PRAGUE OFFICE MARKET OVERVIEW - 2021 | CZECH REPUBLIC - WIKIBANKS

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

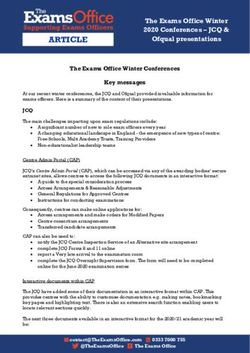

2

Macroeconomic overview

Q1 |Czech Republic

Research & Forecast Report | Colliers International

The Czech Republic remained consumer spending is also

in a state of emergency during expected to lead the recovery,

the entire first quarter of 2021. thanks to the accumulated

This condition was ended in savings amongst the

mid-April and lasted a total of population.

189 days. Despite some

progress of distributing the What could be surprising,

vaccine to the population, it is despite reported closures of

still quite slow in comparison hundreds of restaurants and

with other countries in Europe. even several retail brands and

As the count of new confirmed chains, is that the

cases of COVID decreases, the unemployment rate has

whole country looks forward to remained at similar levels

loosening the measures. There recorded last year, reaching

is however a long road back to 4.2% at the end of March 2021.

normality and the government, This represents approximately

both current and future (which 307,000 jobless individuals in

will be elected in autumn), the country. This rate is

must avoid the mistakes made expected to remain for some

last year. time during 2021 and even

decrease further forward in

As we could expect, the 2022, once the economy can

prolonged state of emergency operate without limitations.

affected the forecasts for GDP.

In general, we are still One big question mark still

expecting a rebound in H2 hangs over inflation. There

2021 from the current were several scenarios warning

slowdown and through 2022. about the inevitability of

According to Oxford increasing consumer prices

Economics, the forecasted however, many economists

growth for this year is 3.3%. and institutions are now

Industry and exports are still forecasting a much more

the main economic engines, conservative outlook for Czech

even with several bottlenecks Republic, ranging from 2.0% to

in supply chains that can limit 2.5% in 2021.

their outputs. By the time

shops re-open, strong

Gross domestic product 8,0

(%)

6,0

4,0

2,0

0,0

-2,0

-4,0

-6,0

-8,0

2018

2021

2011

2012

2013

2014

2015

2016

2017

2019

2020

2022

2023

2024

Czech Republic Czech Republic predictions

Eurozone Eurozone predictions

Sources: Colliers International, Oxford Economics3

Research & Forecast Report | Colliers International

Q1 |Czech Republic

Prague office market

New supply and vacancy Both projects were

refurbishments of older

The first quarter of the year properties. Hybernská 1,

can sometimes be a little located in the city centre near

overlooked, especially after náměstí Republiky, added

traditionally strong fourth 1,500 sq m and Olbrachtova 5,

quarters. But in 2021, when in Prague 4, added 2,000 sq m.

everyone in the Czech Republic With the increasing age of a

is hoping for some large part of the stock, we may

improvement either in well see many landlords

business or in life itself, the consider refurbishment or

situation on the Prague office even change of use, as a

market has broken from reaction to the city’s housing

tradition. crisis. The current modern

office stock in Prague

In the first quarter of 2021, just decreased slightly to 3.69

two developments were million sq m, due to the

completed and added a total of exclusion of several buildings

3,500 sq m to the market. This which were no longer offered

represents one of the lowest for commercial leasing.

levels in the market’s history.

Top 3 Transactions Tenant Property Transaction

of Q1 2021

Novartis Gemini Renegotiation

New Flex Centre BB Centrum B New lease

Sources: Prague Research Forum,

Colliers International Sweco Hydroprojekt Táborská 31 Renegotiation4 Q1 |Czech Republic

Research & Forecast Report | Colliers International

Modern office stock & Occupied Stock Vacant Stock

vacancy in Prague

districts 1 000 000

(sq m)

900 000

800 000

700 000

600 000

500 000

400 000

300 000

200 000

100 000

0

Prague 6

Prague 1

Prague 2

Prague 3

Prague 4

Prague 5

Prague 7

Prague 8

Prague 9

Prague 10

Sources: Prague Research Forum,

Colliers International

Vacancy rate

development Prague City Centre Inner City Outer City

9,0%

8,0%

7,0%

6,0%

5,0%

4,0%

3,0%

2,0%

1,0%

0,0%

2018 2019 2019 2019 2019 2020 2020 2020 2020 2021

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

Sources: Prague Research Forum,

Colliers International

Gross take-up

(sq m) Q1 Q2 Q3 Q4

600 000

500 000

400 000

300 000

200 000

100 000

0

Sources: Prague Research Forum, 2016 2017 2018 2019 2020 2021

Colliers International5

The expected level of supply totalled 45,200 sq m in Q1.

Research & Forecast Report | Colliers International

Q1 |Czech Republic

for the remainder of 2021 is With lower levels of expected

just 65,800 sq m, from which supply, we recommend that

over 55% is already pre-leased. tenants act earlier to secure

Next year looks similar, with their desired office space,

78,300 sq m of space under particularly within new

active construction and due for projects.

completion in 2022. On the

more optimistic side, many The biggest transaction of the

projects have entered quarter was, without a doubt,

construction phases in recent the renegotiation of Novartis in

months, including the long Gemini B in Prague 4, with a

awaited Masaryčka by Penta, size of 14,300 sq m. Among the

with approximately 25,000 sq other major deals of the

m, and PORT 7 by Skanska with quarter, we include a new lease

30,600 sq m. Both projects are of flex-office centre in BB

scheduled for delivery in 2023. Centrum B in Prague 4 (3,300

Furthermore, the market has sq m), the renegotiation of

also recorded a decent Sweco Hydroprojekt in

pipeline, with numerous Táborská 31 in Prague 4 (2,900

projects waiting to secure a sq m) and the expansion of

sufficient pre-lease in order to Livesport in Aspira Business

proceed with construction or, Centre in Prague 5 (2,200 sq

as a condition of financing. m).

As for current vacancy, we are Although sub-leases have

experiencing a slow, but attracted a lot of attention on

increasing trend. By the end of the market recently, they only

Q1 2021, approximately 7.6% contributed to Q1 take-up with

of modern offices in Prague a 4% share, or 3,600 sq m in

were vacant, representing total. But to remain objective,

280,600 sq m. This represent several units that were

an increase of 60 basis points available for sub-lease, were

quarter-on-quarter and 220 re-claimed by the respective

bps year-on-year. In addition to landlords and leased directly.

this, the sublease market is still

quite strong and offers a Rents and incentives

further 75,500 sq m of space

for a variety of conditions, Although vacancy is rising

including below market slightly, demand is still solid

standard prices and contract and occupiers who are

assignments. currently looking for new

offices have a wider range of

Demand choices. Thanks to this fact,

landlords are offering higher

Take-up in Q1 is sometimes fit-out contributions and

overshadowed by strong slightly longer rent-free

demand at the end of the year, periods, than we were

but in the current quarter, the recording in 2019. However,

numbers are a bit more reality strongly differs by

optimistic. Gross take-up developer or property

accounted for 90,200 sq m, an condition. Prime headline rents

increase year-on-year of 30%. in the city centre remained at

Demand is still strongly driven the previous range of €22.00 to

by renegotiations, as they €22.50. Rents for the best

represent share of 46% on the inner-city offices range

gross figure. Pre-leasing activity between €15.50 and €17.00

accounted for an 11% share on and prime office space in outer

gross take-up. city locations can be leased

Net demand, calculated from monthly for between €13.50

newly leased space, and €15.00 per sq m.

expansions and pre-leases6

Key market figures

Q1 |Czech Republic

Research & Forecast Report | Colliers International

Office Stock (sq m) Vacancy Rate

3.69 mln 6.7%

Q1 Gross Demand (sq m) Prime Rent

90,200 €22.50

Q1 Supply (sq m) Under Construction (sq m)

3,500 199,700

Outlook One promising fact is that

some of the largest, or most

As the government plans for significant projects, which have

lifting the restrictions are in been anticipated for years,

sight, and public testing and have entered construction

vaccination processes are phases, or are very close to it.

already under way, we believe Therefore, the pipeline new

that we will soon get at least supply for 2023 and beyond

some idea about the condition could well be above average

and also about the intentions again. A question mark

of companies active on the however still hangs over the

Prague office market. It is new building law and if it will

certain that an acceleration of really positively impact the

activity on the market will not permitting process, as a

be immediate. We still expect number of the proposed

the vacancy rate to rise by projects have been stuck in this

additional basis points, but it process for years.

will be inevitably softened by

low supply at some point in

near future.For more information

Office Agency Research & Forecasting

Petr Žalský Josef Stanko

+420 601 056 858 +420 728 175 024

petr.zalsky@colliers.com josef.stanko@colliers.com

Managing Partner

Tewfik Sabongui

+420 777 150 669

tewfik.sabongui@colliers.com

This report gives information based primarily on Colliers International data, which

may be helpful in anticipating trends in the property sector. However, no warranty is Na Příkopě 859/22

Slovanský dům B/C

given as to the accuracy of, and no liability for negligence is accepted in relation to,

the forecasts, figures or conclusions contained in this report and they must not be

relied on for investment or any other purposes. This report does not constitute and

must not be treated as investment or valuation advice or an offer to buy or sell 110 00 Praha 1

property. ( May 2021 ) © 2021 Colliers International.

Colliers International is the licensed trading name of Colliers International Property

Advisers UK LLP which is a limited liability partnership registered in England and

Wales with registered number OC385143. Our registered office is at 50 George

Street, London W1U 7GA.You can also read