FY19 RESULTS PRESENTATION - ASX: RDY - ReadyTech

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

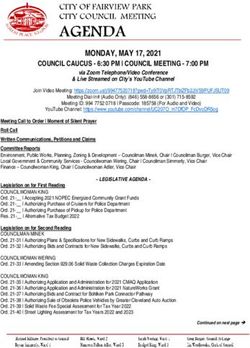

AGENDA

Key Financial and Operational Highlights 3

Growth and Product Strategy 7

Group Financial Results 14

Outlook 21

Appendix 22Key Financial and Operational Highlights

PRO-FORMA PRO-FORMA PRO-FORMA

FY 19 REVENUE EBITDA NPATA

Exceeded

prospectus

$33.0 m

$12.8 m

$5.7 m

forecast

VS Prospectus forecast: +1% VS Prospectus forecast: +1.5% VS Prospectus forecast: +9.7%

YOY%: 13.5% YOY%: 20.8% YOY%: 33.6%

OPERATING

AVERAGE CASH FLOW

CLIENT

CLTV* REVENUE PER REVENUE

to CAC* CONVERSION

CLIENT RATIO

RETENTION

6.9 x

FY18 = 5.8x

$8.9K 98 12% (YoY)

% 96 %

CLTV: Client life time value and CAC: Customer acquisition costs

ReadyTech FY19 results - P 3ACHIEVEMENTS KEY ACHIEVEMENTS IN FY19

CLIENT GROWTH CUSTOMER INVESTMENT PARTNER

GROWTH IN ARPC SUCCESS IN R&D NETWORK

• Record new business • Continued growth (12% •M

aintained strong net client • Over $10m R&D spend for • Increased footprint of

volumes with over 400 growth YOY) in ARPC revenue retention of 96% product improvements and new partner network including

client wins through additional modules modules & customer value Canvas and Go1 for

and increase in user • Increased headcount education and HR and

• Attracting new and higher subscriptions investment in the customer • In the education segment - workforce management

value clients with the spend success function resulting in new customer value includes partners for employment

of new clients won 3.6 • Supported by cross sell strong customer satisfaction enhanced dashboards, to help drive new customer

times greater than those value added services of My scores student services, online referrals to ReadyTech

that churned Profiling and Esher House enrolment and student

(behavioural science) engagement tools • Launch of the ePayroll

• Strong progress in higher partner network to support

education sector and • In the employment segment customer growth through

enterprise strategy – early compliance with Single accountant and bookkeeper

demonstrating success of Touch Payroll (STP) and new networks

the dual brand strategy modules including mobile app,

Financial Controller portal and

onboardingFY19 Result Exceeds Prospectus Forecasts

FY19 RESULTS

FY19 PRO-FORMA FY19 PRO-FORMA PROSPECTUS FY18 PRO-FORMA FY19 vs FY18

$ MILLION

ACTUAL PROSPECTUS VARIANCE % ACTUAL VARIANCE %

Revenue 33.0 32.6 1.0% 29.0 13.5%

Subscription and

29.7 29.2 1.5% 25.6 15.8%

licence revenue

Implementation, training

3.3 3.4 (3.4)% 3.4 (3.8)%

and other revenue

Expenses (20.1) (20.0) (0.7)% (18.4) (9.3)%

EBITDA 12.8 12.7 1.5% 10.6 20.8%

EBITDA Margin % 39.0% 38.8% 0.2% 36.6% 2.4%

ReadyTech FY19 results - P 5Financial Snapshot

CONTINUED GROWTH FY19

SCALABLE PLATFORM FY19

IN SUBSCRIPTION &

LICENCE REVENUE 90% SUPPORTS STRONG

EBITDA MARGIN 39%

Pro Forma Revenue ($m) Pro forma EBITDA ($m) and EBITDA margin (%)

$14m 40%

$37m 39%

90%

$3.3m 90% 90%

37%

$12m

88% 35% 35%

$32m

88%

88% $3.3m 88%

$10m

$27m $3.4m 86% 30%

$3.3m $29.7m $8m

85%

84%

$12.8m

26% 25%

$22m

$3.6m $25.6m $10.6m

$6m

$23.8m 82% $9.6m

$20.1m

$17m

80% $4m $6.1m 20%

$12m 78% $2m 15%

FY16 FY17 FY18 FY19 FY16 FY17 FY18 FY19

Subscription and Implementation, training % Subscription and

EBITDA EBITDA margin (%)

licence revenue and other revenue licence revenue

ReadyTech FY19 results - P 6ReadyTech – What We Do

ReadyTech builds mission-critical SaaS and technology for

managing people in complex regulatory environments and delivers

additional customer value through a range of offerings.

Education & Employment

Managing the Student and Employee Lifecycle

Education Employment

Compliance / Regulation ReadyTech

Regulatory Reporting, Statutory Obligations Value Proposition

Market Leading

Productivity & Automation Value Added Services Data & Predictive Analytics Highly Trusted

Relentless Innovation

Workflow Automation, Employee & Employee & Student Business Intelligence & Insights and unique

Student Self-Service Acquisition, Experience, Success and Retention behavioural science capability

Integrations & Interoperability

Supported integrations Large partner network Includes Finance, HR & Learning

& open APIs Management Systems

ReadyTech FY19 results - P 8Student Management Systems (Education)

ReadyTech provides mission-critical student management systems (SMS) which are at the core of modern tertiary education

institutions and then seeks to drive key performance outcomes such as improved student experience and graduation rates.

THE MODERN EDUCATION INSTITUTION Manage the key

aspects of the student

Customer Relationship Management (CRM) journey from education

to employment

STUDENT MANAGEMENT SYSTEM (SMS)

WORKFLOW &

ADMISSIONS & STUDENT ASSESSMENT

PROCESS ReadyTech Focus

ENROLMENT SERVICES & GRADING

MANAGEMENT

SMS represents the

SCHEDULING & COMMUNICATIONS QUOTES, INVOICING, ALUMNI

ATTENDANCE & ENGAGEMENT PAYMENTS & MANAGEMENT single ‘source of truth’ for

COMMISSIONS student data

ReadyTech Focus

STUDENT STUDENT STUDENT STUDENT WORK PLACEMENT

ASSESSMENT RETENTION EXPERIENCE

ACQUISITION & ALUMNI

REGULATORY REPORTING

Integrates with

other systems such as

Learning Management System (LMS) LMS/key partners

including Canvas

Financial System & Payments

ReadyTech FY19 results - P 9Market Opportunity – Tertiary Education

ReadyTech provides a range of market-leading technology solutions across the tertiary education sector

including mission-critical Student Management Systems (SMS).

Enterprise SaaS Universities

Skills Assessment

TAFE

Student

Management System Student Retention

English Language

SME Private Higher Ed

Student Enterprise

Management System

Skills Assessment

A robust and reliable solution designed to meet all Private VET • Domestic

student management and reporting needs.

Colleges • International

SIZE

Value Adds VETenrol

Payments, international Manages student enrolments in one

enrolments & logistics. centralised location.

Trainer Portal ◂ • Upstream integration • Receive, review, confirm & complete VETsurvey

◂ • Ezidebit integration student enrolments

Perform assessments, attendance ◂ • CRICOS compliance • Customise steps to suit your RTO Create & distribute

& other functions in real time. • Confirm payments education-specific surveys.

◂ • Manage clients, events and classes • Pre-populated compliant surveys

◂ • Record unit results • Reply via email or online

◂

◂

• Manage files and documents

• Contact students via SMS, DM or email

• Hosted and supported solution

ReadyTech FY19 results - P 10Payroll and HR Administration

ReadyTech is at the core of the employment software ecosystem offering mission-critical Payroll and HR Admin solutions.

THE MODERN EMPLOYER

Mission-critical HR

functions such as HR

RECRUITMENT

EMPLOYEE ONBOARDING

INDUCTIONS & CREDENTIALS admin and payroll

WORKFLOW &

TIME ATTENDANCE PAYROLL - TECH / EMPLOYEE SELF PROCESS

ROSTERING MANAGED SERVICE SERVICE ReadyTech Focus

MANAGEMENT

Enable our customers to

SKILLS & BI MANAGER WORKPLACE

TRAINING REPOPORTING PORTAL HEALTH & remain compliant with

SAFETY evolving regulatory

ReadyTech Focus

compliance

EMPLOYEE INTEGRATIONS - ERP,

BANK, STRATEGIC HR etc

EMPLOYEE BENEFITS EMPLOYEE

ACQUISITION EXIT

COMPLIANCE

ATO STATE LAWS FAIR WORK WORK COVER DHS

Add-on modules

such as T&A, WHS, BI

STRATEGIC HR Reporting, workflow

automation enhance

PERFORMANCE COMPENSATION PROFESSIONAL SUCCESSION value for customers

MANAGEMENT SALARY PACKAGING DEVELOPMENT PLANNING READYTECH FOCUS

READYTECH EXPANSION

ReadyTech FY19 results - P 11Market Opportunity – Employment

ReadyTech provides Payroll & HR administration technology and managed services across the

employment market and increasingly targets higher value customers.

SOFTWARE MANAGED SERVICE

SIZE OF BUSINESS REVENUE DISTRIBUTION

5-19 employees 10%

20-199 employees 47%

Enterprise 1000+

>200 employees 43%

Mid-Market 100-1000

SIZE

Small Businesses 1-100

ReadyTech FY19 results - P 12Growth Initiatives

ReadyTech enjoys a range of opportunities to maintain strong rates of growth into the future.

Technology Talent Existing Customers New Customers M&A/Partnerships

Continued investment in Grow APRC with Licence growth,

Invest in new talent Win new and higher M&A strategy and

SaaS products – upsell of modules and cross sell of

to drive growth value customers strategic partnerships

R&D spend of $10M pa value added services

Education – investment in Sales - Investment in ARPC - 12% growth in average Pipeline - Current pipeline of M&A – well capitalised

enterprise/higher education enterprise/higher education revenue per customer from >$15m of potential opportunities and pipeline to acquire

product strategy including: enterprise sales strategy. FY18 to FY19. with a number of recently complementary technology

• New apps Expect to grow incrementally added higher value deals in the and/or customer base with

• Student services sales and marketing spend from Growth - in user subscriptions tertiary education sector. focus in the employment sector.

• Integrations the current 8% of revenue. on the back of strong macro

trends in Tertiary education and Higher Value - New clients New Partnerships

Employment – investment in Customer Success - Invest employment sectors. on average 3.6x larger than Focus on new partnerships to

new modules including: in customer success to grow average client churn. deliver value to customers and

• Onboarding advocacy, ARPC and secure New Value - Offer new referrals.

Target - Employment to target

• Workflow automation retention rates. modules including self-service,

sectors with payroll complexity

• CFO Reporting Portal WHS and business intelligence. Employee Benefits

including retail (e.g. client win

• Enhanced User Interface R&D - Building talent attraction

Glue Store) and construction

strategies and talent pipeline to Cross-Sell - My Profiling and

sectors. Consultants - Launch of

Security – ongoing underpin future growth. Expand behavioural science cross-sell

commitment to invest in R&D capabilities such as data delivering growth and pipeline Education Certified Consultant

Enterprise - Continued

InfoSec – ISO27001 and IRAP analytics and AI. growing strongly into FY20. Program.

development of enterprise sales

compliance. and marketing capability.

ReadyTech FY19 results - P 13GROUP FINANCIAL RESULTS ASX: RDY

Strong Revenue and Earnings Growth

PRO FORMA $ MILLIONS

Highlights

% change vs

FY19 FY18 % Change YOY

Prospectus

Subscription and licence revenue 29.7 25.6 15.8% 1.5% Revenue grew by 13.5% driven by new client wins and

increased sales to existing clients

Implementation, training and other revenue 3.3 3.4 (3.8%) (3.4)%

Total revenue 33.0 29.0 13.5% 1.0%

Operating expenses grew 9.3% driven by investment in new

Salaries and wages (15.2) (13.5) (12.7)% 0.2% Sales and Marketing roles and R&D, as well as increased client

hosting costs

Technology infrastructure and operations (2.5) (2.2) (12.9)% (7.5)%

General and administrative (2.5) (2.8) 10.4% (0.0)%

Benefits of a scaleable platform sees a 13.5% revenue increase

Total operating expenses (20.1) (18.4) (9.3)% (0.7)% delivering a 20.8% increase in EBITDA

EBITDA 12.8 10.6 20.8% 1.5%

Depreciation and amortisation (8.1) (7.3) (10.5)% 2.5%

Depreciation and amortisation figures comparable to capitalised

EBIT 4.7 3.3 43.4% 9% development costs which are amortised over 5 years

Net finance expenses (1.6) (1.4) (16.2)% 0.2%

PBT 3.1 1.9 63.2% 14.5%

Pro-forma net finance expenses based on the terms of new

Income tax expense (Effective rate 30%) (0.9) (0.5) (57.7)% (10.7)% Banking facilities as if they were in place from 1st of July 2017

NPAT 2.2 1.4 65.5% 16.2%

Add: amortisation of acquired intangibles (post-tax) 3.5 2.9 (19.0)% (5.9)%

NPATA 5.7 4.3 33.6% 9.7%

ReadyTech FY19 results - P 15Strong Operating Leverage

Total Operating Expenses (A$m) Capitalised Development Expenses (A$m)

74% 13%

12%

65% 63%

61% 11%

10%

20.1

18.4

17.7 17.5 2.5

2.9 2.8 3.3 3.4

3.4 2.5 3.1 3.2

2.2

2.4 2.2

12.4 11.9 13.5 15.2

FY16 FY17 FY18 FY19 FY16 FY17 FY18 FY19

General and administrative Technology infrastructure and operations Capitalised development expenses % of revenue

Salaries and wages Total operating expences (% of revenue)

ReadyTech FY19 results - P 16Segment Results - Education

$M EDUCATION

YoY $ YoY %

FY19 FY18 vs Prospectus %

Growth Growth

Education Revenue 20.0 17.8 2.1 12% 0%

Education EBITDA 8.1 7.1 1.1 15% 2%

EBITDA Margin % 41% 40% 3% 1%

Highlights

Strong client growth with the average value of client wins

Benefit of enterprise sales staff is paying dividends

3.6x greater than churned customers on average

Greater existing customer spend due to user base growth

Upsell of My Profiling and Esher House performed well and

and/or uptake of more modules

pipeline strong

Continued growth expected through high value qualified

leads especially in pathways and higher education sectors. CLTV to CAC ratio of 6.2X (FY18 = 5.2X)

University of Queensland project tracking well

ReadyTech FY19 results - P 17Segment Results - Employment

$M EMPLOYMENT

YoY $ YoY %

FY19 FY18 vs Prospectus %

Growth Growth

Employment Revenue 13.0 11.3 1.7 15% 3%

Employment EBITDA 6.2 5.1 1.2 23% 0%

EBITDA Margin % 48% 45% 7% -1%

Highlights

Increase in existing client spend driven by employee growth and

additional module uptake through targeted campaigns and Benefit of increased business development staff and

account management team national coverage

Compliance with Single Touch Payroll (STP) increased Strategic alliances with partners and accounting firms

customer spend and switching to ReadyTech delivered new customer wins

CLTV to CAC ratio of 7.1X (FY18 = 6.1X)

ReadyTech FY19 results - P 18Strong Cash Flow Conversion Maintained

Highlights

$ MILLIONS PRO FORMA FINANCIALS

Changes in net working capital

Negative working capital due to customers billed upfront

FY19 FY18 FY17

FY18 working capital impacted by significant amount of Q1

EBITDA 12.8 10.6 9.6 FY18 billings

Changes in working capital (0.3) (1.7) 2.1

Cash flow from operating activities 12.5 8.9 11.7 Capital expenditure

Stable capitalised development costs and capital expenditure

% conversion (as % of EBITDA) 98% 84% 122%

broadly in line with depreciation and amortisation

Capitalised development costs (3.4) (3.2) (3.3)

Other capital expenditure (0.5) (0.6) (0.0)

Strong Cash Flow Conversion

Net cash flow pre financing and tax 8.6 5.2 8.4 $14m 160%

$12m 140&

% conversion (as % of EBITDA) 67% 54% 87% 120%

$10m

100%

$8m

80%

$6m

60%

11.7m 8.9m 12.5m

$4m 40%

122% 84% 98%

$2m 20%

$m 0%

FY17 FY18 FY19

Cashflow Op Cash Converion %

ReadyTech FY19 results - P 19Group Financial Highlights – Capital Structure

Highlights

PRO FORMA NET DEBT AS AT FY19

$ Millions Facility Committed Pro Forma New debt facility in place post listing > Total facility size

$27.5M – Fully drawn at IPO

Facility A 21.5 21.5 Facility A -$21.5M and 3 year amortising

non-revolving cash advance facility

Facility B 6.0 - Facility B - $6M and 3 year revolving multi-option

working capital facility

Total Debt 27.5 21.5

Cash and cash equivalents 6.3

Available cash for use $12.3M which reflects $6.3m of Cash

FY19 Net debt 15.2

and Cash equivalents and $6M prepaid Facility B

FY19 PF EBITDA 12.8

FY19 Net debt / PF EBITDA 1.2x Pro-forma net debt to EBITDA ratio of 1.2x. Bank

covenants 2.5x from 30 September 2019 to 30

June 2020 and 2x from 30 September 2020 to 30

September 2021

ReadyTech FY19 results - P 20Outlook

OUTLOOK ASX: RDY

ReadyTech maintains the prospectus forecast for CY19

Pro-forma Revenue: $35.1M – 14% yoy growth compared to CY18

Pro-forma EBITDA : $14.6M - 28% yoy growth compared to CY18

Business performing to forecast in the first 8 weeks of FY20

New business pipeline will continue to drive revenue growth for

both employment and education segments

Continue to assess complementary technologies and / or

customer bases.

ReadyTech FY19 results - P XXAPPENDIX

STATUTORY TO PRO-FORMA RESULTS RECONCILIATION

$ MILLIONS $ MILLIONS

FY19 FY18 FY19 FY18

Statutory revenue 32.7 25.6 Statutory NPAT (1.5) (2.3)

Employgroup and HR3 - 2.9 Employgroup and HR3 - 1.1

My Profiling (3 months) 0.3 0.8 My Profiling (3 months) and Earnout trueup (0.1) 0.4

R&D tax offset income - (0.3) R&D tax offset income - (0.3)

Pro forma revenue 33.0 29.0 Offer and related IPO costs including Esher house

5.6 2.8

vendor payment

Statutory EBITDA 7.4 5.3

Legacy ownership and structuring - 1.4

Employgroup and HR3 - 1.3

Incremental public company costs (0.3) (0.7)

My Profiling (3 months) and Earnout trueup (0.1) 0.4

Transaction costs 0.2 -

R&D tax offset income - (0.3)

New debt facility 0.3 (0.2)

Impact of lease accounting - 0.5

Amortisation of capitalised development

- (0.4)

Offer and related IPO costs including Esher house expenses

5.6 2.8

vendor payment

Amortisation of acquired intangibles 4.9 4.2

Legacy ownership and structuring - 1.4

Tax effect (3.4) (1.6)

Incremental public company costs (0.3) (0.7)

Pro forma NPATA 5.7 4.3

Transaction costs 0.2 -

Pro forma EBITDA 12.8 10.6

ReadyTech FY19 results - P 23Board of Directors

Director Experience

Marc Washbourne • See management slide

Tony Faure • Currently the Chairman of ASX-listed oOh!media, data intelligence platform PredictHQ and start-up accelerator Polleniz

Board of Directors

ReadyTech’s Board of Directors bring together deep industry, technological, financial and govern

Independent Non-

•

Executive Chairman

CEOof Australian Independent Business Media, Junkee Media, Torque Data, iSelect, biNu, Last

Previously a board member

• Previously CEO of ninemsn, and HomeScreen

Elizabeth Crouch Entertainment,

• Currently and

theManaging

ChairmanDirector

of Customer at the Owned

launch Banking

of Yahoo!Association

Australia

Independent Non- Advisory Council, and is an Emeritus Deputy Chancellor of Macq

• Tony is also a member of the Audit and Risk Committee, and Remuneration and Nomination Committee

Director Experience Executive Director • Currently on the board of the NSW Government’s Institute of Spo

Tony Faure

• Currently the Chairman of ASX-listed oOh!-

• Currently the Chairman of ASX-listed oOh!media, •dataPreviously

intelligence platform PredictHQ

a Non-Executive and ofstart-up

• CurrentlyDirector

the Chairmanat Chandler,

Customer

accelerator Polleni

Owned Macleod Group

Independent Non-

media, data intelligence platform PredictHQ

• Previously a board member of Australian Independent Business Media,

Banking Association, SGS Economics and Planning,

Junkee Media,

Marc Washbourne

and start-up accelerator Pollenizer • See management slide • Elizabeth is also Chairman

and NSW the Torque

ofGovernment’s

Audit Data,

and RiskiSelect,

Non-Government biNu,and

Committee

Schools Las

• Executive

Previously a boardChairman

Advisory Council, and is an Emeritus Deputy

CEO member of Australian

Independent Business Media, Junkee • Previously CEO of ninemsn, and HomeScreen Entertainment, and Managing Chancellor

Director at the launch of Yahoo! Australia

of Macquarie University having served

the governing council for 17 years

Media, Torque Data, iSelect, biNu, Lasttix,

Elizabeth Crouch • • Currently

Tony is also a memberof

the Chairman ofCustomer

the Audit

Timothy Ebbeck and

OwnedRiskBanking

Committee,

• Overand30

Association,Remuneration

yearsSGS of board, and

Economics Nomination

executive

and Committee

andInfrastructure

Sport,Planning, advisory experience

andandNSW acro

Governmen

and Stackla • Currently on the board of the NSW Government’s

Institute of Health the

• Previously CEO of ninemsn, and HomeS- See management slide

Independent

creen Entertainment, Non-

and Managing Direc- Advisory Council, and is an Emeritus

Independent Non- Deputy Chancellor

• of Macquarie

Currently the University

Managing havingand served the Vice

Western Sydney Local Health District

Director Senior governing council

President of fo

Au

tor at the launch of Yahoo! Australia & NZ • Previously a Non-Executive Director at Chandler

Tony Faure

Executive Director

• Tony is also a member of the Audit and Risk • Currently on the board ofExecutive

Marc Washbourne the NSWDirector

Government’s Institute

• of Sport,

Previously

Elizabeth

CFO Health

Crouch

of Infrastructure

Unisys South

Macquarie

and

Pacific,

University

the Western Sydney Loca

Macleod Group, McGrath Estate Agents, and

Hospital Compaq Computers So

Independent Non- Committee, and Remuneration and Nomi- CEO Independent Non-

Marc Washbourne • • Previously

See management slide

a Non-Executive Director at Chandler, Macleod Chief Commercial

Group, McGrath Officer

Estate of Agents,

NBN Co,and and Managing Director of O

of Macquarie

the Remuneration University Ho

Executive Chairman nation Committee Executive Director • Elizabeth is also Chairman of the Audit and Risk

Committee and a member

CEO and Nomination Committee

• Elizabeth is also Chairman of the Audit and Risk Committee • Tim isand alsoa Chairman

member ofofthe theRemuneration

Remunerationand andNomination

NominationComm Com

Elizabeth Crouch •Currently the Chairman of Customer Owned Banking Association, SGS Economics and Planning, and NSW Governme

Independent Non- Advisory Council, and is an Emeritus Deputy Chancellor of Macquarie University having served the governing council f

Timothy

•Over 30 yearsEbbeck

of board, executive and • Over 30 years of board, •Tom ver 15 Matthews

executive

O and advisory

years of experience in private equity, • Overacross

experience 15 years of experience

a breadth of in private

industries

• Currently Managing equity,

including

Director at Pemba principal investme

technology, media,

Executive

advisory experience Director

across a breadth

• Currently on the board of the

Non-ExecutiveNSW Government’s

Director

principal investment, investment banking and

Institute of Sport, Health Infrastructure and the manger

Western

Capital Partners, a leading investor in

Sydney Loc

Independent

of industries including Non-

technology, media, • Currently the Managing Director

middle marketandadvisory Senior • Partner

Vice President

and valuations at Pemba, aAnywhere

of Automation leading

small andprivate

(ANZ)

mid-sized equity

private businesses in investing in s

Executive Director •(Pemba Representative)

consulting and finance Australia and New Zealand

• • Previously

PreviouslyCFO

a Non-Executive Director at Chandler, Macleod Group, McGrath Estate Agents, and Macquarie University H

P

artner at Pemba, a leading private equity

• Currently the Managing Director and Senior

Vice President of Automation Anywhere

of Unisysmanager

South Pacific,

investing Compaq

in small and

private businesses in Australia and New

•

mid-sized Computers Prior to Pemba,

South Tom

Pacific, worked

TMP at

Worldwide

• Currently UK-based

Chairman of the Board specialist

(Asia atPacific and

Coverforce and a Director of Ausreo,

private equi

Japan), C

(ANZ) • Chief

Elizabeth is also Chairman

Commercial OfficerZealand of theCo,

of NBN Audit andand Risk Committee

Managing and

businesses

Director of aservices

member

Oracle (ANZ), ofInstant

sectorstheAccess,

Remuneration and Nomination Com

InteriorCo and ReadyTech

• Previously CFO of Unisys South Pacific, •P

rior to Pemba, Tom worked at UK-based • Previously a co-founder of SB Capital

Compaq Computers South Pacific, TMP • • TomCommittee

Tim is also Chairman of the Remuneration and Nomination previously worked with theofinvestment

and a member

specialist private equity fund Sovereign Capital banking

the Audit and Risk group at Ma

Committee

Partners, Managing Director at Smedvig

Worldwide (Asia Pacific and Japan), CFO Partners where he focussed on healthcare, Capital and a board member of Device

Timothy Ebbeck

and CEO of SAP (ANZ), at Deloitte

• Over 30 years of board, executive and advisory experience acrossCorporate Finance

a breadth

education andbusinesses services sectors focussing

of industries on business

including valuations,

technology, media

Technologies

Chief Commercial Officer of NBN Co, and

Timothy Ebbeck Tom Matthews •T

om previously worked with the investment Mark Summerhayes • Previously at Bain & Company advising

Independent Non- TomIndependent

Matthews Non-

Managing Director of Oracle (ANZ),

•• Currently

Over 15 the Director

years

Non-Executive Managing

of Director

experience in and Senior

private equity,Vice President

principal of Automation

investment,

banking group at Macquarie Bank focussing on

Non-Executive investment

Director Anywhere

banking(ANZ)

and middle market advisory and

corporates on a mix of strategy, M&A, and

• Tim is also Chairman of the Remuneration principal investment opportunities, and gained operational improvement projects

Executive Chairman

Executive Director (Pemba Representative) (Alternate Director to

Non-Executive

and Nomination Committee

Director

and a member

of the Audit and Risk Committee •• Previously

Partner CFO ofaUnisys

at Pemba,

experience at Deloitte Corporate Finance

leadingSouth Pacific,

private equityCompaq

manger Computers

investing in South Pacific,

small and TMP Worldwide

mid-sized

focussing on business valuations, independent (Asia Pacific

private businesses

Tom Mathhews)

and Japan),

in Australia and

(Pemba Representative) expert’s reports and corporate advice

Chief Commercial Officer of NBN Co, and Managing Director of Oracle (ANZ),

• Prior to Pemba, Tom worked at UK-based specialist private equity fund Sovereign Capital Partners where he focussed

• Tim is also services

businesses Chairman of the Remuneration and Nomination Committee and a member of the Audit and Risk Committee

sectors

• Tom previously worked with the investment banking group at Macquarie Bank focussing on principal investment opportu

Tom Matthews • atOver

Deloitte Corporate

15 years Finance focussing

of experience on business

in private equity, valuations,

principal independent

investment, expert’s

investment

ReadyTech reports

banking

FY19 and and corporate

middle

results -Pmarket advice an

24 advisory

Non-Executive DirectorManagement Team

Senior management

Marc Washbourne Nimesh Shah

CEO CFO

• Marc Washbourne was one of the founders of the JobReady • Nimesh has been the CFO of ReadyTech since August 2017

business and was appointed CEO in 2006

• Nimesh has over 20 years’ experience as an executive in technology and

• As a former software developer, Marc brings to ReadyTech over 20 online digital industries across Australia and many parts of Asia including

years of experience in technology and software solutions within the over 7 years as Finance Director of Fairfax Digital

education and employment industries

• Previous CFO experience for companies including pioneering social

• Marc has been an active member of the CEO Institute since 2011 and networking site, Friendster, Inc., and ASX-listed leading media intelligence

is a member of the advisory board of Year 13 Pty Ltd organisation, iSentia Group Limited

• Marc was educated in the U.K. at the Royal Grammar School of High • Nimesh holds an MBA from the Australian Graduate School of

Wycombe and achieved a first-class degree in History from the Management and a Bachelor of Commerce with Merit from the

University of Leeds University of New South Wales. Nimesh is also a member of The Institute

of Chartered Accountants in Australia

Business leadership

Tony Jones Trevor Fairweather Daniel Wyner Michael Benyon

GM, JobReady GM, VETtrak GM, Employgroup GM, HR3

•J

oined JobReady in an • GM of VETtrak since 2018 • GM of Employgroup since 2018 • GM of HR3, Michael has

operational role in 2006 experience spanning 35 years

• Over 20 years of experience • Over 10 years of experience as in payroll software.

•P

roject Director of AVETARS in senior management an executive in the information,

for ACT State Government and executive roles in the software and service industry • Michael has been

technology sector instrumental in building HR3’s

•P

reviously worked on major • Former Asia Pacific Regional trust, growth and influence in

IT transformation projects at • Previous experience at MYOB, Director at CCH Australia, owned the payroll industry.

Universal Music Group in UK Acendre and EstimateOne by multinational global provider of

professional information software • Most recently, Michael worked

solutions and services Wolters with an advisory group with

Kluwer. Previously Head of the ATO on the roll-out of

Strategy, Mergers & Acquisitions Single Touch Payroll (STP)

initiative.

ReadyTech FY19 results - P 25GLOSSARY

A2E Assess2Educate, a ReadyTech product

ACV Annual contract value

ARPC Average revenue per customer

CAC Customer acquisition cost

CAGR Compounded annual growth rate

CLTV Customer lifetime value

CY Refers to the calendar year ending 31 December

DHS Department of Human Services

FY Refers to the financial year ending 30 June

LMS Learning management system

NPATA Net profit after tax but excluding the non-cash amortisation of acquired intangibles

(including customer-related intangibles and acquired software) from prior acquisitions undertaken by ReadyTech

SMS Student management system

STP Single Touch Payroll

WHS Work, health and safety

ReadyTech FY19 results - P 26You can also read