aged Care

premium increases and non-recurring customer support given in 2020. +13% AER New Zealand 3%

Underlying profit

▪ Health Services: Revenue growth driven by improved customer

volumes across most businesses.

▪ Australia Villages and Aged Care: Revenue was stable. Closing

£132m C

D

2020: £66m CER B

occupancy rate was 88% (HY 2020: 82%).

+100% CER

▪ New Zealand Villages and Aged Care: Revenue was flat and underlying

+113% AER

profit declined. Closing occupancy remained stable at 88% (HY 2020:

89%). Combined operating ratio2

A

Bupa HI Pty Ltd (Australia)

2021

93%3

2020

95%

1 Balances have been restated for a gross up between other revenue and financial expense in relation to the remeasurement of i mputed revenue and interest in

respect of interest-free refundable accommodation deposits received by the Group as payment for aged care units in Bupa Villages and Aged Care - Australia.

2 Combined Operating Ratio is an alternative performance metric for insurance businesses. It is calculated based on incurred cl aims and operating expenses

divided by net earned premiums.

3 Bupa HI Pty Ltd (Australia): based on the Solvency II S.05.01 Quantitative Reporting Template (estimated and unaudited).

Bupa half year results presentation 2021 9Section 1 Section 2 Section 3 Section 4 Section 5

Europe and Latin America

Solid revenue growth driven by increased customers Revenue Revenue by business2

across healthcare provision and insurance businesses

£2.0bn

A. Sanitas Seguros 31%

B. Sanitas Dental 5%

Spain: C. Sanitas Hospitals 6%

2020: £1.8bn CER D. Sanitas Mayores 3%

▪ Sanitas Seguros: Solid revenue growth. Underlying profit declined due to E. Bupa Chile 27%

higher claims. +14% CER F. LUX MED (Poland) 12%

+10% AER G. Bupa Acıbadem Sigorta (Turkey) 5%

▪ Sanitas Dental and Sanitas Hospitals: Revenue and underlying profit H. Care Plus (Brazil) 4%

grew driven by higher activity. Underlying profit

I. Bupa Global Latin America 7%

▪ Sanitas Mayores: Underlying profit improved. Closing occupancy rate was

80% (HY 2020: 78%).

£68m

2020: £70m CER

Other countries:

I

-3% CER H

▪ Bupa Chile: Revenue grew driven by outpatient businesses. Underlying -7% AER G

profit was down driven by higher claims. A

Combined operating ratio

F

▪ LUX MED (Poland): Good revenue growth and stable profit. Sanitas S.A de Seguros (Spain)

2021

▪ Bupa Acıbadem Sigorta (Turkey): Good revenue and customer growth.

89%1 B

▪ Care Plus (Brazil), Bupa Mexico and BGLA all delivered improved 2020 E

C

D

performance year-on-year.

84%

1 Sanitas S.A de Seguros (Spain): Prepared under local GAAP (unaudited). Bupa half year results presentation 2021 10

2 Bupa Mexico is not displayed on the chart as its revenue accounts for below 1%Section 1 Section 2 Section 3 Section 4 Section 5

Bupa Global and UK

Revenue growth driven by customer growth in dental Revenue Revenue by business

appointments

£1.7bn

A. Bupa UK Insurance 46%

B. Bupa Global 22%

C. Bupa Dental Care 15%

▪ UK Insurance: Revenue was up and underlying profit increased due to 2020: £1.5bn CER D. Bupa Care Services 12%

improved product mix. The impact of the return of premium provision E. Bupa Health Services 5%

reduced compared to 2020. +9% CER

+8% AER

▪ Bupa Global: Revenue stable and underlying profit declined as claims E

levels increased. Underlying profit

£9m

D

▪ Dental Care: Improved performance with strong revenue growth due to

increased private customer visits.

2020: £22m CER A

C

▪ Care Services: Revenue was flat year-on-year. Underlying profit was

stable. Occupancy up to 82% (HY 2020: 78%). -59% CER

-59% AER

▪ Health Services: Revenue increased. Underlying profit was stable. B

Combined operating ratio

Bupa Insurance Ltd (UK)

2021

97%1

2020

94%

1 Bupa Insurance Limited: Prepared under local GAAP. Excludes our Irish insurer and our associate, Highway to Health (GeoBlue).

Bupa half year results presentation 2021 11Section 1 Section 2 Section 3 Section 4 Section 5

Other businesses

▪ Revenue up 5% to Bupa Arabia Max Bupa (India) Bupa Hong Kong

£232m. ▪ Bupa Arabia is a listed company ▪ Profit declined year-on-year driven ▪ Revenue was up driven by higher

and its results will be published by higher COVID-19 related check-up and nursing services in

▪ Underlying profit in shortly on the Kingdom of Saudi claims. health provision.

other businesses was Arabia stock exchange, the

Tadawul. ▪ The business is being rebranded ▪ We formed Bupa Asia Pacific on

down 16% to £26m at as Niva Bupa and is overseen by 1 July 2021 incorporating Bupa

CER largely driven by the Bupa Global & UK Market Unit Hong Kong and our businesses

Max Bupa in India. from 1 July 2021. in Australia and New Zealand.

Bupa half year results presentation 2021 12Section 1 Section 2 Section 3 Section 4 Section 5

Financial review

Gareth Gareth Evans

Roberts Group

Group Financial Treasurer

Controller

Bupa half year results presentation 2021 13Section 1 Section 2 Section 3 Section 4 Section 5

Financial highlights

Solvency II capital Statutory profit before taxation Underlying profit

coverage ratio1 before taxation

163% £245m £191m

FY 2020: 160% 2020: £153m AER 2020: £133m CER

+36% AER

+44% CER

1 The 2021 Solvency II capital position is an estimate, and it is unaudited.

Bupa half year results presentation 2021 14Section 1 Section 2 Section 3 Section 4 Section 5

Financial overview

Revenue Underlying profit before taxation1 Combined operating ratio2

2021 2021 2021

£6.5bn £191m 95%

2020 (CER) 2020 (CER) 2020

£5.9bn £133m 92%

+9% CER +44% CER +3 ppts

+10% AER +36% AER

▪ Revenue up 9% due to portfolio growth, price ▪ The Group’s combined operating ratio stands

▪ Underlying profit up by 44%. Reduction in

rises in a majority of our insurance markets and at 95%, compared to 92% at prior year.

insurance profits due to higher claims was more

increased activity in health provision.

than offset by higher profits in health provision

▪ Revenue in health insurance grew by 5% due and aged care.

to increased membership portfolio with growth in

▪ Central expenses and net interest margin were

ELA and premium rises in Australia.

lower as higher investment returns were partly

▪ Health provision revenue grew 3% reflecting offset by additional interest costs associated with

higher customer numbers. debt issuances completed in June 2020.

▪ Aged care revenue broadly in line with 2020.

1 Underlying profit is a non-GAAP financial measure. This means it is not comparable to other companies. Underlying profit reflects our trading performance and excludes a number of items included in statutory profit before taxation, to facilitate year-on-year comparison. These items include impairment of intangible assets and

goodwill arising on business combinations, as well as market movements such as gains or losses on foreign exchange, on return-seeking assets, on property revaluations and other material items not considered part of trading performance.

2 Combined operating ratio is an alternative performance metric for insurance businesses. It is calculated based on incurred cl aims and operating expenses divided by net earned premiums. The Group combined operating ratio is calculated based on the S.05.01 Prudential Regulation Authority (SII) form (estimated and unaudited).

Bupa half year results presentation 2021 15Section 1 Section 2 Section 3 Section 4 Section 5

Statutory profit

Statutory profit before

HY 2021 HY 2020

taxation was £245m, up £m (AER)

£92m on 2020, reflecting £m

higher underlying profit, Underlying profit before taxation 191 140

and gains made on Impairment of intangible assets and goodwill arising on business combinations (1) -

acquisitions and

divestments, including Net gain/(loss) on disposal of businesses and transaction costs on business combinations 9 (5)

a one-off gain arising upon Net property revaluation gains 7 11

the transfer of customers

Realised and unrealised foreign exchange gains 9 14

from CS Healthcare into UK

Insurance. Gains/(losses) on return seeking assets, net of hedging 3 (5)

Other non-underlying items 27 (2)

Total non-underlying items 54 13

Statutory profit before taxation 245 153

Bupa half year results presentation 2021 16Section 1 Section 2 Section 3 Section 4 Section 5

Solvency1

HY 2021 Solvency position Solvency II coverage ratio ▪ Capital coverage at the year end was

163% with £1.6bn surplus over Group

Own Funds £4.1bn SCR.

2021 163%

▪ Solvency coverage ratio remains within

Solvency Capital £2.5bn Surplus £1.6bn FY 2020 160% our target capital working range of

Requirement 140% to 170% of SCR.

▪ Our capital coverage is relatively stable

Risk sensitivities2 to exposure from market risk

sensitivities.

Solvency Coverage Ratio 163%

▪ Property remains the most sensitive

Property values - 10% 149% risk to our capital coverage.

HY21 loss ratio worsening by 2% 156%

Interest rate -100bps 161%

Sterling appreciates by 10% 162%

Group specific parameter (GSP)3 +0.2% 162%

Credit spreads + 100bps assuming no credit transition 163%

Pension risk +10% 163%

Equity markets -20% 163%

1 The HY 2021 Solvency II capital position, SCR and coverage ratio are estimates and unaudited.

2 While this table only shows the impact of individual stresses, it is a helpful illustration of the relatively low risk inherent in our capital base. Bupa half year results presentation 2021 17

3 Group Specific Parameter (GSP) is substituted for the insurance premium risk parameter in the standard formula, reflecting the Group’s own loss experienceSection 1 Section 2 Section 3 Section 4 Section 5

Solvency1

Movement in Solvency II

capital surplus from FY 2020

to HY 2021

10

60

50

240 50

20

1,610

20

1,454

1,520

Operating Acquisitions Net capex Debt financing Other Currency risk Capital SII

SII Surplus

capital and market tiering Surplus

FY 2020 2

generation disposals risk restriction 3 HY 2021

1 The HY 2021 Solvency II capital position, SCR and coverage ratio are estimates and unaudited.

2 Operating capital of £240m includes adjusted IFRS comprehensive income, reflecting SII valuation differences and the exclusion of non-operating items.

3 Capital tiering restrictions are applied because the aggregate value of eligible Tier 2 and Tier 3 Own Funds cannot exceed 50% of the Group Solvency Capital Requirement.

Bupa half year results presentation 2021 18Section 1 Section 2 Section 3 Section 4 Section 5

Funding

Leverage has reduced vs Leverage ratio1 ▪ Leverage has reduced again in Debt maturity profile

FY 2020 and liquidity the period to 24.1%

HY 2021

remains strong 24.1% ▪ At 30 June, the £800m revolving

1000

credit facility was drawn by

FY 2020 £290m, having enabled the

25.3% £350m bond repayment in June. 800

HY 2020

27.3% ▪ There were no changes to Bupa’s

credit ratings in the period. 600

FY 2019

25.1%

400

HY 2019

24.3%

200

Leverage ratio when accounting for 0

2021 2022 2023 2024 2025 2026 >2026

IFRS 16 lease liabilities

HY 2021

Bupa Finance plc Senior

31.1%

Bupa Finance plc Tier 2

Subordinated

FY 2020 Bank facilities

32.4%

FY 2019

1 Leverage is calculated based on gross debt (including hybrid debt)

32.7%

divided by gross debt plus equity.

Bupa half year results presentation 2021 19Section 1 Section 2 Section 3 Section 4 Section 5

Cash and financial investments

Net cash generated from operating activities ▪ Net cash generated from operating

Net cash generated

activities decreased from £843m in

from operating activities H1 2020 to £440m as claims

was £440m as claims £440m outflows return to a more normal

outflows normalise level compared to 2020.

£843m ▪ Cash and investments were

marginally down.

(44%) AER

▪ Conservative portfolio, primarily

cash-based but with circa £640m

bond and loan funds.

Cash and investment portfolio ▪ Low yield environment continues to

Conservative portfolio provide a challenging investment

2021 backdrop.

£4.7bn

2020 FY

£4.9bn

Cash and cash-like instruments

(e.g. deposits, liquidity funds, covered bonds)

Return seeking assets

Bupa half year results presentation 2021 20Section 1 Section 2 Section 3 Section 4 Section 5

Sustainability & Environmental, Social and Governance (ESG)

We continue to progress Highlights

our Sustainability agenda ▪ We established a new Board Sustainability

and this a key pillar of our Committee, which ensures the integrated

management of ESG.

new strategy.

▪ We committed to the Science Based Targets

Initiative (SBTi) to reduce our carbon

emissions.

▪ We launched eco-Disruptive, a global

innovation challenge in which Bupa teams are

interacting with eco start-ups.

Bupa half year results presentation 2021 21Section 1 Section 2 Section 3 Section 4 Section 5

Outlook and

operating

priorities

Martin Potkins

Interim Chief

Financial

Officer

Bupa half year results presentation 2021 22Section 1 Section 2 Section 3 Section 4 Section 5

Outlook and operating priorities

A resilient business, • Several of our markets are in advanced stages of vaccine

well-placed to pursue future deployment, but the pace will vary by country.

growth from transformation.

• COVID-19 is still impacting our economies and health systems, but

we are positive about the future.

• Conditions in some markets remain challenging and there is

uncertainty as to the timing and volume at which insurance claims

will return.

• Major shifts in customer expectations and engagement, particularly

in digital healthcare. The pandemic has increased people’s focus on

their health and wellbeing.

• Underlying financial strength, resilience and a diversified business

model.

• Focused on embedding our new strategy and driving growth from

transformation.

Bupa half year results presentation 2021 23Section 1 Section 2 Section 3 Section 4 Section 5

Q&A

Martin Potkins Gareth Gareth Evans

Interim Chief Roberts Group

Financial Group Financial Treasurer

Officer Controller

Bupa half year results presentation 2021 24Section 1 Section 2 Section 3 Section 4 Section 5

Further information

Website

www.bupa.com/corporate/

our performance

Investors:

ir@bupa.com

Bupa half year results presentation 2021 25Appendix

Bupa half year results presentation 2021 26Bupa’s purpose is helping ▪ Founded in 1947, Bupa is a private

people live longer, healthier, company limited by guarantee. With

no shareholders, our customers are

happier lives and making a our focus. We reinvest profits to

better world. benefit our current and future

customers.

▪ We are an international healthcare

company serving over 31 million

customers worldwide.

▪ Our global footprint has grown from

our origins in the UK to Australia,

Spain, Poland, Chile, Brazil, Mexico,

Turkey, the Middle East, the US,

Hong Kong SAR, New Zealand and

Ireland. We also have associate

businesses in Saudi Arabia and Australia and Europe and Latin Bupa Global and UK Bupa Hong Kong

India. We directly employ around New Zealand America

85,000 people. Associate businesses

in Saudi Arabia and

India

IPMI

We also offer international private medical insurance (IPMI) for cover in most countries, including through our associate

business Highway to Health (GeoBlue) in the US.

Market Unit structure

This infographic reflects our market unit structure as of 30 June 2021.

Bupa half year results presentation 2021 27Business mix1 Health insurance2 Health insurance accounts for 72% of our total revenue with

17.9m insurance customers worldwide.

Strong domestic health insurance presence in: UK, Australia,

Bupa in the context of the Spain, Chile, Hong Kong, Turkey, Brazil3 and Mexico and our

associate businesses in Saudi Arabia and India

wider insurance market International Private Medical Insurance: Bupa Global

Dental insurance: Australia, UK, Spain, Chile, Poland, Hong Kong

SAR, Brazil and through Bupa Global

Provision Health provision accounts for 20% of our total revenue with

Personal Lines

Specialist P&C

13.6m customers worldwide. We operate around 390 health

clinics, 22 hospitals and over 1,000 dental centres.

Motor Hospitals: Spain, Chile, Poland and one in the UK

Life

Dental centres: UK, Ireland, Australia, Spain, Chile, New Zealand,

Poland, Brazil and Hong Kong SAR.

Clinics: Spain, Chile, Poland, the UK, Brazil4, Hong Kong SAR,

Saudi Arabia5, Australia, New Zealand and China

Aged Care Residential aged care accounts for 8% of total revenue.

We provide aged care services in the UK, Spain, Australia and New

Zealand

1 All numbers are updated as of FY 2020.

2 We also provide travel insurance, cash plans, subscription products and third party

administration arrangements in different markets.

3 We have a growing domestic health insurance business in Mexico.

4 We also have very small numbers of clinics in other Latin American countries

including Peru.

5 We have an interest in the MyClinic business in Saudi Arabia.

Bupa half year results presentation 2021 28Bupa’s footprint Australia and

New Zealand

Europe and

Latin America

Bupa Global and UK Other

and Market Units Australia New Zealand Spain1 Poland Turkey Chile Brazil

Bupa Global

Latin America2,3 Mexico

United

Kingdom4

Bupa

Global2

Saudi

Arabia5 India5

Hong

Kong SAR

Mainland

China

(as of 30 June 2021) Funding Health insurance

Pay-as-you-go

Dental insurance

Travel insurance

Cash plans

Health provision Clinics

Hospitals

Dental centres

Optical and audiology

Aged care provision Care homes

Retirement villages

Australia and New Zealand Europe and Latin America Bupa Global & UK Other

Australia: New Zealand: Spain: Chile: UK: Saudi Arabia:

Bupa Health Insurance Bupa Villages and Sanitas Seguros Bupa Chile Bupa UK Insurance Private health insurer, Bupa Hong Kong:

Bupa Health Services Aged Care New Sanitas Hospitales Brazil: Bupa Dental Care4 Bupa Arabia5, in which Health insurance and

Bupa Villages and Zealand and New Services CarePlus Bupa Care Services we have a 43.25% provision.

Aged Care Australia Sanitas Dental Mexico: Bupa Health Services stake. We also have an Bupa China:

Sanitas Mayores1 Bupa Mexico IPMI: interest in MyClinic, a Comprises our

Poland: IPMI: Bupa Global2 health clinics business. representative office in

LuxMed Bupa Global India: Beijing and an

Turkey: Latin America2, 3 Max Bupa5: Private integrated medical

Bupa Acıbadem health insurer in India, centre in Guangzhou.

Sigorta in which we hold a

44.42% stake.

1 In Spain we also have day care centres.

2 Global international insurance coverage available in many countries.

3 BGLA’s main operations include Guatemala, Panama, Dominican Republic, Colombia, Ecuador, Bolivia and Chile and a provision business in Peru.

4 We also run dental centres in the Republic of Ireland.

5 Bupa Arabia (Saudi Arabia) and Max Bupa (India) are associate businesses.

Bupa half year results presentation 2021 29Breakdown

of borrowings

HY 2021 FY 2020 HY 2020

£m £m £m

£330m perpetual hybrid bond (guaranteed by Bupa Insurance Ltd) - - 349

£350m senior bond due 2021 - 350 350

£500m subordinated bond due 2023 503 503 503

£300m senior bond due 2024 304 310 309

£400m subordinated bond due 2026 398 397 397

£300m senior bond due 2027 291 300 299

£350m subordinated bond due 2035 347 347 346

Revolving credit facility 290 - -

Bupa Chile borrowings 90 177 172

Other 52 54 41

Total borrowings 2,275 2,438 2,766

Bupa half year results presentation 2021 30Disclaimer

Cautionary statement This document may contain certain ‘forward looking statements’. Statements that are not historical facts, including statements about the

beliefs and expectations of The British United Provident Association Limited (Bupa) and Bupa’s directors or management, are forward looking

concerning forward statements. In particular, but not exclusively, these may relate to Bupa’s plans, current goals and expectations relating to future financial

looking statements condition, performance and results.

By their nature, forward looking statements involve risk and uncertainty because they relate to events and depend upon future circumstances

that may or may not occur, many of which are beyond Bupa’s control and all of which are solely based on Bupa’s current beliefs and

expectations about future events. These circumstances include, among others, global economic and business conditions, market related risks

such as fluctuations in interest rates and exchange rates, the policies and actions of governmental and regulatory authorities, the impact of

competition, the timing, impact and other uncertainties of future mergers or combinations within relevant industries. Such forward looking

statements involve known and unknown risks, uncertainties and other factors, which may cause the actual future condition, results,

performance or achievements of Bupa or its industry to be materially different to those expressed or implied by such forward looking

statements. Other than as required by law, Bupa expressly disclaims any obligations or undertakings to release publicly any updates or

revisions to any forward looking statements to reflect any change in the expectations of Bupa with regard thereto or any change in events,

conditions or circumstances on which any such statement is based. To the fullest extent possible by receipt of, and using, this document, you

release Bupa and each of its affiliates, advisers, directors, employees and agents, in all circumstances (other than fraud) from any liability

whatsoever and howsoever arising from your use of this document. In addition, no responsibility of liability or duty of care is or will be

accepted by Bupa or its respective affiliates, advisers, directors, employees and agents, for updating the document (or any additional

information), correcting any inaccuracies in it or providing any additional information to any person.

Accordingly, none of Bupa or its affiliates, advisers, directors, employees or agents shall be liable (save in the case of fraud) for any loss

(whether direct, indirect or consequential) or damage suffered by any person as a result of relying on any statement in, or omission from, the

document.

Forward-looking statements in this document are current only as of the date on which such statements are made.

Neither the content of Bupa’s website nor the content of any other website accessible from hyperlinks on Bupa’s website is incorporated into,

or forms part of, this document.

Bupa half year results presentation 2021 31You can also read