The New Normal How emerging technologies and economic pressures are reshaping the IT reseller and services channel

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

A CVC Guide

The New Normal

How emerging technologies and

economic pressures are reshaping

the IT reseller and services channel

August 2010

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 2

CONTENTS

Authors.................................................................................................. 3

Introducing the New Normal ................................................................ 4

Customers: Great Expectations, Small Wallets..................................... 6

Thriving Technologies Driving Change .................................................. 9

The Cloud .................................................................................................. 9

Managed Services ................................................................................... 10

Virtualization .......................................................................................... 10

Business Intelligence .............................................................................. 11

Collaboration .......................................................................................... 11

Mobility................................................................................................... 11

Changing Nature of the Channel......................................................... 12

Business Planning ................................................................................... 13

Technology and Vertical Specialization .................................................. 14

Redefining Partnership ........................................................................... 15

Marketing ............................................................................................... 15

Vendor Desires for Optimized Channels ............................................. 17

Cloud Computing and Services ............................................................... 18

Escalating Support Costs ........................................................................ 19

Greater Competition .............................................................................. 19

Direct Pressure ....................................................................................... 19

Consultative Sales ................................................................................... 19

Vertical Specialization............................................................................. 19

Technology Specialization ...................................................................... 20

Customer Satisfaction............................................................................. 20

Margin Differentials ................................................................................ 20

Self‐Sufficiency ....................................................................................... 20

Converging on The New Normal ......................................................... 21

About the Channel Vanguard Council................................................. 23

CVC Supporters ................................................................................... 24

Copyright © 2010 Channel Vanguard Council — All Rights Reserve. No part of this document

maybe copied or republished without prior written consent of the Channel Vanguard Council.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 3

A CVC Guide

The New Normal

How emerging technologies and economic pressures

are reshaping the IT reseller and services channel

August 2010

Principal Author

Lawrence M. Walsh

Executive Director, Channel Vanguard Council

President & CEO, The 2112 Group

Contributing Authors

John J. Convery

Executive Vice President of Vendor Relations and Marketing

Denali Advanced Integration

Spencer Ferguson

President

Wasatch Software

Nancy Hedrick

Founder, President and CEO

CSI Technology Outfitters

Janet Schijns

Senior Vice President, Training & Knowledge Management

Motorola Enterprise Mobility Systems

Ken Totura

Chief Channel Officer

Awareness Technologies

Manuel Villa

President

Via Technologies

Tricia Wurts

President

Wurts and Associates

Copyright © 2010 Channel Vanguard Council — All Rights Reserve. No part of this document

maybe copied or republished without prior written consent of the Channel Vanguard Council.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 4

Introducing

The New Normal

I

n economic terms, the world came to a screeching halt September 15,

2008. On that day, Lehman Brothers – one of the world’s largest financial

services institutions – declared bankruptcy under the weight of the

precipitously declining value of its asset portfolio and inability to cover its

real estate investment losses. Lehman’s collapse was a watershed moment that

marked the beginning of the Great Recession, causing businesses even in

relatively stable industries to suffer from the fallout.

The recession, which officially ended in January 2010, wasn’t a surprise to

those watching economic indicators. In 2008, the U.S. gross domestic product

fell 1.83 percent as the housing and mortgage market collapse dragged down

the entire economy, which then sputtered along through 2009 with virtually

no annual growth. While experts are divided on how well and fast the economy

is recovering in 2010, fears of a double‐dip recession are growing. Economists

have downgraded projections for second‐quarter growth, leaving many

businesses and consumers with a lack of confidence — the net result being

a continuing uncertainty that hampers spending, investments and jobs growth.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 5

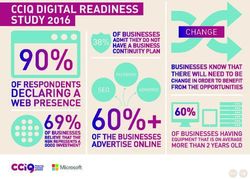

The recession dragged down technology spending as much as any industry.

After enjoying a healthy7 percent growth in 2007, technology sales and

revenue began their decline in 2008. Analyst firms Forrester Research and

Gartner initially forecast a 5 percent increase in 2008 IT spending, but quickly

adjusted their numbers to a less than 3 percent growth as the mortgage and

financial services markets began unraveling. The recession tightened its grip

on the economy in 2009, and IT spending suffered an 8.2 percent year‐over‐

year decline, according to Forrester. IT spending is projected to recover 3.3

percent to 5.4 percent in 2010, however analysts say IT spending won’t return

to 2008 levels until at least 2012.

Despite mixed indicators and lack of general economic confidence, the IT

Channel is projected to see continued improvement in IT spending and revenue

through the second half of 2010. According to the CompTIA IT Industry Business

Confidence Index, six in 10 IT firms expect third‐ and fourth‐quarter IT revenues

to exceed those booked in the first and second quarters, and nearly four in

10 IT firms surveyed say they will add staff in the second half of 2010 as IT

business activity increases. “IT industry executives remain relatively confident

about the tech

sector and

about their

firm’s pros‐

pects, but con‐

cern over the

health of the

U.S. economy

persists,” said

Tim Herbert,

vice president

of research at

CompTIA. “In

some ways the

results point

to a ‘two steps forward, one step back’ mentality, where positive news and mo‐

mentum are followed by unexpected bad news and a renewed sense of nega‐

tivity about economic conditions.”

All of this adds up to what the Channel Vanguard Council calls “The New

Normal” – the resetting of economic realities and expectations as they relate

to the technology marketplace and channel community. The New Normal is

more than just lowering sales and revenue projections; it’s a recalibration of

customer expectations for what they’re willing to pay, a renewed relationship

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 6

between vendors and partners, and a redefinition of business models to these

new realities. In some regards, The New Normal is a return to basics – the need

for disciplined business management and expense control, objective sales and

revenue planning, and repeatable sales models. Even as the economy continues

to regain strength, technology business will cope with certain new realities well

into the foreseeable future.

In this CVC Guide, we will explore how The New Normal is changing customer

expectations, technology consumption, channel fundamentals, vendor focus

and the definition of partnership between vendors and their resellers,

developers and market allies.

Customers: Great Expectations, Small Wallets

The root of the tech sector recession resides in end users’ budgets. The

economy didn’t collapse all at once, and many sectors were actually

persevered during the recession. However, businesses in nearly every

economic sector erred on the side of prudence, cutting spending to preserve

margins, and cash reserves and minimizing risk exposure. IT spending, often

seen as a cost center by businesses, suffered many of these first and recurring

budget cuts, as noted above.

Three things happened during the reces‐

sion, though: New technologies

disrupted traditional IT pricing models, giv‐

ing end users more technology for less.

Likewise, vendors and their partners were

forced to lower pricing on many existing

technologies to preserve install bases, cus‐

tomers and revenues. And end users dis‐

covered that the useful operating life of

many of the technologies was well beyond

the recommended service period specified

by vendors. These factors taught end users

that they no longer had to pay as much for

IT goods and services, that technology sup‐

pliers would negotiate better pricing rather

than lose business, and that companies

could not only do more with less but they

could do more with what they already had.

The effect on the technology sector was

not just lower sales, but longer sales cycles

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 7

where end users strung out assessments, evaluations and purchases.

Perhaps no greater consequence of the recession has been the realignment

of end‐user technology purchasing and return on investment (ROI)

expectations. End users found that they didn’t always get what they wanted,

but usually what they needed and, often, for less. Negotiating best prices is

always part of any sales process; the difference brought by the recession is

increasingly intense pressure for vendors and solution providers to perform for

significantly lower costs. End users leveraged the recession for gains in

purchasing of consultation and professional services, hardware products,

software bundles and maintenance contracts.

Vendors and solution providers went along

with these lower prices and deal yields be‐

lieving they were only temporary and that,

when the economy recovered, pricing and Business consumers

ROI expectations would return to a more lib‐

eral paradigm. It remains too early to say have used the recession

that baseline is completely obliterated, but

the evidence suggests increasing IT budgets to pressure vendors

aren’t making technology sales any easier.

End users are still demanding more products and solution providers

and services for increasingly lower prices.

This goes beyond the usual technology com‐

for better prices on IT

moditization in which product prices de‐ products and services.

crease with their increased availability and

market saturation. It’s actually a reflection of

end users’ organizations seeking to keep

costs in check.

Budget pressures and lower‐than‐normal IT spending are equal reflections of a

lack of confidence in the economy. An improved economic situation means

money is flowing through all business sectors, but not uniformly or consistently.

As a result, even businesses making money are reluctant to restore IT budgets

to previous levels until they have more confidence that revenues and cash flow

are sustainable to support the need for new and expanded IT infrastructure.

Return on investment (ROI) is a staple of the IT sales proposition and process.

Technology’s promise is that every dollar invested will produce some multiple

return of benefit in terms of productivity, cost savings or revenue

enhancement, the general principle of information technology being business

optimization through automation. The New Normal expands ROI to where end

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 8

users don’t just want the promise of potential ROI, they often want definitive

ROI measures and guarantees they will receive the promised benefits of their

investments. End users are increasingly reluctant to invest in new or

replacement technologies unless there is a clearly demonstrable ROI. When IT

budgets were flush with cash, end users had more latitude for experimentation,

letting software collect dust and even allowing some projects to fail. The New

Normal means that latitude is gone, and it’s incumbent upon IT vendors and

solution providers to demonstrate value to make the sale.

ROI pressure is equally

affecting how end users

are assessing and evaluat‐

ing the vendors and solu‐

tion providers with whom

they contract. Customer

loyalty once meant that

vendors could bank on a

certain amount of recur‐

ring renewal, mainte‐

nance and upgrade reve‐

nue from their install

base. Loyalty is a dimin‐

ished factor in The New

Normal. Customers will

shop for what they per‐

ceive is the best value – or

bargain – for their limited

resources and budgets. Likewise, they are increasingly resistant to systems per‐

ceived as “lock‐ins,” meaning their companies are beholden to a vendor’s tech‐

nologies and frameworks. Customers increasingly want choice driven by value

and price, and will not let loyalty or legacy stand in the way.

The New Normal isn’t necessarily uniform across all technology segments. In

fact, some technologies are driving The New Normal, which we will explore in

the next section. But from the customer perspective, The New Normal means

they have more power, flexibility and choice in the IT supplier/consumer rela‐

tionship. Of the three factors, choice is the most intractable since it encom‐

passes the decision to buy what they want when they want it. And sometimes

“when” translates into “later.”

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 9

Thriving Technologies Driving Change

The recession isn’t the only force driving The New Normal. Technology itself is a

significant, if not equal, contributing factor. Thriving and driving technologies

are primarily those that increase productivity, decrease expenses and open

revenue opportunities for consuming businesses. Predominantly, these tech‐

nologies fall into the

broad categories of

cloud computing,

managed services,

virtualization, busi‐

ness intelligence soft‐

ware, collaboration,

mobility and media.

The Cloud. Cloud

computing is proba‐

bly the single great‐

est transformative

trend since the com‐

mercialization of the

Internet nearly two

decades ago. For the

purposes of this re‐

port, we won’t go into specifics on cloud computing; simply put, “the cloud” is

the delivery of IT applications and resources via a shared network in the form of

software as a service (applications), infrastructure (computing resources) and

platform (development resources). The cloud is revolutionizing computing and

automation by lowering costs and making applications more accessible and sys‐

tems easier to manage and secure.

Cloud computing disrupts the way businesses use and pay for technology. From

a business perspective, cloud computing changes the IT sales and purchasing

equation from a capital expense to an operational expense. Where servers and

personal computers were sold as a one‐time fixed cost, cloud computing is sold

on a recurring basis. This lowers the cost to technology consumers and in‐

creases revenue yields, over time, to technology solution providers. Where an

application may cost $100 as an on‐premise solution, a cloud version could

yield as much as $120 plus a $10 per month annual service contract. End users

gain the additional benefit of having more easily updated and maintained appli‐

cations and systems since cloud‐computing applications are often managed by

professional third‐parties.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 10

The challenge the cloud poses for vendors and solution providers is the cost

balance of providing cloud services against the fractional revenue produced by

cloud contracts. The problem in the equation is that the cloud provider bears all

of the upfront delivery cost. Only after a substantial, sustainable customer base

is built and recurring revenues start streaming cash to the business can cloud

computing become profitable.

Managed Services. Managed services shares many of the same business model

characteristics of cloud computing: It’s sold as a recurring revenue model

(operational expense to the customer) and delivered via a remote network con‐

nection. However, managed services is typically the delivery of what were once

break/fix services; it eliminates the need for sending technicians to a customer

site. Managed services provides customers with the ability to cut IT operation

costs and redirect internal re‐

sources by deferring monitoring,

management and maintenance to

qualified third‐parties. Many solu‐

tion providers have transformed

their businesses to either full‐ or

partial‐managed services models,

creating recurring revenue

streams. IT hardware and soft‐

ware vendors have adjusted mod‐

els to either deliver tools for ena‐

bling managed services or channel

models for controlling the opera‐

tional costs of managed service

providers.

Virtualization. Virtualization is a software‐based technology that makes many

of The New Normal efficiencies possible. Developed more than 30 years ago for

time‐sharing on mainframe computers, contemporary virtualization is a means

to consolidate hardware resources by enabling them to run multiple, simultane‐

ous applications. Virtualization applied to servers – file share, application, Web

and storage – means that more applications can run on fewer devices. This re‐

duces power/cooling consumption and physical space requirements while in‐

creases resource utilization. The same principle of running multiple applications

is what enables cloud computing to work more efficiently and with greater

scale than previous generations of application service providers. And, there are

emerging opportunities in desktop virtualization and application streaming.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 11

Business Intelligence. Business intelligence software – such as customer rela‐

tionship management, enterprise resource planning, supply chain manage‐

ment, and accounting and financial management applications suites – are trans‐

forming the way business is managed. These applications provide business

managers with greater transparency into their operations, giving them the

means to make better strategic decisions and reap greater efficiencies. Despite

the recession, businesses have been willing to invest in business intelligence

solutions because of the cost savings and potential increase in revenues. The

complexity of these applications has opened new migration, integration, and

optimization and support services opportunities for solution providers. With

The New Normal, thousands of SMBs are looking to leverage these applications,

which in the past were designed to run large enterprises, for their own opera‐

tional efficiencies.

Collaboration. Collaboration –

or the sharing, modification and

improvement of information – is

fast becoming the heart of the

information age. Collaboration

technology includes everything

from email and instant messag‐

ing to content‐publishing por‐

tals, such as Google Wave and

Microsoft SharePoint, to video

conferencing and unified com‐

munications. Even third‐party

social media networks such as

Twitter and Facebook are forms of mass collaboration. End users have adopted

these tools to make information more readily accessible, speed up knowledge

transfer and leverage the wisdom of previously untouched assets within their

organizations. The opportunities are boundless for the channel, as this technol‐

ogy will create opportunities in consulting, development, security, integration

and other support services.

Mobility. By 2015, smartphones will be the primary means for accessing the

Internet. Today, tablets, netbooks and notebook computers are in greater de‐

mand than conventional desktop computers, and enterprises are making re‐

mote access to applications and data a priority in their strategic technology

planning. The world is increasingly mobile – and while mobility is often expen‐

sive, mostly due to charges levied by carriers, enterprises are absorbing these

costs because highly mobile workforces and remote employees are far more

productive and cost efficient than conventional hard‐wired IT infrastructures.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 12

From a technology‐market perspective, mobility creates opportunities in de‐

vices, application development, integration and maintenance, and service and

support.

These are the winners in the age of The New Normal: emerging technologies

and business models that simultaneously create opportunities and disrupt con‐

ventions. Their value proposition and ultimate legacy is the resetting of the cost

structure and how technology businesses – vendor, distributor and partner –

operate.

Changing Nature of the Channel

What exactly is “The Channel”? To understand the changing nature of the chan‐

nel, we must first define what the channel is. As it pertains to the technology

marketplace, the channel is a sales conduit between suppliers and consumers.

The channel enhances the value of basic technology building blocks by adding

other products and services to create holistic systems that meet the end user’s

specific technology needs and operational requirements.

That’s really academic. In reality, the channel

is a community of businesses with varying

degrees of capabilities, competencies and

capacities. These businesses range from

highly specialized systems integrators and

The New Normal is

independent software vendors to relatively technologies and

simple value‐added resellers. In recent years,

their common nomenclature has been models that both open

“solution provider,” a generic reflection of

their ability to meet end users’ technology opportunities and

needs.

disrupts the status quo.

With such diversity comes widely varying de‐

grees of business maturation and perform‐

ance. In the past, solution providers would

partner with as many as three dozen or more

technology vendors to source their products and services, operating on razor‐

thin profit margins and relying on vendor discounts to provide the means for

their revenue. Worse, few had business plans or objectives; most operated on

general models that were neither directional nor had goals for measuring per‐

formance. And specialization was the purview of the selected few.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 13

The New Normal is forcing solution providers – and all businesses operating in

the channel – to rethink business philosophies, operations and objectives. Busi‐

ness maturation is more than just an evolution, but a necessity for survival and

sustained viability. In this section, we’ll look at the changing nature of business

planning, technology and vertical specialization, peer partnerships, portfolio

selling, and marketing in the channel.

Business Planning

Tom Clancy’s “The Hunt for Red October” is the story of a disenfranchised Rus‐

sian nuclear submarine captain who crafts an elaborate plan to steal his vessel

and defect to the United States. Despite the Kremlin’s assertions to the con‐

trary, CIA analyst Jack Ryan deciphers the clues to the Russian captain’s intent,

but is rebuffed by a U.S. Navy admiral who wants to know “the how.”

Admiral: What's his plan?

Ryan: His plan?

Admiral: Russians don't take a [vulgarity], son, without a plan.

Ryan had all the pieces, but not the plan. Many solution providers are like Ryan

– accidentally successful because they have enough pieces to get them into the

market, but not a plan to achieve real success. A VARBusiness 2007 study found

that only 44 percent of the channel engaged in any kind of quarterly or annual

business planning. Even then, the quality and completeness of business plan‐

ning was subpar.

A business plan is more than just a mission statement or reflection of what a

business does; it is a roadmap

for success that sets opera‐

tional parameters, departmen‐

tal and personnel assignments,

strategic objectives and mile‐

stones. With a business plan in

place, a solution provider is

able to stay on track and focus

on predefined objectives with‐

out distraction. And a business

plan serves as the foundational

benchmark for measuring the

progress and success of each

part of a solution provider’s op‐

erations.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 14

In The New Normal, solution providers find that business planning is an abso‐

lute necessity for success and sustained viability. Through business planning,

solution providers are focusing their operational resources and maximizing

their potential. Solution providers that engage in dynamic business planning –

meaning they create, measure and adjust – are finding greater degrees of suc‐

cess, profitability and growth than their non‐planning counterparts. Further,

solution providers with a business plan are better able to weather economic

changes than those who rely on hope, which – as the cliché goes – is not a plan.

Technology and Vertical Specialization

In his book “Crossing the Chasm,” marketing guru Geoffrey Moore urges busi‐

nesses to target specific verticals, such as health care and financial services, and

expert domains, such as security and storage, to build their businesses. By tar‐

geting segments, he argues, a business is able to leverage the power of peer

referrals to gain customers, capture market share and build revenue. From

there, businesses can “cross the chasm” into adjacent domains.

Solution providers have always had some form of specialization, though their

definitions are somewhat murky. Some have called themselves networking, se‐

curity, storage and PC specialists, but these are more technology capabilities

than specializations. And solution providers too often don’t apply their speciali‐

zations as a plan for capturing customers and growing their businesses. The

New Normal is prompting many solution providers to tap into true specializa‐

tion practices that are aligned to their end users’ technology consumption or

industry.

What solution providers are discovering is that specialization produces better

ROI than buckshot sales or go‐to‐market approaches. Specialization is even

more powerful when both the technology and vertical practices are aligned in a

single focus, such as unified communications for health care, which enables so‐

lution providers to build template solutions that can be sold in mass with mini‐

mal customization. It also makes the solution provider an expert in specific

fields, giving them the ability to speak intelligently with their customers and

share experience from engagements with other customers.

Vendors are increasingly rewarding solution providers that specialize, and even

more solution providers are finding that specialization is rewarded by greater

growth potential and market differentiation from their peers. In The New Nor‐

mal, generalists have a significantly lower channel and general market value

than those who are technology and/or vertically aligned.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 15

Redefining Partnership

According to industry studies, solution providers will establish partnerships with

as many as three dozen different technology vendors. Most of those relation‐

ships are either transactional or inactive, which are often expensive to maintain

and produce little value. What solution providers are now finding is that honing

their vendor relationships to the select few that add the most value is better for

their business than having multiple, nonproducing vendor relationships.

Solution providers once partnered with

vendors because vendors had the high‐

est margins or market leaderships. To‐

day, solution providers are looking for

vendors that provide a rich partnership

program that includes a strong eco‐

nomic value proposition, technical sup‐

port, pre‐ and post‐sales support, mar‐

keting and market development, train‐

ing and certification programs, and

market opportunities. Enhancing a

vendor’s value proposition is the level

of channel distribution (smaller com‐

munities and lower channel conflicts),

end‐user awareness and technology

leadership. When it comes to partner‐

ships, The New Normal paradigm is

about value over volume.

The old partnership paradigm did have solid logic: Solution providers needed

vendor relationships to fulfill their customers’ needs – even if they were only

periodic and transactional. In The New Normal, solution providers are fulfilling

those needs through peer‐level relationships. By partnering with other peers

with complementary capabilities and resources, solution providers are able to

fulfill their customers’ needs without the expense of supporting nonproductive

vendor relationships and technology practices. These synergistic relationships

create additional value by exposing customers to the value a solution provider

can deliver with only a minimum risk of exposing an account to competitive dis‐

placement.

Marketing

Marketing has never been a strong channel characteristic. The preponderance

of solution providers has often relied on vendors for brand awareness, lead

generation and market education: Vendors have far greater resources to sup‐

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 16

port marketing programs, and they’ve been more than happy to keep their

brands top of mind among end users. Controlling the lead generation process

also meant that vendors could distribute sales opportunities to stronger solu‐

tion providers as well as retain leads for their direct sales teams.

Marketing suffered greatly during the recession. Technology vendors cut their

marketing spending deeply, investing mostly in programs that had definitive

outcomes in leads and sales. Consequently, solution providers no longer had

their marketing air cover, and many were forced to extend themselves to find

new opportunities and accounts.

Marketing on a greater scale has become easier and more accessible for solu‐

tion providers. Social me‐

dia, local events, and

Web and search‐based

advertising are substan‐

tially lower in cost than

conventional, national

marketing programs that

vendors have tradition‐

ally managed. These new

marketing outlets are

giving solution providers

greater reach and an im‐

mediate communications

conduit with existing and

prospective customers.

Beyond marketing for customers, solution providers are discovering the power

of the brand. As noted above, vendors have traditionally wanted their brand to

take precedence in the customer relationship. We call this “brand dominance,”

since it’s where the vendor creates the perception its brand is more important

to the customer than its partner’s brand. But branding is more than just identity

– it’s a means for differentiating a solution provider from its competitors. Solu‐

tion providers have discovered that, in The New Normal, they must develop

their brands and differentiate themselves from both their competitors and ven‐

dors to achieve marketplace success.

Marketing does come at a cost no matter what level or degree it is engaged by

a company. Nevertheless, solution providers are learning in The New Normal

that marketing is both their responsibility and an essential part of their business

viability.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 17

These trends in the changing nature of the channel are being driven by neces‐

sity brought by the economic realities of The New Normal. Equally, these trends

are a reflection of the maturation of the channel from a hodgepodge of tech‐

nology‐based companies to organized businesses that specialize in technology

services. This maturation is an absolute necessity given that vendors are faced

with the same economic pressures to evolve. In the next section, we’ll look at

how vendors are driving this channel maturation out of necessity to have better

partners, but also in competition with their partners.

Vendor Desires for Optimized Channels

Solution providers partner with dozens of technology vendors, but vendors

partner with hundreds – if not thousands – of solution providers to take their

products to market and reach customers they could never hope to reach with a

direct sales team. The channel is often seen either as an extension of a vendor’s

sales and customer support systems or as a cooperative that elevates the tech‐

nology value. Solution providers are often referred to as “trusted advisors” –

the people who hold the relationship with the end users and

are able to influence technology decision‐making.

The channel in this sense is

a romantic notion that ig‐

nores the lack of uniformity

in solution provider capa‐

bilities, competencies and

capacities. In fact, the chan‐

nel operates on a 90/10

rule: 90 percent of sales

flow through 10 percent of

partners. That ratio makes

the channel expensive and,

too often, unpredictable.

This ratio is also the reason

the cost of channel sales to

the vendor increase when

more solution providers –

particularly smaller ones –

are added to a channel network.

For years, the vendor community was content with simply adding more part‐

ners to increase transactional volume to mask the lack of value. They would en‐

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 18

tice solution providers to adopt their products for the sake of transactional

sales that produced short‐term gains. Essentially, this “charm and churn” strat‐

egy of recruiting new solution providers and decommissioning underperforming

partners would increase the cost of channel operations, marketing and support

– since the only thing it really accomplished was increasing the size of the part‐

ner pool to which the 90/10 ratio applied. No wonder some vendor executives

deride the channel’s value.

Fortunately for solution providers, the channel has been proven time and again

as a resilient go‐to‐market mechanism for technology vendors. Despite its

costs, the sales volume and reach produced by the channel is higher and more

effective than anything a direct sales model can produce. This is partly why the

channel can be described in a paraphrasing of Winston Churchill’s famous

quote about democracy: “The channel is the worst mean for going to market

except for everything else.”

Even preceding the recession of 2008‐09, vendors shifted focus toward “the

right partners,” or those that produced a higher return on their channel invest‐

ment. Vendors have always had tiered channel programs, providing greater re‐

wards and incentives for their better‐performing partners. Solution providers

gained higher status through financial performance and sales volume. As the

tech market shifted from a volume to a value proposition and vendors sought

greater fiscal efficiencies, channel programs began shifting to the select few

partners that could deliver better performance. Rather that more of the charm‐

and‐churn model, vendors now seek to invest in partners that demonstrate a

higher ROI.

What’s changed since the channel, by definition, has always added value to the

vendor’s go‐to‐market strategy? A lot. Vendors are now faced with the same

economic realities as solution providers in terms of declining customer budgets,

disruptive technology trends, greater levels of competition, and higher opera‐

tional and support costs. Let’s take a look at some of these factors.

Cloud Computing and Services

The services revolution, where IT is delivered as a utility, is changing the model

for how IT is sold and consumed. As discussed in the technology section above,

the recurring services model has greater long‐term profitability for vendors and

solution providers, but lower top‐line revenue compared to on‐premise capital

sales. Vendors are struggling to balance their need to meet gross revenue ex‐

pectations and are shifting the burden of profitability to partners by lowering

product discounts and incenting after‐market, value‐add sales.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 19

Escalating Support Costs

Solution providers have long looked to vendors for marketing, technical and pre

‐ and post‐sales support. Channel support is expensive, and vendors have tried

automating support mechanisms to varying degrees of success. Rewarding part‐

ners for greater self‐sufficiency not only makes the solution provider more prof‐

itable, but displaces the expense burden away from the vendor.

Greater Competition

For more than a decade, it was a near certainty that once an end user became a

consumer of a particular technology or vendor platform, they would remain in

that stable in perpetuity. The recession changed that dynamic as budget con‐

straints trumped vendor loyalty, and the end user’s willingness to switch to low

‐cost alternatives grew more favorable. As a result, vendors are lowering prices

to retain customers, which then creates pressure for greater operational effi‐

ciency. For the channel, that also squeezed margins.

Direct Pressure

Vendors have always had a love‐hate relationship with the channel, and direct

sales teams often look at the channel with a jealous eye. During the recession,

many vendors retreated from the channel believing they would make up for

whatever sales volume was lost through recaptured margins in direct sales.

Vendors always flirt with taking business away from the channel, but they’ve

reduced programming benefits rather than completely eliminating solution pro‐

viders from the sales equation.

Consultative Sales

In the golden age of the channel, vendors and solution providers sold products

on specifications and performance. Firewall throughput, server operational ca‐

pacity, application features, etc., made up the context of the technology sale.

As the recession slashed IT budgets, end users needed a reason to spend

money on new products and services. Vendors and solution providers that en‐

gaged in consultative selling faired far better than those reliant on the transac‐

tional, technology‐driven model. Unfortunately, the consultative sales model is

an art form possessed by few.

Vertical Specialization

While some baseline technologies are increasingly simpler to install, operate

and support, integrated holistic systems for specific industries are becoming

more complex. It’s not enough to know security, storage or databases; in the

vertical context, solution providers need to know the business operational pa‐

rameters of their customers. Vendors correctly understand that they will cap‐

ture more business through partners who better understand their customers’

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 20

business operational necessities and objectives. Vendors are driving more in‐

centives toward partners that demonstrate specialization and greater opera‐

tional performance. They segment solution providers through such metrics as

vertical and technology specialization, customer satisfaction, margin differen‐

tials, business models, sales volume and self‐sufficiency.

Technology Specialization

As noted above, vertical specialization gives solution providers greater depth of

knowledge into the industries they support. Likewise, technology specialization

provides a greater domain expertise for delivering and supporting specific tech‐

nologies. The true intent of supporting specialization, though, is focus: Vendors

don’t want their partners distracted by trying to support too many vendors,

technologies and disparate customers. Specialization is the means to get part‐

ners to concentrate on specific, repeatable objectives. It also has some benefit

in reducing peer‐level competitive conflict, since partners no longer acting as

generalists will have fewer rivals in the field.

Customer Satisfaction

As vendor‐level competition increases and the end user’s ability to change plat‐

forms become easier, customer satisfaction takes on greater importance. Ven‐

dors view their partners as ambassadors to the customer; however, vendors

want some level of ownership over customers. They understand that partner

performance reflects on their brand and reputation, which is why several ven‐

dors are now measuring and rewarding partners based on how customers rate

their work.

Margin Differentials

Cloud computing, managed services and commoditization are putting pressure

on technology prices and margins. As margins become harder to support, ven‐

dors will shift the burden of profitability to partners by reducing discounts and

incentives. The better a partner can generate its own profitability without reli‐

ance on the margin provided by the vendor, the higher they’ll rate in the ven‐

dor channel program.

Self‐Sufficiency

Beyond having partners take greater responsibility for their own profitability,

vendors want solution providers to assume the expense of sales support, tech‐

nical support and field marketing. The expense of sales lead generation passed

through to channel partners alone costs vendors billions of dollars annually.

In The New Normal, technology vendors are not abandoning the channel. They

are, however, taking a more critical position in how they interact and engage

with partners. One may argue that vendors have always given preference to

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 21

high performing partners. While true, The New Normal is prompting vendors to

seek channel networks with less of a bell‐curve performance and more of a lin‐

ear performance in which the partner takes on more risk exposure and guaran‐

tees a predictable return on vendor channel investment.

Converging on ‘The New Normal’

“The New Normal” isn’t new; it’s recurring. The current economic condition is

little more than a plateau that will eventually shift to create a new set of tech‐

nology, business and economic norms that reflect the state of that time. The

New Normal comprises the catalysts that will propel the technology industry

and the channel community to that future state. Virtualization, cloud comput‐

ing, vertical specialization, self‐reliance, redefined go‐to‐market strategies and

other trends will con‐

verge in The New Normal

to create the next trans‐

formative period of the

technology industry.

The New Normal is not a

steady state. If anything,

it’s a period of uncer‐

tainty marked by channel

conflict, disruptive tech‐

nologies, economic pres‐

sure on pricing and mar‐

gins, and unpredictable

demands by customers.

The New Normal is a

near‐perfect storm in which the technology channel must navigate through a

sea of change that’s in constant flux. Uncertainty and perpetual change will

cause many channel businesses to think conservatively and hold back invest‐

ment. But The New Normal is a period for investment in the future, and the

delta between those that invest and those that retrench will define the next

state of the channel.

What must the channel do to navigate through this period? The New Normal is

about the principles on which the channel was built: cooperation and collabora‐

tion in partnership. Solution providers need to partner with vendors and cus‐

tomers to define the tools necessary for future business activity, and they need

to partner with their peers to extend geographic coverage and technology re‐

sources to better serve customers’ needs. Vendors need to partner with their

peers to create synergistic technologies with greater levels of interoperability,

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 22

and customers need to recalibrate their expectations to support technology

suppliers and collaborate on innovative advances.

The ultimate question: Is the channel is still necessary in The New Normal? Yes,

but that’s only the simple answer. Throughout the technology industry’s his‐

tory, the channel has served as a conduit between vendors and customers in

which technologies were integrated and value was added. The channel has pro‐

vided vendors with greater geographic reach and the ability to service custom‐

ers on all levels. And the channel has been the source of information, intelli‐

gence and feedback that fuels innovation. Those things will not change. But like

all transformative periods, The New Normal will require the channel to shift,

and the trends outlined in this report are but a fraction of how the channel is

changing.

Surviving and thriving through The New Normal will require all businesses in the

channel to rethink their business models, make strategic plans based on objec‐

tive data, reset their objectives and expectations, and invest in their desired

future states. While the channel is and always will be a cooperative collabora‐

tion between vendors and solution providers, the responsibility for growing and

maintaining a healthy, vibrant business is an individual responsibility. The New

Normal is the period in which the individual entities of the channel community

must take command of their own destinies or risk disintermediation.

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 23

ABOUT THE CHANNEL VANGUARD COUNCIL

The Channel Vanguard Council, a neutral collaborative comprised of leaders from the technol‐

ogy reseller channel established in 2009, formalized its charter and resolved to fulfilling the

mission of creating standards that will result in the maturation of channel business practices

for vendors, distributors, solution providers, services organizations and value‐added resellers.

CVC serves as an advisory group to CompTIA, the leading association of IT professionals.

Lawrence M. Walsh Todd Thibodeaux

Executive Director, Channel Vanguard Council President and CEO

President and CEO, The 2112 Group CompTIA

CVC Members

Carolyn April Lester Pierre

Director, Industry Analysis Chief Executive Officer

CompTIA Wall Street Network

Peter Cannone Joe Qualgia

Chief Executive Officer Senior Vice President, U.S. Marketing

OnForce Tech Data

John J. Convery Fernando Quintero

Executive Vice President of Vendor Relations Vice President, Channel Sales, Americas

and Marketing McAfee

Denali Advanced Integration

Janet Schijns

Ron Culler, Jr. Senior Vice President,

CTO/Executive Vice President Training & Knowledge Management

Secure Designs Motorola Enterprise Mobility Systems

Greg Donovan Sam J. Ruggeri

Founder and CEO President and Founder

Alpheon Corporation Advanced Vision Technology Group

Spencer Ferguson Lane Smith

President CEO and President

Wasatch Software Do IT Smarter

Gary Fish

Ken Totura

Founder and CEO

Chief Channel Officer

FishNet Security

Awareness Technologies

Nancy Hedrick

Founder, President and CEO Manuel Villa

CSI Technology Outfitters President

Via Technologies

Jay Kirby

Executive Vice President, Sales and Marketing Tricia Wurts

Troubadour President

Wurts and Associates

www..channelvanguardcouncil.comCVC Guide: The New Normal | August 2010 24

SUPPORTERS

The Channel Vanguard Council is supported by the following organizations.

CompTIA (www.comptia.org) is the non‐profit trade association advancing the

global interests of information technology (IT) professionals and companies in‐

cluding manufacturers, distributors, resellers, and educational institutions.

The 2112 Group (www.the2112group.com) is an independent strategic advisory

service provider that specializes in community‐based market discovery and re‐

search for the development of technology product and marketing strategies.

www..channelvanguardcouncil.comYou can also read