TIM Brasil Company's Presentation July, 2018

←

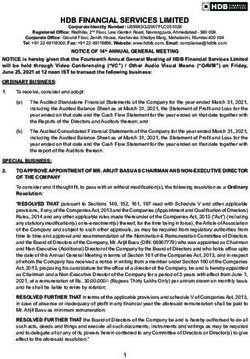

→

Page content transcription

If your browser does not render page correctly, please read the page content below

TIM Brasil

Company’s Presentation

July, 2018

TIM Participações - Investor Relations

Meeting with InvestorsDisclaimer

This presentation contains

Statements that constitute Such forward looking statements are not

forward looking statements regarding guarantees of future performance and

the intent, belief or current expectations involve risks and uncertainties, and actual

of the customer base, estimates regarding results may differ materially from those

future financial results and other aspects projected as a result of various factors.

of the activities.

Analysts and investors are cautioned not Financial results are presented on Pro

to place undue reliance on those forward

looking statements, which speak only as of Forma basis, disconsidering impacts

the date of this presentation. TIM Part from IFRS 15 adoption.

undertakes no obligation to release publicly

the results of any revisions to these forward

looking statements.

TIM Participações - Investor Relations

2

Meeting with InvestorsAgenda

About Us ………………………………………………………………………………………………………4

Market Overview and TIM Positioning ……………………………………………………………………..9

2Q18 Results ……………………………………………………………………………………………......18

Strategic Plan 2018-20 ……………………………………………………………................................. 29

Regulatory Update ……………………………………………………………………………………….....36

Appendix ………………………………………………………………………………………………….... 40

TIM IR app TIM RI app

(English) (Portuguese)

Visit our website and download our IR app:

www.tim.com.br/ir

TIM Participações - Investor Relations

3

Meeting with InvestorsTIM's Turnaround consolidated: from Recovery to Consistent and Sustainable Growth"

Introduced the #2 in Mobile #2 in postpaid Net Service Revenues

first plan focus Net Services users %

5.1%

Presence in on data for (excluding

Revenues

Brazil smartphones M2M) 2.5%

since 1998

>85k km of

Best and Wider fiber optical

#1 in

4G network prepaid -3.0%

Network throughout users -4.3%

the country -5.8%

2013 2014 2015 2016 2017

New Brand and Offers Positioning EBITDA¹ Margin

%

36.6%

33.5%

31.5%

28.4%

26.6%

2013 2014 2015 2016 2017

¹ Normalized Figures. TIM Participações - Investor Relations

5

Meeting with InvestorsStrategic Pillars

Improved Customer Experience due to advances in

6 all other pillars

6 Customer Experience

4G expansion in 700MHz

4 Coverage > 90% of urban population

Integrated channel approach for sales and

Selective expansion of FTTx network 5 customer service

More flexible operator to lead market evolution

Offer based on customer interactions

3 Residential ultra broadband through 4G

network

3 4 5

Convergent offers and multimedia

services Offer Infrastructure Efficiency Digital transformation

2 Creation of a Digital marketplace,

connecting customers and

Digitalization 2 partnerships

Accountability and

1 efficiency as part of

Culture 1 culture

Redesign the Customer Experience of our customers to become the best value for money player leveraging our leadership

position as an Ultra-Broadband player and our disruptive Offer proposition. Shift internal Culture from “excusability” to

Accountability, redesign Platforms and Processes from analogue to Digital to allow a full Digital Transformation.

TIM Participações - Investor Relations

6

Meeting with InvestorsCorporate Social Responsibility

MISSION: We are committed to creating and strengthening resources and strategies for the

democratization of science and innovation that promote human development in Brazil, with

Founded in July, 2013 mobile technology as one of the main facilitators.

PRINCIPLES AND STRATEGIES Applications Education Inclusion & Work

1. Education

Every child and young person has the right to a ZUP – Zeladoria Urbana Participativa Círculo da Matemática do Brasil

science and mathematics education that

represents the advances in knowledge gained in Academic Working Capital

these areas.

Agentes da Transformação Support to Science and

2. Applications Technology Museums and

Technological innovation should serve human Centers

development TIM Tec

Mapas Culturais TIM Faz Ciência

3. Work

Technological innovations are the basis for a new

way of working.

Busca Ativa Escolar TIM + Brazilian Public School

4. Inclusion TIM + Unicef Math Olympics (OBMEP)

People have the right to learn about new

information and communication technologies and

how they influence their everyday decisions.

TIM Stands out in

Sustainability

Member of ISE (Sustainability ISO 14001 certified since 2010, 1st

Joined UN Global Compact Brazilian telco and ISO9001 Quality

in 2008

Index) for 10 consecutive Certification for Billing and Networking Sustainability

years processes

TIM Participações - Investor Relations

7

Meeting with InvestorsCorporate Governance

Committees to Reinforce and Guarantee Solid Corporate Governance

Unique Telco company listed on the Novo Mercado

Highest level of 10 members 3 members

(3 independents) (3 independents)

Corporate

Requirement of

Governance

protection for

minority

Demand for shareholders

transparency and

3 members

disclosures (3 independents)

Legal

Requirements

3 members

(1 independent)

5 members

Brazilian Law (2 independents)

“Lei das S.A”

8 members

Equal rights: vote, dividends and tag along

Higher liquidity Statutory Audit Committee:

• Single class of share (ordinary shares) • Report to Board of Directors

Greater independence of Board of Directors (at least 20%) • Oversight Financial reporting

Strict disclosure policy • Analyze anonymous complaints

Compensation Board and Internal Control and Risk Board operate

indefinitely and act independently

Whistleblower channel website

TIM Participações - Investor Relations

8

Meeting with InvestorsMARKET OVERVIEW and TIM

POSITIONING

TIM Participações - Investor Relations

9

Meeting with InvestorsBrazilian Telcos: Financial X-Ray 2Q

TIM Participações - Investor Relations

10

Meeting with InvestorsBrazilian Telcos: Financial X-Ray 1H

TIM Participações - Investor Relations

11

Meeting with InvestorsBrazilian Telcos: Operational X-Ray 1Q

TIM Participações - Investor Relations

12

Meeting with InvestorsBrazilian Telcos: Revenues X-Ray

Total Services Net Revenues Mobile Service Net Revenue

R$ mln R$ mln

120,999 62,659

62,112

119,286 61,798

118,460

118,143

60,724

2015 2016 2017 LTM12

2015 2016 2017 LTM12

Total Services Net Revenues - Share Mobile Service Net Revenue - Share

% %

3.1% 2.8% 2.3% 1.9%

Nextel Nextel 6.0% 5.5% 4.4% 3.6%

TIM 12.7% 12.3% 13.1% 13.6% 14.1% 13.8% 13.0% 12.2%

Oi

20.9% 19.7% 19.0% 17.8% 19.0%

Oi 21.5% Claro 18.7% 17.6%

Claro 29.1% 29.3% 29.4% 29.8% TIM 23.5% 23.0% 23.8% 24.2%

Vivo 33.6% 34.6% 35.6% 35.7% Vivo 37.7% 40.1% 41.1% 41.1%

2015 2016 2017 1Q18

2015 2016 2017 1Q18

TIM Participações - Investor Relations

13

Meeting with InvestorsChange in Customer Profile and Mix

Changing Customer Base Mix New Customer Profile

Total base in mln customers

Mobile Global Research¹

Consolidation

Stabilization 89% of Brazilians' digital time in mobile is spent on apps

262

Expansion 236

30% of Brazil's digital population uses only mobile device

211

Total 121 149

Prepaid 98 In Brazil, 33% of the digital time is spent on social network and

23

88 instant messaging apps

Postpaid 51

07 08 09 10 11 12 13 14 15 16 17

Brazil “Anatomy of the Consumer”²

c50% of the time is spent watching video and to

communicating with voice

MTR Cuts

R$ Text messaging (SMS) accounts now for only c10% of text

communications

0.41 0.42 0.42 0.42 0.42

0.36

0.32 Usage: Apps x Traditional Services

0.24

0.16 Netflix /

0.10 Whatsapp / Youtube /

0.06 Skype etc

0.03 0.02

Telephone 50% 50% Live TV 50% 50%

07 08 09 10 11 12 13 14 15 16 17e 18e 19e voice calls

¹ Source: comScore

²Source: HSBC TIM Participações - Investor Relations

14

Meeting with InvestorsTIM Brasil: Growth Waves

1 Consumer Mobile (“the Controle wave”)

• Growth mostly based on a «Pure Mobile»

~8% approach with Residential BB opportunity

geographically limited.

~5% • TIM exploits the benefits of its 4G

FTTH/WTTX & acceleration.

Revenues Growth

Convergence

1 2 2 Business Segment (SMB and Top)

Consumer Mobile 3 Market

• Opportunity to gain Market Share and

B2B support a Top Line rebound leveraging on:

& TIM Live (FTTC) Consolidation

Fixed & Mobile

• Brand repositioning and New

Complexity/Timing Portfolio;

• More Convergent approach;

Mobile Market Revenues BB Market Revenues • CEx centric philosophy.

(R$ mln) (R$ mln)

3 FTTH/WTTX & Convergence

CAGR

• Accelerated Fiber deployment (backbone,

CAGR

>3% >6% backhaul and FTTH).

• Additional revenues growth and Convergent

CB expansion thanks to FTTH Service.

2017E 2018 2019 2020 2017E 2018 2019 2020

TIM Participações - Investor Relations

15

Meeting with InvestorsMobile Growth Levers

BEST LOYALTY GO-TO-MARKET &

OFFER PORTFOLIO (CHURN MANAGEMENT) CB MANAGEMENT CEX & DIGITAL

POSITIONING

• Recurring offer and Naked SIM

• Simple and segmented • Better acquisition quality • 1-2-1 management with RTD • Naked SIM to improve simplify and improve the

PREPAID offers • Big Data Analytics to (UP-SELL and RETENTION) acquisition quality and go- customer experience

improve churn prediction to-market flexibility • Continued evolution of digital

channels

• Best offer using “more for • 1-2-1 management (UP-SELL • Best value for money, • Focus on convenience and digital

• Targeted handsets and payment

CONTROLE more” services lock-in offers

and RETENTION) with convenience and control

• Innovation: OTT segmented and dedicated • Push Meu TIM App w/ new

partnerships offers (Mass Market) features (self-caring, up-sell)

• Innovation: dedicated data • Services lock-in offers • 1-2-1 management (UP-SELL • Enhance TIM Black • Focus on convenience and

• Handsets with lock-in as key and RETENTION) with positioning to accelerate the digital payment

PURE package and OTT partnerships

element of proposition for segmented and dedicated recovery of high end • Push Meu TIM App w/ new

POSTPAID for 3P offers

• Convergence in FTTX/WTTX the high end segment offers (Mass Market) customer perception features (self-caring, up-sell)

Monetizing Customer Base Total ARPU Trajectory (R$) Mobile Service Revenues Share¹ (%)

Pure

Postpaid Upsell >26%

24.5% 23.8%

Control Loyalty 23.1% 22.7%

Postpaid Upgrade

Upsell CAGR

High Single Digit

Prepaid Upgrade

Recurring Upsell

Prepaid Upgrade

Non-Recurring Upsell

2017A 2018 2019 2020 2014A 2015A 2016A 2017E 2018 2019 2020

(1) TOP 5 market includes SMP+SME

TIM Participações - Investor Relations

16

Meeting with InvestorsOpportunity for Residential Broadband solutions to be captured

Residential Broadband Penetration Fixed Broadband Market Customers

(mln users)

0 – 20%

40% – 60%

20% - 40%

> 60%

• Broadband Penetration 42%

• Ultra-BB Penetration 6%

• 96% of cities (~50% population) has very low BB

penetration (~20%) CAGR

>6%

• 23% of BB connections have speeds < 2Mpbs

Relevant opportunity to capture a strong

unserved demand for Residential 2017E 2018 2019 2020

Broadband and Ultra-BB connectivity

1 FTTH 2 FTTC 3 WTTX

• Increase of capacity on already saturated areas • Simple and smart solution (plug n play, value for

• Best overall performance (capacity, speed and

money)

stability)

• Refocus with dedicated offer to high income • Focus on customers with limited broadband

• Focus on high value customers and high

areas with historical low sales performance services (suburbs and smaller cities) offers

customer experience standards

• Fast time-to-market to attack new regions

• Smart strategy coverage launching in new cities • Higher speeds (VDSL2+) and ARPU over the

(incremental revenues)

• Leverage in fiber infra already built for mobile existing coverage

• Optimize investments: use of 4G network

• Partnership with content providers • Partnership with content providers (700Mhz) spare capacity

TIM Participações - Investor Relations

17

Meeting with Investors2Q18 RESULTS

TIM Participações - Investor Relations

18

Meeting with InvestorsQuarter Highlights Net Service Revenues (R$ bln)

Total Net Revs.

4.0

R$ 4.2 bln +5.8% +5.0%

3.8 +5.7%

3.6

YoY

Solid results amid worsening MSR Live Revs.

macro and temporary +5.7 % +41.0 %

impacts. YoY YoY 2Q16 2Q17 2Q18

Reshaped user base profile

increases resilience, reducing

EBITDA¹ EBITDA Margin¹ Capex Net Income

prepaid volatility exposure

(~R$ 15 mln impact in MSR +12.7 % 37.6 % 1.02 bln +53.2 %

YoY +2.3 p.p YoY +25.8% YoY YoY

from extraordinary events).

2018 efficiency target at 86%,

supporting EBITDA Margin 12M Postpaid 12M UBB Net 700 Mhz cities FTTH³ HH

expansion. Net Adds² Adds 1,131 +519 (000)

+3.0 mln +75k +215 vs. 4Q17 vs. 4Q17

Operational and Network

metrics remain strong.

¹Normalized figures TIM Participações - Investor Relations

²Postpaid Net Adds Ex-M2M, Source: Company 19

³Addressable households ready to sell Meeting with InvestorsMobile Operations: Managing the Customer Base Through Advanced

Real-Time Analytics

Mobile Base¹ Mix Shift (% of users) Mobile Strategy: upsell based on profiling to increase ARPU

ARPU growth

per segment

(% YoY)

26% Postpaid Pure-Pure Post

34%

paid +0.9%

Control-Pure (pure)

16%

Recurring

Prepaid Total

33% Control-Control

Control +7.8%

ARPU

Non +13%

58% Recurring Pre-Control (YoY)

Prepaid 33%

Daily-Weekly-Monthy Prepaid +0.5%

2Q17 2Q18

Zooming-In Prepaid Dynamics

Improving Acquisition Quality Increasing Recurrence Prepaid 4G Base²

(% Prepaid Gross Adds) (mln of users)

+5.9p.p

Despite Disconnections +27.1p.p

67% 14

+69.0%

Prepaid Base Quality is Gross Adds 40% 8

Improving w/ Recharge M+1

(% Gross Total)

2Q17 2Q18 2Q17 2Q18 2Q17 may/18

¹Source: Company; Anatel

TIM Participações - Investor Relations

20

²Base of May Meeting with InvestorsTIM Live Operations: Focusing on Execution

TIM Live arrives in

Salvador-BA

Sustaining solid revenue growth...

TIM Live ARPU (000) UBB Customer Base (000) TIM Live Revenues (R$ mln)

+12.7% 72,1 +21.5% 423 +41.0% 90

348 64

64,0

2Q17 2Q18 2Q17 2Q18 2Q17 2Q18

… while transitioning focus from FTTC to FTTH

New Customers ARPU¹ (R$ mln; %QoQ) Sales Mix Evolution (% Gross Adds) Net Adds & Available Ports (000)

January 2018 Net

FTTC FTTH Adds

35Mbps June 2018

34%

+19.0% 97.2 ≥ 100 Mbps 40 Mbps

17% 1Q18 2Q18 3Q18e 4Q18e

+7.6% 81.1 34%

75.4 81.7

FTTH

≥ 50 Mbps

66% FTTC

60 Mbps

1Q18 2Q18 1Q18 2Q18

49%

1Q18 2Q18 3Q18e 4Q18e

New portfolio drives ARPU up Higher speed as FTTH offers are introduced Phase-in FTTH, Phase-out FTTC

¹Broadband ARPU

TIM Participações - Investor Relations

21

Meeting with Investors4G at The Core of Mobile Network Strategy

Mobile and Fixed

Coverage Sites

Networks Evolving (Cities)

3,138

(‘000)

17.2

to Support

2,823 14.7

12.5 Mobile Network Usage

(% of data traffic)

4G¹

1,626 8.0

Business Expansion 834 68%

and CEX

55%

TIM P1 P3 P4 TIM P3 P1 P4

1,131

700 MHz available in major 4.3 45% 32%

700 MHz²

869 3.5

capitals helping to close 440

2.3

2Q17 3Q17 4Q17 1Q18 2Q18

indoor coverage gap. 4G 2G + 3G

- -

TIM P1 P3 P4 TIM P1 P3 P4

~40% of urban pop. covered

FTTH Rollout Acceleration

with LTE 700 MHz.

Addressable HH³ Gpon Areas New Cities with FTTH

(‘000) (# areas)

4G enabled devices already 569 68

Salvador – BA (02/Aug)

accounts for 87% of data 42 Suzano – SP (07/Aug)

São Gonçalo – RJ (07/Aug)

traffic. 203

50 7 Nilópolis – RJ (07/Aug)

4Q17 1Q18 2Q18 4Q17 1Q18 2Q18

Mauá – SP

FTTH outside Rio and SP,

based on FTTS project. (1) Number of 4G cities based on Teleco website as of Jun/18. 4G sites extracted from Anatel’s Siec system as of Jun/18

(2) Number of 700Mhz cities and sites in 700 MHz extracted from Anatel’s Mosaico system as of Jun/18. Cities with 700MHz = at least TIM Participações - Investor Relations

one site using this frequency. Number of 700 MHz sites based on sites licensed by Anatel which may include non-active sites. 22

(3) Addressable households ready to sell Meeting with InvestorsVoLTE & Refarming VoLTE Evolution Refarming Strategy Moving on to 2.1 GHz: Teresina Case

Enhancing 4G Throughput Downlink²

(Mbps)

5 mln +14%

Customer Clients¹

using VoLTE

+3%

22

Experience State

Capitals with

-57% VoLTE -44%

in drop in call setup 3Q17 4Q17 1Q18 apr/18 may/18 jun/18

VoLTE (HD calls) is available calls

1,559

time

Before 2.1 GHz After 2.1 GHz

for more than 10 mln Cities with refarming refarming

VoLTE

devices in Brazil.

Refarming pilot started in mid-April improving 4G

throughput and availability in Teresina city

2.1GHz refarming, starting a

Continuous Improvement in LTE Indicators³ Countrywide

new wave after a successful

implementation of LTE 4G Throughput Downlink 4G Throughput Uplink 4G Latency

@1.8GHz. (Mbps) (Mbps) (ms)

+14% -26%

+19%

TIM continues to lead 4G

availability in Open Signal

Report (Jun/18). 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18

(1) Number refers to the first week of July/18

(2) Based on analysis by Ookla® of Speedtest Intelligence® data for Q3 2017–June 2018. Ookla trademarks used under license and

reprinted with permission. TIM Participações - Investor Relations

(3) Based on analysis by Ookla® of Speedtest Intelligence® data for Q1 2017–Q2 2018. Ookla trademarks used under license and reprinted 23

with permission. Meeting with InvestorsSALES

Digital E-Recharges

(Prepaid recharge mix)

Sales in Digital Channels

(Pure postpaid+ control)

Sales in Digital Channels

(Recurring prepaid)

Transformation at

Prepaid recharge mix

+5.3 p.p 1.5x changing driven by

~2x

e-channels.

Full Speed E-sales is a key driver for

TIM’s upselling strategy.

Understanding clients’ needs 2Q17 2Q18 2Q17 2Q18 2Q17 2Q18

to improve customer journey. CARING

Meu TIM Unique Users Caring

(App+Web Users) (Human interactions) Focus on Customer

Re-engineering of processes to -6% Experience supported by

+62%

self-caring.

address clients’ pain points.

Mobile App and

modernized IVR are key in

this approach.

“Meu TIM” App Experience: 2Q17 2Q18 2Q17 2Q18

+4p.p IVR retention

BILLING & COLLECTION

E-Billing E-Payment

(# e-bills delivered) (# clients paying by e-methods)

Best app rating Adjusting incentives and

+28.4% pushing e-billing and

in the Apple +35.8%

e-payment through the

Store among right channels are driving

adoption

Telcos.

2Q17 2Q18 2Q17 2Q18

TIM Participações - Investor Relations

24

Meeting with InvestorsA More Resilient Total Net Revenues Breakdown (R$ mln, %YoY)

Revenue Expansion 3,942 +6.1% +1.4% +5.6% +7.5% 4,171

6M18 Net Service Revenues +5.8%

growing at 6.0% YoY, and MSR

at 5.8% YoY.

Reduction in working days¹ in

Mobile Revenues Mix: Bundled Offers (%) Mobile ARPU (R$,%YoY)

2Q impacted prepaid revenues

due to lower recharge level 21.9

(~0.4% of MSR). No-Bundle

+13.0%

19.4

Mobile Recurring Bundled 76%

Offers Revenues growing at Bundle

34.9% YoY in 2Q18.

2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 2Q18

TIM Participações - Investor Relations

¹Number of full workings days was affected by truck drivers’ strike and Brazil’s National soccer matches in FIFA World Cup. 25

Meeting with InvestorsOpex X-Ray: Efficiency Continues to Be a Key Driver

Normalized Opex Breakdown (R$ mln, %YoY) 2Q Trends Explained

+2.1%

Costs remain under control, growing under inflation and in line with

guidance. Low FX exposure reduce macro risks.

2,552 2,604

1 Selling & Marketing (+0.3% YoY):

232 221 902

COGS

Since 2Q17 costs remain practically stable, 869 869 854 869 871

despite a higher commercial pressure from

901 acquisition mix.

Traffic 924

1Q17 2Q17 3Q17 4Q17 1Q18 2Q18

(Network & Interconnection)

2 Bad Debt (+56% YoY) :

Despite expansion, remains under control (~2% of Gross Revenues). Performance is

mainly explained by the larger revenue base exposed to payment default (up by ~50% in

Market 1,001 the case of Control). To a smaller extent non-recurring items also affected the trend.

952

(Selling & Mkt + Bad Debt)

3 Others (+61% YoY):

Process Explained by non-recurring events, that impacted both 2Q18 and the annual comparison,

444 481

(G&A + Personnel + Others) related to tax ( 2013 and 2014) and civil contingencies.

2Q17 2Q18

Efficiency Plan Recap Efficiency Plan Completion

(R$ bln) 1.7 (R$ mln)

0.4

1.3 86% Completion of 2018

1.0

P18-20 Target, in June

0.7

FY17

Plan Additional New Plan

2017-2019 2020 2018-2020 JAN-18 APR-18 JUL-18 OCT-18

TIM Participações - Investor Relations

26

Meeting with InvestorsSolid Execution Consistent Evolution for Normalized EBITDA & Margin (%; R$ bln, %YoY)

Translated Into 35.3%

37.6% 4,50

33.6%

36.5%

Higher Profitability

31.5% 4,00 35,0%

29.5% +2.3 p.p. 35,0% +2.9 p.p.

EBITDA

2,00

Margin 3,50 30,0%

30,0% 3.04

1.57

& Bottom Line

3,00 2.65 25,0%

1,50 1.39 25,0%

1.29 1.20 2,50

20,0% 20,0%

2,00

1,00

EBITDA +12.7%

15,0% 15,0%

1,50 +14.5%

10,0% 10,0%

0,50 1,00

5,0%

0,50 5,0%

Once again record high 0,00 0,0%

0,00 0,0%

2Q15 2Q16 2Q17 2Q18 6M17 6M18

EBITDA and Margin for a

2nd Quarter

Reported Net Income (R$ mln, %YoY) Capex Acceleration (R$ bln, %YoY)

Net Income boosted to 585 +12.5%

1.66

1.48

~R$ 0.6 bln in 6M18 +66.7%

335 1.02

351 0.81

2Q

Network Capex 2Q 219 +53.2% +25.8%

250

acceleration to anticipate 1Q 132 1Q 0.67 0.65

availability of incremental 6M17 6M18

6M17 6M18

capacity. New IOC distribution %Network 61% 65%

R$ 240 mln to be paid Nov/18

TIM Participações - Investor Relations

27

Meeting with InvestorsCash Flow And NFP Dynamics

Operating Free Cash Flow Ex-License (R$ mln)

Exposure to FX

313

2 Capex

6M18 EBITDA- -186 244

~20%

CAPEX up 16.9% 383

YoY

6M18 OFCF (130)

expanded R$443

mln

OFCF Δ EBTIDA Δ CAPEX Δ WC Δ Non-Recurring OFCF Fx Bands to further reduce

6M17 (YoY) (YoY) (YoY) Items (YoY) 6M18 potential impacts.

Net Financial Position (R$ mln)

Debt

10%

-158 -151 3,231

2,697 313 -437 -101

100% Full Hedged

NFP OFCF 6M18 Net Financial Cash Dividends Paid License NFP

Dec/17 (ex-license) Expenses Taxes +Tower Sales Jun/18

+Other

TIM Participações - Investor Relations

28

Meeting with InvestorsKey Messages & Outlook

Macro recovery decelerating, expectations deteriorating

Focus Survey Estimates for 2018

2018 Targets checkpoint

GDP Growth Inflation FX Rate (BRL-USD)

4.2%

Internal 3.38 Guidance Short Term

Estimates 2.0% 6M18 Results Status

(Plan 18-20) Metrics Targets (2018)

2.7% 4.0% 3.9% 3.32 3.63

1.8%

1) Service 5 – 7% 6%

Revenues

Jan-18 Jun-18 Jan-18 Jun-18 Jan-18 Jun-18

2) EBITDA Growth Doublet Digit 14.5%

Slow and unbalanced economic recovery requires even (YoY)

more focus in execution 3) EBITDA – Capex 13% 16.5%

on Revenues

2H18 actions: 4) IOC Distribution R$ 800 – 900 R$ 470 mln

mln

Accelerate FTTH rollout adjusting phase-in/phase-out with FTTC 5 ) CAPEX ~ R$ 4 bln R$ 1.66 bln

Maintain focus in our own customer base: upsell + migrations to

continuously improve ARPU

Accelerate 700 MHz deployments + 2.1 GHZ refarming to improve

quality and CEX 2018 YE GUIDANCE

B2B (mobile and fixed) turnaround refocused to accelerate results

TIM Participações - Investor Relations

29

Meeting with InvestorsSTRATEGIC PLAN 2018-20

TIM Participações - Investor Relations

30

Meeting with InvestorsExecutive Summary:

More Postpaid and Broadband to support Revenue Growth and Expand Cash Generation

Strategic actions Impact by 2020

• Continued expansion of the best fixed and mobile >4K Cities covered by 4G (96% of Urban

Best in class infrastructure (4G, FTTX) to differentiate experience Population)

customer >2X growth of e-bill and e-pay penetration

• Improve Customer engagement through increased penetration

engagement of Digital interactions ~5X growth in My-TIM App users

• Acceleration of Mobile growth targeting more affluent Mobile CB Mix (%)

segments (e.g., controle, post-paid)

Prepaid >22

Sustain • Growth of Residential BB contribution to top-line 15,8

leadership • Step-change growth in SMB segment leveraging new Postpaid 30% ~50%

position Organization, go-to-market and value proposition

2017 2020

• Development of new and innovative revenue streams (e.g., IoT, 4X growth of residential BB CB ( FTTX +

mobile adv, etc.) WTTx)

• Improvement of Cash Generation ability through “smart” ≥40% EBITDA margin in 2020

Cash-flow Capex and Debt/Tax optimization

generation ≥20% EBITDA-CAPEX on revenues in

• Capture of digitalization efficiency potential 2020

• “Zero-based” approach on traditional efficiency levers

TIM Participações - Investor Relations

Meeting with Investors 31Network: Expansion in Mobile Access and Fiber

FIXED UBB BOOST 4G EVOLUTION

Focus on FTTH and FTTC Capacity Expansion and Coverage Evolution

2017 NEW plan! (2020)

96% urban

13

>4,200 population

FTTH

Coverage

2 cities

>3,000

3.0

4G Cities

FTTH Covered

Coverage

0.1 HH (MM)

1,255 LTE 700MHz

Cities Covered

FTTX

Coverage

3.2 5.9 HH (MM)

411 916

2015 2016 2017 2018 2019 2020

TRANSPORT INFRASTRUCTURE

Capillarity to support Mobile and Residential Services

FTTSITE FTTCITY

2017 NEW plan! (2020)

High Capacity

BackhauL (%)

60% ~80% 450

2017

1,200

2020

~+600 vs Old Plan

TIM Participações - Investor Relations

32

Meeting with InvestorsDigitalization will sustain our CEx improvement while supporting Efficiencies

Customer Management: Simplification of Customer Journey Customer Acquisition: Channel Mix Improvement

Sales in Digital Channels Sales in Digital Channels

Digital Interactions E-Billing E-Payment

(Control+Pure Postpaid) (Live)

(Total) (#users) (#users)

>80%

2x 2017 3x 2017

2X ~2X ~2x vs. 2016

vs. 2016 ~3x

2017 2020 2017 2020 2017 2020 2017 2020 2017 2020

R$0.5 bln

in savings

in 2020

Prepaid Recharges: Experience and Profitability Support Processes & Systems: Upgraded and

Strengthened IT Architecture

Recharge Commission (ex. Process Enhancement

Digital Prepaid Recharge Mix Efficiency Oriented

(% Digital sobre Total)

volume effect)

(R$ mln)

Asset Inventory Compliance Tax:

Management: Clean up: Increase in fiscal credits

-14% RFID tagging process Reduction in WBS utilization (R$ 100 mln/year)

+7p.p. for assets: safe and (>85%) and invoices

reliable tracing (>25%) by 2H18 with A.I

and Bots

Legal Process Optimiz.: Sales & VAS Commiss.:

System automation and Vendor Portal: Automation of the charge

2017 2020 2017 2020 integration of legal processes > 11k invoices/month creation process and VAS

with A.I and Bots already automatized revenue share calculation

TIM Participações - Investor Relations

33

Meeting with InvestorsOpex Evolution: over-executing the Efficiency Plan thanks to Digitalization

initiatives

Opex Evolution Efficiency Plan Highlights

R$ Bln

2018-2020 Plan • Expected OPEX growth below inflation.

2018-2020 except additional cost of TIM Live & WTTx acceleration CAGR

< 4% • Excluding additional acceleration in WTTx and Live business,

Opex should grow bellow 2%.

10.3 < 2%

• Network and postpaid customers structural growth continues

10.2

to impact costs considering the expected acceleration in

commercial activity.

2017 2018 2019 2020

Efficiency Plan Evolution

R$ Bln ~50% from Digitalization

Additional Savings 0.4 1.7 (1.0) ~11.5

Achieved in 2017 10.3

1.3 50% Market Driven

1.1 1.0

P18-20 50% Process Driven Post Paid CB: ~+60%1

Residential BB CB2: 4X Growth1; ~+3M HH passed

Network: Sites ~+30%1; Energy MWh >25%1

0.7 FTTCity Coverage: ~+800 Cities

FY17

Old Plan New Plan Additional New Plan 2017FY Volume & Inflation Savings 2020FY

2017-2019 2017-2019 2020 2017-2020 Structural

Growth

¹ 2020 vs 2017

TIM Participações - Investor Relations

34

Meeting with InvestorsIncreasing Profitability and Cash Generation

EBITDA and Margin Expansion

R$ Bln; % EBITDA - Capex

R$ Bln

>40%

36.6% 5.9

EBITDA 33.5% EBITDA 5.2

Margin

CAPEX 4.5 4.1

5.9

5.2

CAGR 2017-20

Low Double Digit

2016A 2017A 2018 2019 2020

EBITDA

% on Tot.

2016A 2017A 2018 2019 2020 3.9% 11.1% ≥13% ≥20%

Revenues

CAPEX Net Cash Flow Bef. Dividends

R$ Bln New Plan ‘18-’20 R$ Bln

New Plan ‘18-’20

4.5

4.1

Old Plan ‘17-’19

0.4

Old Plan ‘17-’19

∑ ‘18-’20: ~12 bln

-0.5 -0.6

2016A 2017A 2018 2019 2020 2016A 2017A 2018 2019 2020

TIM Participações - Investor Relations

35

Meeting with InvestorsTIM Brasil 2018-’20 Targets SHORT TERM LONG TERM

GOALS DRIVERS TARGETS / KPIs TARGETS / KPIs

Sustain

• Further improve Mobile Service

Service Revenues

Growth:

Service Revenues

Growth:

Revenue Share

Top Line

Growth • Expand Residential BB Revenues 5-7% in 2018 Mid to High Single

contribution

Digit CAGR ‘17-’20

• “Zero-based” approach on EBITDA: EBITDA Margin:

Improve traditional efficiency levers

Profitability • Capture digitalization efficiency Double Digit ≥40% in 2020

potential growth in 2018

• Smart Capex “More with less”

Ebitda-Capex on

Ebitda-Capex on

Revenues:

approach

Expand Cash Revenues: ≥20% in 2020

Generation • Optimize Tax Rate Capex:

• Optimize Debt and Shareholders’ ≥13% in 2018 ~12B R$ in ‘18-’20

Remuneration (~20% on Rev. in 2020)

TIM Participações - Investor Relations

36

Meeting with InvestorsRegulatory Updates

TIM Participações - Investor Relations

37

Meeting with InvestorsBrazilian Spectrum - Caps and Distribution

Spectrum Distribution

Vivo 21 3 26 29 40 20

Nextel 14 14 20

Claro 18 4 29 25 40 20

TIM 11 5 35 22 20 20

Oi 5 43 24 20

0 20 40 60 80 100 120 140

850 MHz 900 MHz 1.800 MHz 2.100 MHz 2.500 MHz 700 MHz

Caps

Band 850 MHz 900 MHz 1.800 MHz 2.100 MHz 2.500 MHz 700 MHz

Regulated Spectrum Cap (12.5+12.5) (2.5+2.5) (25+25) (15+15) (30+30) (20+20)

(FDD Applications) MHz MHz MHz MHz MHz MHz

Global Cap of 80 MHz < Σ of Sub-Caps Specific Caps

TIM Participações - Investor Relations

38

Meeting with InvestorsMain Regulatory Topics 2018

1Q18 2Q18

January February March April May June

700 MHz (Available) PLC 79/2016 Spectrum Management Public Consultation 700 MHz (Switch Off) Grant of Subsidies

• >4.000 cities • New Telecom • Pubilc Consultantion • Quality • João Pessoa • New RGC (Pre PC)

GIRED for LTE services framework (Conclude in 04/08) • Natal

following for more New PPDUR • Maceió Public Consultation

700 MHz (Switch Off) studies. • Public consultation of TAC (TEF) • Manaus • Sectorial data

• Curitiba radiofrequency public • Rejected by • Teresina collection

PERT price (auction, ANATEL • Aracaju

CP “Fator X” • Ongoing ANATEL secondary use and • Belém

• Contribution in Telecom Network postponement) under PLC 79/2016

01/22 Plan discussion discussion yet • Senate CCT Public Consultation

• Área de Tarifação

700 MHz (Switch Off) 700 MHz (Switch Off) do STFC

• Florianópolis • Porto Alegre, São Luis • Strategic Indicators

e São Paulo Interior • New Spectrum Cap

PLC 79/2016

• Public audience in

Senate

TIM Participações - Investor Relations

39

Meeting with Investors700 Mhz and 3,5 GHz Auction

Available LTE TIM, #cities

916 cities

> 1700 cities,

of which: 20 capitals

2016 1Q18 included all capitals 2019E

700 MHz

2 cities 2017 + 975 cities 2018E

> 3500 cities

of which: 21 capital

• Rio de Janeiro

• São Paulo • Florianópolis

Capitals Availabity • Belo Horizonte

• Curitiba • Porto Alegre

2018E

Jun. Jul. Set.

TIM field trials confirm ANATEL studies C

TCU suspends Band vs. IMT coexistence

2002 Auction 2011 2017

3,5 GHz

2005 / 2006 Auction

2015 2018

Blocks of 1,75 MHz Auction proposed, not • TIM coordinates tests w/ ANATEL+Telcos

cancelled

(Auction 003/2002) started

Interference C • 3,5 GHz Public Consultation

Band vs. WiMax Harmonized for IMT (WRC- Further tests

15) Usage Conditions

Interference management

Macro Cell applications

3,5 GHz Auction (award 2019)

TIM Participações - Investor Relations

40

Meeting with InvestorsAPPENDIX

TIM Participações - Investor Relations

41

Meeting with InvestorsHistorical Data: P&L Pro-Forma

TIM Participações - Investor Relations

42

Meeting with InvestorsHistorical Data: Operational

TIM Participações - Investor Relations

43

Meeting with InvestorsHistorical Data: Cash Flow

TIM Participações - Investor Relations

44

Meeting with InvestorsFor Further Information:

Investor Relations

Avenida João Cabral de Melo Neto, n 850, South Tower,

12th floor – Barra da Tijuca

22775-057 Rio de Janeiro, RJ

E-mail: ri@timbrasil.com.br

Vicente Ferreira

E-mail: vdferreira@timbrasil.com.br

Phone: +55 21 98113-1400

Pedro Yagelovic

E-mail: pybsantos@timbrasil.com.br

Phone: +55 21 98113-1881

Rafaela Gunzburger

E-mail: rgunzburger@timbrasil.com.br

Phone: +55 21 98113-1808

Luiza Macedo

E-mail: ldcmacedo@timbrasil.com.br

Phone: +55 21 98113-6312

Visit our Website

www.tim.com.br/ir

TIM Participações - Investor Relations

Meeting with InvestorsYou can also read