SPORTS BETTING: Improving your odds against AML risk - Safe Banking Systems

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The Magazine for Career-Minded Professionals in the Anti-Money Laundering Field

SPORTS

BETTING:

Improving your odds

against AML risk

By all estimates, the U.S. sports betting market is

forecasted to exceed that of the U.K. and possibly

even China. GamblingCompliance, a provider of

business intelligence to the global sports betting

O

industry, projects that the new ruling will create a

n May 14, 2018, a historic ruling by the U.S. Supreme legal sports wagering market worth up to $6 billion

Court overturned the Professional and Amateur Sports in annual revenue by 2023.1 That figure pales in com-

parison to the illegal sports gambling market cur-

Protection Act (PASPA) of 1992, which previously rently estimated at $150 billion annually. In fact,

prohibited states, except Nevada, from authorizing sports illegal sports betting is so entrenched in U.S. culture

gambling. The new ruling empowers each state with the that it accounted for approximately 97 percent of the

authority to legalize and regulate sports betting. State $4.76 billion wagered on the 2018 Super Bowl!2

officials as well as the casino industry have been eagerly

awaiting the decision to take advantage of this revenue-rich Global ramifications

opportunity. Delaware and New Jersey, the first two states to Illegal gambling has a much broader reach than the

legalize sports betting, are currently leading the pack. The U.S. With so much money changing hands through

northeast region is primed to become the epicenter of sports offshore gambling websites, illegal bookmakers and

betting over the next five years, with New York overthrowing other unregulated channels, sports betting is an

Nevada as the largest U.S. sports betting market. New industry ripe for money laundering. When visiting

the GamblingCompliance website, the global reach

Jersey, Massachusetts and Pennsylvania are also expected to

surpass Nevada. Tax revenues generated by in-state casinos

and gaming facilities are forecasted to contribute enormously

to state coffers. Tourist dollars from visiting gamers will

further buoy the local economies.

Reprinted with permission from the September–November 2018, Vol. 17 No. 4

issue of ACAMS Today magazine, a publication of the

Association of Certified Anti-Money Laundering Specialists

© 2018 www.acams.org | www.acamstoday.orgAML CHALLENGES

heavily regulated sectors across the globe. BSA. This includes implementing risk-based

In the U.S., the gaming In addition to comprehensive state gaming AML programs and filing currency transac-

industry is one of the most regulations, U.S. gaming operations are

subject to federal AML requirements. Bank

tion reports (CTRs) and suspicious activity

reports (SARs) for certain transaction thresh-

heavily regulated sectors Secrecy Act/anti-money laundering (BSA/

AML) compliance applies to both in-person

olds, so any additional requirements for

sports betting should be easy to accommo-

across the globe and lawful internet gaming operations.

Nevertheless, the regulatory debate contin-

date. However, more compliance resources

might be needed to handle the expected

ues as states press to keep federal legisla- increase in revenue from attracting a wider

tion out of sports betting. pool of gamers.

of anti-money laundering (AML) issues

Additional growth in the gaming industry

within the gambling industry can be seen.

would only push more sports betting into

For example, recent news items include

casinos in British Columbia unknowingly the shadows away from the eyes of regula-

used to launder drug money and a northern tors and tax authorities. However, with the

California card club fined $5 million for AML federal ban lifted on competitive sports

violations of the Bank Secrecy Act (BSA) gambling, the dynamics of sports betting

dating back to 2009.3 are expected to change dramatically as is

the impact on the AML compliance world.

AML has become the most pressing regula-

tory issue for gambling firms across all Winners and losers

major jurisdictions. In Europe, the Fourth

AML Directive is bringing greater scrutiny Existing gaming venues such as commer-

of AML by regulators and operators as it cial casinos and racetracks are well-posi-

now covers the entire gambling sector after tioned to capitalize on the Supreme Court

previously only applying to casinos. In the decision. They must already meet a high

U.S., the gaming industry is one of the most bar for regulatory compliance under the

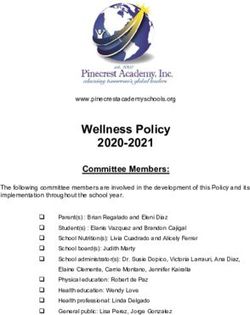

Figure 1: States that would likely offer sports betting

Although professional sports leagues

Within 2 years Within 5 years fought for years against legalization of

sports betting, they have now changed

direction and want a share of the tax reve-

nue from all sanctioned sports betting,

citing that legalization puts a monitoring

burden on them. Leagues are pushing for

an “integrity fee” on each bet, which would

R.I. in essence tax gaming venues on both win-

Del. ning and losing bets.

D.C.

The introduction of an integrity fee also

raises the concern that players, referees,

medical staff or team owners could make

bets or fix results. That is despite the fact

that most leagues have measures in place

to identify subversive activity and work

with companies that use algorithms to

check offshore and underground sports-

books for suspicious betting patterns. How

everything plays out will determine if pro-

fessional sports leagues wind up on the

Source: Center for Gaming Research at the University of Nevada winning or losing end of the stick.

ACAMS Today I September–November 2018 | Vol. 17 No. 4AML CHALLENGES

Preemptive action • Conducting enhanced due diligence

(EDD) on high amount accounts to

Corruption risks like bribery

Even legitimate betting outlets will continue

to face the high risk of criminal activity asso-

identify suspicious patterns. and illegal gratuities are

ciated with sports gambling at a greater

magnitude. In 2014, the Financial Crimes

• Prohibiting “messenger betting” (an

individual places bets on behalf of

also inherent in the

Enforcement Network of the U.S. Treasury another) and training employees on

how to identify this illegal practice.

betting world

Department warned that criminals were

using intermediaries to place bets for

unidentified third parties with legally oper- What it means for banks

efforts to have the federal government set a

ating sports books. The inability to identify a As part of the broader gaming industry, nationwide standard are still in play. Con-

source of funds posed increased money sports betting will likely bring similar risks sumer protection and responsible advertis-

laundering risks. Along with the expected such as money laundering, embezzlement ing are issues being raised while addiction

influx of funds from legalized sports betting and other larcenous crimes due to the cash- advocates are pressing states to fund gam-

comes an increase in opportunities to laun- intense nature of betting at casinos and bling addiction prevention and treatment

der money. New sports books and the casi- racetracks. Corruption risks like bribery with legalization.

nos partnering with them should be prepared and illegal gratuities are also inherent in

If legal sports betting takes off as quickly

to manage this new increased risk. Some the betting world. These risks are not

and with as much money as predicted,

proactive measures to consider include: unique to gambling; however, expect to see

technology will play a large part in helping

other risks related to the implementation of

institutions manage the increased transac-

sports betting. Consider the conflict of

tion volume and likely increase in SARs. In

interest if team owners are allowed to

addition to technology, establishing a risk-

invest in gambling businesses or if live-bet- based approach to compliance will be criti-

ting kiosks are permitted at stadiums cal to thwart money laundering and other

where events take place. Will specific con- financial crimes. Together, they will provide

trols be implemented to prevent this from financial institutions with a solid founda-

happening? In addition, online betting will tion in preparation for the KYC challenges

no doubt require service providers to per- of the next frontier: internet gambling and

form customer verification and screening. peer-to-peer gaming.

Providing banking services to gaming enti-

ties is not for every financial institution.

With their potential vulnerability to money Carol Stabile, CAMS, chief sales

laundering and other financial crime, and marketing officer, Safe Banking

sports-betting operators and other gaming Systems, Mineola, NY, USA,

providers will require a greater level of due carol.stabile@safe-banking.com

diligence to assess BSA/AML risk. Banks

must be prepared to demonstrate that they

can meet the heightened KYC, customer

• Developing thorough know your due diligence and EDD compliance require-

customer (KYC) programs to identify ments for these higher-risk customers.

source of funds through comprehensive

customer vetting. This could include full In the U.S., wrestling with regulations that

background screening and multiple may vary from state-to-state will be another

database searches such as FBI, Nevada challenge to accommodating sports gam-

Gaming and Office of Foreign Assets bling businesses. Although most of the

Control. action on sports betting is left to each state,

1

“New Report by GamblingCompliance Projects That U.S. Sports Betting Marketing Will be World’s Biggest by 2023,” PR Newswire, June 27, 2018,

https://www.prnewswire.com/news-releases/new-report-by-gamblingcompliance-projects-that-us-sports-betting-market-will-be-worlds-

biggest-by-2023-686671641.html

2

“97% of Expected $10 Billion Wagered on March Madness to be Bet Illegally,” American Gaming Association, March 12, 2018,

https://www.americangaming.org/newsroom/press-releasess/97-expected-10-billion-wagered-march-madness-be-bet-illegally

3

“Anti-Money Laundering,” GamblingCompliance, https://gamblingcompliance.com/topics/anti-money-laundering

ACAMS Today I September–November 2018 | Vol. 17 No. 4You can also read