TIK TOK Technologies Ltd Company Snap Shot - February 2017 DRAFT FORM

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

IMPORTANT NOTICE REGARDING TIK TOK TECHNOLOGIES LTD

(“TIK TOK” or “the Company”)

Disclaimer

No communication and no information in respect of any future proposed sale as maybe described in this Company Snap Shot document may be

distributed to the public in any jurisdiction where any registration or approval is required. No steps have been taken yet in any jurisdiction where

such steps would be required. Any future proposed sale that maybe described in this Snap Shot may be subject to specific legal or regulatory

restrictions in certain jurisdictions. TIK TOK takes no responsibility for any violation of any such restrictions by any person. This Snap Shot is not

a prospectus within the meaning of Directive 2003/71/EC, as implemented in each member state of the European Economic Area, and

amendments thereto, including Directive 2010/73/EU to the extent implemented in the relevant member State of the European Economic Area

(together, the “Prospectus Directive”). This Snap Shot is not an offer for the sale of shares nor is it a financial promotion. If TIK TOK does move

forward to an offer for the sale of shares in the Company it will seek authority to issue an approved financial promotion document under section

21 of the Financial Services and Markets Act 2000 (‘FSMA’).

Attention

In the future should the Company move forward with an offer ALL prospective Investors are advised to consult their own professional advisers

before contemplating any investment to which this Snap Shot may refer to or any future related Information Memorandum. In particular, if you

are in any doubt about the suitability of such an investment, you should contact your independent financial adviser authorised under the FSMA

and you are advised not to invest until you have done so. No advice is given by the Company to any future prospective Investors.

Be Aware of the Risks

Investing in the Company involves a number of risks and, in particular, your attention is drawn to the risk factors as set out in this document. An

investment in the Company may not be suitable for all recipients of this document. A prospective investor should consider carefully whether an

investment is suitable for them in light of their personal circumstances and the financial resources available to them. The Ordinary Shares of the

Company are not presently listed or dealt in on any stock exchange which limits the ability of investors to sell their shares.

This document should not be considered as constituting legal, taxation or investment advice by the Company or any of its shareholders,

directors, officers, agents, employees or advisers. Each party to whom this document is made available must make its own independent

assessment of the Company after making such investigations and taking such advice as may be deemed necessary. In particular, any estimates

or projections or opinions contained herein necessarily involve significant elements of subjective judgment, analysis and assumptions and each

recipient should satisfy themselves in relation to such matters. You should be aware that share values and income may go down as well as up

and you may not get back the amount you originally invested. Please note that if the Company moves forward to an offer of its shares that

applications may only be made, and will only be accepted, subject to the Terms & Conditions in that future document. This document does not

constitute, and may not be used for the purposes of, an offer or invitation to subscribe for shares by any person in any jurisdiction.IMPORTANT The attention of prospective Investors is drawn in particular to that part of this Snap Shot or any future Information Memorandum to the section entitled "Risk Factors". TIK TOK TIK TOK Technologies Ltd was formed to further market develop IT systems and programs that in the future when fully developed would represent a clear commercial advantage to consumers. With the continuous development of new IT systems and programs it became clear to the TIK TOK founders that many of the developments in IT systems and programs in recent years did not optimise the consumer advantage to their systems, programs or business models. TIK TOK Technologies Ltd identified the FlashBet Wheel suite of systems, games and programs as a perfect integrated solution to address consumer value issues facing gamblers today. It is estimated that approximately £25 million is bet week in week out on live sporting events in the UK alone. There is a multitude of bookmakers offering many offers and incentives encouraging people to bet. Where these bookmakers aspire to give the consumer value they at times are enticing the gambler to bet beyond their means as the upfront incentives are often a well marketed lure. Each gambler often has multiple accounts at various bookmakers as a function of their lust for upfront incentives/odd boosting or the blatant offer of a win bonus. Where obviously every gambler has his success, the honest gambler should tell you losses are quickly forgotten. An app which provides value, without demanding a huge outlay whilst being attractive to play, would help a gambler control his propensity to bet. (Ref draft: article gamblers racing post). The fact that today’s average gambler holds at least 2 accounts and growing shows the appetite for betting is far from diminishing, therefore building a base of first time and existing gamblers should be achievable. The indication across borders shows similar phenomenal growth and with the ever growing budgets surrounding all sports /sports media and the power and weight of cyber commerce viewing rights and sponsorship exemplify that the sports betting sector will be growing for decades to come. TIK TOK intends to roll out the FlashBet Wheel initially to the fully identified existing markets.

BUSINESS OVERVIEW TIKTOK Technologies Ltd (TIKTOK) is a UK registered Technology Investment Company formed in 2016 which holds proprietary rights to an array of intellectual property including the FlashBet Wheel, Flashbet Mini-Wheel, Draw Predictor, Multi Sports Wheel and the Market Maestro along with other related patentable and protected technology. TIK TOK also operates as an independent software vendor (ISV) business that builds, develops and sells consumer or enterprise software. Although TIK TOK provided software is consumed by end users, it remains the property of the Company. TIK TOK builds and provides software applications that run on some or all backend platforms, like Windows, Linux or Apple. Applications owned by TIK TOK are developed and branded for its own proprietary use to generate its own revenue streams. TIK TOK also takes up strategic equity stakes in junior technology companies and provides support to companies that seek to commercialise their products. TIK TOK also offers a host of development, distribution hosting and support packages for TIK TOK related gaming Apps to potential white label partners on a business to business model, covering front-end and back-end integration giving rise to revenues from licence fees, maintenance fees and revenue split (as a % of gross income). Fees can be either fixed fee or revenue split with white label partners. TIK TOK has acquired the FlashBet Wheel technology including all the Intellectual Property surround the FlashBet suite of Apps. TIK TOK has also taken possession of the full patent rights to that technology. The FlashBet Wheel betting app is operated on a computerized device for managing a bet relating to statistics of a football match result. The statistics relate to FOOTBALL MATCH RESULTS but can be adapted to any team, position, play, or player. FlashBet App is first stage operational and TIK TOK are intending to negotiate with a number of online betting companies to fully commercialise the App by way of White Label Agreements directly and through non-branded affiliates in the Betting and Gaming industry. Full live implementation of FlashBet Token App is scheduled to be released in May 2017. The FlashBet Wheel is Patent Pending under application at the UK Patent office under number: GB1614145.9 FlashBet

Tik Tok Technologies Limited Company Snap Shot Non-Disclosure and Non-Competition: All of the business ideas, concepts, calculations and designs in this document are the intellectual property of TIK TOK Technologies Limited and are subject to the appropriate copyright, trademark and patent laws. The implementation of the ideas contained herein and/or the basic approaches of these ideas will only be possible following written agreement from TIK TOK Technologies Limited. The whole or partial duplication of this document, and/or their circulation to third parties, is not permitted. The recipient of this proposal is liable for all damage caused by such duplication and/or circulation to third parties. With delivery of this document, the recipient promises to maintain strict confidentiality and absolute silence on all ideas, concepts, calculations and designs contained within the document. Important notice: All references made to websites correct at the date of printing (January 2017).

Executive Summary

Introduction

TIK TOK Technologies Ltd (TIK TOK) is an independent online application and software developer, focused on the

gaming, betting and financial market sectors. TIK TOK develops, implements and brands its applications for its own

use and licenses its proprietary, patented and otherwise protected technology to third parties. The company is

launching “FlashBet Wheel” and “FlashBet Exchange” applications that uniquely combines the popular pastimes of

sports betting with social online and mobile gaming. “FlashBet” will be launched on Mid-May, 2017, and TIK TOK are

implementing a rigorous marketing plan to penetrate the sports betting market and gain viral success in this high

growth and fertile market. Between Years 2-4 management projects to gain 317,500, 788,500 and 1.87 million users

respectively, which translates into £15.08 million revenue by 2020.

The Market

The Sports Betting and Social Network Game Industries are rapidly growing markets. It is estimated in the UK alone

that over £25 million is spent on sports bets each week, with the lions share on football. As far as sports betting is

concerned, Europe and Asia are the principle markets representing over 85% of revenue, and as such where the

focus of TIK TOK is concentrated. The online gambling market worldwide was estimated at $35.52 billion (ca. £23.68

billion1) in 2013 and forecast at $45.86 billion (ca. £30.57 billion2) in 20163.

1

Prevailing forex rates pre-Brexit vote

2

Ibid

3

https://www.statista.com/statistics/270728/market-volume-of-online-gaming-worldwide/

1With its unique product – a synthesis of highly popular gambling/gaming elements – in the market, together with a

strong marketing implementation plan, TIK TOK aims to gain market share of 0.0044%, 0.0130% and 0.0233% of

the global online gambling market between Years 2-4 respectively to achieve revenue projections.

Financial Considerations

TIK TOK is seeking to obtain equity financing for the amount of £5,000,000, in exchange for a 162/3% stake of the

company. The following is the revenue, expenses and profit projections for the FlashBet business over the first 4

years of operations following full launch in September 2017.

2018 2019 2020 2021

TOTAL

£64,661 £2,336,096 £7,585,934 £15,081,217

REVENUE

COST OF

(£195,000) (£955,000) (£1,750,000) (£2,002,500)

SALES

GROSS

(£130,339) £1,381,096 £5,835,934 £13,078,717

PROFIT

GROSS

(202%) 59% 77% 87%

MARGIN

The company see these targets as attainable through the strong marketing plan, quality and viral nature of the

product, together with the growing market the company competes in. This company presentation (and more fully in

the TIK TOK Technologies Business Plan) will discuss the tactics and strategies to generate the revenues as stated,

and the implementation to successfully become a fun and exciting viral brand in the sports betting market.

21.0 Business of the Company

1.1 Business Summary & History

TIK TOK Technologies (TIK TOK) is a UK registered Technology Investment Company established in 2016 that holds

proprietary rights to an array of intellectual property, and other patentable and protected technology. It also operates

as an independent software vendor (ISV) business that builds, develops and sells consumer or enterprise software.

The company’s first proposed flagship products, the FlashBet Wheel and FlashBet Mini-Wheel are fun and simple viral

applications – catered to a widespread audience – that uniquely incorporate 6-selection multiple accumulator sports

bets with a premature “cash-out” social exchange platform. FlashBet Exchange to follow.

1.2 Industry Overview

The Online Gambling Industry

In 2016, online gambling is estimated to be a $45.86 billion4 (circa. £30.6 billion) industry, which has experienced

rapid growth over recent years almost doubling in size from $24.73 billion in 20095. Online sports betting accounted

for almost 50% of the overall global online gambling market in 2013, equating to circa. $19.3 billion 6, with mobile

device gambling accounting for 18% in 2012.7

Strong Future Growth

4

https://www.statista.com/statistics/270728/market-volume-of-online-gaming-worldwide/

5

Ibid

6

http://www.egba.eu/facts-and-figures/studies/6-sports-betting-report

7

Ibid

3Analysts forecast the market to grow at a CAGR of 10.73% (in terms of gross gaming yield per year) over the period

2014-20198 – $56.05 billion in 20189. There is evidence of a strong upward trend in mobile device gambling,

expected to account for 44% of the global online gambling market by 201810 as:

Smartphones and tablets continue to penetrate the market; and

Increased device capability and the confidence of users.

Betting firms will capitalise on the increasing popularity of online (and mobile device) gambling by charging more for

currency transactions to generate higher revenue, and with this strong market adoption, online betting brands will be

seeking to increase awareness in this medium.

European and UK Online Gambling Market

Of the $41.36 billion (ca. £27.57 billion) global online gambling market, the EU accounted for 47.6%, mainly due to

the innovative character of European operators and a lack of regulatory opportunities in the US and Asia 11. Betting is

most popular and represents 37% – the European market is expected to rise from €16.5 billion (ca.

$19.7bn/£13.12bn) in 2015 to €24.9 billion (ca. $29.7bn/£19.8bn) in 201612.

Within that European online gambling market, the UK is the largest (est. £2.5bn in 2013 and est. £4.4bn in 2018) and

the most mature market in terms of: product development, service and user interface innovation, industry

consolidation and regulatory approach.

8

http://www.prnewswire.com/news-releases/online-gambling---global-market-research-2015-2019-300192519.html

9

https://www.statista.com/statistics/270728/market-volume-of-online-gaming-worldwide/

10

http://www.egba.eu/facts-and-figures/studies/6-sports-betting-report

11

http://www.egba.eu/facts-and-figures/market-reality/

12

Ibid

4Major Market Participants

In mature markets such as the UK, the management of TIK TOK will be seeking B2B relationships with major

operators, as opposed to going into direct competition with them as a stand-alone operator. The three largest

operators offering essentially the same online betting opportunity to punters in the UK are: William Hill, Bet365 and

Paddy Power that account for 15%, 12%, 8%13 of the UK betting market by online revenue14.

Here is a brief synopsis of each of these online betting powerhouses:

William Hill

Founded as a postal/telephone betting service in 1934 at a time when gambling was illegal in the UK, William Hill is

now licensed in five of the world’s ten largest regulated gambling markets and has a presence in nine countries. The

company reports it has three million active digital customers worldwide and circa 16,000 employees. William Hill’s

2015 online revenues and gross operating profits were £550.7 million and £126.5 million respectively15.

Bet365

Still under the private ownership, Bet365.com was founded in 2000 by the daughter of a bookmaker from a

portakabin in a carpark16 with a £15 million bank loan against the family’s chain of betting shops. Launched in March

2001, Bet365 is now one of the world’s leading online gambling groups with over 19 million customers in almost 200

countries. Circa 25% of its online betting revenues are derived from the UK. The company’s 2014 revenues and gross

operating profits were £1,371 million and £317 million respectively17.

Paddy Power

13

Paddy Power’s share of the UK online betting market prior to its merger with Betfair in 2016

14

Gambling Compliance, UK Online Market Share, October 2015

15

William Hill plc Annual Report and Accounts 2015

16

https://www.theguardian.com/uk/2012/jun/08/denise-coates-woman-bet365-gambling

17

Sunday Times Profit Track 100 Research Report 2015. Bet365’s global headline numbers across all its business operations.

5Founded in 1998 by the merger of three Irish bookmakers, Paddy Power has business divisions in the UK, Ireland,

Australia and Italy. The company announced its merger with online betting exchange giants Betfair in 2015, which

was completed in February 2016, and could well position Paddy Power Betfair plc as the largest online betting

operator in the UK. Paddy Power’s 2015 online revenues and gross operating profits – which the UK accounts for

circa 48% – were €707.3 million and €152.4 million respectively18.

SkyBet.com

Another major player in the UK online betting sector is SkyBet.com, originally a wholly owned subsidiary (Sky Betting

& Gaming) of the satellite television giant Sky plc before it sold an 80% majority stake to CVC Partners in 2015.

SkyBet’s group revenue for 2015 was reported at £247 million, with £117 million coming from SkyBet.com, £117

million from Sky Gaming and £13 million from Oddschecker19, which it had acquired in 2007. The company accounts

for 8% of the UK betting market by online revenue20.

1.3 Current Situation of the Company

TIK TOK is a technology start-up company in the early funding and development stage. It is currently in the

development phase of its first product “FlashBet”, with the proposed product launch date of September, 2017.

1.4 Goals and Objectives

The primary goal of TIK TOK with FlashBet is to create a successful viral mobile sports betting application that

reaches a competitive level of popularity, quantified by acquiring over 300,000 monthly users within 18 months of

operations.

18

Paddy Power plc Annual Report and Accounts 2015

19

http://www.sbcnews.co.uk/sportsbook/2016/03/01/sky-betting-gaming-sees-revenues-increase-by-36/

20

Gambling Compliance, UK Online Market Share, October 2015

6Subsequently, the Company aims to continue to develop its stand-alone betting operation and launch spin-off

variants of the FlashBet Wheel FlashBet Mini-Wheel and FlashBet Exchange applications over the next 4 years of

operations.

The objective is to obtain £5 million of equity investment funding to finance the marketing and development of

FlashBet.

At an estimated £37.7 billion market in 2018, TIK TOK aims to acquire global market share of 0.0044% or £2.34

million revenues within 24 months of product launch.

1.5 Key Success Factors

The two key success factors for FlashBet is a viral product and effective marketing; a product that is unique and

engaging to the majority of online sports betting, regular football pools and national lotto players, together with its

ability to achieve a significant viral effect. These are achieved through:

The Company’s strong development team, with a track record of mobile app development success.

A unique product that adds interesting “Peer to Peer Cash-Out” and “Free-Play” elements to sports combination

accumulator betting, as well as providing a significant reward for sharing with friends via social media.

An effective marketing implementation strategy that creates sufficient brand awareness and drives active

monthly users.

Key Factors for Future Success

The key success factor to the ongoing future success for this company is to continually release new sports betting

verticals to appeal to an increasingly wider user-audience and number of potential B2B partners, as well as the

planned deployment of product spin-off variants.

7A second key factor is to continue to attract and retain a strong, experienced team for its management, development,

sales and marketing activities into the future.

1.6 Structure of the Company

TIK TOK Technologies Ltd, a company registered in the UK is the parent corporation and owns all intellectual

property rights to FlashBet and its associated applications. At an early stage TIK TOK Technologies Ltd intends to

convert to a Public Limited Company (“PLC”) Status.

For each territory entered into as a stand-alone or joint venture operator, a separate subsidiary will be formed. The

proposed group structure at outset is proposed as shown below: The lower company structure will be subject to

change.

82.0 Product Description

2.1 Description of the Product

The “FlashBet Wheel” inspired by the centre-piece of a casino

floor – the roulette wheel – is an engaging interface to generate

odds permutations, which approaches the multiple ‘accumulator’

sports bet from an odds perspective, as opposed to calculating

odds from the player’s selected results predictions.

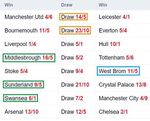

As shown in the illustration opposite, six sporting fixtures are

selected based on 3 Home Wins (1), 2 Draws (N) and 1 Away

Win (2), e.g. from the English Premier League (odds in

brackets):

[1] Chelsea Home Win (2.40/1)

[1] Watford Home Win (2.40/1)

[1] Arsenal Home Win (2.40/1)

[N] Swansea vs Manchester City Draw (3.25/1)

[N] Manchester Utd vs West Ham Draw (3.25/1)

[2] Liverpool Away Win (3.30/1)

Based on these selections, the FlashBet Wheel is spun with ten

neat odds groups being created, from ca. 500/1 to 1,000,000/1.

In this example, FLASH BET has been selected, and the TOTAL

BET of €10,00 spread evenly across the odds groups, creating

10 €1,00 six-fold multiple accumulator bets.

9The first odds group (481/1) is based on the selected fixture odds, i.e. (2.40 X 2.40 X 2.40 X 3.25 X 3.25 X 3.30)/1

and subsequent odds groups by derivatives of the chosen fixtures, such as final score and half-time/full-time

predictions, e.g. the 1,000/1 odds group contains two half-time/full-time predictions, to the 1,000,000/1 odds group

containing five final score predictions.

And, the MANUAL BET feature allows a player to select how their total betting stake is distributed around the wheel,

subject to a bet always being placed in the minimum odds group. It also allows for the wheel to be spun repeatedly

to generate a variety of odds groups in line with a player’s preferences, prior to all of the bets being placed.

Free-Play Version

A free version of the FlashBet Wheel App will be available for download in the Google Play, Windows and Apple

iTunes stores, as well as being available to play on Facebook. Upon download the player will be credited with 1,000

tokens to play with and the FlashBet Wheel will be populated with live sports betting odds, simulating the live

FlashBet experience.

Regular competitions based on a player’s virtual performance will be run to serve as a catalyst to gain viral traction in

the market place, incentivising players to share the FlashBet experience with their friends.

2.2 Certification and Regulatory Standards Required

FlashBet must adhere to the above-mentioned App Stores’ and Facebook’s guidelines for game submission. FlashBet

will meet these specifications through the app creation development firm. This will involve restricting access to users

outside of the US and any other prohibited territories, and paid gaming elements will not be included in the Facebook

version of FlashBet.

All rights to the FlashBet proprietary technology are wholly owned by TIK TOK Technologies Limited based out of the

UK. All licensing, incorporation, permits and insurance requirements for this firm will be completed by April 28, 2017.

The FlashBet Wheel App design and technology is currently Patent Pending in the UK.

102.3 Example Player Attracted to FlashBet

John Squires is a moderate gambler who typically spends circa £70 each week betting

on English Premier League fixtures. Like many gamblers, John prefers Patent Bets that

are a form of full coverage multiple bet offering coverage of all possible combinations

of bets from three selections.

Having predicted the outcomes of six matches – as shown here – John decides to split

his £70 betting stake into two £35 patent bets, with each bet comprising of a £5 stake

on the 7 possible combination bets, i.e. 3 singles, 3 doubles and a treble, which are

shown in more detail below:

Patent Bet #1 Patent Bet #2

Description Payout/£ Description Payout/£

• Single on Middlesbrough @ 16/5 (A) 21.00 • Single on Draw @ 14/5 (D) 19.00

• Single on Sunderland @ 9/5 (B) 14.00 • Single on Draw @ 23/10 (E) 16.50

• Single on Swansea @ 6/1 (C) 35.00 • Single on West Brom @ 11/5 (F) 16.00

• Double on A and B 58.80 • Double on D and E 62.70

• Double on A and C 147.00 • Double on D and F 60.80

• Double on B and C 98.00 • Double on E and F 52.80

• Treble on A and B and C 411.60 • Treble on D and E and F 200.64

Maximum Total Payout: 785.40 Maximum Total Payout: 428.44

If John correctly predicts all six fixture results, his two patent bets will pay out a profit of £1,143.84 (£1,213.84 -

£70)

11John is good at maths but has limited time. Using the FlashBet Wheel he can secure his usual type of minimum odds

groups, to spread his stake evenly and instantly over progressively increasing odds groups, in order to create a

substantial boost in terms of his maximum return potential.

John’s minimum bet odds group segment betting slips are based on his original fixture

selections:

1 Middlesbrough Home Win 3.2/1

1 Sunderland Home Win 1.8/1

1 Swansea Home Win 6.0/1

N Man. Utd v. Leicester Draw 2.8/1

N Bournemouth v. Everton Draw 2.3/1

2 West Brom Away Win 2.2/1

And so, John places 70 £1 bets across all ten market segments: 10 X (7 X £1 bets). He used the Manual Bet feature

in order to alter the specific fixture outcomes in odds groups 1,000/1 and up, to create bet combinations in

accordance with his own preferences.

If John correctly predicts all six fixture results, his seven £1 “minimum bets” will pay out a total profit of £3,423 (7 X

£489) an increase of £2,216.16 ((£3,423 – £1,143.84) – £63 (stake in other odds groups)) over his previous patent

bets. Moreover, he has a further 63 X £1 bets spread across the remaining 9 odds groups ranging from 1,000/1 to

1,000,000/1. John’s football betting has just got a whole lot more exciting with FlashBet!

Note: If John incorrectly predicted some of the fixture results, e.g. Swansea (from patent bet #1) and West Brom (from patent bet #2) didn’t win – these bets

would still return £93.80 and £98.20 respectively. For John’s minimum FlashBets to pay out, he must have correctly predicted all six fixture results.

123.0 Market

3.1 Target Market Profile

TIK TOK have established from their research into gambler profiles and preferences that FlashBet will appeal to a

range of gambling and gaming users, such as:

• Lottery “Lucky Dip” players; who are attracted to high win, low probability, low stake gambling but who can

now add an element of skill and knowledge to their ‘punt’.

• Social gamblers; who can interact with fellow gamblers especially regarding their scheme or team choices and

through the exchange mechanism.

• The sports betting analytical gambler; who may like to pore over team form, injury news and historical match

ups but who wants a quick and easy odds compiler choice, probably as a side bet or alternative when time

constrained.

• Accumulator players; as an alternative or addition to their traditional betting format.

• Football pool players; since effectively FlashBet offers a wider selection of odds choices and by definition better

odds

3.2 Estimated Revenues

The Company estimates to gain negligible revenue in Year 1 (ending six months after launch), gaining 79,388

monthly active users by the end of Year 2, 197,131 users by the end of Year 3 and 340,197 users by the end of Year

134. This will translate into cash generated of circa £748,991, £4.8m and £11.8m in Years 2, 3 and 4 respectively (see

below)21.

Monthly Active Global Market Gross Profit Net Income Cash

Year

Users Share (Loss) (Loss) Generated

2018 10,973 0.00% (£130,339) (£265,339) (£306,264)

2019 79,388 0.00% £1,381,096 £1,059,096 £748,991

2020 197,131 0.01% £5,835,934 £5,327,934 £4,868,969

2021 340,197 0.02% £13,078,717 £12,442,717 £11,827,309

These figures are based on assumptions of being able to achieve these numbers of active users, and management’s

ability to translate this customer base into equivalent industry-standard revenue through the successful acquisition of

B2B affiliations and licensing agreements.

3.3 Rules of Purchase

The rules of purchase of this target market is that the App must have a free to play version offering the opportunity

to buy additional competitively priced gaming tokens and convert to a live betting “real money” interface. In other

words, the quality of FlashBet is critical in that it must contain the minimum threshold of credibility, uniqueness and

shareability for the user to try and continue as a regular user.

21

See Financials (Section 8.0) and ‘Assumptions to Financial Documents’ sections of this Company Presentation.

144.0 SWOT ANALYSIS

The diagram opposite provides a summary of the

primary strengths, weaknesses, opportunities

and threats, currently facing TIK TOK in respect

of its FlashBet business.

4.1 Strengths of FlashBet

Early-mover advantage: FlashBet Wheel is a new

concept for the sports betting industry.

Personal network of contacts at high level: All of

the members of management have an extensive

experience of the different verticals, sectors and

operations they’re responsible for, jointly with a

vast personal network of contacts, e.g. within top

sports betting organisations.

Multiple jurisdictional operation: TIK TOK Technologies Limited is a private limited company registered in the UK

holding all proprietary rights to the FlashBet Wheel, and will initially have subsidiary operational entities in United

Kingdom, France and Spain, and subsequently may apply for a Remote Class 2 Gaming License issued by the Malta

Gaming Authority (MGA).

Dynamic organisation: TIK TOK are a dynamic and flexible organisation that can quickly make and revise decisions in

order to react to market developments. This flexibility is also a result of the fact that control over the company is still

in the hands of the founders.

154.2 Weaknesses of FlashBet

Small organization: TIK TOK is a relatively small organization that needs to develop the business in all aspects very

quickly, requiring a high level of commitment from all employees and consultants working for and with the

company.

No established brand: TIK TOK and FlashBet are new brands unknown to a larger audience. As such – even if

marketing is primarily conducted through our partners and their brands – TIK TOK cannot risk to rely too heavily on

the support of its partners. It must quickly gain its own unique foothold in the space.

Funding: TIK TOK is currently financed by a number of smaller private investors and as such must obtain funding to

expand its marketing, sales and product development activities to successfully compete.

4.3 Opportunities for FlashBet

Easy to multiply concept: It is very easy to multiply the entire set-up for additional verticals. TIK TOK estimate a time

frame of 4-6 weeks to create the graphical interface and back-end API integration required for a new vertical.

Internet usage (and penetration) still growing: The Internet is the fastest growing media, both in terms of

penetration, number of sessions and time spent online. Even in saturated countries like Germany, the US, and UK,

growth is expected to remain high, due to increasing broadband connectivity, online advertising, and online channel

investments.

Online and Mobile App: The FlashBet Wheel App is proprietary sports betting software technology designed to

calculate, present, and facilitate placing of multiple accumulator bets on a range of predetermined sporting fixtures.

Functionality, performance, security and scalability have been confirmed.

Changes in legislation: Further deregulation of monopoly markets, mainly in Europe and the US, is relatively likely.

This will open up new markets and advertising possibilities, which will further boost the growth of betting.

16Partnerships: In place are collaborations with THE LEAGUE magazine and the Legends Network which will enable

larger marketing campaigns at limited cost. Also in place is an agreement with MYCLUBBETTING.COM Limited.

4.4 Threats to FlashBet

Easy to copy concept: While the FlashBet Wheel App is patent-pending in the UK, there is some possibility

competitors of TIK TOK could copy the concept, if not the back-end algorithm itself; however, the adaptation of TIK

TOK’s business model has some prohibitive implications for established betting companies.

Irresistible affiliate deals: Potential partners may choose safe and guaranteed affiliations over the possibly unsafe but

potentially much higher income from a partnership with TIK TOK.

Changes in legislation: The uncertain legislative position in some jurisdictions does not only hold opportunities. There

is also a risk that it can get more difficult to offer and advertise betting and online gaming in certain countries.

Suppliers: TIK TOK’s business is dependent on a number of suppliers. In respect to competitive markets where it

plans to collaborate, it will depend on the provision of fixtures and result administration from those partners.

Regarding the FlashBet technology itself, TIK TOK does rely in part on contracted IT for operational support and

development, together with back-end API integration with its collaborative partners’ betting systems.

175.0 Marketing

5.1 Positioning

FlashBet will be positioned by its product attributes, with potential users seeing the sports betting App as unique and

engaging, in that nothing like it currently exists on the market.

5.2 Sales Strategy and Tactics

The management of TIK TOK will deploy a strategic marketing and sales implementation plan, comprising a series of

push tactics and direct sales marketing over the next two years to create interest and awareness of the FlashBet App,

drive users and acquire key advertisement, sponsorship, licensing and affiliation contracts. The latter will develop

more quickly as FlashBet gains traction in the market and builds a user base over the upcoming months.

5.3 Advertising and Promotion Plans

The following is a brief description of the advertisement and promotional tools used to create customer awareness

and drive monthly active users playing FlashBet. In the months preceding FlashBet’s launch, each channel will focus

on building excitement and engagement with the market. After the product is launched, the promotional plan will be

to aggressively drive users of FlashBet, and maintain high brand recall and playing frequency in users.

Sports Betting Forums

Online forums are literally the place that online players/punters hangout and meet up, like a virtual pub or bar. By

taking the FlashBet App to the target market’s meeting place, TIK TOK will be deploying what is arguably one of the

most effective forms of market penetration.

18Facebook Groups

The Company will create and market to existing groups through Facebook that are interested in online sports betting,

and will use this channel to communicate, build interest and create awareness of FlashBet to target market and build

strong user base.

Odds Comparison Listings

Management have identified odds comparison websites as the ideal place to not only advertise the FlashBet App, but

also as a source of potential affiliate and licensing partners.

Search Engine Optimisation (SEO)

TIK TOK will be sourcing and working with a leading team of search engine experts, to expedite this critical part of

their marketing strategy for the FlashBet App.

Advertising

Online banner advertising works well to build brand awareness, and which, TIK TOK will be deploying on special

interest websites. By implementing paid advertising in this way, the Company will stay in full control over all the

aspects of the advertisement (time frame, message, etc.)

Here are some further marketing strategies forming part of the company’s marketing and sales implementation plan:

• Organic Growth Through Ongoing Competitions, Communications and Sponsorships

• Affiliate Marketing

• Editorial advertising in sports and betting publications, e.g. THE LEAGUE MAGAZINE and Legends Network.

TIK TOK are exploring alternative cost-effective ways of advertising, e.g. free FlashBet listings in online reviews, etc.

196.0 Organisation

6.1 Key Persons Biography

Lord Jordan Lavignasse, Chairman & CEO

As Chairman and CEO, Jordan’s duties are to overseeing the overall vision, direction and strategy of the Company.

Jordan is a French Entrepreneur with years of experience in venture start-up businesses. Jordan’s experience covers

a wide range of business activity from property and construction to mechanical devices and more recently IT Business

Development. Jordan is fluent in English, French, Spanish and Portuguese and is competent in other languages.

CFO to be appointed: Director: A Chartered Accountant has already been identified to fulfil this role. To be appointed

as director. CFO will set up the finance and management reporting function, together with hiring an in-house contract

and licensing specialist.

6.2 Other Non-Executive Directors

Eduardo Autran, Operations Manager

Manager to be appointed Director: Eduardo attended University of Santa Barbara California, and the University of

New Castle and is fluent in French -English - Spanish –Portuguese. Eduardo has a vast experience in Radio, TV and

Film production and promotion and is now using that expertise in the promotion of Apps for full commercialisation.

Lidija Nikolic, Marketing and PR

Lidija Nikolic has been involved with gaming, music and venue brand promotions for many years. Lidija studied in

Belgrade, Vienna, Stockholm, Montpelier, London and Barcelona. Lidija is fluent in English, Spanish, German and

Serbian and is competent in Russian, French, Portuguese and Italian.

206.3 Professional Management Support

The following professionals have been engaged by TIK TOK to guide the Company and to support the management;

Michael Byrne

From his position, as Mobile Marketing and Product Manager at William Hill working closely with Playtech’s Mobile

Product team. Michael moved on to become Head of Mobile William Hill and on to become Chief Executive Officer at

BetandMove.com and was the Chief Commercial Officer of Probability. Currently Senior Director of GTECH/IGT.

NeoMades is a well-recognised name in the business of App Development and Consultancy Support

and are engaged to assist the Company with, native cross-platform development, monitoring, and

centralised maintenance. Architecture: Mobile Backend 360° Apps Panel, unified management off apps data, push

notifications, security and statistics, sustainable and customizable architecture (WS / API), centralized maintenance.

Support: frame-working requirements, promotion, animation, analytics, performance, evolutions, integration in the

information system.

Alear apps and web design. Alear supplies, technical & project management across a wide array of

online site interfaces.

SOS supplies the company with online security and filter data services along with the development

of bespoke solutions.

Flavia Alvis supplies full back support services in IT and Promotional and Digital Material.

6.4 Ownership

There are 100 million shares in issue and the current company ownership of TIK TOK Technologies Ltd is divided

amongst 27 shareholders with Gazel Investment Group Ltd as the majority shareholder.

Management interest are: Lord Jordan Lavignasse: 5,000,000 shares - Lidija Nikolic: 510,000 shares

217.0 Key Risks

7.1 Description of Risks

1. New Company

TIK TOK Technologies Limited are a new company and FlashBet is a new product. This creates significant risk if the

company is unable to gain market traction with its product, create and maintain required users or adapt to any

unforeseen technical problems associated with the product or release process. Additionally, as a start-up it is difficult

to project accurate revenue projections, and any inability to adapt to unforeseen events could negatively affect the

company’s success.

2. Relationship with B2B Partners and Facebook

If the Company is unable to maintain good relationships with affiliates, licensing, sponsorship and other B2B partners,

the business will suffer. As a large majority of the FlashBet Free-Play users will come through the Facebook platform,

it’s imperative TIK TOK maintain a good relationship with Facebook; therefore, any changes, limitations, terminations,

or providing other social media competitors more favourably on behalf of Facebook can have a significantly negative

impact on the company’s success.

3. New and Rapidly Changing Industry

TIK TOK is entering a new and rapidly changing industry, which presents challenges when evaluating the business

and its prospects. The growth of the remote interactive betting industry and the level of demand and market

22acceptance of FlashBet are subject to a high degree of uncertainty. Future operating results will depend on numerous

factors affecting the betting industry, many of which are beyond management’s control, including:

• Continued worldwide growth in the adoption and use of Facebook and other social networks.

• Changes in consumer demographics and public tastes and preferences.

• The availability and popularity of other forms of entertainment.

• The worldwide growth of personal computer, Internet and mobile device users and the rate of such growth.

• General economic conditions, particularly conditions adversely affecting discretionary consumer spending.

• Changes in betting and online gambling legislation and taxation.

Management’s ability to plan for App development, distribution and promotional activities will be significantly affected

by its ability to anticipate and adapt to relatively rapid changes in the tastes and preferences of current and potential

users of FlashBet. New and different types of entertainment may increase in popularity at the expense of online

sports betting. A decline in the popularity of sports betting in general, or FlashBet in particular, would harm business

prospects.

4. Security Breaches

Security breaches, computer viruses and computer hacking attacks could potentially harm TIK TOK’s business and the

results of operations.

5. Loss of Management or Development Team

Any loss of key management or development team members during production and launch of FlashBet would have a

very significant impact on the Company and its ability to meet revenue projections.

238.0 Financial Requirements and Cash Flow Projections

8.1 Type and Amount of Financing Required

The Company in the future will be seeking to raise £5 million in equity financing in exchange for 162/3% ownership in

TIK TOK Technologies Ltd. Please see details of the proposed share capital structure and planned use of the funds

below:

Share Capital Structure of the Fundraise:

Shares on offer: 20,000,000

Offer price per share: £0.25

Minimum investment per allocation: £5,000 (subject to conditions)

Total fundraising expected: £5,000,000

Shares in issue prior to funding: 100,000,000

Shares in issue upon full subscription: 120,000,000

Valuation prior to fundraising: £25,000,000*

Valuation assuming full subscription: £30,000,000**

*Based on an internal enterprise valuation.

** Valuation plus proceeds of the fund-raise.

24Use of Proceeds: (Based on full subscription)

Completion, securing, defending of IP documentation: £380,000

Marketing-development user base setup of secure data storage, licensing of odds service: £1,550,000

Leasing of secure servers and hosting, software maintenance and support: £100,000

Legal, accountancy, registrars – Professional Consultancy Services: £580,000

Management costs – remuneration, accommodation, administration and travel: £800,000

Stage 2 development specified on basis of Stage 1 results and experience – software

and hardware – marketing of Stage 2: £1,450,000

Reserve (contingency) to be added to working capital of the Company: £140,000

Exit Strategy:

The aimed for exit strategy plan for the Company is trade sale or IPO with targeted exit value of £50–100 million. The

Company is aware that outside investors want to collect a return on their investment within a set period of time and

have factored an exit strategy into the Company’s business model. The Company is looking to list on a recognised

sub-market of a Primary Exchange, e.g. the Alternative Investment Market (AIM – London Stock Exchange) or on the

OTC markets as a “Pink Sheets” company with the intention of a subsequent NASDAQ Listing, or the ECM segment of

the Cyprus Stock Exchange all options offer a suitable platform to allow for the trade in the Company’s shares. The

Company also intends to put into place full working manuals for all operations, along with all required accreditation

certifications to allow for an approach via a Bid or Merger.

258.2 Pro-forma Income Statement

KEY

2018 2019 2020 2021 2018 2019 2020 2021

P&L SUMMARY DRIVERS

Revenue Affiliates £64,661 £1,093,644 £3,113,349 £5,285,224 Affiliates Territories 1 3 6 9

Joint

Ventures £0 £890,563 £3,360,036 £7,529,663 Active Users 10,973 58,875 132,374 206,554

Av Income / Active

White lables £0 £351,890 £1,112,549 £2,266,330 User £5.89 £18.58 £23.52 £25.59

Joint

Total Revenues £64,661 £2,336,096 £7,585,934 £15,081,217 Ventures Territories 0 1 3 6

Cost of Sales (£195,000) (£955,000) (£1,750,000) (£2,002,500) Active Users 0 20513 64757 133643

Av Income / Active

Gross Profit (£130,339) £1,381,096 £5,835,934 £13,078,717 User £43.42 £51.89 £56.34

Gross Margin (202%) 59% 77% 87% White lables Territories 0 2 4 8

Overhaed (£135,000) (£322,000) (£508,000) (£636,000) Income per territory £175,945 £278,137 £283,291

Operating

Profit (£265,339) £1,059,096 £5,327,934 £12,442,717 EPS - 0.8 4.0 9.3

Operating Margin (410%) 45% 70% 83% Divendend / share - 0.1 1.3 3.3

Cash generated (£306,264) £748,991 £4,868,969 £11,827,309

268.3 Pro-forma Cash Flow Statement

Cash Flow Statement Year 1 of Operations

TIKTOK FLASHBET

Pro-Forma Cash Flow Statement For Year Ending: June 30, 2018

Total Year

Month: Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

1

Revenues

Affiliate (Aff) Revenues 0 0 0 0 0 0 0 0 6,161 11,698 19,765 27,037 64,661

Joint Venture (JV) Revenues 0 0 0 0 0 0 0 0 0 0 0 0 0

White Label Revenue 0 0 0 0 0 0 0 0 0 0 0 0 0

Total Revenues 0 0 0 0 0 0 0 0 6,161 11,698 19,765 27,037 64,661

Cash In

Previous Month Revenues 0 0 0 0 0 0 0 0 0 6,161 11,698 19,765 37,624

Total Cash Receipts 0 0 0 0 0 0 0 0 0 6,161 11,698 19,765 37,624

Cash Out

Aff. Server & Advertising 0 0 0 0 0 0 (25,000) (15,000) (20,000) (20,000) (20,000) (45,000) (145,000)

JV Server and Advertising 0 0 0 0 0 0 (10,000) (10,000) (12,500) (12,500) (12,500) (22,500) (80,000)

App Dev. Maintenance 0 0 (5,000) (5,000) (5,000) (5,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (80,000)

Staff Costs 0 0 0 (3,000) (7,000) (7,000) (7,000) (14,000) (14,000) (14,000) (14,000) (14,000) (94,000)

Office Overhead 0 0 0 (1,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (17,000)

Legal and Accounting 0 0 (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (10,000)

Travel 0 (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (22,000)

Miscellaneous 0 0 (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (20,000)

Total Cash Payments 0 (2,000) (10,000) (14,000) (19,000) (19,000) (59,000) (56,000) (63,500) (63,500) (63,500) (98,500) (468,000)

Cash Flow Surplus/Deficit (-) 0 (2,000) (10,000) (14,000) (19,000) (19,000) (59,000) (56,000) (63,500) (57,339) (51,802) (78,735) (306,264)

Opening Cash Balance 0 20,000 18,000 8,000 244,000 225,000 456,000 397,000 341,000 277,500 220,161 168,359 0

Financing 20,000 250,000 250,000 520,000

Closing Cash Balance 20,000 18,000 8,000 244,000 225,000 456,000 397,000 341,000 277,500 220,161 168,359 89,624 213,736

27Cash Flow Statement Year 2 of Operations

TIK TOK FLASHBET

Pro-Forma Cash Flow Statement For Year Ending: June 30, 2019

Total Year

Month: Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

2

Revenues

Affiliate (Aff) Revenues 33,569 45,613 56,449 66,209 74,993 82,881 96,157 108,103 118,848 128,529 137,224 145,067 1,093,644

Joint Venture (JV)

0 14,565 27,656 46,728 63,920 79,364 93,271 105,801 109,801 113,377 116,582 119,496 890,563

Revenues

White Label Revenue 0 50,861 1,635 2,762 3,779 4,692 116,375 7,890 9,253 70,481 11,584 72,578 351,890

Total Revenues 33,569 111,039 85,740 115,699 142,692 166,937 305,803 221,794 237,903 312,387 265,390 337,142 2,336,096

Cash In

Previous Month

27,037 33,569 111,039 85,740 115,699 142,692 166,937 305,803 221,794 237,903 312,387 265,390 2,025,991

Revenues

Total Cash Receipts 27,037 33,569 111,039 85,740 115,699 142,692 166,937 305,803 221,794 237,903 312,387 265,390 2,025,991

Cash Out

Aff. Server & Advertising (20,000) (45,000) (35,000) (35,000) (35,000) (35,000) (60,000) (50,000) (50,000) (50,000) (50,000) (50,000) (515,000)

JV Server and

(12,500) (22,500) (22,500) (22,500) (22,500) (22,500) (32,500) (32,500) (32,500) (32,500) (32,500) (32,500) (320,000)

Advertising

App Dev. Maintenance (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (10,000) (120,000)

Staff Costs (14,000) (14,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (21,000) (238,000)

Office Overhead (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (24,000)

Legal and Accounting (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (12,000)

Travel (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (24,000)

Miscellaneous (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (2,000) (24,000)

Total Cash Payments (63,500) (98,500) (95,500) (95,500) (95,500) (95,500) (130,500) (120,500) (120,500) (120,500) (120,500) (120,500) (1,277,000)

Cash Flow

(36,463) (64,931) 15,539 (9,760) 20,199 47,192 36,437 185,303 101,294 117,403 191,887 144,890 748,991

Surplus/(Deficit)

Opening Cash Balance 213,736 177,273 112,342 127,881 118,121 138,320 185,512 221,950 407,253 508,547 625,949 817,837 213,736

Financing

Closing Cash Balance 177,273 112,342 127,881 118,121 138,320 185,512 221,950 407,253 508,547 625,949 817,837 962,727 962,727

288.4 Assumptions to Financial Documents

Financials are based on pro-forma projections, and are subject to significant variation. The following are assumptions

and clarification to the financial documents:

All figures shown are in pound sterling (GBP/£)

FlashBet plans to acquire the envisaged 10,973 monthly active users from a single territory in 2018, 79,388

users from both affiliate and joint venture models over 4 territories and two white label licensees in 2019 and

197,131 users and 4 licensees in 2020 and 340,197 users and 8 licensees in 2021.

In Years 2-4 estimated that 12% of these users will be acquired in Q1, 20% in Q2, 30% in Q3 and 38% in Q4,

due to estimated nature of viral growth.

Annualised revenue of £5.89 per user from affiliate territories in 2018 rising to £25.59 by 2021 and £43.42

rising to £56.34 by 2021 per user from joint venture territories, with attrition rate assumptions in line with

industry averages.

FlashBet will achieve gross margin of 42.3% in Year 2, 67.8% in Year 3 and 81.5% in Year 4.

Stand-alone betting operations expected to commence in Year 2, Q3 and financials subject to separate analysis

once betting operating license obtained.

For more information please contact the Company.

29You can also read