JAIR BOLSONARO PRESIDENT BRAZIL - Danish-Brazilian Chamber of Commerce - The Danish-Brazilian Chamber of ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Novozymes bioblog.com.br O Bioblog é uma iniciativa da Novozymes, multinacional dinamarquesa líder mundial no segmento de soluções enzimáticas e microrganismos, que visa disseminar conhecimento nas áreas de biologia, biotecnologia e sustentabilidade. Com matérias que descrevem desde conceitos básicos, tais como o que é uma enzima ou o que é sustentabilidade, até conteúdos mais robustos, como o cenário do biocombustível no Brasil, o Bioblog é uma rica fonte de informações para as pessoas que desejam estar atualizadas acerca dos principais temas que tratam do desenvolvimento de tecnologias sustentáveis. Acesse o Bioblog e descubra como o universo da biotecnologia está mais próximo do seu dia-a-dia do que você imagina: www.bioblog.com.br

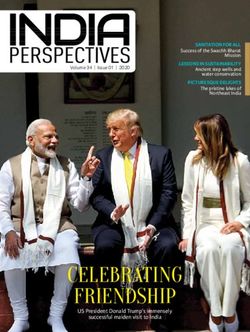

EDITORIAL Brazilian Review

H.R.H. Princess Benedikte

Brazil has a

8 new president

ANNIVERSARY

H.R.H. Princess Benedikte

ECONOMICS

8

Jair Bolsonaro

Ambassador Nicolai Prytz 12

Fernando Honorato, Bradesco 14 Jair Bolsonaro was inaugurated on January 1st as president with

Mario Mesquita, Banco Itaú 16 a cabinet of 22 ministers and his key objective are reforms. The

Luciano Sobral, Santander 18 first priority is the “Previdência” reform and the final reform

Economical News 20 proposal will be presented by the end of January.

Brazilian public has many expectations to the new government

INFORMATION and we are all cautiously optimistic.

New President Jair Bolsonaro 6 The Brazilian economy is slightly improving and the prediction

Brazil New Ministers 10 is a growth of 2,5% with an inflation of 4,0%, a interest rate of

LEGO Bricks Workshop 48 6,5% and the trade balance of 50,0-55,0 billion and unemploy-

Feira Escandinava 2018 50 ment of 11,9%. But, Brazil badly needs the social and political

Chamber Christmas Lunch 56 reforms.

Rio Activities 58 Denmark will have its elections latest June and it is most likely

Chamber Lunch - Banco Santander 60 a change of government will take place but still everything can

Princess Benedikte Institute 64 happen. The polls are still very close in regard to the red-blue

Danes living abroad 66 political groups. It is important to notice ISS will sell their opera-

Maibritt Wolthers Exibition, Santos 68 tion in Brasil and Maersk Line and Damco have merged.

Herlufsholm - An extraordinary school 74 The Dansih-Brazilian Chamber of Commerce will be very active

Transparency International Corruption 2017 78 in 2019 with the following program.

Why brillant people sometimes do dumb things 80

Feb 14th - Ambassador Nikolaj Prytz

PROFILES

Mar 14th - Business Council Meeting - Novo Nordisk

ISS Strategy Update 24

Novo Nordisk 26 Mar 25th - General Assembly

Nordika 28 Apr 2nd - IFU, Helle Bjerre

Vestas 30 May 8/9th - Thomas Bustrup - Danish Industry

Grundfos 32 May 27th - Jesper Rhode Andersen (Start-ups)

Ferring Phamaceuticals 34 Jun 11th - Mercuri Urval

Danfoss 36 Jul 4th

- Chamber Prize 2019 - Gilberto Gil

Maersk Line - Damco 38 Sep 18th - Business Council

Nilfisk 40 Oct 9th - Danish Investment Seminar

Hempel 42 Nov 19th - Octavio de Barros - Economist

LEGO - Ivonne Olivares 44 Nov 29th - Christmas Party

Blue Water Shipping 46

SPORTS We wish all the members and friends a very successful 2019 with

Caroline Wozniacki wins China Open 83 a growing economy and less unemployment and many new op-

Morten Soubak wins African Championship 84 portunities in the Brazilian Market.

32 Jens Olesen

Juan Jose Garcia Chiesa President

Brazil General Manager, GrundfosBrazil New President 2019

Jair Bolsonaro

Brazil’s new president Jair Bolsonaro from eration Car Wash. Lula was from the start of ber 6, 2018, i.e. just under a month till the

the Social Liberal Party (PSL) was elected af- the election campaign the l candidate that first-round election day on October 7, 2018,

ter a second-round head-to-head election on led big in all polls but after his fall to run with a knife in the city of Juiz de Fora, Minas

October 28, 2018 against the candidate from it gave Bolsonaro (PSL)’s election campaign Gerais, during his election campaign rally. It

the Workers` Party (PT), Fernando Haddad. a boost and it gave the Workers` Party (PT) made Bolsonaro unable to continue his elec-

The whole election campaign was marked something to think about. They had to de- tion campaign. There were no political de-

by former Brazilian President Luiz Inácio cide who should be their presidential candi- bates on national Television or any political

Lula da Silva (PT) trying to run for president date so late in the political campaign. They meetings between Bolsonaro and his politi-

again, but he was denied this possibility selected Fernando Haddad, former Minister cal rival Haddad thought the rest of the elec-

in August of 2018 by the Election Court, a of Education in both Lula’s and Dilma’s gov- tion campaign. Bolsonaro communicated a

decision later upheld by the Supreme Court ernment and former Mayor of Sao Paulo. lot though social media with videos and text

due to the 12-year and 1-month sentence for The first round election was overshadowed message from hospital and his home, where

corruption that Lula got for his role in Op- by Bolsonaro getting attacked, on Septem- he was recovering.

Even though neither Bolsonaro nor Haddad

got over 50% of the votes in the first round

it was clear that they would advance to

the second-round election. So the election

would be a battle between economic liber-

alism/ social conservatism (Bolsonaro, PSL)

against democratic socialism (Haddad, PT).

In the second-round election campaign Bol-

sonaro led all political polls over his rival

candidate Haddad that in the last days be-

fore election day got some momentum in his

campaign. Despite Bolsonaro’s health prob-

lems and the fact that he was not able to run

a successful election campaign, the result of

the second-round election was:

6 jul/sep 2014• Jair Bolsonaro from the right-

wing Social Liberal Party (PSL)

55.13%

• Fernando Haddad from the

left-wing Workers` Party (PT)

44.87%

Jair Bolsonaro will take office on January

1, 2019. The New President has not always

been in politics. Bolsonaro has a military

background as he served in the rank of

Captain from 1977-1988. He entered the

political scene in 1988 representing the

Christian Democratic Party (PDC) in the Rio

de Janeiro City Council. Later on, in 1990 he

was elected to the Lower Chamber of Con-

gress where he served for 27 years until 2018

where Bolsonaro leave the Christian Demo-

cratic Party (PDC) and joined the Social Lib-

eral Party (PSL) to become their Presidential

Candidate. A lot has been has been written

and said about Bolsonaro, and he is a per-

son that split the Brazilian people. The next

couple of months and further on will show

if he can gather the Brazilian people, make

the necessary reforms to push Brazil forward

both politically, socially and economically,

but also which way he will take Brazil on

both the domestic and international scene.

MBM

jul/sep 2014 7H.R.H. Princess Benedikte

celebrates her 75 years anniversary

On Monday 29th of April her H.R.H. Princess Benedikte will cel-

ebrate her 75 years anniversary in Copenhagen with many ac-

tivities and a special exhibition at Koldinghus Museum called

“A Princess of Her Time”. H.R.H. Princess Benedikte has been a

great supporter of Brazil and will inaugurate the Princess Bene-

dikte Institute in Curitiba on the 22nd – 23rd of October. H.R.H.

will spend one week in Brazil which include Sao Paulo, Curitiba

and Iguazu Falls. We all look forward to this special visit with

H.R.H. Princess Benedikte who will be accompanied by her “Lady

in Waiting” Mrs. Anne Dorthe Iuel and the Danish ambassador

Nicolai Prytz. The event which will be a special celebration of

HRH with Girls Scouts and a special inauguration of the Princess

Benedikte Institute in Curitiba which is H.R.H. first patronage

outside Denmark. This will be a very exciting time.

JOLBrazil

New Ministers

Hamilton Mourao, Vice President

Jair Bolsonaro, President Onyx Lorenzoni Gustavo Bebianno

Chief of staff Secretary-General of the

Presidency

Paulo Guedes Augusto Heleno Marcos Pontes Dr. Sergio Moro

Economy Institutional Security Science and Technology Justice and Public Security

10 apr/jul 2015Tereza Cristina Fernando Azevedo e Silva Ernesto Araujo Roberto Campos Neto

Agriculture Defence Foreign Affairs President of the Central Bank

Wagner Rosario Luiz Henrique Mandetta Andre Luiz Mendonca Ricardo Velez Rodriguez

Controlling-General Health Attorney General Education

of the Union

Carlos Alberto Tarcisio Gomes de Freitas Gustavo Canuto Osmar Terra

dos Santos Cruz Infrastructure Regional Development Citizenship

Secretary of Government

Marcelo Alvaro Antonio Bento Costa Lima Damares Alves Ricardo de Aquino Salles

Tourism Mines and Energy Women, Family and Environment

Human Rights apr/jul 2015 11Trust - A Danish Resource

To put it very bluntly, I believe that trust is much more than an emotion.

I would even argue that the success of any given society largely depends

on the level of trust between its citizens, including institutions.

I believe that Denmark and Danes are living proof of this hypothesis.

As newly arrived ambassador to Brazil, I feel it is

pertinent – and timely - to highlight this particular

Several global surveys (e.g. World Value

Danish characteristic with the humble hope that it can Survey) point to Denmark as the country

with the highest level of trust between

serve as an inspiration. its citizens. In short, this means that the

general mind-set of the average Dane – by

default - is characterized by an assumption

that people they have never met before

are honest and reliable. It is important to

highlight that this also extends to trust in

Danish institutions, like the government,

the public administration, the police, the

judiciary, the health services, etc.

This is obviously something we feel very

good about, but it is also something that

has a tremendously positive impact on our

society – both socially and economically.

Let me come with a few examples.

Trust is simply a fundamental prerequisite

for the Danish welfare state, which is key

to Denmark being one of the most equali-

tarian countries in the world and with the

highest level of social cohesion. The wel-

fare state is largely financed by income

taxes and Denmark therefore has one of

the highest tax levels in the world. Yet, tax

evasion levels are very low. This is not just

due to control systems, but simply because

Danes feel good about contributing, as

they trust that fellow citizens will do the

same and that the government will put

those contributions to good use in a way

that will benefit the society. Obviously, this

is also closely linked to the fact that Den-

mark has the lowest corruption level in the

world when it comes to public administra-

tion, enabling efficient use of resources.

The high level of trust also has a significant

impact when it comes to business life. For

example, much research regarding the high

level of productivity in Denmark points to

trust as a vital component. The result of a

trusting population is that economic activ-

ity can take place in more cost-efficient

ways as less cumbersome procedures are

needed in order to generate the level of

confidence that efficient business relations

require. Another manifestation of this is a

very business friendly public sector - one of

A Danish self-service roadside

stand with farmer’s produceVirginia

von Bülow

is celebrating

100 years

birthday

Virginia von Bülow is celebrating her 100

The launch of the publication on the past three years of Strategic Sector Cooperation years birthday on January the 9th. Virginia

between Brazil and Denmark at the 4th Innovation Week in Brasília von Bülow was married to Consul General

Adam von Bülow who was a prominent

the main explanations for Denmark’s glob- One example of this is the Danish-Brazilian Dane in the Danish colony for many genera-

al leading position when it comes to the governments’ joint Strategic Sector Coop- tions and also the Chairman of the Danish-

World Bank’s survey on the Ease of Doing eration on Digitalization and Innovation of Brazilian Chamber of Commerce for many

Business Index. the Public Sector. Denmark has the world’s years. We congratulate Virginia on the very

When visiting Denmark, you will notice most digitalized public sector and our ex- special day and wish her all the happiness

other – more curious - manifestations of perience in this area is very useful as digi- and success in the future.

trust throughout various aspects of Danish talization is an effective tool in combating JOL

society. To name a few, if you go for a drive corruption and increasing transparency

outside of major cities chances are you will – aside from increasing productivity and

stumble upon unmanned stands with farm- the service level in the public sector in Bra-

er’s produce and jars with the text “insert zil. This cooperation has been extremely

money”. If, on the other hand, you catch fruitful and last year led to the creation of

the metro in Copenhagen you will see that GNova (www.gnova.enap.gov.br) under

– contrary to most countries – there are no the National School for Public Administra-

turnstiles leading down to the platforms. We tion, which is basically a lab that pushes for

trust citizens to pay their fair share because digitalization and innovation in the Brazil-

the majority of people do pay their fair share. ian public sector.

Altogether, we have good reasons to be The theme of trust is also a key compo-

proud of the high level of trust in Denmark. nent in our joint Nordic efforts in Brazil –

It should therefore come as no surprise in particular within the Nordic Dialogues.

that exactly the aspect of trust has found Throughout 2019, we will continue work-

its way into several of the areas of coopera- ing with our fellow Nordic countries on

tion we have with Brazil. sharing Nordic values with Brazil. While

continuing our work on gender equality

we will share Nordic perspectives on trust

between institutions and individuals. I

find this a particularly important theme

given recent circumstances in Brazil and

I am happy to announce that this year

we have partnered up with Transparency

International in Brazil among others. By

sharing Nordic experiences with trans-

parency, civic engagement and proximity

between citizens and decision makers, we

would like to demonstrate ways to trans-

form political distrust into active citizen-

ship and effective democracy.

Ambassador Nicolai Prytz

Ambassador Nicolai PrytzAn economic agenda for an increasingly volatile world It is still uncertain which economic order of 10.5%, it is around 6.5% of doubt as to the payment of public agenda will prevail in Brazil during in other emerging economies. With debt is removed, which allows artifi- the coming year, but it is possible to lower public spending relative to cially low interest rates a chance of trace some possible consequences for the GDP, the private sector will gain reducing debt through inflation. Less the economic scenario if the broad prominence in the economy. volatile interest rates and lower risk outlines of what has been proposed Meeting the spending ceiling will premium help lengthen investment materialize. It is worth discussing four not be easy and will require reforms, horizons, favor business activity and dimensions of the likely agenda: (1) a including within social security and job creation, and contribute towards public spending ceiling; (2) indepen- pensions. These reforms will have lower currency volatility. dence of the Central Bank; (3) trade to meet the actuarial objectives and As for trade liberalization, the start- liberalization and (4) tax reforms. short-term fiscal challenges, as well ing point should be acknowledging Maintaining the spending ceiling as the maintenance of basic public that Brazil is one of the world’s most will make it possible to reduce public services traditionally rendered by the closed countries when it comes to debt over time and, if well-executed State. But the ceiling is feasible con- trade. Exports and imports are small alongside further reforms, this mea- sidering the reforms and the built-in in terms of the GDP, the importation sure could reduce the austerity of the restraints to expenses already pres- tax rates are higher than those of our public budget. The main expected ef- ent in law. peers, and non-trade barriers also fect over time is a fall in the long-term In regard to independence of the surpass the global average. Studies interest rate. One of the reasons why Central Bank, international experi- show that a gradual trade liberaliza- Brazil has not been able to reduce in- ence shows that this yields positive tion – one which would make Brazil terest rates to date is the size of its effects on inflation, expectations, and merge tariffs to OECD levels and give public debt. With a possible reduc- risk. In general, the chance of undo- the industry ample time to adjust tion, convergence of interest rates to ing inflation expectations is reduced. - could lead to a general fall in the the average rate level seen in other Thus, inflation and interest rate vola- price level of up to 5.0% and growth emerging countries might happen: tility decrease. In addition, the risk acceleration spurred especially by while a 10-year rate in Brazil is in the premium gives way because a source higher productivity.

A country more open to trade also preciation of the exchange rate also tested through the natural challenges

tends to have lower exchange rate contribute towards recovery even if of the proceedings or if the employ-

volatility since shocks adjustments they do not determine it. The Selic ment rate and GDP response is slower

are faster and balancing the exter- rate will be strained on two fronts in than expected.

nal accounts with less intense ex- a scenario like this. On the one hand, Finally, it is worth mentioning that

change rate variations becomes fea- greater growth will lead to increased the international environment is

sible. Lower currency volatility favors inflationary pressure and risks of much less tolerant of issues in emerg-

the business environment as well as price transfers. On the other hand, a ing economies nowadays, and hesita-

investments with long maturities stronger exchange rate will halt infla- tion in implementing reforms has led

whose currency risk component is tion somewhat. to increased volatility in emerging

relevant as it is within infrastructure. In the medium term, it will be pos- countries. This will also hold true in

Finally, a country that is more open to sible to see a fall in the structural 2019. By implementing reforms, Bra-

trade tends to have more stable do- interest rate, with chances of expan- zil would have an interesting oppor-

mestic prices because excess demand sion of credit and investments into tunity to differentiate itself from its

or imbalances quickly spill abroad infrastructure. Interest rates and in- peers and navigate in this more un-

and prices are adjusted accordingly. flation may converge to the average certain global environment in a much

This reduces the risk of inflation and of emerging countries over time. In smoother way, thereby increasing in-

volatility of interest rates and prices, addition, Brazil may return to a me- vestments and business opportunities

and thus helps to enforce the effects dium-term horizon investment grade in all sectors of the economy.

of the dimensions of a spending ceil- through an upgrade within the next

ing and independence of the Central 18 months if the pension reform bill Fernando Honorato

Bank. and Central Bank independence bill Chief Economist - Bradesco

As for a tax reform, its impact will be are approved. Job creation, income

determined by the actual design and increases and the GDP will likely be

details to a much larger extent than boosted, and it may be possible to

the models employed for the other di- see growth rates between 3.0% and

mensions. But in general terms, if the 3.5% in the coming years if there are

reform is revenue neutral - a funda- productivity gains in the economy.

mental requirement for the balance of What are the risks of this scenario?

public accounts - there are still gains Firstly, the basic question is whether

to be derived from simplification. the agenda adopted will really be the

Studies indicate that the country’s one outlined here. We are still wait-

per capita income can increase by as ing for the details and confirmation of

much as USD 2,300 through stream- the broad outlines. Secondly, the ca-

lining payment of taxes to standards pability of political enforcement in

observed in the OECD. Congress will be as important as

There are potential short and me- the economic agenda itself. The

dium term benefits if this agenda faith in the agenda might be

moves forward. In the short term, in-

vestment and consumption are damp-

ened, the economy idle, inflation and

interest rates are low, companies

and households less leveraged, thus,

the economy is in a cyclical position,

which is favorable for faster GDP

growth, job creation, and higher in-

come levels. The improvements to the

financial conditions in recent weeks,

such as the drop in interest rates, the

rise in the stock market, the lowering

of the country risk factor, and the ap- Fernando Honorato

Chief Economist at BradescoA new normal

for the Selic rate

The U.S. central bank, the Fed, is driving also at historically-low levels. Monetary au-

the monetary policy rate to a near-neutral thorities have expressed in documents that

level (i.e., consistent with a real level of they are in the territory of “stimulating mon- Estimates by Itaú economists indicate

interest rate that would keep growth in etary policy, i.e., interest rates below the that, with potential GDP growth of 1.5%-

line with potential, thus not accelerating structural rate.” Nevertheless, we have not 2.0% and the real interest rate at 4.5% to

or decelerating inflation), according to its seen a pickup in domestic demand. stabilize output, the real neutral interest

governors. The nominal short-term rate is Indeed, despite some decompression in rate would range from 2.5% to 3%. Thus,

now 2.25% p.a. In 1990-2007, its average recent weeks, broader financial conditions and assuming 2019 inflation expectations

was 4.36% p.a., and it was below the cur- — as set by longer-term market interest around 4.1% and the current Selic rate at

rent level just 16% of the time. rates and asset prices — have been less 6.5% (implying a real rate between 2.3%

Such simple empirical observation as expansive than the short-term rate sug- and 3.10% p.a., depending on the nomi-

well as sophisticated studies suggest that gests, curtailing the response in terms of nal rate used), its level would range from

the “neutral rate” has declined in the U.S. economic activity. It is reasonable to as- neutral to moderately expansive. If infla-

and other mature economies since the 2008 sume that uncertainties about the reform tion expectations enter a downward path,

crisis. The real neutral interest rate — con- agenda, notably fiscal reforms, also delay monetary policy adjustment may become

sidering the U.S., U.K., Canada and the eu- the recovery in investments and overall necessary to prevent monetary stimuli from

rozone — fell from 2.4% p.a. to 0.7% p.a. economic activity. Even with these caveats, being withdrawn too quickly.

between 2007 and 2016 (data taken from the the combination of modest growth and low But the preceding analysis loses rel-

paper by Holston, Laubach and Williams). inflation fueled a debate about the neutral evance if the country fails in its fiscal ad-

In Brazil’s case, since March the bench- interest rate in Brazil. Are we also facing a justment effort, whose central element is

mark Selic interest rate has been at its lowest new normal for the Selic rate? the pension reform. If it is not approved

nominal level and the short-term real inter- There are reasons to believe that this is in a timely manner, the market’s patience

est rate has ranged from 2.1% to 2.7% (ac- the case. First, if the global interest rate with Brazil’s chronic fiscal imbalance (the

cording to expectations in the Focus survey), environment changed, the Brazilian econ- budget deficit equals 7.1% of GDP) will be

omy is impacted. Domestically, a combi- tested, probably triggering a flight toward

nation of factors may also be in play. The real assets, FX depreciation, and increases

bancarization process since 2004, when in actual and expected inflation. If the fis-

credit expanded from 25.5% to 47.1% of cal adjustment fails, Brazil will not become

GDP, tends to increase the firepower of a new Greece, but the old Brazil, plagued

monetary policy (not only through credit’s with inflation.

higher relative importance but also thanks In a nutshell, while the debate about a

to greater sensitivity of potential borrow- new normal level for the benchmark inter-

ers to changes in credit costs). est rate in Brazil seems valid, given the

The effects of this process on the neutral recent economic performance and certain

Selic rate seem to have been partially neu- structural changes, room for additional

tralized by fiscal and quasi-fiscal expansion monetary policy easing seems minimal,

since 2009. More recently, the introduction unless there is a new round of declines in

of a new regime to price loans granted by inflation expectations. And of course, the

development bank BNDES (which peaked outlook for a new and lower level for the

at 11.3% of GDP), with the creation of the neutral interest rate vanishes completely

Long-Term Rate (TLP), points to substan- if the fiscal adjustment proves to be again

tial reduction in segmentation in the politically unfeasible.

credit market, allowing subsidized

credit to become less important. Mario Mesquita

Chief Economist - Itaú Unibanco

Chief Economist

Mario MesquitaImproving food

and health

… for more than 1 billion people

every day.

At Chr. Hansen we have been pioneering

bioscience since 1874. As a global market

leader we work every day to enable the wider

adoption of natural ingredients within food,

health and agriculture.

Our innovative solutions address some of the

greatest challenges of our generation such as

food waste, sustainable agriculture and the

desire for a more natural and nutritious diet.

www.chr-hansen.comA year in the

sweet spot

After a long period of economic adjust- For that optimistic scenario to unfold, Inflation and monetary

ment, Brazil may be on the verge of a stron- however, we need to assume relative sta-

ger cyclical recovery in economic growth. bility in financial markets, which will de- policy - smooth sailing

As the country has been slowly coming out pend on external conditions and on how in-

of a deep recession, economic slack should vestors assess Brazil’s debt sustainability. The recent dynamics of inflation suggest

help to contain inflationary pressures al- Despite recent efforts to achieve fiscal con- that economic slack continues to be a ma-

lowing the Central Bank to maintain over- solidation, the time bomb of social security jor disinflationary force in Brazil. Yearly core

night rates at historical lows. This should still needs to be dismantled – a task that inflation slowed to 2.8% from 3.2% in 2018,

provide a temporary “sweet spot” for the newly elected government will have to with an even steeper decline in service

corporate profits – even more so consider- prove it can accomplish. prices. Moreover, the behavior of tradable

ing the substantial deleveraging that took prices suggests to us that the exchange rate

place over the past three years. pass-through has been remarkably low, also

Economic activity - probably because of the still weak econo-

finally a cyclical recovery my leading to diminished pricing power of

importers. Under our hypotheses of a rela-

The surge in confidence indicators after tively stable exchange rate and persistently

the results of the October elections, the negative output gap, we see 2019 year-end

widening scope of the economic recovery inflation at 3.7% y/y. With the prospect of

as shown in high frequency indicators, another year of inflation below the target

and the prospect of low interest rates for midpoint, we believe that the Central Bank

some time into the future have led us to will keep its benchmark overnight rate at

anticipate an accelerating rate of GDP 6.5% for all of next year.

growth from 2019. The disappointment of

2018 is, in our view, more related to exter- External accounts and

nal shocks (such as the truckers’ strike in

May) than to underlying economic weak- FX - deteriorating current

nesses. The two pillars for a household account, still strong FDI

consumption-based recovery are, in

our view, still quite solid: a recover- An accelerating economic recovery based

ing job market and growing credit on domestic demand should imply deterio-

concessions. ration in external accounts. We believe im-

We forecast GDP growth at ports will rise strongly for the third straight

3.0% in 2019. We expect private year, up 13% from 2018. With that, the cur-

consumption to contribute about rent account deficit should double 1.6% of

two thirds of headline growth, GDP. On the other hand, we expect another

with the remaining one third strong year for foreign direct investment,

coming from investment. with USD 82 billion inflows in 2019.

We believe that the external environment

and its impact on portfolio inflows will be the

Luciano Sobral main drivers for the BRL. The combination of

Santander Brazil a challenging global environment and rela-tively low interest rate differentials should solve the growing spending problem – it Despite the failed attempt of the current

keep the BRL on a weakening path, with the could even aggravate it, since, especially government to pass reform through Con-

excess FDI and a strong international reserve at the subnational level, one-off revenue is gress, the effort brought the discussion to

position acting to prevent a stronger and often treated as permanent and converted the forefront of any discussion about the

sharper depreciation. We forecast the BRL/ to recurrent spending. country’s economic outlook. Although this

USD rate at 4.00 the end of 2019. The spending cap also makes explicit kind of reform is inherently difficult to ap-

the limitations of this “balance sheet ap- prove, we believe that the newly elected

proach,” as the government risks a shut- government could succeed if it presents a

Fiscal accounts - Brazil’s down if it does not limit spending growth feasible reform and makes that its top pri-

main vulnerability to past inflation. The law will force the new ority early in its term.

government to make hard decisions, either Execution risks are far from negligible,

Brazil’s fiscal accounts will continue to fighting in Congress to remove earmarks but we believe the next government will

be the main point of concern among the from spending to allow for cuts or having to come from a good starting point and will

main macro variables. Despite recent ef- deal with the consequences (such as freezes have significant incentives to complete

forts that stabilized the structural primary on hiring and wage increases for public ser- reforms that would support a strong cycli-

deficit and eliminated future contributors vants) of breaching the spending limits. cal recovery. We believe that removing the

to the deficit (such as subsidized loans risk of fiscal insolvency would be likely to

unleash investment decisions that should

through BNDES), debt/GDP should con- Where economics meets contribute to higher growth under stable

tinue on an upward trajectory, even taking

into account the expected effects of the ap- politics - the reform agenda market conditions, a powerful motivator

proval of pension reform. A 1.5% primary to anyone considering running for reelec-

surplus is required to stabilize the debt/ We subscribe to the view that pension tion in the next electoral cycle. Rationality

GDP ratio, which means that a large fiscal reform is a necessary step for Brazil to will not be the only force in play in this

effort is still necessary. achieve debt sustainability. Without a pen- process, but we believe it will be a strong

In the short term, part of this adjust- sion reform that substantially increases the enough factor to justify our reasonably

ment can continue to be done relying on average retirement age, any fiscal effort bullish outlook.

privatizations and concessions. This strat- would eventually be undermined by a rapid

egy, however, has limitations: it depends demographic transition that would require Luciano Sobral

on Congress’s approval, it taps a limited unrealistic productivity gains to keep the Santander Brazil

supply of assets, and of course, it does not system solvent.

AT FERRING,

WE BELIEVE

IN THE

POWER OF

PEOPLE AND

RESEARCH,

AND WE GO At Ferring, we are committed to helping people become parents and

to keeping mothers and babies healthy, from conception to birth. Over

WHERE IDEAS one third of our research and development investment goes towards

finding innovative treatments in reproductive medicine and women’s

health. We are also passionate about making a difference to people’s

AND SCIENCE health and quality of life through our work in urology, gastroenterology,

endocrinology and orthopaedics.

TAKE US.

PEOPLE COME FIRST ATTax Bureaucracy

Brazil has fallen two positions in the World Bank’s Doing Business ranking, which

measures the impact of regulation and bureaucracy on business operations

Ranking Number of hours per year

Time spent on paying taxes

The leaders of the 1st New Zealand 1st Brazil 1.958

ranking of commercial 2nd Singapore 2nd Bolivia 1.025

opening and five others 3rd Denmark 3th Libya 889

selected countries 46th China 4th Venezuela 792

( in points, from 0 to 100 )

54th Mexico 5th Chad 766

64th Puerto Rico 6th Ecuador 664

1st Singapore 88,5

65th Colombia 7th Gabon 632

2nd Hong Kong 84,5

67th Costa Ricaa 8th Cameroon 624

3rd New Zealand 81,5

4th Australia 80,7

109th Brazil 9th Congo 602

Source: Doing Business 2018/Banco Mundial

5th Chile 76,5

9th USA 71,4

12nd Germany 70,8 World Gross Domestic Product GPD Ranking 2018

93 th

China 57,3

109 th

Argentina 55,0 1st India 7.5% 23rd Spain 2.5%

118 th

Brazil 52,8 2nd China 6.5% 24 th Austria 2.4%

Source: World Economic Forum 3rd Philippines 6.1% 25th Holland 2.4%

4th

Indonesia 5.2% 26 th

Switzerland 2.4%

5th

Poland 5.1% 27 th

Taiwan 2.3%

United Nations

6th

Latvia 4.8% 28 th

Czech Republic 2.3%

Development

7th Hungary 4.8% 28th Peru 2.3%

Programme Rank 8th Slovakia 4.6% 30th Singapore 2.2%

9th

Malaysia 4.4% 31 st

Finland 2.2%

1 Noruega 0,953

10 th

Romania 4.3% 32 nd

Lithuania 2.2%

2 Suiça 0,944

11 st

Cyprus 3.6% 33 rd

Portugal 2.2%

3 Austrália 0,939

12nd Thailand 3.3% 34th South Korea 2.0%

4 Irlanda 0,938 13rd Israel 3.1% 35th Belgium 1.7%

5 Alemanha 0,936 14 th

USA 3.0% 36 th

Sweden 1.6%

11 Denmark 0,929 15 th

Bulgaria 3.0% 37 th

UK 1.5%

79 Brazil 0,759 16th Hong Kong 2.9% 38th France 1.5%

185 Burundi 0,417 17th Croacia 2.8% 39th Brazil 1.3%

186 Niger 0,354 18th Ukraine 2.8% 40th Russia 1.3%

187 Rep. Central Africana 0,367 19 th

Chile 2.8% 41 st

Germany 1.2%

188 Sudão do Sul 0,388 20 th

Mexico 2.6% 42 nd

Norway 1.1%

189 Chade 0,404 21st Tunisia 2.6% 43rd Italy 0.8%

Fonte: Programa das Nações Unidas para 22nd Colombia 2.6% 44th Denmark 0.8%

Desenvolvimento Humano Source: Estadão

20 jul/sep 2009Lei Rouanet

Lei Rouanet as it is known law 8.313/91, that establishes the National Program for Culture Support (Pronac), is today the main

mechanism to enhance culture in Brazil

In 27 years Total impact

In 2018

Quanto cada área injetou na economia R$ 49,8 billion

Released amount of R$ 946 million of

injected in the economy * Billion reais

Million reais R$ 18,5 billion

Cultural heritage (museum sector) 12,1

Direct impact

Scenic Arts 11,8 (referring to the

JAN 27,9

Music 10,4 productive chain)

FEB 29,2

Visual Arts, Audiovisual and Humanities 5,0

MAR 42,7 R$ 31,2 billion

APR 34,8 To each R$ invested, R$ 1,59 goes back to Direct economic impact

MAI 48,1 the society* (referring to the

JUN 60,2 total sponsorships)

JUL 54,3 53.368 THOUSAND

AUG 76,2 CULTURAL PROJECTS

SEP 74,0

OCT 66,1 Legal Security, Bureaucracy and

NOV 84,7 Working Relations Ranking

DEC 347,6

Performance of each country in a 0 to 10 scale

Taxes Burden CANADA 9,1

AUSTRALIA 7,9

OCDE ranking of the charged aliquot by

SOUTH KORES 7,7

country over the companies’ profit

CHILE 7,7

France 34,4 SPAIN 7,0

Brazil* 34,0 POLAND 7,0

Portugal 31,5 THAILANDI 6,8

Mexico 30,0 CHINA 6,5

Germany 29,8 TURKEY 6,4

Japan 29,7 RUSSIA 6,2

Greece 29,0 INDIA 6,1

New Zealand 28,0 MEXICO 6,1

South Korea 27,5 COLOMBIA 6,0

Luxemburg 26,0 INDONESIA 6,0

USA 25,8 PERU 5,9

Holland 25,0 SOUTH AFRICA 5,3

Spain 25,0 ARGENTINA 4,4

Italy 24,0 BRAZIL 4,4

Average of all OCDE countries 23,8

Source: CNI (2018)

*Brazil is still not part of the OCDE, but is

applying to a vacant seat to be part of the

group.

The OCDE countries are those that mostly

charge companies, Brasil, however

will surpass all of them with the taxes

reduction in France.

Source: OCDE jul/sep 2009 21Best average High trend

Percepcion of society profitability in 2018 Women continue to be minority in

about the teachers parliaments, although their presence is

Ibovespa 15,03 growing at a record pace in the USA and

IPCA Treasure 12,31 Brasil

The index is based in a scale of 0 to 100

and takes into consideration, respect, Prefixed Treasure 11,49 USA 23,7%

salary ad attractiveness. RDB 10,31 Mexico 48,4%

Stock Funds 8,27 Argentina 39,5%

France 35,7%

China 100 Robot Funds 8,09

Germany 31,4%

Malaysia 90 Average banks CDB 7,27 United Kingdom 28,9%

Taiwan 70 Multi Stratefy Funds 7,18 Chile 22,7%

Russia 65 LCA and LCI 7,09 Brazil 14,9%

Indonesia 62

Fixed Funds 6,51 Source: Veja São Paulo

Korea 61

Selic Treasure 6,13

Turkey 61

India 58

Major Banks CDB 5,33 Lost Future

New Zealand 57 Countries where most

NOTE: It were considered available

Singapore 50 investments to individuals during 2018 child marriages take place

Canada 49 through online investment platforms, with

liquidity within six months (D < 180). The India 15,5 million

Greece 45

mapped funds were those the open to Bangladesh 4,4 million

UK 44

retail, with minimum investment value of Nigeria 3,5 million

Switzerland 42 up to £ $50000. Brazil 3,0 million

Panama 40 Ethiopia 2,1 million

Source: YUBB

USA 39 Source: Unicef 2017

Finland 38 Report shows

Japan 38

variation of medicine Exports from Brazil

Egypt 33

France 33 consumption across to Arab countries

Germany 32 countries from January to July, in millions US$

Chile 32 Daily doses consumed per 100 Saudi Arabia 1.016,30

Portugal 30 thousand people Arab Emirates 893,9

Holland 30

Egypt 867,0

Peru 27

Mongolia 64,41 Algeria 510,3

Colombia 25 Oman 301,4

Turkey 38,18

Spain 25 Marocco 254,2

Uganda 23 France 25,92

Iraq 207,1

Hungary 22 Brazil 22,75 Bahrain 197,0

Czech Republic 22 England 20,47 Tunisia 173,3

Argentina 21 Denmark 17,84 Lebanon 110,3

Gana 19 Yemen 101,5

Canada 17,05

Italy 16 Jordan 95,5

Japan 14,18

Israel 8 Kuwait 94,6

Germany 11,49 Qatar 92,3

Brazil 2

Peru 10,26 Libya 74,1

Fonte: Varney Foundation Somalia 36,7

Source: Infográfico/ Estadão

Mauritania 34,1

Syria 30,7

Djibouti 16,6

Palestine 9,8

Sudan 5,6

Comoros Islands 1,1

Source: Arab-Brazilian Chamber of Commerce

22 jul/sep 2009Americans lead the raking for job application in Brazil

Authorizations for permanent jobs Main nationalities by

number of people

267 248 268 223

USA 5.098

1st quarter 2nd quarter 3rd quarter 4th quarter

PHILIPPINES 2.127

Authorizations for temporary jobs

UNITED KINGDOM 1.827

CHINA 1.606

6.432 8.476 INDIA 1.459

5.566 5.463

FRANCE 1.424

1st quarter 2nd quarter 3rd quarter 4th quarter ITALY 1.220

Source: OBMIGRA - TEM

Companies and Diseases

foreigners who own or Interest rate

Disease % population

rent lands in Brazil Percentage per year Arterial hypertension 52,2

Spinal problems 40,8

Origin of the foreigners in the Argentina 14,52 High cholesterol 30,5

federation units Turkey 5,36 Cataract 24,9

Portugal 27 Mexico 4,55 Arthritis or rheumatism 21,0

Depression 18,6

Japan 18 Russia 4,27

Parkinson 16,5

Spain 16 Indonesia 3,95 Diabet 15,8

Germany 14 Brazil 2,83 Osteoporosis 15,8

Italy 13 India 2,58 Heart problem 11,7

USA 11 Glaucoma 8,4

South Africa 1,62

China 9 Emphysema, chronic bronchitis 6,0

Malasia 1,48 Stroke 5,3

Argentina 8

Philippines 1,01 Cancer 5,3

Holland 8 Asthma 4,9

Source: INFOGRÁFICO/ESTADÃO

Lebanon 7 Renal insufficiency 4,5

Chile 5 Diabetic retinopathy 1,9

France 5 Macular degeneration 1,5

England 4

Countries with better Alzheimer 0,8

Paraguay 3 conditions for reading Source: ELSI/ Brazil

Switzerland 3 practice

Uruguay 3

Killing Animals

Bolivia 2 Scandinavian countries appear ahaed.

Austria 1 Annual death trigged by species

Canada 1 1st Finland

Shark 10

Peru 1 2nd Norway

Wolf 10

Poland 1 3rd Iceland

Lion 100

4th Denmark Crocodilo 1.000

Developed activities 5th Sweden Roundworm 2.500

Livestock 25 6th Switzerland Schistosoma 10.000

Agriculture 14 7th USA Tse tse fly 10.000

Reforestation 11 8th Germany Canine rabies 25.000

Mining 6 9th Latvia Snake 50.000

Industry 2 10th Holland Human (violent deaths) 475.000

Dam 2 43th Brazil Mosquitos 725.000

Source: Infográfico/ Estadão Source: Universidade Estadual Center Connecticut Source: Estadão

jul/sep 2009 23ISS - Strategy Update

ISS to increase organic growth to 4-6% per annum

by accelerating its Key Account transformation

ISS (ISS.CO, ISS DC, ISSDY), a leading • Operations in 13 countries • These divestments will

global provider of facility services, today will be divested – Thailand, significantly simplify the

announced its ambition to increase or- Philippines, Malaysia, Brunei, business, reducing complexity

ganic growth to 4-6% per annum by ac- Brazil, Chile, Israel, Estonia, and risk. Upon completion,

celerating its transition towards Key Ac- the number of customers is

Czech Republic, Hungary,

count customers. ISS has proven its ability

Slovakia, Slovenia and expected to reduce by 50%

to win and grow Key Account customers

Romania. The exit from non- (from 125,300 to around

and now plans to strengthen its position

further in a market place that offers com- core services will be concluded 62,700) and the number of

pelling, long-term growth potential. A by divesting a number of employees is expected to

two-year programme of expedited invest- business units across the group reduce by 20% (from 490,000

ment, encompassing services (e.g. work- – entirely consistent with ISS’s to around 390,000).

place, technical, catering) and platform strategy of recent years.

(e.g. technology, data and innovation), • The two-year programme of

will materially enhance ISS’s delivery ca- • In 2017, these planned country expedited investment will

pabilities. Investment will include proj- and business unit divestments strengthen ISS’s delivery

ect-related operating expenditure, capital generated a revenue of DKK capability to Key Accounts

expenditure and selected M&A. It will 9,685 million (12% of Group) (including global and regional)

strengthen ISS’s ability to protect and care and is expected to yield

and Operating Profit before

for customers’ property, people and envi-

other items of DKK 373 million attractive financial returns.

ronment. Capital will be reallocated from

(8% of Group). The process

areas that are not core to the Key Account

strategy to help fund this transformation. of divesting countries and • Within 2019 and 2020, ISS

business units is expected to remains committed to paying

As a consequence of this:

conclude during 2020. an ordinary dividend at least

equal to the DKK 7.70 per

share paid in 2018.

• ISS intends to return at

least 25% of net divestment

proceeds to shareholders by

way of a share buy-back or

extraordinary dividend

Jeff Gravenhorst

Group CEO, ISS A/SThese actions are designed to improve ISS’s

financial performance via stronger growth.

As such, ISS has set the following medium

term financial targets:

• Organic growth: 4-6% per

annum (2019 onwards)

“ These bold decisions

reflect our strong conviction

in the growth opportunity

afforded by Key Account

customers. When the time

• Operating margins: Robust comes, it will be tough

and in-line with the historical to part ways with many

range

outstanding colleagues and

• Free cash flow: Around DKK

high quality businesses.

ISS’s strategy 3 billion in constant currency

(by 2021) However, we must focus

The ISS Way – has already created a more

focused organisation, with stricter decision- our capital and resource on

making around the customers it wishes to About ISS those customers, services

serve and the services it provides. Consid-

erable progress has been made, in driving The ISS Group was founded in Copenhagen and geographies that can

growth of Integrated Facility Services (IFS) in 1901 and has grown to become one of

for Key Account customers, especially Glob- the world’s leading Facility Services com- truly benefit from our future

al Key Accounts. 2018 has been a successful panies. ISS offers a wide range of services

year and since the 9-month interim report such as: Cleaning, Catering, Security, prop-

investment in processes,

in November, ISS has won or extended rela- erty and Support Services as well as Facility technology and innovation.

tionships with four major customers with a Management. Global revenue amounted

combined revenue of around DKK 2 billion, to DKK 80 billion in 2017 and ISS has more This acceleration of our

of which new revenue amounts to approxi- than 482,000 employees and activities

mately 1% of the Group total. in more than 70 countries across Europe,

strategy will improve our

ISS will now strengthen and fully leverage Asia, North America, Latin America and offering for Key Account

its operating platform to drive stronger

organic growth in the medium term. The

geographic footprint will be narrowed to

focus on those markets offering a meaning-

ful and attractive opportunity to grow Key

Account customers. The business will be

Pacific, serving thousands of both public

and private sector customers. For more

information on the ISS Group, visit www.

issworld.com.

ISS

customers and deliver a “

stronger and more consistent

financial performance for our

simplified, risk reduced and capital reallo- shareholders.

cated to support core services. Restructur- www.br.issworld.com/

ing costs are expected to fall in 2019 and

again in 2020. Jeff Gravenhorst, Group CEO, ISS A/SNovo Nordisk plant in Montes Claros

A new outcome for

diabetes in Brazil

Brazil has given another step forward to

improve diabetes care. For the first time in

significance because previously the only

insulins distributed by SUS nationally were

Its heritage has given the company experi-

ence and capabilities to help people over-

the country, people with type one diabe- human insulin with syringe application, in come obesity, hemophilia, growth disor-

tes will have access, through the country’s which the patient himself is responsible ders and other serious chronic diseases.

public healthcare system (SUS), to rapid- for removing the dose corresponding to The production site in Montes Claros (MG)

acting mealtime insulin prefilled pens. The his treatment. In addition to potentially Approximately 28 million people use Novo

insulins were produced by Novo Nordisk, a improve the administration of a correct Nordisk’s diabetes products around the

global healthcare company with 95 years of dosage, bring more comfort, facilitate the world. In Brazil, the company has an insu-

innovation and leadership in the treatment handling, storage and transportation of the lin factory that was inaugurated in 2007,

of diabetes, in Brazil’s only insulin factory, medicine; the prefilled pens, may contrib- located in Montes Claros, Minas Gerais.

in Montes Claros, in Minas Gerais State. ute to a better treatment adherence. With 64,000 m2, the equivalent of seven

The insulins are available in all states in the Diabetes is a global challenge. Today, more football fields, the site is Latin America’s

country, including the Federal District. than 400 million people live with the dis- largest insulin manufacturing facility, em-

The Brazilian population will be experienc- ease in the world and, according to projec- ploys around 1,000 employees and is the

ing a lot of first times because, besides the tions, until 2045, that number should reach largest Novo Nordisk manufacturing facil-

unprecedent fact of receiving insulin pens 730 million. That means that, in less than ity outside Denmark, where the company is

through SUS; it is also the first time that three decades, 1 in every 9 people in the headquartered.

SUS will make available modern insulins world will have diabetes. Considered one of the most modern facto-

produced in Brazil. In January 2018, the Brazil occupies the 4th place in the world in ries in the world, the relevance of Montes

Brazilian Health Regulatory Agency (AN- number of adults with diabetes, account- Claros site is impressive. It exports medi-

VISA) granted Novo Nordisk insulin factory ing 12 million of people, according to the cines to more than 50 countries, which

permission to supply the rapid-acting insu- International Diabetes Federation (IDF). In represents more than a quarter of all the

lin – insulin aspart - to the Brazilian market children, it occupies the 3rd place among drug exportation in Brazil, and its insulin

(the production facility already exported to the countries with more cases of the dis- production represents 15% of all the insulin

more than 50 countries). After, the compa- ease, for a total of more than 88,000. consumed in the world.

ny won the Ministry of Health rapid-acting These are alarming numbers. In addition, 60% of the components used

insulins bid, and generated R$ 50 million That’s why the commitment with the dis- in the manufacturing and packaging of

(US$ 12,8 million approximately) in savings ease must go beyond providing medicines. this insulin pen were made in Brazil, which

in public healthcare costs. In addition to supplying the pens, the com- means that people with diabetes will be us-

For the company, this historical mark re- pany also continues investing in the educa- ing a product that is, in its majority, Brazil-

inforces its commitment of more than 25 tion of health professionals to enhance the ian. Made in Brasil to Brazil. For more info,

years with Brazil and, especially, with peo- diagnosis and treatment of diabetes. visit www.novonordisk.com.br/moc.

ple with diabetes. The pens should serve Novo Nordisk is present in 79 countries,

around 400,000 patients, according to the employs 43,200 people, and is focused Novo Nordisk

Ministry of Health. on promoting changes and innovations to

For the patients, this has an even greater modify the diabetes scenario in the world.

www.novonordisk.com.brNordika Tanks shipped from China

Nordika – A company in

transformation and development!

Nordika is a company, with a long history after was named NNE Pharmaplan A/S. The aim of Nordika is to continue to be the

going back to its roots in Denmark. It all After a change of global strategy in 2014, reference in the business. We believe that

began in the 1930 when Novo Nordisk em- Nordika do Brazil is born as a direct Spin being the best is hard work but there is no

ployed the first engineers. It later became Off, focused on the Latin America market. sense in not striving to be the best. The aim

“Novo Nordisk Engineering / NNE A/S”. In The possibility to continue as a fully Dan- is to not overdo and not to underdo, but to

year 2007 as a part of a Global Strategy – ish owned company separated from Novo deliver to the client a high level of quality

NNE acquired the German pharmaceutical Nordisk and with a strong partner agree- in the engineering design the makes it pos-

engineering company Pharmaplan from ment with NNE Pharmaplan consolidated sible for him to execute his project with a

Fresenius Group and the company there- the strong presence in the Brazil and LA- minimum of risk, on time and budget. To

TAM market and Nordika do Brasil has con- ensure that Nordika beside the project ex-

stantly been growing since. ecution model, work in the latest software

technologies as REVIT, BIM and other 3D

object tools. This ensure a significantly in-

creased accuracy on calculating the project

cost. And furthermore, reduce the risk of

change orders and delays from the suppli-

ers during the construction.

Today Nordika has around 100 employees

all specialized in pharmaceutical engineer-

ing. To be cost efficient and to add the best

value to our clients, Nordika’s strategy is

to have the all the experts and specialists

inhouse and partner up with trusted third

part suppliers for the more regular part of

the engineering e.g. structure, offices and

civil installations. The numbers of people

working for Nordika in third part suppliers’

variates a lot depending on the workload

in Nordika, but it can often be a 100 to 300

persons.

Nordika BionetNordika’s engineering solutions are based

Nordika Bionet services in bioprocessing on many years of international experience

combined with exclusive and dedicated

The list of references in the LATAM market In 2016 and 2018 (Nordika did not attend in service for pharma, biotech and medical

is long, with projects executed in Argen- 2017), Nordika won the Sindusfarma Award devices engineering and design services

tina, Chile and Mexico. Most of the clients for – “Best supplier of installations and with the flexibility that the Latin America

are larger international pharmaceuti- project execution”. And ISPE Brazil Chap- marked needs.

cal companies, where communication in ter (International Society for Pharmaceuti- Nordika’s employee had always focus on

English is needed. Therefore, most of the cal Engineering) – has awarded Nordika to the – The highest standards for good busi-

work is done in English and a large part be “Company of the year” every year from ness ethics, eminent service and always

of the communication with the clients 2014 until 2018. want to perform their best. For without the

as well. The last few years clients within The Strong spine of Nordika – is a combi- excellent staff there are at Nordika – Nordi-

other segments somehow related to Phar- nation of a strong QMS (Quality Manage- ka would not exist. The company have and

maceutical engineering have contacted ment System), and a strong project execu- are always going after the best employees

Nordika. It has opened a new potential tion model, both developed based on many within our field.

business area as Nordika has been able to years of experience with pharmaceutical So, with the Danish roots, long history,

compete in these areas of Engineering for projects internationally. The project model eminent employees, mission and val-

semiconductor industry and food & Bever- is based on the PMI model (PMBOK). Nor- ues in mind – Nordika is going to have

age. Amongst these projects Nordika has dika’s QMS system was in 2015 certified by a bright future in Brazil and the rest of

executed a project for Coca-Cola, design- Lloyd as the first in the world to comply with Latin America.

ing a new standard for their future con- the new ISO 9001:2015 standard. Nordika Nordika

centration plants. The company also de- has never received a “major” remark in a

signed and managing the constructions of Lloyd audit and has just been recertified.

the world biggest beverage tanks. Due to To ensure compliance with all ethic, good www.nordika.dk

its close relationship with technology pro- financial and accounting principals in a

viders, the company had also the opportu- market characterized by corruptions scan-

nity to work with emerging technologies dals, Nordika every year are fully financial

like high-energy batteries for planes, bus- audited by an international accounting firm

ses and cars. e.g. PWC, E&Y.

The business of Nordika is divided into four Business Units

• Engineering, Qualification services

Feasibility studies, Conceptual Design Specialized in compliance issues,

Studies, Basic and Detail Design. ANVISA, EMA, FDA, ICH, PIC/S etc.

Project procurement, Construction

Management. • Advanced Technologies

Automation Representing high end technologies

Full service provider for most major companies, enabling local applications

industrial automation platforms. and services support for pharma

Focused on optimizing productivity by production equipments.

automation.

Ole Broch Nielsen, General ManagerVestas strengthens its presence in the Brazilian wind energy market The year of 2018 was very positive for the 800 indirect jobs, causing a major socioeco- 100 GW milestone achieved great envi- wind energy market in Brazil and expecta- nomic impact in the region. Turbine delivery ronmental value as it contributed to the tions could not be more optimistic. Accord- is scheduled for the first quarter of 2020 and removal of more than 100 million tonnes ing to the 10-year energy expansion plan commissioning is planned for the end of the of CO2 from the atmosphere, providing published by the Brazilian government in second quarter of the same year. sustainable and cost-effective solutions to 2017, the country could reach 28.5 GW of In order to consolidate the 4 MW platform meet world energy demand. wind capacity by 2026, growing between as the most competitive in the Brazilian “Brazil is a strategic country for Vestas. 1.1 and 2.0 MW per year. Walking alongside market, Vestas announced in December a Our latest investments in the country, this industry optimism in the country is the partnership with Casa dos Ventos, one of such as the partnership with Echoenergia wind turbine manufacturer Vestas, which the main wind energy companies in Brazil, and Casa dos Ventos and the expansion of made several important investments in the which requested the production of 151 MW the Aquiraz plant, reinforce our long-term second half of 2018, reinforcing its long- through an order of 36 V150-4.2 MW wind commitment to the local market and im- term commitment to the Brazilian market. turbines for its Folha Larga wind farm in pact not only on the wind energy segment, In September it was announced that V150- Bahia. With the expansion of the compa- but also on the socioeconomic context. In 4.2 GW, the company’s largest onshore tur- ny’s manufacturing capacity in the country addition, these initiatives have contributed bine, will begin to be produced locally on by nationalizing V150-4.2 GW turbine pro- considerably to the recently achieved glob- Brazilian soil, for the first time breaking the duction, Vestas will enable its customers al reach of 100 GW. We are very optimistic 4 MW barrier in the country. The mark was to access the latest technology developed about the future of the wind energy sector reached with the request of 101 MW to sup- with excellent financing conditions. in the country and I believe that Vestas will ply and install 24 turbines for a wind farm lo- Presumably, the year 2019 will also be very continue to play a key role in the develop- cated in Serra do Mel, Rio Grande do Norte, productive for the Danish company glob- ment of this market in 2019, as well as con- conducted by Echoenergia, a Brazilian com- ally. In late 2018, Vestas became the first tinue to support the Brazilian initiative to pany controlled by Actis. The production will company to achieve the expressive 100 GW promote a cleaner and sustainable energy take place at the Vestas plant in Aquiraz, in milestone in the world, which means that matrix” says Rogério S. Zampronha, presi- the state of Ceará, which received an invest- it alone accounted for approximately 10% dent of Vestas in Brazil and LATAM South. ment of 23 million euros for its expansion, of wind and solar installed capacity around generating more than 200 direct jobs and the world, totaling 1 TW. In addition, the Vestas

You can also read