North American airport modernizations place focus on optimizing concessions - Travel Markets Insider

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Special Issue

TFWA

World Exhibition

October 2022

North American airport modernizations place focus

INSIDE INSIDER

on optimizing concessions

Harper Dennis Hobbes Executive

Director Simon Black and Senior

Managing Director Nadine Heubel

target North America

Rouge Duty Free opens the first Creed

boutique in the Caribbean

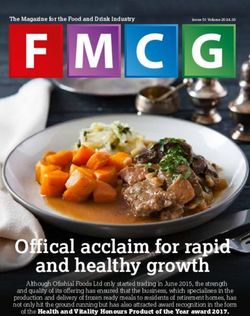

The famed Jeppesen Terminal at Denver International Airport, site of one of the most ambitious development plans in the

United States. TMI speaks with Concessions Planning International, which is advising DEN as it creates and implements a

concessions program that is a benchmark in North American airports. See story on page 26.

With U.S. airports like New TMI also speaks with Susan recovery in Latin America.

York’s LaGuardia and Newark Gray, of Concessions Planning Another sign of renewed

Liberty Airport undergoing International, about its work with business confidence in the travel

massive modernizations, and Denver International Airport. retail channel is the swell of new

Fantasy Fragrances, LLC rolls out the

air traffic predictions growing CPI is helping DEN create a fragrance launches, complete

new Frida Kahlo-inspired fragrance

stronger, this issue of Travel concessions program designed to with exciting HPPs at the in the Americas

Markets Insider looks at how be a “benchmark for decades to Point of Sale. We are delighted

airport concessions can better come.” to cover several of the new

serve the traveling public – and Although travel retail still products here.

provide more income to the faces many challenges, Duty As part of our broad-based

airport. Free Americas, for one, appears spirits coverage, TMI also takes

TMI speaks with Simon to have come through the worst an in-depth look at the future of

Black, Executive Director of of the crisis in relatively strong gin consumption in the Americas

Europe’s leading travel retail and condition. DFA CEO Jerome Falic travel retail channel, prepared

airport concessions consultancy, credits the company’s spread of specially for us by spirits expert

Harper Dennis Hobbs, about geographic locations and variety Joe Bates.

his plans for expansion into the of operating models for the We hope you all enjoy all Joe Bates reports on the gin

North America market. HDH’s success. this and more, Inside Insider, business in the Americas travel

recent hire of former Heinemann TMI also focuses on more and look forward to seeing you retail market.

Americas CEO Nadine Heubel new store openings in the in Cannes at the TFWA World

shows how serious they are about Caribbean, including the debut Exhibition & Conference.

Plus Products-People-Places

ramping up their operations in the of the first Creed boutique in the Lois Pasternak

The Insider View

region. islands, and analyzes the fledging Editor/Publisher

1 October 2022TABLE OF CONTENTS

Retail and News Features

NUMBERS & ASSOCIATION NEWS Latin America

m1nd-set: how to appeal to younger Slow economic recovery to gather

shoppers when they travel Page 8 pace in fourth quarter Page 38

WTTC: Domestic travel keeps U.S. #1 Brazil to privatize both Rio airports Page 39

as world’s biggest travel market Page 12 Ezeiza’s Mega-sweepstakes returns Page 39

TFWA Conference and workshops Eco updates: Brazil & Uruguay Page 39

focus on post-pandemic era Page 14 Aena wins management of 11 airports

IAADFS: 2023 Summit promises more in Brazil Page 40

flexibility and broader audience Page 18

BEAUTY

North America Essence Corp animates at POS as

Hawaii shows recovery with return of fragrance sales rebound Page 42

90+% of tourists Page 16 Lolita Lempicka returns to the Americas Page 46

IBBI brings ICONIC to TRA Page 46

Dufry’s new “Destination 2027” strategy Page 20 Frida Khahlo perfume debuts Page 48

DFA: Diversified geographic and Reba Americas launches fragrances for

business models bolster recovery Page 22 super stars Maluma and Billie Eilish Page 50

Hudson expands U.S. footprint Page 25 Tairo honors BAs with an early Christmas Page 50

Canada border businesses down 45% Page 33 Lendava expands line, wins honors Page 50

ACCESSORIES

SPECIAL COVER FEATURES

Montblanc unveils “On the Move” vision Page 52

One on One with CPI’s Susan Gray: How

Denver International Airport is creating SPIRITS

a benchmark concessions program Page 26 Special Report:

Gin takes aim at the Americas Page 54

Harper Dennis Hobbs: Powerhouse retail

consultant brings its vision and expertise Tito’s “storms back” as it turns 25 Page 60

to North America Travel Retail Page 30 Talisker launches travel retail exclusive Page 62

FlyWithWine debuts innovation in Cannes Page 62

CARIBBEAN & CRUISE Also: Champagne Lanson, Glenfiddich, Page 63

Rouge to open first Creed Boutique Brown-Forman, Mijenta Tequila,

in the Caribbean + 2 stores in Tulum Page 34 Pernod Ricard, Chivas, Distell, Bacardi

Cardow family expands into liquor

business in St. Thomas Page 36 Grey Goose and International Shoppes

Cruise industry begins strong rebound Page 37 celebrate the US Open at JFK Page 70

October 2022 6INSIDER

How to appeal to younger shoppers when they travel:

m1nd-set analyzes Millennials vs Gen Zs

In one of its most recent studies, travel

research agency m1nd-set took a deep look

at how travel retailers should best market

to younger consumers when they travel.

The two-month age-demographic specific

research found significant differences and

unique trends between Millennials and the

younger Gen Zs.

In its August newsletter, m1nd-set

explained that the research looked at the

importance of both of these age segments,

comparing their behavior to that of all

passengers, and analyzed how they buy,

what they buy, why they buy and how

much they spend among a range of other

behavioral traits.

Millennials –who were born between

the early 80s and mid 90s and are currently

aged between 26 and 41, have much more

spending power than the Gen Zs segment, following the interaction, while only 67% Peter Mohn, Owner & Chief

who are currently aged between 10 and of Gen Z shoppers said they purchased a Executive Officer at m1nd-set, explained:

25. But Gen Zs represent around one third product thanks to the interaction. “It is extremely important for travel retail

of the global population and their share of marketers marketing to Millennials and

consumer spend will grow significantly. Reaching out: Touch Points Gen Z traveling consumers to understand

In its newsletter, m1nd-set notes that Another significant difference in where to reach their target audiences when

while Millennials were the first generation shopper behavior is how Gen Zs and they are not traveling. For both these age

to grow up in the age of the internet, Gen Millennials react to communications touch segments, it’s clearly online where they

Zs are the first generation to grow up in the points. More than half of Millennials can be found but among Gen Zs it’s most

age of mobile internet and social media, (55%) notice touch points prior to their commonly on the mobile and via certain

and this impacts how and when to reach purchase in GTR when traveling. This is social media services.”

them when they travel, says m1nd-set. above the 47% reported for all passengers. Mohn says that “Platforms such as

Significantly, only 15% of the Gen Zs say TikTok have to be integral to the marketing

Engagement they noticed touch points prior to purchase. mix for marketers who are intent on

There are significant differences in This indicates the generational behavior reaching Gen Z shoppers while Millennials

how the two groups react when shopping. differences in general regarding how and are more prone to be across multiple

One major difference, m1nd-set reports, is where the various age groups source and platforms such as Facebook, Instagram and

their respective tendency to engage with digest their information. Twitter.”

important shopping influencers, such as

communications touch points and sales

staff. Gen Zs tend to approach the sales

associates in Duty Free shops considerably Editor/Publisher: Lois R. Pasternak

less than Millennials. Only 38% of the In Memoriam: Paul A. Pasternak

younger age segment say they engage Executive Editor: Michael Pasternak

with sales associates, 30% lower than Editorial Contributors: John Gallagher, Joe Bates

Millennials, 68% of whom interact with Production Coordinator & Designer: Chris Hetzer

Design and Production: It’s About Time, Inc.

store staff. Millennials also tend to engage Webmaster: Michael Pasternak

with sales associates more than average, Printing by The Printer’s Printer. Ft. Lauderdale, Florida

since 65% of travelers from all age groups This publication is a special supplement of Travel Markets Insider, published

by Pasternak Communications, Inc., 255 NE 3rd Ave No. 312, Delray Beach,

interact with sales staff. FL. 33444 USA. www.travelmarketsinsider.net

The impact of the interaction is also E-mail: editor@travelmarketsinsider.net

lower among Gen Z shoppers, reports Tel (561) 908-2119

Travel Markets Insider is a weekly newsletter distributed 50 times a year

m1nd-set. More than eight out of ten via e-mail, on a subscription basis only.

shoppers among Millennials and all age The annual subscription is US$200. Printed in the USA. All rights reserved.

groups combined report a positive outcome © 2022 by Pasternak Communications, Inc.

October 2022 8INSIDER

Mohn added: “Although a sizeable

proportion of the Gen Z consumer

generation is still below 18 and whose

purchasing power barely surpasses their

parents’ allowance, the potential among this

generation – both as future customers and

disruptors – is not to be underestimated.”

Socially conscious

“Both Millennials and Gen Zs have

a strong tendency to favor sustainable

practices when shopping in Travel Retail,”

Mohn continued. “While they are keen on

championing brands with a strong social

and environmental impact and story, they

are equally intent on shouting out on social

media about less virtuous brands and will

be quick to name shame companies and

brands which do not demonstrate ethical

and environmentally friendly practices.

This is particularly true among Gen Zs,”

Mohn concluded.

Planned vs impulse

m1nd-set also reveals that Millennials

are more apt to plan their purchase in

Travel Retail (79% vs 64% for Gen Zs),

but more Gen Zs purchase on impulse

Spending trends One of the major differences is the (36% of Gen Zs compared to 21% among

Average spend is another area where overall spend among both age groups. Millennials and 18% among all age

m1nd-set reports considerable differences Whether in domestic or Travel Retail, groups).

between Millennials and Gen Z consumers Millennials represent a higher proportion Gen Zs are also keener to enter

in Travel Retail. Spend among both age of the overall consumer spend. Both the physical store, says m1nd-set (49%

segments is significantly lower than the generations combined currently represent compared to 38% among Millennials and

average among all age groups which is just over 30% of total retail spend, but this 44% of all passengers). Once in the stores

US$101. share is set to increase to 48% by the end however, Millennials tend to purchase

For Millennials, average spend is $70, of the decade. more; 23% of Millennials purchased

with the highest spend allocated to the In Travel Retail, the spend is currently compared to 17% of Gen Z shoppers and

Electronics category at $124, followed by 6% among Gen Z consumers and 25% 22% of total passengers, generating a

Jewellery & Watches at $118 and Fashion among Millennials. According to m1nd- conversion rate of 61% for Millennials,

& Accessories at $98. set the Millennials’ share of spend in 35% among Gen Zs and 50% for all

Average spend in Travel Retail among Travel Retail will increase by only a few passengers.

Gen Z shoppers is considerably lower at percentage points by the end of the decade More information on m1nd-set’s

$44, with the highest spend being allocated while the growth in spend by 2030 among research and consultancy services can

to Perfumes at $111, Electronics, $103 and Gen Zs consumers is expected to be more be obtained from m1nd-set by writing to

Alcohol, $61. than threefold. info@m1nd-set.com.

October 2022 1011 October 2022

INSIDER

WTTC: Domestic travel helped U.S. retain its position as the

world’s biggest Travel & Tourism market

The latest World Travel & Tourism 11th position in 2021. grow more than 41% this year. For the next

Council’s Economic Trends Report, Across Asia-Pacific, major Travel 10 years, it predicts business travel could

released Sept. 6 and conducted by Oxford & Tourism markets saw huge losses grow an average of 5.5% annually and may

Economics, ranks the U.S. as the world’s in international spending. In addition return faster in the Asia-Pacific region.

biggest and most powerful Travel & to China, countries like Thailand and WTTC predicts by 2032, China will

Tourism market by GDP contribution. Japan, which ranked fifth and eighth in overtake the U.S. to become the world’s

But WTTC notes that the rankings international visitor spending before the biggest Travel & Tourism market.

in the U.S., like other top economies, pandemic, fell out of the top 20 altogether The research shows China’s Travel &

are bolstered through high numbers of in 2021. Tourism contribution to GDP could reach

domestic travel, as international visitor $3.9 trillion by 2032, making it the world’s

numbers plummeted. Business Travel and China growth most powerful Travel & Tourism market,

Despite its number one position, the outlook is positive and India could leapfrog Germany to reach

U.S. Travel & Tourism’s contribution to According to WTTC’s forecasts, third place with a projected value of $457

the U.S. economy fell by $700 billion from worldwide business travel is expected to billion.

2019, to just under $1.3 trillion last year.

WTTC ranks China second and

Germany third for sector GDP con-

tributions, representing no change in

ranking since 2019. However, total sector

economic contribution in both countries

declined versus 2019.

China contributed more than $814

billion to the Chinese GDP last year

(vs. $1.86 trillion in 2019); Germany’s

contributions to its economy were $251

billion compared with over $391 billion in

2019.

The UK slipped dramatically from

fifth place in 2019 to ninth in 2021, with a

contribution of just over $157 billion, the

biggest fall among the top 10 countries.

Julia Simpson, WTTC President

& CEO, said that the report shows the

resilience of the Travel & Tourism sector.

“Despite a challenging macro

environment, Travel & Tourism has

bounced back. The world, with some

exceptions, is traveling again. And we are Thw chart above compares the contribution of Travel & Tourism to GDP against the 2019 level.

seeing a resurgence in business travel. Over For instance, the sector’s contribution to GDP in Europe was 47.1% below the pre-pandemic level

the next 10 years, Travel & Tourism growth in 2020, and the gap reduced to 32.3% below 2019’s level in 2021, showing a strong rebound. It is

will outstrip the overall growth rate of the estimated that the sector’s performance in Europe could surpass 2019’s level in 2024 when Travel

global economy.” & Tourism contribution to the region’s GDP could reach 4.1% above the pre-pandemic amount.

Asia-Pacific is forecasted to be the first region to revert to the 2019 scenario (in 2023), while all the

International visitor spending other regions are estimated to recover completely in 2024.

In terms of international traveler In 2022, as travelers’ confidence improves, the global Travel & Tourism sector is estimated to

spend, France, which was ranked fourth hasten its pace of recovery to 43.7% compared to 2021 and add a further 10 million jobs. WTTC

before the pandemic, overtook Spain, says that the sector is likely to return to pre-pandemic levels around the end of 2023 and the

China, and the U.S. to grab first place. preliminary data for the first half of 2022 supports this forecast.

Looking at a longer-term forecast, between 2022 and 2032, Travel & Tourism’s contribution to the

China, which remains closed to much

global economy is expected to grow at an average annual rate of 5.8% which is more than double

of the rest of the world, was in second

the 2.7% average annual growth rate estimated for the global economy. In that same period, the

place for international visitor spending

sector is forecasted to generate 126 million additional jobs.

before the pandemic but fell dramatically to

October 2022 1213 October 2022

INSIDER

Erik Juul-Mortensen, TFWA President; David McWilliams, Adjunct Professor of Global Economics at Trinity College Dublin’s School of Business;

Raymond Cloosterman, Founder and CEO of Rituals; Swan Sit, AF Ventures Operating Partner

TFWA Conference and workshops focus on post-pandemic era

The conferences and workshops who will address brand-building in a Property Director Fraser Brown, Incheon

at the 2022 Tax Free World Exhibition changing world. Cloosterman’s Unilever International Airport Corporation Director

& Conference will offer a content-rich, background and creation of a luxury Duty Free Management Team Sung Bin Im,

business-relevant format that will focus on lifestyle chain make him ideally qualified and Chief Digital & Commercial Officer of

key themes for the post-pandemic era, says to discuss all matters branding. Istanbul Airport Ersin Inankul.

organizer TFWA. The Conference will also look at life Topics for discussion will include

From economics and the Metaverse, in the Metaverse with the help of a global the evolution of the airport retail business

to brand-building in a changing world, the expert on new digital technologies: Swan model, new customer trends and spending

opening Conference of the 2022 TFWA Sit, Operating Partner of AF Ventures, patterns, changes to the airport retail mix,

World Exhibition & Conference will a Leading Voice on Clubhouse and the and the integration of digital into the

address some key trends shaping duty free former Global Head of Digital Marketing commercial offer. The panelists will also

and travel retail in the aftermath of the for Nike, Revlon, and Estée Lauder. This explore some of the challenges faced by

COVID-19 crisis. is a topic of great relevance as the Travel airports and airlines over the European

Taking place from 9-11:45 CET on Retail industry increasingly harnesses summer season, and the travel industry’s

Monday Oct. 3, in the Grand Auditorium of the power of artificial intelligence and preparedness for the return of pre-2020

the Palais des Festivals, the TFWA World augmented reality. international traffic levels.

Conference will open with a State of the The TFWA Conference is being The Innovation in Action session

Industry address from TFWA President moderated this year by Juliet Mann, an will look at the latest developments in

Erik Juul-Mortensen. experienced TV anchor, specializing in customer engagement courtesy of speakers

Juul-Mortensen will be followed by business news. She was a correspondent including Intelligent Track System Founder

a discussion between David McWilliams, for CNN’s weekly business features show & CEO Morten Pankoke and Founder &

Adjunct Professor of Global Economics Marketplace Europe and is currently host CEO of Inflyter Wassim Saadé. Also on

at Trinity College Dublin’s School of of The Agenda, the weekly current affairs the program are Alexander Trieb, Founder

Business and one of the most authoritative talk show on CGTN. and CEO of Duffle, a digital travel retail

– and entertaining – voices on economics marketplace, and John Williams, Global

and geopolitics today; and Raymond TFWA workshops Scotch Director at Diageo.

Cloosterman, Founder and CEO of Rituals, The popular TFWA workshops return This workshop will showcase some

this year, with two sessions scheduled of the latest technological solutions that

during lunchtime on Tuesday, Oct. 4, for are helping brands and retailers engage

The Airport Forum; and Wednesday, Oct. travelers in new ways and put the spotlight

5, for Innovation in Action in the I5 studio on some of those new initiatives, and

inside the Palais des Festivals. explore how new tech is helping shape

The Airport Forum session will positive passenger experiences in the post-

feature Heathrow Airport Retail & pandemic world.

The TFWA Conference is being moderated by Juliet Mann, host of The Agenda on CGTN.

October 2022 1415 October 2022

INSIDER

Hawaii: July visitor arrivals reach 92+% of July 2019 figures but full

recovery not forecast until 2025

Preliminary visitor statistics released communities,” he expaloins. the U.S. East in July 2022, up by 2.3%

by Hawaii’s Department of Business, “Travelers from around the world have compared to the 243,498 visitors in July

Economic Development and Tourism come to know and appreciate that Hawaii 2019. U.S. East visitors spent $643.4

(DBEDT), report that 919,154 visitors is indeed a special place where dreams do million in July 2022, up 26 percent

came to the Hawaiian Islands in July 2022, come true,” he said. from $510.7 million in July 2019. Daily

representing a 92.4% recovery from July spending by U.S. East visitors in July 2022

2019. Visitor Spending and Visitor Arrivals by ($260 per person) increased significantly in

This is the highest monthly visitor Major Market comparison to July 2019 ($216 per person,

count since January 2020. Visitors spent All 919,154 visitors in July 2022 +20.1%).

$1.94 billion in the state in July 2022, an arrived by air service, mainly from the There were 23,133 visitors from Japan

increase of 14.3% compared to the $1.70 U.S. West and U.S. East. In comparison, in July 2022 compared to 134,587 visitors

billion reported for July 2019. 995,210 visitors (-7.6%) arrived by air (-82.8%) in July 2019. Visitors from Japan

Despite the strong numbers, DBEDT service in July 2019. spent $42.8 million in July 2022 compared

does not forecast full recovery until 2025. No out-of-state cruise ships came to to $186.5 million (-77%) in July 2019.

Hawaii Tourism Authority President Hawaii in July 2022 or in July 2019. Daily spending by Japanese visitors in July

and CEO John De Fries, comments: The average length of stay by visitors 2022 ($233 per person) was flat compared

“Meaningful economic recovery in July 2022 was 9.36 days, up from 8.92 to July 2019 ($234 per person, -0.4%).

continued during the peak summer month days (+4.9%) in July 2019. In July 2022, 25,684 visitors arrived

of July as Hawaii saw significant increases The statewide average daily census from Canada compared to 26,939 visitors

in total visitor spending from the U.S. and was 277,444 visitors in July 2022 (-4.7%) in July 2019. Visitors from Canada

Canada markets compared to July 2019. compared to 286,419 visitors (-3.1%) in spent $57.1 million in July 2022, compared

Travel demand from Japan is anticipated July 2019. to $50.1 million (+14%) in July 2019.

to gradually increase as we head into the Daily spending by Canadian visitors in

fall and winter seasons, with the recent U.S. tourist spend higher than in 2019 July 2022 ($189 per person) increased

resumption of air service between Tokyo- In July 2022, 528,319 visitors arrived compared to July 2019 ($158 per person,

Kona and Tokyo-Honolulu adding to the from the U.S. West, an increase of 14.2% +19.6%).

steady return of international flights.” compared to 462,676 visitors in July 2019. In July 2022, there were 92,861

De Fries said that Hawaii’s destination U.S. West visitors spent $973.8 million in visitors from All Other International

management work will continue to focus July 2022, up 45.4% from $669.8 million Markets, which included visitors from

on educating visitors about traveling within in July 2019. Daily spending by U.S. West Oceania, Other Asia, Europe, Latin

the islands in a manner that is mindful, “as visitors in July 2022 ($211 per person) was America, Guam, Philippines and the

we seek to balance the economic vitality of much higher compared to July 2019 ($165 Pacific Islands. In comparison, there were

our industry with the health of our natural per person, +27.6%). 127,510 visitors (-27.2%) from All Other

environment and the well-being of our There were 249,157 visitors from International Markets in July 2019.

October 2022 16NATUR AL ELEMENTS

MASTERFULLY COMBINED.

THE 17 ITS TRADE DRESS, AND THE BEE LOGO ARE TRADEMARKS.

PERFECT WAY TO ENJOY PATRÓN IS RESPONSIBLY. ©2022. PATRÓN, October 2022

HANDCRAFTED IN MEXICO. IMPORTED BY THE PATRÓN SPIRITS COMPANY, CORAL GABLES, FL. TEQUILA – 40% ALC. BY VOL.INSIDER

IAADFS promises more flexibility and broader audience for

2023 Summit of the Americas

The International Association of rooms have already been renewed by last much more strictly confined to only duty

Airport & Duty Free Stores opened year’s participants.” free.

registration for exhibitors at the 2023 Payne said that the Association “Today, travel retail has morphed into

Summit of the Americas the first week of has a general floor plan laid out, but has something much broader; it is much more

September – much earlier than last year not laid out specific spaces yet so as to of a mixture. We want to accommodate

-- in the expectation that the recovery accommodate requests. that,” he said.

underway and positive momentum from

the 2022 event, will spur interest in Networking Eliminating airport gate deliveries

participating. The Association is also deciding In other IAADFS activities, the

The Summit will take place April where to place a networking area, Association is coordinating more with

16-19, 2023 at the Palm Beach County considering either in a hallway, within other organizations to achieve certain

Convention Center in Palm Beach, Florida. a ballroom or in the room where they changes. Working with Airports Council

Michael Payne, IAADFS President will hold the content sessions. In any International, the IAADFS is trying to

& CEO tells TMI that the organization event, there will be a dedicated area for eliminate gate deliveries of items bought at

is looking to be flexible to accommodate networking, Payne assured. the duty free store, for example.

as many requests as possible, and will be “We want to be a little more flexible “We would like Customs to do some

opening the show to a broader audience. than normal because it will take time for demonstration projects, which will show

“We wanted to start the process people to figure out what they want to do. that we really do not need to still have that

earlier to give people a chance to make But we want to work with them to help requirement in place in the U.S. Customs

their decisions, and allow exhibitors provide as good a return on investment as has expressed some willingness to test this

to get their spot. We wanted to get that possible,” he added. to see that they still get what they need out

momentum going,” said Payne. of [secure gate deliveries] but so do our

Opening registration earlier also gives Fewer content sessions, more industry members,” said Payne.

Payne the opportunity to speak to people in partners “With the staffing and turnover

Cannes during TFWA World Exhibition to In response to the feedback the difficulties going on in the airports these

answer questions they may have. Association got after last year’s event, there days, gate delivery is just another burden

Initial response was good, he said, will also be a more streamlined education that isn’t necessary.

with 14-15 commitments for exhibition program. “The stores and airports have to

space received in the first week. “Most likely we will hold only four provide staff to provide the service, and

Payne says that attendees will be sessions, to allow more exhibitors and some people do not trust the system and

seeing a few changes from last year, when visitors to attend,” noted Payne, who said would rather not shop if they cannot take

the Association tested a hybrid, abbreviated it is partnering with organizations like the item with them. Customs worries that

format as the industry eased back in to live Airports Council International (ACI) and people will buy duty free and then pass

events. the Airport Retail & Restaurant Association it to someone domestically, but in many

(ARRA) to put together the sessions. international terminals there really is no

Trade Floor returns opportunity to do that. ACI has been very

The 2023 Summit returns to a more Capturing more of the travel experience instrumental in helping us get this issue

traditional format featuring an exhibit hall Payne notes that the IAADFS has initiated,” he explained.

in combination with a limited number of also been having conversations with Payne says that the IAADFS is also

private exhibit/meeting rooms. ARRA about doing more projects together, monitoring several issues, including

“The Palm Beach Convention Center including opening the duty free show to making sure that the revenue allocated to

has a substantial exhibit area on the first more ARRA members. airports and operators from the CARES

floor, which we had chosen not to use last “We might incorporate some Food & Act* is getting utilized properly.

year. But we will use it in 2023 based on Beverage exhibiters in the upstairs area. “We are talking to the airport

the feedback we got from exhibitors,” There are now a number of companies authorities to determine that those funds

explained Payne. doing duty free, travel retail and food and get to the operators they were meant for,”

“Some people liked having the beverage. And we think there will be others he said.

spaces spread around but most of the as the industry tries to capture the whole *The Coronavirus Aid, Relief, and

exhibitors said they would prefer to be customer experience,” he said. “With Economic Security Act (CARES Act) is a $2.2

in a more central location. So we are ARRA’s engagement, we will probably trillion economic stimulus bill passed by the

working on designing a floor plan that will have more interest among the F&B sector.” 116th U.S. Congress and signed into law by

accommodate those who want stands. But Payne said inviting more categories to President Donald Trump on March 27, 2020.

we are still going to offer the private rooms exhibit could open the show up, especially

that we did last year. A number of these as opposed to 30 years ago when it was

October 2022 182 23

Join us in West Palm Beach, Florida, for the 2023 Summit of the

Americas, the most important event for the duty free and travel

retail industry in the Americas and Caribbean! Take advantage

of the opportunity to meet industry colleagues for

networking, learning, and business-to-business meetings

during this three-day show.

Visit www.2023summitoftheamericas.org to learn more about

registration, room reservations, and ways to increase brand

exposure through exhibit space and sponsorship.

April 16 – 19 I Palm Beach County Convention Center I West Palm Beach, Florida

19 October 2022INSIDER

Dufry’s new strategy “Destination 2027” focuses on

Four Pillars to enhance travelers’ experience

Dufry presented the new company

strategy at Capital Markets Day in London

on Sept. 6.

Under the name of “Destination

2027,” the four-pillar strategy is designed

to “make travelers happier,” says the

company.

Solid fundamentals but shifts in

consumer behavior and travel patterns

The airport travel market has proven

to be a resilient and attractive space,

showing a strong rebound after the COVID

crisis, said the travel retail giant, which --

after a steady acceleration of demand over

the past six months -- expects passenger

volume to resume growth in line with the and nationalities, as well as through Dufry reports that it will strive

historical trajectory. digital channels, with extensive digital for “superior profitability” with a logic

While its fundamentals are solid, engagement before and after travel, to drive of zero-based budgeting, focused on

the industry is experiencing a significant consideration and loyalty. disproportionally allocating resources to

shift in consumer behavior and in Dufry’s travel experience revolution activities that make the most impact for the

travel patterns, notes Dufry. “Consumer also brings together travel retail and food customer, while leveraging technology to

demographics have changed, bringing & beverage through its transformative simplify work and operations.

about, amongst other things, a stronger business combination with Autogrill. This In addition to budgeting discipline,

demand for personalized experiences, will allow Dufry to engage consumers Dufry will systematically and actively

a greater influence of online media in with a broader set of products and a wider manage its portfolio of concessions, with

purchasing decisions, and stronger interest range of experiences, which will provide “a stronger focus on the evaluation of full

for sustainable, healthy, ecofriendly platform to make travelers happier during profitability and cash flow contribution.

products,” said the company in an official travel,” says the company.

statement. 4. Connecting the other three pillars of the

Travel patterns are also changing, it 2. Continue to Diversify its Geographical strategy, ESG continues to be a defining

noted, with stronger rebound of domestic Presence to tap into fast-growing markets ambition for Dufry and a “strong light-

and short-haul routes, increasing share of and hedge against regional economic house” for its day-to-day business, which

low-cost service, acceleration of leisure cycles and shocks. the company says is “providing a source

vs. business travel, and different mix in the Building on a strong portfolio of of inspiration of what to do best for our

origin of international travelers, especially international airport locations and global customers, our employees, and the world

on the path to full recovery after COVID. brands, Dufry will continue to expand its at large.”

footprint, with strong focus on the highly

Four pillar strategy attractive and resilient U.S. market, and a Xavier Rossinyol said: “The new

To cater to the needs of these “new” dedicated strategy for Asia-Pacific, building company strategy has been crafted

travelers, and continue to lead the Travel a team focused on a set of strategic markets based on a deep understanding of our

Experience space, Dufry developed a new in the region and on the fast-growing stakeholders’ needs, customer insights and

strategy, “Destination 2027,” built around cohort of the Chinese traveler. the current market trends evolution.

four pillars. In Europe and Rest of the World, “Our new strategy ‘Destination 2027’

1. Launch a Travel Experience Revolution Dufry will accelerate its business will be delivered by further empowering

by creating – together with brand and development process and set clear priorities our already excellent teams and reinforcing

landlord partners – a unique, new value and targets. them when needed. As a team, we are in a

proposition for customers. The combination of travel experience position to generate sustainable long-term

The new value proposition is based revolution and geographical expansion is value for all our stake-holders, including

on customized offerings for travelers, expected to translate into annual turnover employees, landlords, brand partners, and,

including elements of experience, new growth of 5% to 7% in 2025-2027. finally, our shareholders.

categories, and exclusive products. “This is supported by the trans-

This experience will be delivered both 3. Foster a Culture of Operations formative business combination with

in physical “smart” stores, with a modular Improvement to fuel profitability, Autogrill as an inherent part of our vision

concept that allows it to customize the accelerate cash-flow generation, and to deliver a holistic travel experience and to

offering to different passengers, routes reinvest in growth. make travelers happier.”

October 2022 2021 October 2022

INSIDER

DFA opened a Macallan Boutique at JFK Terminal 7 last year, one of only four in the world.

One on One with Jerome Falic, Duty Free Americas CEO

Diversified geographic and business models help DFA recovery

Despite the difficulties of the past taking out others,” says Falic.

few years, Duty Free Americas performed DFA this month started construction

strongly due in large part to its different on a 3,000 square foot extension to the

trading models and the variety of the store, which will expand the retail area by

geographic locations in which it operates. another 25%.

According to published rankings, the “The expansion will enable us to

Florida-based company had sales above house many more beauty brands, most of

US$1.6 billion in 2021. The Moodie Davitt which will be niche brands. We are going

Report on Top Travel Retailers positions to be introducing many new fragrance

the company as #10, an impressive brands, which are really taking off in

achievement among global giants and China. And we have several brands that we

Asian super stars. were able to sign exclusively.

“Business has come back quite a bit, “In the next few weeks we will be

in almost every area,” confirms Jerome Jerome Falic, DFA CEO installing the newest Gucci counter with

Falic, DFA CEO, speaking with TMI cosmetics and fragrance. We just brought

recently. The company operates about 200 completely. We were closed for most of the in anther brand from Shiseido, called Ipsa.

shops across all its locations, including in month of July. But we have now re-opened In October, we expect to receive the new

some of the key airports in the U.S., along and are doing quite well again. August was Valentino cosmetics and fragrance counter

major borders in North and South America, a very good month. Business came back

The DFA Macau store is now 100% dedicated to beauty.

as well as in the Chinese resort of Macau, strong. This is all due to Chinese

which was a bright spot through most of traffic.”

the pandemic. The company expects this

momentum to continue. DFA’s

DFA in Asia Macau store is now 100%

“We had a very strong 2020 and 2021 dedicated to beauty, and the

through DFA Macau in the Venetian Hotel company has introduced many

in Asia. We were very fortunate,” confirms exclusive, niche brands in this

Falic, who said the store was closed for store.

just a few weeks during the height of the “Throughout 2020, 2021 and

pandemic. as recently as this past month, we

“But surprisingly, we have gone a have been bringing in new brands.

little backwards in Macau in 2022. The We are continually fine-tuning the

year started off strong but then dropped off selection, bringing in some brands,

October 2022 22Miami International Airport Atlanta International Airport

Miami, FL USA Atlanta, GA USA

The Venetian The Venetian Punta Cana Airport

Macau Macau Dominican Republic

The Venetian Miami International Airport

Macau Miami, FL USA

THE PREMIER TRAVEL RETAILER IN THE AMERICAS

discover more at dutyfreeamericas.com

23 October 2022INSIDER

that should be completed in December or

January.”

U.S. Northern Border

DFA’s border business also delivered Miami International

very solid returns, says Falic. Airport and DFA opened

“We have been quite fortunate here as a joyous free-standing

well, on our side of the border,” he says. LEGO store in the

North Terminal this

DFA operates more than 30 stores on the

summer.

U.S. side of the border with Canada.

“When the U.S. and Canada re-opened

the border after closing for COVID, we

have seen our business growing every day.

I hear how difficult it is on the Canadian

side, but our business is coming back quite Airports

strong.” DFA is the duty free concessionaire concessionaire. DFA has received an

at Miami International Airport (MIA), extension on its concession contract in

U.S. Southern Border Hartsfield-Jackson Atlanta International Atlanta, as well as Miami.

The DFA duty free stores on the Airport (ATL) and New York JF Kennedy “We are very happy with all of our

Southern border never even shut down, International Airport, Terminal 7, among airports. Every one of our U.S. airports

confirmed Falic, since they catered to the others. has their own dynamic and way of doing

large number of students and essential business. We also have a lot of airports

workers who cross over between the Miami that never get reported on, but they are

U.S. and Mexico every day. And since “Miami has been fantastic for us. And very important in our portfolio—like

the border re-opened fully in 2021, Falic this business is growing every day. We Panama and Punta Cana in the Dominican

reports that business has been much opened a Lego store in MIA a couple of Republic, for example.

stronger. months ago – and it has been doing great. “We have a large presence in

“We never closed. We stayed open We opened a new Montblanc shop also. Panama, and Punta Cana Airport has been

everywhere on the Southern border and During most of the past two years we never a wonderful airport for us, especially

business was pretty good. It never really stopped. We are always building, always throughout the pandemic. Once people

stopped.” fixing the stores. We had just remodeled started to travel and they wanted to go to

Following the closure of the DFA/ one of the shops before COVID, and now a resort destination, many came to Punta

UETA San Ysidro flagship in 2016 due to we plan to remodel more of them. Miami Cana. We have done, and continue to do,

modernization and expansion of the port of continues to grow for us,” says Falic. some important changes in Punta Cana.”

entry between the U.S. and Mexico, DFA The DFA concession contract at MIA

has obtained a new property that will house still has several years to go, and qualifies Challenges & Opportunities

a multi-story, multi-use facility. Although for extensions. As a result of the COVID Even as Falic feels that the DFA

the company had originally planned to have disruptions, a ruling by the Miami-Dade business is getting back to normal, he

the new facility completed sometime in Board of County Commissioners and admits there is still a ways to go, especially

2020, Falic tells TMI that it will probably the Mayor added an additional four-year as travel picks up more and more.

still be a few years before that project will extension to the current contract, which “I see a lot of growth opportunities

go forward. will have it run through 2029. ahead. And we are constantly making

changes within our shops, always

Latin America New York JFK Terminal 7 upgrading, looking for new opportunities

DFA has had a long-time presence “Terminal 7 continues to do quite and new brands to bring in to the shops,

operating major stores on the Uruguayan well,” says Falic. “We have the Macallan new offerings.”

border and was in the process of opening Boutique there, one of only four in the Looking at short-term challenges,

new locations on the Brazilian border when world. We are always looking to see where Falic, like many other airport operators,

COVID sidetracked the progress. we can add something different to our says that staffing continues to be an issue.

Falic confirmed that the new store shops, and we have something very special “We use job fairs wherever we

DFA had planned to open on the Brazilian for Terminal 7 coming up, which we can possibly can. Wages have become very

border in Foz do Iguaçu is taking longer discuss at a later date.” competitive and it is much more costly to

than expected, although several of its stores As part of JFK’s modernization plans, run the business,” he says.

on the Uruguay side of the border are open Terminal 7 is scheduled to be demolished Operators are also experiencing

and had stayed open during much of 2020. as other terminals are expanded. “This is supply side issues and product shortages.

It also operates a store in the Iquique Free still about three years away, though,” notes “We could be selling even more, and

Zone in Chile. Falic. recover even faster, if we had higher fill

“We are very strong on the Uruguay rates. As much as business is back, this is

side of the border but opening stores on the Atlanta, Panama, Punta Cana where we feel we could be much stronger,

Brazil side is a much slower process,” he Atlanta is another major U.S. airport if our purchase orders were fulfilled

says. where DFA is the exclusive duty free 100%.”

October 2022 24INSIDER

Left: Civil Rights Trail Market by Hudson At Birmingham-Shuttlesworth International Airport. Right: The Atrium At Colorado Springs

Hudson expands U.S. airport footprint with new retail concession at Colorado

Springs Airport and expansion in Birmingham

Hudson has won a new 7-year contract The new stores will boast One of the key new retail concepts

at Colorado Springs Airport (COS) and “Instagrammable” backdrops for travelers, is The Civil Rights Trail Market, which

announced a 7-year contract extension at with storefronts that feature vibrant along with other new locally curated

Alabama’s Birmingham-Shuttlesworth wrap-around designs and eye-catching stores, “truly celebrate the culture of this

International Airport (BHM). imagery that recreates some of the most legendary city, while driving excellence in

recognizable sites – like Pike’s Peak – in the traveler experience,” said Brian Quinn,

COS: brand accessibility & local photogenic, shareable moments. EVP and Deputy CEO of Hudson.

partnerships Hudson will also introduce local The Civil Rights Trail Market by

COS serves more than two million brands through a rotating incubator Hudson is a first-of-its-kind concept travel

travelers a year, and is a gateway to historic program. In partnership with Colorado convenience store that pays homage to

sites, and a popular adventure and sports Springs entrepreneur Linda Weise and the historic civil rights movement and

scene. the Community Cultural Collective, local the U.S. Civil Rights Trail. Through a

Under the new contract, Hudson artists, businesses, and craftspeople will partnership with Lee Sentell, Author of ,

will introduce three stores– two travel have dedicated spaces to display their the storefront dons an official timeline

convenience and one specialty retail. Each work and showcase their neighborly love, and powerful imagery of the national and

store will be individually crafted with with the offering continually evolving and local civil rights movements. Copies of the

unique design elements and offer locally expanding. book are available for purchase as well as

sourced products to create a sense of place Civil Rights Trail branded merchandise

perfect for the Colorado Springs lifestyle BHM: reimagined portfolio inspired by honoring Birmingham’s leading role in the

and experience. Alabama movement and presence along the Trail.

Hudson will begin operating at COS As part of the 7-year contract The other locally-themed concepts

on September 1, 2022, with construction extension, Hudson has transformed four are Magic City Market by Hudson, Sweet

for the three new stores starting in 2023. of its existing retail spaces in BHM into Home Alabama by Hudson and Alabama

The new stores will operate under the HG locally-themed stores and introduced a Sports Connection, a specialty retail

COS Concessionaires JV with local Airport new specialty brand Automated Retail unit. concept offers sports memorabilia and

Concessions Disadvantage Business With a footprint of more than 5,000 square apparel, with a large selection of branded

Enterprise (ACDBE) Partner Uyen Le, feet, these new concepts honor Alabama’s merchandise from universities in the

owner of two Beauty Bars in Colorado culture and important place in American surrounding area, including Miles College,

Springs. history while creating a brand experience Samford University, and UAB: The

uniquely positioned for the airport and its University of Alabama at Birmingham.

Concepts designed specifically For COS more than 2.5 million annual travelers. In addition, Automated Retail is a

The three stores – one pre-security Hudson has been operating at BHM 24/7 specialty retail brand destination

and two post-security – will span more for 19 years, a tenure that includes a long- specifically tailored to the local market.

than 4,700 square feet of concessions standing partnership with local Airport Automated Retail at BHM features

space, and be anchored by Hudson – Concessions Disadvantaged Business accessories from Happy Socks, and furry

Colorful Colorado, a locally-themed Enterprise (ACDBE) Partner Irmatean friends wearing University of Alabama

travel convenience concept equipped with Watson, Inc. apparel in an Automated Teddy Machine

self-checkout and mobile POS; Hudson The new stores are located throughout from Build-A-Bear Workshop.

Nonstop; and specialty retail concept The Concourses A and C, and the Automated

Atrium At Colorado Springs, featuring a Retail unit is affixed to Hudson’s other

collection of local, regional, national, and travel convenience store, Hudson Vulcan.

global brands. Several stores offer self-checkout registers.

25 October 2022INSIDER

Denver International Airport’s 2.6 million square foot Jeppesen Terminal features an internationally recognized peaked roof, reflective of the snow-capped

Rocky Mountains, and designed to evoke the early history of Colorado when Native American teepees were located across the Great Plains.

One on One with CPI Managing Director Susan Gray

How global consultancy CPI is helping Denver International Airport

create a benchmark Concessions Program Master Plan

There is an unprecedented wave of airport infrastructure and terminal investments underway in the U.S. – a phenomenon that

began prior to the pandemic outbreak, but which should accelerate since the U.S. Department of Transportation’s Federal Aviation

Administration (FAA) announced it is awarding nearly $1 billion from President Biden’s Bipartisan Infrastructure Law funding to 85

airports across the country to improve terminals of all sizes.

Denver International Airport (DEN) is in the forefront of preparing for the future. Passenger traffic is returning at an incredible rate,

and DEN is now ranked as the third-busiest airport in the United States and one of the top ten busiest airports in the world according to

Airport Council International’s data for 2021. In recognition of its new concessions program, DEN has even been shortlisted for Airport

of the Year at the Frontier Awards.

TMI speaks at length with Susan Gray, managing director of the key consultancy – Concession Planning International --that is

helping DEN develop and implement a Master Plan for its concessions that is designed to be a benchmark for decades to come. Lois

Pasternak reports.

Last fall, Denver International Airport workshop the commercial and customer

CEO Phil Washington announced Vision experience opportunity that existed at the

100, a plan to ensure that the airport will airport.

have the capacity and infrastructure to “The DEN project has been a huge

support 100 million annual passengers and ambitious undertaking on the part

within the next eight to 10 years. This of the Denver International Airport

strategic plan will guide the airport’s management team,” CPI Managing

work over the next three to five years, and Director Susan Gray tells Travel Markets

was formulated after months of intensive Insider.

research, including the consideration of “These initial engagements have

community, employee and stakeholder developed into the most exciting,

feedback and suggestions, said the airport. Susan Gray, Concession Planning International professionally respectful working

Most of the planning related to the Managing Director relationship, and the creation of what

concessions program was done in close we believe to be one of the most

coordination with Australia-based specialist continents. comprehensive, considered, and ambitious

airport commercial planning consultancy DEN began working on its Master strategic concessions programs we have

Concession Planning International (CPI), Plan long before the announcement of worked on in the last decade,” she added.

which has advised on world-class programs Vision 100, however. The Airport Authority Since that 2017 workshop, CPI

for more than 100 airports across six originally engaged CPI back in 2017 to was engaged to develop and support

October 2022 26INSIDER

The Great Hall project is currently working on Phase 1 and Phase

2 concurrently. Phase 1 work is in the center of the terminal where

crews are constructing new ticketing areas for United and Southwest,

widening the balconies on Level 6, adding four new restrooms and

adding 31,000 square feet to Jeppesen Terminal.

Phase 2 work broke ground this summer on the north end of the

terminal. The primary focus of Phase 2 is to enhance security by

building a new security checkpoint on Level 6 in the northwest corner

of Jeppesen Terminal. All Phase 2 work will be done by mid-2024.

However, the new checkpoint is scheduled to open by early-2024.

Left: Newly renovated portion of the Jeppesen Terminal, completed by

DEN in Fall 2021.

implementation of an airport-wide Expansion Program will build 39 new where possible to do so, including the new

commercial Master Plan and strategy and gates, increasing gate capacity at the airport expansions;

plan for the three main concourses at Denver by 30%. The first four new gates opened on • Revisited the category mix and identified

Airport, each one handling circa 20m+ the west side of Concourse B in November the appropriate split of retail, travel

passengers. Currently handling around 65 2020 and 16 new gates opened on the east convenience and F&B in the future;

million passengers annually, DEN is forecast side of Concourse C in May 2022. • Rearticulated the airports’ vision for

to reach 110 million before 2040. Work continues in the two remaining the concessions program, ensuring that it

DEN is centered around the Elrey expansion areas across all three concourses. attracts the very best operators with the

B. Jeppesen Terminal—which acts as a All expansion areas are expected to be most appropriate brands and concepts for

processor. This is the airport’s iconic main operational in 2022. its passenger mix by concourse and reflect

building with roof sails that mimic the Critically, the project includes around the very best that Colorado and Denver has

snow-capped Rocky Mountains beyond. 10,000 sq ft of additional concessions space to offer;

Jeppesen Terminal celebrated its 25th programmed for the concourse expansions • Very importantly - ensured that the

anniversary in 2020. alone, notes Gray. program would provide great opportunities

This processor supports three large She says that the concessions Master for local operators and brands to do

linear concourses which are linked by an Plan that CPI and DEN have developed business at the airport.

underground train as well as a pedestrian does the following:

bridge from the main terminal to concourse • Maximizes the concessions space in the “The new spaces in the concourse

A. ‘center cores’ of each concourse; expansions are incredible spaces. We

DEN has been expanding the • Identifies and maximizes the concessions are immensely proud of them,” says

concourses, adding gate capacity as fast opportunities throughout each concourse Gray. “There is a marked contrast

as it can reasonably do so. The Gate at concourse level and mezzanine level between the old infrastructure and the

new infrastructure. While this is a little

frustrating, it’s a very tangible expression

of DEN’s ambition; they promised a better

experience, and they’re making it happen.”

CPI did not design the new spaces in

isolation, Gray explains further.

“We spent a lot of time making

sure the seating strategy will support

the concessions delivery. By identifying

the amount and type of seating needed

in each area of the airport, with an

emphasis on providing what we term

‘F&B-friendly’ seating, we can ensure

the F&B concessions can maximize their

opportunity.

“In a very busy, capacity constrained

airport, passengers get the best service, as

they can be served fast and consume their

purchase in their preferred location whether

27 October 2022INSIDER

that be nearby or in a remote gate lounge,” still existed with some concession spaces, to passenger flow, seating, bathrooms, and

she says. she admits. Despite the large scale of other services and amenities.”

When the new CEO Phil Washington the expansions, DEN is still very space

arrived last year, he re-stated the intent to constrained when all the functional, Top engagement key to success

enhance the customer experience as part of operational and customer service With a primary focus of optimizing

the airport’s new Vision 100 strategic plan. requirements were factored in. As a result, the commercial potential of the main three

“The concessions Master Plan some of the new concessions had to have concourses at DEN, while delivering

supports this by providing better quality more support space at apron level and less an outstanding and distinctive customer

environments, greater choice and at concourse level. CPI tried to give these experience, CPI worked primarily with

essentially as much concessions capacity locations as much additional space as DEN’s concessions team. But they were

as possible as we plan to meet the growing possible, says Gray. also engaged with the executive leadership

demands of DEN’s traffic,’’ she says. “The new spaces at concourse level team throughout.

are of super quality; strategically placed to “I cannot stress enough how important

Balancing challenges and compromise provide choice to passengers in a superb, the commitment of the airport’s leadership

As airport commercial planners, CPI high quality environment with good service has been to the success of this program,”

is used to compromise, stressed Gray. provisions. There is not a single new unit says Gray. “It would have been very

“Unlike other environments, we that is in a poor location. As planning easy to stick with what they knew. But

understand and accept that our customers consultants we identify and advise airports they recognized that they had a massive

are primarily in the airport to fly on how much concessions space they need opportunity to not just improve the

somewhere, not buy. It’s our job to balance and where it should be located to deliver concessions and customer experience but

that with the airport’s need to generate non- maximum revenues. When compromises create a program that is a benchmark in

aero revenue, and our collective desire to are necessary – and they always are, in North American airports. And they are

deliver a great experience to everyone who airports – we would always rather take doing it.”

travels through our infrastructure.” reduced square feet if it means the space CPI was also plugged in directly to

Even with the expansion, challenges we do have is in the best location relative the airport’s planning and design team and

their own project teams.

“Too many airports work in

departmental silos; the DEN team

Award-Winning Mercantile Dining & Provision at DEN provided the opportunity for CPI and the

introduces “next level” offer concessions team to engage directly with

the architects and engineers designing the

new expansions and we were able to have

important and very respectful discussions

that have had incredible results for DEN

and their airline partners.”

Gray says that CPI has also been

working intensively with the DEN team

to make sure all the existing concessions

spaces can be re-leased in a timely manner.

“The COVID pandemic slowed our

plans, but the concessions team is now

really confident it has a robust program

and will be getting those opportunities in-

market as soon as possible,” she concluded.

“From our perspective as a global

commercial consulting firm, we’ve found

that the airports who had the ability – or

perhaps it was the courage – to stay their

In August, Denver Mayor Michael concept of the same name in Union Square, course during the recent COVID pandemic

B Hancock opened the new Mercantile the unit is ‘next level’ in terms of the fit- are the ones who are recovering faster.

Dining & Provision concept at the center out, the menu offering, the choice it offers Airports such as DEN had the courage

core of Concourse A. – bar, sit-down dining and take-away – and of their convictions; Penny May, Chief

With Mercantile Market, James Beard customer service, says Gray. Commercial Officer and SVP Concessions

Award-winning chef Alex Seidel brings “In line with some of the concessions Pamela Dechant, with the new CEO Phil

a wide-ranging grab-and-go section and Master Plan’s key principles, the unit opens Washington, were integral to the City of

cafe, endless counter seating and quiet up the views to the airfield, letting in loads Denver’s decision to carry on with the

dining areas in 4,500 square feet and an of natural light and views to the planes and major concourse development programs.

open kitchen design that features a 15 seat mountains beyond. It’s a step-change – and This means the airport is so well positioned

Chef’s Counter overlooking Mercantile it’s a statement of intent from the DEN to leverage the return of passengers

chefs preparing each dish to order. team. This is just the beginning!” she says. in record numbers and give them an

An adaption from a downtown experience they can be proud of.’’

October 2022 28You can also read