Real Estate PACA - FINDING EXTRA VALUE IN AUSTRALIA'S OFFICE MARKET - APAC Real Estate

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

A PAC

REIT CONSOLIDATION IN SINGAPORE

HINES' CLAIRE THIELKE ON HONG KONG

KEPPEL’S ALPHA IN SEOUL

Real Estate JUNE — JULY 2019

w

FINDING

EXTRA VALUE

IN AUSTRALIA'S

OFFICE MARKETContents

4 Feature: Australian offices 12 China news

Investors face extremely CapitaLand sells Shanghai office to discretionary fund

tight yields in Sydney and EC World buys Hangzhou logistics warehouse

Melbourne's CBD office JLL's Jim Yip on Shanghai offices

markets. How do the other

office markets look today?

13 Hong Kong news

Swire Properties, CMBC sell Hong Kong tower

Hong Kong loses Asia Pacific CRE crown to Beijing

6 Feature: Singapore REITs Wang On Group buys Hong Kong asset for US$99m

Singapore's REIT market is

set for further consolidation,

as trusts look to buy each 14 Australia news

other to gain scale and stand Dexus buys Melbourne office for US$1bn

out from the crowd. Savills' Edward Washer on Sydney logistics

Perron buys half share in Sydney mall

16 Japan news

8 Interview: Claire Thielke

Japan Hotel REIT acquires Tokyo hotel

Hines' new Hong Kong

LaSalle Logiport REIT acquires Tokyo, Osaka logistics

head, Claire Thielke, and her

Invesco J-REIT snaps up offices

team have big plans for the

gateway city and the wider

Asia Pacific region.

18 Singapore news

Frasers Centrepoint Trust buys one-third stake in mall

Perennial, investors sell Chinatown Point Mall

10 Feature: Keppel's Alpha in CapitaLand offloads StorHub self-storage business

Seoul

The private fund manager of

Singapore's Keppel Capital 20 Fund and joint venture news

is pursuing more assets in SC Capital raises US$850m for discretionary property fund

the South Korean capital. ESR raises US$630m for Japanese logistics fund

CapitaLand raises US$391m for discretionary equity fund

Issue 1 / June - July 2019 Cover design: Subscribe to our

Phone +61 413 303 475 Katie Cameron weekly newsletter

APAC Real Estate is your Email news@apacrealestate.com Each week we send out

source for Asia Pacific On the cover a round-up of stories

real estate news and Post PO Box 63, This issue's cover from across the region. If

intelligence. It is North Melbourne image is of Melbourne, features news, interviews

independently published VIC 3051 where the CBD office and deep dives about

and free to read Australia vacancy rate has fallen property markets across

at: APACrealestate.com below 4%. the Asia Pacific region.

Join the conversation Twitter: @apacrealestate | facebook.com/apacrealestate | Linkedin.com/company/apac-real-estate

© 2019 APAC Real Estate. All Rights Reserved.

02 APAC Real Estate Jun-Jul 2019Taking an Asia Pacific view

Real estate is local, the saying goes. However, capital flows In the first edition, we speak with Hines' new Hong Kong,

into real estate continue to become increasingly global. Claire Thielke, about the firm's expansion plans in the

Industry players have outposts in most gateway cities today, region. We check out Australia's various office markets, as

whether they are scouting for new capital sources or yields reach historic lows in Sydney and Melbourne's

undervalued assets. CBDs.

While the US and Europe have long attracted the lion's We also take a look at Singapore's fragmented REIT market

share of institutional real estate investment, Asia pacific and whether a couple of small mergers over the past year

markets are incrementally increasing their share in global are the start of something bigger. And we dive into Alpha

property capital. Investment Partners' recent acquisitions in Seoul.

That's where APAC Real Estate comes in — to track real As this is the first issue, any ideas, tips or feedback would

estate capital flows throughout Asia Pacific, and those be greatly appreciated. You can reach me at

heading into the region. benn@apacrealestate.com.

Benn Dorrington

Editor

APAC Real Estate Jun-Jul 2019 03AUSTRALIA

Sydney and Melbourne CBD office yields

are getting tight. What else is out there?

Sydney, Australia

In sunny Sydney, companies in the central near and far, driving a 13% increase in CBD for A$240m, reflecting a 4.5% yield.

business district have to think twice before Sydney CBD office market investments to Charter Hall Prime Office Fund’s A$804m

relocating to another workplace in A$7.17bn in 2018, reported advisor acquisition of 10 & 12 Shelley Street was

Australia’s largest office market. That’s Colliers. And the heightened appetite for reportedly completed at a similar yield.

because there has been an office supply assets in both locations have pushed down While limited new supply across both

drought in the CBD that has seen the premium yields to 4.8% in the Sydney markets will keep the pressure on available

vacancy rate fall to 4.1% as of January this CBD and 4.7% in Melbourne’s CBD. space and rents, investors will have to keep

year, the lowest it has been in over a “Yields in Melbourne and Sydney are very an eye on rental growth to ensure some of

decade. tight and there’s a perception that people these deals deliver.

"Sydney

Head south to the country’s second largest are buying at tight yields for the

office market, Melbourne CBD, and the opportunity for further rental growth,”

If you did go hard in the

vacancy rate is even lower at 3.2%. While Grant Nichols, fund manager of Centuria or Melbourne market,

the workspace shortages have proven Metropolitan REIT, told APAC Real

you have to ask what sort of

challenging for businesses looking for new Estate. “There is some very strong rental

rental growth you intend to

digs nearby, the high occupancy rates have growth happening through these markets,

accelerated rental growth for landlords in so arguably you can pay 5% yields and in a achieve because if you’ve paid

recent years. couple of years you get the running yield a very tight yield and you don’t

Prime net effective rents in the Sydney and back up to something more palatable

get that rental growth, you’re

Melbourne CBD’s increased 17.5% and because the rental growth has been so

15% respectively during the year to end- strong.” stuck with a fairly low returning

January 2019, according to advisor Knight

Frank. Years of significant rental gains

Last year, Japanese real estate firm Daibiru

Corporation bought the 275 George Street

asset for quite some time,

Nichols said.

"

have enticed real estate investors from prime office development in Sydney’s

04 APAC Real Estate Jun-Jul 2019AUSTRALIA

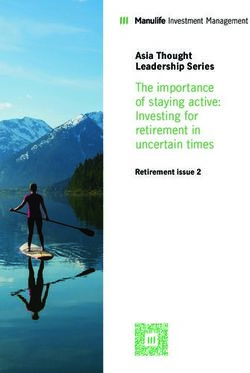

CBD office Overall Vacancy Overall Vacancy Premium Premium investor interest in Australia’s next biggest

markets Rate 1H19 Rate Jan-20 Yields 1H19 Yields Jan-20 office markets, Brisbane and Perth.

These secondary markets are starting to see

Sydney 4.1% 4.4% 4.8% 4.8% the green shoots of an office recovery story

after vacancy rates spiked at 23% in Perth

Melbourne 3.2% 3.4% 4.7% 4.6% CBD and 16% in Brisbane CBD in 2016

and 2017, respectively, according to UBS

Brisbane 13.% 12.5.% 5.3% 5.1%

Asset Management - Real Estate & Private

Perth 18.5% 19.3% 6% 6% Markets.

In a research note, UBS AM-REPM’s

Adelaide 14.2% 14% 6.3% 6.2% Adeline Chan said vacancy rates were now

starting to trend downwards, with rents

Canberra 12.2% 14.6% 6%* 5.9%*

expected to reverse their contractionary

Source: Colliers International / *Grade A space course. “All things considered, Brisbane's

macro story has more legs to stand on than

Perth given the strong population growth

expected as well as the diversified

economic growth drivers, although Perth

appears more attractive from a yield and

After years of growth and yield that will run high capacity trains from the capital value perspective,” Chan wrote.

compression in Australia’s major office outer west suburbs to the outer southeast However, investors should be mindful of

markets, offices markets beyond the CBD via new inner-city underground stations. that the lack of depth and liquidity across

and in other cities are gaining attention. While Melbourne has other long-term the smaller markets in Brisbane and Perth

Beyond the CBD infrastructure projects in the planning do make them a riskier proposition than

Infrastructure and amenities are raising the stages, occupiers are gravitating to metro Sydney and Melbourne.

profile of certain metropolitan and office markets like Richmond and nearby The secondary cities will best suit investors

suburban office markets in Sydney and Cremorne for other reasons. chasing a greater risk tolerance with the

Melbourne. Take the metro office market ability to ride through cycles, while Sydney

of Chatswood, 10km north of Sydney’s and Melbourne, though in the late stages of

CBD, where Centuria Metropolitan REIT the cycle, will remain attractive options for

owns a 9,395 sq.m. office and a quarter investors with a more stable risk profile,

stake in another building. Chan said. Another market to keep in mind

Chatswood prime asset yields range is Adelaide. While the South Australian

between 5.5%-6.25%, while its prime capital has low rents and a CBD vacancy

vacancy rate currently sits below 4%, rate at 13.5%, the city is home to the

according to advisor JLL. However, the Australian government’s A$90bn naval

most exciting development for Chatswood shipbuilding program.

is the $8.3bn newly-opened Sydney Metro Nichols, who has been keeping a close eye

Northwest rail project that will connect the on the Adelaide market after his fund

city’s booming north-western suburbs with bought a 50% stake in the Bendigo &

trains running every four minutes at peak Adelaide Bank headquarters for A$92.3m

times. last year, said the economic flow-on effects

Grant Nichols

The new rail project is the first stage of the of the program were yet to be truly seen in

larger Sydney Metro project, which will Just a few kilometres southeast of the CBD, the city. Finally, Australia's official capital

link up Chatswood to underground stations Richmond and Cremorne have become city, Canberra, has also drawn local and

throughout the CBD and beyond to the innovation hubs, attracting tech companies overseas investor interest in recent months.

southwest by 2024. It will have driverless such as online jobs board SEEK, online Singapore-based SC Capital Partners

trains, the first in the country, and has a real estate portal REA Group and bought the 28,519 sq.m. Finlay Crisp

target capacity of 40,000 passengers per CarSales.com. Centuria’s Nichols said Centre in the capital's civic CBD for

hour, similar to other metro rail systems companies were drawn to the retail A$62m in mid May, with plans for a

worldwide. amenities on offer in those areas as a way A$50m refurbishment. The Centuria

Melbourne is also boosting its public to attract and retain the best talent. Diversified Property Fund then purchased

transport infrastructure, with the Secondary cities the 6,709 sq.m. Optus Centre building in

construction of the A$11bn Metro Tunnel Go further afield and there is growing the CBD for A$35m in late May.

APAC Real Estate Jun-Jul 2019 05SINGAPORE

Singapore REITs

poised for further

consolidation

Singapore real estate investment trusts announced plans to merge and become one float market cap of less than S$500m and

(REITs) have flourished since the early of the largest diversified REITs in almost 40% of them trade less than S$1m

2000s, however players in the crowded Singapore, with assets totalling S$6.8bn. by value a day, according to Principal.

market are now looking to consolidation to The deal would grow its portfolio to seven Additionally, most REITs need to grow by

stand out from the pack. assets, including the $1.8bn One Raffles acquisition because of limited internal

“Singapore’s success as a hub for REIT Place office and retail complex, the growth in Singapore.

listings has been double edged,” Shern S$1.2bn OUE Bayfront office and retail “A low cost of capital is critical for

Ling Koh, portfolio manager for Principal complex and the S$1.2bn Mandarin acquisitions to be accretive but this is

Global Investors in Singapore, told APAC Orchard Singapore hotel, boosting OUE C- harder to achieve for the smaller listed

Real Estate. “Whilst the number of REITs REIT’s market capitalisation to about SREITs with low trading liquidity,” Koh

listed here has grown to 42 today from just S$2.9bn. “The proposed combination of said. “Mergers help to boost scale and

1 back in 2002, the market has become OUE Commercial Trust (OUECT) and trading liquidity thereby improving the cost

more fragmented in recent years.” OUE Hospitality Trust (OUEHT) is a bold of capital. With scale also comes

Things started to change last year though, step but potentially a necessary one in an diversification - tenant departures tend to

when ESR REIT and Viva Industrial Trust era where ‘big is beautiful’ amongst the disproportionately impact smaller REITs.”

announced they would merge to become Singapore-listed real estate investment Looking more broadly, boosting the

the city-state’s fourth-largest industrial trusts (S-REITs),” analysts led by Mervin number of larger and more liquid REITs

property trust. After the merger was Song at DBS Group Holdings said in a note should attract more institutional capital to

completed in October last year, the at the time. The move to merge will not the market. Koh said local/regional private

enlarged ESR REIT had roughly S$3bn in only lift the company profile for some banking and retail money had dominated

assets made up of 56 properties with a total smaller S-REITs, but should also improve the small cap REIT space so far, however a

gross floor area of more than 1.26m sq.m. portfolio diversification and the cost of broader investor base would likely boost

Then in April this year, OUE Commercial capital. More than a quarter of the REITs overall trading liquidity in the sector.

REIT and OUE Hospitality Trust listed on the Singapore exchange have free It would also improve the chances of

06 APAC Real Estate Jun-Jul 2019SINGAPORE

ESR REIT Viva ESR REIT

47 properties Industrial Trust (post-merger)

+ =

AUM: S$1.7bn 9 properties 56 properties

Market cap: S$816m AUM: S$1.3bn AUM: c. S$3bn

6th largest 10th largest Market cap: S$1.7bn

industrial S-REIT industrial S-REIT 4th largest

industrial S-REIT

OUE OUE OUE

Commercial Hospitality Commercial Trust

+

Trust Trust (post-merger)

=

4 properties 3 properties 7 properties

AUM: S$1.7bn AUM: S$1.7bn AUM: S$6.8bn

Market cap: S$1.5bn

Market cap: S$1.3bn Market cap: S$2.9bn

11th largest 24th largest Singapore's 8th

S-REIT S-REIT largest REIT

S-REITs gaining inclusion into global pressure,” he said. “We see merger in Sabana REIT and its manager is in line

equity indices and attract even more opportunities in the industrial and with ESR’s long-term strategy of investing

international attention. In the case of the hospitality REITs space, which has a larger in a broad range of real estate investment

OUE merger, the DBS Group analysts proportion of smaller REITs [below vehicles that would provide us with access

argued “a larger and more liquid OUECT- US$1bn in market cap].” to a portfolio of industrial properties in

HT will likely place it on the radar of a Principal’s Koh also expected more various stages of the property life cycle,”

wider pool of institutional investors and noted ESR co-founders and co-CEOs

potentially result in greater broker Jeffrey Shen and Stuart Gibson. Then there

coverage.”

“Singapore’s is the S$11bn merger of Singapore’s

success as a hub

Principal’s Koh added that there is an government-linked companies CapitaLand

for REIT listings

“arbitrage opportunity” between public and and Ascendas-Singbridge that may also

has been

private valuations, with public valuations, prompt M&A activity. "There may also be

double edged”

especially among smaller S-REITs, looking scope for Capitaland and Ascendas-

Shern Ling Koh

relatively cheaper than private valuations, Singbridge related REITs that are in

where cap rates have compressed overlapping sectors to merge given that

significantly. Vijay Natarajan, an analyst at they now all fall under the same parent,”

RHB Research Institute Singapore, said in consolidation to come, particularly in the Koh said. Ascendas-Singbridge owns the

a note that there had been increasing M&A more fragmented industrial REIT space. Ascendas REIT, Ascendas Hospitality

interest among S-REITs, driven by limited Take Hong Kong-headquartered logistics Trust and Ascendas India Trust, while

acquisition options in the local market, property platform ESR, which owns the CapitaLand owns the CapitaLand Mall

favourable REIT market conditions and ESR REIT and took control of logistics- Trust, CapitaLand Commercial Trust,

aspirations to grow larger to better focused Sabana REIT in May after Ascott Residence Trust, CapitaLand Retail

compete. The trend is likely to continue, acquiring a 9.9% interest in the trust and a China Trust and CapitaLand Malaysia Mall

with more smaller REITs feeling the 51% stake in its manager. “The investment Trust.

APAC Real Estate Jun-Jul 2019 07HONG KONG

Hines’ Claire Thielke on value-add

opportunities in Hong Kong

US real estate firm Hines is seeking out what we call the ‘Hines Alpha.’” property management activities. In fact, the

opportunities to wield its value-add While Hines is arguably best known as an firm has sponsored almost 60 investment

capabilities in Hong Kong, as it maps out office developer, the firm has notched up funds, on top of numerous one-off vehicles,

its Asia Pacific expansion plans from the experience across most real estate asset totalling US$51.2bn of equity since it was

financial capital. The US$120.6bn privately classes, in addition to investment, asset and founded in 1957.

owned business opened its first Hong Kong “Another opportunity that excites us about

office earlier this year, appointing former Hong Kong and the platform here is the

Hines Investment Management COO Claire opportunity to partner with property

Thielke to lead the new team as managing holders on joint venture redevelopments or

director. provide third-party services, such as

“As a global firm, one of our differentiators development management,” the MD said.

is that we can really look across the “Part of the reason these partnerships can

spectrum of our own coverage and look at be so compelling is that they tend to work

where there are trends or changes well when you have long-time generational

underway or taking hold in one market and landlords, of which there are many in Hong

not in others,” Thielke told APAC Real Kong.”

Estate. “We are particularly enthusiastic The firm sees opportunities to work with

about the value-add space and asset local landlords and deploy the latest

repositioning where we can draw on Hines’ technology and trends to extract more value

development expertise. We’re actively from their assets. “As a JV partner or a

looking across the product spectrum for the third-party provider, we work with partners

right opportunities where we can apply Claire Thielke to implement that on portfolios that they

08 APAC Real Estate Jun-Jul 2019HONG KONG

already have or even individual buildings, so that’s Hines in

something that we would look to do here,” she said.

Asia Pacific

The new outpost will also serve as Hines’ Asia

Pacific headquarters, where co-CEO Ray Lawler 1996

will oversee the firm’s activities across the region. Opens first Asia

Pacific office

“The launch of the APAC headquarters in Beijing

really coincides with the launch of Asia

Pacific as its own independent region at

Hines and that’s a very big deal because

it’s been 25 years since Hines has

2001

launched an independent region,” Acquires

Thielke said. Hyundai Motor

Tower, Beijing

“It is a big shift to have Asia Pacific as its own

region with its own flexibility and ability to spread

its wings across numerous markets, while also

continuing to build on the incredible work that our

teams led by David Warneford in Australia and

2002

James Morrison in China.” Hines has had a presence

Completes

in the region since 1996, when it planted its first

Embassy House

outpost in Beijing to oversee its China operations. development,

The firm made its inaugural Asia Pacific acquisition Beijing

in the Chinese capital with the purchase of the 24- Above: Hyundai Motor

storey Hyundai Motor Tower in 2001. It then Tower in Beijing, Hines' first

completed its maiden development, the 32-storey purchase in Asia Pacific.

Embassy House apartment tower in Beijing, in 2002.

Below: The firm's first

The company then established its Australian

2012

APAC development, the

business in 2012, and set up offices in Seoul and Establishes

Tokyo in 2013 and 2017, respectively. Thielke and Embassy House in Beijing. Australian platform

Drew Huffman, who was also appointed director in Sydney

when the new office was announced, will not only

oversee the Hong Kong operations, but will also be

scouting out new business opportunities across the

region. While Hong Kong continues as an important

gateway city to Asia, the special administrative

2013

region has its risks. Advisor Colliers noted that

Sets up

various sectors of Hong Kong’s property market Seoul office

have slowed since the second half of 2018, not to

mention the broader issues of a slowing global

economy and the US-China trade war.

For Thielke, it’s about finding defensive strategies,

as well as taking a rigorous and thoughtful approach

2017

when deploying capital. The Hong Kong team will Establishes

also be looking for opportunities arising from the Tokyo office

Greater Bay Area infrastructure boom that is

connecting Hong Kong, Macau and nine cities

within China’s Guangdong province.

Colliers believes the Greater Bay Area plan and the

likely very slow pace of interest rate increases this

year should “offset any slower economic growth

2019

Opens Asia Pacific

from the trade war”. “We are committed to the

headquarters

region and believe in the underlying fundamentals of

in Hong Kong

it,” Thielke said. “We’re taking a long-term view.”

APAC Real Estate Jun-Jul 2019 09SOUTH KOREA

Keppel's Alpha seeks out value-add in Seoul

Alpha Investment Partners, the private fund “We are confident that 42,300 sq.m. Yeouido Finance Tower in

management arm of Keppel Capital, is the Yeouido business district (YBD), the

scouting out real estate assets in Seoul after

more can be achieved 20-storey Nonhyun Building in the

acquiring a trio of offices in the South with the establishment Gangnam business district (GBD) and the

Korean capital earlier this year.

of Keppel Capital’s local 13,000 sq.m. Naeja Building in the

The Singapore-based firm is not new to the Gwanghwamun CBD. The Alpha CEO said

city, having managed in excess of US$4bn

asset management arm, the firm improved its assets by expanding

worth of office, retail, logistics and hotel Keppel Investment leasable space, introducing creative design

assets across South Korea since 2004. That

Management (KIM) in works, rejuvenating the properties as well

said, the Keppel Capital group has invested as managing costs. “For instance, we have

more than KRW 680bn (US$570m) in the

Seoul, in 2018.” acquired buildings with relatively low

city since April and has had a local team on In late April, Keppel Capital-managed occupancy rates, and through proactive

the ground to source deals and oversee Keppel REIT exchanged contracts to buy leasing efforts, we have increased the

asset and leasing management for almost a the 28-storey T Tower in Seoul’s CBD occupancies to over 90%, as well as

year. from investment manager PGIM Real improved the average rentals of our assets

“As an active investor in the Seoul market, Estate for KRW 252.6bn, marking the substantially,” he said.

we continue to see attractive opportunities trust’s first office deal in the city. Then in The string of deals follows a record year

that fit well with our value-add investment May, Alpha’s Alpha Asia Macro Trends for office investments in 2018, with total

strategy, in particular for the Alpha Asia Fund III acquired three grade-A office and investments reaching KRW 11 trillion in

Macro Trends Fund series,” Alpha CEO retail complexes in the city for about KRW Seoul, according to advisor Savills. The

Alvin Mah told APAC Real Estate. 430bn. The deal comprised the demand for real estate in Asia’s fourth

10 APAC Real Estate Jun-Jul 2019SOUTH KOREA

largest economy has been strong among

domestic and foreign buyers alike,

especially for offices in the capital.

Limited supply in Seoul has drove the

average vacancy rate for prime offices

down to 11.7% in 1Q19, Savills noted. The

contraction was driven by no new prime

space entering the market, while net

absorption reached 37,200 sq.m. during the

quarter. Co-working operators continue to

expand throughout the city, with

Singapore’s JustCo leasing space at Seoul

Finance Center in the CBD earlier this

year, while IT-related businesses continue

to grow their footprint. Average prime

office rents have increased 1.4% year-on-

year across Seoul, with CBD rents posting

the highest gains at 1.7% YOY.

The supply story is expected to turn around

though, with more than 1.1m sq.m. of new

prime space projected to come onto the

Seoul market over the next five years, says

advisor Colliers. YBD will be the market to

watch, with supply peaking in 2020 when

new grade A offices like the 393,305 sq.m.

Park One and Korea Post Building 68,431

sq.m. are scheduled for completion.

On the investment side, competition has

pushed average prime office cap rates to

mid-4% during the first quarter, according

to Savills. The market is also watching the

South Korean economy closely after GDP

grew by 1.8% YOY in 1Q19, the weakest

rate of growth since 2009, while keeping an

eye on late-cycle conditions and the

ongoing US China trade war.

“While market cycles and political trends

may temporarily impact the office real

estate sector, structural shifts in the market

will play a more definitive role in the Clockwise from top left:

development and use of commercial Seoul prime office vacancy rates, 1Q19 T Tower; Yeouido Finance

Source: Savills Tower; Naeja Building;

space,” Alpha’s Mah said. “For Alpha, we

20%

will stay close to the market, taking a and Nonhyun Building.

pragmatic approach in our investment

strategy.”

15%

Globally, Alpha Investment Partners has

completed more than 160 transactions

worth more than US$20bn in total since 10%

2004. Keppel Capital, which has US$21bn

of assets under management, is the asset

management arm of Keppel Corporation, 5%

the Singapore-listed conglomerate with

offshore and marine, property,

0%

infrastructure and investment businesses. CBD GBD YBD OVERALL

APAC Real Estate Jun-Jul 2019 11CHINA

Singapore’s CDL

pays US$973m JLL's Jim Yip on

Shanghai offices

Q&A

for Chinese

developer, How much investor appetite has there been for Shanghai offices this year?

Shanghai asset

Shanghai’s real estate investment transactions have shown strong signs of growth

since the start of 2019. Foreign capital has become the talk of the town and there

stakes has been no let up from domestic players. JLL statistics show that total transaction

volumes for Shanghai's real estate investment market reached an accumulative

48.9 billion RMB in Q1, representing a year-on-year increase of 136%. China's

Singapore-listed City Developments economic growth is increasingly on a path of stability and sustainability,

Limited (CDL) agreed to buy a 24% stake maintaining a medium-to-high growth rate in recent years. China’s, especially

in Chinese developer Sincere Property Shanghai’s continued reforms and opening up has made it increasingly attractive

Group and a majority stake in one of its to foreign investment. Meanwhile, the increasingly tightening of China's property

Shanghai commercial assets for a financing channels drives cash-strapped companies to offload their high-quality

combined RMB 6.7bn (US$973.3m). The assets for liquidity, thereby shifting market enthusiasm gradually from sellers to

deal marks CDL’s single largest buyers. Financially strong domestic and foreign buyers have more opportunities to

investment in China and expands the find suitable assets in the market.

firm’s geographical presence from 3 cities

to 20, the buyer said in May. Yip is Head of China Capital Markets at JLL

CDL will pay RMB 5.5bn for its stake in

Sincere, gaining board representation as it

becomes the firm’s second-largest EC World REIT CapitaLand sells

shareholder after the target’s founder and

chairman Wu Xu. The Singaporean buys Hangzhou Shanghai office to

logistics property discretionary fund

property firm also purchased a 70%

interest in Sincere’s Shanghai Hongqiao

Sincere Centre, a prime commercial asset

in the heart of Shanghai’s Hongqiao CBD,

for US$164m for US$452m

for RMB 1.2bn. Singapore-listed EC World REIT agreed Singapore-listed CapitaLand has sold the

The 35,739 sq.m. property includes to buy a three-storey e-commerce Innov Center in Shanghai’s Yangpu

offices, serviced apartments, a retail warehouse and two 14-storey offices in the district to its maiden discretionary fund,

component and a basement carpark. Chinese city of Hangzhou for a combined CapitaLand Asia Partners I, for RMB

“Rapid urbanisation, economic growth and S$223.6m (US$164m). The Fuzhou E- 3.1bn (US$451.6m). “Shanghai Innov

rising disposable incomes will continue to Commerce property features 171,795 Center, a predominantly office integrated

drive demand for real estate in China," sq.m. of warehouse space and 42,489 development located in a mature,

said CDL CEO Sherman Kwek. sq.m. of office and auxiliary area, the technology-focused decentralised office

"Leveraging Sincere’s development and buyer announced in May. The fully- market, was acquired in 2017 to be the

asset management capabilities, local occupied property is let to Fuyang Yunton seed asset to kickstart CapitaLand’s

expertise and wide geographical presence E-Commerce and Zhejiang Yuntong E- discretionary fund business,” CapitaLand

in China, CDL will be able to significantly Commerce on five-year leases, with Group CEO and president Lee Chee

boost its scale and accelerate its growth in further five-year options. Koon said.

this huge market with a substantial Hangzhou, the capital of the Zhejiang CapitaLand plans to divest the Pufa

portfolio and pipeline of development province, has a population of 9.8m and is Tower, an office development in

projects and investment properties." one of the core cities in the Yangtze River Shanghai’s prime Lujiazui CBD, to CAP I

Sincere’s founder and chairman Wu Xu Delta Economic Zone. The city, home to as well. A joint venture between the firm

added: "CDL’s investment and support Alibaba Group’s global headquarters, has and an unnamed investor bought a 70%

will be instrumental in accelerating become a hub for e-commerce, where the interest in the 34-storey building for

Sincere’s growth as we continue to sector grew by 17.5% in Hangzhou last RMB2.75bn (S$546m) in January. The

increase our land bank and pipeline of year. EC World REIT invests in real estate real estate firm raised US$391m in the

properties with the aim of achieving even used primarily for e-commerce, supply- first closing of CAP I last month, focusing

stronger sales growth.” chain management and logistics purposes. on assets in Singapore, China and Japan.

12 APAC Real Estate Jun-Jul 2019HONG KONG

Swire Properties,

CMBC sell Hong

Kong tower for

US$605m

Swire Properties, CMBC sell Hong Kong

tower for US$605m Hong Kong-listed

Swire Properties and China Motor Bus

Company (CMBC) have agreed to sell a

26-storey office in Hong Kong’s North

Point area for HK$4.75bn (US$605.2m).

The two vendors separately announced the

disposal of their 50% stakes in the 625

King’s Road property, with Swire

Properties noting that it would record a

HK$965m statutory gain on the sale.

CMBC said they initially received an

unsolicited offer from a special purpose

vehicle owned Gateway Real Estate Fund

VI, a fund managed by Hong Kong-based

Gaw Capital, Mingtiandi reported.

The 28,000 sq.m. grade-A tower is served

by the North Point MTR station and is a

Hong Kong

short distance from the Taikoo Place

Wang On Group Hong Kong loses business community. The office building,

which oversees Victoria Harbour, is

buys Hong Kong Asia Pacific CRE occupied by a mix of financial, investment

and professional services corporations.

asset for US$99m crown to Beijing The deal is expected to close in July this

year. The transaction follows Gaw

Hong Kong-listed Wang On Group and its Beijing became the top Asia Pacific Capital’s HK$12bn acquisition of a

subsidiary Wang On Properties have metropolitan commercial real estate portfolio 12 shopping centres in Hong

agreed to buy a commercial podium at a investment market for the first time, just Kong from Link REIT in December.

Hong Kong residential community for beating Hong Kong in the first quarter of Gaw Capital, which has US$18bn of assets

HK$780m (US$99.4m). The two investors 2019. The Chinese capital recorded under management, has raised five co-

bought the holding company that owned investments totalling US$4.46bn in 1Q19, mingled funds targeting the Greater China

the commercial accommodation of The while Hong Kong reported US$4.42bn, and APAC regions since it was established

Parkside complex, the buyers said in an according to data provider Real Capital in 2005.

announcement. Analytics. The firm also manages value-

The asset, located at 18 Tong Chun Street Beijing leapfrogged to the pole position add/opportunistic funds in Vietnam and the

in the New Territories’ town of Tseung from seventh place in 2018, thanks to two US, as well as a pan-Asia hospitality fund

Kwan O, has 32,564 sq.ft. of total lettable mega deals worth more US$1.3bn. and a European Hospitality Fund.

space, along with 49 car parking spaces. “Traditionally, Beijing was considered a Established in 1972, Swire Properties has

The existing tenancies are all held under a government city, more than a major investments across Hong Kong, mainland

fixed term with the earliest ending this year commercial real estate investment target,” China, Singapore and the US.

and the latest running until 2021. said Petra Blazkova, senior director of Listed on the Hong Kong stock exchange,

The vendor is a vehicle jointly owned by analytics for Asia Pacific at RCA. “Cross- Swire develops and manages commercial,

Angelo, Gordon and Company and Mordril border capital flows, however, appear to be retail, hotel and residential properties such

Properties, according to a Mingtiandi changing the nature of the market and the as Pacific Place mixed-use development in

report. The deal is scheduled to close in city is becoming more appealing to Hong Kong and the Taikoo Li Sanlitun

July this year. institutional investors.” mixed-use complex in Beijing.

APAC Real Estate Jun-Jul 2019 13AUSTRALIA

Dexus buys Centuria enters Salter Brothers

Melbourne office into Australian snap up Brisbane

for US$1bn healthcare hotel for US$103m

Australian REIT Dexus and the Dexus Australian-listed Centuria Capital has Melbourne-based fund manager Salter

Wholesale Property Fund have teamed up expanded into Australia's healthcare real Brothers Group have purchased the Next

to buy an office asset in Melbourne from estate sector after acquiring a majority Hotel in Brisbane from financial services

Brisbane-based QIC Global Real Estate stake in Heathley Limited for A$24.4m firm Challenger for A$150m

for A$1.476bn (US$1.03bn). The 80 (US$16.9m). Heathley is a specialised (US$103.9m). The 4.5-star hotel has 304

Collins Street precinct comprises 105,000 healthcare property fund manager with rooms in the city's Queen Street Mall,

sq.m. of net lettable area in the CBD, A$620m of assets under management, according to the Urban Developer.

including an existing 47-storey grade A including medical centres, day hospitals The property was formerly known as the

office tower, the buyer announced in May. and tertiary aged care. Lennons Hotel Brisbane, but was

The complex also features a new 35-level Following the transaction, the vehicle will refurbished and reopened with Singapore

office tower, a new retail podium with 21 be renamed Centuria Heathley and operator Next Story Group in 2014.

occupiers and a 255-room boutique hotel. Centuria's total AUM will grow to Challenger bought the rebranded asset for

Dexus also raised A$900m in an A$6.2bn. The new vehicle has the capacity A$133m in 2015. The deal grows SBG's

institutional placement to partly fund its to expand to about A$1bn in AUM in the hotel portfolio about A$1bn, made up of

share of the purchase. near term through known potential more than 2,400 rooms across seven hotels

Under the deal, Dexus will own a 75% projects. in Australia. “The transaction represents a

stake and DWPF will hold the outstanding Centuria said the Australian healthcare strong opportunity for us to enter the

25% interest. The buyer said the precinct real estate sector was highly fragmented, Brisbane market at this point in the cycle,

was acquired at a 5.3% equivalent yield with a limited number of securatised and as we expect the market to continue to

and a circa 8% IRR. institutional real estate managers in the recover in the coming years as new supply

“Following the acquisition of 52 and 60 space. is absorbed,” Robert Salter said.

Collins Street last year, this acquisition

further enhances our scale and presence in

the tightly held ‘Paris end’ of the

Melbourne CBD, a prime location where

our customers want to be,” said Dexus

CEO Darren Steinberg. “Importantly,

Savills'

Edward Washer

Q&A

vacancy in the Melbourne CBD office

market is nearing an all-time low,

supported by strong population growth and

on Sydney logistics

significant pre-commitments across the

How active has Sydney's industrial and

upcoming supply pipeline.”

logistics investment market been this year?

80 Collins Street, Melbourne

With a very active 2018, 2019 has seen a significant amount of interest in Sydney’s

industrial and logistics market. Due to drivers in the market, we have had a scarce

level of on-market activity and have therefore not satisfied the demand. Interest

levels have been extremely high, however due to further reduced supply, we haven’t

seen many landmark purchases.

What is your outlook for the rest of the year?

I believe we will see a highly competitive and active back end of the year, due to the

level of interest already in the sector and the amount of active groups that are

seeking core assets in strategic locations. The market has shown there is more

runway to go in the cycle, and I believe we will see yields tighten further to record

levels throughout the second half of 2019. Sydney’s industrial market is heavily

supply-constrained, which will continue to underpin the performance of the market.

Washer is Director & Head of South Sydney office – Industrial & Logistics at Savills

14 APAC Real Estate Jun-Jul 2019AUSTRALIA

Charter Hall fund

bags Adelaide

Melbourne, offices

for US$192m

Charter Hall‘s PFA fund has purchased

two offices in Melbourne and Adelaide for

a combined A$275m (US$192.3m),

marking its first deals in either CBD

market. The fund bought the 737 Bourke

Street building in Melbourne for A$192m

and the 121 King William Street property

in Adelaide for $82.25m, the company

announced in May.

Westfield Burwood shopping centre

Located near Southern Cross train station,

Perth's Perron GPT buys five

the grade-A Melbourne asset offers 18,500

sq.m. of net lettable office and retail area.

buys half share Sydney logistics

The nine-storey property is 98% occupied,

with tenants including Lion Dairy and

Drinks, owned by the global Kirin

Holdings, Symbion Health and the

in Sydney mall warehouses for

Victorian Building Authority.

It has a 5.5-year weighted average lease

for US$398m US$147m

expiry (WALE) and average rent reviews

Perth-based Perron Group has agreed to Australian property firm GPT has snapped

of 3.7% per annum. Charter Hall noted that

acquire a 50% share in the Westfield up five prime logistics properties in Sydney

the Docklands precinct was reaching

Burwood shopping centre in Sydney for A$212m (US$146.8m) and started a

capacity with limited future supply

from Scentre Group for A$575m new development in Melbourne’s west.

opportunities and high tenant demand

(US$398.2m), reflecting a 4.1% premium. The Sydney assets have a total lettable area

driving down the precinct’s prime vacancy

The 63,248 sq.m. shopping centre is of 88,200 sq.m., a combined weighted

rate to 0.7%, as of end-2018.

located near Burwood train station in average lease expiry of 8.6 years and an

“These acquisitions reflect strategic

Sydney’s inner west, Scentre Group initial passing yield of 5.4%.

investments in the core Melbourne and

announced in May. The acquisitions are expected to close in

Adelaide office markets which are

Situated 12km from the CBD, Westfield July, the buyer said in May.

continuing to experience strong tenant

Burwood has 230 stores, including anchor The group, which has A$24bn of assets

demand and effective rental growth,” Head

tenants David Jones, Kmart, Target, Event under management, also started a 26,000

of Charter Hall Direct, Steven Bennett,

Cinemas, Coles and Woolworths. sq.m. logistics project at Truganina in

said. Charter Hall is an Australian-listed

“We are excited by the unique opportunity Melbourne’s west. “These acquisitions and

property fund manager, with A$28.4bn of

to invest in one of the highest quality developments are consistent with GPT’s

assets under management.

shopping centres in Australia,” said Perron strategy to grow our position in the

737 Bourke Street, Melbourne

Group CEO Ross Robertson. “Westfield logistics sector,” said GPT CEO Bob

Burwood is one of the top 50 shopping Johnston. “The assets are all well located

centres in Australia with customer with good access to transport links and will

visitation of more than 14m per annum and benefit from ongoing demand and

total retail sales of close to $500m.” constrained supply.”

The shopping centre was first built in 1966 The deal comes after GPT acquired two

and then later rebuilt in the late 1990s to prime logistics assets and an 8.9-hectare

reopen in 2000. Perron Group already parcel of land in the western Melbourne

owns 50% stakes in Westfield Woden in suburbs of Derrimut and Truganina in

Canberra, Westfield Airport West in February this year. GPT, which owns retail,

Melbourne and Westfield Geelong in the office and logistics, is one of Australia’s

Victorian city of Geelong. largest diversified property groups.

APAC Real Estate Jun-Jul 2019 15JAPAN

Sekisui House

sells office,

housing assets

for US$642m

Japanese developer Sekisui House has sold

three offices and four residential buildings

across Tokyo, Osaka and Kanagawa to its

Sekisui House REIT for JPY 70.14bn

(US$641.8m).

The transaction included the 12,472 sq.m.

Akasaka Garden City office building

valued at JPY 28.7bn in Tokyo’s Minato

ward, the company said in May.

Hilton Tokyo Odaiba hotel The asset is located in a highly-

concentrated business district in central

Japan Hotel REIT Invesco J-REIT Tokyo and is near the Akasaka-mitsuke,

Nagata-cho and Aoyama-itchome train

acquires Tokyo snaps up offices stations.The portfolio featured the 7,341

sq.m. Garden City Shinagawa Gotenyama

hotel for US$561m for US$74m office in Tokyo’s Shinagawa area, as well

as the 12,958 sq.m. Hommachi Minami

Japan Hotel REIT purchased a 453-room Invesco Office J-REIT acquired two offices

Garden City office in Osaka.

hotel in Tokyo for JPY 62.4bn in Tokyo and Yokohama City from Godo

The J-REIT said the Garden City

(US$561.5m) to take advantage of the Kaisha Wing Property for a combined JPY

Shinagawa Gotenyama asset was located in

upcoming 2020 Tokyo Olympics. The 4- 8.14bn (US$74.2m). The REIT acquired

a highly appealing for leading foreign

star Hilton Tokyo Odaiba hotel is located the Otowa Prime Building in Tokyo for

companies, with four nearby trains stations.

in Odaiba, one of the most popular tourist JPY 6.83bn and the Techno Wave 100

The Hommachi Minami Garden City

destinations in the capital, and comes with property in Yokohama City for JPY

property is positioned on Midosuji Street,

multiple Japanese, Western and Chinese 1.31bn. The 5,719 sq.m. Tokyo property is

Osaka’s main street and home to numerous

restaurants and other facilities, the REIT located in the city’s Bunkyo ward, home to

financial institutions including banks and

announced. tertiary institutions including The

insurance companies.

Various events for the Tokyo 2020 University of Tokyo, University of

The portfolio had three Tokyo apartment

Olympics and Paralympics are set to be Tsukuba and Ochanomizu University. The

complexes comprising more than 6,000

held in the Odaiba area. Additionally, the REIT said the property, situated near the

sq.m. of lettable area, as well as the 2,723

international broadcasting centre and main Gokokuji and the Edogawabashi metro

sq.m. Esty Maison Yokohama-aobadai

press centre will be situated at the nearby stations, was a rare find due to a shortage

North residential building in Yokohama, a

Tokyo Big Sight exhibition centre. of office buildings and relatively new

city south of Tokyo.

The transaction grows JHR’s portfolio to buildings available for lease in the area.

The deal will grow Sekisui House REIT’s

43 hotels across the country, totalling JPY The 18-storey Yokohama asset has 50,463

portfolio to 120 properties worth a

374.5bn (US$3.37bn). The deal comes as sq.m. of total floor area and is close to the

combined JPY 527.5bn.

Japan’s number of overseas tourists Kanagawa-Shimmachi train station, which

The deal follows Invesco Office J-

increased 8.7% year-on-year to 32.1m in is one stop away from the Yokohama

REIT’s acquisition of two offices in Tokyo

2018, surpassing the 30m mark for the first central station. A lack of new supply

and Yokohama from Godo Kaisha Wing

time ever, according to advisor Savills. in Yokohama City has pushed the office

Property for a combined JPY 8.14bn

Japanese authorities have set a goal to vacancy rate to about 3%, as of 3Q18. “The

(US$74.2m) earlier this month.

reach 40m annual visitors by 2020, when property is expected to be attractive to

Sekisui House REIT was listed on the

Tokyo hosts the Olympic games. There tenants who look for wide spaces for

Tokyo stock exchange in 2014 and focuses

were JPY 287bn worth of transactions in reasonable rent level in the area

mainly on prime residential, office and

Japan’s hotel investment market in 2018, surrounding Yokohama or Tokyo

hotel real estate across Tokyo, Osaka and

down 3% on the previous year. metropolitan area,” the company said.

Nagoya.

16 APAC Real Estate Jun-Jul 2019JAPAN

LaSalle Logiport ESR purchases J-REIT IIF snaps

REIT acquires Tokyo site for up Japanese

logistics assets US$1bn mega assets for

for US$259m logistics park US$225m

LaSalle Logiport REIT (LLR) agreed to Logistics real estate platform ESR bought a Tokyo-listed Industrial & Infrastructure

buy three warehouses and two land plot in the Greater Tokyo area and plans to Fund (IIF) acquired five commercial

leaseholds located across Tokyo and Osaka invest more than US$1bn to develop it into properties located across Japan worth a

for a combined JPY 28.39bn (US$259.4m). one of the biggest logistics parks in Japan. combined JPY 24.65bn (US$224.9m). IIF,

The Tokyo-listed firm also announced it The initial phase of the ESR Yokohama a J-REIT managed by Mitsubishi Corp-

was divesting its LOGIPORT Hiratsuka Distribution Centre will feature two UBS Realty, purchased the parcel of

Shinmachi warehouse for JPY 7.7bn. modern, four-storey logistics warehouses logistics, manufacturing, research and

The company said the newly-acquired totalling 393,226 sq.m. in gross floor area. development facilities from different

assets comprised large-scale, high The site is located on Tokyo Bay in the sellers, the company said. The firm

specification modern logistics facilities, as southern part of Yokohama, a city in the acquired the IIF Shin-Kawasaki R&D

well as leasehold parcels of land with Kanagawa Prefecture — some 45km from Centre in Kawasaki-shi, a city in the

future redevelopment potential. the Tokyo CBD. “Low vacancy and Greater Tokyo area, from Mitsubishi

In the Greater Tokyo area, the J-REIT continued strong demand coupled with the Logisnext for JPY 6.3bn, reflecting a net

bought the 40,773 sq.m. LOGIPORT constrained supply of premium space operating income (NOI) yield of 7.4%. The

Kashiwa Shonan warehouse from BTS5 around Tokyo Bay makes this Yokohama company bought the 31,071 sq.m. IIF

Real Estate Hanbai GK for JPY 9.3bn, site a rare opportunity,” ESR co-CEO Akishima Logistics Centre in Akishima-

reflecting a net operating income (NOI) Stuart Gibson and ESR president Charles shi, a city in the western part of the Tokyo

yield of 5.1%. de Portes said together in a statement. The Metropolis, from a private seller for JPY

The fully-let asset is located in the Shonan project is backed by ESR’s Redwood Japan 8.02bn, representing a 4.3% NOI yield.

industrial complex, home to many large- Logistics Fund 2, Equity International (EI) The IIF Ichikawa Food Processing Centre

scale logistics facilities, and is near and a major US pension fund. The plot is in Ichikawa, another city in the Greater

National Route 16, where it can service the only 15km from Yokohama Port; 30km Tokyo area, was purchased from

Greater Tokyo area. away from Haneda International Airport; Mitsubishi Corporation Urban

The company bought the 23,565 sq.m. and about 40km from the Port of Tokyo Development for JPY 6.2bn. The company

LOGIPORT Sayama Hidaka warehouse in container terminal. The vacancy rate of also acquired the IIF Hyogo Tatsuno

the Greater Tokyo area from Kawagoe logistics warehouses in the Tokyo Bay area Logistics Centre in Tatsuno-shi, as well as

Nishi GK for JPY 6.43bn at an NOI yield stood at 2.4% at the end of 2018, according the IIF Gifu Kakamigahara Manufacturing

of 4.6%. The fully-occupied property is to advisor CBRE. Centre in the city of Kakamigahara.

also near National Route 16, with good

access to the Tokyo consumption area,

Tama region and Central Saitama region.

In Osaka, the company purchased a 25%

stake in the LOGIPORT Osaka Taisho

property from OTL1 GK for JPY 7.14bn.

LLR also acquired leasehold land at the

Higashi Ogishima site in the Greater Tokyo

area and the Suminoe property in Osaka.

Listed on the Tokyo stock exchange in

2016, LaSalle Logiport REIT invests in

prime logistics real estate across Tokyo and

Osaka. The J-REIT owns a portfolio

comprising 11 properties worth JPY

189.1bn in total. It is sponsored by US-

headquartered LaSalle Investment

Management, which has US$64.3bn of

assets under management.

APAC Real Estate Jun-Jul 2019 17SINGAPORE

Oxley sells

Chevron House

complex for

S$1.025bn

Listed property developer Oxley Holdings

has agreed to dispose of the Chevron

House complex in Singapore for as much

as S$1.025bn (US$758m).

The 24,273 sq.m. property at 30 Raffles

Place features 27 storeys of office

accommodation and a 5-level retail

podium, according to an announcement.

The purchaser, Golden Compass (BVI), is

reportedly a fund managed by US

investment manager AEW, according

to a Mingtiandi report. The deal follows an

unsolicited offer made by AEW for the

asset in March this year.

Oxley said it had commenced

refurbishment works on the property in

Waterway Point mall March that would be completed before the

deal closed.

Frasers Centrepoint Trust buys one- The S$1.025bn deal comprises the

acquisition of Chevron House’s holding

third stake in shopping centre for company, Oxley Beryl, and existing bank

loans.

US$319m Golden Compass will acquire 82.35% of

Oxley Beryl for S$210m on first

Frasers Centrepoint Trust (FCT) has It will also acquire a third interest in FC completion, and then pay the outstanding

acquired a one-third interest in the Retail Trustee, the trustee-manager of SST, amount and take over the existing loans on

Waterway Point mall in Singapore from as well as taking on a S$191m loan. final completion.

another Frasers Property subsidiary for FCT will fund the deal through a private The deal comes after a strong first quarter

S$440.6m (US$319.9m). Waterway Point placement of new units and a non- in Singapore’s commercial real estate

is a 34,485 sq.m. suburban shopping centre renounceable preferential offering of new investment market, according to Colliers.

located next to the Punggol light rail and units to existing unitholders. Office and retail property investment

train station, Frasers Property announced in FCT is listed on the Singapore stock quadrupled year-on-year to S$1.1bn

May. exchange and owns a S$2.77bn portfolio of (US$800m) due to the Manulife Centre and

The property is 98.1% occupied and has a suburban shopping centres throughout Rivervale Mall deals.

wide range of tenants including FairPrice Singapore. “We expect favorable fundamentals in the

Finest, Shaw Theatres, Uniqlo and H&M. It owns the Causeway Point, Northpoint Singapore office market, steady office

The shopping centre had an annual footfall City North Wing, Anchorpoint, YewTee rental growth and a supply shortfall over

of 29.1m in 2018, up 3.9% on the year Point, Bedok 2019-2021 to support investors’ interest for

prior, while tenant sales also rose 10% to Point and Changi City Point malls. commercial properties,” the advisor wrote

S$379.1m last year. Frasers Property said FCT holds an 18.8% stake in PGIM Real in its 1Q19 update.

the mall, valued at S$1.3bn, was located in Estate AsiaRetail Fund, a non-listed retail Oxley Holdings is a Singaporean property

a favourable catchment area supported by fund that owns six malls and an office in developer, with a portfolio of development

strong population growth. Singapore and four shopping centres in and investment projects in Singapore, the

The deal will see FCT acquire a third of Malaysia, as well as a 31.15% stake in United Kingdom, Ireland, Cyprus,

Frasers-owned Sapphire Star Trust (SST), Malaysia-listed retail REIT, Hektar Real Cambodia, Malaysia, Indonesia, China,

which owns the mall. Estate Investment. Myanmar, Australia, Japan and Vietnam.

18 APAC Real Estate Jun-Jul 2019SINGAPORE

Perennial, CapitaLand UOL, UIC buy out

investors sell offloads StorHub Marina Bay

Chinatown Point self-storage partners for

Mall for business for US$499m

US$383m US$136m

Singapore-listed United Industrial

Corporation (UIC) and its parent company

Perennial Real Estate Holdings and a Singapore real estate firm CapitaLand has UOL have taken control of the Marina

consortium of investors, divested its interests in StorHub, one of Square Shopping Mall and Marina

including Singapore Press Holdings, have Singapore’s largest self-storage businesses, Mandarin Hotel in Singapore in a deal

agreed to see their stakes in the Chinatown to an unnamed investor for S$185m worth S$675.3m (US$499.3m). UIC agreed

Point Mall in Singapore in a deal worth (US$136.3m). to buy a combined 24.7% stake from

S$520m (US$383.2m). StorHub’s 74,322 sq.m. portfolio features Singaporean property group OUE and two

The sellers offloaded their interests to a 12 storage facilities, including 11 other vendors in Marina Centre Holdings

fund managed by Pan Asia Realty properties in Singapore and one asset in (MCH) for S$485.3m, according to a

Advisors, which is a joint venture between Shanghai, CapitaLand announced. regulatory announcement. MCH is a

Japan’s Mitsubishi Estate and Hong Kong- Jason Leow, president and CEO of subsidiary of UIC and owns investments in

headquartered CLSA, according to Singapore & International at CapitaLand, the Marina Square retail and commercial

announcements made in April. Chinatown said the sale was part of the group’s capital complex, which comprises the Marina

Point Mall features a retail mall and four recycling plans. Square Shopping Mall and the Marina

strata office units totalling 19,755 sq.m. of “In 2018, CapitaLand divested S$4 billion Square hotels.At the same time, MCH also

net lettable space in the heart of the worth of assets and deployed S$6.11 billion bought a 25% interest in Aquamarina Hotel

Chinatown precinct in Singapore’s CBD. into new investments,” he said. Private Limited (AHPL) from a subsidiary

The deal value includes S$225m in cash for “We will stay disciplined in recycling our of OUE for S$190m. AHPL, which is a

the issued shares, in addition to shareholder assets for reinvestment and capital joint venture between MCH and UIC, owns

loans. Perennial is the largest stakeholder redeployment, with an annual divestment the Marina Mandarin Singapore, one of the

in the asset with a 50.64% interest and will target of at least S$3 billion.” hotels located in the Marina Square retail

gain S$125.3m in net proceeds from the and commercial complex.

One of the StorHub facilities

disposal.

“The divestment is also aligned with

Perennial’s active capital recycling strategy

to rebalance its portfolio and maximise

returns for shareholders,” said Perennial

CEO Pua Seck Guan. Perennial Real Estate

syndicated a group of investors to buy the

asset for S$250m in total in July 2010, and

then invested S$91m into redeveloping the

property.

Perennial Retail Management will continue

in its role as the property manager of

Chinatown Point Mall. Headquartered and

listed in Singapore, Perennial Real Estate is

a real estate owner, developer and manager,

as well as a healthcare services owner.

Perennial Real Estate has a combined real

estate portfolio of more than 6m sq.m.

across China, Singapore, Malaysia,

Indonesia and Ghana.

In Singapore, it has invested in and

manages assets including Capitol

Singapore, CHIJMES, AXA Tower, 111

Somerset and House of Tan Yeok Nee.

APAC Real Estate Jun-Jul 2019 19You can also read