RBA calls the year ahead - The View - Clime Investment Management

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

RBA calls the year ahead

By John Abernethy

Last week, the Governor of the Reserve Bank of Australia, Philip Lowe, gave a seminal address to the National

Press Club in Canberra titled “The Year Ahead”. Any speech by the Governor is important, but this address will

be far more influential than most because of its unusually forthright predictions and the context in which it

was delivered.

In terms of context, investment markets (particularly equities and property markets) are steaming ahead, and

this week saw Wall Street at an all-time high. The ASX has similarly been performing strongly, although not at

record levels, while property markets have been exceptionally robust.

It is clear that stimulus prospects and expectations for vaccine deployment have boosted investor optimism

over the pace of economic recovery from the pandemic recession.

Governor Philip Lowe of the RBA

Monetary policy and “Lowe” interest rates!

Governor Lowe was both clear and direct by stating that “very significant monetary support will need

to be maintained for some time to come. It is going to be some years before the goals for inflation and

unemployment are achieved. So it is premature to be considering withdrawal of the monetary stimulus.”

And further

“The cash rate will be maintained at 10 basis points for as long as is necessary. The Board has no appetite to

go into negative territory and has done as much as it reasonably can with interest rates. Before increasing

the cash rate, the Board wants to see inflation sustainably within the 2 to 3 per cent target range. Meeting

this condition will require a tighter labour market and stronger wages growth than we are currently forecasting.

It is difficult to determine exactly when this condition might be met but, based on the outlook I have discussed

today, we do not expect it to be before 2024, and it is possible that it will be later than this. So the message is:

interest rates are going to be low for quite a while yet. The Reserve Bank is committed to provide the support the

economy needs as its recovers from the pandemic.”

The View | RBA calls the year ahead 2These statements and forecasts are significant for investors and particularly self-funded retirees in pension

mode. Low risk interest bearing investments (e.g. bonds and term deposits) are likely to generate yields that

are substantially below the rate of inflation for years. Therefore, passive and low risk investments will generate

income flows that are well below both the required return to match long term pension liabilities and the short

term cash flow needs of pension payments.

The sustainment of low interest rates was given extra support by the announcement of QE2 by Governor

Lowe. After the first $100 billion of QE is completed, a further $100 billion will be undertaken over the ensuing

12 months. The RBA will buy more bonds than the Commonwealth will issue, and we suspect it will also be

active in State Government bond markets. A particular focus will be on the Victorian and QLD governments

which have blown out their debt as they embarked on border closures.

Given the above, it is remarkable that these pressing issues are not debated in Parliament (bar an interesting

Senate enquiry - see below), nor do they receive serious press coverage or discussion. However, one positive

from this outlook is that no political party would dare contemplate either changes to or debasement of

franking credits. The franking overlay will be essential to sustain pension fund income.

Recovery is occurring and fairly rapidly

Governor Lowe observed that despite the pandemic having very significant economic costs, the downturn was

not as deep as feared, and the recovery has started earlier and has been stronger than expected. Employment

growth has been strong, as have retail sales and new house building. Across many indicators, including GDP,

the outcomes have been better than forecasts and “often better than our (the RBA) upside scenarios as well”.

As an illustration, in August the RBA’s central forecast was that the unemployment rate would end 2020 at

close to 10% and still be above 7% at the end of 2022. In the RBA’s upside scenario, the unemployment rate

was expected to end 2020 a little lower than 10%, but still be around 7% later this year. The actual outcome

for the unemployment rate has been much better than this, with the peak now looking to be behind us and

the unemployment rate ending 2020 at 6.6%.

What explains these better-than-expected outcomes?

The first is the success that Australia has had in containing the virus. That success has meant that the restrictions

on activity have been less disruptive than feared, and allowed more of us to get back to work sooner and it

has reduced some of the economic scarring from the pandemic.

The second factor is the very significant fiscal policy support in Australia, which is almost 15% of GDP. Most

of this support has been delivered by the Australian Government, but the states and territories have also

played a role. This support has been more substantial than was assumed in August, and has provided a boost

to incomes and jobs and helped front load the recovery by creating incentives for people to bring forward

spending.

The View | RBA calls the year ahead 3The third factor is that Australians adapted and innovated: households and businesses have adjusted and

changed what they do and how they do it, and this resilience has helped keep the economy going and kept

people in jobs.

Many firms changed their business models, moved online, used new technologies and reconfigured their

supply lines. Households adjusted too, with spending patterns changing significantly. Some of the spending

that would normally have been done on travel and entertainment has been redirected to other areas, including

electrical goods, homewares and home renovations. Online spending also surged, increasing by 70% over the

past year.

A fourth factor, and one that has not been acknowledged, is the consumption and activity benefits that have

flowed from about 400,000 Australians that have returned from living overseas. Prior to COVID-19 some one

million Australians were living or working overseas. About 40% have now returned (so called expats) and

these people (in the main) have returned with capital (and possibly a tax bill).

This great inflow has to some extent offset the expenditure of overseas tourists. It has also added to the

expenditure that was redirected back into the Australian economy when Australians could not tour offshore.

Despite the flexibility and resilience of the national response, there is still substantial spare capacity in the

Australian economy. The unemployment rate is higher today than it has been for almost 2 decades and many

people cannot get the hours of work they want. And in terms of output, we remain well behind where we

thought we would be: when the National Accounts are published for the December quarter, they are likely to

show that the level of GDP is 4% lower than it was expected to be a year ago.

The View | RBA calls the year ahead 4Inflation is running at 1.25%, well below the medium-term target of 2–3%, and wage growth is the lowest in

decades, with the Wage Price Index increasing by just 1.4% over the past year. Given the spare capacity that

currently exists, these low rates of inflation and wage increases are likely to be with us for some time.

The RBA view of the year ahead

Of course, much will depend upon the path of the pandemic. The development of vaccines in record time

is clearly good news. It has reduced one of the big uncertainties and could provide the foundation for a

vigorous and sustainable recovery in the global economy, even though the global rollout of vaccines faces

challenges and there are a range of other uncertainties about the global economy.

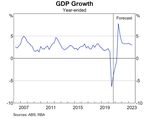

Nevertheless, the RBA has released its forecast of a “central scenario”, which is for the upswing in the Australian

economy to continue, with above-trend growth over the next couple of years. GDP is expected to increase by

3.5% over 2021 and 2022. The level of GDP should return to its end-2019 level by the middle of 2021, which is

6 to 12 months earlier than previously expected.

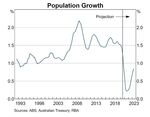

The View | RBA calls the year ahead 5Notwithstanding this recovery, the RBA is expecting that growth in GDP will be checked over the forecast

period by lower population growth. The forecasts of a year ago were expecting the population to grow by

1.6% per year over 2020 and 2021, but the actual outcome is likely to be around 0.2% in 2021, the lowest

since World War I. This slower population growth has a direct effect on the size of our economy and means

that we will not get back to the previous trend for GDP until immigration recommences in earnest at some

point in 2023/24.

In the labour market, the RBA expects the rate of unemployment to continue to decline. In the central

scenario, it is expected to reach 6% by the end of 2021 and around 5.25% by mid-2023. Job vacancies, job

ads and business hiring intentions are at high levels, which suggests continuing solid employment growth

over the next few months. Beyond that, some slowing in employment growth is expected when the JobKeeper

program comes to an end in March.

Given this outlook, the RBA believes that both wages growth and inflation will remain subdued.

In its central scenario, the RBA believes that wages growth will pick up from its current low rate, but to do so

only gradually and still be below 2% at the end of 2022.

Consistent with this, and the ongoing spare capacity in the economy, inflation in underlying terms is also

forecast to stay below 2% over the next couple of years: the central forecast for 2021 is 1.25% and for 2022

it is 1.5%. In passing it should be noted by investors to not become “spooked” by inflation headlines over the

next 6 months. The RBA noted that inflation is expected to spike to around 3% in the June quarter, reflecting

swings in the prices of child care and other administered prices, but then to return to below 2% by the end

of 2021.

The View | RBA calls the year ahead 6Income and household expenditure

Over the next 6 months, household income is expected to decline as the pandemic support payments unwind.

Normally, when income falls, so too does consumption. But we are not in normal times. The extra savings

over the past 6 months and the bigger financial buffers can support future spending – people will have more

freedom to spend as restrictions are eased and be more willing to spend as uncertainty recedes. As noted

above, the 400,000 returned expats will also contribute and ensure that the recovery in consumer spending

continues as parts of JobKeeper fall away from April.

Another important factor bearing on household spending is the housing market. The dynamics in the housing

market look to be in a positive phase, with prices rising across most of the country. It remains to be seen

how long this will continue, but sustainable increases in asset prices support household balance sheets and

encourage spending through positive wealth effects. Higher housing prices can also encourage additional

residential construction and lower mortgage rates are the icing on the cake – so to speak!

Governor Lowe goes to the Senate

After his presentation at the National Press Club, the Governor was joined by his Deputy Governor (Dr Guy

Debelle) and were cross examined (loosely speaking) by the ALP’s Shadow Assistant Treasurer Dr Andrew

Leigh (Harvard PhD and former Professor of Economics at ANU).

Labor Shadow Assistant Treasurer Dr Andrew Leigh

The View | RBA calls the year ahead 7The dialogue between the parties was briefly covered in the press and it is worth reviewing because it seems

that Dr Leigh feels that the RBA is not achieving its mandates of higher inflation, full employment and higher

wages. Dr Leigh’s views seem to echo those of former Prime Minister Paul Keating, who has criticised the RBA

as being behind the economic curve.

The interesting part of the dialogue was Dr Leigh’s thoughts that the level of QE should or could be substantially

increased. In his view, that would drive interest rates lower (bond yields), lower the currency, create demand,

create imported inflation and push up wages.

Nothing that was suggested by Dr Leigh was remarkable - other than it was remarkable that he openly

promoted a massive QE program. Seemingly, he would suggest that Australia’s QE should match that of

overseas Central Banks (whom he also suggested had better qualified executives than the RBA) and maybe

the RBA should buy over 50% of all bonds on issue. Therefore seemingly he would support negative interest

rates for Australia and more extraordinary pain for retirees seeking reliable income.

While Governor Lowe and Dr Debelle did their best to push back against Dr Leigh, the discussion heightens

the risk that cash interest rates in Australia may be pushed negative at some point. Governor Lowe indicated

that cash rates of 0.1% were a ceiling and not a floor.

We therefore retain our strong view that investors need to critically review their portfolios to determine if

adequate income is being generated or is likely to be generated from it in coming years.

General Advice Warning

This document and its contents are general in nature and do not constitute or convey personal financial advice. It has been prepared without

consideration of anyone’s financial situation, needs, or financial objectives. You should obtain a copy of the relevant Product Disclosure Statement

before making any investment decisions.

Before acting on the areas discussed and contained herein, you should consider whether it is appropriate for you and whether you need to seek

professional advice.

The authors and distributors of this document accept no liability for any loss or damage suffered by any person as a result of that person, or any other

person, placing any reliance on the contents of this document.

The View | RBA calls the year ahead 8You can also read