Managing Divergent Recoveries - Bizweek

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

CURRENCY MOVEMENT

March 2020 - 2021:

The year of the dollar

ÉDITION 337

ÉDITION 151 –– VENDREDI

VENDREDI09

23AVRIL 2021

JUIN 2017 L’HEBDOMADAIRE DIGITAL GRATUIT

L’ HEBDOMADAIRE ÉLECTRONIQUE GRATUIT

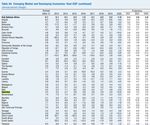

APRIL 2021 WORLD ECONOMIC OUTLOOK (WEO) GROWTH FORECASTS

Managing Divergent

Recoveries

It is one year into the COVID-19 pandemic and the global community still confronts extreme social and

economic strain as the human toll rises and millions remain unemployed. Yet, even with high uncertainty

about the path of the pandemic, a way out of this health and economic crisis is increasingly visible. Thanks

to the ingenuity of the scientific community hundreds of millions of people are being vaccinated and this is

expected to power recoveries in many countries later this year. Economies also continue to adapt to new ways

of working despite reduced mobility, leading to a stronger than anticipated rebound across regions. Addi-

tional fiscal support in large economies, particularly the United States, has further improved the outlook. In

the latest World Economic Outlook, the International Monetary Fund (IMF) is now projecting a stronger

recovery for the global economy compared with our January forecast, with growth projected to be 6 percent

in 2021 (0.5 percentage point upgrade) and 4.4 percent in 2022 (0.2 percentage point upgrade), after an

estimated historic contraction of -3.3 percent in 2020myt.mu | 8908

Res lakaz

Pey avek

my.t money

Recharge

CASH

Offer valid until 30th April. Conditions apply.

Activ ou

BACK unlimited

mobile data

Pey ou

bann bil

CEB CWA MTVENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 3

BIZ ALERT

CURRENCY MOVEMENT

March 2020 - 2021:

The year of the dollar

Last year was clearly the year of the dollar when it comes to analysing currency trends. With the dollar being the main anchor currency, the fortunes

of the United States economy were the drivers of all such movements. There have been phases of the dollar falling as the virus infection cases relent-

lessly went up and the government stood back without taking any major steps in terms of trying to prevent the same. Then there were the US Elec-

tions where the run-up was felt in the currency market all the time. And last, the growth forecasts of the US economy continued to improve over time

T

and now it does appear that the economy will only move in the upward direction

his scenario has been support-

ed by the Fed with the assur-

across geographies which can be seen in the

foreign investment trends especially in the

economy emitting the right signals.

• Among the developed markets the pound

Volatility

ances of buyback of bonds stock market which gets reflected in balance and euro gained by 10.9% and 7.1% Annualized monthly volatility during the

as well as maintaining a low of payments and hence currency value. against the dollar. year is a useful indicator to capture the noise

interest rate regime. However, A way to gauge how things have changed • The other currencies which went up on during the year and here the INR fared well

notwithstanding these positive impulses, the in the currency market is to look at averag- a point-to-point basis were Australian with 3.3%. The other currencies that had

bond yields have been rising of late with es for the months starting March 2020 till dollar (19.4%), rand (10.2%), renminbi volatility of less than 5% were pound, yen,

the 10-year yield now at 1.74%. last year it March 2021 and measuring the changes that (7.3%), Mexican peso and won (7.2%), renminbi, Hong Kong dollar, Singapore

was around 70 bps. Inflation concerns have have taken place over the year along with the Taiwan dollar (6.2%), rupiah (5.6%), dollar, ringgit, Philippine peso, won and Tai-

come in expectations. Hence there has been volatility. The former says whether the cur- Singapore dollar (5.3%), Philippine peso wan dollar.

an increase of around 100 bps during this rency is stronger or weaker against the dol- (5.2%), baht (4.2%), ringgit (4.5%) and Those with volatility between 5-10% were

period. lar, while the latter speaks more on the noise Indian rupee (2.3%). Quite clearly the rupiah, Australian dollar, ruble and baht.

This becomes important for the rest of elements during the year. Both of them pro- rupee was managed well to ensure there Currencies with volatility of above 10%

the world as global investment flows are vide fairly revealing pictures. was no sharp appreciation which could were real, rand, Turkish lira and Mexican

driven by these factors. When the US econ- have exacerbated problems with declin-

omy is doing well and bond yields go up, Currency movements ing exports.

peso.

there is a tendency for investors to invest in • The currencies which depreciated against

domestic markets. Also, with growth pros- The dollar over the year had declined, but the dollar were yen (1%), real (15.4%),

[Source: Analysis by CARE

pects improving investment in physical as- interestingly has been strengthening since Turkish lira (21%), Mauritian Rupee.

RATINGS (AFRICA) PRIVATE

sets open up thus making the US market at- February mainly due to the concerns that • Hong Kong dollar and ruble remained vir-

were there earlier being addressed and the LIMITED - April 2021]

tractive. This leads to a reallocation of funds tually unchanged.VENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 4

LA TOUR

APRIL 2021 WORLD ECONOMIC OUTLOOK (WEO) GROWTH FORECASTS

Managing Divergent

Recoveries

It is one year into the COVID-19 pandemic and the global community still confronts extreme social and economic strain as the human toll rises and

millions remain unemployed. Yet, even with high uncertainty about the path of the pandemic, a way out of this health and economic crisis is increas-

ingly visible. Thanks to the ingenuity of the scientific community hundreds of millions of people are being vaccinated and this is expected to power

recoveries in many countries later this year. Economies also continue to adapt to new ways of working despite reduced mobility, leading to a stronger

than anticipated rebound across regions. Additional fiscal support in large economies, particularly the United States, has further improved the out-

look. In the latest World Economic Outlook, the International Monetary Fund (IMF) is now projecting a stronger recovery for the global economy

compared with our January forecast, with growth projected to be 6 percent in 2021 (0.5 percentage point upgrade) and 4.4 percent in 2022 (0.2

percentage point upgrade), after an estimated historic contraction of -3.3 percent in 2020

Asset Purchase

Programs and Mauritius

The COVID-19 crisis saw

an unprecedented use of

unconventional monetary policy

instruments among emerging

market and developing economies.

Twenty-seven emerging market

and developing economies

launched Asset Purchase Programs

(APPs), with most announcing

them for the first time—starting with

Indonesia on March 2, 2020. Most

emerging market and developing

economy central banks justified

APPs as a means to counter market

dysfunction, with only a handful

(Ghana, Indonesia, Mauritius) also

stating the support of government

financing as a motivation for the

program.23 The vast majority of

countries announced that their

purchases were confined to

government bonds; only a few

also announced purchases of

corporate or bank bonds (Brazil,

Chile, Hungary, Mauritius) or equities

(Egypt).

formative forces of digitalization and auto-

mation, many of the jobs lost are unlikely to

return, requiring worker reallocation across

sectors—which often comes with severe

earnings penalties.

Swift policy action worldwide, including

$16 trillion in fiscal support, prevented far

worse outcomes. Our estimates suggest last

year’s severe collapse could have been three

times worse had it not been for such support.

Because a financial crisis was averted, me-

dium-term losses are expected to be smaller

N

than after the 2008 global financial crisis, at

around 3 percent. However, unlike after the

onetheless, the future pre- the level of GDP it was forecast to have in tations. The average annual loss in per capita 2008 crisis, it is emerging markets and low-in-

sents daunting challenges. 2022 in the absence of this pandemic. Other GDP over 2020-24, relative to pre-pandem- come countries that are expected to suffer

The pandemic is yet to be de- advanced economies, including the euro area, ic forecasts, is projected to be 5.7 percent greater scarring given their more limited pol-

feated and virus cases are ac- will also rebound this year but at a slower in low-income countries and 4.7 percent in icy space.

celerating in many countries. pace. Among emerging markets and devel- emerging markets, while in advanced econ- “A high degree of uncertainty surrounds our pro-

Recoveries are also diverging dangerously oping economies, China is projected to grow omies the losses are expected to be smaller jections. Faster progress with vaccinations can uplift

across and within countries, as economies this year at 8.4 percent. While China’s econ- at 2.3 percent. Such losses are reversing gains the forecast, while a more prolonged pandemic with

with slower vaccine rollout, more limited pol- omy had already returned to pre-pandemic in poverty reduction, with an additional 95 virus variants that evade vaccines can lead to a sharp

icy support, and more reliant on tourism do GDP in 2020, many other countries are not million people expected to have entered the downgrade. Multi-speed recoveries could pose financial

less well. expected to do so until 2023. ranks of the extreme poor in 2020 compared risks if interest rates in the United States rise further

The upgrades in global growth for 2021 with pre-pandemic projections. in unexpected ways. This could cause inflated asset

and 2022 are mainly due to upgrades for ad- Daunting challenges Uneven recoveries are also occurring valuations to unwind in a disorderly manner, financial

vanced economies, particularly to a sizeable

upgrade for the United States (1.3 percentage

ahead within countries as young and lower-skilled

workers remain more heavily affected. Wom-

conditions to tighten sharply, and recovery prospects to

deteriorate, especially for some highly leveraged”, says

points) that is expected to grow at 6.4 per- en have also suffered more, especially in Gita Gopinath, the Economic Counsellor

These divergent recovery paths are likely to

cent this year. This makes the United States emerging market and developing economies. and Director of the Research Department at

create wider gaps in living standards across

the only large economy projected to surpass Because the crisis has accelerated the trans- the International Monetary Fund.

countries compared to pre-pandemic expec-

Cont’d on page 5VENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 5

LA TOUR

High uncertainty

surrounds the global

outlook

Future developments will depend on the

path of the health crisis, including whether

the new COVID-19 strains prove susceptible

to vaccines or they prolong the pandemic; the

effectiveness of policy actions to limit persis-

tent economic damage (scarring); the evolu-

tion of financial conditions and commodity

prices; and the adjustment capacity of the

economy. The ebb and flow of these drivers

and their interaction with country-specific

characteristics will determine the pace of

the recovery and the extent of medium-term

scarring across countries. In many aspects,

this crisis is unique. In certain countries,

policy support and lack of spending oppor-

tunities have led to large increases in savings

that could be unleashed very quickly should

uncertainty dissipate. At the same time, it is

unclear how much of these savings will be

spent, given the deterioration of many firms’

and households’ balance sheets (particularly

among those with a high propensity to con-

sume out of income) and the expiration of

loan repayment moratoria. In sum, risks are

assessed as balanced in the short term, but

tilted to the upside later on.VENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 6

ACTA PUBLICA

ONLINE RETAILING

How to navigate

the new normal

After a year of exponential growth, online retailing is among the sectors best placed to succeed in 2021. However, with the coronavirus (Covid-19)

pandemic persisting in many countries, companies will not find it easy to capitalise on the opportunities presented by the new retail environment. As

well as responding to changed consumer needs, companies will need to explore which markets offer most potential, all the while navigating increased

regulatory barriers, as well as cyber-security and labour risks. In this special report published on the 7th of April, The Economist Intelligence Unit

dives deep into the opportunities and threats facing online retailing and highlights the key factors to consider while preparing for success in a fiercely

T

competitive sub-sector

he pandemic transformed re-

tail in 2020. In its new report, In a fiercely competitive sector, there will

the Economic Intelligence Unit be both winners and losers from the market

(EIU) estimates that global on- transformation, depending on retailers’ abili-

line retail sales expanded by ty to shift online and retain customers. Suc-

32% in that year, to US$2.6trn, even while cess will be underpinned by several factors,

the overall retail market contracted by over including: - Competitive product positioning

2%. After such a record year for online re- and pricing strategies; - User-friendly digital

tail, growth will inevitably slow from 2021, platforms; - Efficient inventory management;

but online retailers will not easily give up the - Fast and efficient fulfilment processes

ground they have gained. Beyond thinking about their customer bas-

The uncertainties over the rollout of coro- es and product offerings, retailers will need to

navirus (Covid-19) vaccines and the emer- devise new strategies in three key areas:

gence of new strains of the virus will keep Next-generation technologies: After

social distancing measures in place in many slashing inventories early in 2020, many US

countries in 2021. Moreover, the ease of on- retailers faced a shortage of goods in sectors for click-and-collect or online fulfilment) or expand their physical presences and reach a

line shopping and home delivery has made such as apparel and electronics during the micro-fulfilment areas. In the US, Amazon larger customer base. However, they will face

them attractive options to many consumers, holiday season. Striking a good demand-sup- and Walmart were opening dark stores even challenges in the new retail landscape. Small-

who will continue to use these methods even ply balance amid increased uncertainty will before the pandemic struck and have since er franchise partners are unlikely to be capa-

when they can walk into shops again. Com- be challenging but crucial to success in 2021, amplified these efforts. Online grocery retail- ble (financially or otherwise) of building and

bining data and forecasts that cover 58 mar- encouraging investment in data analytics. Us- ing gained popularity in Europe during the running specialised flagship outlets. Those

kets worldwide, the EIU forecasts that global ing the latest technologies to collect and an- lockdowns, and retailers who were previously running fast-food chains may shift to oper-

online retail sales will increase their share of alyse user data in real time will be helpful in servicing online orders from physical shops ating cloud kitchens, for instance, but starting

total retail sales to nearly 20% by 2025, up framing both online and offline strategies. An might find that approach unsustainable in the a new business after facing steep losses amid

from 10.3% in 2019. Much of this growth increasing number of retailers (such as Nike) longer term, forcing investment in dedicated a global recession will be challenging. Big-

will be driven by two factors. are already collecting customer data directly, fulfilment centres. ger franchises might also see their business

Developing markets: The pandemic has besides collecting insights from tech giants The power of platforms: Online market- shrink, as companies in the fashion or luxury

helped to narrow the gap between Asian and such as Facebook or Google. places and multi-brand retailers will need to space move to service online orders from out

North American consumer markets and has Retailers will also need to make the most explore ways to widen their seller networks of the country and seek more control over

shown the former to be more resilient. Out- of developments in machine learning and after the pandemic. A new generation of dig- pricing and inventory.

side Asia, there will be opportunities for ex- AI-powered chatbots to personalise custom- ital entrepreneurs, forced to start their own Employees: Lockdowns, the rising li-

pansion in the Middle East and Latin Amer- er interactions. Online fashion retailing will businesses following job losses, might pro- quidity crisis among retailers, and the fall in

ica, where online retail surged in 2020 but increasingly involve AI to allow customers vide new opportunities. The popularity of consumer demand for non-essentials have

much of these markets remains in the hands to visualise themselves wearing the products online shopping, wider adoption of digital resulted in furloughs and lay-offs across the

of unorganised players. they wish to buy. Over time, tech-heavy retail- payments and increased use of social media retail sector over the past year. Some former

Online food and grocery delivery: In ers will seek new modes of revenue via dig- (such as Instagram and TikTok) for market- retail workers will find new opportunities in

a year that led to a decline of nearly 4% in ital advertising (as Amazon and Walmart are ing have given many entrepreneurs the option warehousing, logistics and courier services,

global consumer spending, expenditure on doing) or selling their digital technologies (as to trade from home, without having to invest which are expanding to support the surge in

food and beverages still rose by 5%. Online Ocado has) to a new generation of online re- capital in renting stores or office spaces. online sales.

grocery has been the biggest beneficiary, ex- tailers, blurring the line between retailers and Indeed, data from the US show a record In the US alone, a net figure of 751,000

panding from a small base pre-Covid to ac- technology companies. increase in new business applications (24%, retail jobs was lost in 2020, while warehous-

count for the lion’s share of online sales in Commercial real estate: While low foot- year on year), especially in retail (54%). Many ing and courier services gained 115,000 and

most markets. Online grocery is expected to fall has shut down several bricks-and-mortar of these entrepreneurs will rely on online 124,000 jobs, respectively. However, stocking

retain its momentum over other categories of outlets, retailers still need to store their goods marketplaces in which to expand and pro- products in warehouses or delivering orders

goods until at least 2023, when non-food re- in a way that allows them to fulfil the maxi- mote their businesses. Providing digital and to customers can be more physically demand-

tailing will start to accelerate again. mum number of online orders in the short- logistics support to small and local businesses ing and less enticing for a cashier or shop

est time possible. This creates opportunities will be a good way for marketplaces not only assistant who enjoyed interacting with cus-

How to build winning to turn vacant shops or shopping centres to expand their product variety, but also to

placate regulators, who are keen to support

tomers. Working conditions in warehouses

are definitely challenging, while delivery jobs

strategies? into “dark stores” (warehouse spaces used

small sellers. are mostly contractual and involve no securi-

ty. Pay is often lower than in retail jobs, too.

Who stands to lose? In the short term, with the supply of work-

ers high, online retailers will have little incen-

Amid all the opportunities thrown up by tive to improve working conditions or raise

online retailing, there will also be losers from pay. Even as recruitment markets tighten, this

the transition. may not be financially viable for many online

Franchise operators: As retail chains step companies, which are already struggling to

up investment in digitalisation in 2021, the widen margins. Instead, they may increase

need to cut costs elsewhere will require many investment in automating fulfilment and

to adjust their physical footprint; pull out of warehousing jobs, while courier services will

unprofitable markets; and operate fewer, but explore alternatives such as drone deliveries.

more specialised stores offering personalised Although unwelcome with employees, this

experiences. Companies are now more likely move away from reliance on people could al-

to bypass third parties and build direct rela- low retailers to accelerate productivity growth

tionships with customers via digital channels. and profitability.

The franchise business model has been a [Source: A report by The Economist

popular and efficient way for retail chains to Intelligence Unit - 07 April 2021]VENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 7

POST SCRIPTUM

Pandemic: Commercial

Real Estate at a Crossroads

Empty office buildings. Reduced store hours. Unbelievably low hotel room rates. All are signs

of the times. The containment measures put in place last year in response to the pandemic

ANDREA DEGHI,

shuttered businesses and offices, and dealt a severe blow to the demand for commercial real

Financial Sector Expert estate—especially, in the retail, hotel, and office segments

in the Global Financial

Stability Analysis Division

of the IMF’s Monetary and

Capital Markets Department

FABIO M. NATALUCCI,

Deputy Director of the same

Department

B

eyond its immediate impact, The risk of a fall in prices grows when we 5 percentage points (due to a change in

the pandemic has also clouded can observe large price misalignments— consumer and corporate preferences) could

the outlook for commercial that is, when prices in the commercial real lead to a drop in fair values by 15 percent

real estate, given the advent of estate market deviate from those implied by after five years.

trends such as the decline in economic fundamentals, or “fair values.” One must keep in mind, however, that

demand for traditional brick-and-mortar Our recent analysis shows that these price there is huge uncertainty about the outlook

retail in favor of e-commerce, or for offices misalignments magnify downside risks for commercial real estate, making a

as work-from-home policies gain traction. to future GDP growth. For instance, a definitive assessment of price misalignments

Recent IMF analysis finds these trends 50-basis-point drop in the capitalization extremely difficult.

could disrupt the market for commercial rate from its historical trend—a commonly

real estate and potentially threaten financial used measure of misalignment—could Policymakers’ role in

stability. raise downside risks to GDP growth by countering financial

1.4 percentage points in the short term

stability risks

The financial stability (cumulatively over 4 quarters) and 2.5

connection percentage points in the medium term

Low rates and easy money will help

(cumulatively over 12 quarters).

nonfinancial firms continue to be able to

The commercial real estate sector has

COVID-19’s heavy toll access credit, thereby helping the nascent

the potential to affect broader financial recovery in the commercial real estate

stability: the sector is large; its price sector. However, if these easy financial

movements tend to reflect the broader Looking at the impact of the pandemic, conditions encourage too much risk-

macro-financial picture; and, it relies our analysis also shows that price taking and contribute to the pricing

heavily on debt funding. misalignments have increased. Unlike misalignments, then policymakers could

In many economies, commercial real estate previous episodes, however, this time around turn to their macroprudential policy toolkit.

loans constitute a significant part of banks’ the misalignment does not stem from Tools like limits on the loan-to-value or

lending portfolios. In some jurisdictions, excessive leverage build-up, but rather from debt service coverage ratios could be used

nonbank financial intermediaries (e.g., a sharp drop in both operating revenues to address these vulnerabilities. Moreover,

insurance firms, pension funds, or and the overall demand for commercial real policymakers could look to broaden the

investment funds) also play an important estate. reach of macroprudential policy to cover

role despite the fact that banks remain As the economy gains momentum, nonbank financial institutions, which

the largest providers of debt funding to the misalignment is likely to diminish. are increasingly important players in

the commercial real estate sector globally. Nevertheless, the potential structural commercial real estate funding markets.

An adverse shock to the sector can put changes in the commercial real estate Finally, to ensure the banking sector

downward pressure on commercial real market due to evolving preferences in stays strong, stress testing exercises

estate prices, adversely affecting the credit our society will challenge the sector. could help inform decisions on whether

quality of borrowers and weighing on the For example, a permanent increase in adequate capital has been set aside to cover

balance sheets of lenders. commercial property vacancy rates of commercial real estate exposures.VENDREDI 09 AVRIL 2021 | BIZWEEK | ÉDITION 337 8

DEBRIEF

LUTTE CONTRE LE BLANCHIMENT DE CAPITAUX

ET LE FINANCEMENT DU TERRORISME

Réouverture partielle : Cim Finance

soutient ses clients avec une période

Konformitas de grâce

Afin de ne pas pénaliser les clients qui n’ont pas pu effectuer leurs

aux côtés des

paiements dus à la fin du mois de mars, Cim Finance applique une

période de grâce jusqu’au 16 avril 2021 pour les paiements à effectuer.

« Nous sommes conscients que certains de nos clients n’ont pas pu effec-

entreprises pour leur

tuer leurs paiements pour la fin du mois de mars en raison des restrictions

sanitaires en place. C’est pour cela que nous avons décidé qu’aucun intérêt

supplémentaire ne leur sera facturé pour les montants dus, et ce, jusqu’au

16 avril 2021. Nos clients ayant les cartes de crédit Cim verront un ajust-

mise en conformité

ement des frais de paiements tardifs sur leurs relevés du mois d’avril.

Les clients faisant face à des difficultés financières peuvent contacter nos

équipes en appelant au 203 6698 pour toute assistance », explique Roger

Li, Head of Consumer Finance de Cim Finance.

Proposer des conseils et un accompagnement de qualité aux entreprises en matière de

mise en conformité avec les lois relatives à la lutte contre le blanchiment de capitaux MC Vision redouble de vigilance pour

et le financement du terrorisme (AML/CFT). C’est la mission que s’est donnée la réouverture de neuf Canal+ Stores

Dans l’optique de protéger son personnel, ses collaborateurs et le

Konformitas, une société de conseil nouvellement créée

L

grand public, MC Vision a renforcé son protocole sanitaire et sécuri-

a capacité des entreprises à veiller au respect taire pour la réouverture de neuf de ses CANAL+ STORES dans le

des normes et des règlements est désormais un cadre du déconfinement progressif, annoncé par l’État. Ainsi, depuis

facteur clé pour leur croissance à long terme. le 1er avril, ces succursales sont ouvertes du lundi au samedi et les

D’où la mission de cette société, basée à Ebène, qui clients y ont accès selon le même ordre alphabétique établi pour les

proposera des services complets, allant de l’évaluation supermarchés et autres commerces, à savoir A – F : lundi et jeudi, G –

à la mise en place de procédures internes, en passant N : mardi et vendredi et O – Z – mercredi et samedi.

par la formation.

La lutte contre le blanchiment de capitaux et le

financement du terrorisme s’est considérablement LUX* La Baraquette Resort &

renforcée au cours de ces dernières années. Cela a eu Residences présente un monde de

pour résultat de rendre plus complexes les normes et

les règlements que doivent respecter les institutions possibilités avec « LUX* Unlimited »

financières, les entreprises et professions non-fi-

nancières désignées et les agences gouvernementales.

« Les entreprises privées ont un rôle important à jouer dans

la lutte contre le blanchiment de capitaux pour aider le pays à

sortir de la liste noire de l’Union européenne. De plus, le non-re-

spect des lois en vigueur peut avoir de graves conséquences sur

leurs activités et leurs employés, d’où notre mission de les accom-

pagner. Nous les aiderons à identifier les risques afin d’optimiser

leurs procédures voire, si nécessaire, mettre en place de nouvelles

structures internes pour mieux les protéger », explique Yotsna

Lalji Venketasawmy, Chief Executive Officer (CEO) notamment les agents immobiliers, les négociants en

de Konformitas Consulting Ltd. métaux précieux et pierres précieuses, les casinos et les Situé dans la pittoresque ville portuaire de Marseillan, LUX* La

Les services de Konformitas s’adresseront aux insti- maisons de jeux, les professions juridiques (avocats, Baraquette Resort & Residences (qui ouvrira ses portes en 2023) sur-

tutions financières ainsi qu’aux Entreprises et Profes- notaires, etc.), les comptables, ainsi que les prestataires plombe un vignoble privé et l’impressionnant étang de Thau, long de

sions Non Financières Désignées (EPNFD), qui inclut de services aux trusts et aux sociétés. 240 km inscrit au patrimoine mondial de l’UNESCO. Ce projet archi-

tectural mixte, construit en partenariat avec le principal promoteur

Propriétés & Co, propose 133 appartements élégants, allant du studio

Performance du Groupe ENL :

à la chambre à coucher, 30 villas avec patio méditerranéen ainsi que 4

villas spectaculaires en front de mer. Les propriétaires de résidences ne

possèdent pas seulement la clé d’une maison de campagne en France

Perte opérationnelle de près ; ils peuvent également échanger leurs nuits gratuites dans d’autres

LUX* Resorts & Hotels à l’île Maurice et au Vietnam, offrant ainsi

d’un milliard de roupies

aux propriétaires des vacances gratuites dans certaines des destina-

tions les plus enchanteresses du monde. L’adhésion à « LUX* Unlim-

ited » s’accompagne d’une multitude de privilèges et d’avantages. Les

Les premiers mois du confine- prix varient entre 300 000 euros pour une Suite Jardin avec une cham-

ment national occasionné par la bre et 4,5 millions d’euros pour une luxueuse villa en bord de mer.

pandémie de Covid-19 ont lourde-

ment impacté la performance du

groupe ENL. Le rapport annuel de MC Vision lance une chasse aux

l’entreprise pour l’exercice financi- œufs… virtuelle

er 2020 fait état d’une perte opéra- MC Vision a or-

tionnelle de près d’un milliard de ganisé une chasse

roupies, due essentiellement à l’ar- aux œufs virtuelle

rêt de ses activités hôtelières. sur son profil Ins-

Dans une analyse détaillée, pub- tagram CANAL+

liée dans le rapport annuel sous Maurice du 2 au 5

forme d’interview, le CEO d’ENL, avril, dans le cadre

Hector Espitalier-Noël, relève que de la célébration de la

toutes les activités du groupe ont Pâques. Les abonnés

fait preuve de résilience à l’issue étaient ainsi invités

à s’amuser en famille

du premier confinement, à l’ex- er le tourisme. Selon lui, l’exercice en cherchant ces pe-

ception notable de l’hôtellerie, qui financier en cours s’annonce diffi- tits œufs de Pâques

continue d’être affectée par l’inac- cile, avec ce deuxième confinement bien dissimulés.

tivité due à la fermeture des fron- national qui ne fait qu’exacerber « En sus de l’ouverture

tières nationales. Les plans d’aide l’environnement incertain dans le- des chaînes pendant ce-

mis en place par le gouvernement, quel évolue le groupe. tte période particulière,

notamment avec la création de la Le CEO d’ENL s’attend à ce nous avons voulu venir

Mauritius Investment Corpora- que le groupe retrouve sa rentabil- avec un concept atypique de chasse aux œufs virtuelle pour permettre à nos

tion, sont d’un soutien précieux, ité en 2022, sauf pour l’hôtellerie abonnés de se divertir en famille », rappelle Ghislaine Tchibozo, CEO

mais ne pallient pas l’urgence de où la reprise ne serait pas prévue de MC Vision.

rouvrir les frontières et de relanc- avant 2023.You can also read