Tighter credit conditions fuel housing slump into 2019

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Tighter credit conditions fuel

housing slump into 2019

www.discount-mortgages.net.au Suite 301,29-31 Lexington Drive, Bella Vista NSW 2153Key Insights

• Continued declines in the housing market have been dictated by tightening credit

policies which have restricted borrowers

• Sydney and Melbourne markets are the biggest drivers of the housing slump

• A rise in prices is predicted to emerge in mid-to-late 2019

The continued plummet in national property prices

The nationwide property price decline has continued to the end of 2018 with a -6.42%

change in dwelling values across 5 capital cities since December 20171. This consistent

decrease marks the sharpest fall since the GFC as national dwelling values have dropped

4.1% this year2. However, the decline is most heavily concentrated in the major cities of

Sydney and Melbourne which faced an 8.1% and 5.8% drop, respectively, in the past 12

months3. This fall has emerged from the influx of new apartments and a net drop in

migration which collectively fuel the growth of the housing slump.

Exhibit 1: Changes in house price growth in major capital cities

Source: CoreLogic

1 ‘CoreLogic Home Property Value Index – Monthly Indices- 31 December 2018’, CoreLogic,

https://www.corelogic.com.au/research/monthly-indices

2 Lawless.T, ‘Australian Dwelling Values Fell 4.8% Through 2018, Marking The Weakest Housing Market Conditions Since 2008’, CoreLogic,

https://www.corelogic.com.au/news/australian-dwelling-values-fell-48-through-2018-marking-weakest-housing-market-conditions-0

3 CoreLogic, ‘Property Market Chart Pack December 2018 , https://www.corelogic.com.au/sites/default/files/2018-

12/Monthly%20Property%20Market%20and%20Economic%20Update%20December%202018_0.pdf

www.discount-mortgages.net.au Suite 301,29-31 Lexington Drive, Bella Vista NSW 2153Tighter credit policies are restricting buyer opportunities

However, predictions for the market have identified that price growth within the current

conditions will not occur in the short term. Whilst historically housing downturns have

been catalysed by rising interest rates or unexpected economic shocks, the contemporary

slump has been triggered by the introduction of stricter lending conditions and harsher

criteria for borrowers. These changes are a response to tighter regulations instated by

authorities, such as APRA, and the Royal Commission which now aims to limit risky

lending. Such limitations on credit standards have produced an 11.9% decrease in loan

approvals since September 2017 and a 4.8% decline over the quarter.

Exhibit 2: Substantial drop in lending approvals

Source: ABS; RBA (December 2018)

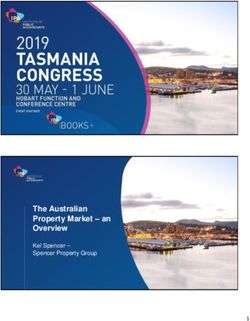

Significant changes to occur in the long-term

Whilst the current market estimates a continued decline in the short term, a halt to the

nation’s falling property prices is forecasted to emerge between mid-to-late 2019.

According to the Domain Property Price Forecast, housing prices are estimated to hit a

peak to trough fall of 12% by mid-2019. In addition to Domain, ANZ estimates are

expecting the current market to bottom out by the end of 2019 before facing a gradual

4% increase in 2020. This increase will be combined with an estimated rise in RBA rates in

August 2020 which will bring the housing downturn to an end. Changes to prices are also

www.discount-mortgages.net.au Suite 301,29-31 Lexington Drive, Bella Vista NSW 2153estimated to emerge from the 2019 Federal election as it brings potential adjustments to

negative gearing and capital gains tax.

Exhibit 3: Estimates and forecast for the housing market 2018-2020

House price forecasts

2018 (estimate) 2019 (forecast) 2020 (forecast)

Australia -6% 1% 4%

(combined

capitals)

Sydney -8% 0% 4%

Melbourne -9% -1% 4%

Brisbane 0% 4% 5%

Perth -5% 5% 3%

Adelaide 2% 2% 2%

Hobart 12% 2% 2%

Canberra 2% 4% 4%

Unit price forecasts

2018 (estimate) 2019 (forecast) 2020 (forecast)

Australia -3% 2% 3%

(combined

capitals)

Sydney -3% 3% 5%

Melbourne -1% 1% 1%

Brisbane -6% 3% 3%

Perth -6% 2% 2%

Adelaide -1% 2% 2%

Hobart 0% 0% 3%

Canberra -5% 2% 2%

Data Source: Domain Property Price Forecast

Conclusion

Hence, with current market conditions, property prices will continue to remain stale into

2019 with tightening credit and an influx of supply. However, in these circumstances, first

home buyers should take advantage of the reduced competition and any window of

opportunity before price growth accelerates into the end of 2019. By focusing on key

indicators such as discounting, auction clearance rates and days on markets, buyers will

be able to capitalise on the housing downturn.

www.discount-mortgages.net.au Suite 301,29-31 Lexington Drive, Bella Vista NSW 2153About Discount Mortgages We are a digital technology-driven financing solutions business. We design smart financing solutions for home buyers, investment property buyers and small to medium businesses. With over 30 lenders on our panel and growing, we source highly cost- effective loan products and deals to save our clients money, time and complex paperwork. Report by Deepika Veeraragavan Deepika is currently taking her Bachelor of Commerce/Economics at UNSW. She has a passion and keen interest in economic analysis and it's importance in today's business world. Disclaimer Discount Mortgages disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. This communication reflects our analysts’ opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. www.discount-mortgages.net.au Suite 301,29-31 Lexington Drive, Bella Vista NSW 2153

You can also read