Financial Orbit Highlights

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Financial Orbit Highlights

Financial Orbit Highlights

‘Thoughts from Jackson Hole…we are still in a hole’

The temptation for even the most committed of financial professionals to sneak off away

from their desks and financial information terminals would have been very high last week if

it had not been for the start of the Jackson Hole summit. Mario Draghi stole the show despite

a second tier billing indicating again that what is happening in the European economy does

matter no matter where you reside. We stay in interesting times…with all the positive and

negative connotations that this observation brings.

So what have been my highlights of the last week?

Draghi’s last chart indicates these are not normal times;

Still…it was ‘risk on’ time (again);

High sector valuations and geopolitics: shrug the shoulders;

Job security…and mortgage affordability;

China will bail us out, won’t they?;

Back to the start: we are in a hole

Feel free to contact me on any aspect of the above…or anything else in fact.

Chris Bailey

Founder, Financial Orbit

Email: chris.bailey@financialorbit.com

Web: www.financialorbit.com

Twitter: @financial_orbit

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

Chart of the week came late in the week with this contribution from Mario Draghi’s

presentation at the Jackson Hole economic conference. Oh yes, negative real interest rates

are here to stay for a while. That is far from normal…

Of course Mr Draghi also was more expansive on the use by national European governments

of fiscal policy to help boost their local economies. Well…you can see the reason why it is

‘all hands on deck’ below. Relative to history Europe’s economy has not been doing well…

(h/t @ObsoleteDogma)

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

Meanwhile, to carry on the theme from last week, sentiment (indicated here by the AAII

Index) continued to shift strongly and positively…

…and the VIX compressed

My view of the above? Too much positive sentiment tells you to be cautious.

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

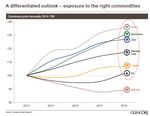

GaveKal Capital had this fascinating chart on a very interesting posting which observed:

'Not A Single Developed Sector Is Trading Below 22x P/E'

High sentiment indeed…as evidenced by the oil price shrugging off geopolitical concerns

All hopes on shale then…

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

So, no surprises then that US workers are confident about job security?

But hang on…mortgage affordability is fading

It remains a mixed up US economic ‘recovery’.

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

Still China is going to bail us out all isn’t it? After all steel consumption is primed to

replicate the US in the 1970s…

…and e-commerce sales are so strong:

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

Which is why…the iron ore futures curve is so weak of course (iron ore being a major

input into steel production and hence an important indicator on Chinese growth hopes).

Back to Jackson Hole as a finale…as this Financial Times cartoon, central bankers are still

in a hole

Careful investment position selection remains the key. Protect your beta, focus on ‘panning

for alpha’ as someone said to me earlier in the week.

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022Financial Orbit Highlights

Popular posts on www.financialorbit.com over the last week:

1. A guest post covering some fascinating into the fast-evolving Chinese technological markets was the most

viewed post during the last week. Link here.

2. The regular 'Stories we should be thinking about' was the second most popular post during the last

week. Link here.

3. A surprising number three a posting on the Denver Gold Forum from eleven months ago. Looking back at it

again a nice posting...but I don't know why it suddenly was so popular. Link here.

4. The first guest posting on Financial Orbit on 'Provincial Diversification' in China (published originally a

few weeks ago) was the fourth most popular posting. Link here.

5. A posting with four excellent charts on stock market sector valuation, Apple, the oil market and cyber

security was the fifth most popular posting of the last week. Link here.

And a final post which did not make the top five was this one titled 'Glencore - some great presentation slides

(even if I never seem to buy the stock)'

The wrap: the best bits of Financial Orbit each day…

Friday 22nd August wrap (link here) Japan's sales tax impact in a historic context, I compare the FTSE-100

index to Groundhog Day, RSA Insurance, Yellen speaks, Draghi speaks...and have a good weekend

Thursday 21st August wrap (link here) A few thoughts on the Asian and European PMI numbers, why

sentiment changes lead to only one conclusion and corporate insights from Ahold

Wednesday 20th August wrap (link here) Mining via Fortescue and Glencore, Chinese anti-trust fines, an

alternative $HKD big mac index, Carlsberg and problems in Russia, Staples

Tuesday 19th August wrap (link here) NZ shows problems with raising interest rates, worrying US mortgage

affordability, Imperial Tobacco, APM-Maersk, CRH, BHP, Dick's Sporting & great charts

Monday 18th August wrap (link here) Chinese property & the Australian misery index, guest post on huge

growth in Chinese e-commerce and related change, taking profits in Dollar General and levels to buy Daimler

All views here are my own and do not represent any form of investment advice. My research is only suitable for "professional investors" as

defined under UK law and should not be accessed by any retail investors.

Financial Orbit Highlights volume XX (August 2014)

Daily updates at: www.financialorbit.com Twitter: @financial_orbit Email: chris.bailey@financialorbit.com

Downloaded from www.hvst.com by IP address 192.168.208.10 on 03/12/2022You can also read