2022 MARKET OUTLOOK Risk. Return. Impact - NEI Investments

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2022 MARKET OUTLOOK Risk. Return. Impact.

CONTENTS

Introduction............................................................................................................. 3

Risk. Return. Impact. by asset class........................................................................ 4

Global fixed income: Amundi Asset Management..................................................... 5

Global high yield fixed income: Principal Global Investors ...................................... 6

Global impact bonds: Wellington Management......................................................... 8

Canadian equity: QV Investors.................................................................................. 10

U.S. equity: AllianceBernstein.................................................................................. 11

Global equity: Baillie Gifford (growth)....................................................................... 14

Global equity: Federated Hermes (core).................................................................. 16

Global equity: Impax Asset Management (thematic)............................................... 18

Inflation perspectives............................................................................................ 20

Fixed income.............................................................................................................. 21

Amundi Asset Management............................................................................... 21

Principal Global Investors.................................................................................. 21

Wellington Management.................................................................................... 22

Equity......................................................................................................................... 22

QV Investors........................................................................................................ 22

AllianceBernstein............................................................................................... 23

Net zero outlook.................................................................................................... 24

Fixed income.............................................................................................................. 25

Wellington Management.................................................................................... 25

Equity......................................................................................................................... 28

Baillie Gifford...................................................................................................... 28

Federated Hermes............................................................................................. 30

Impax Asset Management................................................................................. 32

Summary................................................................................................................... 33

»2 2022 market outlookIntroduction

INTRODUCTION

The pace of change that we have witnessed over the with thoughts on what our funds can do to address

past two years has been stunning. Developments that climate change.

have typically taken a decade to play out have been

condensed into mere months. As we look back at 2021 There is no question the investment landscape will be

and to the year ahead in our 2022 Market Outlook, a changing in 2022. There are many issues investors will

key lesson I take away is that urgency, focus, and need to navigate through. Central bankers have

investment can create profound change, a clear already set the stage for less accommodative policies

testament to human ingenuity. going forward. How will this impact returns, given that

many asset classes are already at stretched

For example, let’s look at technology. Economic valuations historically? What will the COVID-19 variant

shutdowns meant businesses didn’t have years to plan known as Omicron do to our market projections? How

and execute new digital strategies. But with focus and persistent will inflationary pressures be, and how

investment, the digital transformation of our economy should investors be protecting their portfolios in a

happened. Moving to health care, the needs of the higher-inflation environment? Climate change creates

pandemic created an environment of urgency and risks, but also opportunities for investors, and there is

action. Thanks to advancements in mRNA research, much we can do to accelerate the transition to a net

Pfizer and Moderna were able to compress the vaccine zero emission economy.

development cycle from 10-plus years to just one year.

We encourage you to explore the many deep insights

Bold actions were taken to help the economy as well. for investors in the pages ahead. At NEI Investments,

Governments and central bankers around the world we see risks to our forecasts increasing, and with that

unleashed record amounts of monetary and fiscal comes the potential for increased volatility. However,

stimulus to ensure that pandemic-damaged our outlook for the year ahead remains cautiously

economies would have enough support to ensure optimistic. Stretch that time horizon out to the next

there were no permanent loss of jobs or economic decade, and that optimistic outlook increases

output. Today, Canada has numerically recovered all substantially. In the words of our global growth

jobs lost during the pandemic. U.S. consumer manager Baillie Gifford, “The potential for a few

spending has now fully recovered and is above pre- innovative companies to drive progress as well as

COVID trends. Inflation, which has spent decades on a stock market returns has perhaps never been greater.

declining path, has broken to the upside as well. As investors we are in the privileged position to

contribute meaningfully to solving society’s greatest

So, what’s next? In this report, we asked our sub- challenges and we believe over the long term the

managers for their views on what will change in the approach will deliver sustainable and superior returns

investment landscape in 2022, the risks and return for our clients.” I cannot think of a better way of

opportunities for investors, and what impact our encapsulating the combined challenges and

investment dollars can have on solving ESG issues opportunities that lie ahead for us all.

like climate change, biodiversity, human rights,

and governance. Wishing you all a safe, prosperous, and impactful 2022.

We have organized the report into sections: the first is

by asset class, including fixed income (global bonds, John Bai, CFA

high-yield bonds, global impact bonds) and equity Senior Vice President and

(Canadian, U.S., global, and growth equities). We also Chief Investment Officer

squarely address a key concern for most investors,

with a special section on inflation. Finally, we wrap up

2022 market outlook 3«RISK. RETURN. IMPACT.

BY ASSET CLASS

RISK

RETURN

»4 2022 market outlookRisk. Return. Impact. by asset class

Global fixed income: Risk

Amundi Asset Management The two risks to keep an eye on are:

How do you see the investment landscape 1. Higher-than-expected impact coming from China’s

real estate market, which would weaken an already

changing in 2022?

downwardly revised growth outlook for China and

Next year, major central banks will start unwinding Asia, and potentially for the global economy.

the unprecedented level of monetary policy

2. Inflation continuing to surprise on the upside,

accommodation. Inflation has surprised to the upside

forcing the Fed to hike rates faster than expected

and has been coming in above consensus and central

while taking the federal funds rate significantly

bank forecasts for most of this year, whilst measures

above neutral, tipping the economy into a major

of long-term inflation expectations are generally

slowdown or recession.

more consistent with (and in many cases above)

inflation targets. This is not a surprise given the

degree of fiscal and monetary coordination during Return

this pandemic. We believe credit will continue to deliver positive returns

With demand clearly exceeding supply, monetary as spreads will remain contained by an improved

authorities will need to adapt and remain flexible to growth outlook. Corporates have managed to pass

address what is becoming a more permanent shift in through price pressure to consumers, keeping profit

inflation, particularly in the U.S. and U.K. margins under control. Financials and subordinated

RN

debt in particular remain our preferred choice.

There is also the prospect of more fiscal stimulus

from the U.S. (President Joe Biden’s infrastructure Emerging-market (EM) high-yield hard currency bonds

plan has been approved and there is more on the are also likely to be supported as real yields in core

pipeline), and the E.U. is set to accelerate the bond markets will remain negative and commodity

deployment of its new recovery fund. Granted, most prices elevated. Moreover, some EM central banks

of the fresh fiscal stimulus is aimed at boosting have proactively tightened monetary policy, which

potential output, limiting the long-term impact on coupled with attractive bond risk premia will present

price dynamics, but it can still exacerbate price good investment opportunities in the next year.

pressure in the coming years. While China’s economy With the Fed likely to start hiking rates in 2022, and

has slowed, developed-market GDP is expected to potentially accelerating its tapering of quantitative

grow above trend in 2022 and many economies will easing, volatility is likely to increase. This will create

have exceeded pre-COVID real GDP levels in 2022. opportunities in fixed income as the market has not

The U.S. is likely to be running a positive output gap fully priced this in. Protecting the portfolio from a

that hasn’t been observed in decades. higher-than-anticipated yield environment remains

Therefore, for the first time in decades investors attractive, either via options on U.S. Treasury futures

face an investment landscape that places inflation as and/or U.S. inflation-linked bonds.

a key risk. How central banks, and particularly the There are relative market opportunities on yield

Fed, deal with the various tradeoffs will be critical for curves, with the U.S. Treasury curve likely to flatten

asset returns and volatility. Within this backdrop, and that of the eurozone likely to steepen as the

there are plenty of opportunities in fixed income and European Central Bank pushes back rate hike

foreign exchange markets; the key is to be selective. expectations for next year. This should also support

corporate and sovereign spreads in the eurozone

periphery and favour the U.S. dollar versus the euro.

2022 market outlook 5«Some emerging-market currencies in high-yield securities will likely produce negative returns. High-

countries are attractive versus fundamentals and yield bonds, due to their higher coupons and shorter

present decent carry opportunities. durations, have historically been able to offset periods

of rising rates and produce superior positive returns.

Impact Inflation will continue to be a primary economic topic

of conversation, though we see supply chain

We saw incredible momentum both on the supply and improvements in 2022 as the world returns to a more

the demand side, with record levels of issues on GSS synchronized post-COVID state. What will not change

(Green, Social, and Sustainable bonds) both from in 2022 are the expectations of continued earnings

public (governments, supra, and agencies) and private growth by corporations, continued improvement in

entities (from banks to utilities, from IG rated to now leverage metrics, and declining defaults. Estimates

some high-yield names). The eurozone has been and for growth remain strong and the recovery in business

will remain one of the biggest issuers as part of the investment and continued improvement in labour

toolkit will be financed by social bonds and green productivity suggest a robust economy. Governments’

issuances. We expect to be quite active on the race to continued focus on medium-term objectives such as

net zero and see many companies committing to rebuilding infrastructure, tackling climate change,

emission targets. Green bonds but also sustainability and addressing social inequality will all be positive for

linked bonds are quite interesting as a way to showcase credit. The landscape still looks good for spread

for an issuer a commitment to reach specific KPIs products to significantly outperform risk-free assets.

(like lower carbon intensity). This was the scenario investors experienced in 2021,

and it will be in sharper focus in 2022 as the Fed not

On climate and energy transition, from carbon intensity

only tapers but tightens monetary policy.

to temperature, we have many indicators that help us

assess each issuer and give a complete 360 degree

view on companies. We still think that some risks are Risk

not fully priced here and don’t view utilities for Although our fundamental global outlook remains

example as the traditional place to hide but still as a quite strong and there are few signs of late-cycle

sector that is at the epicentre if the energy transition excesses, there are many uncertainties on the horizon

and that offers few risk/rewards at least on the senior that could cause bouts of volatility. For example, will

part of the capital structure. We like to bias our there be a COVID variant that grinds the economy to

portfolios toward highly rated companies while halt? In June and July of this year, we saw rising

maintaining good level of carry. infections from the Delta variant, but there was very

little impact on the markets. If a COVID variant rises

up again that closes economies for a time, it will be

Global high yield fixed income: very negative for high-yield fixed income. Another

Principal Global Investors uncertainty is if investors see a much more hawkish

stance from central banks, especially the Fed, in

How do you see the investment landscape response to the highest inflation in three decades. In

changing in 2022? this scenario, you will see quicker interest rate hikes,

causing a slowdown in economies that could harm

The landscape in 2022 will look different in many ways, high-yield issuers. Also, will the uncertainty in China

as it will now be two years since the pandemic began. from the crackdown on property developers spill over

The immense fiscal and monetary stimulus seen to other economies? Our base case scenario is that

during this time will slow down, and we expect the Fed China will contain the fallout in the property sector,

to begin tightening at some point in 2022. Against this but this is a risk. So far, it appears the country is

backdrop of a rising-rate environment, higher-quality managing the process, but it is one of the biggest

bonds such as Treasuries and investment-grade financial challenges they have faced in years.

»6 2022 market outlookRisk. Return. Impact. by asset class

Return Finally, we see opportunities in “green bonds” as they

will continue to perform well into 2022 with strong

With credit conditions remaining supportive even as investor demand for loans that help advance global

the Fed begins the tapering process, we still see value sustainability goals while simultaneously rebuilding

in reopening sectors such as travel, transportation, the economy.

and other cyclical industries. We continue to see

opportunities in these sectors despite spreads Impact

tightening at or near post-financial-crisis peaks thanks

to expectations of very low default rates and these More than at any time in our careers, we have the

sectors trading at slight spread advantages. Many opportunity to make an impact now. One opportunity,

travel and transportation names were investment- as mentioned earlier, is the growing prevalence of

grade names prior to the pandemic. Although spreads green bonds. Green bonds are increasingly being

on names such as United Airlines, Delta Airlines, or recognized by supranational organizations, banks, and

Carnival Cruise Lines are significantly tighter today corporations as an essential tool to finance climate-

than at the height of the pandemic, according to our related and other environmental projects. In its

analysis they still trade significantly wider than in simplest terms, a green bond is a conventional bond

2019, wider than other high-yield issuers and at with an environmentally friendly use of proceeds.

meaningfully more attractive levels than investment- Examples of green bond projects include renewable

grade credit. energy infrastructure, energy-efficient buildings, clean

transportation and waste management, and recycling.

Another opportunity we see is in the “fallen angels” As investors, we can allocate a portion of a portfolio to

(investment-grade issuers downgraded to high yield) green bonds to support positive climate change

that we expect to become rising stars in 2022. solutions without having to compromise the investment

Companies in the energy (Occidental Petroleum), food goal of optimal returns. In fact, issuance in 2021 is on

& beverage (Kraft Heinz), and automotive (Ford) sectors pace for a record year, as seen in the following exhibit,

are expected to transition to investment grade. and we expect 2022 to be more of the same.

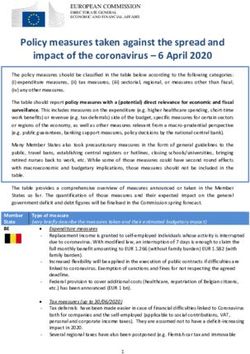

Issuance of green, social, sustainability bonds growing on pace

$700

Green Bonds Social Bonds Sustainability Bonds

$600

Annual Issuance ($billions)

$500

$400

$300

$200

$100

$0

2013 2014 2015 2016 2017 2018 2019 2020 2021F

Source: Moody’s, September 30, 2021.

2022 market outlook 7«Another opportunity for impact is the improved focus tail risks. However, as we look across the fixed income

on company engagement. We don’t want to spectrum, we still see pockets of attractive value for

automatically exclude an investment in a company investors to consider, notably in some non-traditional

with a lower ESG score because there might be credit sectors. Our other quantitative indicators are

opportunities for alpha within that investment. The mostly quite positive at this time: corporate behaviour

new face of investing is not having to pick between remains generally conservative, monetary policy is

income or idealism. The new face of long-term still supportive (despite steps toward tightening), and

investing is the ability to get both. The focus on market technicals are strong, all of which keep us

engagement has become more acute and we have from advocating for more cautious portfolio positioning.

focused on educating companies on the growing The prospect of higher-than-expected, longer-lasting

importance that institutional and individual investors structural inflation suggests that major central banks

place on ESG factors. We have seen tangible evidence may feel the need to start tightening policy sooner

of changes at companies we are invested in due to rather than later. A potential policy mistake in the

this engagement, such as one company hiring a form of tightening too soon or too quickly could prompt

Diversity Inclusion Director and engaging in an us to adopt a more defensive risk stance in 2022.

environmental impact report.

Global impact bonds: Despite the planned tapering

Wellington Management of Fed asset purchases in

2022, monetary policy should

How do you see the investment landscape

changing in 2022? continue to provide an

The increase in yields over the course of 2021 puts

economic boost...

fixed income sectors in a better position to generate

positive total returns in 2022. We maintain a neutral

Risk

risk posture overall, having grown wary of some fixed

income exposures in recent weeks, particularly certain We believe the primary risk revolves around the shift

higher-yielding credit sectors. We modestly reduced to tighter global monetary policy. Other key risks that

risk recently, after having maintained a pro-cyclical bear watching in 2022 include:

risk posture over the course of 2021. However, we still

believe some spread sectors can benefit from • Chinese deleveraging—We expect to see persistent

continued above-trend global growth, underpinned by market pressure on the Chinese real estate sector

healing labour markets and an improving public health as the credit turmoil associated with Evergrande

backdrop. We suspect global inflation may prove more continues to unfold. However, we view the recent

enduring than the Fed and broad markets expect, even steps the Chinese government has taken to better

as some supply bottlenecks ease. Enduring inflation manage the sector as a potentially encouraging

would test the Fed’s patient resolve in removing policy sign for the future, including measures (such as

accommodation. Despite the planned tapering of Fed the “Three Red Lines” policy) aimed at deleveraging

asset purchases in 2022, monetary policy should to ensure sustainable longer-term growth. Near

continue to provide an economic boost, likely to be term, China’s economy and asset prices have been

augmented by additional fiscal stimulus measures hit by a convergence of external and domestic

(including the U.S. infrastructure bill). shocks, some of which have to do with the country’s

political calendar and its regulatory actions in

Regarding valuation, recently rich levels in many 2021. Fortunately, none of these shocks seems to

credit sectors could leave investors vulnerable to have derailed the development or longer-term

negative returns if markets encounter unanticipated momentum trends of the economy. We will continue

»8 2022 market outlookRisk. Return. Impact. by asset class

to assess whether fallout from recent events decrease. This is despite concerns around lofty

threatens normalization of economic conditions equity valuations. Sectors like high yield have

over the coming months. limited upside due to tight credit spreads, while

maintaining the usual credit downside. Equities, on

• New COVID-related disruptions—A new vaccine- the other hand, can continue to appreciate in a

resistant variant could force countries or large parts middle- to late-cycle economic scenario, while the

of countries to return to a full lockdown. Consumer convertibles themselves retain a bond “floor,”

spending has been buoyed by low interest rates, helping to mitigate potential losses. We also favour

government programs, and pent-up demand for convertibles because they offer the opportunity to

many activities, but a downside surprise regarding allocate to issuers that often aren’t available in

COVID-19 could weigh on confidence. other markets, particularly in the technology and

biotech sectors.

• Deterioration in credit metrics—Leverage metrics

have swiftly returned to pre-pandemic levels. Free

cash flow generation held up well through the Impact

shock as companies pulled levers to position

We are slowly emerging from the COVID-19 pandemic

conservatively. Corporate cash flows should be

to a world further burdened by socioeconomic

more stable going forward, given the less cyclical

inequities, which are especially pronounced in the

mix of sectors (more food & beverage, technology,

developing world. Given the blows delivered to small

and pharmaceutical companies) and banking

businesses and the increasingly crucial role of digital

regulation. Shareholder-friendly activities remain

connectivity in a socially distant environment, we are

low for now, but we will be closely monitoring

focused on identifying solutions within our Financial

whether merger-and-acquisition activity picks up if

Inclusion and Digital Divide impact themes, particularly

issuers look to take advantage of low borrowing

within emerging markets.

costs to diversify or increase the scale of their

businesses. With the global economic downturn brought on by

COVID-19, as well as the continuing shift of business

Return models online, small businesses and entrepreneurs

have lost portions of their customer bases and felt

A few credit sectors stand out to us as having a higher pressure to boost their online presence. To help

probability of generating excess returns in 2022: address this need, we have identified an issuer that

provides financial technology solutions that enable

• EM high-yield sovereign debt looks particularly

and lower the costs of ecommerce for small- and

attractive because it is one of the few sectors in

medium-sized businesses in Brazil. This issuer’s

which credit spreads are still trading wider than

financial technology-as-a-service platform is

their historical median levels. Granted, many EM

differentiated to service small businesses and

countries’ fundamentals have deteriorated

facilitates their ability to scale, making the issuer a

somewhat as a result of increased debt burdens

key actor to accelerate financial inclusion in Brazil.

amid the COVID crisis. On the other hand, global

institutional support has been forthcoming from the As work, school and life generally shifted online

likes of the IMF and World Bank. While as always, during COVID-19, access to reliable digital connectivity

we expect some idiosyncratic EM debt defaults, we increased in necessity and will continue to serve a

believe a carefully assembled basket of high- critical role in education and job training and access

conviction issuers should serve investors well over to information and services. In light of this trend, we

the medium term. have identified a telecommunications and energy

company within our Digital Divide theme which works

• Convertible bonds exhibit a trait that many other

to help rural communities participate in the digital

fixed income sectors lack right now: positive

economy by increasing connectedness in Costa Rica.

convexity, or increasing duration when yields

2022 market outlook 9«Percent of income loss by global income quintile due to COVID-19

Poorest Second Third Fourth Richest

0

-1

-2

-3 -2.6

-3.5

-4

-5 -4.9

-5.1 -5.1

-6 -5.7

2020 2021

-6.6 -6.7 -6.6 -6.6

-7

Source: COVID-19 leaves a legacy of rising poverty and widening inequality, World Bank Blogs, October 2021.

Our investment in this issuer highlighted another repeat itself, it does often rhyme. With many of the

impact area of focus, which is to invest in issuers that broader equity indices trading at lofty valuations, a

deliver their services sustainably. We invested in this strong margin of safety is likely to be an important

issuer’s sustainability-linked bond, whose coupon rate precursor to outperformance in a more challenging

is tied to the installation of smart electricity meters, go-forward environment for equities.

which can play a key role in increasing the energy

efficiency of electric grids. Risk

Risk seeking behaviour is alive and well. Initial public

Canadian equity: QV Investors offerings are coming to market at a blistering pace

and earlier-stage growth stocks with no income

How do you see the investment landscape generation but high hopes for a promising future are

changing in 2022? receiving hefty valuations.

While the global economy has continued to recover As we move further past the depths of the pandemic,

alongside ongoing vaccination efforts, inflationary the costs associated with stabilizing the economy

pressures and supply chain issues are beginning to are coming to the forefront. Many individuals and

temper near-term expectations. These forces will have businesses continue to struggle while labour

an impact on some of our businesses, but productivity shortages, inflation, and supply chain challenges have

gains and price increases should generally help to become prevalent. As governments attempt to secure

mitigate these risks. Stimulus efforts across the world new revenue sources to manage higher debt loads,

are focused on reducing the likelihood of a below- incrementally higher taxes and regulations may begin

trend recovery and avoiding what many developed to weigh on corporate profits.

markets saw after the global financial crisis.

With record highs in stock markets and record lows

Today’s investing climate in some respects reminds in interest rates, risk management may not be in

us of the tech bubble of the late 1990s, although the vogue but it is more important than ever. Now is not

fiscal and monetary backdrop is quite different today. the time for disciplined investors to throw caution to

Back then, growth at any price was in vogue, and less the wind while chasing short-term returns outside of

attention was on everyday businesses offering their core competencies.

valuable services. Although history doesn’t necessarily

» 10 2022 market outlookRisk. Return. Impact. by asset class

Return U.S. equity: AllianceBernstein

The current environment is creating opportunities for

many of our companies. Our energy holdings are How do you see the investment landscape

benefitting from strong supply-side discipline, and changing in 2022?

recovering demand has driven pricing to a multiyear

Are equity market gains sustainable? After a strong

high. Excess cash flows from this sector are now

run through October 2021, the risk of a correction

being consistently used to reduce debt and enhance

should not be ignored. However, we believe that stocks

returns to shareholders. Our consumer discretionary

still offer attractive long-term return potential that

holdings are also well positioned for strong consumer

can’t be sourced elsewhere and should prevail over

spending in the years ahead.

time, even if a short-term downturn materializes.

Our portfolios contain many world-class businesses

Global equity investors returned to buy at market dips

that generate strong cash flows and attractive

as better-than-expected earnings reports and

returns on capital. In many cases, we expect portfolio

economic data in the U.S. helped quell concerns over

holdings to ramp up dividends or share buybacks in

the possibility of a slowing economic recovery. Market

the next 24 months. We remain very selective on the

sentiment was buoyed by favourable third-quarter

businesses that enter our portfolios, including only

earnings results from a broad range of companies

those we believe to be enduring franchises at

driven by robust demand, strong corporate balance

attractive valuations. With this discipline, we continue

sheets, and resilient consumer activity. Positive

to see attractive risk-adjusted returns going forward.

earnings momentum outpaced inflation and

overshadowed ongoing concerns surrounding the

Impact coronavirus Delta variant, supply-chain disruptions,

The economic exposures and growth prospects within and a sharp increase in energy costs.

our portfolios are balanced and diversified, with many

real-life connections to our daily lives. Sustainable

franchises are often the best positioned to support Market sentiment was buoyed

their customers, employees, and society for the long

term. For example, the largest and most well by favourable third-quarter

capitalized holdings should be favourably positioned earnings results from a broad

to support the energy transition through research

and development, capital, and strategic imperatives. range of companies driven by

Other companies are well positioned to further global

goals of reducing emissions, through their existing

robust demand, strong

infrastructure and technical expertise. We maintain corporate balance sheets, and

ongoing dialogue with companies regarding their

sustainability priorities and evolution over time.

resilient consumer activity.

This type of portfolio is well-positioned to absorb After a period of underperformance for defensive

future uncertainties and unknowns, allowing us to stocks, a broadening market can represent real

capture relatively consistent earnings growth over time. opportunity. Defensive sectors continued to grow

Our experience shows that periods of low market earnings and cash flow during the period when the

confidence tend to serve as valuable opportunities for market chose not to reward them with higher share

our portfolios, as other market participants tend to prices. Simply put, there are some high-quality,

overreact or reduce exposure to quality enduring defensive companies with stable businesses and

businesses that we believe will continue to survive, cash flows that are currently available at very

and in some cases thrive, for the long term. attractive prices.

2022 market outlook 11 «Risk How AllianceBernstein builds an

inflation-resilient portfolio

The greatest risk is a more challenging inflation and

interest-rate environment, in which the only choices Uncertainty around inflation suggests maintaining

available to central banks are difficult ones. Policy balanced exposure

rates in the U.S., Europe, and China are likely to

remain on hold until at least the end of 2022. For now,

we believe that inflation is likely to fall back next year. J.P.Morgan Microsoft Roche

We continue to think that this pressure is transitory, VISA The Home Depot

but risks are heavily skewed to the upside. Upward

pressure on prices has already been less transitory

Inflation winners: Deflation winners:

than expected, perhaps hinting at a more fundamental

Banks Pharmceuticals,

shift in inflation dynamics. Focus on: Defence, Utilities

High quality

Equity market valuations remain at the high end of companies with

their historical range and are especially heightened in pricing power

certain industries. After this year’s rebound from the

pandemic-induced collapse, earnings growth is

forecast to fall back to more normal levels in 2022. The result is a macro-resilient portfolio of companies with

strong cash flows and resilient business models.

China’s property market, the U.S. debt ceiling, and

soaring energy prices in Europe all cloud the outlook.

We’re also concerned that supply-side dislocations Source: AB

stemming from COVID-19 could be more pervasive

Holdings are subject to change. References to specific securities are presented

and persistent than expected. Even after a recovery to to illustrate the application of our investment philosophy only and are not to be

the new normal, the global growth outlook faces many considered recommendations by AB. The specific securities identified and

risks that prevailed before the pandemic, including described herein do not represent all of the securities purchased, sold or

populism and elevated debt. Rising corporate taxes recommended for the portfolio, and it should not be assumed that investments

and heightened regulatory risk remain concerns. in the securities identified were or will be profitable. Logos, brands and other

trademarks in this presentation are the property of their respective trademark

Our strategy seeks to capture the upside in rising holders. They are used for illustrative purposes only and are not intended to

convey any endorsement or sponsorship by, or association or affiliation with, the

markets but also to mitigate downside risks. We do

trademark holders. Representative holdings from AB’s U.S. Strategic Core Equity

that by targeting holdings with a combination of strategy. As of September 30, 2021.

quality, stability, and attractive prices, what we refer to

as “QSP” stocks. As rates rise in today’s environment,

Return

QSP stocks should do well as stability appears cheap.

Our portfolio cushioned losses across diverse markets In this environment, we believe investors should

over the past decade, and we believe that it is well balance near-term optimism with medium-term

positioned to reduce risk if volatility strikes again. caution. Focusing on high-quality companies, with

relatively stable shares trading at attractive prices, is

a prudent strategy in our view.

Quality companies with strong balance sheets and

businesses with high cash flows should be well

positioned for an array of known and unknown risks.

Shares that have demonstrated stable trading patterns

should hold up better in bouts of volatility that may

strike along the road to recovery.

» 12 2022 market outlookRisk. Return. Impact. by asset class

In a market in which the most popular growth Impact

stocks look especially expensive, focusing on price is

also critical. We own quality compounders—quality stocks that can

consistently compound shareholder value—with

consistent growth drivers, rather than hypergrowth

themes with stretched valuations. Among stocks with

...the global growth outlook undervalued stability characteristics, we like

faces many risks that prevailed attractively priced companies with solid business

models. We prefer companies that earn higher return

before the pandemic, including on invested capital over rebounding companies with no

populism and elevated debt. earnings to show. Select supermarkets and utilities,

for example, are attractively valued in historical terms

and versus other stocks, with much higher free-cash-

Relative valuations of defensive sectors, such as flow yields compared to bonds too. Finally, we look for

health care, consumer staples, and utilities, are much companies that have been mispriced by the markets

lower versus their 10-year history than sectors such despite improving future prospects.

as information technology and consumer

discretionary. Within expensive sectors, investors can

also find select high-quality companies that trade at

attractive valuations.

Relative valuations of defensive sectors are attractive

Historical valuation percentiles (U.S. market, 10-yrs ending Sept. 30, 2021)*

Expensive 100

Non-defensives Defensives 85

62

55

46

13 14 14 14

1 2

Materials Energy Cons. Utilities Health Financials Comm. Real Industrials Cons. Technology

Cheap staples care services estate disc.

Past performance and historical analysis do not guarantee future results.

As of September 30, 2021. Source: I/BE/E/S, MSCI, Refinitiv, Russell Investments and AB.

*Valuation percentiles for sectors are based on cap-weighted average price-to next 12 months earnings forecasts relative to benchmark and relative to their own history.

Valuation percentiles calculated within Europe (including the U.K.), Japan, and the U.S. separately, subsequently averaged using MSCI World aggregate market capitalization

weights to arrive at the Developed Market numbers. The investable universe contains Russell 1000 stocks in the U.S. and the MSCI World index constituents from Europe

(including the U.K.) and Japan.

2022 market outlook 13 «Focusing on quality compounders and Global equity:

discounted stability

Baillie Gifford (growth)

Quality Discounted

compounders stability How do you see the investment landscape

changing in 2022?

Microsoft AutoZone Baillie Gifford’s key competitive advantage lies in our

ability to look beyond the next year and focus on the

The Home Depot American seismic changes that will play out over the next

Electric Power decade. We do so from the bottom up, focusing our

United

Healthcare Northrop research efforts on finding those companies that are

Grumman innovating to drive these changes. As such, we have

no strong view on the direction of the broader

investment landscape during 2022. However, there

are a number of themes present in our portfolio that

Holdings are subject to change. It should not be assumed that investments in any

specific security were or will be profitable. Exhibit does not represent all of the support our view of the world in 2032. Perhaps the

securities purchased, sold or recommended for client in the product. References most exciting themes on that timeframe lie within

to specific securities discussed are not to be considered recommendations by energy, software, and genomics (the science of

AllianceBernstein L.P. genomes/genetics)—a slightly different take on ESG

to most sustainable investors.

Brands and other trademarks in this exhibit are the property of their respective

trademark holders. They are used for illustrative purposes only, and are not intended

The energy transition away from carbon could be the

to convey any endorsement or sponsorship by, or association or affiliation with,

the trademark holders. most significant growth driver of the next decade.

Critical needs include more efficient methods of home

As of September 30, 2021. Source: MSCI and AB. heating and electricity-based road transportation,

and companies can make large contributions toward

In terms of sector allocation, we are overweight in

deployment at scale.

information technology, but more in the defensive side

of the sector, as well as in some consumer staples In software, we are enthused by a new cohort of

and utilities stocks. Highly profitable businesses with companies that are providing scale as a service,

resilient revenues tend to help mitigate risk in periods levelling the playing field between small companies

of volatility, unlike their nonearning counterparts. Such and large ones and lowering the barriers to entry for

a development is what we have observed in technology entrepreneurship. Amazon led the way with its cloud

stocks. We’re underweight in higher-risk parts of the computing offering, but we are seeing this play out

market, such as materials and industrials. in other industries such as communications (Twilio)

and ecommerce (Shopify). We expect this to drive up

We’re optimistic about the future for defensive stocks

levels of new business formation, to the benefit

and for our portfolio. Our goal is to maintain QSP—the

of society.

three core elements that underpin our philosophy—at

all times. In today’s environment, fundamental analysis A paradigm shift is coming in the health care world as

and deep knowledge across companies is essential to big data and artificial intelligence collide in what has

make dynamic, forward-looking assessments. The traditionally been an industry resistant to change. The

future isn’t going to look like the past, and investment advent of affordable gene sequencing precipitates an

analysis must be based on an insightful understanding era of highly personalized medicine, with treatments

of what’s really driving companies and industries in developed in a more efficient and focused manner.

order to plot a path back to normal. This looks set to lower costs for the health care

system while serving large unmet needs and improving

» 14 2022 market outlookRisk. Return. Impact. by asset class

patient outcomes. Particularly promising areas their revenues and earnings potential, our Chinese

include neurodegeneration (Denali Therapeutics) and holdings remain among the best growth opportunities

cancer diagnostics (Illumina’s Grail). available to us. In the short run, however, there has

clearly been an impact on share prices and,

Risk consequently, on the portfolio’s performance.

Events in China have been the focus for many investors Return

recently, as its government has intensified and

widened its regulatory crackdown on some privately The Global Stewardship portfolio is experiencing a

listed companies. Our current view remains largely in gradual evolution, driven mainly by a couple of main

line with our longer-term thinking. We believe there is themes. Firstly, there has been a gradual “changing of

a cyclical element to Chinese regulation. The Chinese the guard” with respect to technology stocks, with

state is now pushing back against private companies, what we believe are among the next generation of

seeking to reassert a greater level of control. technology winners. These include Meituan, Twilio,

and Affirm. Secondly, there is an increasing number

It seems reasonably clear that companies which had of holdings in areas where change was underway

been perceived to be ignoring the warnings of pre-COVID but has been accelerated during or because

regulators (Ant and Didi for example) have been of the pandemic; Zoom, Upwork, and Samsung SDI

punished as a result. This is to be expected, and we are all good examples.

want our holdings to work with the authorities over

time in order to succeed as businesses in the context With Affirm, for example, it is our contention that the

of the needs of the broader Chinese society. In company is positively aligned with both merchants

addition, as we have previously noted we believe that and consumers in its mission to offer simple, honest,

greater oversight of, and restrictions on, fast-moving and transparent financial products. Such services

technology firms should be anticipated, both in China are available via online merchants that today include

and abroad. Moreover, this is, on balance, a positive Amazon, Peloton, and those on the Shopify platform.

development. For example, regulation of the Chinese We believe innovation is good for the long term of the

ecommerce sector is focussed on creating a level financial services industry, and are keen to support

playing field for consumers, merchants, and employees. those businesses with the potential to lower frictional

As responsible investors it is hard to argue against costs for stakeholders. The company’s most recent

such ambitions. results very clearly highlight the success the

company is having in appealing to a greater array of

merchants and consumers, while slowly expanding

its offering beyond its core lending product. For

The energy transition away example, Affirm has attracted US$300M of deposits

from carbon could be the most in its savings products this year with absolutely no

promotional spending.

significant growth driver of

When considering Zoom Video Communications, in

the next decade. the last 18 months we’ve seen video conferencing

move from a “nice to have” to a “must have” for most

We could go on discussing this complex area but in organizations. As we shift from home working to

the interest of brevity we should attempt to answer hybrid arrangements, this desire for hyper connectivity

perhaps the key question for investors: will increased is likely to endure, if not increase further. Despite it

government intervention lead to a sustained valuation being a difficult period for Zoom in performance terms

discount on Chinese stocks? In the long run, we as we emerge from strict COVID-19 restrictions, the

believe the answer is no: as outlined above this is just Global Stewardship team remains enthused by its

a cyclical reassertion of authority. When judged on long-term view, with the launch of new Zoom features

2022 market outlook 15 «like built-in apps and a digital event offering, as well Codexis develops custom enzymes. It works with

as traction in Zoom Phone. The latter is a unified app health care companies to help improve the drug

for phone, video, meetings, and chat. It allows the manufacturing process, providing the active ingredients

user to seamlessly make and receive phone calls, for many drugs produced by GSK, Merck, and

share content, participate in video meetings, and send Novartis. In each case the enzyme is “designed in,”

chat messages from Zoom desktop and mobile apps, with Codexis receiving a payment at each stage of

functionalities that are proving popular among regulatory approval and, ultimately, ongoing royalties

customers in the hybrid working transition. All these if commercialization is achieved.

developments suggest Zoom is closer to the start

than the end of its growth opportunity.

Global equity:

Impact Federated Hermes (core)

With engagement at the heart of our process, we

How do you see the investment landscape

learn a lot from the exceptional founders and

management teams of our portfolio companies, changing in 2022?

improving our understanding of these industries, and Global equity markets have continued to break new

the nature of technology-driven disruption. This is a ground this year, but the bull market that started in

two-way process, and so we expect these interactions 2009 is showing signs of fatigue. Equity valuations are

to be our greatest opportunity for impact above and at peak levels with measures such as the GDP to

beyond simply owning impactful businesses. The market capitalization ratio at an all-time high, and

potential for a few innovative companies to drive although earnings growth remains strong, momentum

progress as well as stock market returns has perhaps has started to slow.

never been greater. As investors we are in the

privileged position to contribute meaningfully to Part of the reason for this is technical, with

solving society’s greatest challenges and we believe comparable earnings set to get more difficult from

over the long term this approach will also deliver here. Inflation and supply constraints are also playing

sustainable and superior returns for our clients. their part, although the latter is likely to mean that

growth is being delayed rather than declining, which

At a stock level, perhaps the impact potential is is reflected in robust earnings growth estimates for

highest in health care, in which we believe we are on 2022. We have already started to see how much

the cusp of great transformation. Global Stewardship importance investors are placing on quarterly earnings

has exposure to innovative treatments, via holdings and guidance statements, and we expect that this will

such as those mentioned previously. More recently we continue in 2022. This favours companies exposed to

have been buying some of the companies that underpin structural trends, such as the transition toward a

these firms as the “picks and shovels” of the health more sustainable economy, which has accelerated

care world. Illumina (gene sequencing machines) has during the pandemic and shows no signs of abating.

been a holding in Global Stewardship since the

strategy’s inception, and it has been joined over the However, the debate around whether inflation is

past six months by 10x Genomics and Codexis. transitory or not will continue to rage, at least for the

first half of 2022. As such, the sensitivity of markets

10x Genomics pioneered the field of single cell towards inflationary expectations and interest rates

sequencing, in which biology can be interrogated at a is also likely to remain high, which could lead to some

much greater level of granularity than before. For significant, short-term factor and sentiment swings

applications such as oncology, where no two cancers and keep volatility at an elevated level. Our belief is

are alike, diagnostic tools that allow for more detailed that inflation will be transitory, which is consistent

analyses are a welcome addition to the arsenal of with what the bond markets (and central bankers)

medical researchers. are telling us.

» 16 2022 market outlookRisk. Return. Impact. by asset class

This expected volatility is somewhat welcome as it material weaknesses. This approach has been

provides opportunities for active investors with diverse successful over many years and tangible evidence of

portfolios to generate alpha by taking advantage of this can be found in the way our portfolios have

short-term price swings to build exposure to performed since the pandemic started. With

sustainable companies with structural advantages uncertainty remaining high, we continue to believe

that should grow regardless of the market that remaining disciplined and diversified be vital

environment. next year and beyond.

Risk

Inflation expectations are likely to the remain a key Global equity markets have

influence on markets as we head into 2022. Currently, continued to break new ground

inflation expectations are elevated, especially in the

U.S., but with inflation-hedged bonds still showing this year, but the bull market

negative real yields, the bond market is indicating that that started in 2009 is showing

it is transitory and suggests that interest rate rises

are likely to be modest. Any change to the belief that signs of fatigue.

inflation is transitory could result in interest rates

rising faster than expected, creating a real risk for the

global economy and global equity markets. Return

Meanwhile, earnings are likely to decelerate from here We are starting to emerge from a crisis, which has in

as comparable figures from last year start to become many ways changed how people behave and what is

more difficult to beat. Currently, expectations remain most important to them. The surge in working from

high, with supply chain issues delaying rather than home has undoubtedly raised the importance of having

reducing demand. With higher expectations comes a a better work-life balance. This has tempted some to

higher risk of disappointment, and investors are leave their city apartments and head for more space in

already paying particularly closer attention to company the country or the suburbs for a better quality of life. It

earnings and guidance statements. With markets has, alongside the pandemic, also severely disrupted

close to all-time highs, there is considerable downside consumption of services such as entertainment and

risk for companies that fail to meet expectations, restaurants, which has been usurped by spending on

especially those with a high valuation multiple. things like household goods or renovations, a

development that looks set to continue.

One other consideration is with respect to ESG. In

2021, we saw some of the more popular sustainable Automation is likely to be another beneficiary of the

investments become detached from their underlying economic transition. We have already seen an

fundamentals as inflows into so-called “ESG assets” acceleration of this trend, but we expect it to continue

driven by a herd mentality chased a common core of due to the increasing scarcity of labour in lower-paying

opportunities. ESG characteristics should be a jobs. As countries such as the U.K. transition towards

consideration for all investment decisions, rather having a higher skilled, higher paid workforce, the

than be thought of as a narrow set of opportunities. demand for automation should grow. This will not

This is our approach, and we continue to find a diverse happen overnight, however, but it provides a nice

range of companies with good or improving ESG structural advantage for companies that provide

characteristics that are less obvious but that are these solutions.

contributing to the sustainable transition.

The transition to a more sustainable economy also

One of the foundations of our investment approach continues to represent an exceptional investment

is to identify a diverse range of companies that look opportunity. Embracing sustainability is not just about

attractive from multiple perspectives and have no avoiding risks, it is also about finding opportunities.

2022 market outlook 17 «Companies that play an active role in adapting to and experience, and that also represent their stakeholders.

mitigating some of the greatest environmental and We also want companies to have a clear strategy, a

social challenges that we see today are likely to be sustainable business model and robust risk

doubly rewarded, enjoying robust growth in demand management processes. Transparency is critical in

while further benefiting from future policy and this regard, so improving disclosures is key in our

legislative action to promote sustainable development. holding companies to account.

Impact

Global equity:

Engagement is a key part of our process, and we Impax Asset Management

will continue to speak to companies on a range of

ESG issues. Being an active owner is vital in holding (thematic)

companies to account, not only in ensuring the

adequate management of the ESG risks they face, How do you see the investment landscape

but also in encouraging firms to change for the better. changing in 2022?

We believe improvements can unlock significant

shareholder value over the long term. Effective Throughout these challenging times, Impax has been

stewardship is one of the principal activities that encouraged that public policymakers and businesses

enable us to deliver this for our clients. have continued to pay attention to the sustainability

themes that underpin our investment thesis. As we look

Our engagement is therefore focused on ensuring ahead, we believe the outcomes of the COP26 climate

companies are responsibly governed and well talks and the policies of the Biden Administration are

managed to deliver sustainable long-term value likely to accelerate the transition to a more

while improving the lives of employees, promoting sustainable economy. For example, the recently

diversity, and supporting communities. Indeed, our passed U.S. infrastructure bill is supportive of the

engagement plans cover a range of societal and sectors in which Impax invests. A constructive capital-

environmental issues in which we believe we can expenditure environment is good for our strategy

make a positive impact. overall, and the renewed focus on sustainability and

green infrastructure in the U.S. should provide

From an environmental viewpoint, this includes multi-year demand for the companies in our portfolio.

ensuring companies have credible strategies to reduce

emissions to be aligned with 1.5-degree targets,

Risk

building a circular economy to achieve sustainable

levels of consumption, protecting biodiversity, and Companies not delivering on growth expectations

controlling pollution of air, land, and water to below (because supply chains take longer to normalize, or

harmful levels. for other reasons), in combination with rising yields

leading to declining allocations or reallocations out of

On a social level, our focus is on human rights linked

equities, are the largest current bigger-picture risks

to company operations, products, and supply chains,

to the portfolio.

plus the provision of affordable essential goods and

improving human capital management and labour Valuations in the market are generally priced for

rights to help achieve a healthy, skilled, and productive optimal conditions and can be challenging, particularly

workforce. We are also encouraging companies to when framed against a macroeconomic backdrop of

develop strong corporate cultures that help build a inflation, higher raw materials prices, decelerating

more equal society. growth, and persistent supply chain bottlenecks.

To do this, we seek strong governance and Additionally, during sharp sector or style rotations,

management of the most material risks. This requires the inherently more cyclical nature of the thematic

effective boards that have the required skill and universe can be a detractor—however, for this reason

» 18 2022 market outlookYou can also read